UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-38235

NaaS Technology Inc.

(Translation of registrant’s

name into English)

Newlink Center, Area G, Building 7, Huitong

Times Square,

No.1 Yaojiayuan South Road, Chaoyang District,

Beijing, China

(Address of principal executive

office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

EXPLANATORY NOTE

This current report on Form 6-K, including the exhibit hereto,

is incorporated by reference into the registration statement on Form F-3 of the Company (File No. 333-273515) and

shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

The following unaudited consolidated statements of profit or loss and

other comprehensive loss for the three months ended March 31, 2023 and 2024 and unaudited consolidated statements of financial position

of NaaS Technology Inc. as of March 31, 2024 have been prepared and presented in accordance with the International Financial Reporting

Standards.

The following table presents our unaudited consolidated statements

of profit or loss and other comprehensive loss for the periods indicated:

| | |

For the Three Months Ended | |

| | |

March 31, 2023 | | |

March 31, 2024 | |

| (In thousands, except for share and per share and per ADS data) | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| | | |

| | | |

| | |

| Charging services revenues | |

| 24,061 | | |

| 47,836 | | |

| 6,625 | |

| Energy solutions revenues | |

| 10,872 | | |

| 47,209 | | |

| 6,538 | |

| New initiatives revenues | |

| 1,228 | | |

| 1,192 | | |

| 165 | |

| Total

revenues | |

| 36,161 | | |

| 96,237 | | |

| 13,328 | |

| | |

| | | |

| | | |

| | |

| Cost

of revenues | |

| (30,047 | ) | |

| (71,889 | ) | |

| (9,957 | ) |

| Gross

profit | |

| 6,114 | | |

| 24,348 | | |

| 3,371 | |

| | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | |

| Selling and marketing expenses | |

| (66,389 | ) | |

| (71,201 | ) | |

| (9,861 | ) |

| Administrative expenses | |

| (45,497 | ) | |

| (123,005 | ) | |

| (17,036 | ) |

| Research and development expenses | |

| (7,832 | ) | |

| (21,523 | ) | |

| (2,981 | ) |

| Total

operating expenses | |

| (119,718 | ) | |

| (215,729 | ) | |

| (29,878 | ) |

| | |

| | | |

| | | |

| | |

| Other (losses)/gains,

net | |

| 493 | | |

| 4,786 | | |

| 663 | |

| | |

| | | |

| | | |

| | |

| Operating

loss | |

| (113,111 | ) | |

| (186,595 | ) | |

| (25,844 | ) |

| Fair value changes of convertible instruments | |

| — | | |

| (7,790 | ) | |

| (1,079 | ) |

| Fair value changes of financial instruments at fair value through profit or loss | |

| 13,571 | | |

| (12,928 | ) | |

| (1,791 | ) |

| Finance costs | |

| (7,060 | ) | |

| (17,732 | ) | |

| (2,456 | ) |

| Loss

before income tax | |

| (106,600 | ) | |

| (225,045 | ) | |

| (31,170 | ) |

| Income tax expenses | |

| (3,055 | ) | |

| (2,687 | ) | |

| (372 | ) |

| Net

loss | |

| (109,655 | ) | |

| (227,732 | ) | |

| (31,542 | ) |

| Net loss attributable to: | |

| | | |

| | | |

| | |

| Equity holders of the company | |

| (109,655 | ) | |

| (227,399 | ) | |

| (31,496 | ) |

| Non-controlling interests | |

| — | | |

| (333 | ) | |

| (46 | ) |

| | |

| (109,655 | ) | |

| (227,732 | ) | |

| (31,542 | ) |

| Basic and diluted loss per share for loss attributable to the ordinary shareholders of the Company (Expressed in RMB per share) | |

| | | |

| | | |

| | |

| Basic | |

| (0.05 | ) | |

| (0.09 | ) | |

| (0.01 | ) |

| Diluted | |

| (0.05 | ) | |

| (0.09 | ) | |

| (0.01 | ) |

| Basic and diluted loss per ADS for loss attributable to the ordinary shareholders of the Company (Expressed in RMB per ADS) | |

