false

0000070487

0000070487

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

National Research Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-35929

|

47-0634000

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1245 Q Street, Lincoln, Nebraska

|

68508

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(402) 475-2525

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

|

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| $.001 Par Value Common Stock |

NRC |

The NASDAQ Stock Market |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| |

|

| |

Emerging growth company ☐

|

| |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

| |

|

Item 2.02

|

Results of Operations and Financial Condition.

|

| |

|

| |

On February 13, 2024, National Research Corporation, a Delaware corporation (the "Company"), issued a press release announcing its financial and operating results for the fourth quarter and year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

On February 14, 2024, the Company will hold a conference call and online Web simulcast in connection with the Company’s announcement of its earnings for the fourth quarter and year ended December 31, 2023. An archive of such conference call and simulcast and the related question and answer session will be available online at https://events.q4inc.com/attendee/823574505.

|

| |

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

| |

|

| |

On February 8, 2024, Kevin R. Karas, Senior Vice President, Chief Financial Officer, Treasurer and Secretary of the Company notified the Company of his decision to retire effective March 31, 2024. In connection with his retirement, Mr. Karas entered into a Retirement Transition Agreement which provides that he will receive one year of base salary continuation payments from April 1, 2024 through March 31, 2025. The Company and its Board of Directors extend their gratitude to Mr. Karas for his over 13 years of service.

Also, on February 8, 2024, the Company’s Board of Directors approved the promotion of Linda Stacy, Vice President of Finance, to the position of Principal Accounting Officer, effective on March 31, 2024. The following is biographical information for Ms. Stacy:

Linda Stacy, 53, joined the Company as Accounting Controller in 2006 and was promoted to Vice President of Finance in 2008. From 1999 to 2006, Ms. Stacy served in various roles at MDS Pharma Services, a drug discovery and development company. Ms. Stacy started her career as a Certified Public Accountant at BKD CPAs & Advisors.

|

| |

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

|

| |

(d)

|

Exhibits.

|

| |

|

|

| |

EXHIBIT

NUMBER

|

EXHIBIT DESCRIPTION

|

| |

|

|

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

| |

|

| |

The information contained in Items 2.02 and 9.01 of this report and the exhibits hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

| |

|

| |

The information in Items 2.02, 5.02, and 9.01 of this report and the exhibits hereto may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by forward-looking statements. Please refer to the paragraph at the end of the attached press release and various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risks, uncertainties, and other factors that may affect future results.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NATIONAL RESEARCH CORPORATION

|

| |

(Registrant)

|

|

| |

|

|

|

Date: February 13, 2024

|

By:

|

/s/ Kevin R. Karas

|

| |

|

Kevin R. Karas

|

| |

|

Senior Vice President Finance, Chief Financial Officer, Treasurer and Secretary

|

Exhibit 99.1

|

|

1245 Q Street, Lincoln, NE 68508

P: 1 800 388 4264 | F: 402 475 9061

nrchealth.com

|

|

Contact:

|

Kevin R. Karas

Chief Financial Officer

402-475-2525

|

NATIONAL RESEARCH CORPORATION ANNOUNCES

FOURTH QUARTER AND CALENDAR YEAR 2023 RESULTS

LINCOLN, Nebraska (February 13, 2024) — National Research Corporation, dba NRC Health, (NASDAQ:NRC) today announced results for the fourth quarter 2023.

CEO Commentary

Michael Hays, Chief Executive Officer, commented: “We’re pleased to start 2024 with momentum from another consecutive quarter of growth in new sales and operating margin. We have trimmed non-core service lines, and developed our capability across the patient, customer, and employee experience continuum to focus on our clients’ most important needs. With industry-leading solutions – from C-Suite strategy through The Governance Institute, to customized data benchmarking and analysis, to actionable front-line solutions – NRC is better positioned than ever, and our highest ever Net Promoter Score of 75, a level rarely achieved by any brand, is a testament to delivering value to our partners.”

Mr. Hays continued, “I’m particularly excited by our expanded executive team and growth plan. We expect to roll out new Market Experience, PX, CX, and EX products regularly over the coming year and beyond. Meanwhile, we are ramping up our sales, IT, and innovative product development resources, with a focus on AI enabled solutions, to deliver more to our customers while improving our efficiency. We believe we are strongly positioned to expand Human Understanding across the experience lifecycle to recognize and respond to individuals as consumers, patients, and caregivers. In fulfilling our mission, we believe we are positioned to increase share across historical and expanded markets while creating more opportunity for our associates and value for our stockholders.”

Financial Summary

Kevin Karas, Chief Financial Officer, commented on the financial results, “Diluted earnings per share increased for the fourth straight quarter through a combination of sequentially improving new sales, focused cost control, and lower share count attributable to share repurchases. We continue to focus on returning to revenue growth, expanding our margins, and stockholder returns.”

