|

PROSPECTUS SUPPLEMENT NO. 6

|

Filed Pursuant to Rule 424(b)(3)

|

|

(to prospectus dated July 12, 2021)

|

Registration No. 333-257438

|

NRX Pharmaceuticals,

Inc.

8,757,258 Shares of Common Stock

3,586,250 Shares of Common Stock Issuable Upon Exercise

of Warrants

________________________________

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus, dated July 12, 2021 (the “Prospectus”), related

to the resale, from time to time, of up to 8,757,258 shares of common stock, par value $0.001 per share (the “Common Stock”),

of NRX Pharmaceuticals, Inc. (“NRx”) by the selling securityholders (including their pledgees, donees, transferees

or other successors-in-interest) identified in the Prospectus (the “Selling Securityholders”) and the issuance

by NRx of up to 3,586,250 shares of Common Stock upon the exercise of outstanding warrants, with the information contained in NRx’s

Current Report on Form 8-K, which was filed with the Securities and Exchange Commission (the “SEC”) on October

21, 2021 (the “Current Report”). Accordingly, NRx has attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and, if

there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information

in this prospectus supplement.

The Common Stock is listed on the Nasdaq Global

Market (“Nasdaq”) under the symbol “NRXP” and NRx’s warrants are listed on Nasdaq under the

symbol “NRXPW”. On October 20, 2021, the closing sale price of the Common Stock as reported on Nasdaq was $11.09, and the

closing sale price of NRx’s warrants as reported on Nasdaq was $4.94.

NRx is an “emerging growth company”

under the federal securities laws and, as such, has elected to comply with certain reduced public company disclosure requirements. See

“Prospectus Summary–Implications of Being an Emerging Growth Company” beginning on page 2 of the Prospectus and

in any applicable prospectus supplement.

NRx’s business and investment in the

Common Stock involve significant risks. These risks are described in the section titled “Risk Factors” beginning on

page 5 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities commission

has approved or disapproved of the securities to be issued or sold under the Prospectus or passed upon the accuracy or adequacy of the

Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is October

21, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

October 21, 2021 (October 15, 2021)

NRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38302

|

|

82-2844431

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1201 Orange Street, Suite

600

Wilmington, Delaware

|

|

19801

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(484) 254-6134

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since last

report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.001 per share

|

|

NRXP

|

|

The Nasdaq Stock Market LLC

|

|

Warrants to purchase one share of Common Stock

|

|

NRXPW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On October 15, 2021, NRX

Pharmaceuticals, Inc. (the “Company”) entered into a Shareholder Agreement (the “Agreement”)

with Shimshon Hen and David Sepiashvili, each an Israeli citizen (collectively, the “Shareholders”), which sets

out the framework for the establishment of a new joint venture between the Company and the Shareholders (“VaccineCo”)

that will be responsible for the development and commercialization of the BriLifeTM vaccine (the “Vaccine”).

The Shareholders have worked

with the Company in successfully bidding for and signing a Memorandum of Understanding with the Ministry of Defense of the State of Israel

via the Israel Institute for Biological Research under which the Company has been granted the exclusive, worldwide right to develop the

Vaccine (the “MoU”). In addition, the Shareholders successfully assisted the Company in obtaining the emergency

use authorization for ZyesamiTM in the Nation of Georgia and continues to interface with regulatory authorities in the region.

The Agreement provides

that the Company will hold 60% of the equity interest in VaccineCo with the Shareholders holding the remaining 40%. VaccineCo is expected

to have a four-member board of directors (the “Board”), and the Company and the Shareholders will each be entitled

to appoint two members to the Board. All financial decisions of the Board will require the consent of 75% of its members. Under the Agreement,

the Company will receive 60%, and the Shareholders will receive 40%, of all net profits derived from all related rights, title and interests

in, and sales of, the Vaccine. The parties will work with the Company’s tax, regulatory and legal advisors in its selection of the

appropriate jurisdiction of formation for VaccineCo.

Among others, the Agreement

requires the Shareholders to:

|

|

·

|

take any and all necessary actions to support the negotiation and execution of an exclusive license agreement

to the Company and/or VaccineCo for the development and marketing of the Vaccine;

|

|

|

·

|

assist in obtaining all permits, licenses and approvals from all local, regional and national governmental

departments and other regulatory health authorities, including the European Medicines Agency and the World Health Organization, as applicable,

which are necessary for the Company and/or VaccineCo to advance the current clinical trials of the Vaccine in Georgia and to commence

clinical trials of the Vaccine in Ukraine and such other countries as the parties shall agree;

|

|

|

·

|

assist the Company and/or VaccineCo in furthering, organizing and/or commencing clinical trials of the

Vaccine in each of the abovementioned countries;

|

|

|

·

|

market and sell the Vaccine, once approved, in all countries of the Caucasus region, Russia, Peru, and

such other countries as the parties shall agree; and

|

|

|

·

|

pay 40% of all costs of developing, marketing, and selling the Vaccine.

|

In consideration for the

Shareholders’ commencement of work under the Agreement as consultants to the Company prior to the formation of VaccineCo, the Agreement

provides that the Company will grant the Shareholders 4,000,000 shares of the Company’s common stock, par value $0.001 per share

(the “Shares”). On October 20, 2021, the Shares were issued by the Company to the Shareholders under the Company’s

2021 Omnibus Incentive Plan.

The Agreement contains

standard and customary provisions relating to confidentiality, protection of the Company’s intellectual property rights and compliance

with applicable laws, including the Foreign Corrupt Practices Act, and the Company’s procedures for engaging sales agents and other

local representatives to assist the Shareholders in the performance of their services. The Agreement has a term contemporaneous with the

Company’s involvement with the Vaccine under the MoU or any license granted pursuant thereto. Either party may terminate the Agreement

with thirty (30) days’ prior written notice following a breach by the other party.

The Agreement does not

purport to include all matters that will need to be addressed between the Company and the Shareholders in connection with the establishment

and operation of VaccineCo, but is intended to serve as a framework for commencing work and may be amended to address additional issues

as the development of the Vaccine progresses.

The Company has been granted

a business charter in Luxembourg for Succursale(s) luxembourgeoise(s) de NRx Pharmaceuticals, Inc. (the Luxembourg branch of NRx Pharmaceuticals,

Inc.). The registered business purpose as stated in the business charter is to develop and market pharmaceuticals and vaccines against

COVID-19 and depression.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

|

NRX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

Date:

|

October 21, 2021

|

By:

|

/s/ Alessandra Daigneault

|

|

|

|

|

Name:

|

Alessandra Daigneault

|

|

|

|

|

Title:

|

General Counsel and Corporate Secretary

|

|

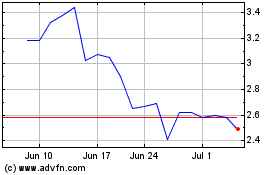

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

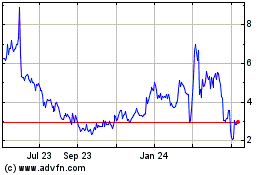

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Apr 2023 to Apr 2024