0000711377false--05-3100007113772023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 25, 2023 |

Neogen Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Michigan |

0-17988 |

38-2367843 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

620 Lesher Place |

|

Lansing, Michigan |

|

48912 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 517 372-9200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.16 par value per share |

|

NEOG |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Severance Letter Agreements

In order to align with market practices and enhance retention of Named Executive Officers, on October 26, 2023, Neogen Corporation (the “Company”) entered into letter agreements (collectively, the “Severance Letter Agreements”) with John E. Adent (the Company’s Chief Executive Officer), Douglas E. Jones, David H. Naemura and Amy M. Rocklin (collectively, Company Named Executive Officers) as well as certain other Company corporate officers (collectively “Participants”). The Severance Letter Agreements provide eligibility to the Participants to receive the termination benefits described below. The Severance Letter Agreements were developed by the Compensation Committee with the Company’s compensation consultant and approved unanimously by the Board of Directors.

The summary below of the material terms of the form of Severance Letter Agreement applicable to the Participants is qualified in its entirety by reference to the full text of the form of Severance Letter Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1, and is incorporated herein by reference.

The Severance Letter Agreements provide the Participants with certain payments and benefits (i) following specified termination events and (ii) following specified termination events subsequent to a change of control of the Company. The Severance Letter Agreements supersede prior severance plans or arrangements, including any prior severance plans or arrangements in any employment agreements that contain applicable severance provisions.

Under the Severance Letter Agreements, a Participant will receive the following payments and benefits if the Company determines that (i) the Participant resigned for Good Reason (as defined in the Severance Letter Agreements) or (ii) the Participant was involuntarily terminated by the Company for reasons other than for Cause (as defined in the Severance Letter Agreements):

•Two times (Chief Executive Officer) or equal to (other Named Executive Officers) the Participant’s base salary, payable ratably over a period of twelve months, in accordance with the Company’s regular payroll practices;

•Participant’s financial year Target Bonus opportunity (as defined in the Severance Letter Agreements), in a lump sum in the first payment of the Severance Benefits; and

•During the severance period (subject to specified events that would terminate such payments on an earlier date), an amount equal to the full cost of continuation coverage premiums under COBRA for the Participant.

If the Participant resigns for Good Reason or the Participant is involuntarily terminated by the Company for reasons other than for Cause, in each case within 12 months following a Change in Control (as defined in the Severance Letter Agreements), a Participant will receive the Severance Benefits described above as well as full acceleration of vesting of all outstanding equity-based awards granted to the Participant by the Company.

The right to receive payments and benefits under the Severance Letter Agreements is subject to the Participant’s delivery and non-revocation of a valid waiver and release of claims and any other document deemed appropriate by the Company. Payments will be delayed until the effectiveness of the release and, as required, by Section 409A of the Internal Revenue Code of 1986, as amended. Upon a determination by the Company that the Participant has engaged in Detrimental Activity (as defined in the Severance Letter Agreements), the payments and benefits under the Severance Letter Agreements will cease and prior payments and benefits would be subject to recovery.

Retention Bonus for David Naemura

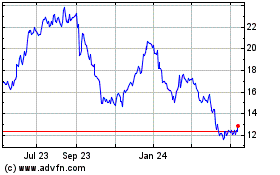

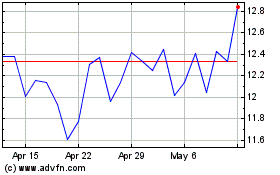

As an additional mechanism to retain critical talent, the Board of Directors of the Company approved a one-time grant of options (the “Retention Bonus”) on October 26, 2023 (the “Grant Date”), for David H. Naemura, the Company's Chief Financial Officer. The options have an aggregate value of $2,200,000 at an exercise price equal to the closing price of the Company’s common stock on the Grant Date. The options are subject to a “double trigger” of stock performance and time, such that they will be eligible to vest based on achievement of a stock price hurdle (the “Stock Price Hurdle”) in three approximately equal installments. Each installment of the Retention Bonus will vest on the anniversaries of the Grant Date if the Stock Price Hurdle has been achieved. If the Stock Price Hurdle has not been achieved on an anniversary of the Grant Date, the installment will vest on the date on which the Stock Price Hurdle is achieved. Achievement of the Stock Price Hurdle requires substantial growth in the Company’s stock price, with the Stock Price Hurdle representing a twenty percent (20%) price appreciation over the closing price of the Company’s common stock as of the Grant Date. The options will be eligible to vest during a seven-year performance period from the Grant Date. The Retention Bonus was granted pursuant to, and is subject to the terms and conditions of, the Company’s 2023 Omnibus Incentive Plan and, except as otherwise provided herein, the Company’s form of option agreement.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On October 26, 2023, the Board of Directors of the Company approved the amended and restated bylaws (the bylaws, as so amended and restated, the “Amended and Restated Bylaws”), effective immediately. The Amended and Restated Bylaws have been updated to enhance and modernize the Company’s corporate governance, including among other things:

•Expressly providing for any shareholder or board meeting to be held virtually or via means of remote communication and for the electronic transmission of notices for shareholder and board meetings (to the extent allowed under applicable law).

•Enhancing and modernizing the procedural mechanics and disclosure requirements in connection with potential shareholder nominations of directors and submission of shareholder proposals at shareholder meetings, including, among others, the following:

oRequiring the notice of director nomination or other business to be presented to be delivered to the Company no earlier than 120 days and not later than 90 days (previously no earlier than 90 days and not later than 60 days) prior to the anniversary date of the preceding year’s annual meeting;

oRequiring additional disclosures and representations from nominating or proposing shareholders, proposed nominees and other persons associated with nominating or proposing shareholders;

oRequiring that proposed nominees make themselves available for and submit to interviews by the Board or any Board committee within 10 days following the date of any reasonable request therefor from the Board or any Board committee; and

oPermitting the Company to disregard a nomination or business if the proposing shareholders (or a qualified representative) do not appear at the meeting.

•Providing that the nomination of any director nominee proposed by a shareholder in a nomination notice shall be disregarded and no vote on the election of such proposed nominee shall occur (notwithstanding that proxies in respect of such vote may have been received by the Company) if, after such shareholder or any shareholder associated person provides notice pursuant to Rule 14a-19(b) under the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) with respect to such proposed nominee, such shareholder or shareholder associated person either (A) notifies the Company that such shareholder or shareholder associated person no longer intends to solicit proxies in support of the election of such proposed nominee in accordance with Rule 14a-19 under the Exchange Act or (B) fails to comply with the requirements of Rule 14a-19 under the Exchange Act.

•Removing the ability of the President to call a special meeting of shareholders, but retaining the ability of a majority of the Board and of the holders of 50% or more of the Company’s issued and outstanding common shares to call a special meeting.

•Requiring the location of the annual meeting of shareholders to be where the Board may determine.

