UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE

ACT OF 1934

Miromatrix Medical Inc.

(Name of Subject Company)

Miromatrix Medical Inc.

(Name of Persons Filing Statement)

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

60471P108

(CUSIP Number of Class of Securities)

Jeff Ross

Chief Executive Officer

6455 Flying Cloud Drive, Suite 107

Eden Prairie, MN 55344

(952) 942-6000

(Name, address, and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

Steven C. Kennedy

Michael A. Stanchfield

Brandon A. Mason

Faegre Drinker Biddle & Reath LLP

2200 Wells Fargo Center

90 South Seventh Street

Minneapolis, Minnesota 55402

(612) 766-7000

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9C relates solely to the below listed preliminary

communications made before the commencement of a planned tender offer (the “Offer”) by Morpheus Subsidiary Inc. (“Purchaser”),

a wholly owned subsidiary of United Therapeutics Corporation (“Parent”), to acquire all of the issued and outstanding

shares of the common stock, par value $0.00001 per share, of Miromatrix Medical Inc. (the “Company”), to be commenced

pursuant to the Agreement and Plan of Merger, dated as of October 29, 2023, by and among Parent, Purchaser, and the Company (the “Merger

Agreement”). Upon the consummation of the Offer, Purchaser will merge with and into the Company (the “Merger”)

pursuant to Section 251(h) of the Delaware General Corporation Law with the Company as the surviving corporation.

Items #1 and #2 listed above were first used or made available on

October 30, 2023. In addition, the information set forth under Items 1.01 and 9.01 of the Current Report on Form 8-K filed by the

Company with the U.S. Securities and Exchange Commission (the “SEC”) on October 30, 2023 (including all exhibits attached

thereto) is incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this filing regarding matters that are not

historical facts are forward-looking statements. Words such as “anticipates,” “believes,” “expects,”

“intends,” “plans,” “potential,” “projects,” “would,” and “future,”

or similar expressions, are intended to identify forward-looking statements.

Forward-looking statements contained

in this filing include, but are not limited to statements relating to: the timing of the consummation of the business combination transaction

between Parent and the Company (the “Transaction”); the potential financial upside of the Transaction; Parent’s

research and development pipeline, including its plans to address the shortage of transplantable organs; Parent’s expectation that

the Transaction will help enhance its ability to achieve its organ manufacturing goals; the Company’s expectation that the Transaction

will accelerate the development of its pipeline; Parent’s plan to innovate for the unmet medical needs of its patients and to benefit

its other stakeholders, and its plan to provide a brighter future for patients through the development of novel pharmaceutical therapies

and technologies that expand the availability of transplantable organs; and the ability of the Company’s technology platform, whether

prior to or following the consummation of the Transaction, to address the availability of organs for patients in need. Each of these forward-looking statements

involves substantial risks and uncertainties that could cause actual results to differ significantly from those expressed or implied by

such forward-looking statements, including, without limitation, risks and uncertainties related to: the risk that the Transaction

may not be completed in a timely manner or at all, which may adversely affect the Company’s business and the price of the Company’s

common stock; the failure to satisfy the conditions to the consummation of the Transaction, including the tender of a majority of the

outstanding shares of the Company’s common stock; the occurrence of any event, change or other circumstance that could give rise

to the termination of the merger agreement; the effect of the announcement or pendency of the Transaction on the Company’s business

relationships, operating results, and business generally; risks that the proposed Transaction disrupts current plans and operations of

the Company or Parent and potential difficulties in the Company’s employee retention as a result of the Transaction; risks related

to diverting management’s attention from the Company’s ongoing business operations; the outcome of any legal proceedings that

may be instituted against the Company related to the merger agreement or the Transaction; the ability of Parent to successfully integrate

the Company’s operations and technology after the Transaction closes; future research and development results, including preclinical

and clinical trial results; the timing or outcome of FDA approvals or actions, if any and other risks and uncertainties, such as those

described in periodic and other reports filed by Parent and the Company with the Securities and Exchange Commission, including their respective

most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Any

forward-looking statements are made based on the current beliefs and judgments of Parent’s and the Company’s management,

and the reader is cautioned not to rely on any forward-looking statements made by Parent or the Company. Except as required by law, Parent

and the Company do not undertake any obligation to update (publicly or otherwise) any forward-looking statement, whether as a result

of new information, future events, or otherwise.

