UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

Filed by the Registrant

|

☑

|

|

Filed by a Party other than the Registrant

|

☐

|

Check the appropriate box:

☑ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

LIQTECH INTERNATIONAL, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

| |

|

☒

|

No fee required

|

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

LIQTECH INTERNATIONAL, INC.

Industriparken 22C

DK2750 Ballerup, Denmark

September , 2023

To our Stockholders:

The Annual Meeting of the Stockholders (the “Meeting”) of LiqTech International, Inc. (the “Company”) will be held at 3:00 p.m., local time on Thursday, November 9, 2023, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark. Details of the business to be conducted at the Meeting are provided in the enclosed Notice of Annual Meeting of Stockholders and Proxy Statement, which you are urged to read carefully.

On behalf of our Board of Directors, I cordially invite all stockholders to attend the Meeting. It is important that your shares be voted on the matters scheduled to come before the Meeting. Whether or not you plan to attend the Meeting, I urge you to vote your shares. We encourage you to vote your proxy by mailing in your enclosed proxy card in the enclosed postage-paid envelope or vote online or over the telephone according to the instructions in the proxy card. If you attend the Meeting, you may revoke such proxy and vote in person if you wish. Even if you do not attend the Meeting, you may revoke such proxy at any time prior to the Meeting by executing another proxy bearing a later date or providing written notice of such revocation to the Chief Executive Officer of the Company.

| |

Sincerely,

|

| |

/s/ Fei Chen |

| |

Fei Chen

|

| |

Chief Executive Officer, Principal Executive

Officer and Director

|

Important Notice Regarding the Availability of Proxy Materials for the annual meeting of stockholders to be held on November 9, 2023: In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, we are now providing access to our proxy materials, including the Proxy Statement, our Annual Report for the fiscal year ended December 31, 2022 and a form of proxy relating to the Meeting, over the internet. All stockholders of record and beneficial owners will have the ability to access the proxy materials at www.proxyvote.com. These proxy materials are available free of charge.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF LIQTECH INTERNATIONAL, INC.

TO BE HELD ON NOVEMBER 9, 2023

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of LiqTech International, Inc., a Nevada corporation (the “Company”), will be held at 3:00 p.m., local time on Thursday, November 9, 2023, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark for the following purposes:

| |

1.

|

To elect a slate of nominees consisting of current directors Alexander Buehler, Fei Chen, Peyton Boswell, Richard Meeusen, and Martin Kunz to serve as directors of the Company;

|

| |

|

|

| |

2.

|

To approve an amendment to our Articles of Incorporation increasing the number of authorized shares of common stock from 12,500,000 shares to 50,000,000 shares;

|

| |

|

|

| |

3.

|

To ratify the appointment of Sadler, Gibb & Associates, L.L.C. as the Company’s independent registered public accountants for the fiscal year ending December 31, 2023;

|

| |

|

|

| |

4.

|

To consider and vote upon such other matter(s) as may properly come before the Meeting or any adjournment(s) thereof.

|

The Company’s Board of Directors recommends that you vote in favor of proposals 1, 2, and 3.

Stockholders of record as of the Record Date (September 19, 2023) are entitled to notice of, and to vote at, this Meeting or any adjournment or postponement thereof.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES SO THAT A QUORUM WILL BE PRESENT AND A MAXIMUM NUMBER OF SHARES MAY BE VOTED. IT IS IMPORTANT AND IN YOUR INTEREST FOR YOU TO VOTE. WE ENCOURAGE YOU TO VOTE YOUR PROXY BY MAILING IN YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE, OR VOTE ONLINE OR OVER THE TELEPHONE ACCORDING TO THE INSTRUCTIONS IN THE PROXY CARD.

THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

|

Date: September , 2023

|

BY ORDER OF THE BOARD OF

|

| |

DIRECTORS

|

| |

|

| |

Fei Chen

|

| |

Chief Executive Officer, Principal Executive

Officer and Director

|

PROXY STATEMENT

LIQTECH INTERNATIONAL, INC.

Industriparken 22C

DK2750 Ballerup, Denmark

This Proxy Statement and the accompanying proxy card are being furnished with respect to the solicitation of proxies by the Board of Directors (the “Board”) of LiqTech International, Inc., a Nevada corporation (the “Company” or “LiqTech”), for the Annual Meeting of the Stockholders (the “Meeting”) to be held at 3:00 p.m. local time on Thursday, November 9, 2023, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark.