•Clarifying how shareholder meetings can be adjourned and the mechanics around notice relating thereto.

•Clarifying and modernizing (i) quorum and voting standards and (ii) election and proxy procedures.

•Modernizing and clarifying the powers of the Board, including clarifying the duties of the chair of the Board, clarifying that any director elected or appointed to fill any director vacancies will serve for the remainder of the term of the Board class, clarifying the powers of Board committees and clarifying the timing and process requirements of Board meetings and Board action.

•Modernizing and clarifying the powers of officers of the Company.

•Clarifying that indemnification for directors and officers is mandatory and providing additional detail on indemnification and advance expenses for directors, officers and employees (as applicable).

•Requiring the Company’s registered office to be in Michigan and permitting any other office to be where the Board may from time to time determine.

•Making various other non-substantive updates and ministerial and conforming changes.

The foregoing summary of the Amended and Restated Bylaws does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amended and Restated Bylaws, which is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On October 25, 2023, the Company held its 2023 Annual Meeting of Shareholders. At the meeting, 203,160,554 of the 216,310,582 shares outstanding and entitled to vote were present and voted. The matters listed below were submitted to a vote of the shareholders though the solicitation of proxies. The proposals are described in detail in the Company’s Proxy Statement dated as of, and filed with Securities and Exchange Commission on, September 18, 2023. The voting results are as follows:

Proposal 1 – Election of Directors

|

|

|

|

|

|

|

|

|

Nominee |

|

For |

|

|

Withheld |

|

Aashima Gupta |

|

|

173,676,074 |

|

|

|

22,019,553 |

|

Raphael A. Rodriguez |

|

|

187,452,904 |

|

|

|

8,242,723 |

|

Catherine E. Woteki, Ph.D. |

|

|

190,787,923 |

|

|

|

4,907,704 |

|

Proposal 2 – To Approve, by Non-Binding Vote, the Compensation of the Company’s Named Executive Officers

The shareholders approved, by non-binding vote, the compensation of the Company’s named executive officers, as disclosed in the proxy materials.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

|

|

Against |

|

|

Abstain |

|

|

Broker Non-Vote |

|

|

188,942,194 |

|

|

|

6,399,654 |

|

|

|

294,342 |

|

|

|

7,464,927 |

|

Proposal 3 – To Approve, on an Advisory Basis, the Frequency of Future Advisory Votes on Executive Compensation

The shareholders approved, on an advisory basis, the frequency of future advisory votes on executive compensation, as disclosed in the proxy materials.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

|

|

2 Years |

|

|

3 Years |

|

|

Abstain |

|

|

194,187,940 |

|

|

|

83,339 |

|

|

|

1,162,434 |

|

|

|

202,477 |

|

Following the Annual Meeting of Shareholders, in accordance with the recommendation of the Board and the vote of holders of a majority of the Company’s shares, the Board selected every one year as the frequency of future advisory votes on executive compensation.

Proposal 4 – To Approve the Establishment of the Neogen Corporation 2023 Omnibus Incentive Plan

The shareholders approved the establishment of the Neogen Corporation 2023 Omnibus Incentive Plan, as disclosed in the proxy materials.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

|

|

Against |

|

|

Abstain |

|

|

Broker Non-Vote |

|

|

183,704,273 |

|

|

|

11,662,966 |

|

|

|

268,951 |

|

|

|

7,464,927 |

|

Proposal 5 – Ratification of the Appointment of the Company’s Independent Registered Public Accounting Firm

The shareholders ratified the appointment of BDO USA, P.A. as the Company’s auditors for the fiscal year ending May 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

|

|

Against |

|

|

Abstain |

|

|

Broker Non-Vote |

|

|

192,927,257 |

|

|

|

10,053,877 |

|

|

|

119,983 |

|

|

|

- |

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

NEOGEN CORPORATION |

|

|

|

|

Date: |

October 31, 2023 |

By: |

/s/ Amy M. Rocklin |

|

|

|

Name: Amy M. Rocklin

Title: Chief Legal & Compliance Officer, Corporate Secretary

|

AMENDED AND RESTATED

BYLAWS

OF

NEOGEN CORPORATION

Section 1.Registered Office. The registered office of Neogen Corporation (“the Corporation”) will be located at such location in the State of Michigan as the Board of the Corporation (the “Board” or the “Board”) designates in accordance with applicable law.

Section 2.Principal Office. The principal office of the Corporation will be located at such location as the Board determines.

Section 3.Other Offices. The Corporation also can have other offices at such locations as the Board or the business determines.

Article II

SHAREHOLDERS AND MEETINGS

Section 1.Annual Meeting of Shareholders. The annual meeting of the shareholders of the Corporation for the election of directors and for the transaction of such other business as may properly come before the meeting will be held at such place and time as the Board determines. The Board can, in its sole discretion, determine that a meeting will not be held at any place, but can instead be held by means of remote communication.

Section 2.Special Meetings of Shareholders.

(a)A special meeting of shareholders (i) can be called at any time by a majority of the Board, and (ii) will be called by the Secretary of the Corporation (“the Secretary”) upon the request by written notice by one or more shareholders entitled to vote not less than an aggregate of 50% of the Corporation’s issued and outstanding common shares. Any such request by shareholders will be (i) delivered to or received by the Secretary at its principal executive offices, (ii) be signed by each shareholder (or its duly authorized representative) requesting such special meeting, and (iii) set forth the purpose of such proposed special meeting. The Secretary will prepare, sign, and mail the notices requisite to such meeting.

Section 3.Notice of Meetings of Shareholders. Written notice of each annual or special meeting of shareholders, stating the time, place, and purposes thereof, will be given not less than ten (10) or more than sixty (60) days before the date of such meeting to each shareholder of record entitled to vote at the meeting. Such notice can be given personally, by mail or by a form of electronic transmission to which the shareholder has consented. If a

shareholder or proxy holder can be present and vote at a meeting by remote communication, the means of remote communication allowed will be included in the notice of the meeting.

Section 4.Adjournment of Shareholder Meetings and Notice Thereof. Any meeting of shareholders can be adjourned to another time or place by the person presiding and acting as the chair of the meeting in accordance with Section 7 of Article V or by a vote of the shares present in person or by proxy, and the Corporation can transact at any adjourned meeting only such business that could have been transacted at the original meeting unless notice of the adjourned meeting is given. Notice need not be given of the adjourned meeting if the time and place to which the meeting is adjourned are announced at the meeting at which the adjournment is taken, unless after the adjournment the Board fixes a new record date for the adjourned meeting. If notice of an adjourned meeting is given, such notice will be given to each shareholder of record entitled to vote at the adjourned meeting in the manner prescribed in these bylaws for the giving of notice of meetings. A shareholder or proxy holder may be present and vote at the adjourned meeting by means of a remote communication if they were permitted to be present and vote by that means of remote communication in the original meeting notice.

