UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

Current

Report Pursuant to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 10, 2016 (March 9, 2016)

TICC CAPITAL CORP.

(Exact name of registrant as specified in

its charter)

| Maryland |

000-50398 |

20-0188736 |

| (State or other jurisdiction |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| of incorporation) |

|

|

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

(Address of principal

executive offices and zip code)

Registrant’s

telephone number, including area code: (203) 983-5275

Check the appropriate box below if the Form 8-K is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under thae Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On March

9, 2016, TICC Capital Corp. (the “Company” or “TICC”), issued a press release announcing that,

in consultation with the Special Committee of the Company’s Board of Directors, TICC Management, LLC, the

Company’s investment adviser (the “Adviser”), signed a fee waiver letter (the “Letter”)

pursuant to which the following changes will take effect on April 1, 2016 with regard to the calculation of the

advisory fees under the Investment Advisory Agreement, dated July 1, 2011, between the Company and the Adviser:

| · | The base management fee will be reduced from 2.00% to 1.50%; |

| · | The Adviser has agreed to forgo the payment of any base management fees on funds received in connection

with any capital raises until the funds are invested; |

| · | The calculation of the Company’s income incentive fee will be revised to include a total

return requirement that will limit TICC’s obligation to pay the Adviser an income incentive fee if TICC has generated cumulative

net decreases in net assets resulting from operations during the calendar quarter for which such fees are being calculated and

the eleven preceding quarters (or if shorter, the number of quarters since April 1, 2016) due to unrealized or realized net losses

on investments and even in the event TICC’s net investment income exceeds the minimum

return to TICC’s stockholders required to be achieved before the Adviser is entitled to receive an income incentive

fee (which minimum return is commonly referred to as the preferred return or the hurdle rate); |

| · | The income incentive fee will incorporate a “catch-up” provision

which will provide that the Adviser will receive 100% of TICC’s net investment income with respect to that portion

of such net investment income, if any, that exceeds the preferred return but is less than 2.1875% quarterly (8.75% annualized)

and 20% of any net investment income thereafter; and |

| · | The hurdle rate used to calculate the income incentive fee will change from a variable rate based

on the five-year U.S. Treasury note plus 5.00% (with a maximum of 10%) to a fixed rate of 7.00%. |

After these changes

take effect, under no circumstances will the aggregate fees earned from April 1, 2016 by the Adviser in any quarterly period be

higher than those aggregate fees would have been prior to the adoption of these changes.

A copy of the press

release is attached hereto as Exhibit 99.1, and a copy of the Letter is attached hereto as Exhibit 10.1. The foregoing description

is qualified in its entirety by reference to the full text of the press release and the Letter, which are incorporated herein by

reference.

Item 2.02 Results of Operations and

Financial Condition

On March 10, 2016,

the Company issued a press release announcing its financial results for the quarter and year ended December 31, 2015. The text

of the press release is included as an Exhibit 99.2 to this Form 8-K.

The information disclosed

under this Item 2.02, including Exhibit 99.2 hereto, is being furnished and shall not be deemed filed for purposes of Section 18

of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities

Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

TICC Management, LLC’s Fee Waiver Letter, dated March 9, 2016 |

| |

|

|

| 99.1 |

|

Press release dated March 9, 2016 |

| |

|

|

| 99.2 |

|

Press release dated March 10, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 10, 2016 |

TICC CAPITAL CORP. |

| |

|

|

| |

By: |

/s/ Saul B. Rosenthal |

| |

|

Saul B. Rosenthal |

| |

|

President |

Exhibit 10.1

TICC Management, LLC

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

March 9, 2016

Steven P. Novak

Chairman of the Board of Directors

Chairman of the Special Committee of the Board of Directors

TICC Capital Corp.

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

| Re: | Fees Payable under Investment Advisory Agreement |

Dear Mr. Novak:

Reference is hereby

made to the Investment Advisory Agreement (the “Advisory Agreement”), dated July 1, 2011, by and between

TICC Capital Corp. (the “Corporation”) and TICC Management, LLC (the “Adviser”).

Capitalized terms used but not defined herein shall have the meaning ascribed to them in the Advisory Agreement.

Beginning with the

quarter commencing on April 1, 2016 (the “Effective Date”) and until such time as the Advisory Agreement

is otherwise modified or amended, the Adviser hereby agrees to calculate the Base Management Fee and the Incentive Fee based on

pre-Incentive Fee net investment income as indicated below (respectively referred to herein as the “Amended Management

Fee” and the “Amended Income Incentive Fee”), and to permanently waive such portion of

the Base Management Fee and the Incentive Fee based on pre-Incentive Fee net investment income that is in excess of the Amended

Management Fee and the Amended Income Incentive Fee, respectively, that the Adviser would otherwise be entitled to receive under

the Advisory Agreement prior to the Effective Date.

