- Global Data and Operational Leaders in Retail, Restaurant,

Commercial Real Estate, Travel & Hospitality Industries Report

that Consumer Behavior Is Critical for Decision-Making, but Many

Teams Are Falling Short in Using It

- Among Top Concerns Are Data Security and Accuracy

Near Intelligence, Inc. (Nasdaq: NIR) (“Near” or the “Company”),

a global leader in privacy-led data intelligence on people, places,

and products, today announced the results of its “State of Global

Consumer Behavior Data Survey” which reveals how changing consumer

behavior is significantly impacting the way companies are

approaching their business strategy.

Of the respondents, 59.8% said that changes in consumer behavior

have caused their organization to rethink its business strategy in

the past year, and 70.4% of executives worried about the economic

impact of a potential recession.

"Consumer behavior data has become increasingly valuable in

driving business decisions and is being utilized across a wide

range of use cases. From visitor insights and customer profiles to

competitive intelligence and inventory planning, data is proving

vital to businesses’ success. Additionally, consumer behavior data

provides valuable insights into shopping trends, eating habits, and

travel patterns, among others,” said Anil Mathews, CEO of Near.

Near partnered with Hanover Research to survey 590 global data

and operational leaders working in the retail, restaurant,

commercial real estate, and travel & hospitality industries.

The survey examined the ways in which consumer behavior data is

used to make business decisions to address challenges and assess

sentiment about the state of the industry.

“Without a steady stream of up-to-date data on consumer

behavior, companies are essentially flying blind,” said Steven

Williams, Chief Research Officer, Hanover Research.

Leveraging consumer data to stay ahead of the

competition

The survey findings suggest that companies recognize the value

of consumer behavior data and are looking for ways to leverage it

to stay ahead of the competition. However, executives also

indicated they would like to have more data available to them:

- 77.5% agree that consumer behavior data is critical for making

informed business decisions.

- However, 72.1% of executives also indicate that they would like

to have more data available to them for business decisions.

- 56.7% of organizations plan to increase their use of consumer

behavior data for decision-making in the coming year.

Data still not utilized for decision-making

Despite the importance of data for business decisions, many

teams still struggle to use it effectively. According to survey

results:

- The majority of executives, or 64.2%, believe their

organization is doing better than competitors in using data for

decision-making.

- 38.9% of respondents report their organization has a lot of

data, but isn't effective in using it to make informed

decisions.

- Nearly 40% of data executives say they have missed business

opportunities due to insufficient data.

Hurdles to utilizing data

The top hurdles to using consumer behavior data for

decision-making include:

- Finding high-quality data sources (34%)

- Blending data (32.5%)

- Making data actionable (27.7%)

- Ensuring privacy compliance (26.5%)

- Visualizing data (24.3%)

Although most organizations have a chief data officer or similar

role, nearly a third of data executives said their organization

does not have one, and 64% of data executives said they would like

more technical expertise on their team so they can better utilize

data.

Data security and accuracy remain top concerns

Data security and data accuracy are two key concerns that many

data executives share.

- The majority of respondents, or 78%, agreed that data security

and avoiding data breaches is a top priority for their

organizations.

- Additionally, 94.4% expressed a level of concern about poor or

unreliable data quality.

When researching third-party data sources, data security (69.2%)

and data accuracy (63.8%) are the top features and functionality

that executives look for. However, these two features are also the

most challenging to find in third-party data sources.

Still room for improved transparency

Transparency around privacy is also important to executives, but

many state that there's still room for improvement.

- 92.7% of executives expressed some level of concern around

adherence to privacy regulations.

- 66.8% are confident that their organization is complying with

all data privacy regulations in the regions where they

operate.

- 70.9% feel confident that their organization is transparent

with the way they collect and use consumer data.

Consumer data integral to planning for 2023 and

beyond

According to the survey, over half, or 56.7%, of organizations

plan to use more consumer behavior data for decision-making in

2023. To achieve their goals, businesses are focusing on a range of

areas, including:

- Growing footfall to locations (53.7%)

- Improving customer experience (52.0%)

- Online visits and sales (47.1%)

- Optimizing staffing (37.1%)

- Inventory turnover (35.5%)

To achieve these goals, businesses plan to:

- Get more teams involved in using data for decision-making

(47.4%)

- Use data for additional use cases (43.2%)

- Do more to integrate siloed data across departments

(40.4%)

- Integrate consumer behavior data with additional sources of

third-party data (38.0%)

Download a copy of the full report:

https://business.near.com/the-state-of-global-consumer-behavior-data

About Near

Near, a global, full-stack data intelligence

software-as-a-service (“SaaS”) platform curates one of the world’s

largest sources of intelligence on people, places, and products.

The Near platform’s patented technology processes data from an

estimated 1.6 billion unique user IDs and 70 million points of

interests, in more than 44 countries. Near’s data and insights

empower marketing and operations teams to understand consumers’

online and offline behaviors, affinities, and attributes in order

to engage them and grow their businesses. With a presence in Los

Angeles, Paris, Bangalore, Singapore, Sydney, and Tokyo, Near

serves scaled enterprises in retail, real estate, restaurant/QSR,

travel/tourism, telecom, and financial services. For more

information, please visit https://near.com.

About Hanover Research

Founded in 2003, Hanover Research is a global research and

analytics firm that delivers market intelligence through a unique,

fixed-fee model to more than 1,000 clients. Headquartered in

Arlington, Virginia, Hanover employs high-caliber market

researchers, analysts, and account executives to provide a service

that is revolutionary in its combination of flexibility and

affordability. Hanover was named a Top 50 Market Research Firm by

the American Marketing Association in 2015, 2016, 2017, 2018, and

by the Insights Association in 2019. To learn more about Hanover

Research, visit www.hanoverresearch.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230522005058/en/

Near - Media Inquiries Kat Harwood, Near PR@near.com

Investor Relations Marc P. Griffin, ICR

Marc.Griffin@icrinc.com

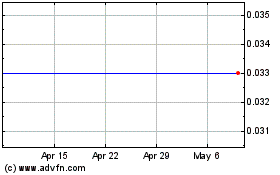

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Nov 2023 to Nov 2024