NRC Announces Fourth Quarter 2023 Results

Page 2

February 13, 2024

For the quarter ended December 31, 2023, compared to the quarter ended December 31, 2022:

| |

●

|

Diluted earnings per share increased to $0.36 from $0.27. The 2022 period included a $0.10 per share cumulative foreign currency translation expense associated with exiting the Canadian market.

|

| |

●

|

Revenue was $38 million in each period, as increased new core sales were offset by reductions in non-core revenue.

|

From a capital standpoint, the Company remains well-positioned to execute the entire range of capital allocation alternatives, including funding innovation and growth investments, dividends, and share repurchases. During 2023, the Company returned $55 million to stockholders in the form of dividends and stock repurchases, and another $15 million in stock was repurchased in January of 2024. Return on average equity improved to 51% in 2023 from 40% in 2022, primarily resulting from returning capital to stockholders through dividends and stock repurchases.

For the remainder of 2024, capital allocation is expected to focus primarily on growth and innovation initiatives (including facilities renovation) and the regular quarterly dividend. At December 31, 2023, the Company had approximately $30 million of net debt, $30 million available on its revolving line of credit, and $56 million available on its delayed draw term facility.

CFO Retirement

Kevin Karas, Chief Financial Officer, has informed the Company of his intent to retire effective March 31, 2024. Chief Executive Officer, Michael Hays, commented: “We appreciate Kevin’s leadership and contributions over a remarkable 13-years of service. Under Kevin’s watch, the Company’s revenue has more than doubled, the market capitalization of our common stock has quadrupled, and we have returned over $255 million to our stockholders in the form of dividends and stock repurchases. Additionally, his integrity, insistence on quality, and unfailing good nature have reinforced our culture and helped develop a deep and talented team that is ready to assume his responsibilities. Our Vice President of Finance, Linda Stacy, has been promoted to Principal Accounting Officer effective March 31. We are grateful for Kevin’s service and wish him a productive and happy retirement.”

Dividend

The Company’s Board of Directors has declared a quarterly cash dividend of $0.12 (twelve cents) per share payable Monday, April 15, 2024, to shareholders of record as of the close of business on Friday, March 29, 2024.

NRC Announces Fourth Quarter 2023 Results

Page 3

February 13, 2024

Conference Call

A live simulcast of National Research Corporation’s 2023 fourth quarter conference call will be available online at https://events.q4inc.com/attendee/823574505 February 14, 2024, beginning at 11:00 a.m. Eastern time. The online replay will follow approximately one hour later and continue for 30 days.

About NRC

For more than 40 years, NRC Health (NASDAQ: NRC) has led the charge to humanize healthcare and support organizations in their understanding of each unique individual. NRC Health’s commitment to Human Understanding® helps leading healthcare systems get to know each person they serve not as point-in-time insights, but as an ongoing relationship. Guided by its uniquely empathic heritage, NRC Health’s patient-focused approach, unmatched market research, and emphasis on consumer preferences are transforming the healthcare experience, creating strong outcomes for patients and entire healthcare systems. For more information, email info@nrchealth.com, or visit www.nrchealth.com.

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases such as “believes,” “expect,” “focus,” “potential,” “will,” derivations thereof, and similar terms and phrases. In this press release, the statement related to the roll out of new products, future use of AI, our ability to improve efficiency, the potential to expand Human Understanding and increase market share, and future revenue growth, margins, stockholder returns, and capital allocation are forward-looking statements. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements, including those risks and uncertainties as set forth in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2022 and various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission. We disclaim any obligation to update or revise any forward-looking statements to reflect actual results or changes in the factors affecting the forward-looking information.

NRC Announces Fourth Quarter 2023 Results

Page 4

February 13, 2024

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

Unaudited Condensed Consolidated Statements of Income

(In thousands, except per share data)

| |

|

Three months ended

December 31

|

|

|

Twelve months ended

December 31

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

38,001 |

|

|

$ |

38,144 |

|

|

$ |

148,580 |

|

|

$ |

151,568 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct

|

|

|

13,793 |

|

|

|

13,987 |

|

|

|

56,015 |

|

|

|

57,049 |

|

|

Selling, general and administrative

|

|

|

11,070 |

|

|

|

10,541 |

|

|

|

46,621 |

|

|

|

42,699 |

|

|

Depreciation and amortization

|

|

|

1,429 |

|

|

|

1,375 |

|

|

|

5,899 |

|

|

|

5,277 |

|

|

Total operating expenses

|

|

|

26,292 |

|

|

|

25,903 |

|

|

|

108,535 |

|

|

|

105,025 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

11,709 |

|

|

|

12,241 |

|

|

|

40,045 |

|

|

|

46,543 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

41 |

|

|

|

134 |

|

|

|

820 |

|

|

|

168 |

|

|

Interest expense

|

|

|

(269 |

) |

|

|

(286 |

) |

|

|

(862 |

) |

|

|

(1,209 |

) |

|

Reclassification of cumulative translation into earnings

|

|

|

-- |

|

|

|

(2,569 |

) |

|

|

-- |

|

|

|

(2,569 |

) |

|

Other, net

|

|

|

(13 |

) |

|

|

(49 |

) |

|

|

(41 |

) |

|

|

(118 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense)