Article III

Nominations for Directors and Other Agenda Items

Section 1.Annual Meetings of Shareholders.

(a)Nominations of persons for election to the Board (each, a “Proposed Nominee”) and the proposal of other business to be considered by the shareholders can be made at an annual meeting of shareholders only (A) by or at the direction of the Board or (B) by any shareholder of the Corporation (the “Noticing Party”) who (i) was a shareholder of record of the Corporation at the time the notice required by paragraph (b) of this Section 1 of Article III is delivered to the Secretary and at the time of the annual meeting, (ii) is entitled to vote at the meeting, and (iii) complies with the notice procedures and other applicable requirements set forth in paragraph (b) of this Section 1 of Article III as to such business or nomination. Clause (B) of the immediately preceding sentence is the exclusive means for a shareholder to make nominations or submit other business for action at any annual meeting of shareholders, other than matters properly brought before the meeting pursuant to notice given under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and included in the Corporation’s notice of meeting.

(b)Without qualification or limitation of any other requirement, for any nominations or any other business to be properly brought before an annual meeting by a shareholder pursuant to clause (B) of the first sentence of paragraph (a) of this Section 1 of Article III, the shareholder must have given sufficient, timely notice thereof in writing to the Secretary and any such proposed business must constitute a proper matter for shareholder action. For the purposes of any nominations of persons for election to the Board and the proposal of other business to be considered by the shareholders, to be timely, a shareholder’s

2

notice will be delivered to the Secretary at the principal executive offices of the Corporation not earlier than the close of business on the one hundred twentieth (120th) day nor later than the close of business on the ninetieth (90th) day prior to the first anniversary of the date of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than sixty (60) days after such anniversary date, notice by the shareholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or, if the first public announcement of the date of such annual meeting is less than one hundred (100) days prior to the date of such annual meeting, the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by the Corporation). In no event will the public announcement of an adjournment or postponement of an annual meeting commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above.

(c)To be sufficient, a shareholder’s notice delivered pursuant to this Section 1 of Article III must set forth:

(A) As to each Proposed Nominee, if any, whom the shareholder proposes to nominate for election or reelection as a director:

(i) all information relating to such Proposed Nominee that would be required to be disclosed in a proxy statement required to be made in connection with solicitations of proxies for election of such Proposed Nominee as a director in a contested election, or as is otherwise required, in each case pursuant to and in accordance with Regulation 14A under the Exchange Act;

(ii) a written questionnaire with respect to the background and qualification of such Proposed Nominee completed by the Proposed Nominee in the form required by the Corporation (which form the shareholder will request in writing from the Secretary and which the Secretary will provide to such shareholder within ten (10) days after receiving such request);

(iii) such Proposed Nominee’s written consent to being named as a nominee and to serving as a director if elected;

(iv) such Proposed Nominee’s written representation and agreement in the form required by the Corporation (which form the shareholder will request in writing from the Secretary and that the Secretary will provide to such shareholder within ten (10) days after receiving such request) that: (aa) such Proposed Nominee is not and will not become party to any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how such

3

Proposed Nominee, if elected as a director of the Corporation, will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to the Corporation or any Voting Commitment that could limit or interfere with such Proposed Nominee’s ability to comply, if elected as a director of the Corporation, with such Proposed Nominee’s fiduciary duties under applicable law; (bb) such Proposed Nominee is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the Corporation with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director or nominee that has not been disclosed to the Corporation; (cc) such Proposed Nominee will, if elected as a director, comply with applicable law, the rules of any securities exchanges upon which the Corporation’s securities are listed, all applicable publicly disclosed corporate governance, ethics, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of the Corporation, and any other Corporation policies and guidelines applicable to directors (which will be provided to such Proposed Nominee within five (5) business days after the Secretary receives any written request therefor from such Proposed Nominee), and applicable fiduciary duties under state law; (dd) such Proposed Nominee consents to serving as a director, if elected as a director of the Corporation; (ee) such Proposed Nominee intends to serve as a director for the full term for which such Proposed Nominee is standing for election; (ff) such Proposed Nominee will provide facts, statements and other information in all communications with the Corporation that are or will be true and correct and that do not and will not omit to state any fact necessary in order to make the statements made, in light of the circumstances under which they are made, not misleading; and (gg) such Proposed Nominee will tender his or her resignation as a director of the Corporation if the Board determines that such Proposed Nominee failed to comply with the provisions of this Article III in all material respects, provides such Proposed Nominee of notice of any such determination and, if such failure may be cured, such Proposed Nominee fails to cure such failure within ten (10) business days after delivery of such notice to such Proposed Nominee; and

(v) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three (3) years, and any other material relationships, between or among, on the one hand, the shareholder and any other beneficial owner, if any, of the Company’s securities, and their respective affiliates and associates, or others acting in concert therewith, and, on the other hand, each Proposed Nominee, and their respective affiliates and associates, or others acting in concert therewith, including, without

4

limitation all information that would be required to be disclosed pursuant to Item 404 promulgated under Regulation S-K under the Exchange Act if the shareholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant.

(B) If the notice relates to any business other than a nomination of a person for election as a director, that the shareholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and in the event that such business includes a proposal to amend these bylaws, the language of the proposed amendment), the reasons for conducting such business at the meeting and any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made, and a description of all agreements, arrangements and understandings between such shareholder and beneficial owner, if any, and any other person or persons (including their names) in connection with the proposal of such business by such shareholder.

(C) As to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made:

(i) the name and address of such shareholder and beneficial owner(s) (in the case of the shareholder, as they appear on the Corporation’s books);

(ii)

(a) the class or series and number of shares of capital stock or other securities of the Corporation that are, directly or indirectly, owned beneficially and of record by such person,

(b) any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege,

(c) any option or right with a settlement payment or mechanism at a price related to any class or series of shares, or other securities, of the Corporation or any subsidiary of the Corporation with a value derived in whole or in part from the value of any class or series of shares, or other securities, of the Corporation or any subsidiary of the Corporation, or any derivative or synthetic arrangement having the characteristics of a long position in any class or series of shares, or other securities, of the Corporation or any subsidiary of the Corporation, or any contract, derivative,

5

swap or other transaction or series of transactions designed to produce economic benefits and risks that correspond substantially to the ownership of any class or series of shares, or other securities, of the Corporation or any subsidiary of the Corporation, including due to the fact that the value of such contract, derivative, swap or other transaction or series of transactions is determined by reference to the price, value or volatility of any class or series of shares, or other securities, of the Corporation, or any subsidiary of the Corporation, whether or not such instrument, contract or right will be subject to settlement in the underlying class or series of shares, or other securities, of the Corporation or any subsidiary of the Corporation, through the delivery of cash or other property, or otherwise (a “Derivative Instrument”), directly or indirectly owned beneficially by such person and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Corporation,