Additional Information and Where to Find

It

The tender offer referenced in this filing has

not yet commenced. This filing is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to

sell any securities, nor is it a substitute for the tender offer materials described herein. The solicitation and offer to buy shares

of the Company common stock will only be made pursuant to an offer to purchase and related tender offer materials that Parent intends

to file with the SEC (collectively, the “Offer to Purchase”). At the time the planned tender offer is commenced, Parent

and its acquisition subsidiary will file a Tender Offer Statement on Schedule TO and thereafter the Company will file a Solicitation/Recommendation

Statement on Schedule 14D-9 with the SEC with respect to the tender offer. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

CAREFULLY BOTH THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER

DOCUMENTS), AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, IN EACH CASE, AS THEY MAY BE AMENDED

FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL EACH CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS

SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related letter of transmittal,

certain other tender offer documents, and the Solicitation/Recommendation Statement on Schedule 14D-9 will be made available to all

stockholders of the Company at no expense to them and will also be made available for free at the SEC’s website at www.sec.gov.

Additional copies of the tender offer materials may be obtained for free by contacting Innisfree M&A Incorporated, the Information

Agent for the tender offer, at (877) 456-3463 (toll free) or by email at info@innisfreema.com. Copies of the documents filed with the

SEC by the Company may be obtained at no charge on the Company’s website at https://miromatrix.gcs-web.com/financial-information/sec-filings

or by contacting the Company’s Investor Relation Contact at ir@miromatrix.com.

In addition to the Offer to Purchase, the

related letter of transmittal and certain other tender offer documents, and the Solicitation/Recommendation Statement on Schedule 14D-9,

the Company files annual, quarterly and current reports, proxy statements and other information with the SEC, which are available to the

public from commercial document-retrieval services at the SEC’s website at http://www.sec.gov.

Exhibit 99.2

Miromatrix Investor FAQ

Pending Acquisition by United Therapeutics Corporation

October 30, 2023

Why did Miromatrix agree to be acquired by United Therapeutics?

This transaction provides Miromatrix Medical Inc. (Nasdaq: MIRO)

shareholders with a substantial premium and allows them to participate in the potential upside of the combination with United

Therapeutics Corporation (Nasdaq: UTHR) through the Contingent Value Right (CVR) described below. United Therapeutics is dedicated

to rectifying the severe shortage of transplantable organs, which is aligned with the mission of Miromatrix, and has the resources

to accelerate the development of the Miromatrix product pipeline. The Board of Directors of Miromatrix believes that this

transaction is in the best interest of Miromatrix shareholders and unanimously recommends that shareholders tender their shares in

response to the tender offer described below once it has commenced.

What are the terms of the transaction, including the Contingent

Value Right?

United Therapeutics will pay Miromatrix shareholders up to $5.00 per

share in cash, composed of a $3.25 per share payment at closing plus a CVR representing the right to receive an additional $1.75 per share

if Miromatrix’s development-stage, fully-implantable kidney product known as mirokidney™ is implanted into a living human

patient by the end of 2025 in a clinical trial that meets the requirements described in the form of CVR Agreement attached to the Merger

Agreement. This transaction represents a 213% premium based on the closing payment, and a 381% premium if the CVR is achieved, in both

cases when compared to Miromatrix’s closing stock price on October 27, 2023.

What needs to happen to close the transaction?

In the coming days, United Therapeutics will commence a tender offer

for the outstanding shares of Miromatrix’s common stock. In order to close, a majority of Miromatrix’s shares must be tendered

into the offer and a number of other customary closing conditions must be satisfied.

When do you expect to close the transaction?

The transaction is expected to close in December 2023, subject to the

satisfaction of customary closing conditions. The tender offer documents also will be subject to review by the U.S. Securities and Exchange

Commission, which may impact timing.

Did Miromatrix consider alternative transactions?

After exploring a number of financing, partnering, and

acquisition alternatives, the Miromatrix Board of Directors unanimously determined that the acquisition proposed by United

Therapeutics is in the best interest of Miromatrix shareholders in light of the company’s stage of development, future cash

needs, stock price, and prevailing market conditions. Additional detail on the alternatives considered by the Miromatrix Board will

be included in the tender offer materials to be filed by Miromatrix with the Securities and Exchange Commission in the coming

days.