| | | |

| | | |

| | |

| Basic | |

| (0.50 | ) | |

| (0.91 | ) | |

| (0.13 | ) |

| Diluted | |

| (0.50 | ) | |

| (0.91 | ) | |

| (0.13 | ) |

| Weighted average number of ordinary shares outstanding-basic | |

| 2,196,978,125 | | |

| 2,508,694,151 | | |

| 2,508,694,151 | |

| Weighted average number of ordinary shares outstanding-diluted | |

| 2,196,978,125 | | |

| 2,508,694,151 | | |

| 2,508,694,151 | |

| Net loss | |

| (109,655 | ) | |

| (227,732 | ) | |

| (31,542 | ) |

| Other comprehensive loss that will not be reclassified to profit or loss in subsequent period: | |

| | | |

| | | |

| | |

| Fair value changes on equity investment designated at fair value through other comprehensive loss, net of tax | |

| (23,353 | ) | |

| (40,676 | ) | |

| (5,634 | ) |

| Currency translation differences | |

| (1,240 | ) | |

| 552 | | |

| 76 | |

| Other comprehensive loss, net of tax | |

| (24,593 | ) | |

| (40,124 | ) | |

| (5,558 | ) |

| Total comprehensive loss | |

| (134,248 | ) | |

| (267,856 | ) | |

| (37,100 | ) |

| Total comprehensive loss attributable to: | |

| | | |

| | | |

| | |

| Equity holders of the company | |

| (134,248 | ) | |

| (267,523 | ) | |

| (37,054 | ) |

| Non-controlling interests | |

| — | | |

| (333 | ) | |

| (46 | ) |

| | |

| (134,248 | ) | |

| (267,856 | ) | |

| (37,100 | ) |

The following table presents our unaudited consolidated statements

of financial position:

| | |

As of | |

| | |

December 31, 2023 | | |

March 31, 2024 | |

| (In thousands) | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 436,242 | | |

| 297,071 | | |

| 41,144 | |

| Trade receivables | |

| 73,144 | | |

| 69,288 | | |

| 9,596 | |

| Contract assets | |

| 77,684 | | |

| 72,938 | | |

| 10,102 | |

| Financial assets at fair value through profit or loss | |

| 70,164 | | |

| 57,515 | | |

| 7,966 | |

| Inventories | |

| 22,458 | | |

| 22,343 | | |

| 3,094 | |

| Prepayments, other receivables and other assets | |

| 436,377 | | |

| 471,674 | | |

| 65,326 | |

| Other financial assets | |

| 27,898 | | |

| 26,961 | | |

| 3,734 | |

| Total current assets | |

| 1,143,967 | | |

| 1,017,790 | | |

| 140,962 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Right-of-use assets | |

| 14,026 | | |

| 12,253 | | |

| 1,697 | |

| Financial assets at fair value through profit or loss | |

| 34,788 | | |

| 34,818 | | |

| 4,822 | |

| Financial assets at fair value through other comprehensive income | |

| 104,970 | | |

| 64,294 | | |

| 8,905 | |

| Other financial assets | |

| 100,718 | | |

| 102,066 | | |

| 14,136 | |

| Investments accounted for using equity method | |

| 267 | | |

| 267 | | |

| 37 | |

| Property, plant and equipment | |

| 4,378 | | |

| 3,948 | | |

| 547 | |

| Intangible assets | |

| 13,320 | | |

| 12,626 | | |

| 1,749 | |

| Goodwill | |

| 40,085 | | |

| 40,100 | | |

| 5,554 | |

| Other non-current assets | |

| 8,580 | | |

| 7,042 | | |

| 975 | |

| Total non-current assets | |

| 321,132 | | |

| 277,414 | | |

| 38,422 | |

| Total assets | |

| 1,465,099 | | |

| 1,295,204 | | |

| 179,384 | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Interest-bearing bank borrowings | |

| 72,953 | | |

| 229,545 | | |

| 31,792 | |

| Current lease liabilities | |

| 7,154 | | |

| 7,567 | | |

| 1,048 | |

| Trade payables | |

| 152,066 | | |

| 147,995 | | |

| 20,497 | |

| Income tax payables | |

| 19,170 | | |

| 21,942 | | |

| 3,039 | |

| Convertible bonds | |

| 272,684 | | |

| 251,070 | | |

| 34,773 | |

| Other payables and accruals | |

| 293,003 | | |

| 227,136 | | |

| 31,459 | |

| Total current liabilities | |

| 817,030 | | |

| 885,255 | | |

| 122,608 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Non-current lease liabilities | |