(d) any proxy, contract, arrangement, understanding, or relationship pursuant to which such person has a right to vote any shares of any security of the Corporation,

(e) any agreement, arrangement, understanding or relationship, including any repurchase or similar “stock borrowing” agreement or arrangement, engaged in, directly or indirectly, by such shareholder, the purpose or effect of which is to mitigate loss to, reduce the economic risk (of ownership or otherwise) of any class or series of the shares of the Corporation by, manage the risk of share price changes for, or increase or decrease the voting power of, such shareholder with respect to any class or series of the shares of the Corporation, or which provides, directly or indirectly, the opportunity to profit or share in any profit derived from any decrease in the price or value of any class or series of the shares, or other securities, of the Corporation or any subsidiary of the Corporation,

(f) any rights to dividends or other distributions on the shares of the capital stock of the Corporation owned by such person that are separated or separable from the underlying shares of the Corporation,

(g) any proportionate interest in shares of the Corporation or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such shareholder is a general partner

6

or, directly or indirectly, beneficially owns an interest in a general partner of such a general or limited partnership or in which any members of such shareholder’s immediate family have an interest, and

(h) any performance-related fees (other than an asset-based fee) that such person is entitled to based on any increase or decrease in the value of shares of the Corporation or Derivative Instruments, if any, as of the date of such notice;

(iii) a description of any agreement, arrangement or understanding with respect to the nomination or proposal between or among such person, any of its respective affiliates or associates, and any others acting in concert with any of the foregoing;

(iv) a representation that the shareholder is a holder of record of stock of the Corporation entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such business or nomination;

(v) a representation from the Noticing Party as to whether such Noticing Party or any Shareholder Associated Person (as defined herein) intends or is part of a group that intends (I) to deliver a proxy statement and/or form of proxy to a number of holders of the Corporation’s voting shares reasonably believed by such Noticing Party to be sufficient to approve or adopt the business to be proposed or elect the Proposed Nominees, as applicable, (II) to engage in a solicitation (within the meaning of Rule 14a-1(l) under the Exchange Act) with respect to the nomination or other business, as applicable, and if so, the name of each participant (as defined in Item 4 of Schedule 14A under the Exchange Act) in such solicitation, or (III) otherwise to solicit proxies from shareholders in support of such proposal or nomination; and

(vi) any other information relating to such shareholder and beneficial owner, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder.

Such notice must also include all information required by Rule 14a-19 under the Exchange Act. The Corporation may also require any Proposed Nominee to furnish such other information as it may reasonably require to determine the eligibility of such Proposed Nominee to serve as an independent director of the Corporation under the listing standards of the principal U.S. exchange upon which the Corporation’s capital stock is listed, any applicable rules of the

7

Securities and Exchange Commission and publicly disclosed standards, if any, used by the Board in determining the independence of the Corporation’s directors or that could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such nominee in relation to such shareholder or beneficial owner. Without limitation on any obligation of any such shareholder to update material information, the information required by clauses (C)(ii) and (C)(iii) of this section (c) will be updated by such shareholder and beneficial owner, if any, not later than ten (10) days after the record date for determining the shareholders entitled to vote at the meeting to disclose such information as of that record date. In addition, the Board may require any Proposed Nominee to submit to interviews with the Board or any committee thereof, and such Proposed Nominee will make themselves available for any such interviews within ten (10) days following any reasonable request therefor from the Board or any committee thereof.

(d)Notwithstanding anything to the contrary in the second sentence of Article III, Section 1(b), in the event that the number of directors to be elected to the Board at an annual meeting is increased and there is no public announcement by the Corporation naming all of the nominees for director or specifying the size of the increased Board at least one hundred (100) days prior to the first anniversary of the preceding year’s annual meeting, a shareholder’s notice required by this Section 1 will also be considered timely, but only with respect to nominees for any new positions created by such increase, if it is delivered to the Secretary at the principal executive offices of the Corporation not later than the close of business on the tenth (10th) day following the day on which such public announcement is first made by the Corporation.

Section 2.Special Meeting of Shareholders. Only such business will be conducted at a special meeting of shareholders as is brought before the meeting pursuant to the Corporation’s notice of meeting. Nominations of persons for election to the Board may be made at a special meeting of shareholders at which directors are to be elected pursuant to the Corporation’s notice of meeting (1) by or at the direction of the Board, or (2) provided that the Board has determined that directors will be elected at such special meeting, by any shareholder of the Corporation who (i) is a shareholder of record of the Corporation at the time the notice provided for in this Article III is delivered to the Secretary of the Corporation and at the time of the special meeting, (ii) is entitled to vote at the meeting and upon such election, and (iii) complies with the notice procedures set forth in this Article III as to such nomination. Subject to Article III, Section 3(c), in the event a special meeting of shareholders is duly called for the purpose of electing one or more directors to the Board, any such shareholder may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting, if the shareholder’s notice containing the information required by Article III, Section 1(b) and Section 1(c) hereof with respect to any nomination will be delivered to the Secretary at the principal executive offices of the Corporation not earlier than the close of business on the one hundred twentieth (120th) day prior to such special meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such special meeting or, if the first public announcement of the date of such special meeting is less than one hundred (100) days prior to the date of such special meeting, the tenth (10th) day

8

following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at such meeting. In no event will the public announcement of an adjournment or postponement of a special meeting commence a new time period (or extend any time period) for delivering the shareholder’s notice as described above.

(a)With respect to nominees for election as a director by shareholders or other business proposed by shareholders to be considered at a meeting, only such persons who are nominated in accordance with the procedures set forth in Section 1 or Section 2 of this Article III or the Articles of Incorporation will be eligible to be elected at an annual or special meeting of shareholders of the Corporation to serve as directors and only such other business will be conducted at a meeting of shareholders as is brought before the meeting in accordance with the procedures set forth in Section 1 of this Article III. Except as otherwise provided by applicable law, the Articles of Incorporation or these bylaws, the person presiding at the meeting of shareholders will have the power (A) to determine whether a nomination or any other business proposed to be brought before the meeting by or on behalf of a shareholder was made or proposed, as the case may be, in accordance with the procedures set forth in Section 1 of Article III (including whether the shareholder or beneficial owner, if any, on whose behalf the nomination or proposal is made solicited (or is part of a group which solicited) or did not so solicit, as the case may be, proxies in support of such shareholder’s nominee or proposal in compliance with such shareholder’s representation as required by clause (C)(v) of paragraph (c) of Section 1 of Article III) and (B) if any proposed nomination or other business was not made or proposed in compliance with Section 1 of Article III, to declare that no action will be taken on such nomination or other proposal and that such nomination will be disregarded or that such proposed other business will not be transacted. Notwithstanding the provisions of Article III, Section 1, if the shareholder (or a qualified representative of the shareholder) does not appear at the annual or special meeting of shareholders of the Corporation to present a nomination or other business, such nomination will be disregarded and such proposed other business will not be transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation. For purposes of Article III, Section 1, to be considered a qualified representative of a shareholder, a person must be a duly authorized officer, manager or partner of such shareholder or must be authorized by a writing executed by such shareholder or an electronic transmission delivered by such shareholder to act for such shareholder as proxy at the meeting of shareholders and such person must produce such writing or electronic transmission, or a reliable reproduction of the writing or electronic transmission, at the meeting of shareholders.