The

Amended Management Fee and the Amended Income Incentive Fee shall be calculated as follows:

Amended Management Fee

The Amended Management

Fee shall be calculated at an annual rate of 1.50%. The Amended Management Fee shall be payable quarterly in arrears, and shall

be calculated based on the average value of the Corporation’s gross assets at the end of the two most recently completed

calendar quarters, and adjusted pro rata for any share issuances, debt issuances, repurchases or redemptions during the

current calendar quarter; provided, however, that no Amended Management Fee shall be payable on the cash proceeds

received by the Corporation in connection with any share or debt issuances until such proceeds have been invested in accordance

with the Corporation’s investment objectives. The Amended Management Fee for any partial month or quarter shall be pro-rated.

Amended Income Incentive Fee

The Amended Income

Incentive Fee shall be determined and paid quarterly in arrears based on the amount by which (x) the “Pre-Incentive

Fee Net Investment Income” (as defined below) for the calendar quarter beginning with the calendar quarter that commences

on or after April 1, 2016 exceeds (y) the “Preferred Return Amount” (as defined below) for the calendar quarter.

For this purpose, “Pre-Incentive

Fee Net Investment Income” means interest income, dividend income and any other income (including, without limitation,

any accrued income that the Corporation has not yet received in cash and any other fees such as commitment, origination, structuring,

diligence and consulting fees or other fees that the Corporation receives from portfolio companies) accrued during the calendar

quarter, minus the Corporation’s operating expenses accrued during the calendar quarter (including, without limitation, the

Amended Management Fee, administration expenses and any interest expense and dividends paid on any issued and outstanding preferred

stock, but excluding the Amended Income Incentive Fee and the Capital Gains Fee). For the avoidance of doubt, Pre-Incentive Fee

Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or

depreciation.

The “Preferred

Return Amount” shall be determined on a quarterly basis, and shall be calculated by multiplying 1.75% by the Corporation’s

net asset value at the end of the immediately preceding calendar quarter. The Preferred Return Amount shall be calculated after

making appropriate adjustments to the Corporation’s net asset value at the end of the immediately preceding calendar quarter

for any share issuances, debt issuances, repurchases or redemptions during the calendar quarter.

The calculation of

the Amended Income Incentive Fee for each quarter shall be as follows:

(A) No

Amended Income Incentive Fee shall be payable to the Adviser in any calendar quarter in which the Corporation’s Pre-Incentive

Fee Net Investment Income does not exceed the Preferred Return Amount;

(B) 100%

of the Corporation’s Pre-Incentive Fee Net Investment Income for such quarter, if any, that exceeds the Preferred Return

Amount but is less than or equal to an amount (the “Catch-Up Amount”) determined on a quarterly basis

by multiplying 2.1875% by the Corporation’s net asset value at the end of such calendar quarter. The Catch-Up Amount is intended

to provide the Adviser with an incentive fee of 20% on all of the Corporation’s Pre-Incentive Fee Net Investment Income when

the Corporation’s Pre-Incentive Fee Net Investment Income reaches 2.1875% per quarter (8.75% annualized) for such quarter;

and

(C) For

any quarter in which the Corporation’s Pre-Incentive Fee Net Investment Income exceeds the Catch-Up Amount, the Amended Income

Incentive Fee shall equal 20% of the amount of the Corporation’s Pre-Incentive Fee Net Investment Income for such quarter;

provided that, no Amended Income

Incentive Fee shall be payable except to the extent 20% of the “cumulative net increase in net assets resulting from operations”

during the calendar quarter for which such fees are being calculated and the eleven (11) preceding quarters (or the appropriate

portion thereof in the case of any of the Corporation’s first eleven calendar quarters that commence on or after April 1,

2016) exceeds the cumulative Amended Income Incentive Fees accrued and/or paid pursuant hereto for such eleven (11) preceding quarters

(or the appropriate portion thereof in the case of any of the Corporation’s first eleven calendar quarters that commences

on or after April 1, 2016). For the foregoing purpose, the “cumulative net increase in net assets resulting from operations”

is the amount, if positive, of the sum of Pre-Incentive Fee Net Investment Income, realized gains and losses and unrealized appreciation

and depreciation of the Corporation for the calendar quarter for which such fees are being calculated and the eleven (11) preceding

calendar quarters (or the appropriate portion thereof in the case of any of the Corporation’s first eleven calendar quarters

that commence on or after April 1, 2016).

Aggregate Fee Limitation

The Adviser will continuously

calculate the aggregate fees payable to it by the Corporation under the revised fee structure described herein (the “New

Fee Structure”) and the fee structure described in the Advisory Agreement (the “Prior Fee Structure”),

and if, at any time after the Effective Date, the aggregate fees under the New Fee Structure for any quarter would be greater than

the aggregate fees under the Prior Fee Structure for such quarter, the Corporation shall only be required to pay the Adviser the

lower of these two amounts.