ADDITIONAL INFORMATION REGARDING THE PROPOSED TRANSACTION

The tender offer described

in this document has not yet commenced. This document is for informational purposes only and is neither an offer to purchase nor a

solicitation of an offer to sell any shares of the common stock of Miromatrix or any other securities, nor is it a substitute for

the tender offer materials described herein. At the time the planned tender offer is commenced, a tender offer statement on Schedule

TO, including an offer to purchase, a letter of transmittal and related documents, will be filed by United Therapeutics and its

wholly owned subsidiary Morpheus Subsidiary Inc. with the Securities and Exchange Commission (the “SEC”), and a

solicitation/recommendation statement on Schedule 14D-9 will be filed by Miromatrix with the SEC.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY

BOTH THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS),

AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, IN EACH CASE, AS THEY MAY BE AMENDED FROM TIME

TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL EACH CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER

BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES.

The Offer to Purchase, the related letter of transmittal,

certain other tender offer documents, and the Solicitation/Recommendation Statement on Schedule 14D-9 will be made available to

all stockholders of Miromatrix at no expense to them and will also be made available for free at the SEC’s website at www.sec.gov.

Additional copies of the tender offer materials may be obtained for free by contacting Innisfree M&A Incorporated, the Information

Agent for the tender offer, at (877) 456-3463 (toll free) or by email at info@innisfreema.com. Copies of the documents filed with the

SEC by Miromatrix may be obtained at no charge on Miromatrix’s website at https://miromatrix.gcs-web.com/financial-information/sec-filings

or by contacting Miromatrix’s Investor Relation Contact at ir@miromatrix.com. In addition to the Offer to Purchase, the

related letter of transmittal and certain other tender offer documents, and the Solicitation/Recommendation Statement on Schedule 14D-9,

Miromatrix files annual, quarterly and current reports, proxy statements and other information with the SEC, which are available to the

public from commercial document-retrieval services at the SEC’s website at http://www.sec.gov.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this filing regarding matters that

are not historical facts are forward-looking statements. Words such as “anticipates,” “believes,” “expects,”

“intends,” “plans,” “potential,” “projects,” “would,” and “future,”

or similar expressions, are intended to identify forward-looking statements.

Forward-looking statements

contained in this filing include, but are not limited to statements relating to: the timing of the consummation of the business

combination transaction between United Therapeutics and Miromatrix (the “Transaction”); the potential financial

upside of the Transaction; United Therapeutics’ dedication to addressing the severe shortage of transplantable organs; and the acceleration of Miromatrix’s pipeline. Each of these

forward-looking statements involves substantial risks and uncertainties that could cause actual results to differ significantly

from those expressed or implied by such forward-looking statements, including, without limitation, risks and uncertainties

related to: the risk that the Transaction may not be completed in a timely manner or at all, which may adversely affect

Miromatrix’s business and the price of Miromatrix’s common stock; the failure to satisfy the conditions to the

consummation of the Transaction, including the tender of a majority of the outstanding shares of Miromatrix’s common stock;

the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the

effect of the announcement or pendency of the Transaction on Miromatrix’s business relationships, operating results, and

business generally; risks that the proposed Transaction disrupts current plans and operations of Miromatrix or United Therapeutics

and potential difficulties in Miromatrix’s employee retention as a result of the Transaction; risks related to diverting

management’s attention from Miromatrix’s ongoing business operations; the outcome of any legal proceedings that may be

instituted against Miromatrix related to the merger agreement or the Transaction; the ability of United Therapeutics to successfully

integrate Miromatrix’s operations and technology after the Transaction closes; future research and development results,

including preclinical and clinical trial results; the timing or outcome of approvals or actions by the U.S. Food and Drug

Administration, if any and other risks and uncertainties, such as those described in periodic and other reports filed by United

Therapeutics and Miromatrix with the SEC, including their respective most recent Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q, and Current Reports on Form 8-K.

Any forward-looking statements are made based on the current

beliefs and judgments of United Therapeutics’ and Miromatrix’s management, and the reader is cautioned not to rely on any

forward-looking statements made by United Therapeutics or Miromatrix. Except as required by law, United Therapeutics and Miromatrix do

not undertake any obligation to update (publicly or otherwise) any forward-looking statement, whether as a result of new information,

future events, or otherwise.

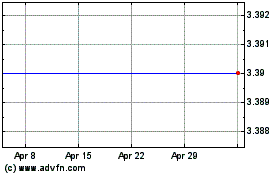

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From Apr 2024 to May 2024

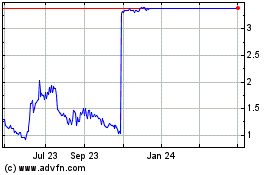

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From May 2023 to May 2024