UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 2)*

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

LM Funding America, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

502074404

(CUSIP Number)

Bruce Rodgers

c/o LM Funding America, Inc.

1200 West Platt Street, Suite 100

Tampa, Florida 33606

813-222-8996

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

April 30, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this Schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the

liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Bruce Rodgers

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States of America

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

1,150,000

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

178,128

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

1,328,128

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

8.72%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

The following constitutes the Amendment No. 2 to Schedule 13D filed by the undersigned (the “Amendment”).

Item 1.

Security and Issuer.

This Amendment relates to the Common Stock, par value $0.001 per share (the “Shares”), of LM Funding America, Inc., a Delaware corporation (the “Issuer”). The address of the principal executive

offices of the Issuer is 1200 West Platt Street, Suite 100, Tampa, FL 33606.

This Amendment is being filed to report a change in the ownership percentage of Mr. Rodgers as a result of (i) the grant by the Issuer to Mr. Rodgers of 650,000 restricted Shares on April 20, 2023

pursuant to the LM Funding America, Inc. 2021 Omnibus Incentive Plan (the “Plan”), and (ii) the accelerated vesting on June 30, 2023, of certain options granted to Mr. Rodgers on April 20, 2023 under the Plan, both as described in more detail below.

Such grants and the terms of the options were previously disclosed and described by the Issuer on a Form 8-K filed by the Issuer on April 26, 2023 (as amended on May 15, 2023) and a Form 4 filed by Mr. Rodgers on April 24, 2023.

On April 20, 2023 (the “Grant Date”), the Issuer granted to Mr. Rodgers 650,000 restricted Shares that are subject to vesting. On the same date, the Issuer granted Mr. Rodgers options to purchase

1,000,000 Shares under the Plan pursuant to a Stock Option Award Agreement (the “Options”). Pursuant to the Stock Option Award Agreement, the Options vest as to 50% of the total amount of the award on the one-year anniversary of the Grant Date and

50% of the total amount of the award on the two-year anniversary of the Grant Date (subject to accelerated vesting upon a change of control of the Issuer or upon a termination of Mr. Rodger’s employment with the Issuer “without cause” or “for good

reason” within the meaning of Mr. Rodger’s employment agreement), provided that Mr. Rodgers is in continuous employment or service to the Issuer through the applicable vesting date. The Options are subject to accelerated vesting as follows: (a) 50%

of the portion of the Options that are scheduled to vest during the first year after the Grant Date were scheduled to vest as of June 30, 2023, if the Issuer’s bitcoin mining operations achieved 500 petahash of computing power as of June 30, 2023,

and (b) 50% of the portion of the Options that are scheduled to vest during the second year after the Grant Date will vest as of June 30, 2024, if the Issuer’s bitcoin mining operations achieve 1,000 petahash of computing power as of June 30, 2024.

As a result of the Issuer’s bitcoin mining operations achieving 500 petahash of computer power as of June 30, 2023, as of June 30, 2023, Mr. Rodgers had the right to acquire within 60 days an additional 500,000 Shares of the Issuer.

Item 2. Identity and Background.

(a) This statement is filed by Bruce Rodgers.

(b) The principal business address of Mr. Rodgers is 1200 West Platt Street, Suite 100, Tampa, Florida 33606.

(c) The principal business of Mr. Rodgers is serving as the Chairman, Chief Executive Officer, and President of the Issuer.

(d) Mr. Rodgers has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) Mr. Rodgers has not, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is

subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Mr. Rodgers is a citizen of the United States of America.

Item 3.

Source or Amount of Funds or Other Consideration.

Item 3 of this Schedule 13D is hereby being amended to add the following information:

On April 20, 2023, the Issuer granted to Mr. Rodgers an aggregate of 650,000 Shares of restricted common stock under the Plan and pursuant to a Restricted

Stock Award Agreement. Such Shares vest in twelve substantially equal installments on each monthly anniversary of the Grant Date for twelve months following the Grant Date (subject to accelerated vesting upon a change of control of the Issuer),

provided that Mr. Rodgers is in continuous employment or service to the Issuer through the applicable vesting date.

