Delaware54-1560050000-52008FALSE000123981900012398192021-11-152021-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 10, 2023

Luna Innovations Incorporated

(Exact name of registrant as specified in its charter)

301 1st Street SW, Suite 200

Roanoke, VA 24011

(Address of principal executive offices, including zip code)

540-769-8400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | LUNA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth Company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On August 10, 2023, Luna Innovations Incorporated (the “Company”) issued a press release announcing its financial results for the three and six months ended June 30, 2023, as well as information regarding a conference call to discuss these financial results and the Company's recent corporate highlights and outlook. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Also, on August 10, 2023, the Company is posting an updated slide presentation on its corporate website and will be using the presentation in connection with the conference call discussed above. A copy of the presentation is furnished herewith as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d)Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Luna Innovations Incorporated |

| | |

| By: | | /s/ Scott A. Graeff |

| | Scott A. Graeff

President and Chief Executive Officer |

Date: August 10, 2023

Exhibit 99.1

Luna Innovations Reports Second-Quarter 2023 Results

Reaffirms Full-Year 2023 Outlook

Q2 Highlights

•Total revenues of $29.2 million, up 11% year over year

•Gross margin of 58%, compared to 61% for the prior year

•Net loss of $1.6 million, compared to net loss of $2.4 million for the prior year

•Adjusted EBITDA of $2.7 million, compared to $1.2 million for the prior year

•Adjusted EPS of $0.04, compared to $(0.02) for the prior year

(ROANOKE, VA, August 10, 2023) - Luna Innovations Incorporated (NASDAQ: LUNA), a global leader in advanced optical technology, today announced its financial results for the three and six months ended June 30, 2023.

"We continue to see abundant opportunities for Luna’s capabilities and are particularly pleased this quarter with strong performance from our Sensing business," said Scott Graeff, President and Chief Executive Officer of Luna. "We did experience a distinct difference in the growth rates of our two businesses – Sensing and Communications Test. Our Sensing business, including our project-based solutions, grew strongly. Pressure in the broader Communications market did impact our Communications Test business. We continue to secure large, multi-unit, follow-on orders in our primary markets, and we are seeing significant wins with new applications.”

Second-Quarter Fiscal 2023 Financial Summary

Highlights of the financial results for the three months ended June 30, 2023 are:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Change |

| (in thousands, except share and per share data) | | 2023 | | 2022 | | |

| Revenues | | $ | 29,164 | | | $ | 26,162 | | | 11 | | % |

| | | | | | | |

| Gross profit | | 16,865 | | | 15,963 | | | 6 | | % |

| Gross margin | | 58 | % | | 61 | % | | |

| | | | | | |

| Operating expense | | 17,079 | | | 18,425 | | | (7) | | % |

| Operating loss | | (214) | | | (2,462) | | | | |

| Operating margin | | (1) | % | | (9) | % | | | |

| | | | | | |

| Other expense, net and income tax benefit | | (344) | | | (480) | | | | |

| | | | | | | |

| Net loss from continuing operations | | $ | (558) | | | $ | (2,942) | | | | |

| | | | | | | |

| (Loss)/income from discontinued operations, net of tax of $(346) and $(856) | | (1,038) | | | 591 | | | | |

| | | | | | | |

| Net loss | | $ | (1,596) | | | $ | (2,351) | | | | |

| | | | | | | |

| Loss per diluted share (EPS) | | $ | (0.05) | | | $ | (0.07) | | | | |

| Adjusted EPS | | $ | 0.04 | | | $ | (0.02) | | | | |

| Diluted weighted average shares outstanding | | 33,634,538 | | | 32,478,736 | | | | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 2,732 | | | $ | 1,184 | | | 131 | | % |

A reconciliation of Adjusted EPS and Adjusted EBITDA to the nearest comparable figures under generally accepted accounting principles ("GAAP") can be found in the schedules included in this release.

Revenues for the three months ended June 30, 2023 increased 11% compared to the prior-year period.

