UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant

|

x

|

|

|

|

|

Filed by a Party other than the Registrant

|

¨

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to Rule 14a-11(c) or

Rule 14a-12

|

TICC Capital Corp.

(Name of Registrant as Specified in Its

Charter)

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

|

¨

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously Paid:

|

|

|

(2)

|

Form,

schedule or registration statement No.:

|

TICC Capital Corp. (the "Company") has filed with

the Securities and Exchange Commission, and disseminated to its stockholders, a proxy statement and accompanying WHITE proxy card

to be used to solicit votes in connection with the Company’s Annual Meeting of Stockholders scheduled to be held on September

2, 2016.

On August 9, 2016, representatives of the Company gave a presentation

to representatives of Institutional Shareholder Services Inc. regarding the Company (the "ISS Presentation"). Slides

for the ISS Presentation are attached hereto.

August 2016 TICC Capital Corp. Investor Presentation

2 Additional Information and Where to Find It TICC has filed a definitive proxy statement on Schedule 14A and a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for TICC’s 2016 annual stockholder meeting (the “Annual Meeting”). The Company has distributed the definitive proxy statement and a WHITE proxy card to each stockholder entitled to vo te at the Annual Meeting. TICC STOCKHOLDERS ARE URGED TO READ THE COMPANY’S PROXY MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD BECAUSE THESE MATERIALS CONTAIN IMPORTANT INFORMATION ABOUT TICC AND THE ANNUAL MEETING. These documents, including any proxy statement (and amendments and supplements thereto) and other documents filed by the Company with the SEC, may be obtained fre e of charge at the SEC’s website (http://www.sec.gov), at TICC’s investor relations website (http://ir.ticc.com), or by writing to TICC at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830 (telephone number 203 - 983 - 5275). Participants in the Solicitation The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company's stockholders with respect to the Annual Meeting. Information about the Company's directors and executive officers a nd their ownership of the Company's common stock is set forth in the proxy statement on Schedule 14A filed with the SEC on July 12, 20 16 (the “Schedule 14A”). To the extent holdings of such participants in TICC securities have changed since the amounts described in t he Schedule 14A, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Chang e i n Ownership on Form 4 filed with the SEC. Forward Looking Statements This press release contains forward - looking statements subject to the inherent uncertainties in predicting future results and co nditions. Any statements that are not statements of historical fact (including statements containing the words "believes," "plans," "an tic ipates," "expects," "estimates" and similar expressions) should also be considered to be forward - looking statements. Certain factors coul d cause actual results and conditions to differ materially from those projected in these forward - looking statements. These factors are identified from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update su ch statements to reflect subsequent events, except as may be required by law.

3 ▪ Completed IPO in November 2003 as Technology Investment Capital Corp . (“TICC”) – Newly formed Business Development Company (“ BDC ”) – Initially created to invest in the debt and/or equity securities of technology - related companies – Raised $ 150 million initial IPO ▪ TICC Capital Corp. today (as of June 30 th , 2016) – $ 630 m illion portfolio composed of 94 portfolio company and CLO investments – 65 % of the portfolio is in senior secured debt – Investment portfolio marked to fair market value TICC Capital Corp. History

4 Recent Background Aug 2015 Sept. 2015 Nov. 2015 Dec. 2015 Feb. 2016 April 2016 Sept. 2016 TICC announced that an affiliate of Benefit Street Partners L.L.C. (“BSP”) had entered into an acquisition agreement with TICC Management, LLC, which required approval by TICC shareholders. Subsequently, NexPoint delivered a proposal to act as TICC Capital’s (“Company” or “TICC”) new investment adviser - TPG Specialty Lending (TSLX) sent a non - binding proposal for acquisition of all shares outstanding of TICC Capital for $7.50 per share in TSLX stock - NexPoint announced its intention to nominate a competing slate of six directors and to solicit proxies to vote against the BSP proposals at the Special Meeting TSLX revised its non - binding proposal from $7.50 per share to an all stock offer representing 90% of TICC’s net asset value per share as of the date of an agreement TICC Special Meeting held* * See Appendix for details TSLX announced its intent to nominate a director candidate at the Annual Meeting and to submit a proposal at the Annual Meeting to terminate the existing investment advisory agreement The Company’s independent directors met with Mr. T. Kelley Millet, TSLX’s nominee, to discuss the Company TICC 2016 Shareholder Meeting