For the Meeting, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”), to our stockholders primarily via the internet. On or about September 25, 2023, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) that contains notice of the Meeting and instructions on how to access our proxy materials on the internet, how to vote at the Meeting and how to request printed copies of the proxy materials.

These proxy materials are also available free of charge on the internet at www.proxyvote.com. Stockholders are invited to attend the Meeting to vote on the proposals described in this Proxy Statement. However, stockholders do not need to attend the Meeting to vote. Instead, stockholders may simply complete, sign and return the proxy card in the enclosed postage-paid envelope or vote online or over the telephone according to the instructions in the proxy card.

We will bear the expense of solicitation of proxies for the Meeting, including the printing and mailing of this Proxy Statement. We may request persons, and reimburse them for their expenses with respect thereto, who hold stock in their name or custody or in the names of nominees for others to forward copies of such materials to those persons for whom they hold Common Stock (as defined below) and to request authority for the execution of the proxies. In addition, some of our officers, directors and employees, without additional compensation, may solicit proxies on behalf of the Board personally or by mail, telephone or facsimile.

VOTING SECURITIES, VOTING AND PROXIES

Record Date

Only stockholders of record of the Company’s common stock, $0.001 par value (the “Common Stock”), as of the close of business on September 19, 2023 (the “Record Date”) are entitled to notice and to vote at the Meeting and any adjournment or adjournments thereof.

Voting Stock

As of the Record Date, there were _______ shares of Common Stock outstanding. Each holder of Common Stock on the Record Date is entitled to one vote for each share then held on the matters to be voted at the Meeting. No other class of voting securities was then outstanding.

Quorum

The presence at the Meeting of a majority of the issued and outstanding shares of Common Stock as of the Record Date, in person or by proxy, is required for a quorum. Should you submit a proxy, even though you abstain as to a proposal, or you are present in person at the Meeting, your shares shall be counted for the purpose of determining if a quorum is present.

Broker Non-Votes

Broker “non-votes” are included for the purposes of determining whether a quorum of shares is present at the Meeting. A broker “non-vote” occurs when a nominee holder, such as a brokerage firm, bank or trust company, holding shares of record for a beneficial owner, does not vote on a particular proposal because the nominee holder does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Proposal 1 is considered a non-routine matter, and a broker or other nominee holder cannot vote without instructions on non-routine matters. Consequently, we expect broker non-votes with respect to Proposal 1. Proposals 2 and 3 are considered routine matters, and a broker or other nominee holder is permitted to vote on routine matters without instructions.

Voting

The election of directors requires the approval of a plurality of the votes cast at the Meeting, and broker non-votes are expected to occur with respect to Proposal 1. Abstentions and broker non-votes will have no effect on the outcome of Proposal 1. Proposal 2 requires the approval of the holders of a majority of the Common Stock issued and outstanding as of the Record Date. Abstentions and broker non-votes will have the effect of votes against Proposal 2. Proposal 3 requires the approval of a majority of votes cast at the meeting. Abstentions and broker non-votes will have no effect on the outcome of Proposal 3.

If you are the beneficial owner, but not the registered holder of our shares of Common Stock, you cannot directly vote those shares at the Meeting. You must provide voting instructions to your nominee holder, such as your brokerage firm or bank, by following the specific directions provided to you by your nominee holder.

If you wish to vote in person at the Meeting but you are not the record holder, you must obtain from your record holder a “legal proxy” issued in your name and bring it to the Meeting. At the Meeting, ballots will be distributed with respect to the proposals to each stockholder (or the stockholder’s proxy if not the management proxy holders) who is present and did not deliver a proxy to the management proxy holders or another person. The ballots shall then be tallied, one vote for each share owned of record as follows:

| |

●

|

the votes on the election of directors being either “FOR”, “WITHHOLD ALL” or “FOR ALL EXCEPT” (where stockholders may withhold such vote by writing the names of such nominee(s) in a space provided on the ballot); and

|

| |

●

|

the votes on Proposal 2 and Proposal 3 being either “FOR,” ”AGAINST” or “ABSTAIN”.

|

Proxies

The form of proxy solicited by the Board affords you the ability to specify a choice among approval of, disapproval of, or abstention with respect to, the matters to be acted upon at the Meeting. Shares represented by the proxy will be voted, and where the solicited stockholder indicates a choice with respect to the matter to be acted upon, the shares will be voted as specified. If no choice is given, a properly executed proxy will be voted in favor of the proposals.