Gross margin was 58% for the three months ended June 30, 2023, compared to 61% for the three months ended June 30, 2022, driven primarily by product mix. Operating loss and margin were $0.2 million and 1% of total revenues, respectively, for the three months ended June 30, 2023, compared to an operating loss of $2.5 million and 9% of total revenues, respectively, for the three months ended June 30, 2022.

Net loss was $1.6 million, or $0.05 per fully diluted share, for the three months ended June 30, 2023, compared to net loss of $2.4 million, or $0.07 per fully diluted share, for the three months ended June 30, 2022. Adjusted EPS was $0.04 for the three months ended June 30, 2023 compared to $(0.02) for the three months ended June 30, 2022.

Adjusted EBITDA was $2.7 million for three months ended June 30, 2023, compared to $1.2 million for the three months ended June 30, 2022.

Six Months Ended Fiscal 2023 Financial Summary

Highlights of the financial results for the six months ended June 30, 2023 are:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, | | Change |

| (in thousands, except share and per share data) | | 2023 | | 2022 | | |

| Revenues | | 54,209 | | | 48,642 | | | 11 | | % |

| | | | | | | |

| Gross profit | | 31,838 | | | 30,242 | | | 5 | | % |

| Gross margin | | 59 | % | | 62 | % | | |

| | | | | | |

| Operating expense | | 34,184 | | | 35,069 | | | (3) | | % |

| Operating loss | | (2,346) | | | (4,827) | | | | |

| Operating margin | | (4) | % | | (10) | % | | | |

| | | | | | |

| Other expense, net and income tax benefit | | (54) | | | 542 | | | | |

| | | | | | | |

| Net loss from continuing operations | | $ | (2,400) | | | $ | (4,285) | | | | |

| | | | | | | |

| Net (loss)/income from discontinued operations, net of income taxes of $(346) and $3,283 | | (1,038) | | | 11,515 | | | | |

| | | | | | | |

| Net (loss)/income | | $ | (3,438) | | | $ | 7,230 | | | | |

| | | | | | | |

| (Loss)/earnings per diluted share (EPS) | | $ | (0.10) | | | $ | 0.22 | | | | |

| Adjusted EPS | | $ | 0.04 | | | $ | 0.02 | | | 100 | | % |

| Diluted weighted average shares outstanding | | 33,483,978 | | | 32,361,560 | | | | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 3,586 | | | $ | 2,905 | | | 23 | | % |

A reconciliation of Adjusted EPS and Adjusted EBITDA to the nearest comparable GAAP figures can be found in the schedules included in this release.

Revenues for the six months ended June 30, 2023 increased 11% compared to the prior-year period.

Gross profit of $31.8 million for the six months ended June 30, 2023 increased from $30.2 million for the six months ended June 30, 2022 primarily due to higher sales. Operating loss and margin improved to $2.3 million and 4% of total revenues, respectively, for the six months ended June 30, 2023, compared to $4.8 million and 10% of total revenues, respectively, for the six months ended June 30, 2022.

Net loss was $3.4 million, or $0.10 per fully diluted share, for the six months ended June 30, 2023, compared to a net income of $7.2 million, or $0.22 per fully diluted share, for the six months ended June 30, 2022. Adjusted EPS was $0.04 for the six months ended June 30, 2023, compared to $0.02 for the six months ended June 30, 2022.

Adjusted EBITDA was $3.6 million for the six months ended June 30, 2023, compared to $2.9 million for the six months ended June 30, 2022.

Q2 and Recent Business Highlights

•Recognized significant wins for monitoring systems, including a contract for the largest power utility company in Italy

•Secured large, follow-on, multi-unit Terahertz order for EV battery production process monitoring

•Drove significant wins in our RIO line of lasers supported by macro trends such as LiDAR

•Secured a seven-figure blanket order for polarization modules from a major data center hyper-scaler

•Named industry veteran as Managing Director for Europe, Middle East and Africa region

•Hosted Luna's first Investor Day in New York City, outlining the company's plans for future growth

2023 Full-Year Outlook

Luna is reaffirming the 2023 revenue and adjusted EBITDA outlook it originally provided on March 14, 2023:

•Total revenue of $125 million to $130 million for the full year 2023

•Adjusted EBITDA of $14 million to $18 million for the full year 2023

In addition, Luna expects total revenues in the range of $29 million to $32 million for the third quarter 2023.