5 ▪ TICC is seeking to re - elect Tonia Pankopf as an independent director ▪ TICC is seeking shareholder approval to adopt majority vote standard (in uncontested situations) for election of directors ▪ TPG Specialty Lending, Inc. has nominated its own candidate for the same board seat on TICC’s 5 - member board ▪ TSLX is soliciting TICC shareholder votes for a binding vote to terminate TICC’s investment advisory agreement with the external manager, TICC Management, LLC 2016 Shareholder Meeting – To Be Held on Sept. 2, 2016

6 ▪ After 2015 Special Meeting, Board reached out to top 20 investors and had dialogue with nine ▪ Significant Reduction in Advisory Fees – In March 2016 , TICC Management agreed to a series of ongoing fee waivers (effective April 1 , 2016 ) with respect to its management fee and income incentive fee – Base management fee reduction by 50 basis points to 1 . 50 % – No base management fee on funds received in connection with capital raises until they are invested – Fixed hurdle rate of 7 . 0 % for incentive income fee as opposed to previous variable rate – The calculation of TICC’s income incentive fee was revised* – The income incentive fee incorporated a “catch - up” provision** Aggregate fees earned under the fee waivers cannot be higher than what aggregate fees would have been prior to the adoption of these changes * Revised to include a total return requirement that will limit TICC’s obligation to pay TICC Management an income incentive fe e i f TICC has generated cumulative net decreases in net assets resulting from operations during the calendar quarter and the eleven precedi ng quarters due to unrealized or realized net losses on investments ** Catch - up provision provides that TICC Management will receive 100% of TICC’s net investment income with respect to that porti on of such net investment income, if any, that exceeds the preferred return but is less than 2.1875% quarterly (8.75% annualized) and 20% of an y net investment income thereafter TICC Board Is Responsive to Shareholder Feedback

7 ▪ Independent Chairman − Steve Novak, independent director and Chair of Special Committee formed in 2015, was appointed Chairman of the Board in March 2016 ▪ Comprehensive Review of Alternatives − Special Committee of TICC's board considered wide range of alternatives from January to April 2016. The Committee was assisted by Morgan Stanley and Wachtell , Lipton, Rosen & Katz − Among others, considered status quo, TICC Management's updated investment strategy, new external adviser, internalizing management, sale of company, liquidation − Determined that executing TICC Management's updated investment strategy was in stockholders' best interests ▪ Share repurchase − Repurchased $51.6 million of shares since Jan. 2015 ($25.6 million during 1Q2016) − 8.8 million shares repurchased represent 14.6% of shares outstanding as of Dec. 31, 2014 TICC Board Is Responsive to Shareholder Feedback (contd.)

8 ▪ Invest in higher - yielding corporate debt securities that are held on a less levered basis short term ▪ De - emphasize TICC’s exposure to CLO investments over the long term ▪ Rotate out of more broadly - syndicated loans into a combination of middle market and narrowly - syndicated loans through purchases in both the primary and secondary markets. That rotation resulted in a weighted average yield increase of approximately 4.7% on $36.0 million of reinvested capital during 2Q 2016 ** ▪ As a result of portfolio rotation within CLO portfolio during 2Q2016, the weighted average effective yield (GAAP) of CLO equity investments at current cost was approximately 12.8%, compared with 8.5% as of March 31, 2016 Updated Investment Strategy Is Yielding Results 11% 11% sequential increase in Net Asset Value (NAV) per share ($6.54 vs. $5.89 in 1Q2016) NAV/share 62% 62.5% sequential increase in GAAP Net Investment Income (NII) ($0.13 vs $0.08 in 1Q2016) GAAP NII 10% 10.3% sequential increase in Core Net Investment Income (NII) per share ($0.32 vs $0.29 in 1Q2016. See Appendix for reconciliation of GAAP NII and Core NII) Core NII 80bps *80bps increase in weighted average yield of cash income producing securities (at current cost) to 14.1% – the highest in three years Portfolio Yield* 2Q2016 Result Highlight **The weighted average yield is calculated based on the exit/purchase price of the investments and the interest expected to be rece ive d using the stated rate of interest on the date of exit/purchase assuming a 5 - year exit (which is based on the Company’s historical investment assumptions) or to maturity, whichever is sooner

