PROSPECTUS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275689

NanoString Technologies, Inc.

16,000,000 Shares

Common Stock

Offered by the Selling Stockholders

The selling stockholders identified herein may from time to time offer or sell up to 16,000,000 shares of our common stock, $0.0001 par value per share, issuable upon exercise of warrants to purchase our common stock issued by us to the selling stockholders. To the extent that any selling stockholders resell any securities, the selling stockholders may be required to provide you with this prospectus and a prospectus supplement identifying and containing specific information about the selling stockholders and the amount and terms of the securities being offered. You should read this prospectus and any applicable prospectus supplement before you invest.

We are registering the securities for resale pursuant to a Registration Rights Agreement (as defined herein) that we entered into with the selling stockholders in connection with the Exchange Transaction, as more fully described in the section entitled “Prospectus Summary—The Exchange Transaction.” Our registration of our common stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of our common stock. The selling stockholders identified in this prospectus may sell our common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell the securities in the section entitled “Plan of Distribution.” We will not receive any proceeds from the sale of our common stock by the selling stockholders. We will receive the proceeds from any exercise of the warrants on a cash basis.

The securities may be sold directly to you, through agents or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities will also be set forth in a prospectus supplement. Our common stock is listed on the Nasdaq Global Market under the symbol “NSTG.” On November 29, 2023, the last reported sale price of our common stock on the Nasdaq Global Market was $0.50 per share. Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

Investing in our securities involves risks. Please carefully read the information under the headings “Risk Factors” beginning on page 4 of this prospectus and “Item 1A – Risk Factors” of our most recent report on Form 10-K or 10-Q that is incorporated by reference in this prospectus before you invest in our securities. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 30, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, the selling stockholders may from time to time sell the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities that may be offered. Each time the selling stockholders sell securities through agents, underwriters or dealers we will provide one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. Before you invest in our securities, you should read both this prospectus and any applicable prospectus supplement together with the additional information described in the sections titled “Where You Can Find More Information” and “Incorporation by Reference.”

Neither we nor the selling stockholders have authorized anyone to provide you with information that is different from that contained, or incorporated by reference, in this prospectus, any applicable prospectus supplement or in any related free writing prospectus. Neither we nor the selling stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus and any applicable prospectus supplement or any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in the applicable prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Prospectus Summary

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the matters set forth in the section titled “Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Unless the context indicates otherwise, references in this prospectus to “NanoString Technologies, Inc.,” “we,” “our” and “us” refer, collectively, to NanoString Technologies, Inc., a Delaware corporation, and its subsidiaries taken as a whole.

Company Overview

We develop, manufacture and market technologies that unlock scientifically valuable and clinically actionable information from minute amounts of biological material, primarily for life science researchers in the fields of genomics and proteomics. Our mission is to offer an ecosystem of innovative discovery and translational research solutions that enable our customers to map the universe of biology, enabling scientific exploration that may lead to new therapies that can improve the human condition.

Our technologies include proprietary chemistries that enable the labeling and counting of single molecules. Our product platforms are used for scientific discovery and clinical research applications, often in connection with pharmaceutical product development and human clinical trials of potential new therapies. Our proprietary chemistries may reduce the number of steps required to conduct certain types of scientific experiments, enable the collection of multiple data points in a single experiment and allow for multiple experiments to be conducted at once. Our chemistries and instruments are also able to extract information from multiple types of biological samples, including those that are often challenging to work with using other scientific methods or platforms. As a result, we are able to develop tools that are easier for researchers to use and that may generate larger amounts of data and faster, more consistent scientific results.

Our products platforms consist of (i) our spatial biology platforms, including our CosMx Spatial Molecular Imager, or CosMx, our GeoMx Digital Spatial Profiler, or GeoMx, and our AtoMx Spatial Informatics Platform, or AtoMx, a cloud-based, open source and fully integrated informatics solution for use with CosMx, and (ii) our nCounter Analysis System, our original product platform for multi-plex bulk gene expression analysis. All our product platforms include instruments, related consumables, software and services, have the versatility to detect both RNA and protein expression and are able to generate reliable and reproduceable data in a variety of biological sample types, including formalin fixed paraffin embedded, or FFPE, sample types. Our product platforms allow our customers to progress their research in areas such as oncology, immunology and neurology. We market and sell our instruments and related consumables to researchers in academic, government and biopharmaceutical laboratories for research use, both through our direct sales force and through selected distributors in certain markets.