(b)For purposes of these bylaws, “public announcement” means disclosure in a press release reported by a national news service or in a document publicly filed by the Corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Exchange Act and the rules and regulations promulgated thereunder.

9

(c)Notwithstanding the provisions of Section 1 or Section 2 of this Article III, a shareholder will also comply with all applicable requirements of state law and the Exchange Act and the rules and regulations thereunder with respect to the matters set forth therein. Nothing in this Article III will be deemed to affect any rights: (i) of shareholders to request inclusion of proposals in the Corporation’s proxy statement pursuant to Rule 14a-8 under the Exchange Act or (ii) of shareholders to request inclusion of nominees in the Corporation’s proxy statement pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder.

(d)If any Noticing Party or any Shareholder Associated Person provides notice pursuant to Rule 14a-19 under the Exchange Act, such Noticing Party must deliver to the Secretary, no later than five (5) business days prior to the applicable meeting date, reasonable evidence that the requirements of Rule 14a-19 under the Exchange Act have been satisfied. If (A) any Noticing Party or any Shareholder Associated Person provides notice pursuant to Rule 14a-19(b) under the Exchange Act and (B) such Noticing Party or Shareholder Associated Person subsequently either (x) notifies the Corporation that such Noticing Party or Shareholder Associated Person no longer intends to solicit proxies in support of director nominees other than the Corporation’s nominees in accordance with Rule 14a-19 under the Exchange Act or (y) fails to comply with the requirements of Rule 14a-19 under the Exchange Act (or fails to timely provide reasonable evidence sufficient to satisfy the Corporation that the shareholder has satisfied the requirements of Rule 14a-19 under the Exchange Act), then the nomination of such Proposed Nominee will be disregarded and no vote on the election of such Proposed Nominee will occur (notwithstanding that proxies in respect of such vote may have been received by the Corporation). Additionally, any shareholder directly or indirectly soliciting proxies from other shareholders must use a proxy card color other than white, which shall be reserved for the exclusive use for solicitation by the Board.

For purposes of these bylaws, “Shareholder Associated Person” means, with respect to a Noticing Party and, if different from such Noticing Party, any beneficial owner of common shares of the Corporation on whose behalf such Noticing Party is providing notice of any nomination or other business proposed, (I) any person directly or indirectly controlling, controlled by, under common control with such Noticing Party or such beneficial owner, (II) any member of the immediate family of such Noticing Party or such beneficial owner sharing the same household, (III) any person or entity who is a member of a “group” (as such term is used in Rule 13d-5 under the Exchange Act (or any successor provision)) with, or is otherwise known by such Noticing Party, such beneficial owner or other Shareholder Associated Person to be acting in concert with, such Noticing Party, such beneficial owner or any other Shareholder Associated Person with respect to the stock of the Corporation (or the voting thereof), (IV) any affiliate or associate of such Noticing Party, such beneficial owner or any other Shareholder Associated Person, (V) if such Noticing Party or such beneficial owner is not a natural person, any persons associated with such Noticing Party (or such beneficial owner) responsible for the formulation of and decision to propose the business or nomination to be brought before the meeting, (VI) any participant (as defined in paragraphs (a)(ii)-(vi) of Instruction 3 to Item 4 of Schedule 14A) with such Noticing Party, such beneficial owner or any other Shareholder

10

Associated Person with respect to any proposed business or nominations, as applicable, (VII) any beneficial owner of common shares of the Corporation owned of record by such Noticing Party or any other Shareholder Associated Person (other than a shareholder that is a depositary) and (VIII) any Proposed Nominee.

Section 1.Quorum of Shareholders. Except as otherwise required by applicable law, including the Michigan Business Corporation Act (together with any successor or replacement statute, the “MBCA”), or set forth in the Articles of Incorporation, a majority of the outstanding common shares of the Corporation entitled to vote at the meeting, present by the record holders thereof in person or by proxy, will constitute a quorum at any meeting of the shareholders. The shareholders present in person or by proxy at such meeting may continue to do business until adjournment, notwithstanding the withdrawal of enough shareholders to leave less than a quorum. Whether or not a quorum is present, the meeting may be adjourned by a vote of the shares present. When the holders of a class or series of shares are entitled to vote separately on an item of business, this Section 1 of Article IV applies in determining the presence of a quorum of such class or series for transaction of the item of business.

Section 2.Quorum of Directors. A majority of the members of the Board then in office and, unless the resolution of the Board establishing the committee provides otherwise, of the members of a committee constitutes a quorum for the transaction of business by the Board or such committee.

Article V

Voting, Elections and Proxies

Section 1.Voting. Unless provided otherwise in the Articles of Incorporation or these bylaws, each shareholder, at every meeting of the shareholders, will be entitled to one vote, in person or by proxy, for each common share of the Corporation held by such shareholder. A vote may be cast either orally or in writing and otherwise as provided in these bylaws. If an action other than the election of directors is to be taken by vote of the shareholders, it will be authorized by a majority of the votes cast by the holders of shares entitled to vote on the action, unless a greater vote is required by applicable law. Except as otherwise provided in the Articles of Incorporation, directors will be elected by a plurality of the votes cast at an election. Unless otherwise provided in the Articles of Incorporation, abstaining from a vote or submitting a ballot marked “abstain” with respect to an action is not a vote cast on that action.

Section 2.Proxies. Each shareholder entitled to vote at a meeting of shareholders may authorize another person or persons to act for them by proxy. Without limiting the manner in which a shareholder may authorize another person or persons to act for them as proxy, the following methods constitute a valid means by which a shareholder may grant authority to

11

another person to act as proxy: (a) the execution of a writing authorizing another person or persons to act for the shareholder as proxy, which may be accomplished by the shareholder or by an authorized officer, director, employee, or agent signing the writing or causing their signature to be affixed to the writing by any reasonable means including, but not limited to, facsimile signature; and (b) transmitting or authorizing the transmission of an electronic transmission to the person who will hold the proxy or to a proxy solicitation firm, proxy support service organization or similar agent fully authorized by the person who will hold the proxy to receive that transmission. Any means of electronic transmission must either set forth or be submitted with information from which it can be determined that the electronic transmission was authorized by the shareholder. If an electronic transmission is determined to be valid, the inspectors of election, or, if there are no inspectors, the persons making the determination will specify the information upon which they relied. No proxy will be voted or acted upon after three (3) years from its date, unless the proxy provides for a longer period. The authority of the holder of a proxy to act is not revoked by the incompetence or death of the shareholder who executed the proxy unless, before the authority is exercised, written notice of an adjudication of the incompetence or death is received by the officer or agent responsible for maintaining the list of shareholders. A shareholder whose shares are pledged will be entitled to vote the shares until the shares have been transferred into the name of the pledgee or a nominee of the pledgee. A person holding shares in a representative or fiduciary capacity may vote such shares without a transfer of such shares into such person’s name.