9 – A vote to terminate the investment advisory agreement is NOT a vote for TSLX – If investment advisory agreement is terminated, TICC would have to either sign a new investment advisory agreement, hire an internal management team, merge or liquidate – High Investment Company Act stockholder approval threshold for a new agreement is the lower of 67 % of votes cast at a quorum or over 50 % of outstanding shares – Termination would put TICC’s operations in disarray, which would place the Company’s financial performance and its quarterly distributions at risk – TSLX has publicly criticized TICC’s distribution policy, and we believe, wants to see TICC significantly reduce its distribution payments to its shareholders – Termination of the investment advisory agreement could trigger potential default under $ 240 million of CLO securitization notes – TSLX has not said how electing their board nominee would improve TICC's performance – TSLX has not clearly stated whether they want to take control of the management of TICC’s assets or what their nominee’s position is with respect to TICC’s distribution policy – If approved, TSLX’s proposal to terminate the existing Investment Advisory Agreement, could result in TICC being left with NO investment advisor, NO management team and NO operational infrastructure TSLX Proposal Creates Significant Risk and Uncertainty

Financial and Stock Price Performance

11 ▪ Strong relative performance – TICC’s Total Shareholder Return (TSR) has dramatically outperformed its peer median since the 2008 credit crisis which coincides with adoption of its current investment strategy ▪ Valuation multiple is consistent with the peer group – Contrary to TSLX assertion, TICC has traded at a valuation multiple in - line with its Peer Group* ▪ Strong Core Net Investment Income (NII) has largely funded distributions – TICC has generated strong returns on its CLO equity investments ( 25 . 8 % at current cost as of 2 Q 2016 ) – Due to high levels of cash income received from CLO investments, the gap between Core NII and GAAP NII has widened (see Appendix for details) – Most of the distribution has been funded by Core NII – Core NII includes actual cash received from investments – Change in NAV is primarily due to unrealized losses TICC has Delivered on its Investment Objectives *Peer Group: AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC, and TCRD.

12 ▪ Advisory fee is below peer median – LTM Advisory Fee as % of Avg . Assets and Total Investments is below Peer Group* . – Advisory Fee as % of NII is lower than the Peer Group* TICC has Delivered on its Investment Objectives – (contd.) *Peer Group: AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC, and TCRD.

13 TICC’s TSR Has Outperformed Its Peers Since 2008 Source: SNL Financial. Data as of 8/5/2016 Notes: Peers include externally - managed BDCs with >$100MM market capitalization and pre - 2009 IPOs, and externally - managed BDCs with $250 - 750MM market capitalization; peers include AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC,TCRD TICC: +292% (100.00) (50.00) 0.00 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 450.00 12/31/2008 3/25/2009 6/17/2009 9/9/2009 12/2/2009 2/24/2010 5/19/2010 8/11/2010 11/3/2010 1/26/2011 4/20/2011 7/13/2011 10/5/2011 12/28/2011 3/21/2012 6/13/2012 9/5/2012 11/28/2012 2/20/2013 5/15/2013 8/7/2013 10/30/2013 1/22/2014 4/16/2014 7/9/2014 10/1/2014 12/24/2014 3/18/2015 6/10/2015 9/2/2015 11/25/2015 2/17/2016 5/11/2016 8/3/2016 Total Shareholder Return (12 - 31 - 2008 to 8 - 5 - 2016) TICC TICC BDC Peers S&P 500 (%) BDC Peers: +146% S&P 500: +185%

14 TICC Has Traded at a Price/NAV Consistent With Its Peers 0.87 0.87 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Price/NAV Multiple 12 - 31 - 2008 to 8 - 5 - 2016 TICC Peer Median Source: FactSet. Data as of 8/5/2016 Notes: Peers include AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC, and TCRD