Spatial Biology Platforms

GeoMx, which was commercially launched in 2019, is a pioneering product platform in the emerging field of spatial biology. While nCounter and other common gene expression analysis technologies use bulk analysis approaches, GeoMx is used to analyze selected regions of an intact biological sample without the need to reduce or destroy the sample, enabling researchers to see how gene expression might vary across those regions. CosMx, which was commercially launched in December 2022, is a new product platform in the field of spatial biology and complements our GeoMx platform. While GeoMx offers researchers the ability to profile gene expression activity in a selected region of interest that may contain multiple cells or cell types, CosMx is designed to enable multiplexed spatial profiling of RNA and protein targets at a single and sub-cellular resolution level. While GeoMx allows for more rapid, higher throughput analysis of gene expression activity in selected regions of interest, CosMx is designed to allow researchers to “drill down” into a specific single cell or sub-cellular area in a region of interest to gather more information as desired or required.

AtoMx, which was commercially launched in December 2022, is a cloud-based, open-source spatial biology informatics platform, initially for use with CosMx. Researchers’ desire for ever larger amounts of data in their spatial biology experiments has led to significant “big data” management issues, including the ability to store, access and efficiently analyze experimental data at a reasonable cost. AtoMx is designed to enable researchers to perform image analysis and data visualization, as well as sharing of data and analysis with collaborators, using scalable and on-demand cloud images generated by spatial biology experiments, while avoiding the large computing infrastructure and security costs associated with operating in-house data centers.

In advance of and subsequent to our commercial launch of CosMx, GeoMx, and AtoMx, we have provided selected customers in-house sample testing services whereby customers send biological samples to our facilities to be analyzed using our product platforms and selected consumables under our technology access program, or TAP. Upon completion of each project, the raw data and analysis report is provided to the customer.

nCounter Platform

nCounter, which was commercially launched in 2008, is used to conduct what is known as “bulk” gene expression analysis, whereby biological samples are first reduced, and then gene expression, specifically quantities of selected RNA or proteins, are measured at their average levels throughout the totality of the sample. nCounter can be used to analyze the activity of up to 800 genes in a single experiment.

We derive a substantial majority of our revenue from the sale of our products, which consist of our CosMx, GeoMx, and nCounter instruments and related proprietary consumables. Our instruments are designed to work only with our consumables products. Accordingly, as the installed base of instruments grows, we expect recurring revenue from consumables sales to become an increasingly important driver of our operating results. Our consumables include our standardized CosMx, GeoMx and nCounter panel products, nCounter custom codeset products that contain a specific set of targets for scientific analysis as requested by a customer, and the Prosigna breast cancer assay which is manufactured for our partner Veracyte Inc, or Veracyte. We also derive revenue from processing fees related to proof-of-principle studies, including from our CosMx and GeoMx Technology Access Program (“TAP”). For CosMx, GeoMx, and nCounter, we offer extended service contracts and generate service revenue. In addition, we generate revenue from AtoMx in the form of software subscription fees which include license, cloud computing, and data storage.

We use third-party contract manufacturers to produce our instruments and certain raw materials for our consumables. We build our consumables, including our panels, custom code sets and reagent packages, at our greater Seattle, Washington area facilities.

Recent Development

As previously disclosed, on November 17, 2023, after a trial in the U.S. District Court for the District of Delaware in the matter of 10x Genomics, Inc. et al v. NanoString Technologies, Inc., No. 21-CV-653-MFK, a jury verdict was entered in favor of plaintiffs, 10x Genomics, Inc. and Prognosys Biosciences, Inc. (the “Plaintiffs”), and against us. The jury found that we willfully infringed U.S. Patent Nos. 10,472,669, 10,961,566, 10,983,113, 10,996,219, 11,001,878, 11,008,607, and 11,293,917, and awarded Plaintiffs approximately $31 million in damages, consisting of approximately $25 million of lost profits and a $6 million royalty. We expect to file post-trial motions to overturn the jury’s verdict and/or amend the judgment. The Plaintiffs, through post-trial motions, may seek to enhance the damages award up to three times based on the jury’s finding of willful infringement. We respectfully disagree with the jury’s findings and plan to vigorously contest the verdict and judgment through post-trial motions in the district court, and through appeal to the U.S. Court of Appeals for the Federal Circuit.

