Starwood Downgraded to Neutral - Analyst Blog

March 06 2012 - 8:15AM

Zacks

We have recently downgraded our

rating on the shares of Starwood Hotels & Resorts

Worldwide Inc. (HOT) to Neutral from Outperform due to a

slowdown in 2012 RevPAR growth target in North America, weak EBITDA

projection as well as weakness in certain international

markets.

We were impressed with Starwood’s

outperformance in the recently concluded fourth quarter of 2011.

The strength of the namesake brand allows the company to charge a

premium for its hotel rooms. Moreover, the company is in a

steady expansion mode. Starwood has over half of its hotel

properties outside the U.S., an international exposure that not

many of its peers can boast of. Starwood will open 80 new hotels in

2012, with 75% of them being outside North America, primarily in

the faster growing Asia (60.0%). The company’s balance sheet also

remains in good shape.

However, although we believe that

Starwood is well positioned for the long term, we expect the

operating environment to weaken in the near term before improving.

In the developed markets, unemployment remains extremely high and

the pressure of public and private debt is mounting, leading to a

slower pace of recovery. Management expects lodging recovery in

North America to be slower in 2012 than 2011.

Exchange rate shifts will negatively

impact Starwood’s hotel business in 2012. EBITDA will be hurt by

approximately $7 million net of benefits from Euro hedge.

Additionally, there are several Starwood properties awaiting

renovations in 2012. Hence, 2012 renovations and the hotels sold in

2011 will adversely impact the company’s total owned EBITDA by $10

million.

To add to the worry, there is the

Eurozone debt crisis. RevPAR was flat in Europe in the fourth

quarter of 2011 due to the austerity measures and fragile economic

conditions in Europe. Management commented that softness in demand

will likely loom in future, despite the adoption of crucial

measures in resolving the crisis. Deceleration in European RevPAR

is a cause of concern given Starwood’s considerable exposure to

that region.

The other geographies are also not

in a very good shape. Unrest in Middle East and Africa as well as

the Korean Peninsula remains another area of apprehension. In

Japan, although occupancies recovered well from early 2011, revival

of average daily rate was still down compared to the pre-earthquake

level. In fact, China, Starwood’s one of the strongest hubs,

targets economic growth of 7.5% in 2012. It is the slowest rate

since 2004.

Moreover, we believe all the

positive attributes in the stock are reflected at the current

level. Hence, in light of the current state of industry

fundamentals, we recommend investors to remain on the

sidelines.

Starwood, which competes with the

likes of Marriott International Inc.

(MAR) and Wyndham Worldwide

Corporation (WYN), currently retains the Zacks #3 Rank

that translates into a short-term Hold rating.

STARWOOD HOTELS (HOT): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

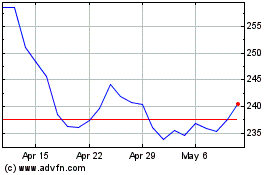

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

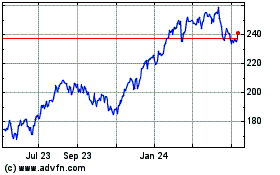

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024