Luna is not providing an outlook for net income, which is the most directly comparable GAAP measure to Adjusted EBITDA, because changes in the items that Luna excludes from net income to calculate Adjusted EBITDA, such as share-based compensation, tax expense, and significant non-recurring charges, among other things, can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of Luna's routine operating activities.

The outlook above does not include any future acquisitions, divestitures, or unanticipated events.

Non-GAAP Financial Measures

In evaluating the operating performance of its business, Luna’s management considers Adjusted EBITDA and Adjusted EPS, which are non-GAAP financial measures. Adjusted EBITDA and Adjusted EPS exclude certain charges and income that are required by GAAP. Adjusted EBITDA and Adjusted EPS provide useful information to

both management and investors by excluding the effect of certain non-cash expenses and items that Luna believes may not be indicative of its operating performance, because either they are unusual and Luna does not expect them to recur in the ordinary course of its business, or they are unrelated to the ongoing operation of the business in the ordinary course.

Adjusted EBITDA and Adjusted EPS should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. Adjusted EBITDA and Adjusted EPS have been reconciled to the nearest GAAP measure in the table following the financial statements attached to this press release.

Conference Call Information

As previously announced, Luna will conduct an investor conference call at 5:00 pm (ET) today, August 10, 2023, to discuss its financial results for the three and six months ended June 30, 2023. The investor conference call will be available via live webcast on the Luna website at www.lunainc.com under the tab "Investor Relations." To participate by telephone, the domestic dial-in number is 1.800.715.9871 .and the international dial-in number is.1.646.307.1963. Participants should ask to join the Luna Innovations Incorporated conference call, conference ID 6350168, and are advised to dial in at least fifteen minutes prior to the call. A replay of the conference call will be available on the company's website under "Webcasts and Presentations" for 30 days following the conference call.

About Luna

Luna Innovations Incorporated (www.lunainc.com) is a leader in optical technology, providing unique capabilities in high-performance, fiber optic-based, test products for the telecommunications industry and distributed fiber optic-based sensing for a multitude of industries. Luna’s business model is designed to accelerate the process of bringing new and innovative technologies to market.

Forward-Looking Statements

The statements in this release that are not historical facts constitute “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include Luna's expectations regarding its projected full year 2023 and third quarter of 2023 financial results and outlook, and the Company's ability to secure additional significant wins. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of Luna may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for Luna's products and services to meet expectations, failure of target market to grow and expand, technological

and strategic challenges, uncertainties related to the macroeconomic conditions and those risks and uncertainties set forth in Luna’s Form 10-Q for the quarter ended June 30, 2023, and Luna's other periodic reports and filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on Luna’s website at www.lunainc.com. The statements made in this release are based on information available to Luna as of the date of this release and Luna undertakes no obligation to update any of the forward-looking statements after the date of this release.

Investor Contact:

Allison Woody

Phone: 540-769-8465

Email: IR@lunainc.com

Luna Innovations Incorporated

Consolidated Balance Sheets (Unaudited)