| 6,936 | | |

| 5,057 | | |

| 700 | |

| Interest-bearing bank borrowings | |

| 681,821 | | |

| 563,821 | | |

| 78,088 | |

| Deferred tax liabilities | |

| 2,917 | | |

| 2,833 | | |

| 392 | |

| Total non-current liabilities | |

| 691,674 | | |

| 571,711 | | |

| 79,180 | |

| Total liabilities | |

| 1,508,704 | | |

| 1,456,966 | | |

| 201,788 | |

| EQUITY | |

| | | |

| | | |

| | |

| Share capital | |

| 165,183 | | |

| 173,932 | | |

| 24,089 | |

| Subscription receivable | |

| (4,696 | ) | |

| (4,696 | ) | |

| (650 | ) |

| Warrant outstanding | |

| — | | |

| 29,587 | | |

| 4,098 | |

| Additional paid in capital | |

| 7,196,341 | | |

| 7,307,704 | | |

| 1,012,105 | |

| Other reserves | |

| (65,699 | ) | |

| (105,823 | ) | |

| (14,656 | ) |

| Accumulated losses | |

| (7,338,168 | ) | |

| (7,565,567 | ) | |

| (1,047,819 | ) |

| Non-controlling interests | |

| 3,434 | | |

| 3,101 | | |

| 429 | |

| Total equity | |

| (43,605 | ) | |

| (161,762 | ) | |

| (22,404 | ) |

| Total equity and liabilities | |

| 1,465,099 | | |

| 1,295,204 | | |

| 179,384 | |

Three Months Ended March 31, 2024 Compared to Three Months

Ended March 31, 2023

Revenues

Total revenues reached RMB96.2 million (US$13.3

million) for the first quarter of 2024, representing an increase of 166% year over year. The increase was mainly attributable to strong

execution in the ramping up of charging services and stable delivery in our energy solution projects throughout the first quarter of 2024.

Charging

services revenues contributed RMB47.8 million (US$6.6 million) for the first quarter of 2024, with a growth rate of 99% year over year.

The increase was primarily attributable to a reduced proportion of platform-based incentives relative to the commission fees we

generated through our charging services. We offered platform-based incentives to end-users to boost the use of our network, and charging

services revenues are recorded net of end-user incentives. Costs associated with end-user incentives and recorded as reductions to total

revenues totaled RMB91.3 million (US$12.6 million) and RMB69.7 million for the first quarter of 2024 and 2023, respectively.

Energy solutions revenues for the first quarter

of 2024 increased by 334% year over year to RMB47.2 million (US$6.5 million). The increase was primarily driven by revenues from the delivery

of on-going energy solution projects, especially photovoltaic projects and engineering procurement construction projects, that provide

renewable energy generation, energy management and energy storage solutions.

New initiatives revenues remained relatively stable

at RMB1.2 million (US$0.2 million) for the first quarter of 2024 as compared with the same period in 2023 as we continued to launch new

initiatives to expand our market offerings.

Cost of revenues, gross profit and gross margin

Total

cost of revenues increased 139% to RMB71.9 million (US$10.0 million) for the first quarter of 2024 from RMB30.0 million for the first

quarter of 2023. The change was largely in line with revenue growth.

Total gross profit grew 4.0 times year over year

from RMB6.1 million for the first quarter of 2023 to RMB24.3 million (US$3.4 million) for the first quarter of 2024, benefiting from solid

revenue growth and a year-over-year improvement in gross margin from 16.9% to 25.3%. Gross margin improvement was mainly attributable

to an increased number of profitable orders in charging services and as a result of our growing know-how and capabilities in delivering

and executing energy solution projects of different scales.

Operating expenses

Total operating expenses increased from RMB119.7

million for the first quarter of 2023 to RMB215.7 million (US$29.9 million) for the first quarter of 2024. Operating expenses as a percentage

of revenues decreased year over year from 331% to 224%, mainly due to the increase in total revenues and optimization of operation.

Selling and marketing expenses increased 7.2%

from RMB66.4 million for the first quarter of 2023 to RMB71.2 million (US$9.9 million) for the first quarter of 2024. The increase was

mainly attributable to an increase in the sales and marketing expenses for our energy solutions business, partially offset by a reduction

in excess incentives to end-users in connection with our mobility connectivity services. Costs associated with excess incentives to end-users

included in selling and marketing expenses were RMB26.6 million (US$3.7 million) for the first quarter of 2024, accounting for 0.6 times

charging services revenues, compared with RMB41.7 million and 1.7 times, respectively, for the same period of 2023. The reduction in costs

associated with excess incentives to end-users was attributable to a reduced proportion of platform-based incentives relative to the commission

fees we generated through our charging services.