We continue to evaluate the impact of the verdict on our business, results of operations, and financial condition. While the verdict does not prevent us from continuing to sell GeoMx products anywhere in the world, the verdict or any future attempts by the Plaintiffs to obtain injunctive relief may negatively impact future product sales.

Since inception, we have not achieved profitable operations or positive cash flows from operations. As of September 30, 2023, we held approximately $97.1 million in cash, cash equivalents, and short-term investments. It is very difficult to estimate future liquidity requirements due in part to the verdict and pending litigation. As a result of the verdict and pending litigation, we may be unable to generate sufficient cash flows to meet our required financial obligations, including debt service, liquidity covenants and other obligations due to third parties within one year after the filing date of this registration statement. If we are unable to generate such cash flows, we may be required to take additional actions to address our liquidity needs, including additional cost reduction measures such as further reducing operating expenses, including workforce reductions or reducing our research and development activities, which could have a material adverse effect on our business and prospects. We may also be required to adopt one or more alternatives, such as selling assets, refinancing, or restructuring indebtedness or obtaining additional equity capital on terms that may be onerous and/or highly dilutive. Our ability to refinance indebtedness will depend on the capital markets and our financial and operational condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms. We currently have no commitments to engage in any specific transactions and there can be no assurance that we will be able to complete additional or alternative financings, business development transactions or other strategic alternatives. In addition, the instruments governing our indebtedness contain provisions that could result in our obligations becoming immediately due and payable or being deemed to be in default if applicable cross default, cross-acceleration and/or similar provisions are triggered. If we are unable to raise additional funds when needed, our financial condition, operating results, prospects, and ability to meet our debt obligations could be adversely affected. If these initiatives are unsuccessful, we may consider other alternatives, including seeking relief under the United States Bankruptcy Code, pursuant to which we may elect to pursue a court-supervised bankruptcy restructuring or sales process.

Given the uncertainty regarding our financial condition, substantial doubt exists about our ability to continue as a going concern for a reasonable period of time.

Corporate Information

We were incorporated in Delaware in June 2003. Our principal executive offices are located at 530 Fairview Avenue, North, Seattle, Washington 98109 and our telephone number is (206) 378-6266. Our common stock trades on The Nasdaq Global Market under the symbol “NSTG.” Information contained on the website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

Unless the context indicates otherwise, as used in this prospectus, the terms “NanoString,” “we,” “us” and “our” refer to NanoString Technologies, Inc. and its subsidiaries, NanoString Technologies Europe Limited, NanoString Technologies SAS, NanoString Technologies International, Inc., NanoString Technologies Germany GmbH, NanoString Technologies Asia Pacific Limited, NanoString Technologies Singapore Pte Limited, NanoString Technologies (Beijing) Co. Ltd., NanoString Technologies Spain, S.L. and NanoString Technologies Netherlands B.V. We use “NanoString”, “NanoString Technologies”, “nCounter”, “nCounter SPRINT”, “nSolver”, “GeoMx,” “CosMx,” and “AtoMx” and other marks as trademarks in the United States and other countries. This prospectus contains references to our trademarks as well as third-party trademarks. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use of third-party trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

The Exchange Transaction

On November 7, 2023, we consummated a privately negotiated exchange agreement, or the Exchange Agreement, with respect to the exchange of approximately $216 million aggregate principal amount of our outstanding 2.625% Convertible Senior Notes due 2025 for (i) approximately $216 million in aggregate principal amount of our 6.95% Senior Secured Notes due 2026, or the 2026 Notes, and (ii) warrants to purchase an aggregate of 16,000,000 shares of our common stock, at an exercise price of $1.69 per share, or the Warrants. We refer to the exchange of the 2025 Notes for the 2026 Notes and the Warrants, collectively, as the Exchange Transaction.

