Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 31 2023 - 6:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2023

Commission File Number 001-34837

MAKEMYTRIP LIMITED

(Exact name of registrant as specified in its charter)

19th Floor, Building No. 5

DLF Cyber City

Gurugram, India, 122002

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Other Events

Unaudited Business and Financial Highlights for the Quarter ended September 30, 2023

On October 31, 2023, MakeMyTrip Limited (“MakeMyTrip”) issued a press release announcing its unaudited business and financial highlights for the fiscal second quarter of 2024 (i.e. quarter ended September 30, 2023). A copy of the press release dated October 31, 2023 is attached hereto as Exhibit 99.1.

Exhibit

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 31, 2023

|

|

|

MAKEMYTRIP LIMITED |

|

|

By: |

|

/s/ Rajesh Magow |

Name: |

|

Rajesh Magow |

Title: |

|

Group Chief Executive Officer |

Exhibit 99.1

EARNINGS PRESS RELEASE

Strong year on year Revenue and Operating Performance on the back of robust travel demand

National, October 31, 2023 (NASDAQ: MMYT) — MakeMyTrip Limited, India’s leading travel service provider, today announced its unaudited financial and operating results for its fiscal second quarter ended September 30, 2023 as attached herewith and available at www.sec.gov/ and on our website at http://investors.makemytrip.com.

Business & Financial Highlights | Q2 FY24

|

|

|

|

|

Q2 FY24 ($ Million) |

Q2 FY23 ($ Million) |

YoY Change (Constant Currency)2 |

Gross Bookings |

1,839.7 |

1,514.7 |

23.8% |

Revenue as per IFRS |

168.7 |

131.3 |

32.8% |

Adjusted Margin1 |

|

|

|

Air Ticketing |

80.3 |

75.0 |

10.7% |

Hotels and Packages |

75.7 |

57.4 |

36.7% |

Bus Ticketing |

21.8 |

16.9 |

34.0% |

Others |

11.0 |

7.5 |

50.7% |

EBITDA |

13.5 |

10.7 |

|

Results from Operating Activities |

6.7 |

3.9 |

|

Adjusted Operating Profit (Loss)1 (also referred to as Adjusted EBIT)3 |

28.2 |

15.1 |

|

Profit / (Loss) for the period |

2.0 |

(6.8) |

|

•Travel demand continues to be robust across categories. We witnessed strong growth both in terms of Gross Bookings and profitability despite the second quarter of fiscal year being a seasonally weaker quarter for leisure travel. For Q2 FY24, Gross Bookings grew by 23.8% YoY in constant currency2 to $1.8 billion from $1.5 billion in Q2 FY23.

•Adjusted Operating Profit1 was $28.2 million in Q2 FY24, as compared to $15.1 million in Q2 FY23 registering growth of 86.8% YoY.

•EBITDA for Q2 FY24 was $13.5 million, as compared to $10.7 million for Q2 FY23. Profit in Q2 FY24 was $2.0 million, as compared to a loss of $6.8 million in Q2 FY23.

•On October 31, 2023, our wholly-owned subsidiary, MakeMyTrip (India) Private Limited, entered into an agreement to acquire a majority interest in Savaari Car Rentals Private Limited, provider of inter-city car rental services in India. The transaction is expected to be completed prior to December 31, 2023. This acquisition is intended to expand our presence in the inter-city car rental market in India.

Commenting on the results, Rajesh Magow, Group Chief Executive Officer, MakeMyTrip, said,

“While the second quarter of fiscal year tends to be a seasonally weaker period for leisure travel, we are pleased to report strong year-on-year revenue growth and expansion in Adjusted Operating Profit.1 Our innovative travel solutions, brand strength and ability to deliver superior value to our customers and our partners are helping us to drive profitable growth.”

Notes:

(1)This is a non-IFRS measure. Reconciliations of IFRS measures to non-IFRS financial measures and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(2)Constant currency refers to our financial results assuming constant foreign exchange rates for the current fiscal period based on the rates in effect during the comparable period in the prior fiscal year. This is a non-IFRS measure. Reconciliations of IFRS measures to Non-IFRS financial measures and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(3)Adjusted Operating Profit is commonly referred to among investors and analysts in India as Adjusted EBIT.

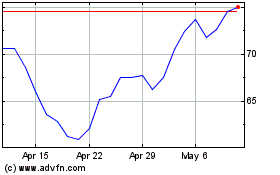

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Apr 2024 to May 2024

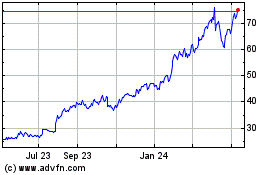

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From May 2023 to May 2024