|

|

|

(241 |

) |

|

|

(2,770 |

) |

|

|

(83 |

) |

|

|

(3,728 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

11,468 |

|

|

|

9,471 |

|

|

|

39,962 |

|

|

|

42,815 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

2,610 |

|

|

|

2,830 |

|

|

|

8,991 |

|

|

|

11,015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

8,858 |

|

|

$ |

6,641 |

|

|

$ |

30,971 |

|

|

$ |

31,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share of Common Stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Share

|

|

$ |

0.36 |

|

|

$ |

0.27 |

|

|

$ |

1.26 |

|

|

$ |

1.28 |

|

|

Diluted Earnings Per Share

|

|

$ |

0.36 |

|

|

$ |

0.27 |

|

|

$ |

1.25 |

|

|

$ |

1.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares and share equivalents outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

24,437 |

|

|

|

24,648 |

|

|

|

24,540 |

|

|

|

24,922 |

|

|

Diluted

|

|

|

24,548 |

|

|

|

24,775 |

|

|

|

24,673 |

|

|

|

25,052 |

|

NRC Announces Fourth Quarter 2023 Results

Page 5

February 13, 2024

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

Unaudited Condensed Consolidated Balance Sheets

(Dollars in thousands, except share amounts and par value)

| |

|

December 31,

2023

|

|

|

December 31,

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

6,653 |

|

|

$ |

25,026 |

|

|

Accounts receivable, net

|

|

|

12,378 |

|

|

|

14,461 |

|

|

Other current assets

|

|

|

5,329 |

|

|

|

4,229 |

|

|

Total current assets

|

|

|

24,360 |

|

|

|

43,716 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

28,205 |

|

|

|

17,248 |

|

|

Goodwill

|

|

|

61,614 |

|

|

|

61,614 |

|

|

Other, net

|

|

|

8,258 |

|

|

|

7,883 |

|

|

Total assets

|

|

$ |

122,437 |

|

|

$ |

130,461 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current portion of notes payable

|

|

$ |

7,214 |

|

|

$ |

4,491 |

|

|

Accounts payable and accrued expenses

|

|

|

6,194 |

|

|

|

5,136 |

|

|

Accrued compensation

|

|

|

3,953 |

|

|

|

4,551 |

|

|

Deferred revenue

|

|

|

14,834 |

|

|

|

15,198 |

|

|

Dividends payable

|

|

|

2,906 |

|

|

|

2,956 |

|

|

Other current liabilities

|

|

|

1,102 |

|

|

|

1,085 |

|

|

Total current liabilities

|

|

|

36,203 |

|

|

|

33,417 |

|

| |

|

|

|

|

|

|

|

|

|

Notes payable, net of current portion and unamortized debt issuance costs

|

|

|

29,470 |

|

|

|

17,690 |

|

|

Other non-current liabilities

|

|

|

7,809 |

|

|

|

7,321 |

|

|

Total liabilities

|

|

|

73,482 |

|

|

|

58,428 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, authorized 2,000,000 shares, none issued

|

|

|

-- |

|

|

|

-- |

|

|

Common stock, $0.001 par value; authorized 110,000,000 shares, issued 31,002,919 in 2023 and 30,922,181 in 2022, outstanding 24,219,887 in 2023 and 24,628,173 in 2022

|

|

|

31 |

|

|

|

31 |

|

|

Additional paid-in capital

|

|

|

178,213 |

|

|

|

175,453 |

|

|

Retained earnings (accumulated deficit)

|

|

|

(30,530 |

) |

|

|

(25,184 |

) |

| |

|

|

|

|

|

|

|

|

|

Treasury stock

|

|

|

(98,759 |

) |

|

|

(78,267 |

) |

|

Total shareholders’ equity

|

|

|

48,955 |

|

|

|

72,033 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

122,437 |

|

|

$ |

130,461 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

National Research Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35929

|

| Entity, Tax Identification Number |

47-0634000

|

| Entity, Address, Address Line One |

1245 Q Street

|

| Entity, Address, City or Town |

Lincoln

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68508

|

| City Area Code |

402

|

| Local Phone Number |

475-2525

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NRC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000070487

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

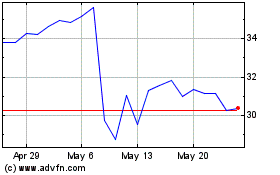

National Research (NASDAQ:NRC)

Historical Stock Chart

From Apr 2024 to May 2024

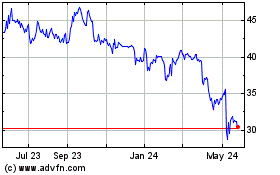

National Research (NASDAQ:NRC)

Historical Stock Chart

From May 2023 to May 2024