0001609065PATHFINDER BANCORP, INC.false00016090652023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

(Exact name of Registrant as specified in its charter)

Commission File Number: 001-36695

|

|

Maryland |

38-3941859 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

214 West First Street, Oswego, NY 13126

(Address of Principal Executive Office) (Zip Code)

(315) 343-0057

(Issuer's Telephone Number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

PBHC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02 – Results of Operations and Financial Condition

On November 1, 2023, Pathfinder Bancorp, Inc. issued a press release disclosing its third quarter 2023 financial results. A copy of the press release is included as Exhibit 99.1 to this report.

The information in Item 2.02 to this Form 8-K and Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth in such filing.

Item 9.01 – Financial Statements and Results

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

PATHFINDER BANCORP, INC. |

|

|

|

|

|

Date: |

November 1, 2023 |

|

By: |

/s/ James A. Dowd |

|

|

|

|

James A. Dowd |

|

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Investor/Media Contacts

James A. Dowd, President, CEO

Walter F. Rusnak, Senior Vice President, CFO

Telephone: (315) 343-0057

Pathfinder Bancorp, Inc. Announces Third Quarter 2023 Net Income of $2.2 Million

Highlights Include Continued Deposit Base and Net Interest Margin Stability

OSWEGO, N.Y., November 1, 2023 (GLOBE NEWSWIRE) -- Pathfinder Bancorp, Inc. ("Company") (NASDAQ: PBHC), the holding Company for Pathfinder Bank ("Bank"), announced third quarter 2023 net income available to common shareholders of $2.2 million or $0.35 per basic and diluted share. This reflects a decrease of $1.0 million compared to the $3.2 million or $0.52 per basic and diluted share, earned in the third quarter of 2022. The Company's total revenue for the third quarter of 2023, after provision for credit losses, was $10.4 million, a decrease of $811,000, or 7.2%, compared to the same quarter in 2022. The Company's total revenue for the nine months ended September 30, 2023, after provision for credit losses, was $31.0 million, a decrease of $2.4 million, or 7.3%, compared to the same nine month period in 2022.

Performance Highlights for the Three Months Ended September 30, 2023:

•The Company reported a 32.0% increase in interest and dividend income to $17.7 million for the three month period ended September 30, 2023. This represents an increase from the $13.4 million reported for the same three month period in 2022.

•Total interest expense for the three months ended September 30, 2023, increased to $7.6 million from the $2.6 million reported in the third quarter of 2022.

•The Company's net interest income after provision for credit losses was $9.2 million for the three month period ended September 30, 2023. This level of net income represents a decrease of 8.4% from the $10.1 million reported for the third quarter of 2022.

•Noninterest income demonstrated modest growth, with the Company reporting $1.2 million for the third quarter of 2023, an increase of 2.8% from $1.2 million reported in the corresponding prior year period.

•For the three months ended September 30, 2023, noninterest expenses were $7.7 million. This is a 5.3% increase when compared to the $7.3 million reported in the third quarter of 2022.

Performance Highlights for the Nine Months Ended September 30, 2023:

•The Company reported substantial growth in its cumulative interest and dividend income, growing to $49.3 million for the nine month period ended September 30, 2023. This was a 36.8% increase from the $36.1 million reported during the corresponding nine month period ended September 30, 2022.

•The Company's total interest expense for the nine months concluded September 30, 2023, was $19.6 million. This was an increase from the $5.9 million reported during the nine month period ended September 30, 2022.

•Net interest income, after the provision for credit losses, for the nine month period ended September 30, 2023, was recorded at $27.1 million. This represents a marginal decline of 7.7% from the $29.4 million reported for the comparable nine month period ended September 30, 2022.

1

•The Company's noninterest income for the nine month period ended September 30, 2023, was $3.9 million, reflecting a slight decrease of 4.6% from the $4.1 million reported during the first nine months of 2022.

•Noninterest expenses for the nine months ended September 30, 2023, were $22.4 million, an increase of 3.2% from the $21.7 million reported during the first nine months of 2022.

James A. Dowd, President, and Chief Executive Officer of Pathfinder Bank, commented on the Bank's performance and forward-looking strategies following the third quarter of 2023. He underscored the Bank's increased emphasis in 2023 on bolstering both balance sheet and contingently-available liquidity. He further noted the Bank’s success in maintaining its deposit balances, despite the pressures that have reduced deposits industry-wide, and emphasized the necessity of executing on strategies designed to continuously monitor and manage deposits and other sources of liquidity in the current economic environment. He additionally discussed proactive measures that the Company continues to take to counterbalance the effects of declining net interest margin through operational streamlining and technological enhancements.

"This quarter, much like what has been observed across the entirety of the banking sector, we encountered several challenges including a volatile interest rate environment, net interest margin compression, and an increase in personnel expenses. Despite these challenging economic conditions, we still performed well, earning $2.2 million for the quarter and a total of $6.8 million in the first nine months of 2023," Mr. Dowd noted.

“Despite recent market fluctuations affecting Pathfinder and the vast majority of our peer institutions, as well as the broader regional and community banking sector, our core operating philosophies remain consistent. Our confidence continues to be bolstered by an encouraging increase in our interest and dividend income, thanks to the robust performance of our interest-generating asset portfolios. We remain strategically poised to meet the evolving needs of our customers in an expanding and rapidly changing local and regional market, both now and in the future."

Discussing the Company’s operational metrics, he noted, “The provision for credit losses increased to $2.7 million for the first three quarters of 2023, up markedly from the $871,000 recorded in the same nine month period of 2022. This $1.8 million increase is largely attributable to ongoing issues with two significant commercial real estate and commercial loan relationships that we have been vigilantly monitoring. As an integral component of our balance sheet management directives, and fully consistent with our operating policies, we recognized loan charge-offs in the third quarter, amounting to $3.9 million, which were primarily related to those two multi-loan relationships. These charge-offs, while large, were substantially reserved for in prior periods in accordance with our conservative accounting methodologies."

“At present, these two significant credit relationships are being managed under rigorous 'workout' processes and are being overseen by our seasoned lending team and their advisors. Our strategy involves active dialogue with the borrowers, crafting tailored repayment plans, adding additional sources of collateral when available and methodical advancement towards loan collateral liquidation should that become necessary."

"In the third quarter of 2023, we reported a return on average assets ('ROAA') of 0.63% and a return on average equity ('ROAE') of 7.5%. These results represent declines from the previous year's third quarter when the ROAA and ROAE stood at 0.93% and 11.49%, respectively. Despite this, we are pleased by our sequential quarterly profitability growth, demonstrating our resilience and the effectiveness of our adaptive strategies," Dowd added.