(in thousands, except share data)

| | | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 | | |

| | (unaudited) | | | | |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 3,277 | | | $ | 6,024 | | | |

| Accounts receivable, net | 33,813 | | | 33,249 | | | |

| Contract assets | 9,601 | | | 7,691 | | | |

| Inventory | 42,003 | | | 36,582 | | | |

| Prepaid expenses and other current assets | 5,159 | | | 4,328 | | | |

| | | | | |

| Total current assets | 93,853 | | | 87,874 | | | |

| Property and equipment, net | 4,761 | | | 4,893 | | | |

| Intangible assets, net | 17,371 | | | 18,750 | | | |

| Goodwill | 27,313 | | | 26,927 | | | |

| | | | | |

| Operating lease right-of-use assets | 3,670 | | | 4,661 | | | |

| | | | | |

| Other non-current assets | 3,321 | | | 3,255 | | | |

| Deferred tax asset | 4,842 | | | 4,647 | | | |

| | | | | |

| Total assets | $ | 155,131 | | | $ | 151,007 | | | |

| Liabilities and stockholders’ equity | | | | | |

| Liabilities: | | | | | |

| Current liabilities: | | | | | |

| Current portion of long-term debt obligations | $ | 3,000 | | | $ | 2,500 | | | |

| | | | | |

| Accounts payable | 10,306 | | | 8,109 | | | |

| Accrued and other current liabilities | 11,375 | | | 16,694 | | | |

| Contract liabilities | 3,463 | | | 4,089 | | | |

| Current portion of operating lease liabilities | 1,899 | | | 2,239 | | | |

| | | | | |

| Total current liabilities | 30,043 | | | 33,631 | | | |

| Long-term debt obligations, net of current portion | 27,734 | | | 20,726 | | | |

| Long-term portion of operating lease liabilities | 2,062 | | | 2,804 | | | |

| | | | | |

| | | | | |

| Other long-term liabilities | 419 | | | 444 | | | |

| | | | | |

| Total liabilities | 60,258 | | | 57,605 | | | |

| Commitments and contingencies | | | | | |

| Stockholders’ equity: | | | | | |

| | | | | |

Common stock, par value $0.001, 100,000,000 shares authorized, 35,739,827 and 34,901,954 shares issued, 33,908,336 and 33,105,080 shares outstanding at June 30, 2023 and December 31, 2022, respectively | 36 | | | 35 | | | |

Treasury stock at cost, 1,831,491 and 1,796,862 shares at June 30, 2023 and December 31, 2022, respectively | (5,960) | | | (5,607) | | | |

| Additional paid-in capital | 108,709 | | | 104,893 | | | |

| Accumulated deficit | (5,734) | | | (2,296) | | | |

| Accumulated other comprehensive loss | (2,178) | | | (3,623) | | | |

| Total stockholders’ equity | 94,873 | | | 93,402 | | | |

| Total liabilities and stockholders’ equity | $ | 155,131 | | | $ | 151,007 | | | |

Luna Innovations Incorporated

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2023 | | 2022 | | 2023 | | 2022 | |

| | | | |

| Revenues | $ | 29,164 | | | $ | 26,162 | | | $ | 54,209 | | | $ | 48,642 | | |

| Cost of revenues | 12,299 | | | 10,199 | | | 22,371 | | | 18,400 | | |

| Gross profit | 16,865 | | | 15,963 | | | 31,838 | | | 30,242 | | |

| Operating expense: | | | | | | | | |

| Selling, general and administrative | 13,439 | | | 14,768 | | | 26,736 | | | 28,056 | | |

| Research, development and engineering | 2,722 | | | 2,665 | | | 5,538 | | | 5,207 | | |

| Amortization of intangible assets | 918 | | | 992 | | | 1,910 | | | 1,806 | | |

| Total operating expense | 17,079 | | | 18,425 | | | 34,184 | | | 35,069 | | |

| Operating loss | (214) | | | (2,462) | | | (2,346) | | | (4,827) | | |

| Other income/(expense): | | | | | | | | |

| | | | | | | | |

| Other (expense)/income | (110) | | | 53 | | | (18) | | | 73 | | |

| Interest expense, net | (584) | | | (111) | | | (953) | | | (224) | | |

| Total other expense, net | (694) | | | (58) | | | (971) | | | (151) | | |

| Loss from continuing operations before income taxes | (908) | | | (2,520) | | | (3,317) | | | (4,978) | | |