Section 3.Fixing of Record Dates. The Board may fix a record date, which will not be more than sixty (60) nor less than ten (10) days before the date of any meeting of shareholders, nor more than sixty (60) days prior to the effective date of any other action proposed to be taken, for the purpose of determining shareholders entitled to notice of and to vote at such meeting of shareholders or any adjournment thereof, or to express consent or dissent from a proposal without a meeting, or to receive payment or any dividend or allotment of any rights or for the purpose of any other action. A record date may not precede the date on which the resolution fixing the record date is adopted by the Board. If no record date is fixed by the Board, the record date for the determination of shareholders entitled to notice of or to vote at a meeting of shareholders will be the close of business on the day next preceding the day on which notice is given, or if no notice is given, the day next preceding the day on which the meeting is held, and the record date for determining shareholders for any other purpose will be the close of business on the day on which the Board adopts the resolution relating thereto. When a record date has been fixed for the determination of shareholders of record entitled to notice of or to vote at a meeting of shareholders, such record date will apply to any adjournment of the meeting, unless the Board fixes a new record date for the adjourned meeting.

Section 4.List of Shareholders Entitled to Vote. The officer or agent who has charge of the stock transfer books of the Corporation will make and certify a complete list, based upon the record date for a meeting of shareholders, of the shareholders entitled to vote at such meeting or any adjournment thereof, arranged alphabetically, with the address of and the number of shares held by each shareholder. Such list will be produced at the time and place of

12

the meeting and may be inspected by any shareholder during the entire meeting. If a meeting of shareholders is held solely by means of remote communication, then the list will be open to the examination of any shareholder during the entire meeting by posting the list on a reasonably accessible electronic network and the information required to access the list will be provided with the notice of the meeting. Such list will be prima facie evidence as to who are the shareholders entitled to examine the list or to vote in person or by proxy at the meeting.

Section 5.Participation by Remote Communication. If authorized by the Board in its sole discretion, and subject to such guidelines and procedures as the Board may adopt, shareholders and proxy holders not physically present at a meeting of shareholders may participate in a meeting of shareholders by conference telephone or other means of remote communication and will be considered present in person and may vote at the meeting, whether such meeting is held at a designated place or solely by means of remote communication, provided that (a) the Corporation implements reasonable measures to verify that each person considered present and permitted to vote at the meeting by means of remote communication is a shareholder or proxy holder; (b) the Corporation implements reasonable measures to provide each shareholder and proxy holder a reasonable opportunity to participate in the meeting and to vote on matters submitted to the shareholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings; (c) if any shareholder or proxy holder votes or takes other action at the meeting by means of remote communication, a record of the vote or other action will be maintained by the Corporation; and (d) all participants are advised of the means of remote communication.

Section 6.Inspectors of Election. In advance of any meeting of shareholders, the Board may appoint any one or more persons, other than nominees for office, as inspectors of election to act at such meeting or any adjournment thereof. If inspectors are not so appointed, the person presiding at a shareholders’ meeting can, and on request of a shareholder entitled to vote thereat will, appoint one or more inspectors. In case a person appointed fails to appear or act, the vacancy may be filled by appointment made by the Board in advance of the meeting or at the meeting by the person presiding thereat. Unless otherwise prescribed by applicable law, the duties of such inspectors will include: determining the number of shares outstanding and the voting power of each share; the shares represented at the meeting; the existence of a quorum; the validity and effect of proxies; the receipt of votes, ballots or consents, and the hearing and determination of all challenges and questions arising in connection with the right to vote; the counting and tabulating of votes, ballots or consents; the determination of the result of the vote; and such acts as are proper to conduct the election or vote with fairness to all shareholders.

Section 7.Conduct of Meetings. At each meeting of shareholders, the Chair of the Board or, in the absence of the Chair of the Board, the Chief Executive Officer, or in the absence of both the Chair of the Board and the Chief Executive Officer, the President or such other person designated by the Board will preside and act as the chair of the meeting. The chair will determine the order of business, may adjourn any meeting from time to time and will have the authority to establish rules for the conduct of the meeting, which may include, without

13

limitation, the following: (i) the establishment of an agenda or order of business for the meeting; (ii) the determination of when the polls will open and close for any given matter to be voted on at the meeting; (iii) rules and procedures for maintaining order at the meeting and the safety of those present; (iv) limitations on attendance at or participation in the meeting to shareholders of record of the Corporation, their duly authorized and constituted proxies or such other persons as the chair of the meeting will determine; (v) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (vi) limitations on the time allotted to questions or comments by participants. Any rules adopted for, and the conduct of, the meeting will be fair to shareholders.

Section 1.General Powers. The business and affairs of the Corporation will be managed by or under the direction of the Board, except as otherwise provided in the MBCA.

Section 2.Number and Term of Directors. The number of directors which will constitute the whole Board will not be less than five nor more than eleven. Within these limits, the number of directors will be determined from time to time by resolution of the Board. In lieu of electing the whole number of directors annually, the directors will be divided into three classes designated as Class I, Class II, and Class III, each class to be as nearly equal in number as possible. Each class of directors will serve a term of three years. The class of directors whose term expires at the time of the shareholders’ meeting for a given year will be elected to hold office until the third succeeding annual meeting. Should a vacancy occur or be created, any director elected or appointed to fill such vacancy will serve for the remainder of the term of the class in which the vacancy occurs or is created. Notwithstanding any of the foregoing, each director will serve until their successor is elected and has qualified or until the director’s earlier death, retirement, resignation or removal. If the number of directors is changed, any increase or decrease in the number of directors will be apportioned among the classes so directors in each class remains as nearly equal in number as possible.

Section 3.Voting. The vote of the majority of the directors present at a meeting at which a quorum is present constitutes the action of the Board or of a committee unless the vote of a greater number is required by applicable law or, in the case of a committee, the resolution of the Board establishing the committee.

Section 4.Chair of the Board. The Board may elect a Chair of the Board from among its members. Subject to the control vested in the Board by statute, by the Articles of Incorporation, or by these bylaws, the Chair of the Board will have such duties and powers as from time to time may be assigned to such person by the Board, the Articles of Incorporation or these bylaws.