"Given the prevailing economic uncertainties which could lead to subdued loan demand, we are projecting a conservative annual loan growth rate of around 4% for the next 12 to 24 months. Concurrently, we are handling

2

an escalation in our interest expenses with deep analysis and proactive engagement with customers to counteract the potential long-term effects of a prolonged elevated interest rate environment. Our focused approach to deposit growth, as a means to boost liquidity, acknowledges a potential moderation in loan growth as a strategic move to reinforce our long-term financial health."

"Our focused cost management strategies are effectively offsetting the challenges of rising labor costs and the initial financial implications from our recently opened downtown Syracuse, NY branch. While total interest expenses have increased, contributing to a contraction in net interest income, we have successfully kept operating costs in check, with only a 3.2% year-over-year increase for the first nine months of 2023."

Mr. Dowd highlighted the Bank's strong financial position amidst the current economic challenges. "We expect continued pressure on net interest margins. However, our comprehensive set of interest rate risk management tools, including enforceable interest rate swap agreements and significant holdings of adjustable-rate financial instruments, will provide a measure of protection against margin erosion for the rest of the year."

"Looking ahead, the anticipated economic resurgence in Central New York, powered by unprecedented levels of private capital investments, suggests a promising outlook for the region and for the Company. We remain diligently committed to upholding the quality of our assets, our prudent credit decisioning, and meeting the evolving demands of our customers. Direct year-over-year comparisons of our operating results will be complex, as a consequence of the current unique market dynamics, but Pathfinder Bank is firmly positioned to navigate existing short-term challenges and capture emerging opportunities, backed by our consistent underwriting standards, strong financial health, and dedicated team—all aligning for the benefit of our customers, employees, and shareholders."

Income Statement for the Three and Nine Months Ended September 30, 2023

For the quarter ended September 30, 2023, the Company reported a net income of $2.2 million, a decrease of $1.0 million, or 31.6%, from $3.2 million reported in the third quarter of 2022. Net interest income, before provision for credit losses, decreased by $720,000, or 6.7%, to $10.1 million for the third quarter of 2023, compared to the same period in the third quarter of 2022. The provision for credit losses for the quarter increased to $833,000, up from $710,000 in the third quarter of 2022. Net interest income after provision for credit losses decreased to $9.2 million for the third quarter of 2023, from $10.1 million recorded in the third quarter of 2022. Noninterest income for the third quarter of 2023 was $1.2 million, a slight increase from the third quarter of 2022. As a result, total revenues after provision for credit losses was $10.4 million for the third quarter of 2023, a decrease from the $11.2 million reported in the third quarter of 2022. Noninterest expenses increased to $7.7 million in the third quarter of 2023, an increase of $386,000, or 5.3%.

For the nine months ended September 30, 2023, net interest income before provision for credit losses was $29.8 million, a slight decrease from the $30.2 million reported for the comparative period of 2022. Interest and dividend income for this period was $49.3 million, a substantial increase of $13.3 million, or 36.8%, compared to $36.1 million for the first nine months of 2022. The increase is mainly attributable to a $7.4 million increase in interest income from loans and a $4.7 million increase in interest income from taxable debt securities. These gains were more than offset by an increase of $13.7 million in total interest expense paid on interest-bearing liabilities. Noninterest income for the first nine months of 2023 was $3.9 million, a decrease of $188,000 or 4.6%, compared to the $4.1 million reported for the same period in 2022. Noninterest expenses totaled $22.4 million, an increase of $686,000, or 3.2%, when compared to the $21.7 million recorded in the first nine months of 2022.

Overall, before accounting for income taxes, net income for the first nine months of 2023 was $8.6 million, a decrease from the $11.7 million reported in 2022. After providing for income taxes, which amounted to $1.8

3

million for this period, the net income attributable to noncontrolling interest and Pathfinder Bancorp, Inc. stood at $6.8 million, compared to $9.5 million in the previous year.

Components of Net Interest Income

In the third quarter of 2023, the Company's net interest income, before provision for credit losses, faced significant challenges, primarily related to the cost of interest-bearing liabilities, resulting in reported net interest income of $10.1 million. This represented a decrease of $720,000, or 6.7%, from the third quarter of the previous year. This contraction in net interest income underscores the challenges presented by the complex market landscape, particularly the pressures from increasing interest expenses, despite the bolstering effect of our growing interest and dividend income.

During the quarter ended September 30, 2023, interest and dividend income demonstrated resilience, rising to $17.7 million, a 32.0% increase from the same quarter in 2022. This improvement was driven by strategic growth in our loan interest income, contributing an additional $2.6 million, and bolstered by enhanced earnings from taxable debt securities, which provided an additional $1.4 million. Despite these gains, the three month period ended September 30, 2023 faced a significant interest income offset due to a marked increase in interest expenses, which climbed by $5.0 million. This increase in interest expense was a consequence of prevailing market volatility and rising competitive pressures brought about by rising interest rates. The most notable increase in interest expenses was a $4.3 million rise in costs tied to interest on deposits. This increase, catalyzed by the economic environment and aggressive market competition, necessitated a strategic review of our interest-bearing liabilities portfolio. In response to rising interest expenses, the Company has proactively recalibrated its asset and liability strategies to ensure a more balanced and financially sound stance amidst market unpredictability. In year-to-date analysis, net interest income before provision for credit losses was slightly dampened, standing at $29.8 million, a marginal decrease of $464,000, or 1.5%, in comparison to the preceding year. This subtle downtrend is primarily attributable to interest expense of $19.6 million, marking a 235% increase from the corresponding period in 2022. These increases were the result of general increases in short-term rates that have occurred in persistent upward increments since the first quarter of 2022.

Provision for Credit Losses

In the third quarter of 2023, the Company faced a complex economic landscape, including those arising from global economic shifts and industry-specific challenges. These factors required the Company to heighten its vigilance with respect to risk management. For the third quarter of 2023, the Company recorded a provision for credit losses of $833,000, which represented an increase from the $710,000 provision recorded in the same quarter of the previous year. This year-over-year increase in the quarterly provision for credit losses was primarily the result of $3.6 million in charge-offs related to two large loan relationships that totaled $15.0 million at June 30, 2023. The substantial majority of the charged-off $3.6 million related to these relationships was fully reserved for in prior periods. These two large multi-loan relationships totaled approximately $11.5 million at September 30, 2023, of which virtually all of the outstanding loan balances were collateralized.