| Income tax (benefit)/expense | (350) | | | 422 | | | (917) | | | (693) | | |

| | | | | | | | |

| Net loss from continuing operations | (558) | | | (2,942) | | | (2,400) | | | (4,285) | | |

| (Loss)/income from discontinued operations, net of income tax expense (benefit) of $(346), $(856), $(346), and $166. | (1,038) | | | 591 | | | (1,038) | | | 594 | | |

| Gain on sale of discontinued operations, net of tax of $3,117 | — | | | — | | | — | | | 10,921 | | |

| Net (loss)/income from discontinued operations | (1,038) | | | 591 | | | (1,038) | | | 11,515 | | |

| | | | | | | | |

| | | | | | | | |

| Net (loss)/income | $ | (1,596) | | | $ | (2,351) | | | $ | (3,438) | | | $ | 7,230 | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share from continuing operations: | | | | | | | | |

| Basic | $ | (0.02) | | | $ | (0.09) | | | $ | (0.07) | | | $ | (0.13) | | |

| Diluted | $ | (0.02) | | | $ | (0.09) | | | $ | (0.07) | | | $ | (0.13) | | |

| Net (loss)/income per share from discontinued operations: | | | | | | | | |

| Basic | $ | (0.03) | | | $ | 0.02 | | | $ | (0.03) | | | $ | 0.36 | | |

| Diluted | $ | (0.03) | | | $ | 0.02 | | | $ | (0.03) | | | $ | 0.36 | | |

| Net loss per share attributable to common stockholders: | | | | | | | | |

| Basic | $ | (0.05) | | | $ | (0.07) | | | $ | (0.10) | | | $ | 0.22 | | |

| Diluted | $ | (0.05) | | | $ | (0.07) | | | $ | (0.10) | | | $ | 0.22 | | |

| Weighted average shares: | | | | | | | | |

| Basic | 33,634,538 | | | 32,478,736 | | | 33,483,978 | | | 32,361,560 | | |

| Diluted | 33,634,538 | | | 32,478,736 | | | 33,483,978 | | | 32,361,560 | | |

Luna Innovations Incorporated

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| | 2023 | | 2022 | | |

| | | |

| Cash flows used in by operating activities | | | | | |

| Net (loss)/income | $ | (3,438) | | | $ | 7,230 | | | |

| Adjustments to reconcile net (loss)/income to net cash used in operating activities | | | | | |

| Depreciation and amortization | 2,740 | | | 2,694 | | | |

| Share-based compensation | 2,172 | | | 2,177 | | | |

| | | | | |

| Loss on disposal of property and equipment | 278 | | | — | | | |

| Gain on sale of discontinued operations, net of tax | — | | | (10,921) | | | |

| Deferred taxes | (194) | | | (124) | | | |

| | | | | |

| Change in assets and liabilities | | | | | |

| Accounts receivable | (168) | | | (6,555) | | | |

| Contract assets | (1,815) | | | 140 | | | |

| Inventory | (4,798) | | | (4,281) | | | |

| Other current assets | (804) | | | (3,870) | | | |

| Other long-term assets | (93) | | | 646 | | | |

| Accounts payable and accrued and other current liabilities | (3,653) | | | 6,123 | | | |