The Warrants are exercisable in whole or in part at an exercise price of $1.69 per share and expire on the fifth anniversary of issuance. Warrant holders may pay the exercise price in cash, or elect to exercise the Warrant on a “cashless” basis. The Warrants prohibit any exercise by a holder to the extent that, following such exercise, the holder, together with any affiliates and “group” members (as such term is used under Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act), would beneficially own more than a fixed percentage of the total number of shares of our issued and outstanding common stock, or the Beneficial Ownership Cap, which will initially be either 4.99% or 9.99%. The Beneficial Ownership Cap may not be increased above the limitations in Nasdaq Listing Rule 5635(b), or the Nasdaq Cap, without stockholder approval.

On November 7, 2023, we also entered into a registration rights agreement, or the Registration Rights Agreement, with the investors party thereto, whereby we agreed to prepare and file with the SEC a Registration Statement on Form S-3, or such other form as required to effect a registration of the common stock issued or issuable upon exercise of the Warrants and such indeterminate number of additional shares of common stock as may become issuable upon exercise of, in exchange for, or otherwise pursuant to the Warrants.

We sold the 2026 Notes and Warrants to the investors party to the Exchange Agreement in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

The Securities That May Be Offered

The selling stockholders identified herein may from time to time offer and sell up to 16,000,000 shares of our common stock issuable upon exercise of the Warrants. Each time the selling stockholders sell securities through agents, underwriters, or dealers, we will provide a prospectus supplement that will describe the specific amounts, prices and terms of the securities being offered. We will not receive any proceeds from the sale of our common stock by the selling stockholders. We will receive the proceeds from any exercise of the Warrants on a cash basis.

The securities may be sold to or through underwriters, dealers or agents or directly to purchasers or as otherwise set forth in the section titled “Plan of Distribution.” Each prospectus supplement will set forth the names of any underwriters, dealers, agents or other entities involved in the sale of securities described in that prospectus supplement and any applicable fee, commission or discount arrangements with them.

Common Stock

The selling stockholders may offer shares of our common stock, par value $0.0001 per share, issuable upon exercise of the Warrants. Holders of our common stock are entitled to receive dividends declared by our board of directors out of funds legally available for the payment of dividends, subject to rights, if any, of preferred stockholders. We have not paid dividends in the past and have no current plans to pay dividends. Each holder of common stock is entitled to one vote per share. The holders of common stock have no preemptive rights.

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific risk factors discussed in the section of the applicable prospectus supplement titled “Risk Factors,” together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk Factors” of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk Factors” in our most recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. The words “believe,” “anticipate,” “could,” “continue,” “depends,” “expect,” “expand,” “forecast,” “intend,” “predict,” “plan,” “rely,” “should,” “will,” “may,” “seek,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and include statements regarding the intent, belief or current expectations of our management that are subject to known and unknown risks, uncertainties and assumptions. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This prospectus and the documents incorporated by reference in this prospectus may contain market data that we obtain from industry sources. These sources do not guarantee the accuracy or completeness of the information. Although we believe that our industry sources are reliable, we do not independently verify the information. The market data may include projections that are based on a number of other projections. While we believe these assumptions to be reasonable and sound as of the date of this prospectus, actual results may differ from the projections.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of our common stock by the selling stockholders. We will receive the proceeds from any exercise of the Warrants on a cash basis. We intend to use the proceeds from the exercise of the Warrants on a cash basis, if any, for general corporate and working capital purposes.

SELLING STOCKHOLDERS

This prospectus relates to the possible resale by certain of our stockholders, who we refer to in this prospectus as the “selling stockholders,” of up to 16,000,000 shares of our common stock issuable upon exercise of Warrants that were issued and outstanding prior to the original date of filing of the registration statement of which this prospectus forms a part. The following table provides the names of the selling stockholders and the number of shares of our common stock offered by such selling stockholders under this prospectus. The selling stockholders listed below have previously been granted registration rights with respect to the shares offered hereby pursuant to that Registration Rights Agreement, by and between us and certain of our securityholders. The shares offered by this prospectus may be offered from time to time by the selling stockholders listed below. The selling stockholders are not obligated to sell any of their shares offered by this prospectus, and reserve the right to accept or reject, in whole or in part, any proposed sale of shares. The selling stockholders listed below may also offer and sell less than the number of shares indicated. The selling stockholders are not making any representation that any shares covered by this prospectus will or will not be offered for sale.