Also on April 20, 2023, the Issuer granted to Mr. Rodgers Options to purchase 1,000,000 Shares of the Issuer under the Plan and pursuant to a Stock Option Award Agreement. The Options have an

exercise price of $0.751 per share and vest as set forth in Item 1 above. The Options will expire 10 years from the date of grant and otherwise generally terminate early within 90 days after a termination of employment (or 12 months due to death or

disability).

The foregoing description of the Restricted Stock Award Agreement and Stock Option Award Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Restricted Stock Award Agreement and Stock

Option Award Agreement, a copy of which is filed hereto as Exhibit 1 and Exhibit 2, respectively, and incorporated herein by reference.

Item 4. Purpose of Transaction.

Reference is made to Item 1 and Item 3, which are hereby incorporated by reference.

All of the shares of Issuer Common Stock were acquired for investment purposes. Mr. Rodgers intends to evaluate his holdings in the Issuer on an ongoing basis. Mr. Rodgers may, from time to time,

acquire additional Shares or other securities of the Issuer. In addition, he may dispose of any or all securities of the Issuer in any manner permitted by applicable securities laws. Such decisions will be based on various factors, including, without

limitation, market conditions, the price at which such Shares can be purchased or sold, the financial condition and prospects of the Issuer, general economic, financial, market and industry conditions, and Mr. Rodgers’ personal financial condition.

Pursuant to Mr. Rodgers’ continued service as Chairman, President and Chief Executive Officer of the Issuer, Mr. Rodgers may receive future equity awards from the Issuer in accordance with the applicable compensation plans, as may be in effect from

time to time.

As Chief Executive Officer of the Issuer, Mr. Rodgers is involved in the oversight and management of the Issuer and setting policy for the Issuer. Mr. Rodgers also participates, as the Chairman of the

Board of Directors of the Issuer, in the consideration of, and taking action on, significant corporate events and opportunities involving the Issuer. As a result, from time to time he may consider proposals that relate to or would result in the matters

listed in Items 4(a)-(j) of Schedule 13D.

Except as otherwise described herein, Mr. Rodgers has no plan or proposal with respect to the Issuer in his capacity as a shareholder which relates to or would result in any of the matters listed in Items 4(a)-(j) of Schedule 13D. Mr. Rodgers

reserves the right to determine in the future whether to change the purpose or purposes described above or whether to adopt plans or proposals of the type referenced above.

Item 5. Interest in Securities of the Issuer.

|

|

(a)-(b)

|

|

As of the date of this Amendment, Mr. Rodgers is deemed to beneficially own 1,262,788 Shares, which represents approximately 8.72% of the outstanding Shares based on

14,651,883 Shares outstanding, which is the total number of Shares outstanding as of the date of the filing of this Amendment. Mr. Rodgers has the sole power to vote and dispose of 1,150,000 Shares, which is comprised of (i) the 650,000

restricted Shares granted to Mr. Rodgers by the Issuer on April 20, 2023, and (ii) the 500,000 Shares issuable upon the exercise of the Options as of June 30, 2023. Mr. Rodgers has shared voting and dispositive power over 178,128 Shares,

which includes (i) 84,661 Shares issuable upon the exercise of stock options held by Ms. Carollinn Gould, the spouse of Mr. Rodgers, that are currently exercisable or exercisable within 60 days of the date of this Amendment, (ii) 92,486

Shares beneficially owned by CGR63, LLC, which is owned by the Bruce M. Rodgers Revocable Trust and Carol Linn Gould Revocable Trust, (iii) 823 Shares beneficially owned by BRR Holding, LLC, an entity over which Mr. Rodgers and his spouse

share voting and dispositive control, (iv) 118 Shares beneficially owned by the Bruce M. Rodgers IRA, and (v) 40 Shares beneficially owned by the Carollinn Gould IRA. The percentage of ownership reported in this Item 5 was calculated in

accordance with Rule 13d-3(d)(1)(i) promulgated under the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

|

|

|

(c)

|

|

Except as described in this Amendment, Mr. Rodgers has not effected any transaction with respect to the Shares in the past 60 days.

|

|

|

|

|

|

|

|

(d)

|

|

To the best knowledge of Mr. Rodgers, Mr. Rodgers does not have and does not know any other person who has the right to receive or the power to direct the receipt of

dividends from, or the proceeds from the sale of, and Shares beneficially owned by Mr. Rodgers.

|

|

|

|

|

|

|

|

(e)

|

|

Not applicable.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Other than as described herein, there are no contracts, arrangements, understandings or relationships between Mr. Rodgers and any other person with respect to the securities of the Issuer.