Effective January 1, 2023, The Company implemented the Current Expected Credit Loss ("CECL") methodology, following the guidelines of the Financial Accounting Standards Board ASU 2016-13. This methodology necessitates a more forward-looking approach, demanding comprehensive projections of credit losses based on historical data, current market conditions, and reasonable future expectations. The adoption of the CECL methodology required the Company to make a one-time, non-recurring adjustment in the Allowance for Credit Losses ("ACL"). Although this procedural change did not directly affect the Bank's reported income or earnings per share upon adoption, it mandated a substantial increase of $2.9 million in the ACL. Consequently, it had an impact on the Bank's balance sheet through a specific transition adjustment of $2.1 million (equivalent to $0.36 per share) after considering income tax implications, as reflected on January 1, 2023. This strategic move aligns

4

with our overarching objective of bolstering financial robustness, ensuring that we adequately provision our reserves to counteract potential credit-related losses in the future.

Noninterest Income

In the third quarter of 2023, the Company reported noninterest income of $1.2 million, a marginal increase of $32,000, or 2.8%, compared to the same quarter in 2022. For the year-to-date, noninterest income was $3.9 million, marking a decrease of $188,000, or 4.6% from the corresponding nine month period in 2022.

This variation in noninterest income can be primarily attributed to factors influencing recurring noninterest income, which excludes volatile items such as unrealized gains or losses on equity securities and nonrecurring gains on sales of loans, investment securities, foreclosed real estate, premises, and equipment. Recurring noninterest income was $1.2 million for the three months ended September 30, 2023, a decline of $108,000, or 8.2% from the same three month period in 2022. Recurring noninterest income was $3.9 million for the nine months ended September 30, 2023, a decline of $230,000, or 5.7% from the same nine month period in 2022.

The following table details the components of noninterest income for the three and nine months ended September 30, 2023, and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

For the three months ended |

|

|

For the nine months ended |

|

(In thousands) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

Change |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

Change |

|

Service charges on deposit accounts |

|

$ |

343 |

|

|

$ |

334 |

|

|

$ |

9 |

|

|

|

2.7 |

% |

|

$ |

913 |

|

|

$ |

876 |

|

|

$ |

37 |

|

|

|

4.2 |

% |

Earnings and gain on bank owned life insurance |

|

|

165 |

|

|

|

156 |

|

|

|

9 |

|

|

|

5.8 |

% |

|

|

466 |

|

|

|

441 |

|

|

|

25 |

|

|

|

5.7 |

% |

Loan servicing fees |

|

|

99 |

|

|

|

74 |

|

|

|

25 |

|

|

|

33.8 |

% |

|

|

238 |

|

|

|

260 |

|

|

|

(22 |

) |

|

|

-8.5 |

% |

Debit card interchange fees |

|

|

22 |

|

|

|

180 |

|

|

|

(158 |

) |

|

|

-87.8 |

% |

|

|

455 |

|

|

|

639 |

|

|

|

(184 |

) |

|

|

-28.8 |

% |

Insurance agency revenue |

|

|

310 |

|

|

|

258 |

|

|

|

52 |

|

|

|

20.2 |

% |

|

|

1,001 |

|

|

|

849 |

|

|

|

152 |

|

|

|

17.9 |

% |

Other charges, commissions and fees |

|

|

265 |

|

|

|

310 |

|

|

|

(45 |

) |

|

|

-14.5 |

% |

|

|

764 |

|

|

|

1,002 |

|

|

|

(238 |

) |

|

|

-23.8 |

% |

Noninterest income before gains |

|

|

1,204 |

|

|

|

1,312 |

|

|

|

(108 |

) |

|

|

-8.2 |

% |

|

|

3,837 |

|

|

|

4,067 |

|

|

|

(230 |

) |

|

|

-5.7 |

% |

Net gains (losses) on sales of securities, loans and foreclosed real estate |

|

|

28 |

|

|

|

(151 |

) |

|

|

179 |

|

|

|

-118.5 |

% |

|

|

243 |

|

|

|

(46 |

) |

|

|

289 |

|

|

|

-628.3 |

% |

(Losses) gains on marketable equity securities |

|

|

(39 |

) |

|

|

- |

|

|

|

(39 |

) |

|

|

0.0 |

% |

|

|

(208 |

) |

|

|

39 |

|

|

|

(247 |

) |

|

|

-633.3 |

% |

Total noninterest income |

|

$ |

1,193 |

|

|

$ |

1,161 |

|

|

$ |

32 |

|

|

|

2.8 |

% |

|

$ |

3,872 |

|

|

$ |

4,060 |

|

|

$ |

(188 |

) |

|

|

-4.6 |

% |

Compared to the same three and nine month periods in 2022, debit card interchange income declined $158,000, or 87.8%, and $184,000, or 28.8%, for the three and nine months ended September 30, 2023, respectively. Absent the decline in debit card interchange income, discussed below, recurring noninterest income increased $50,000, or 4.4%, in the three months ended September 30, 2023, as compared to the same three month period in 2022 and decreased $46,000, or 1.3%, in the nine months ended September 30, 2023, as compared to the same nine month period in 2022.

The decline in debit card income was due in part to the recognition of increased customer card rewards program redemption rates among the Bank’s active debit card users. During the third quarter of 2023, the Bank recognized a $73,000 nonrecurring reduction of debit card interchange income to increase its estimate of currently unused rewards that are likely to be redeemed by customers in future periods. This adjustment was made after a re-evaluation of recent customer reward program redemption patterns. Absent this one-time adjustment related to the rewards program, debit card interchange income would have declined for the quarter by $85,000, or 47.2%, and $111,000, or 17.4%, for the three and nine months ended September 30, 2023, respectively, compared to the same three and nine month periods in 2022. The $85,000 quarterly decline in debit card interchange income, not due to the one-time rewards program revenue adjustment, discussed above, was primarily due to changes in the number of debit card processor reporting cycles in the nine months ended September 30, 2023, as compared to the same nine month period in 2022, adjusted on a year-to-date basis in the third quarter of 2023. Debit card interchange income was also reduced by modest declines in consumer transactional deposit accounts and reduced consumer utilization of the Bank’s debit card offerings.

5

Noninterest Expense

In the third quarter of 2023, the Company reported noninterest expenses totaling $7.7 million, an increase of $386,000, or 5.3%, in comparison to the same quarter in 2022. This increase was primarily driven by inflationary pressures in a broad array of areas as explained below. Additionally, our strategic opening of the Bank's eleventh full-service branch in November 2022, contributed to this quarterly year-over-year increase.

The primary driver of this year-over-year quarterly increase in noninterest expenses was an increase of $225,000 or 84.3%, in professional and other services expense. Absent that increase, noninterest expenses increased $161,000, or 2.3%, in the quarter ended September 30, 2023, as compared to the same quarter in 2022. The increase in professional and other services expense was primarily the result of a $154,000 increase in third-party software service costs, related in part to the Company's continuing efforts to increase process automation, and a $61,000 increase in non-recurring consulting fees.