Revocability of Proxies

Even if you execute a proxy, you retain the right to revoke it and change your vote by notifying us at any time before your proxy is voted. Such revocation may be effected by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of the Chief Executive Officer (the “CEO”) of the Company at the address of the corporate headquarters of the Company set forth above in the Notice to this Proxy Statement or your attendance and voting at the Meeting. Unless so revoked, the shares represented by the proxies, if received in time, will be voted in accordance with the directions given therein.

You are requested, regardless of the number of shares you own or your intention to attend the Meeting, to sign the proxy and return it promptly in the enclosed envelope or vote online or over the telephone according to the instructions in the proxy card.

Interests of Officers and Directors in Matters to Be Acted Upon

No person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year and no associate of any of the foregoing persons has any substantial interest, direct or indirect, in any matter to be acted upon.

Dissenters’ Rights of Appraisal

Under the Nevada Revised Statutes and the Company’s Articles of Incorporation, as amended, stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board is comprised of five (5) directors. Directors are elected annually at each annual meeting to serve until the next annual meeting or until their successors are duly elected and qualified, subject to their earlier death, resignation or removal.

The Board has recommended for election current directors Alexander Buehler, Fei Chen, Peyton Boswell, Richard Meeusen, and Martin Kunz (each, a “Nominee” and collectively, the “Nominees”). Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the Nominees. In the event that any Nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute Nominee as the Board may propose. Each of the Nominees has agreed to serve if elected, and we have no reason to believe that they will be unable to serve.

The Nominees, their ages and current positions with the Company are as follows:

|

Name

|

|

Age

|

|

Title(s)

|

|

Alexander Buehler

|

|

|

48

|

|

Chairman of the Board

|

|

Fei Chen

|

|

|

59

|

|

Director and Chief Executive Officer

|

|

Peyton Boswell

|

|

|

52

|

|

Director

|

|

Richard Meeusen

|

|

|

68

|

|

Director

|

|

Martin Kunz

|

|

|

58

|

|

Director

|

A brief biography of each Nominee is set forth below:

Alexander Buehler. Mr. Buehler has served as a Director since August 11, 2017 and as Chairman of the Board of Directors since June 23, 2023. He currently serves as the President and CEO of Integrated Water Services, a PE-backed company focused on the design-build of water and wastewater treatment systems along with the provision of MBR (membrane bioreactor) products and technologies. Beforehand, he served as the Company’s Interim CEO from March 17, 2022, to September 12, 2022, before which he served as President and CEO of the Brock Group, a leading industrial services provider to multiple industries. Prior thereto, Mr. Buehler served as the EVP of Global Resources for Intertek, the President and CEO of Energy Maintenance Services, and the CFO of Energy Recovery. Mr. Buehler also serves on the Board of Energy Recovery, and he has previously served on the Board of Viscount Systems. He received a B.S. in Civil Engineering from the United States Military Academy at West Point and an MBA in Finance from the Wharton School at the University of Pennsylvania.

Fei Chen. Ms. Chen has served as a Director and Chief Executive Officer since September 12, 2022. Ms. Chen most recently served as Senior Vice President, Global Commercials of Topsoe A/S (“Topsoe”), a world leader in catalysts and chemical processes for clean energy, with revenue of DKK 6.225 billion (approx. US$850 million) in 2021. Prior to serving as Senior Vice President of Topsoe, Ms. Chen served as its Vice President of Chemical Technology Business and Sales (2017-2020) and Vice President of Global Research and Development (2014-2017). Additionally, Ms. Chen has served as a Board Member of Liquid Wind AB (Sweden) since 2021 and a Board Member of Jiangsu JiTRI-Topsoe Clean Energy Research and Development Co. Ltd. (China) since 2018. From 2013 to 2018, Ms. Chen also served as a Board Member of Brunata International A/S (Denmark). Ms. Chen earned her Ph.D. in Polymer Materials from the Technical University of Denmark (DTU) and holds a Master of Biochemical Engineering degree and a Bachelor of Chemical Engineering from Zhejiang University in China. She also attended the IMD Business School where she received certificates in Business Financing and Advanced High-Performance Leadership. She also graduated from the Stanford Executive Program at the Stanford Graduate School of Business.