Sincerely yours,

| |

TICC Management, LLC |

|

| |

|

|

|

| |

By: |

/s/ Jonathan H. Cohen |

|

| |

|

Name: Jonathan H. Cohen |

|

| |

|

Title: Chief Executive Officer |

|

Exhibit 99.1

TICC ANNOUNCES

INVESTMENT ADVISORY FEE WAIVER ARRANGEMENT INTENDED TO BE “BEST-IN-CLASS”

Base Management

Fees Reduced from 2.00% to 1.50%, Among Other Provisions

Names Independent

Director, Steve Novak, Chairman of the Board

GREENWICH, CT – March 9, 2016 – TICC Capital

Corp. (NASDAQ: TICC) (“TICC” or the “Company”) today announced that TICC Management, LLC (“TICC Management”),

in consultation with the Special Committee of the Board of Directors, has agreed to a series of ongoing fee waivers with respect

to its management fee and income incentive fee. These changes follow a comprehensive process led by the Special Committee of the

Board of Directors, including a detailed analysis of best-in-class practices in the industry, conducted with the assistance of

its financial advisor, Morgan Stanley & Co. LLC.

Under the terms of the fee waiver, which will take effect on

April 1, 2016:

| · | The base management fee will be reduced from 2.00% to 1.50%; |

| · | TICC Management has agreed to forgo the payment of any base management fees on funds received in connection with any capital

raises until the funds are invested; |

| · | The calculation of the Company’s income incentive fee will be revised to include a total return requirement that will

limit TICC’s obligation to pay TICC Management an income incentive fee if TICC has generated cumulative net decreases in

net assets resulting from operations during the calendar quarter for which such fees are being calculated and the eleven preceding

quarters (or if shorter, the number of quarters since April 1, 2016) due to unrealized or realized net losses on investments and

even in the event TICC’s net investment income exceeds the minimum return to TICC’s

stockholders required to be achieved before TICC Management is entitled to receive an income incentive fee

(which minimum return is commonly referred to as the preferred return or the hurdle rate); |

| · | The income incentive fee will incorporate a “catch-up” provision which will

provide that TICC Management will receive 100% of TICC’s net investment income with respect to that portion of such net investment

income, if any, that exceeds the preferred return but is less than 2.1875% quarterly (8.75% annualized) and 20% of any net investment

income thereafter; and |

| · | The hurdle rate used to calculate the income incentive fee will change from a variable rate based on the five-year U.S. Treasury

note plus 5.00% (with a maximum of 10%) to a fixed rate of 7.00%. |

After these changes take effect, under no circumstances will

the aggregate fees earned from April 1, 2016 by TICC Management in any quarterly period be higher than those aggregate fees would

have been prior to the adoption of these changes.

“We firmly believe that the changes made under the fee

waiver have resulted in a fee arrangement that is now best-in-class in the BDC industry, and are intended to more closely align

the financial incentives of the manager with the interests of TICC’s stockholders,” said Steve Novak, the Chairman

of the Special Committee of TICC's Board of Directors.

The Board also determined to have an independent Chairman of

the Board and announced that Steve Novak has been named Chairman of the Board, effective March 1, 2016.

Peter O’Brien, Independent Director of the Board said,

“We are pleased to name Steve, an independent director, as Chairman, which we believe is in accordance with good corporate

governance practices.”

Mr. Novak has served as an independent director of TICC Capital

since 2003. He is Chairman of the Board of Directors and Chief Executive Officer of Quisk, Inc., an early stage mobile payments

company, and is the Founder and former Chairman of the Board of Directors of Mederi Therapeutics Inc., a medical device company.

Until July 2010, Mr. Novak also served on the Board of Directors of CyberSource Corporation, an Internet based e-payments processing

company acquired by Visa in 2010, where he most recently served as the Lead Independent Director and Chairman of the Nominating

Committee. A CFA, Mr. Novak previously served as President of Palladio Capital Management, LLC and as the Principal and Managing

Member of the General Partner of Palladio Partners, LP, an equities hedge fund, from July 2002 until July 2009. Mr. Novak received

a Bachelor of Science degree from Purdue University and an M.B.A. from Harvard University.

This press release only contains a summary of certain terms

of the fee waiver letter. For the full terms and conditions of the fee waiver letter, please see the exhibit to the Form 8-K filed

by TICC with the Securities and Exchange Commission relating to the fee waiver letter.

About TICC Capital Corp.

TICC Capital Corp. is a publicly-traded

business development company principally engaged in providing capital to established businesses, investing in syndicated bank loans

and purchasing debt and equity tranches of collateralized loan obligations.

Forward-Looking Statements

This press release contains forward-looking statements subject

to the inherent uncertainties in predicting future results and conditions. Any statements that are not statements of historical

fact (including statements containing the words "believes," "plans," "anticipates," "expects,"

"estimates" and similar expressions) should also be considered to be forward-looking statements. Certain factors could

cause actual results and conditions to differ materially from those projected in these forward-looking statements. These factors

are identified from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update

such statements to reflect subsequent events.