In the nine months ended September 30, 2023, the Company reported noninterest expenses totaling $22.4 million, which marked an increase of $686,000, or 3.2%, in comparison to the same quarter in 2022. The primary driver of this year-over-year quarterly increase in noninterest expenses was an increase of $419,000 or 37.7%, in professional and other services expense. Absent that increase, noninterest expenses increased $267,000, or 1.3%, in the nine months ended September 30, 2023, as compared to the same nine month period in 2022. This increase in professional and other services expense in the nine months ended September 30, 2023, as compared to the same nine month period in 2022, was primarily the result of a $282,000 increase in third-party software service costs, related in part to the Company's continuing efforts to increase process automation, a $113,000 increase in non-recurring legal fees, and a $50,000 increase in non-recurring consulting fees.

The moderate increase in noninterest expenses in the first nine months of 2023, when contrasted with the corresponding period in 2022, underscores the Company's robust expense management strategies. These practices have proven effective, even in the face of a fluctuating economic landscape marked by inflationary pressures, particularly within the labor market. Our unwavering commitment to striking a balance between competitive employee compensation and prudent expense management has enabled us to navigate the challenges of rising labor costs. Our strategic financial approach prioritizes both sustained profitability and investment in our workforce, thereby enhancing customer service and strengthening our position in the market.

The following table details the components of noninterest expense for the three and nine months ended September 30, 2023, and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

For the three months ended |

|

For the nine months ended |

(In thousands) |

|

September 30, 2023 |

|

September 30, 2022 |

|

Change |

|

September 30, 2023 |

|

September 30, 2022 |

|

Change |

Salaries and employee benefits |

|

$4,154 |

|

$4,196 |

|

$(42) |

|

-1.0% |

|

$12,243 |

|

$12,030 |

|

$213 |

|

1.8% |

Building and occupancy |

|

868 |

|

835 |

|

33 |

|

4.0% |

|

2,699 |

|

2,491 |

|

208 |

|

8.4% |

Data processing |

|

483 |

|

485 |

|

(2) |

|

-0.4% |

|

1,519 |

|

1,552 |

|

(33) |

|

-2.1% |

Professional and other services |

|

492 |

|

267 |

|

225 |

|

84.3% |

|

1,531 |

|

1,112 |

|

419 |

|

37.7% |

Advertising |

|

144 |

|

199 |

|

(55) |

|

-27.6% |

|

516 |

|

621 |

|

(105) |

|

-16.9% |

FDIC assessments |

|

222 |

|

162 |

|

60 |

|

37.0% |

|

663 |

|

606 |

|

57 |

|

9.4% |

Audits and exams |

|

159 |

|

141 |

|

18 |

|

12.8% |

|

476 |

|

424 |

|

52 |

|

12.3% |

Insurance agency expense |

|

273 |

|

229 |

|

44 |

|

19.2% |

|

817 |

|

687 |

|

130 |

|

18.9% |

Community service activities |

|

55 |

|

58 |

|

(3) |

|

-5.2% |

|

151 |

|

193 |

|

(42) |

|

-21.8% |

Foreclosed real estate expenses |

|

44 |

|

17 |

|

27 |

|

158.8% |

|

76 |

|

57 |

|

19 |

|

33.3% |

Other expenses |

|

759 |

|

678 |

|

81 |

|

11.9% |

|

1,660 |

|

1,892 |

|

(232) |

|

-12.3% |

Total noninterest expenses |

|

$7,653 |

|

$7,267 |

|

$386 |

|

5.3% |

|

$22,351 |

|

$21,665 |

|

$686 |

|

3.2% |

6

There were also noteworthy changes in building and occupancy costs for the three and nine month periods ended September 30, 2023. During the third quarter of 2023, these costs increased by $33,000, representing a 4.0% rise, reaching a total of $868,000. Over the first nine months of 2023, we observed a more substantial increase of $208,000, or 8.4%, to $2.7 million. These increases were primarily driven by expenses related to the opening of our newest full-service branch and secondarily related to increases in general maintenance and other costs associated with operating facilities due to general inflationary factors.

Statement of Financial Condition at September 30, 2023

On September 30, 2023, the Company recorded total assets of $1.40 billion, marking an increase of $728,000, or 0.1%, from December 31, 2023. This growth is primarily due to an increase in available-for-sale securities, which increased by $15.1 million, or 7.9%, from December 31, 2022. Additionally, marketable equity securities experienced a significant increase of 61.8% from $1.9 million as of December 31, 2022, to $3.0 million at September 30, 2023. Substantially offsetting these increases were a decline in cash and cash equivalents of $10.8 million, or 30.6% at September 30, 2023 as compared to December 31, 2022. The decline in cash and cash equivalents was due to seasonal and other transitory factors at September 30, 2023.

Earlier in the year, the Bank prioritized enhancing balance sheet liquidity. Outstanding loan balances declined by $1.6 million, or 0.2%, from $897.7 million at December 31, 2022, to $896.1 million at September 30, 2023. This change underscores a strategic transition, highlighting a move from prioritizing liquidity to meeting the stabilizing loan demand as the year advanced.

The third quarter was marked by an increase in deposits for the Bank of $26.8 million or 2.4% from balances at June 30, 2023. This set the total deposits at $1.13 billion at the close of September 30, 2023, up $2.4 million from December 31, 2022. In light of general industry trends that have pressured deposit balances, this stability is a testament to the Bank's robust customer loyalty and resilience amidst a challenging competitive landscape.

The Company's equity increased $2.8 million, or 2.5%, up from $111.0 million at December 31, 2022, to $113.8 million at September 30, 2023. This increase was primarily the result of the Bank's consistent net income trajectory and cumulative retention of earnings. With the Bank's capital metrics significantly above regulatory guidelines, the Company has firmly positioned itself in a zone of strength, ensuring future flexibility and the ability to navigate economic variations. In the third quarter of 2023, Pathfinder Bancorp, Inc. demonstrated its robustness and dexterity in navigating the financial landscape. With focus firmly set on future growth, the Bank's leadership remains steadfast in reinforcing its fiscal foundation and enhancing shareholder value.