Peyton Boswell. Mr. Boswell has served as a Director since August 11, 2017 and currently serves as the Chairman of the Compensation Committee. Mr. Boswell is the Managing Director of Woodfield Renewables and previously served as the Chief Executive Officer of EnterSolar, LLC, a provider of commercial solar photovoltaic solutions that he co-founded in 2010. Prior to entering the solar industry, Mr. Boswell was a finance and investment banking professional for 15 years with J.P. Morgan and Bank of America. Mr. Boswell is a Chartered Financial Analyst (CFA) and has earned a BA from Cornell University and holds an MBA from Columbia Business School.

Richard Meeusen. Mr. Meeusen has served as a Director since August 26, 2020 and currently serves as the Chairman of the Audit Committee. Mr. Meeusen most recently served as President, Chief Executive Officer and Chairman of Badger Meter, Inc., a publicly traded international manufacturer and seller of flow measurement equipment, primarily to the water industry. Mr. Meeusen retired as Chief Executive Officer on December 31, 2018 after serving 17 years as the company’s Chief Executive Officer and, before that, 7 years as its Chief Financial Officer. Prior to Badger Meter, Mr. Meeusen was Chief Financial Officer of Zenith Sintered Products and, before that, worked for Arthur Andersen & Co as a Senior Manager. In addition to his board service at LiqTech, Mr. Meeusen previously served for 16 years as a director of Menasha Corporation, a $2 billion privately-held packaging and display equipment company and for 8 years on the board of Serigraph Corporation. Mr. Meeusen founded The Water Council in 2007, a 180-member industry trade group where he still serves as a director. Mr. Meeusen earned an MBA degree from the Kellogg School of Management at Northwestern University.

Martin Kunz. Mr. Kunz has served as a Director since June 23, 2023. Mr. Kunz currently serves as the President and CEO of Concentric AB, a publicly traded globally operating company listed on the Swedish Stock Exchange that specializes in innovative solutions in flow control and fluid power. Prior to serving as President and CEO of Concentric AB, Mr. Kunz served between 2015 and 2021 in several Senior Commercial and General Management roles at Xylem Inc., (NYSE:XYL), a global leader in water technologies, and prior to Xylem as Vice President Supply Management Valves & Controls at Pentair PLC (NYSE:PNR), a global manufacturer of water and fluid solutions, valves and controls, equipment protection and thermal management products. Mr. Kunz holds a degree in Industrial Engineering from the University of Kaiserslautern, Germany.

Director Expertise

The following is a brief description of the specific experience and qualifications, attributes or skills of each director that led to the conclusion that such person should serve as a director of the Company.

Mr. Buehler’s experience in general management and strategic planning as well as new product development, corporate development, mergers & acquisitions, operations management, manufacturing process optimization, sales management, and back-office administration provides the Board with valuable perspective across all corporate functions and relevant industries. Mr. Buehler has substantial experience in the global water, oil & gas, and manufacturing industries.

Ms. Chen’s substantial leadership experience with an emphasis on revenue growth and commercial scaling, and her particular industry knowledge of water treatment, chemical, and clean energy operations, make her a valuable member of the Board.

Mr. Boswell's experience in establishing and growing a successful renewable energy business and prior experience in investment banking provide the Board with a unique perspective on corporate finance and strategic growth matters. Further, the Board has determined that he qualifies as an Audit Committee Financial Expert.

Mr. Meeusen’s prior experience in finance, operations, marketing and sales along, his leadership experience as a director of a publicly traded company, and his long executive management responsibility in the water industry and in developing technology growth businesses distinguish him as an integral part of the Company’s Board. Further, the Board has determined that he qualifies as an Audit Committee Financial Expert.

Mr. Kunz’s experience in general management of global businesses, his functional expertise in sales, marketing, operations and supply chain management, combined with his industry expertise in water and fluid management adds valuable perspectives to the board about profitable growth and strategic market & business development.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of the Nominees has been involved in any legal proceeding that is material to the evaluation of their ability or integrity relating to any of the items set forth under Item 401(f) of Regulation S-K. None of the Nominees is a party adverse to the Company or any of its subsidiaries in any material proceeding or has a material interest adverse to the Company or any of its subsidiaries.

Family Relationships

None of the Nominees or the Company’s executive officers are related by blood, marriage or adoption.