TICC Contacts

Media:

Brandy Bergman/Meghan Gavigan

Sard Verbinnen & Co

212-687-8080

Exhibit 99.2

TICC Announces Results of Operations

for the Quarter and the Year Ended December 31, 2015 and

Announces Quarterly Distribution of

$0.29 per Share

GREENWICH, CT – 03/10/2016 – TICC Capital Corp.

(NasdaqGS: TICC) (“TICC,” the “Company,” “we,” “us” or “our”) announced

today its financial results for the quarter and year ended December 31, 2015, and announced a distribution of $0.29 per share

for the first quarter of 2016.

HIGHLIGHTS

| · | For

the year ended December 31, 2015, we recorded approximately $87.5 million of total investment

income and $38.6 million of net investment income, compared to $117.3 million of total

investment income and $65.5 million of net investment income for the year ended December

31, 2014. |

| · | Our core net investment

income (“Core NII” also previously referred to as “estimated distributable

net investment income”) for the quarter ended December 31, 2015 was approximately

$0.26 per share. |

| o | Core

NII represents that portion of our estimated annual taxable net investment income available

for distribution to our common shareholders attributable to the quarter. The Company’s

distribution policy is based, to a significant extent, on our Core NII. |

| · | For

the quarter ended December 31, 2015, we recorded net investment income of approximately

$4.5 million, or approximately $0.08 per share. In the fourth quarter, we also recorded

net realized capital losses of approximately $4.2 million and net unrealized depreciation

of approximately $67.6 million. Our

CLO positions suffered significant price declines in the quarter, with $43.9 million

of that net unrealized depreciation associated with our CLO investments. In total, we

had a net decrease in net assets resulting from operations of approximately $67.3 million

or approximately $1.14 per share for the fourth quarter. |

| | |

| o | Total

investment income for the fourth quarter of 2015 amounted to approximately $18.8 million,

which represents a decrease of approximately $4.3 million from the third quarter of 2015. |

| · | For

the quarter ended December 31, 2015, we recorded investment income from our portfolio

as follows: |

| § | approximately

$10.0 million from our debt investments, |

| § | approximately

$8.5 million from our collateralized loan obligation (“CLO”) equity investments,

and |

| § | approximately

$0.3 million from all other sources. |

| o | While

reportable GAAP earnings from our CLO equity class investments for the three months ended

December 31, 2015 was approximately $8.5 million, we received or were entitled to receive

approximately $19.2 million in distributions. Our experience has been that cash flows

have historically represented a reasonable estimate of CLO equity investment taxable

earnings. In general, we currently expect our annual taxable income to be higher than

our GAAP earnings on the basis of the difference between cash distributions actually

received (and record date distributions to be received) and the effective yield income.

Our distribution policy will be based upon our estimate of that taxable income (as required

for a regulated investment company). |

| o | Our

weighted average credit rating on a fair value basis was 2.2 at the end of the fourth

quarter of 2015 (compared to 2.2 at the end of the third quarter of 2015). |

| | o | Our

total expenses for the quarter ended December 31, 2015 were approximately $14.3 million,

up from the third quarter of 2015 by approximately $2.0 million. We note that in the

4th quarter of 2015, we recognized approximately $2.6 million of incremental

expenses primarily related to the engagement of legal and financial advisors to the Company’s

Special Committee. |

| · | Our

Board of Directors has declared a distribution of $0.29 per share for the first quarter

of 2016. |

| o | Payable

Date: March 31, 2016 |

| o | Record

Date: March 17, 2016 |

| · | During

the fourth quarter of 2015, we made approximately $20.7 million in additional investments

in senior secured loans. |

| o | For

the year ended December 31, 2015, we invested approximately $234.8 million, consisting

of $173.8 million in corporate securities and $61.0 million in CLO equity. |

| o | For

the fourth quarter of 2015, we received proceeds of approximately $207.9 million from

repayments, sales and amortization payments on our debt investments. |

| · | As

of December 31, 2015, the weighted average yield of our debt investments at current cost

was approximately 7.1%, compared with 7.2% as of September 30, 2015. |

| | |

| · | As

of December 31, 2015, the weighted average effective yield (GAAP) of CLO equity investments

at current cost remained approximately 11.3%, compared with 11.3% as of September 30,

2015. |

| | |

| · | As

of December 31, 2015, the weighted average cash yield of our CLO equity investments was

approximately 27.4%, compared with 25.4% as of September 30, 2015. |

| | |

| · | As

of December 31, 2015, net asset value per share was $6.40 compared with the net asset

value per share as of September 30, 2015 of $7.81. |

| | |

| · | At

December 31st, we had one investment on non-accrual status with a cost basis of approximately