7

Asset Quality

The following table details all nonaccrual loans relationships at September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Type |

Collateral Type |

Number of Loans |

|

|

Loan Balance |

|

|

Average Loan Balance |

|

|

Weighted LTV at Origination/ Modification |

|

|

Status |

Secured residential mortgage: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate |

|

18 |

|

|

$ |

1,659 |

|

|

$ |

92 |

|

|

|

75 |

% |

|

Individual loans are under active resolution management by the Bank. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Museum |

|

1 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

79 |

% |

|

The borrower is expected to receive specific government grant funding this year and be finalized by the end of 2023. This will allow for a reduction of the outstanding loan balance upon their finalization. |

|

Office Space |

|

1 |

|

|

|

1,682 |

|

|

|

1,682 |

|

|

|

78 |

% |

|

The loan is secured by a first mortgage with strong tenancy and a long-term lease. The borrower is seeking outside financing and the Bank is in regular communication with the borrower. |

|

Manufacturing |

|

1 |

|

|

|

1,341 |

|

|

|

1,341 |

|

|

|

54 |

% |

|

The loan is secured by a first mortgage with strong tenancy and a long-term lease. The borrower is seeking outside financing and the Bank is in regular communication with the borrower. |

|

All other |

|

8 |

|

|

|

2,000 |

|

|

|

250 |

|

|

|

138 |

% |

|

Individual loans are under active resolution management by the Bank. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial lines of credit: |

|

|

9 |

|

|

|

1,530 |

|

|

|

170 |

|

|

|

(1 |

) |

|

Individual lines are under active resolution management by the Bank. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial loans: |

|

|

10 |

|

|

|

3,710 |

|

|

|

371 |

|

|

|

(1 |

) |

|

Individual loans are under active resolution management by the Bank. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer loans: |

|

|

85 |

|

|

|

2,871 |

|

|

|

34 |

|

|

|

(1 |

) |

|

Individual loans are under active resolution management by the Bank. |

|

|

|

133 |

|

|

$ |

16,173 |

|

|

|

|

|

|

|

|

|

(1) These loans were originated as unsecured or with minimal collateral.

The adjustments in the Bank's allowance for credit losses, recorded in the third quarter of 2023, reflect the institution's proactive and conservative approach to addressing potential credit risks. Management notes that all relevant and current data regarding loan collectability has been appropriately reflected in the allowance for credit losses as of September 30, 2023. As of September 30, 2023, the allowance for credit losses saw a marginal net increase of 2.9% to $15.8 million from $15.3 million at December 30, 2022. During the quarter ended September 30, 2023, the Bank charged off $3.9 million in loans, of which $3.6 million related to two large commercial real estate and commercial loan relationships.

Nonperforming loans represented 1.8% of the total loans as of September 30, 2023, marking an increase from 1.0% at June 30, 2023. The allowance for credit losses was 1.8% of total loans at September 30, 2023, as compared to 1.7% at December 31, 2022. As a result of the charge-off activity in the third quarter of 2023, the allowance for credit losses to nonperforming loans ratio decreased from 169.9% at June 30, 2023 to 97.5% at September 30, 2023.

The Bank's management retains a proactive approach to analyzing and recording potential future loan losses and remains vigilant in overseeing all credit relationships, guaranteeing that Company continuously integrates

8

ongoing evaluations of loan recoverability into the allowance for credit losses. Actions taken during the most recent quarter underscore the Bank's enhanced preparedness for potential credit losses.

Moving forward, the leadership of Pathfinder Bancorp, Inc. is unwavering in its dedication to maintaining the highest benchmarks in asset quality and risk oversight. Through judicious choices and proactive strategies, the Bank endeavors to anticipate and mitigate any repercussions of loan fluctuations on its financial structure, reinforcing fiscal resilience and prioritizing shareholder value.

Liquidity

Balance sheet liquidity remains a cornerstone for Pathfinder Bancorp, Inc., given the dynamic nature of banking regulations and evolving investor expectations. The Bank's management consistently employs robust modeling, stress tests, and internal reporting mechanisms to manage both immediate and long-term projected liquidity. As of September 30, 2023, the Bank's leadership is confident in the adequacy of its current and projected liquidity positions.

The Bank's analysis indicates that expected cash inflows from loans and investment securities are sufficiently robust to meet all projected financial obligations. In the third quarter of 2023, the Bank's non-brokered deposit balances increased modestly to $884.2 million at September 30, 2023 from $864.6 million and $876.8 million and June 30, 2023 and December 31, 2022, respectively. Total deposits were $1.13 billion at September 30, 2023 as compared to $1.18 billion and $1.13 billion at September 30, 2022 and December 31, 2022, respectively.

Pathfinder Bancorp, Inc. maintains a robust affiliation with the Federal Home Loan Bank of New York, granting the Bank access to a diverse suite of advanced facilities. Beyond its core liquidity sources, the Bank also has several unused but available credit lines at its command, including lines issued by other financial institutions and the Federal Reserve's Discount Window.

Additionally, the Bank is qualified to access the Federal Reserve's Bank Term Funding Program ("BTFP"), a supplementary source of contingent funding. This platform enables depository institutions to offer select investment securities as collateral for one-year callable term advances at market-driven rates. The BTFP will remain available until its projected closure in March 2024.

Cash Dividend Declared

On October 2, 2023, the Company announced the declaration of its cash dividend for the fiscal quarter ended September 30, 2023. The Board of Directors has declared a cash dividend of $0.09 per share on the Company's voting common and non-voting common stock, along with a cash dividend of $0.09 per notional share for the Company's issued warrant. This dividend will be payable to all shareholders of record on October 20, 2023, and is scheduled to be paid on November 10, 2023.

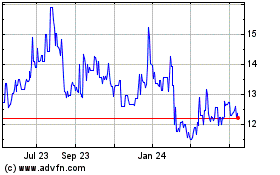

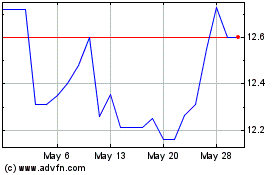

With the Company's common stock closing price on September 30, 2023, at $13.80, the implied dividend yield stands at 2.6%. The quarterly cash dividend of $0.09 reflects an annualized dividend payout ratio of 24.6%. The Company’s Board of Directors continues to balance its commitment to return capital to its shareholders through dividends while maintaining an appropriately strong capital position.

9

About Pathfinder Bancorp, Inc.

Pathfinder Bank is a New York State chartered commercial bank headquartered in Oswego, whose deposits are insured by the Federal Deposit Insurance Corporation. The Bank is a wholly owned subsidiary of Pathfinder Bancorp, Inc., (NASDAQ SmallCap Market; symbol: PBHC). The Bank has eleven full-service offices located in its market areas consisting of Oswego and Onondaga Counties and one limited purpose office in Oneida County. Through its subsidiary, Pathfinder Risk Management Company, Inc., the Bank owns a 51% interest in the FitzGibbons Agency, LLC. At September 30, 2023, there were 4,713,353 shares of voting common stock issued and outstanding, as well as 1,380,283 shares of non-voting common stock issued and outstanding. The Company's common stock trades on the NASDAQ market under the symbol "PBHC." At September 30, 2023, the Company and subsidiaries had total consolidated assets of $1.40 billion, total deposits of $1.13 billion and shareholders' equity of $113.8 million.