| Contract liabilities | (693) | | | 1,196 | | | |

| Other long term-liabilities | — | | | (1,523) | | | |

| Net cash used in operating activities | (10,466) | | | (7,068) | | | |

| Cash flows used in investing activities | | | | | |

| Acquisition of property and equipment | (1,180) | | | (1,657) | | | |

| Acquisition of intangible property | (63) | | | — | | | |

| Proceeds from sale of property and equipment | — | | | 25 | | | |

| Proceeds from sale of discontinued operations | — | | | 12,973 | | | |

Acquisition of Luna Innovations Germany GmbH | — | | | (22,085) | | | |

| Other | — | | | 4 | | | |

| Net cash used in investing activities | (1,243) | | | (10,740) | | | |

| Cash flows provided by financing activities | | | | | |

| Payments on finance lease obligations | (25) | | | (24) | | | |

| Proceeds from borrowings under debt obligations | 8,500 | | | 21,150 | | | |

| Payments of debt obligations | (1,000) | | | (15,772) | | | |

| Repurchase of common stock | (353) | | | (294) | | | |

| Proceeds from ESPP | 546 | | | 521 | | | |

| Proceeds from the exercise of stock options | 1,234 | | | 1,158 | | | |

| Net cash provided by financing activities | 8,902 | | | 6,739 | | | |

| Effect of exchange rate changes on cash and cash equivalents | 60 | | | (1,195) | | | |

| Net decrease in cash and cash equivalents | (2,747) | | | (12,264) | | | |

| Cash and cash equivalents-beginning of period | 6,024 | | | 17,128 | | | |

| Cash and cash equivalents-end of period | $ | 3,277 | | | $ | 4,864 | | | |

Luna Innovations Incorporated

Reconciliation of Net (Loss)/Income to EBITDA and Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | |

| Net (loss)/income | $ | (1,596) | | | $ | (2,351) | | | $ | (3,438) | | | $ | 7,230 | |

| Net (loss)/income from discontinued operations | (1,038) | | | 591 | | | (1,038) | | | 11,515 | |

| Net loss from continuing operations | (558) | | | (2,942) | | | (2,400) | | | (4,285) | |

| Interest expense, net | 584 | | | 111 | | | 953 | | | 224 | |

| | | | | | | |

| Income tax (benefit)/expense | (350) | | | 422 | | | (917) | | | (693) | |

| Depreciation and amortization | 1,323 | | | 1,538 | | | 2,740 | | | 2,694 | |

| EBITDA | 999 | | | (871) | | | 376 | | | (2,060) | |

| Share-based compensation | 1,118 | | | 934 | | | 2,172 | | | 2,000 | |

| Integration and transaction expense | 160 | | | 156 | | | 249 | | | 2,000 | |

| Amortization of inventory step-up | — | | | 257 | | | — | | | 257 | |

Other non-recurring charges (1) | 455 | | | 708 | | | 789 | | | 708 | |

| Adjusted EBITDA | $ | 2,732 | | | $ | 1,184 | | | $ | 3,586 | | | $ | 2,905 | |

(1) - Other non-recurring charges primarily include facility consolidation and one-time insurance deductible.

Luna Innovations Incorporated

Reconciliation of Net (Loss)/Income to Adjusted EPS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | |

| Net (loss)/income | $ | (1,596) | | | $ | (2,351) | | | $ | (3,438) | | | $ | 7,230 | |

| Net (loss)/income from discontinued operations | (1,038) | | | 591 | | | (1,038) | | | 11,515 | |

| Net loss from continuing operations | (558) | | | (2,942) | | | (2,400) | | | (4,285) | |

| Share-based compensation | 1,118 | | | 934 | | | 2,172 | | | 2,000 | |

| Integration and transaction expense | 160 | | | 156 | | | 249 | | | 2,000 | |

| Amortization of intangible assets | 918 | | | 992 | | | 1,910 | | | 1,813 | |

| Amortization of inventory step-up | — | | | 257 | | | — | | | 257 | |

| | | | | | | |

| | | | | | | |

Other non-recurring charges (1) | 455 | | | 708 | | | 789 | | | 708 | |

| Income tax effect on adjustments | (663) | | | (762) | | | (1,280) | | | (1,695) | |

| Adjusted income (loss) from continuing operations | $ | 1,430 | | | $ | (657) | | | $ | 1,440 | | | $ | 798 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted EPS | $ | 0.04 | | | $ | (0.02) | | | $ | 0.04 | | | $ | 0.02 | |

| | | | | | | |

| | | | | | | |

| Adjusted weighted average shares: | | | | | | | |

| Diluted | 33,635 | | | 32,479 | | | 33,484 | | | 32,362 | |

(1) - Other non-recurring charges primarily include facility consolidation and one-time insurance deductible.