$15.5 million and a fair value of approximately $13.5 million. This loan was purchased

for a total of approximately $10.7 million in separate purchases in 2011 and 2013. |

| | |

| · | As

previously announced, TICC Funding LLC, a special purpose vehicle and wholly-owned subsidiary

of TICC, which had previously entered into a revolving credit facility (the "Facility"),

had repaid in full its $150 million of outstanding borrowings under the Facility and

had unilaterally terminated the Facility as of December 31, 2015 in accordance with its

terms. The Facility had been scheduled to mature on October 27, 2017. |

| | |

| · | Since

the November 5, 2015 authorization of our share repurchase program through March 4, 2016,

we have repurchased approximately 8.5 million shares of our common stock at a weighted

average price of approximately $5.79 for a total of approximately $49.3 million, representing

14.2% of all of our shares outstanding as of September 30, 2015. |

| | |

| · | On

March 9, 2016, TICC Management, LLC (the “Adviser”) signed a fee waiver letter

that implemented, effective as of April 1, 2016, a series of ongoing fee waivers with

respect to the base management fee and income incentive fee payable to the Adviser under

the Investment Advisory Agreement between us and the Adviser. |

Supplemental Information Regarding Core Net Investment Income

On a supplemental basis, we provide information

relating to core net investment income, which is a non-GAAP measure. This measure is provided in addition to, but not as a substitute

for, net investment income. This non-GAAP measure may differ from similar measures used by other companies, even if similar terms

are used to identify such measures. It should be noted that the current description of core net investment income differs from

prior descriptions due to the change in the method of accounting for CLO equity investment income, effective January 1, 2015.

Core net investment income represents net investment income adjusted for additional taxable income on our CLO equity investments.

Income from CLO equity investments, for

generally accepted accounting purposes, is recorded using the effective yield method. This method requires the calculation of

an effective yield to expected redemption based upon an estimation of the amount and timing of future cash flows, including recurring

cash flows as well as future principal payments; the difference between the actual cash received (and record date distributions

to be received), and the effective yield calculation is an adjustment to cost. Accordingly, investment income recognized on CLO

equity investments in the GAAP statement of operations differs from the estimated taxable net investment income (which is generally

based upon the cash distributions actually received and record date distributions to be received by us during the period), and

the resulting difference is referred to below as “CLO equity additional estimated taxable income. We believe that core net investment income is a useful indicator of performance during this period. Further, because the

regulated investment company requirements are to distribute taxable earnings, and capital gains incentive fees may not be fully

currently tax deductible, core net investment income provides a better indication of estimated taxable income for the period.

The following table provides a reconciliation of net investment

income to core net investment income for the three months and year ended December 31, 2015:

| | |

Three Months Ended

December 31, 2015 | | |

Year Ended

December 31, 2015 | |

| | |

Amount | | |

Per Share

Amounts (basic) | | |

Amount | | |

Per Share

Amounts (basic) | |

| Net investment income | |

$ | 4,510,261 | | |

$ | 0.08 | | |

$ | 38,580,922 | | |

| 0.65 | |

| CLO equity additional estimated taxable income | |

| 10,681,941 | | |

| 0.18 | | |

| 37,497,502 | | |

| 0.62 | |

| Core net investment income | |

$ | 15,192,202 | | |

$ | 0.26 | | |

$ | 76,078,424 | | |

| 1.27 | |

We will host a conference call to discuss our fourth quarter

and year end results today, Thursday, March 10, 2015 at 10:00 AM ET. Please call 888-339-0740 to participate. A replay of the

conference call will be available for approximately 30 days. The replay number is 877-344-7529, and the replay passcode is 10082261.

A presentation containing further detail regarding our year-end

and quarterly results of operations has been posted under the Investor Relations section of our website at www.ticc.com.

The following financial statements are unaudited and without

footnotes. Readers who would like additional information should obtain our Form 10-K for the period ended December 31, 2015, and

subsequent reports on Form 10-Q as they are filed.

TICC CAPITAL CORP.

CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES - UNAUDITED

| | |

December 31,

2015 | | |

December 31,

2014 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Non-affiliated/non-control investments (cost: $767,295,604 @ 12/31/15; $999,433,538 @12/31/14) | |

$ | 638,890,282 | | |

$ | 967,612,035 | |

| Affiliated investments (cost: $7,392,352 @ 12/31/15; $4,268,722 @ 12/31/14) | |

| 6,825,269 | | |

| 1,585,303 | |

| Control investments (cost: $16,750,000 @ 12/31/15; $16,800,000 @ 12/31/14) | |

| 11,000,000 | | |

| 14,960,000 | |

| Total investments at fair value (cost: $791,437,956 @ 12/31/15;

$1,020,502,260 @ 12/31/14) | |

| 656,715,551 | | |

| 984,157,338 | |

| Cash and cash equivalents | |

| 23,181,677 | | |

| 20,505,323 | |

| Restricted cash | |

| 17,965,232 | | |

| 20,576,250 | |

| Deferred debt issuance costs | |

| 3,769,875 | | |

| 5,669,747 | |

| Interest and distributions receivable | |

| 12,268,997 | | |

| 11,442,289 | |

| Securities sold not settled | |

| 7,845,706 | | |

| - | |

| Other assets | |

| 321,044 | | |

| 290,245 | |

| Total assets | |

$ | 722,068,082 | | |

$ | 1,042,641,192 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Accrued interest payable | |