Forward-Looking Statement

Certain statements contained herein are “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are generally identified by use of the words "believe," "expect," "intend," "anticipate," "estimate," "project" or similar expressions, or future or conditional verbs, such as “will,” “would,” “should,” “could,” or “may.” These forward-looking statements are based on current beliefs and expectations of the Company’s and the Bank’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s and the Bank’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to: risks related to the real estate and economic environment, particularly in the market areas in which the Company and the Bank operate; fiscal and monetary policies of the U.S. Government; inflation; changes in government regulations affecting financial institutions, including regulatory compliance costs and capital requirements; fluctuations in the adequacy of the allowance for credit losses; decreases in deposit levels necessitating increased borrowing to fund loans and investments; the effects of the COVID-19 pandemic; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; the risk that the Company may not be successful in the implementation of its business strategy; changes in prevailing interest rates; credit risk management; asset-liability management; and other risks described in the Company’s filings with the Securities and Exchange Commission, which are available at the SEC’s website, www.sec.gov.

This release contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position, or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

10

PATHFINDER BANCORP, INC.

FINANCIAL HIGHLIGHTS

(Dollars and shares in thousands except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months |

|

|

For the nine months |

|

|

ended September 30, |

|

|

ended September 30, |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Condensed Income Statement |

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income |

$ |

17,671 |

|

|

$ |

13,383 |

|

|

$ |

49,335 |

|

|

$ |

36,071 |

|

Interest expense |

|

7,611 |

|

|

|

2,603 |

|

|

|

19,575 |

|

|

|

5,847 |

|

Net interest income |

|

10,060 |

|

|

|

10,780 |

|

|

|

29,760 |

|

|

|

30,224 |

|

Provision for credit losses |

|

833 |

|

|

|

710 |

|

|

|

2,665 |

|

|

|

871 |

|

|

|

9,227 |

|

|

|

10,070 |

|

|

|

27,095 |

|

|

|

29,353 |

|

Noninterest income excluding net gains on sales of

securities, loans and foreclosed real estate |

|

1,204 |

|

|

|

1,312 |

|

|

|

3,837 |

|

|

|

4,067 |

|

Net gains (losses) on sales of securities, loans and foreclosed real estate |

|

28 |

|

|

|

(151 |

) |

|

|

243 |

|

|

|

(46 |

) |

(Losses) gains on marketable equity securities |

|

(39 |

) |

|

|

- |

|

|

|

(208 |

) |

|

|

39 |

|

Noninterest expense |

|

7,653 |

|

|

|

7,267 |

|

|

|

22,351 |

|

|

|

21,665 |

|

Income before income taxes |

|

2,767 |

|

|

|

3,964 |

|

|

|

8,616 |

|

|

|

11,748 |

|

Provision for income taxes |

|

573 |

|

|

|

772 |

|

|

|

1,772 |

|

|

|

2,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest and

Pathfinder Bancorp, Inc. |

$ |

2,194 |

|

|

$ |

3,192 |

|

|

$ |

6,844 |

|

|

$ |

9,475 |

|

Net income attributable to noncontrolling interest |

|

18 |

|

|

|

12 |

|

|

|

87 |

|

|

|

73 |

|

Net income attributable to Pathfinder Bancorp Inc. |

$ |

2,176 |

|

|

$ |

3,180 |

|

|

$ |

6,757 |

|

|

$ |

9,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and For the Periods Ended |

|

|

September 30, |

|

|

December 31, |

|

|

September 30, |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Selected Balance Sheet Data |

|

|

|

|

|

|

|

|

Assets |

$ |

1,400,649 |

|

|

$ |

1,399,921 |

|

|

$ |

1,396,946 |

|

Earning assets |

|

1,309,049 |

|

|

|

1,313,069 |

|

|

|

1,307,430 |

|

Total loans |

|

896,123 |

|

|

|

897,754 |

|

|

|

886,206 |

|

Deposits |

|

1,127,853 |

|

|

|

1,125,430 |

|

|

|

1,180,583 |

|

Borrowed funds |

|

110,613 |

|

|

|

115,997 |

|

|

|

65,621 |

|

Allowance for credit losses |

|

15,767 |

|

|

|

15,319 |

|

|

|

13,632 |

|

Subordinated debt |

|

29,867 |

|

|

|

29,733 |

|

|

|

29,689 |

|

Pathfinder Bancorp, Inc. Shareholders' equity |

|

113,770 |

|

|

|

110,997 |

|

|

|

107,301 |

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios |

|

|

|

|

|

|

|

|

Net loan charge-offs (annualized YTD) to average loans |

|

0.61 |

% |

|

|

0.04 |

% |

|

|

0.03 |

% |

Allowance for credit losses to period end loans |

|

1.76 |

% |

|

|

1.71 |

% |

|

|

1.54 |

% |

Allowance for credit losses to nonperforming loans |

|

97.49 |

% |

|

|

169.93 |

% |

|

|

128.30 |

% |

Nonperforming loans to period end loans |

|

1.80 |

% |

|

|

1.00 |

% |

|

|

1.20 |

% |

Nonperforming assets to total assets |

|

1.17 |

% |

|

|

0.66 |

% |

|

|

0.78 |

% |

The above information is preliminary and based on the Company's data available at the time of presentation.

11

PATHFINDER BANCORP, INC.

FINANCIAL HIGHLIGHTS

(Dollars and shares in thousands except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months |

|

|

For the nine months |

|

|

ended September 30, |

|

|

ended September 30, |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Key Earnings Ratios |

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

0.63 |

% |

|

|

0.93 |

% |

|

|

0.65 |

% |

|

|

0.94 |

% |

Return on average common equity |

|

7.50 |

% |

|

|

11.49 |

% |

|

|

7.88 |

% |

|

|

11.39 |

% |

Return on average equity |

|

7.50 |

% |

|

|

11.49 |

% |

|

|

7.88 |

% |

|

|

11.39 |

% |

Net interest margin |

|

3.07 |

% |

|

|

3.32 |

% |

|

|

3.02 |

% |

|

|

3.18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Share, Per Share and Ratio Data |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average shares outstanding -Voting |

|

4,671 |

|

|

|

4,564 |

|

|

|

4,640 |

|

|

|

4,550 |

|

Basic and diluted earnings per share - Voting |

$ |

0.35 |

|

|

$ |

0.52 |

|

|

$ |

1.10 |

|

|

$ |

1.55 |

|

Basic and diluted weighted average shares outstanding - Series A Non-Voting |

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

Basic and diluted earnings per share - Series A Non-Voting |

$ |

0.35 |

|

|

$ |

0.52 |

|

|

$ |

1.10 |

|

|

$ |

1.55 |

|

Cash dividends per share |

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.27 |

|

|

$ |

0.27 |

|

Book value per common share at September 30, 2023 and 2022 |

|

|

|

|

|

|

$ |

18.67 |

|

|

$ |

17.88 |

|

Tangible book value per common share at September 30, 2023 and 2022 |

|

|

|

|

|

|

$ |

17.91 |

|

|

$ |

17.11 |

|

Tangible common equity to tangible assets at September 30, 2023 and 2022 |

|

|

|

|

|

|

|

7.82 |

% |

|

|

7.37 |

% |

Tangible common equity to tangible assets at September 30, 2023 and 2022, adjusted |