The number of shares and percentages of beneficial ownership set forth below are based on 48,118,306 shares of our common stock outstanding as of November 14, 2023. Beneficial ownership is determined under the SEC rules and regulations and generally includes voting or investment power over securities. We have prepared the table based on information given to us by, or on behalf of, the selling stockholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares of Common Stock Issuable Upon Exercise of Warrants |

| Name of Selling Stockholder | | Shares Beneficially Owned Prior to Offering(1) | | Number of Shares Being Offered | | Shares Beneficially Owned After Offering |

| | | Number | Percent(2) | | | | Number(3) | | Percent |

Braidwell Partners Master Fund LP(4) | | 10,793,050 | 18.3% | | 10,793,050 | | 0 | | 0% |

Deerfield Partners, L.P.(5) | | 5,206,950 | 9.8% | | 5,206,950 | | 0 | | 0% |

| | | | | |

| (1) | Figures in this column include the shares of common stock issuable upon exercise of Warrants without taking account any limitation on exercise pursuant to the terms of the Warrants, as set forth in footnotes (4) and (5) below. |

| | | | | |

| (2) | The percentage reflects 48,118,306 shares of our common stock outstanding as of November 14, 2023 and gives effect to the total number of shares of our common stock beneficially owned and offered hereby by the respective selling stockholder. |

| | | | | |

| (3) | The number of shares beneficially owned after the offering assumes that each selling stockholders’ Warrant has been fully exercised. Information with respect to shares owned beneficially after the offering assumes the sale of all of the shares offered and that no other purchases or sales of our securities by the selling stockholders have occurred or will occur following the closing of the transactions contemplated by the Exchange Agreement. We are unable to determine the number of shares that will actually be sold pursuant to this prospectus. |

| | | | | |

(4) | The number of shares disclosed as being beneficially owned prior to the offering consists of 10,793,050 shares issuable upon exercise of a Warrant to purchase our common stock held by Braidwell Partners Master Fund LP, or Braidwell Partners. The Beneficial Ownership Cap in the Braidwell Partners Warrant prohibits the exercise thereof to the extent that, upon such exercise, the number of shares of common stock then beneficially owned by the holder and its affiliates and any other person or entities with which such holder would constitute a Section 13(d) “group” would exceed 9.99% of the total number of issued and outstanding shares of our common stock. In addition, the Beneficial Ownership Cap in the Braidwell Partners Warrant may not be increased above the Nasdaq Cap without stockholder approval. Accordingly, notwithstanding the number of shares reported, Braidwell Partners disclaims beneficial ownership of the shares of common stock issuable upon exercise of the Warrant to the extent that (i) upon such exercise, the number of shares beneficially owned by Braidwell Partners, its affiliates and any such group members, in the aggregate, would exceed the Braidwell Beneficial Ownership Cap or (ii) such exercise would otherwise require the issuance of shares of common stock in excess of the Nasdaq Cap without stockholder approval. The address of the selling stockholder is P.O. BOX 309, Ugland House, Grand Cayman, KY1-1104 Cayman Islands. |

| | | | | |

(5) | The number of shares disclosed as being beneficially owned prior to the offering consists of 5,206,950 shares issuable upon exercise of a Warrant to purchase our common stock held by Deerfield Partners, L.P., or Deerfield Partners. The Beneficial Ownership Cap in the Deerfield Partners Warrant prohibits the exercise thereof to the extent that, upon such exercise, the number of shares of common stock then beneficially owned by the holder and its affiliates and any other person or entities with which such holder would constitute a Section 13(d) “group” would exceed 4.99% of the total number of issued and outstanding shares of our common stock. Accordingly, notwithstanding the number of shares reported, Deerfield Partners disclaims beneficial ownership of the shares of common stock issuable upon exercise of the Warrant to the extent that upon such exercise, the number of shares beneficially owned by Deerfield Partners, its affiliates and any such group members, in the aggregate, would exceed the Deerfield Beneficial Ownership Cap. The address of the selling stockholder is c/o Deerfield Management Company, L.P., 345 Park Avenue South, 12th Floor, New York, NY 10010. |

In addition, we may name additional selling stockholders from time to time. Information about such additional selling stockholders, including their identities and the securities to be registered on their behalf, will be set forth in a prospectus supplement, in a post-effective amendment or in filings that we make with the SEC under the Exchange Act that are incorporated by reference in this prospectus.