15 TICC’s Advisory Fee as % of Avg. Assets Is Below Peer Median 3.4 3.3 3.1 3.0 2.7 2.7 2.7 2.6 2.5 2.5 2.3 2.2 2.0 1.7 1.5 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 PSEC TSLX PNNT MCC AINV TCRD FSC ARCC GSBD GAIN SLRC GLAD TICC BKCC TCPC LTM Advisory Fees (ending 2Q2016*)/Average Assets Peer Median (excl TSLX): 2.6% % Source: SEC filings. * 2Q2016 available for TICC, ARCC, BKCC, GAIN, SLRC, TSLX only. All other peers based on 1Q2016 data.

16 TICC’s Fees to External Advisor Are Consistent With Peer Median 28.0 27.8 27.2 26.6 26.5 25.4 23.7 23.7 23.5 23.4 22.2 20.9 18.6 14.7 12.6 0.0 5.0 10.0 15.0 20.0 25.0 30.0 SLRC PSEC TSLX PNNT FSC MCC ARCC GAIN AINV TICC TCRD GSBD GLAD BKCC TCPC LTM Advisory Fees (ending 2Q2016*)/Total Investment Income Peer Median (excl. TSLX): 23.7% Source: SEC filings. * 2Q2016 available for TICC, ARCC, BKCC, GAIN, SLRC, TSLX only. All other peers based on 1Q2016 data.

Distributions and Net Asset Value (NAV)

18 TICC’s Investment in CLOs Resulted in High Cash Returns 9.2% 8.5% 8.7% 8.7% 8.4% 8.2% 8.1% 7.8% 7.7% 7.6% 7.2% 7.1% 7.1% 7.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Portfolio Yield vs. CLO Equity Cash Yield Wtd. Avg. GAAP yield of debt investments Wtd. Avg. cash distribution yield of cash income producing CLO equity investments Source: SEC filings. TICC Investor Presentations.

19 Widening Gap between Core NII and GAAP NII $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Net Investment Income (NII) Comparison (per share) GAAP NII Core NII Source: SEC filings. TICC Investor Presentations.

20 Distributions to Shareholders Have Largely Come from Core NII $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Source of Distributions (per share) Core NII GAAP NII Distributions declared and paid Core NII % of Distributions 83% 86% 97% 103% 100% 97% 97% 72% 141% 110% 117% 90% 104% 110% Source: SEC filings. TICC Investor Presentations.

21 NAV Has Been Impacted by Unrealized Losses 6.54 (4.04) (1.97) (0.43) 9.90 3.06 0.02 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 Beginning FY2013 NAV Cum. GAAP NII Others Distributions Unrealized Gains/(Losses) Realized Gains/(Losses) 2Q'16 NAV TICC NAV Per Share Bridge Source: SEC filings. TICC Investor Presentations.

Our Nominee

23 – Director since 2003 – Managing Partner of Pareto Advisors, LLC, an investment management consulting business, since 2005 – Member of the Board of Directors of Landec Corporation (NASDAQ : LNDC), and serves on its Corporate Governance and Nominating Committee and chairs its Audit Committee – Extensive knowledge and experience in the investment management industry - Senior Analyst and Managing Director at Palladio Capital Management, LLC. from 2004 through 2005 - Technology Analyst and Portfolio Manager with P.A.W. Capital Partners, LP from 2001 to 2003 - Senior Analyst and Vice President at Goldman, Sachs & Co. from 1999 to 2001 & at Merrill Lynch & Co. from 1998 to 1999 – Member of the Board of Directors of the University System of Maryland Foundation from 2006 to 2012 – Designated as a National Association of Corporate Directors (NACD) Leadership Fellow by the NACD – Received a Bachelor of Arts degree, summa cum laude, from the University of Maryland and an Master of Science degree from the London School of Economics – Brings diverse perspective to the Board along with valuable knowledge of corporate governance Our Nominee - Tonia L. Pankopf