Item 7. Material to Be Filed as Exhibits.

|

|

1. Restricted Stock Award Agreement, dated April 20, 2023.

|

|

|

|

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Exhibit 1

LM FUNDING AMERICA, INC.

2021 OMNIBUS INCENTIVE PLAN

RESTRICTED STOCK AWARD

Bruce Rodgers

1200 W Platt Street, Suite 100

Tampa, Florida 33606

Dear Mr. Rodgers:

You have been granted an award of shares of the common stock (“Common Stock”) of LM Funding America, Inc. (the “Company”) constituting Restricted Stock (this “Award”) under the LM Funding America,

Inc. 2021 Omnibus Incentive Plan (the “Plan”) with terms and conditions described below. This Award is granted under and governed by the terms and conditions of the Plan. Additional provisions regarding this Award and definitions of

capitalized terms used and not defined in this Award can be found in the Plan.

|

Grant Date:

|

April 20, 2023

|

|

|

Number of Shares of Restricted Stock

(“Restricted Shares”):

|

650,000

|

|

|

Vesting Schedule:

|

The Shares will vest and become exercisable in equal increments of one twelfth (1/12) of the total Shares beginning on May 31, 2023 and continuing on the last day of each of the succeeding eleven (11) calendar

months thereafter, provided that you remain in continuous employment or service with the Company or an Affiliate until the applicable vesting date

Notwithstanding the foregoing, the Restricted Shares will vest in full upon a Change of Control, if you are continuously employed with, or in the service of, the Company or an Affiliate thereof through the day

preceding the date of the Change of Control.

|

|

|

Termination of Employment or Service:

|

Upon your termination of employment with, or cessation of services to, the Company or an Affiliate thereof prior to the date the Restricted Shares are vested, you will forfeit the unvested Restricted Shares.

|

|

|

Release of Shares:

|

The Restricted Shares will be held in an account at the Company’s transfer agent pending vesting. As soon as practicable after any Restricted Shares vest, the applicable restrictions on the Restricted Shares

will be removed and such Shares will be issued according to your instructions.

|

|

Transferability of

Restricted Shares:

|

You may not sell, transfer or otherwise alienate or hypothecate any of your Restricted Shares until they are vested. In addition, by accepting this Award, you agree not to sell any Shares acquired under this

Award other than as set forth in the Plan and at a time when applicable laws, Company policies or an agreement between the Company and its underwriters do not prohibit a sale.

|

|

Voting and Dividends:

|

While the Restricted Shares are subject to forfeiture, you may exercise full voting rights and will be entitled all dividends and other distributions paid with respect to the Restricted Shares, in each case so

long as the applicable record date occurs before you forfeit the Restricted Shares; provided that any dividends and distributions other than cash dividends will be held in the custody of the Company and will be subject to the same risk of

forfeiture, restrictions on transferability and other terms of this Award that apply to the Restricted Shares with respect to which such distributions were made. All such non-cash dividends or other distributions will be paid to you within

45 days following the full vesting of the Restricted Shares with respect to which such distributions were made.

|

|

Transferability of Award:

|

You may not transfer or assign this Award for any reason, other than as set forth in the Plan. Any attempted transfer or assignment will be null and void.

|

|

Market Stand-Off:

|

In connection with any underwritten public offering by the Company of its equity securities pursuant to an effective registration statement filed under the Securities Act of 1933, as amended, you agree that you

will not directly or indirectly sell, make any short sale of, loan, hypothecate, pledge, offer, grant or sell any option or other contract for the purchase of, purchase any option or other contract for the sale of, or otherwise dispose of or

transfer or agree to engage in any of the foregoing transactions with respect to, any Shares acquired under this Award without the prior written consent of the Company and the Company’s underwriters. Such restriction will be in effect for

such period of time following the date of the final prospectus for the offering as may be determined by the Company. In no event, however, will such period exceed one hundred eighty (180) days. You agree to execute any lock-up agreement or

similar agreement requested by the Company or the Company’s underwriters to evidence the foregoing obligations plus such other obligations that are generally applied to Company stockholders in connection with the underwritten public offering.