Vote Required

The election of directors requires the approval of a plurality of the votes cast at the Meeting. Proposal 1 is a “non-discretionary” or “non-routine” item, meaning that brokerage firms cannot vote shares in their discretion on behalf of a client if the client has not given voting instructions. Accordingly, if you hold your shares in street name and fail to instruct your broker to vote your shares, your shares will not be counted as votes cast and will have no effect on the outcome of Proposal 1.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE ELECTION OF EACH OF THE NOMINEES AS DIRECTOR

PROPOSAL TWO

APPROVAL OF AMENDMENT TO OUR ARTICLES OF INCORPORATION INCREASING

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 12,500,000 TO 50,000,000

On September 13, 2023, our Board approved, and directed that there be submitted to our stockholders for approval, a proposed amendment to our Articles of Incorporation to increase the number of authorized shares of Common Stock from 12,500,000 to 50,000,000 (the “Authorized Share Increase”). The proposed Certificate of Amendment to the Articles of Incorporation (the “Certificate of Amendment”) is attached hereto as Annex A and is incorporated by reference into this proxy statement.

As of September 14, 2023, 5,727,310 shares of our Common Stock were issued and outstanding, 296,777 shares of our Common Stock were subject to unvested outstanding restricted stock unit awards, 560,097 shares of our Common Stock were subject to outstanding warrants, 3,930,008 shares of our Common Stock were subject to outstanding pre-funded warrants, and 627,613 shares of our Common Stock were reserved for future issuance under our equity compensation plans. Accordingly, 11,141,805 of the 12,500,000 authorized shares of our Common Stock are currently issued or reserved while 1,358,195 of the authorized shares of our Common Stock remain available for future issuance.

To ensure that a sufficient number of shares of Common Stock will be available for issuance by us in connection with our future business needs, the Board has approved, subject to stockholder approval, an amendment to the Articles of Incorporation, in the form set forth as Annex A, to increase the number of shares of Common Stock authorized for issuance from 12,500,000 to 50,000,000.

Effective Date

If the proposed amendment to the Articles of Incorporation to give effect to the Authorized Share Increase is approved at the Annual Meeting, subject to the conditions set out in this Proposal 2, then the Authorized Share Increase will become effective, at such time and date, if at all, as determined by the Board in its sole discretion, on the effective date of the Certificate of Amendment with the office of the Secretary of State of the State of Nevada, which we would expect to be the date of filing (the “Effective Date”).

Purposes of the Authorized Share Increase

The Board believes it would be prudent and advisable to have the additional shares available to provide increased flexibility regarding the potential use of shares of Common Stock for business and financial purposes in the future. An increased number of authorized but unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our authorized shares. The additional shares could be used for various purposes without further stockholder approval. These purposes may include: (i) raising capital, if we have an appropriate opportunity, through offerings of Common Stock or securities that are convertible into Common Stock; (ii) expanding our business through potential strategic transactions, including mergers, acquisitions, and other business combinations or acquisitions of new technologies or products; (iii) establishing strategic relationships with other companies; (iv) exchanges of Common Stock or securities that are convertible into Common Stock for other outstanding securities; (v) providing equity incentives to attract and retain employees, officers or directors; and (vi) other purposes.

Principal Effects of the Authorized Share Increase

Common Stock. If the proposed amendment is approved by our stockholders, the additional authorized shares of Common Stock would have rights identical to our currently outstanding Common Stock. The amendment to the Articles of Incorporation would increase the number of authorized shares of our Common Stock from 12,500,000 to 50,000,000.

Future issuances of shares of Common Stock or securities convertible into shares of Common Stock could have a dilutive effect on our earnings per share, book value per share and the voting interest and power of current stockholders since holders of Common Stock are not entitled to preemptive rights.

Preferred Stock. Our Articles of Incorporation also currently authorize the issuance of 2,500,000 shares of preferred stock, none of which are issued or outstanding. The proposed amendment to the Articles of Incorporation would not change the authorized number of shares of preferred stock.

Listing. Our shares of Common Stock currently trade on the Nasdaq Capital Market. Following the Authorized Share Increase, which may or may not occur in the Board’s sole discretion even if we receive stockholder approval, we intend for our Common Stock to continue to be listed on the Nasdaq Capital Market under the symbol “LIQT”.

Authorized but Unissued Shares; Potential Anti-Takeover Effects. SEC rules require disclosure of the possible anti-takeover effects of an increase in authorized capital stock and other charter and bylaw provisions that could have an anti-takeover effect. Although we have not proposed the increase in the number of authorized shares of Common Stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances, such shares could have an anti-takeover effect. The additional shares could be issued to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board or management and thereby have the effect of making it more difficult to remove directors or members of management by diluting the stock ownership or voting rights of persons seeking to effect such a removal. Accordingly, if the proposed amendment is approved, the additional shares of authorized Common Stock may render more difficult or discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of Common Stock, or the replacement or removal of members of the Board or management.

