Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

April 05 2017 - 6:09AM

Edgar (US Regulatory)

Filed Pursuant to 497(a)

File No. 333-202672

Rule 482ad

TICC Capital Corp.

6.50% Notes Due 2024

Final Pricing Term Sheet

April 4, 2017

|

Issuer:

|

TICC Capital Corp.

|

|

|

|

|

Title of the Securities:

|

6.50% Notes due 2024 (the “2024 Notes”)

|

|

|

|

|

Initial Aggregate Principal Amount Being Offered:

|

$57,500,000

|

|

|

|

|

Option to Purchase Additional Notes:

|

Up to an additional $8,625,000 aggregate principal amount of Notes within 30 days

|

|

|

|

|

Underwriting Discount:

|

$0.78125 per Note; $1,796,875 total (assuming the over-allotment option is not exercised)

|

|

|

|

|

Net Proceeds to the Issuer, before Expenses:

|

$24.21875 per Note; $55,703,125 total (assuming the over-allotment option is not exercised)

|

|

|

|

|

Initial Public Offering Price:

|

100% of aggregate principal amount

|

|

|

|

|

Denominations:

|

Issue the Notes in denominations of $25.00 and integral multiples of $25.00 in excess thereof

|

|

|

|

|

Principal at Time of Payment:

|

100% of the aggregate principal amount; the principal amount of each Note will be payable on its stated maturity date.

|

|

|

|

|

Type of Note:

|

Fixed rate note

|

|

|

|

|

Coupon Rate:

|

6.50% per annum

|

|

|

|

|

Day Count:

|

30/360

|

|

|

|

|

Original Issue Date:

|

April 12, 2017

|

|

|

|

|

Stated Maturity Date:

|

March 30, 2024

|

|

|

|

|

Date Interest Starts Accruing:

|

April 12, 2017

|

|

|

|

|

Interest Payment Date:

|

Every March 30, June 30, September 30, and December 30, beginning June 30, 2017. If an interest payment date falls on a non-business day, the applicable interest payment will be made on the next business day and no additional interest will accrue as a result of such delayed payment.

|

|

|

|

|

Interest Periods:

|

The initial interest period will be the period from and including April 12, 2017, to, but excluding, the initial interest payment date, and the subsequent interest periods will be the periods from and including an interest payment date to, but excluding, the next interest payment date or the stated maturity date, as the case may be.

|

|

|

|

|

Regular Record Dates for Interest:

|

March 15, June 15, September 15, December 15, beginning June 15, 2017

|

|

|

|

|

Optional Redemption:

|

The Notes may be redeemed in whole or in part at any time or from time to time at Issuer’s option on or after March 30, 2020 upon not less than 30 days nor more than 60 days written notice by mail prior to the date fixed for redemption thereof, at a redemption price of 100% of the outstanding principal amount of the Notes to be redeemed plus accrued and unpaid interest payments otherwise payable thereon for the then-current quarterly interest period accrued to the date fixed for redemption.

|

|

|

|

|

Repayment at Option of Holders:

|

Holders will not have the option to have the Notes repaid prior to the stated maturity date.

|

|

|

|

|

Listing:

|

Issuer intends to list the Notes on the NASDAQ Global Select Market, within 30 days of the original issue date under the trading symbol "TICCL."

|

|

|

|

|

CUSIP / ISIN:

|

872 44T 307 / US872 44T 3077

|

|

|

|

|

Joint Book-Running Managers:

|

Ladenburg Thalmann & Co. Inc.

BB&T Capital Markets, a division of BB&T Securities,

LLC

Compass Point Research & Trading LLC

William Blair & Company L.L.C.

|

The issuer has filed a registration statement (including

a prospectus and related prospectus supplement) with the U.S. Securities and Exchange Commission (SEC) for this offering.

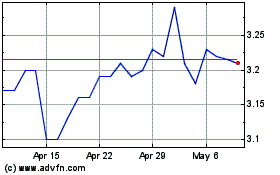

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

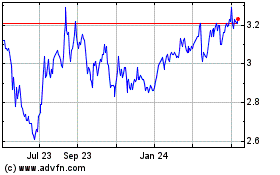

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024