|

|

Tax Matters:

|

You understand that you (and not the Company or any Affiliate) will be responsible for your own federal, state, local or foreign tax liability and any other tax consequences that may arise as a result of the

transactions contemplated by this Award. You will rely solely on the determinations of your tax advisors or your own determinations, and not on any statements or representations by the Company or any of its agents, with regard to all such

tax matters. You understand that you may alter the tax treatment of the Shares subject to this Award by filing an election under Section 83(b) of the Internal Revenue Code of 1986, as amended (the “Code”). Such election must be filed within

thirty (30) days after the date of this Award to be effective. You should consult with your tax advisor to determine the tax consequences of acquiring the Shares and the advantages and disadvantages of

filing the Code Section 83(b) election. You acknowledge that it is your sole responsibility, and not the Company’s, to file a timely election under Code Section 83(b), even if you request the Company or its representatives to make this

filing on your behalf.

The following two paragraphs are applicable only to employees of the Company:

To the extent that the receipt or the vesting of the Restricted Shares, or the payment of dividends on the Restricted Shares, results in income to you for federal, state or local income tax purposes, except as

otherwise provided in the following paragraph, you will deliver to the Company at the time the Company is obligated to withhold taxes in connection with such receipt, vesting or payment, as the case may be, such amount as the Company

requires to meet its withholding obligation under applicable tax laws or regulations. If you fail to do so, the Company has the right and authority to deduct or withhold from other compensation payable to you (including Restricted Shares as

described in the following paragraph) an amount sufficient to satisfy its withholding obligations or to delay delivery of the shares.

If you do not make an election under Code Section 83(b) in connection with this Award and only if permitted by the Company, you may satisfy the withholding requirement in connection with the vesting of the

Restricted Shares, in whole or in part, by electing to have the Company withhold for its own account the number of Restricted Shares that would otherwise be released to you on the date the tax is to be determined having an aggregate Fair

Market Value (on the date the tax is to be determined) equal to the tax that the Company must withhold in connection with the vesting of such Restricted Shares. The Fair Market Value of any fractional Share not used to satisfy the

withholding obligation (as determined on the date the tax is determined) will be paid to you in cash.

|

|

Miscellaneous:

|

• This Award may be amended only by written consent signed by both you and the Company, unless

the amendment is not to your detriment. Notwithstanding the foregoing, this Award may be amended or terminated by the Board or the Committee without your consent in accordance with the provisions of the Plan.

• The failure of the Company to enforce any provision of this Award at any time will in no way

constitute a waiver of such provision or of any other provision hereof.

• In the event any provision of this Award is held illegal or invalid for any reason, such

illegality or invalidity will not affect the legality or validity of the remaining provisions of this Award, and this Award will be construed and enforced as if the illegal or invalid provision had not been included in this Award.

• As a condition to the grant of this Award, you agree (with such agreement being binding upon

your legal representatives, guardians, legatees or beneficiaries) that this Award will be interpreted by the Committee and that any interpretation by the Committee of the terms of this Award or the Plan, and any determination made by the

Committee pursuant to this Award or the Plan, will be final, binding and conclusive.

• This Award may be executed in counterparts.

|

BY SIGNING BELOW AND ACCEPTING THIS RESTRICTED STOCK AWARD, YOU AGREE TO ALL OF THE TERMS AND CONDITIONS DESCRIBED HEREIN AND IN THE PLAN. YOU ALSO ACKNOWLEDGE RECEIPT OF THE PLAN.

|

LM FUNDING AMERICA, INC.

|

|

|

By: /s/ Richard Russell

Richard Russell

|

By: /s/ Bruce Rodgers

Bruce Rodgers

|

Date: April 20, 2023

|

|

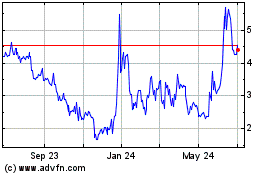

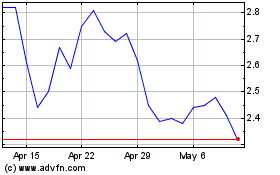

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Apr 2023 to Apr 2024