$ | 2,139,866 | | |

$ | 2,596,564 | |

| Investment advisory fee and net investment income incentive fee payable to affiliate | |

| 4,195,901 | | |

| 6,183,486 | |

| Securities purchased not settled | |

| - | | |

| 11,343,179 | |

| Credit facility | |

| - | | |

| 150,000,000 | |

| Accrued expenses | |

| 3,278,587 | | |

| 629,127 | |

| Notes payable - TICC CLO 2012-1 LLC, net of discount | |

| 236,519,017 | | |

| 236,075,775 | |

| Convertible senior notes payable | |

| 115,000,000 | | |

| 115,000,000 | |

| Total liabilities | |

| 361,133,371 | | |

| 521,828,131 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| NET ASSETS | |

| | | |

| | |

| Common stock, $0.01 par value, 100,000,000 share authorized; 56,396,435

and 60,303,769 shares issued and outstanding, respectively | |

| 563,965 | | |

| 603,038 | |

| Capital in excess of par value | |

| 594,047,019 | | |

| 623,018,818 | |

| Net unrealized depreciation on investments | |

| (134,722,405 | ) | |

| (36,344,922 | ) |

| Accumulated net realized losses on investments | |

| (68,772,889 | ) | |

| (63,212,472 | ) |

| Distributions in excess of net investment income | |

| (30,180,979 | ) | |

| (3,251,401 | ) |

| Total net assets | |

| 360,934,711 | | |

| 520,813,061 | |

| Total liabilities and net assets | |

$ | 722,068,082 | | |

$ | 1,042,641,192 | |

| Net asset value per common share | |

$ | 6.40 | | |

$ | 8.64 | |

TICC CAPITAL CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED

| | |

Year Ended

December 31, 2015 | | |

Year Ended

December 31, 2014 | | |

Year Ended

December 31, 2013 | |

| | |

| | |

| | |

| |

| INVESTMENT INCOME | |

| | | |

| | | |

| | |

| From non-affiliated/non-control investments: | |

| | | |

| | | |

| | |

| Interest income - debt investments | |

$ | 48,556,075 | | |

$ | 50,855,738 | | |

$ | 52,133,176 | |

| Income from securitization vehicles and investments | |

| 34,901,766 | | |

| 59,516,739 | | |

| 47,241,423 | |

| Commitment, amendment fee income and other income | |

| 2,332,680 | | |

| 5,451,167 | | |

| 4,278,203 | |

| Total investment income from non-affiliated/non-control investments | |

| 85,790,521 | | |

| 115,823,644 | | |

| 103,652,802 | |

| From affiliated investments: | |

| | | |

| | | |

| | |

| Interest income - debt investments | |

| 300,544 | | |

| 116,738 | | |

| - | |

| Total investment income from affiliated investments | |

| 300,544 | | |

| 116,738 | | |

| - | |

| From control investments: | |

| | | |

| | | |

| | |

| Interest income - debt investments | |

| 1,371,874 | | |

| 1,384,358 | | |

| 1,439,341 | |

| Total investment income from control investments | |

| 1,371,874 | | |

| 1,384,358 | | |

| 1,439,341 | |

| Total investment income | |

| 87,462,939 | | |

| 117,324,740 | | |

| 105,092,143 | |

| EXPENSES | |

| | | |

| | | |

| | |

| Compensation expense | |

| 1,158,622 | | |

| 1,860,683 | | |

| 1,647,971 | |

| Investment advisory fees | |

| 19,770,170 | | |

| 21,150,190 | | |

| 19,096,229 | |

| Professional fees | |

| 5,690,799 | | |

| 2,149,699 | | |

| 1,996,290 | |

| Interest expense | |

| 20,936,057 | | |

| 22,907,942 | | |

| 18,960,677 | |

| Insurance | |

| 68,679 | | |

| 68,638 | | |

| 68,638 | |

| Directors' Fees | |

| 514,501 | | |

| 316,500 | | |

| 322,501 | |

| Transfer agent and custodian fees | |

| 332,796 | | |

| 284,212 | | |

| 229,124 | |

| General and administrative | |

| 1,340,326 | | |

| 1,398,064 | | |

| 1,589,758 | |

| Total expenses before incentive fees | |

| 49,811,950 | | |

| 50,135,928 | | |

| 43,911,188 | |

| Net investment income incentive fees | |

| (929,933 | ) | |

| 5,603,821 | | |

| 6,580,705 | |

| Capital gains incentive fees | |

| - | | |

| (3,872,853 | ) | |

| (1,192,382 | ) |

| Total incentive fees | |

| (929,933 | ) | |

| 1,730,968 | | |

| 5,388,323 | |

| Total expenses | |

| 48,882,017 | | |

| 51,866,896 | | |

| 49,299,511 | |

| Net investment income | |

| 38,580,922 | | |

| 65,457,844 | | |

| 55,792,632 | |