24 T. Kelley Millet - TSLX Nominee – TICC’s independent directors interviewed Mr . Millet on April 22 , 2016 , their views are presented below : Tonia Pankopf T. Kelley Millet 1940 Act/ BDC Experience x FASB ASC 820 Fair Valuation of Illiquid Investments x Portfolio Origination Experience Broad Credit Experience Finance/ Accounting Expertise x x Capital markets x x Senior Management/ Leadership Experience x x Diversity x Corporate Governance x Public/ Shareholder relations x Director Recruitment/Succession Matrix

Appendix

26 December 2015 Special Meetings ▪ TICC Capital sought shareholder approval for a new investment advisory agreement in connection with proposed majority acquisition of TICC Management, LLC (TICC’s external advisor) by Benefit Street Partners L.L.C. ▪ Transaction would have resulted in Benefit Street Partners managing the portfolio, with TICC Management owners retaining 24.9% interest in the manager ▪ Board believed that Benefit Street’s involvement could help TICC shift its investment focus to more high - yielding, originated or narrowly syndicated corporate debt securities. The Company's investment advisor has since undertaken those changes with strong initial results ▪ TSLX and NexPoint Partners, L.P. both ran proxy campaigns against the new investment advisory agreement, creating significant confusion regarding the new advisor – 57.6% of shares voted were in favor of new investment advisory agreement between TICC and Benefit Street Partners. – Vote was not sufficient to meet the required approval standard under the Investment Company Act of the lower of 67 % of votes cast at a quorum or over 50 % of outstanding shares 2015 Special Meeting

27 As a business development company, TICC Capital has elected to be treated, and intends to qualify annually, as a RIC under Subchapter M of the Code, beginning with our 2003 taxable year. As a RIC, TICC generally will not have to pay corporate - level U.S. federal income taxes on any income that it distributes to the stockholders as dividends. To continue to qualify as a RIC, TICC must , among other things, meet certain source - of - income and asset diversification requirements. In addition, to qualify for RIC tax treatment TICC must distribute to stockholders , for each taxable year, at least 90% of “ investment company taxable income ”. Distribution Requirements for TICC Source: Section 852(a)(1)(A) of the Internal Revenue Code of 1986, as amended.

28 22.0% 14.4% 13.8% 8.7% 6.2% 4.4% 3.7% 3.6% 3.6% 3.1% 2.5% 2.2% 2.2% 2.1% 2.1% 1.9% 1.3% 1.0% 1.0% telecommunication services printing and publishing business services financial intermediaries consumer services software utilities diversified insurance healthcare chemicals logistics radio and television leisure goods travel IT consulting computer hardware aerospace and defense education Other ▪ $ 629 . 7 million portfolio 1 composed of 94 unique investments ▪ Average investment by fair value represents 1 . 1 % of total portfolio 1 ▪ Top 10 unique investments by fair value represent 25 . 2 % of total portfolio 1 , 5 Investment Portfolio Investment Portfolio by Asset Type 1 Investment Portfolio by Industry 1,3 65.5% of TICC’s investments are in senior secured debt 1 1. At fair value as of 6/30/16. 2. “Other” includes: subordinated notes, common stock, preferred equity and earnout rights. 3. Excludes CLO equity and CLO debt investments. 4. “Other” includes pharmaceuticals and retail. 5. Does not combine different investments in the same company or CLO vehicle. 4 First - Lien 51.5% Second - Lien 14.0% CLO Debt 1.0% CLO Equity 31.6% Other 2 1.8%

29 Quality Portfolio TICC’s debt portfolio has a weighted - average internal credit grade of 2 . 2 1 Closer monitoring is required. Full repayment of the outstanding amount of TICC’s cost basis and interest is expected for the specific tranche. A reduction of interest income has occurred or is expected to occur. Full repayment of the outstanding amount of TICC’s cost basis is expected for the specific tranche. Company is ahead of expectations and/or outperforming financial covenant requirements and such trend is expected to continue . Grade 1 Grade 2 Grade 3 Grade 4 Grade 5 Portfolio Grading 1. At fair value as of 6/30/16. Grade 2 83.4% Grade 3 13.9% Grade 5 2.7% Full repayment of the outstanding amount of TICC’s cost basis and interest is expected, for the specific tranche. Full repayment of the outstanding amount of TICC’s cost basis is not expected for the specific tranche.

