Current Report Filing (8-k)

January 04 2016 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________________________

FORM 8-K

Current

Report Pursuant to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 4, 2016 (December 31, 2015)

TICC CAPITAL CORP.

(Exact name of registrant as specified in

its charter)

| Maryland |

000-50398 |

20-0188736 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

(Address of principal

executive offices and zip code)

Registrant’s

telephone number, including area code: (203) 983-5275

Check the appropriate box below if the Form 8-K is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under thae Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.02 Termination of a Material Definitive Agreement.

On January 4, 2016,

TICC Capital Corp. (the “Company”) issued a press release announcing that TICC Funding LLC, a special purpose vehicle

and wholly-owned subsidiary of the Company, which previously entered into a revolving credit facility (the "Facility")

with Citibank, N.A., has repaid in full its $150 million of outstanding borrowings under the Facility and has unilaterally terminated

the Facility as of December 31, 2015 in accordance with its terms.

The Facility was secured by a pool of loans

that had been contributed to TICC Funding by the Company. Subject to certain exceptions, pricing under the Facility was based

on the London interbank offered rate for an interest period equal to three months plus a spread of 1.50% per annum. Interest

on the borrowrings was payable quarterly in arrears. In connection with the early repayment and termination of the Facility, the

Company was required to pay a prepayment fee equal to $562,500 and aggregate breakage and administrative fees equal to approximately

$10,900. The Facility had been scheduled to mature on October 27, 2017.

A copy of the press

release announcing the completion of the Company’s repayment of outstanding borrowings under the Facility and its subsequent

termination of the Facility is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press release dated January 4, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: |

January 4, 2016 |

|

TICC CAPITAL CORP. |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

By: |

/s/ Saul B. Rosenthal |

| |

|

|

|

Saul B. Rosenthal |

| |

|

|

|

President |

| |

|

|

|

|

Exhibit 99.1

TICC Announces Full Repayment and Termination of Credit Facility

GREENWICH, CT--(Marketwired – January 4, 2016) - TICC

Capital Corp. (NASDAQ: TICC) (the "Company") announced today that TICC Funding LLC, a special purpose vehicle and wholly-owned

subsidiary of the Company, which previously entered into a revolving credit facility (the "Facility"), has repaid in

full its $150 million of outstanding borrowings under the Facility and has unilaterally terminated the Facility as of December

31, 2015 in accordance with its terms. The Facility had been scheduled to mature on October 27, 2017. This repayment is consistent

with TICC’s current strategy as discussed on the Company's November 9, 2015 conference call.

About TICC Capital Corp.

TICC Capital Corp. is a publicly-traded business development

company principally engaged in providing capital to established businesses, investing in syndicated bank loans and purchasing debt

and equity tranches of collateralized loan obligations. Companies interested in learning more about financing opportunities should

contact Debdeep Maji at (203) 983-5285.

Forward-Looking Statements

This press release contains forward-looking statements subject

to the inherent uncertainties in predicting future results and conditions. Any statements that are not statements of historical

fact (including statements containing the words "believes," "plans," "anticipates," "expects,"

"estimates" and similar expressions) should also be considered to be forward-looking statements. Certain factors could

cause actual results and conditions to differ materially from those projected in these forward-looking statements. These factors

are identified from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update

such statements to reflect subsequent events.

Contact:

Bruce Rubin

203-983-5280

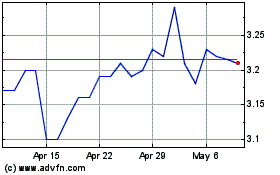

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

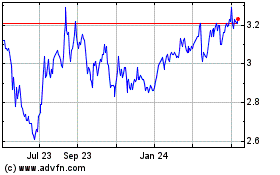

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024