| | |

| | | |

| | | |

| | |

| Net change in unrealized depreciation/appreciation on investments | |

| | | |

| | | |

| | |

| Non-Affiliate/non-control investments | |

| (101,525,472 | ) | |

| (49,550,856 | ) | |

| (3,199,673 | ) |

| Affiliated investments | |

| 7,057,989 | | |

| 1,227,261 | | |

| - | |

| Control investments | |

| (3,910,000 | ) | |

| (990,000 | ) | |

| (43,821 | ) |

| Total net change in unrealized depreciation/appreciation on investments | |

| (98,377,483 | ) | |

| (49,313,595 | ) | |

| (3,243,494 | ) |

| | |

| | | |

| | | |

| | |

| Net realized (losses) gains on investments | |

| | | |

| | | |

| | |

| Non-Affiliated/non-control investments | |

| 425,240 | | |

| (14,788,183 | ) | |

| 6,395,596 | |

| Affiliated investments | |

| (6,762,328 | ) | |

| (4,704,466 | ) | |

| - | |

| Total net realized (losses) gains on investments | |

| (6,337,088 | ) | |

| (19,492,649 | ) | |

| 6,395,596 | |

| | |

| | | |

| | | |

| | |

| Net (decrease) increase in net assets resulting from operations | |

$ | (66,133,649 | ) | |

$ | (3,348,400 | ) | |

$ | 58,944,734 | |

| | |

| | | |

| | | |

| | |

| Net increase in net assets resulting from net investment income per common share: | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.65 | | |

$ | 1.11 | | |

$ | 1.09 | |

| Diluted | |

$ | 0.65 | | |

$ | 1.06 | | |

$ | 1.03 | |

| Net (decrease) increase in net assets resulting from operations per common share: | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.11 | ) | |

$ | (0.06 | ) | |

$ | 1.15 | |

| Diluted | |

$ | (1.11 | ) | |

$ | (0.06 | ) | |

$ | 1.09 | |

| Weighted average shares of common stock outstanding: | |

| | | |

| | | |

| | |

| Basic | |

| 59,752,896 | | |

| 58,822,732 | | |

| 51,073,758 | |

| Diluted | |

| 69,786,048 | | |

| 68,855,884 | | |

| 61,106,910 | |

TICC CAPITAL CORP.

FINANCIAL HIGHLIGHTS - UNAUDITED

| | |

Year Ended | | |

Year Ended | | |

Year Ended | | |

Year Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2013 | | |

2012 | | |

2011 | |

| Per Share Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net asset value at beginning of period | |

$ | 8.64 | | |

$ | 9.85 | | |

$ | 9.90 | | |

$ | 9.30 | | |

$ | 9.85 | |

| Net investment income(1)(3) | |

| 0.65 | | |

| 1.11 | | |

| 1.09 | | |

| 0.98 | | |

| 0.92 | |

| Net realized and unrealized capital (losses) gains(2)(3) | |

| (1.84 | ) | |

| (1.14 | ) | |

| 0.06 | | |

| 0.82 | | |

| (0.47 | ) |

| Net change in net asset value from operations | |

| (1.19 | ) | |

| (0.03 | ) | |

| 1.15 | | |

| 1.80 | | |

| 0.45 | |

| Distributions per share from net investment income | |

| (1.14 | ) | |

| (1.00 | ) | |

| (1.16 | ) | |

| (1.12 | ) | |

| (0.99 | ) |

| Distributions based on weighted average share impact | |

| 0.01 | | |

| (0.03 | ) | |

| (0.04 | ) | |

| (0.04 | ) | |

| — | |

| Tax return of capital distributions | |

| - | | |

| (0.16 | ) | |

| — | | |

| — | | |

| — | |

| Total distributions(4) | |

| (1.13 | ) | |

| (1.19 | ) | |

| (1.20 | ) | |

| (1.16 | ) | |

| (0.99 | ) |

| Effect of shares issued, net of offering expenses | |

| - | | |

| — | | |

| — | | |

| (0.04 | ) | |

| (0.01 | ) |

| Effect of shares repurchased, gross | |

| 0.08 | | |

| 0.01 | | |

| — | | |

| — | | |

| — | |

| Net asset value at end of period | |

$ | 6.40 | | |

$ | 8.64 | | |

$ | 9.85 | | |

$ | 9.90 | | |

$ | 9.30 | |

| Per share market value at beginning of period | |

$ | 7.53 | | |

$ | 10.34 | | |

$ | 10.12 | | |

$ | 8.65 | | |

$ | 11.21 | |

| Per share market value at end of period | |

$ | 6.08 | | |

$ | 7.53 | | |

$ | 10.34 | | |

$ | 10.12 | | |

$ | 8.65 | |

| Total return(5) | |

| (4.35 | )% | |

| (17.22 | )% | |

| 14.68 | % | |

| 30.49 | % | |

| (14.19 | )% |

| Shares outstanding at end of period | |

| 56,396,435 | | |

| 60,303,769 | | |

| 53,400,745 | | |

| 41,371,286 | | |

| 32,818,428 | |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets at end of period (000’s) | |