30 Reconciliation of Core Net Investment Income (Per Share) Note: Certain numbers may not tie to financial statements due to rounding. On a supplemental basis, we provide information relating to core net investment income, which is a non - GAAP measure. This measur e is provided in addition to, but not as a substitute for, net investment income. Our non - GAAP measure may differ from similar measures by other companies , even if similar terms are used to identify such measures. Core net investment income represents net investment income adjusted for additional cash dist rib utions received, or entitled to be received (if any, in either case), on our CLO equity investments and also excludes our capital gains incentive fee. Income from investments in the “equity” class securities of CLO vehicles, for GAAP purposes, is recorded using the effective int erest method based upon an effective yield to the expected redemption utilizing estimated cash flows, compared to the cost resulting in an effective yie ld for the investment; the difference between the actual cash received or distributions entitled to be received and the effective yield calculation is an adjustmen t t o cost. Accordingly, investment income recognized on CLO equity securities in the GAAP statement of operations differs from the cash distributions actually r ece ived by us during the period, (referred to below as “CLO equity additional distributions”). In addition, since the capital gains incentive fee, for general ly accepted accounting purposes, is based on the hypothetical liquidation of the entire portfolio (and as any capital gains incentive fee may be non - recurring), suc h fees are excluded when calculating core net investment income. We believe that core net investment income is a useful indicator of performance durin g t his period. Further, as the Regulated Investment Company (RIC) requirements are to distribute taxable earnings, and capital gains incenti ve fees may not be fully currently tax deductible, core net investment income may provide a better indication of estimated taxable income for a report ing period than does GAAP net investment income, although we can offer no assurance that will be the case as the ultimate tax character of our earnings can not be determined until tax returns are prepared after the end of a fiscal year. We note that these non - GAAP measures may not be useful indicators of taxabl e earnings, particularly during periods of market disruption and volatility. 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 3/31/2015 12/31/2014 9/30/2014 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 GAAP Net investment income $0.13 $0.08 $0.08 $0.18 $0.18 $0.21 $0.21 $0.29 $0.29 $0.33 $0.32 $0.23 $0.30 $0.23 CLO Equity Additional Distributions $0.18 $0.21 $0.18 $0.16 $0.14 $0.17 - - - - - - - - Capital gains incentive fee - - - - - - - -$0.01 -$0.01 -$0.04 -$0.02 $0.05 -$0.05 $0.01 Core net investment income $0.32 $0.29 $0.26 $0.34 $0.32 $0.38 $0.21 $0.28 $0.28 $0.29 $0.30 $0.28 $0.25 $0.24

31 TICC - Selected Peers Are More Comparable Ticker Market Value Total Assets (M) TICC $ 288 $ 667 ACAS 1,736$ 5,515$ MAIN 1,300$ 1,901$ GBDC 968$ 1,665$ HTGC 993$ 1,332$ NMFC 855$ 1,572$ TCAP 792$ 1,016$ ARCC $ 4,832 $ 9,208 PSEC $ 2,969 $ 6,246 SLRC $ 865 $ 1,639 FSC $ 806 $ 2,422 BKCC $ 607 $ 1,155 PNNT $ 522 $ 1,276 MCC $ 400 $ 1,062 TCRD $ 392 $ 751 AINV $ 1,300 $ 3,093 TCPC 803$ 1,271$ GSBD 728$ 1,131$ GAIN 246$ 506$ GLAD 189$ 311$ MVC 182$ 454$ TPG AND TICC SELECTED PEER GROUPS TICC-Selected Peers (6) TPG-Selected Peers (7) Shared Peers (8) Source: FactSet . Market value is as of 8/4/2016 and total assets is as of 3/31/2016.

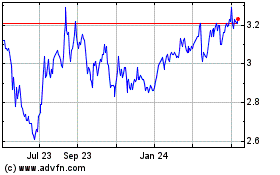

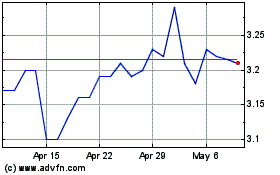

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024