Second-Quarter 2023 Results Investor Supplemental Materials August 10, 2023

Safe Harbor Luna Innovations Incorporated © 2 Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding its technological and product capabilities, market growth and its market position, sales wins, revenue growth, customer activity, engagement and prospects, recurring sales, margin, general product performance, the company's future financial performance, including guidance, and market recognition of key technologies and demand for its products, the company’s overall growth potential, its capitalization and access to, and deployment of, capital, its strategic position and corporate and leadership strength and culture. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, customer relationships, failure of demand for the company’s products and services to meet expectations, failure to penetrate target markets or of those markets to grow and expand, technological, operational and strategic challenges, integration of acquisitions, global supply chain issues, geopolitical and economic factors and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation, August 10, 2023, and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA and Adjusted EPS, which are non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Net Income to Adjusted EBITDA and Net Income to Adjusted EPS are included in the appendix to this presentation.

Speakers Luna Innovations Incorporated © 3 Scott Graeff President & Chief Executive Officer Brian Soller Chief Technology Officer & EVP, Corporate Development Gene Nestro Chief Financial Officer & SVP, Finance

Why Luna? Our investment thesis Luna Innovations Incorporated © 4 Enabling the future with fiber Proprietary measurement technology, offering unparalleled combination of resolution, accuracy and speed Customers in large, growing markets: Infrastructure, Energy, Defense, Communications, Automotive & Aerospace Aligned with macro trends in Energy, Infrastructure, Transport, Communications and more Robust IP portfolio with over 700 patents owned or in-licensed Attractive capital deployment, funded all investments internally; disciplined M&A Leverage: Scalable platforms, processes and people in place

Second-Quarter FY23 Results Luna Innovations Incorporated © 5

Second-Quarter 2023: Key Financial Results • Revenues of $29.2M, up 11% year over year • Gross margin of 58%, compared to 61% for the prior year • Net loss of $1.6M, compared to net loss of $2.4M for the prior year • Adjusted EBITDA1 of $2.7M, compared to $1.2M for the prior year • Adjusted EPS1 of $0.04, compared to $(0.02) for the prior year Luna Innovations Incorporated © 6 1Adj EPS and EBITDA are a non-GAAP measures. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation.

Second-Quarter 2023 and Recent Highlights • Recognized significant wins for monitoring systems, including a contract for the largest power utility company in Italy • Secured large, follow-on, multi-unit Terahertz order for EV battery production process monitoring • Drove significant wins in our RIO line of lasers supported by macro trends such as LiDAR • Secured a seven-figure blanket order for polarization modules from a major data center hyper- scaler • Named industry veteran as Managing Director for Europe, Middle East and Africa region • Hosted Luna’s first Investor Day in New York City, outlining the company’s plans for future growth • Coverage initiated by two additional analysts – Stifel – Needham Luna Innovations Incorporated © 7

Revenue has been driven by strong organic growth, supplemented by efficient M&A $59.1 $87.5 $109.0 $54.2 FY20 FY21 FY22 FY23E Revenue1 (millions) Luna Innovations Incorporated © 8 2023 guidance: $125M - $130M 1Results exclude Luna Labs Q3 Guidance

We have delivered solid AEBITDA, while internally funding many initiatives $7.9 $7.6 $12.1 $3.6 FY20 FY21 FY22 FY23E Adjusted EBITDA1,2 (millions) Luna Innovations Incorporated © 9 FY23 guidance: $14M to $18M 1Results exclude Luna Labs 2 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in this presentation.

Balance Sheet • Balance sheet on June 30, 2023: – $155.1M in total assets o $3.3M in cash and cash equivalents o $63.8M in working capital • Total debt of $30.7M outstanding Luna Innovations Incorporated © 10

2023 Guidance1 Luna Innovations Incorporated © 11 Full-year total revenue $125M to $130M Full-year adjusted EBITDA $14M to $18M Top-line revenue guidance for Q3 $29M to $32M 1 The outlook above does not include any future acquisitions, divestitures or unanticipated events..