Administrative expenses increased from RMB45.5

million for the first quarter of 2023 to RMB123.0 million (US$17.0 million) for the first quarter of 2024. Setting aside equity-based

compensation, administrative expenses increased from RMB31.8 million for the first quarter of 2023 to RMB62.8 million (US$8.7 million)

for the first quarter of 2024, primarily due to higher professional fees and office expenses.

Research and development expenses increased from

RMB7.8 million for the first quarter of 2023 to RMB21.5 million (US$3.0 million) for the first quarter of 2024. The increase in research

and development expenses was primarily due to our continued dedication of resources to innovate and improve our business.

Finance costs

Finance costs increased from RMB7.1 million for

the first quarter of 2023 to RMB17.7 million (US$2.5 million) for the first quarter of 2024 because we utilized more borrowings in the

first quarter of 2024.

Income tax expenses

Income tax expenses were RMB2.7 million (US$0.4

million) in the first quarter of 2024, compared with income tax expenses of RMB3.1 million for the same period of 2023.

Net loss and non-IFRS net loss attributable to ordinary shareholders;

net margin and non-IFRS net margin

Net loss attributable to ordinary shareholders

was RMB227.4 million (US$31.5 million) for the first quarter of 2024, compared with a net loss attributable to ordinary shareholders of

RMB109.7 million for the same period in 2023. Non-IFRS net loss attributable to ordinary shareholders was RMB126.4 million (US$17.5 million)

for the first quarter of 2024, compared with non-IFRS net loss attributable to ordinary shareholders of RMB102.3 million for the same

period in 2023. Net margin increased from negative 303% for the first quarter of 2023 to negative 236% for the first quarter of 2024 and

non-IFRS net margin increased from negative 283% for the first quarter of 2023 to negative 131% for the first quarter of 2024. See “Non-IFRS

Financial Measures” for details.

Non-IFRS Financial Measures

We use non-IFRS measures such as non-IFRS net

loss and non-IFRS net margin, non-IFRS net debt and non-IFRS total liabilities to total assets ratio, in evaluating our operating results,

financial position and for financial and operational decision-making purposes. We believe that non-IFRS financial measures help identify

underlying trends in our business and financial position that could otherwise be distorted by the effect of certain expenses that we include

in our results for the period and affect certain instruments convertible to our equity. We believe that non-IFRS financial measures provide

useful information about our results of operations and financial position, enhances the overall understanding of our past performance

and future prospects and allow for greater visibility with respect to key metrics used by our management in our financial and operational

decision-making.

Non-IFRS financial measures have limitations as

analytical tools and should not be considered in isolation or construed as an alternative to IFRS financial measures or any other measure

of performance or as an indicator of our operating performance and financial position. Investors are encouraged to review non-IFRS financial

measures and the reconciliation to their most directly comparable IFRS measures. Non-IFRS financial measures presented here may not be

comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently,

limiting their usefulness as comparative measures to our data. We encourage investors and others to review our financial information in

its entirety and not rely on a single financial measure. Non-IFRS net loss was arrived at after excluding share-based compensation expenses,

fair value changes of convertible instruments, and fair value changes of financial assets at fair value through profit or loss. Non-IFRS

net margin was calculated by dividing non-IFRS net loss by total revenue.

The table below sets forth unaudited reconciliations

of our IFRS and non-IFRS results for the periods indicated:

| | |

For the Three Months Ended | |

| | |

March 31, 2023 | | |

March 31, 2024 | |

| (In thousands) | |

RMB | | |

RMB | | |

US$ | |

| Cost of revenues | |

| (30,047 | ) | |

| (71,889 | ) | |

| (9,957 | ) |

| Share-based compensation expenses | |

| 494 | | |

| 3,474 | | |

| 481 | |

| Non-IFRS cost of revenues | |

| (29,553 | ) | |

| (68,415 | ) | |

| (9,476 | ) |

| | |

| | | |

| | | |

| | |

| Selling and marketing expenses | |

| (66,389 | ) | |

| (71,201 | ) | |

| (9,861 | ) |

| Share-based compensation expenses | |

| 4,888 | | |

| 11,971 | | |

| 1,658 | |

| Non-IFRS selling and marketing expenses | |

| (61,501 | ) | |

| (59,230 | ) | |

| (8,203 | ) |

| | |

| | | |

| | | |

| | |

| Administrative expenses | |

| (45,497 | ) | |

| (123,005 | ) | |

| (17,036 | ) |

| Share-based compensation expenses | |

| 13,668 | | |

| 60,250 | | |

| 8,345 | |

| Non-IFRS administrative expenses | |

| (31,829 | ) | |

| (62,755 | ) | |

| (8,691 | ) |

| | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (7,832 | ) | |

| (21,523 | ) | |

| (2,981 | ) |

| Share-based compensation expenses | |

| 1,890 | | |

| 4,621 | | |

| 640 | |

| Non-IFRS research and development expenses | |

| (5,942 | ) | |

| (16,902 | ) | |

| (2,341 | ) |

| | |

| | | |

| | | |

| | |

| Operating loss | |

| (113,111 | ) | |

| (186,595 | ) | |

| (25,844 | ) |

| Share-based compensation expenses | |

| 20,940 | | |

| 80,316 | | |

| 11,124 | |

| Non-IFRS operating loss | |

| (92,171 | ) | |

| (106,279 | ) | |

| (14,720 | ) |

Recent Developments

| · | Charging volume transacted through our network reached 1,216 GWh for the first quarter of 2024, representing

an increase of 19% year over year. |

| · | Gross transaction value transacted through our network reached RMB1.2 billion (US$160.1 million) for the

first quarter of 2024, representing an increase of 17% year over year. |

| · | Number of orders transacted through our network reached 50.3 million for the first quarter of 2024, representing

an increase of 13% year over year. |

| · | We continue to witness a positive trend in our Net Take Rate (NTR) and Gross Take Rate (GTR). NTR measures our return from transactions arising from our mobility connectivity services after adjusting for incentives which

are paid to end-users through our partnered platform in the form of discounts and promotions to boost the use of our network. NTR is calculated

by taking our gross receipts from transactions, deducting transaction outgoings and incentives, and adding income from membership programs.

The result is then expressed as a percentage of the total transaction value. GTR is calculated as the percentage of our commission income

derived from the gross transaction value at charging stations, indicating our share of charging stations’ gross income. |

| · | Effective at the open of business on June 13, 2024 (U.S. Eastern Time), the ratio of our ADSs

to our Class A ordinary shares has changed from one ADS to 10 Class A ordinary shares to one ADS to 200 Class A ordinary

shares. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NaaS Technology Inc. |

| |

|

|

|

| |

By |

: |

/s/ Alex Wu |

| |

Name |

: |

Alex Wu |

| |

Title |

: |

Chief Financial Officer |

Date: June 18, 2024

Exhibit 99.1

Unit 1304, 13/F, Two Harbourfront, 22 Tak Fung Street, Hunghom,

Hong Kong.

香港 紅磡 德豐街 22

號 海濱廣場二期 13 樓 1304 室

Tel 電話: (852) 2126 2388 Fax 傳真:

(852) 2122 9078

Email 電郵: info@czdcpa.com

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation

by reference in the Amendment No. 1 to Registration Statement on Form F-3 (No. 333-273515) and related Prospectus of NaaS Technology

Inc. of our report dated May 9, 2024, with respect to the audited consolidated financial statements of NaaS Technology Inc. for the year

ended December 31, 2023. We also consent to the reference to us under the heading “Experts” in such Registration Statements.

We consent to the incorporation by reference

in the Registration Statement on Form S-8 (No. 333-276278) of NaaS Technology Inc. of our report dated May 9, 2024, with respect to the

audited consolidated financial statements of NaaS Technology Inc. for the year ended December 31, 2023.

/s/ Centurion ZD CPA &

Co.

Centurion ZD CPA & Co. Certified Public Accountants

Hong Kong, May 9, 2024

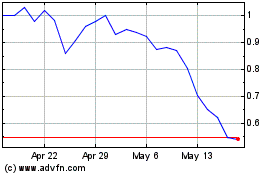

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From May 2024 to Jun 2024

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From Jun 2023 to Jun 2024