0001218683 False 0001218683 2023-11-13 2023-11-13 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

_______________________________

Mawson Infrastructure Group Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-40849 | 88-0445167 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

201 Clark Street

Sharon, Pennsylvania 16146

(Address of Principal Executive Offices) (Zip Code)

(412) 515-0896

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | MIGI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On November 13, 2023, Mawson Infrastructure Group Inc. (the “Company”) issued an earnings press release for the quarter ending September 30, 2023.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company cautions that statements in this report that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility of the Company’s need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility in the value and prices of cryptocurrencies, and further or new regulation of digital assets. More detailed information about the risks and uncertainties affecting the Company is contained under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K filed with the SEC on March 23, 2023, Quarterly Report on Form 10-Q filed with the SEC on May 15, 2023, August 21, 2023, and November 13, 2023, and in other filings that the Company has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Mawson Infrastructure Group Inc. |

| | | |

| | | |

| Date: November 13, 2023 | By: | /s/ Rahul Mewawalla |

| | | Rahul Mewawalla |

| | | President & Chief Executive Officer |

| | | |

EXHIBIT 99.1

Mawson Infrastructure Group Inc. Reports Q3 2023 Financial Results

Selected Unaudited Financial Highlights for Q3 FY 2023

Self-mined Bitcoin revenue and Bitcoin mined increased 41% and 35% Q/Q,

respectively, to $6.9 Million and 246 BTC

Total Quarterly Revenue increased to $11.3 Million

SG&A Expenses Decreased 42% Q/Q

PITTSBURGH, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Mawson Infrastructure Group Inc. (NASDAQ: MIGI) (“Mawson”, Company), a digital infrastructure company, today announced its unaudited financial results and highlights for the third quarter ending September 30, 2023.

Rahul Mewawalla, CEO and President of Mawson, said, “We are delighted to deliver a second successful consecutive quarter of significant double-digit sequential revenue growth for our self-mining business as we continued to execute our new operating excellence model combined with our business, technology, and financial optimization efforts. We are also pleased to see the impact of our driving operational efficiencies and our cost-optimization activities, which have contributed to improved operating leverage and lower SG&A expenses for our businesses. Across all our 3 businesses, self-mining, co-location services, and energy management, we are focused on enhancing value for all our stakeholders.”

Q3 2023 Financial and Recent Business Highlights

- Total Revenue increased 7% Q/Q to $11.3 million

- Self-Mined BTC revenue increased 41% Q/Q to $6.9 million

- SG&A expense declined 42% Q/Q and 27% Y/Y to $3.7 million

- Ramped up self-mining at Bellefonte site to 8.8 MW and 2,545 miners hashing

- Total self-miners hashing increased to approximately 16,730 across sites

- 109 MW power capacity able to support approximately 35,480 miners or 3.7 EH/s1

- Announced signing of a new co-location customer for approximately 50MW in October 2023, with approximately 15,876 Bitmain Antminer S19 XP miners

- Announced appointment of a new Board member, former United States Congressman from Pennsylvania

___________

1 Includes approximately 1.3 EH/s from self-mining platform and approximately 2.4 EH/s from co-location platform.

BTC Hosting and Co-location Services Update

Mawson announced on October 19, 2023 that the Company had signed an agreement to provide a new customer, a wholly owned subsidiary of Consensus Technology Group, with co-location services for approximately 15,876 Bitmain Antminer S19 XP miners or approximately 50 MW at Mawson’s Midland, Pennsylvania facilities. The co-location customer agreement has Mawson providing co-location services to the customer for 12 months and the parties can extend further upon mutual agreement. Mawson received initial shipments of these Bitmain Antminer S19 XP miners and commenced installing miners towards the end of October and is continuing its deployments into the month of November 2023.

Conferences and Events Update

Mawson has planned for its CEO and President, Rahul Mewawalla to join the following upcoming conferences and events. Please contact IR@Mawsoninc.com for further information.

- North American Blockchain Summit in Fort Worth, Texas in November 2023

- Europe Blockchain Next Block Expo in Berlin, Germany in December 2023

- Annual Needham Growth Conference in New York City, New York in January 2024

- Quantum Conference in Miami, Florida in January 2024

Third Quarter 2023 GAAP Financial Results

Revenue for the third quarter 2023, ended September 30, 2023, increased 7% sequentially to $11.3 million. The increase was the result of the successful increase in Mawson’s self-mining business across its Pennsylvania sites. Over the same quarter last year, revenue decreased 60% driven by the Company’s sale of its Georgia facility in October 2022.

Cost of revenue in the third quarter of 2023 decreased 58% compared to the same period in the prior year and increased 10% sequentially to $7.7 million, from $7.0 million. Higher energy costs associated with the increased load of self-mining capacity across the Pennsylvania sites, were offset by lower energy usage from the reduction in co-location operations part way through the quarter. Year on year lower energy and associated costs from the sale of the Georgia facility led to the comparative reductions, respectively. Gross profit increased 3% sequentially to $3.6 million driven by combination of operational improvements, lower power costs, improved BTC market metrics, and decreased 64% from $10.1 million from the same quarter last year driven by the reduction in self-mining and co-location operations associated with the sale of the Company’s Georgia facility.

SG&A expense for the third quarter of 2023 decreased 42% sequentially to $3.7 million from $6.3 million due to the initial results of the Company’s operational efficiencies and our cost-optimization activities implemented by new management over recent months and decreased from $5.0 million compared to the same quarter last year.

In the third quarter of 2023, Mawson incurred a net loss of $16.2 million compared to $17.7 million in the prior quarter and $8.2 million for the same quarter last year, with an adjusted EBITDA of a net loss of $0.04 million in the third quarter of 2023 compared to a net loss of $0.18 million in the prior quarter.

About Mawson Infrastructure

Mawson Infrastructure Group (NASDAQ: MIGI) is a digital infrastructure company. Mawson’s vertically integrated model is based on a long-term strategy to promote the global transition to the new digital economy. Mawson aligns digital infrastructure, sustainable energy, and next-generation fixed and mobile data center solutions, enabling efficient Bitcoin production and on-demand deployment of digital infrastructure assets. Mawson Infrastructure Group is emerging as a global leader in ESG focused digital infrastructure and Bitcoin mining.

For more information, visit: https://mawsoninc.com/

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Mawson cautions that statements in this press release that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon Mawson’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility that Mawson’s need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility in the value and prices of cryptocurrencies and further or new regulation of digital assets. More detailed information about the risks and uncertainties affecting Mawson is contained under the heading “Risk Factors” included in Mawson’s Annual Report on Form 10-K filed with the SEC on March 23, 2023, and Mawson’s Quarterly Reports on Form 10-Q filed with the SEC on May 15, 2023, August 21, 2023, November 13, 2023 and in other filings Mawson has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Mawson undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

Investor Contact:

Sandy Harrison

Chief Financial Officer

IR@mawsoninc.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

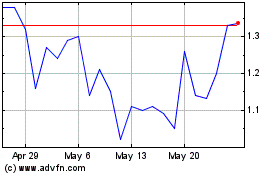

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Apr 2024 to May 2024

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From May 2023 to May 2024