Appendix 12Luna Innovations Incorporated ©

Reconciliation of Net (Loss)/Income to Adjusted EBITDA Luna Innovations Incorporated © 13 A P P EN D IX 1 Other non-recurring charges primarily include facility consolidation, one-time insurance deductible, etc. (in thousands) 2023 2022 2023 2022 Reconciliation of EBITDA and Adjusted EBITDA GAAP net income/(loss) (1,596)$ (2,351)$ (3,438)$ 7,230$ Income from discontinued operations, net of tax (1,038) 591 (1,038) 11,515 GAAP net income/(loss) from continuing operations (558) (2,942) (2,400) (4,285) Interest expense, net 584 111 953 224 Income tax (benefit)/expense (350) 422 (917) (693) Depreciation and amortization 1,323 1,538 2,740 2,694 EBITDA 999 (871) 376 (2,060) Share‐based compensation 1,118 934 2,172 2,000 Integration and transaction expense 160 156 249 2,000 Amortization of inventory step‐up ‐ 257 ‐ 257 Other non‐recurring charges (1) 455 708 789 708 Adjusted EBITDA 2,732$ 1,184$ 3,586$ 2,905$ Three Months Ended June 30, (Unaudited) Six Months Ended June 30, (Unaudited)

Reconciliation of Net (Loss)/Income to Adjusted EPS Luna Innovations Incorporated © 14 A P P EN D IX 1 Other non-recurring charges primarily include facility consolidation, insurance one-time deductible, etc. 2023 2022 2023 2022 Reconciliation of Net (loss)/Income to Adjusted EPS GAAP net income/(loss) (1,596)$ (2,351)$ (3,438)$ 7,230$ Income from discontinued operations, net of tax (1,038) 591 (1,038) 11,515 GAAP net income/(loss) from continuing operations (558) (2,942) (2,400) (4,285) Adjustments: Share‐based compensation 1,118 934 2,172 2,000 Integration and transaction expense 160 156 249 2,000 Amortization of intangible assets 918 992 1,910 1,813 Amortization of inventory step‐up ‐ 257 ‐ 257 Other non‐recurring charges (1) 455 708 789 708 Total adjustments: 2,651 3,047 5,120 6,778 Income tax effect on adjustments (663) (762) (1,280) (1,695) Adjusted income (loss) from continuing operations 1,430$ (657)$ 1,440$ 798$ Adjusted EPS 0.04$ (0.02)$ 0.04$ 0.02$ Adjusted weighted average shares: Diluted 33,635 32,479 33,484 32,362 Three Months Ended June 30, (Unaudited) Six Months Ended June 30, (Unaudited) (in thousands, except per share data)

Historical Quarterly Results Luna Innovations Incorporated © 15 A P P EN D IX June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 Revenues 26,162$ 29,153$ 31,702$ 25,045$ 29,164$ Cost of revenues 10,199 12,234 12,367 10,072 12,299 Gross profit 15,963 16,919 19,335 14,973 16,865 Gross margin 61% 58% 61% 60% 58% Operating expense: Selling, general and administrative 14,612 12,065 13,292 13,207 13,279 Research, development and engineering 2,665 2,204 2,853 2,817 2,722 Amortization of intangibles 992 988 1,238 992 918 Integration and deal related expense 156 184 488 89 160 Total operating expense 18,425 15,441 17,871 17,105 17,079 Operating income/(loss) (2,462)$ 1,478$ 1,464$ (2,132)$ (214)$ (in thousands) Three Months Ended

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

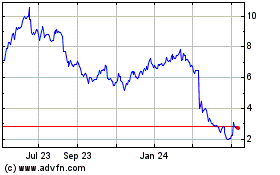

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

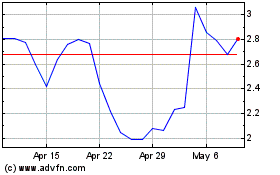

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024