Section 5.Resignation and Removal of Directors. Any director may resign at any time upon written notice to the Corporation. The resignation of any director will take effect upon

14

receipt of notice thereof or at a later time specified in such notice. A director or the entire Board may be removed only for cause.

Section 6.Regulations. The Board may adopt such rules and regulations for the conduct of the business and management of the Corporation that are not inconsistent with applicable law, including the MBCA, the Articles of Incorporation or these bylaws as the Board may deem appropriate or proper.

Section 7.Action by Unanimous Written Consent. Action required or permitted to be taken under authorization voted at a meeting of the Board or of any committee thereof may be taken without a meeting if, before or after the action, all members of the Board then in office or of such committee, as the case may be, consent to the action in writing or by electronic transmission. The consents will be filed with the minutes of proceedings of the Board or such committee and will have the same effect as a vote of the Board or committee for all purposes.

Section 8.Committees of Directors. The Board may designate one or more committees, each committee to consist of one or more of the directors of the Corporation. Each committee and each member thereof will serve at the pleasure of the Board.

Section 9.Powers and Duties of Committees. Any committee, to the extent provided in a resolution or resolutions of the Board or in these bylaws, will have and may exercise all powers and authority of the Board in the management of the business and affairs of the Corporation, subject to any limitations under applicable law (including the MBCA), the Articles of Incorporation or these bylaws. Each committee may adopt its own rules of procedure and may meet at stated times or on such notice as such committee may determine and, unless otherwise provided in a resolution of the Board, the Articles of Incorporation or these bylaws, may designate one or more subcommittees, each of which will consist of one or more members, to which all or part of the power and authority of the committee may be delegated. Each committee will keep regular minutes of its proceedings and report the same to the Board.

Section 10.Power to Fill Vacancies. Vacancies in the Board and newly created directorships resulting from any increase in the authorized number of directors may be filled by the shareholders or by the Board. If the directors remaining in office constitute fewer than a quorum, they may fill vacancies by the affirmative vote of a majority of all the directors remaining in office. Any director elected or appointed to fill such vacancy will serve for the remainder of the term of the class in which the vacancy occurs or is created.

Section 11.Regular Meetings of Board. Regular meetings of the Board will be held at such times and places as the Board will from time to time determine. After there has been such determination and notice thereof has been given to each member of the Board, no further notice will be required for any such regular meeting.

Section 12.Special Meetings of Board. Special meetings of the Board may be called from time to time by the Chair of the Board, the Chief Executive Officer, or the President and will be called by the Chair of the Board or the Secretary upon the request by written notice of a

15

majority of the Board then in office directed to the Chair of the Board or the Secretary. Notice of any special meeting of the Board, stating the time and place of such special meeting, will be given to each director. Such notice will be given personally, by telephone, by overnight courier or by a form of electronic transmission not less than twenty-four (24) hours before the time of the meeting.

Section 13.Participation in Meeting by Remote Communication. A member of the Board or of a committee designated by the Board may participate in a meeting by means of telephone, video, or similar communications equipment through which all persons participating in the meeting can communicate with the other participants. Participation in a meeting pursuant to this Section 13 of Article VI constitutes presence in person at the meeting.

Section 14.Compensation. The compensation of directors may be fixed by the Board or the power to fix such compensation may be delegated by the Board. Members of either standing or special committees may be allowed such compensation as the Board or any authorized committee thereof may determine.

Section 1.Officers. The officers of the Corporation will be appointed by the Board and will include a President, a Secretary and a Treasurer. The Board may, in its discretion, appoint any other officers, including without limitation a Chief Executive Officer and any such other officers and agents as it may deem necessary. None of the officers need be a director of the Corporation. The Board may delegate to the Chief Executive Officer or the President the power to appoint or remove certain officers as designated by a resolution of the Board. Each officer will hold office for the term for which they are elected or appointed or until their successor is duly elected or appointed and qualified or until their resignation or removal.

Section 2.Resignation and Removal of Officers. Any officer of the Corporation may resign at any time upon written notice to the Corporation. The resignation of any officer will take effect upon receipt by the Corporation of notice thereof or at a later time specified in such notice. An officer of the Corporation may be removed at any time by the Board or by the officer appointing such person with or without cause, but such removal will be without prejudice to the contract rights, if any, of the officer so removed. The election or appointment of any officer does not itself create contract rights.

Section 3.Chief Executive Officer. The Chief Executive Officer, subject to the oversight of the Board, will have the final authority over the general policy and business of the Corporation. The Chief Executive Officer will have all powers and authorities usually incident to the office of the Chief Executive Officer, except as specifically limited by a resolution of the Board, and will perform such other duties as may be prescribed from time to time by the Board or these bylaws. If no Chief Executive Officer is appointed, the duties and powers of the Chief Executive Officer will be performed by the President.

16

Section 4.President. The President will have general supervision over the business of the Corporation. The President will have all powers and duties usually incident to the office of the President except as specifically limited by a resolution of the Board. The President will have such other powers and perform such other duties as may be assigned to such person from time to time by the Board or the Chief Executive Officer.

Section 5.Secretary. The Secretary will preserve in books of the Corporation true minutes of the proceedings of all meetings of the shareholders, the Board and the committees of the Board. The Secretary will give all notices required by statute, bylaw or resolution. The Secretary will have such other powers and perform such other duties in the management of the Corporation as may be provided in these bylaws or that are otherwise usually incident to the office of the Secretary or that will otherwise be determined by resolution of the Board not inconsistent with these bylaws, or that will otherwise be assigned to such person from time to time by the Chief Executive Officer or the President.

Section 6.Treasurer. The Treasurer will have custody of all corporate funds and securities and will keep in books belonging to the Corporation full and accurate accounts of all receipts and disbursements. The Treasurer will deposit all moneys, securities and other valuable effects in the name of the Corporation in such depositories as may be designated for that purpose by the Board. The Treasurer will disburse the funds of the Corporation as ordered by the Board, taking proper vouchers for such disbursements, and will render to the Chief Executive Officer, the President and the Board, whenever requested by them, an account of all their transactions as Treasurer and of the financial condition of the Corporation. The Treasurer will have such other powers and perform such other duties in the management of the Corporation that are otherwise usually incident to the office of the Treasurer or that will otherwise be determined by resolution of the Board not inconsistent with these bylaws or that will otherwise be assigned to such person from time to time by the Chief Executive Officer or the President.

Section 7.Combined Offices. The Board may combine any of the above-described offices and any individual may hold one or more offices, but an officer will not execute, acknowledge or verify an instrument in more than one capacity if the instrument is required by law or the Articles of Incorporation or these bylaws to be executed, acknowledged or verified by two or more officers.

Article VIII

Stocks and Transfers

Section 1.Issuance of Certificates for Shares of Stock. The shares of the Corporation shall be represented by certificates or, if authorized by the Board, may be issued without certificates. Authorization to issue shares in uncertificated form shall not affect outstanding shares already represented by a certificate until the certificate is surrendered to the Corporation.