DESCRIPTION OF CAPITAL STOCK

The description of our capital stock is incorporated by reference to Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 28, 2023.

PLAN OF DISTRIBUTION

We are registering the offer and sale of up to 16,000,000 shares of common stock issuable upon exercise of the Warrants. The selling stockholders will be required to pay all underwriters’ or agents’ commissions and discounts, brokerage fees, underwriter marketing costs associated with the sale of shares of our common stock pursuant to this prospectus. We have agreed to reimburse each selling stockholder for up to $25,000 per registration pursuant to the Registration Rights Agreement in respect of the shares of common stock issuable upon exercise of the Warrants. We will also bear all other reasonable expenses incurred in effecting the registration of the shares of common stock covered by this prospectus, including, without limitation, all registration, listing and qualification fees, printing and accounting fees and fees and expenses of our counsel and our accountants.

The shares of common stock beneficially owned by the selling stockholders covered by this prospectus may be offered and sold from time to time by the selling stockholders.

The selling stockholders may sell securities:

•purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

•ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•on any national securities exchange or quotation service on which our common stock may be listed or quoted at the time of sale or in the over-the-counter market;

•through trading plans entered into by a selling stockholder pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

•to or through underwriters or broker-dealers;

•in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•in privately negotiated transactions;

•in options transactions or other transactions in which the selling stockholder satisfies its obligations through the delivery of shares of our common stock;

•in connection with short sales;

•through a combination of any of the above methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholders may directly solicit offers to purchase securities or agents may be designated to solicit such offers. We will, in the prospectus supplement relating to such offering, name any agent that could be viewed as an underwriter under the Securities Act and describe any commissions that we must pay. Any such agent will be acting on a best efforts basis for the period of its appointment or, if indicated in the applicable prospectus supplement, on a firm commitment basis. This prospectus may be used in connection with any offering of our securities through any of these methods or other methods described in the applicable prospectus supplement. In addition, any shares that qualify for sale pursuant to Rule 144 or another exemption from registration under the Securities Act may be sold under Rule 144 or such other exemption rather than pursuant to this prospectus.

The distribution of the securities may be effected from time to time in one or more transactions:

•at a fixed price or prices that may be changed from time to time;

•at market prices prevailing at the time of sale;

•at prices related to such prevailing market prices; or

•at negotiated prices.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. Each prospectus supplement will describe the method of distribution of the securities and any applicable restrictions.

The prospectus supplement with respect to the securities of a particular series will describe the terms of the offering of the securities, including the following:

•the name of the agent or any underwriters;

•the public offering or purchase price;

•if applicable, the names of any selling stockholders;

•any discounts and commissions to be allowed or paid to the agent or underwriters;

•all other items constituting underwriting compensation;

•any discounts and commissions to be allowed or paid to dealers; and

•any exchanges on which the securities will be listed.

If any underwriters or agents are utilized in the sale of the securities in respect of which this prospectus is delivered, we and the selling stockholders will enter into an underwriting agreement or other agreement with them at the time of sale to them, and we will set forth in the prospectus supplement relating to such offering the names of the underwriters or agents and the terms of the related agreement with them.

If a dealer is utilized in the sale of the securities in respect of which the prospectus is delivered, the selling stockholders will sell such securities to the dealer, as principal. The dealer may then resell such securities to the public at varying prices to be determined by such dealer at the time of resale.

Agents, underwriters, dealers and other persons may be entitled under agreements that they may enter into with us and the selling stockholders to indemnification by us against certain civil liabilities, including liabilities under the Securities Act.

Certain agents, underwriters and dealers, and their associates and affiliates may be customers of, have borrowing relationships with, engage in other transactions with, and/or perform services, including investment banking services, for us or one or more of our respective affiliates in the ordinary course of business.