|

|

|

|

|

|

|

7.82 |

% |

|

|

7.38 |

% |

Throughout the accompanying document, certain financial metrics and ratios are presented that are not defined under generally accepted accounting principles (GAAP). Reconciliations of the non-GAAP financial metrics and ratios, presented elsewhere within this document, are presented below:

|

|

|

|

|

|

|

|

|

As of and |

|

|

For the nine months |

|

|

ended September 30, |

|

|

(Unaudited) |

|

Non-GAAP Reconciliation |

2023 |

|

|

2022 |

|

Tangible book value per common share |

|

|

|

|

|

Total equity |

$ |

113,770 |

|

|

$ |

107,301 |

|

Intangible assets |

|

(4,624 |

) |

|

|

(4,640 |

) |

Tangible common equity |

|

109,146 |

|

|

|

102,661 |

|

Common shares outstanding |

|

6,094 |

|

|

|

6,001 |

|

Tangible book value per common share |

$ |

17.91 |

|

|

$ |

17.11 |

|

|

|

|

|

|

|

Tangible common equity to tangible assets |

|

|

|

|

|

Tangible common equity |

$ |

109,146 |

|

|

$ |

102,661 |

|

Tangible assets |

|

1,396,025 |

|

|

|

1,392,306 |

|

Tangible common equity to tangible assets ratio |

|

7.82 |

% |

|

|

7.37 |

% |

|

|

|

|

|

|

Tangible common equity to tangible assets, adjusted |

|

|

|

|

|

Tangible common equity |

$ |

109,146 |

|

|

$ |

102,661 |

|

Tangible assets |

|

1,396,025 |

|

|

|

1,392,306 |

|

Less: Paycheck Protection Program (PPP) loans |

|

- |

|

|

|

(693 |

) |

Total assets excluding PPP loans |

$ |

1,396,025 |

|

|

$ |

1,391,613 |

|

Tangible common equity to tangible assets ratio, excluding PPP loans |

|

7.82 |

% |

|

|

7.38 |

% |

* Basic and diluted earnings per share are calculated based upon the two-class method for the nine months ended September 30, 2023 and 2022.

Weighted average shares outstanding do not include unallocated ESOP shares.

The above information is preliminary and based on the Company's data available at the time of presentation.

12

PATHFINDER BANCORP, INC.

FINANCIAL HIGHLIGHTS

(Dollars and shares in thousands except per share amounts)

The following table sets forth information concerning average interest-earning assets and interest-bearing liabilities and the yields and rates thereon. Interest income and resultant yield information in the table has not been adjusted for tax equivalency. Averages are computed on the daily average balance for each month in the period divided by the number of days in the period. Yields and amounts earned include loan fees. Nonaccrual loans have been included in interest-earning assets for purposes of these calculations.

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

(Unaudited) |

|

2023 |

|

2022 |

|

|

|

|

|

Average |

|

|

|

|

|

Average |

|

Average |

|

|

|

Yield / |

|

Average |

|

|

|

Yield / |

(Dollars in thousands) |

Balance |

|

Interest |

|

Cost |

|

Balance |

|

Interest |

|

Cost |

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

Loans |

$895,900 |

|

$12,470 |

|

5.57% |

|

$880,097 |

|

$9,895 |

|

4.50% |

Taxable investment securities |

376,455 |

|

4,628 |

|

4.92% |

|

363,877 |

|

3,108 |

|

3.42% |

Tax-exempt investment securities |

27,831 |

|

507 |

|

7.29% |

|

42,855 |

|

351 |

|

3.28% |

Fed funds sold and interest-earning deposits |

11,395 |

|

66 |

|

2.32% |

|

10,383 |

|

29 |

|

1.12% |

Total interest-earning assets |

1,311,581 |

|

17,671 |

|

5.39% |

|

1,297,212 |

|

13,383 |

|

4.13% |

Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

Other assets |

102,738 |

|

|

|

|

|

90,482 |

|

|

|

|

Allowance for credit losses |

(19,028) |

|

|

|

|

|

(13,050) |

|

|

|

|

Net unrealized losses

on available-for-sale securities |

(13,275) |

|

|

|

|

|

(10,983) |

|

|

|

|

Total assets |

$1,382,016 |

|

|

|

|

|

$1,363,661 |

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

$90,992 |

|

$124 |

|

0.55% |

|

$101,907 |

|

$85 |

|

0.33% |

Money management accounts |

14,503 |

|

4 |

|

0.11% |

|

16,097 |

|

4 |

|

0.10% |

MMDA accounts |

218,601 |

|

1,642 |

|

3.00% |

|

244,884 |

|

427 |

|

0.70% |

Savings and club accounts |

121,710 |

|

68 |

|

0.22% |

|

140,425 |

|

52 |

|

0.15% |

Time deposits |

493,907 |

|

4,385 |

|

3.55% |

|

440,227 |

|

1,339 |

|

1.22% |

Subordinated loans |

29,837 |

|

492 |

|

6.60% |

|

29,655 |

|

442 |

|

5.96% |

Borrowings |

110,780 |

|

896 |

|

3.24% |

|

78,232 |

|

254 |

|

1.30% |

Total interest-bearing liabilities |

1,080,330 |

|

7,611 |

|

2.82% |

|

1,051,427 |

|

2,603 |

|

0.99% |

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

169,825 |

|

|

|

|

|

189,317 |

|

|

|

|

Other liabilities |

15,768 |

|

|

|

|

|

12,248 |

|

|

|

|

Total liabilities |

1,265,923 |

|

|

|

|

|

1,252,992 |

|

|

|

|

Shareholders' equity |

116,093 |

|

|

|

|

|

110,669 |

|

|

|

|

Total liabilities & shareholders' equity |

$1,382,016 |

|

|

|

|

|

$1,363,661 |

|

|

|

|

Net interest income |

|

|

$10,060 |

|

|

|

|

|

$10,780 |

|

|

Net interest rate spread |

|

|

|

|

2.57% |

|

|

|

|

|

3.14% |

Net interest margin |

|

|

|

|

3.07% |

|

|

|

|

|

3.32% |

Ratio of average interest-earning assets

to average interest-bearing liabilities |

|

|

|

|

121.41% |

|

|

|

|

|

123.38% |

The above information is preliminary and based on the Company's data available at the time of presentation.