17

Section 2.Regulations Relating to Transfer; Transfer Agent. The Board may make such rules and regulations as it may deem expedient, not inconsistent with the MBCA, the Articles of Incorporation or these bylaws, concerning the issuance, transfer and registration of shares of capital stock of the Corporation. The Board may appoint, or authorize any officer to appoint, one or more transfer agents and one or more registrars and may require all certificates for capital stock to bear the signature or signatures of any of them.

Section 3.Transferable Only on Books of Corporation. All transfers of capital stock will be made on the books of the Corporation only upon delivery to the Corporation or its transfer agent of a written direction of the holder of record of the shares, in person or by such holder’s attorney lawfully constituted in writing, and, subject to Section 6 of this Article VIII, if such shares are certificated, upon surrender of the certificate or certificates representing such shares duly endorsed.

Section 4.Registered Shareholders. The Corporation will have the right to treat the holder of record of any share as the absolute owner thereof, and will not be bound to recognize any equitable or other claim to, or interest in, such share on the part of any other person, whether or not the Corporation will have express or other notice thereof, except as may be otherwise expressly provided by the statutes of Michigan.

Section 5.Cancellation. Each certificate for capital stock surrendered to the Corporation for exchange or transfer shall be cancelled and no new certificate or certificates or uncertificated shares shall be issued in exchange for any existing certificate, other than pursuant to Section 6 of this Article VIII, until such existing certificate shall have been cancelled.

Section 6.Lost, Destroyed, Stolen and Mutilated Certificates. In the event that any certificate for shares of capital stock of the Corporation is mutilated, the Corporation will issue a new certificate or uncertificated shares in place of such mutilated certificate. In case any such certificate is lost or destroyed the Corporation can issue a new certificate for capital stock or uncertificated shares in the place of any such lost or destroyed certificate. The applicant for any substituted certificate or for uncertificated shares will surrender any mutilated certificate or, in the case of any lost or destroyed certificate, furnish satisfactory proof of such loss, theft or destruction of such certificate and of the ownership thereof. The Corporation can, in its discretion, require the owner of a lost or destroyed certificate, or their representative, to furnish to the Corporation a bond with an acceptable surety or sureties and in such sum as will be sufficient to indemnify the Corporation against any claim that may be made against it on account of the lost or destroyed certificate or the issuance of such new certificate or uncertificated shares in respect thereof.

18

Subject to the provisions of the Articles of Incorporation and applicable law, any dividends upon the common shares of the Corporation may be declared by the Board in accordance with the MBCA and these bylaws.

Article X

RIGHT OF INSPECTION

Section 1.Balance Sheet. Upon written request of a shareholder, the Corporation will mail to the shareholder its balance sheet as of the end of the preceding fiscal year, its statement of income for such fiscal year, and if prepared by the Corporation, its statement of source and application of funds for such fiscal year.

Section 2.Right of Inspection. Any shareholder of record, in person or by attorney or other agent, will have the right during the usual hours of business to inspect for any proper purpose the Corporation’s stock ledger, a list of its shareholders, and its other books and records, if the shareholder gives the Corporation written demand describing with reasonable particularity his or her purpose and the records he or she desires to inspect, and the records sought are directly connected with the purpose. A proper purpose shall mean a purpose reasonably related to such person’s interest as a shareholder. The demand shall be delivered to the Corporation at its registered office in Michigan or at its principal place of business. In every instance where an attorney or other agent shall be the person who seeks to inspect, the demand shall be accompanied by a power of attorney or other writing that authorizes the attorney or other agent to act on behalf of the shareholder.

Article XI

Execution of Instruments

Checks, Contracts, Conveyances, Etc. Except as otherwise required by law, the Articles of Incorporation or these bylaws, any contract, conveyance, lease, power of attorney or other agreement, instrument or document may be executed and delivered in the name and on behalf of the Corporation by such officer or officers or person or persons as from time to time may be designated by the Board or by such officer or officers of the Corporation authorized by the Board to make such designation.

19

Article XII

INDEMNIFICATION

Section 1.Indemnification of Officers and Directors. The Corporation will indemnify any person who (a) is or was a director or officer of the Corporation or (b) is or was a director or officer of the Corporation and who is or was serving at the request of the Corporation as a director, officer, partner, trustee, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, whether for profit or not, to the fullest extent authorized or permitted by applicable law (as now or hereafter in effect but, in the case of any future amendments, only to the extent such amendment permits the Corporation to provide broader indemnification rights than before such amendment). The foregoing right to indemnification will inure to the benefit of the heirs, executors and personal and legal representatives of such persons. Notwithstanding the foregoing, the Corporation will not be obligated to indemnify any director or officer (or their heirs, executors or personal or legal representatives) in connection with a proceeding (or part thereof) initiated by such person unless (i) such proceeding (or part thereof) was authorized or consented to by the Board or (ii) was brought or made to enforce this Section 1 of Article XII and the indemnitee has been successful in such action, suit, proceeding or claim (or part thereof).

Section 2.Advancement of Expenses. The Corporation will, to the fullest extent permitted by applicable law (as now or hereafter in effect but, in the case of any future amendment, only to the extent such amendment permits the Corporation to provide broader advancement rights than before such amendment), pay or reimburse the reasonable expenses (including attorneys’ fees) of any director or officer incurred in defending or otherwise participating in any action, suit or proceeding contemplated by Section 1 of this Article XII in advance of its final disposition, subject to the Corporation’s prior receipt of a written undertaking executed by or on behalf of such director or officer to repay all amounts advanced if it is ultimately determined that such person did not meet the standard of conduct, if any, required for or was not otherwise entitled to indemnification under this Article XII or pursuant to any other bylaw, the Articles of Incorporation or any contract between such person and the Corporation under the circumstances.

Section 3.Other Rights to Indemnification; Rights Not Exclusive. The Corporation may, to the extent authorized from time to time by the Board, provide rights to indemnification and to the advancement of expenses to employees and other agents of the Corporation. The rights to indemnification and to the advancement of expenses conferred in this Article XII will not be exclusive of any other right that any person may have or hereafter acquire under these bylaws, the Articles of Incorporation, any statute, agreement, vote of shareholders or disinterested directors or otherwise. Any repeal or modification of this Article XII will not adversely affect any rights to indemnification and to the advancement of expenses of a director or officer of the Corporation existing at the time of such repeal or modification with respect to any acts or omissions occurring prior to such repeal or modification.

20

Section 4.Insurance. The Corporation will have power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, partner, trustee, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against them and incurred by them in any such capacity or arising out of their status as such, whether or not the Corporation would have the power to indemnify them against such liability under applicable law.

Article XIII

MISCELLANEOUS