In order to facilitate the offering of the securities, any underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the securities or any other securities the prices of which may be used to determine payments on such securities. Specifically, any underwriters may over-allot in connection with the offering, creating a short position for their own accounts. In addition, to cover over-allotments or to stabilize the price of the securities or of any such other securities, the underwriters may bid for, and purchase, the securities or any such other securities in the open market. Finally, in any offering of the securities through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions allowed to an underwriter or a dealer for distributing the securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. Any such underwriters are not required to engage in these activities and may end any of these activities at any time.

Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. The applicable prospectus supplement may provide that the original issue date for your securities may be more than two scheduled business days after the trade date for your securities. Accordingly, in such a case, if you wish to trade securities on any date prior to the third business day before the original issue date for your securities, you will be required, by virtue of the fact that your securities initially are expected to settle in more than three scheduled business days after the trade date for your securities, to make alternative settlement arrangements to prevent a failed settlement.

Under the Registration Rights Agreement, we have agreed to indemnify each selling stockholder as a party thereto against certain liabilities that they may incur in connection with the sale of the securities registered hereunder, including liabilities under the Securities Act, and to reimburse each selling stockholder for any reasonable legal fees and other reasonable expenses incurred by them in connection with investigating or defending any such liability.

We have agreed to maintain the effectiveness of this registration statement until the earlier of (i) the date on which all securities have been sold under this registration statement or Rule 144 under the Securities Act or (ii) the first date following November 7, 2024 on which all of the securities may be immediately sold to the public without registration or restriction (including without limitation as to volume by each holder thereof), and without compliance with any “current public information” requirement, pursuant to Rule 144 under the Securities Act, assuming the exercise of the Warrants for cash.

To the extent permitted by applicable law, the plan of distribution set forth above may be modified in a prospectus supplement or otherwise.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Wilson Sonsini Goodrich & Rosati, Professional Corporation, Seattle, Washington. Additional legal matters may be passed on for us, or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement. Certain members of, and investment partnerships comprised of members of, and persons associated with, Wilson Sonsini Goodrich & Rosati, P.C. own less than 1% of our common stock.

EXPERTS

The consolidated financial statements of NanoString Technologies, Inc. appearing in NanoString Technologies, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2022, and the effectiveness of NanoString Technologies, Inc.’s internal control over financial reporting as of December 31, 2022, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.nanostring.com. Information accessible on or through our website is not a part of this prospectus.

This prospectus and any prospectus supplement is part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. You should review the information and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities that we are offering. Forms of any documents establishing the terms of the offered securities are filed as exhibits to the registration statement of which this prospectus forms a part or under cover of a Current Report on Form 8-K and incorporated in this prospectus by reference. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should read the actual documents for a more complete description of the relevant matters.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference much of the information that we file with the SEC, which means that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or incorporated by reference in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form 8-K and, except as may be noted in any such Form 8-K, exhibits filed on such form that are related to such information), until the offering of the securities under the registration statement of which this prospectus forms a part is terminated or completed:

•our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 28, 2023; •the portions of our Definitive Proxy Statement on Schedule 14A (other than information furnished rather than filed) that are incorporated by reference into our Annual Report on Form 10-K, filed with the SEC on April 28, 2023; •our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, filed with the SEC on May 3, 2023, August 3, 2023 and November 6, 2023, respectively; •our Current Reports on Form 8-K filed with the SEC on January 27, 2023, March 2, 2023, June 27, 2023, August 3, 2023, September 7, 2023, October 10, 2023, November 6, 2023, November 7, 2023 and November 20, 2023 in each case, other than information furnished rather than filed; and •the description of our common stock contained in the Registration Statement on Form 8-A relating thereto, filed with the SEC on June 21, 2013, including any amendment or report filed for the purpose of updating such description. You may request a copy of these filings, at no cost, by writing or telephoning us at the following address and telephone number:

NanoString Technologies, Inc.

530 Fairview Avenue North

Seattle, Washington 98109

Attn: Investor Relations

(206) 378-6266

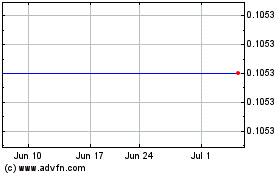

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Apr 2024 to May 2024

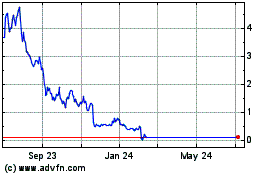

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From May 2023 to May 2024