| 360,935 | | |

| 520,813 | | |

| 526,242 | | |

| 409,603 | | |

| 305,102 | |

| Average net assets (000’s) | |

| 487,894 | | |

| 560,169 | | |

| 506,093 | | |

| 363,584 | | |

| 318,305 | |

| Ratio of expenses to average net assets | |

| 10.02 | % | |

| 9.26 | % | |

| 9.74 | % | |

| 9.35 | % | |

| 4.77 | % |

| Ratio of net investment income to average net assets | |

| 7.91 | % | |

| 11.69 | % | |

| 11.02 | % | |

| 10.23 | % | |

| 9.42 | % |

| Portfolio turnover rate | |

| 24.96 | % | |

| 45.91 | % | |

| 38.22 | % | |

| 55.42 | % | |

| 38.47 | % |

| (1) | Represents per share net investment income for the period,

based upon average shares outstanding. |

| (2) | Net realized and unrealized capital gains include rounding

adjustments to reconcile change in net asset value per share. |

| (3) | During the first quarter of 2015, the Company identified

a non-material error in its accounting for income from CLO equity investments. Prospectively as of January 1, 2015, the Company

records income from its CLO equity investments using the effective yield method in accordance with the accounting guidance in

ASC 325-40, Beneficial Interests in Securitized Financial Assets, based upon an estimation of an effective yield to maturity

utilizing assumed cash flows. An out-of-period adjustment to net investment income incentive fees, in the amount of $2.4 million,

or $0.04 per share, is reflected in the year ended December 31, 2015. Prior period amounts are not materially affected. |

| | During quarter ended September 30, 2015, the Company recorded an out

of period adjustment related to a miscalculation of discount accretion which increased

interest income and increased investment cost, by approximately $1.4 million. For the

year ended December 31, 2015, approximately $1.1 million, or $0.02 per share, of the

adjustment related to prior years. The increase in the investment cost has a corresponding

effect on the investment's unrealized depreciation of the same amount. Management concluded

the adjustment was not material to previously filed financial statements. |

| (4) | Management monitors available taxable earnings, including

net investment income and realized capital gains, to determine if a tax return of capital may occur for the year. To the extent

the Company’s taxable earnings fall below the total amount of the Company’s distributions for that fiscal year, a

portion of those distributions may be deemed a tax return of capital to the Company’s stockholders. |

| (5) | Total return equals the increase or decrease of ending

market value over beginning market value, plus distributions, divided by the beginning market value per share, assuming dividend

reinvestment prices obtained under the Company’s dividend reinvestment plan, excluding any discounts. |

| (6) | The following table provides supplemental performance ratios

measured for the years ended December 31, 2015, 2014, 2013, 2012 and 2011: |

| | |

Year Ended | | |

Year Ended | | |

Year Ended | | |

Year Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2013 | | |

2012 | | |

2011 | |

| Ratio of expenses to average net assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expenses before incentive fees | |

| 10.21 | % | |

| 8.95 | % | |

| 8.68 | % | |

| 6.33 | % | |

| 3.72 | % |

| Net investment income incentive fees | |

| (0.19 | )% | |

| 1.00 | % | |

| 1.30 | % | |

| 1.50 | % | |

| 0.70 | % |

| Capital gains incentive fees | |

| 0.00 | % | |

| (0.69 | )% | |

| (0.24 | )% | |

| 1.52 | % | |

| 0.35 | % |

| Ratio of expenses, excluding interest expense, to average net assets | |

| 5.73 | % | |

| 5.17 | % | |

| 6.00 | % | |

| 7.35 | % | |

| 4.38 | % |

About TICC Capital Corp.

TICC Capital Corp. is

a publicly-traded business development company principally engaged in providing capital to established businesses, investing in

syndicated bank loans and purchasing debt and equity tranches of collateralized loan obligations. Companies interested in learning

more about financing opportunities should contact Debdeep Maji at (203) 983-5285.

Forward-Looking Statements

This press release contains forward-looking statements subject

to the inherent uncertainties in predicting future results and conditions. Any statements that are not statements of historical

fact (including statements containing the words "believes," "plans," "anticipates," "expects,"

"estimates" and similar expressions) should also be considered to be forward-looking statements. Certain factors could

cause actual results and conditions to differ materially from those projected in these forward-looking statements. These factors

are identified from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update

such statements to reflect subsequent events.

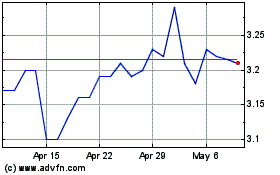

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

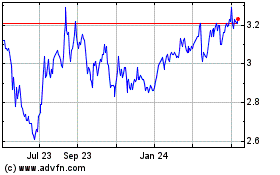

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024