13

PATHFINDER BANCORP, INC.

FINANCIAL HIGHLIGHTS

(Dollars and shares in thousands except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, |

|

(Unaudited) |

|

2023 |

|

2022 |

|

|

|

|

|

Average |

|

|

|

|

|

Average |

|

Average |

|

|

|

Yield / |

|

Average |

|

|

|

Yield / |

(Dollars in thousands) |

Balance |

|

Interest |

|

Cost |

|

Balance |

|

Interest |

|

Cost |

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

Loans |

$900,917 |

|

$34,919 |

|

5.17% |

|

$863,191 |

|

$27,561 |

|

4.26% |

Taxable investment securities |

371,615 |

|

12,749 |

|

4.57% |

|

348,499 |

|

7,850 |

|

3.00% |

Tax-exempt investment securities |

31,077 |

|

1,441 |

|

6.18% |

|

37,593 |

|

612 |

|

2.17% |

Fed funds sold and interest-earning deposits |

11,750 |

|

226 |

|

2.56% |

|

19,950 |

|

48 |

|

0.32% |

Total interest-earning assets |

1,315,359 |

|

49,335 |

|

5.00% |

|

1,269,233 |

|

36,071 |

|

3.79% |

Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

Other assets |

99,431 |

|

|

|

|

|

85,652 |

|

|

|

|

Allowance for credit losses |

(18,043) |

|

|

|

|

|

(13,040) |

|

|

|

|

Net unrealized losses

on available-for-sale securities |

(12,919) |

|

|

|

|

|

(7,230) |

|

|

|

|

Total assets |

$1,383,828 |

|

|

|

|

|

$1,334,615 |

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

$94,116 |

|

$315 |

|

0.45% |

|

$104,874 |

|

$234 |

|

0.30% |

Money management accounts |

14,651 |

|

12 |

|

0.11% |

|

16,212 |

|

12 |

|

0.10% |

MMDA accounts |

241,550 |

|

4,539 |

|

2.51% |

|

255,933 |

|

985 |

|

0.51% |

Savings and club accounts |

127,490 |

|

199 |

|

0.21% |

|

139,798 |

|

150 |

|

0.14% |

Time deposits |

472,614 |

|

10,820 |

|

3.05% |

|

401,297 |

|

2,625 |

|

0.87% |

Subordinated loans |

29,793 |

|

1,447 |

|

6.48% |

|

29,617 |

|

1,284 |

|

5.78% |

Borrowings |

99,029 |

|

2,243 |

|

3.02% |

|

70,833 |

|

557 |

|

1.05% |

Total interest-bearing liabilities |

1,079,243 |

|

19,575 |

|

2.42% |

|

1,018,564 |

|

5,847 |

|

0.77% |

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

174,143 |

|

|

|

|

|

194,220 |

|

|

|

|

Other liabilities |

16,100 |

|

|

|

|

|

11,808 |

|

|

|

|

Total liabilities |

1,269,486 |

|

|

|

|

|

1,224,592 |

|

|

|

|

Shareholders' equity |

114,342 |

|

|

|

|

|

110,023 |

|

|

|

|

Total liabilities & shareholders' equity |

$1,383,828 |

|

|

|

|

|

$1,334,615 |

|

|

|

|

Net interest income |

|

|

$29,760 |

|

|

|

|

|

$30,224 |

|

|

Net interest rate spread |

|

|

|

|

2.58% |

|

|

|

|

|

3.02% |

Net interest margin |

|

|

|

|

3.02% |

|

|

|

|

|

3.18% |

Ratio of average interest-earning assets

to average interest-bearing liabilities |

|

|

|

|

121.88% |

|

|

|

|

|

124.61% |

The above information is preliminary and based on the Company's data available at the time of presentation.

14

PATHFINDER BANCORP, INC.

FINANCIAL HIGHLIGHTS

(Dollars and shares in thousands except per share amounts)

Net interest income can also be analyzed in terms of the impact of changing interest rates on interest-earning assets and interest bearing liabilities, and changes in the volume or amount of these assets and liabilities. The following table represents the extent to which changes in interest rates and changes in the volume of interest-earning assets and interest-bearing liabilities have affected the Company’s interest income and interest expense during the years indicated. Information is provided in each category with respect to: (i) changes attributable to changes in volume (change in volume multiplied by prior rate); (ii) changes attributable to changes in rate (changes in rate multiplied by prior volume); and (iii) total increase or decrease. Changes attributable to both rate and volume have been allocated ratably. Tax-exempt securities have not been adjusted for tax equivalency.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

2023 vs. 2022 |

|

|

2023 vs. 2022 |

|

|

Increase/(Decrease) due to |

|

|

Increase/(Decrease) due to |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

Increase |

|

|

|

|

|

|

|

|

Increase |

|

(In thousands) |

Volume |

|

|

Rate |

|

|

(Decrease) |

|

|

Volume |

|

|

Rate |

|

|

(Decrease) |

|

Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

181 |

|

|

$ |

2,394 |

|

|

$ |

2,575 |

|

|

$ |

1,248 |

|

|

$ |

6,110 |

|

|

$ |

7,358 |

|

Taxable investment securities |

|

111 |

|

|

|

1,409 |

|

|

|

1,520 |

|

|

|

551 |

|

|

|

4,348 |

|

|

|

4,899 |

|

Tax-exempt investment securities |

|

(731 |

) |

|

|

887 |

|

|

|

156 |

|

|

|

(188 |

) |

|

|

1,017 |

|

|

|

829 |

|

Interest-earning deposits |

|

3 |

|

|

|

34 |

|

|

|

37 |

|

|

|

(40 |

) |

|

|

218 |

|

|

|

178 |

|

Total interest income |

|

(436 |

) |

|

|

4,724 |

|

|

|

4,288 |

|

|

|

1,571 |

|

|

|

11,693 |

|

|

|

13,264 |

|

Interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

|

(57 |

) |

|

|

96 |

|

|

|

39 |

|

|

|

(39 |

) |

|

|

120 |

|

|

|

81 |

|

Money management accounts |

|

(2 |

) |

|

|

2 |

|

|

|

- |

|

|

|

(2 |

) |

|

|

2 |

|

|

|

- |

|

MMDA accounts |

|

(317 |

) |

|

|

1,532 |

|

|

|

1,215 |

|

|

|

(95 |

) |

|

|

3,649 |

|

|

|

3,554 |

|

Savings and club accounts |

|

(41 |

) |

|

|

57 |

|

|

|

16 |

|

|

|

(22 |

) |

|

|

71 |

|

|

|

49 |

|

Time deposits |

|

182 |

|

|

|

2,864 |

|

|

|

3,046 |

|

|

|

544 |

|

|

|