Reservation of Right to Abandon the Authorized Share Increase

We reserve the right to abandon the Authorized Share Increase without further action by our stockholders at any time before the Effective Date, even if our stockholders authorize the Authorized Share Increase at the Annual Meeting. By voting in favor of the Authorized Share Increase, you are expressly authorizing the Board to determine not to proceed with, and abandon, the Authorized Share Increase if it should so decide.

Vote Required

Approval of the Authorized Share Increase Proposal requires a number of “FOR” votes that is a majority of the shares of Common Stock issued and outstanding as of the Record Date and entitled to vote on this Proposal 2. Abstentions have the same effect as votes against Proposal 2. Proposal 2 is a “discretionary” or “routine” item, meaning that brokerage firms are permitted to vote shares in their discretion on behalf of a client even if the client has not given voting instructions; however, any broker non-votes that do occur will have the same effect as a vote against Proposal 2.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF AMENDMENT TO OUR ARTICLES OF INCORPORATION INCREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 12,500,000 TO 50,000,000.

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee of the Board has appointed Sadler, Gibb & Associates, L.L.C. (“Sadler”) as the Company’s independent registered public accountants for the fiscal year ending December 31, 2023. Although ratification of the appointment of our independent registered public accounting firm is not required by our Bylaws or otherwise, the Board is submitting the appointment of Sadler to our stockholders for ratification because we value the views of our stockholders. In the event stockholders do not ratify the appointment, the appointment will be reconsidered by the Audit Committee and the Board. Even if the selection is ratified, the Audit Committee in its discretion may select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

The Company does not expect a representative of Sadler to be present at the Meeting.

Audit Fees, Audit-Related Fees, Tax Fees & All Other Fees

Audit fees are the aggregate fees billed or expected to be billed by our independent auditors for the audit of our annual consolidated financial statements for the years ended December 31, 2022 and 2021 and for the review of our quarterly financial statements. During 2022 and 2021, audit fees were $169,000 and $164,000, respectively. Our auditors did not provide any tax compliance, planning services or audit-related services for the Company. Our auditors did not provide any other services than those described above.

Audit Committee Pre-approval

The policy of the Audit Committee is to pre-approve all audit and non-audit services provided by the independent accountants. These services may include audit services, audit-related services, tax fees, and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated pre-approval authority to certain committee members when expedition of services is necessary. The independent auditor and management are required to periodically report to the full Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval delegation and the fees for the services performed to date. The Audit Committee approved all of the services described above in advance during the fiscal year ended December 31, 2022.

We are asking our stockholders to ratify the selection of Sadler as our independent registered public accountants.

Proposal 3 shall be approved if the majority of votes cast in person or by proxy are in favor of such action. Since Proposal 3 is considered a routine matter, we do not expect broker non-votes. Abstentions will not be treated as votes cast and will have no impact on the proposal.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE RATIFICATION OF THE APPOINTMENT OF SADLER, GIBB & ASSOCIATES, L.L.C.

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

CORPORATE GOVERNANCE

Committees of our Board of Directors

Committee Composition

The Board has an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. The following table sets forth the current membership of each of these committees:

|

Audit Committee

|

|

Compensation Committee

|

|

Governance & Nominating

Committee

|

|

Richard Meeusen*

|

|

Peyton Boswell*

|

|

Alexander Buehler*

|

|

Peyton Boswell

|

|

Richard Meeusen

|

|

Richard Meeusen

|

|

Martin Kunz

|

|

Alexander Buehler

Martin Kunz

|

|

Peyton Boswell

Martin Kunz

|

| |

|

|

|

|

* Chairman of the committee

Audit Committee

Our Audit Committee consists of Richard Meeusen (Chair), Peyton Boswell and Martin Kunz, each of whom is an independent director as defined in the NASDAQ and SEC rules. Based upon past employment experience in finance and other business experience requiring accounting knowledge and financial sophistication, our Board has determined that Mr. Meeusen is an “Audit Committee Financial Expert” as defined in Item 407(d)(5) of Regulation S-K, and that each member of our Audit Committee is able to read and understand fundamental financial statements. We have implemented a written charter for our Audit Committee, available at www.liqtech.com, that provides that our Audit Committee is responsible for:

● appointing, compensating, retaining, overseeing and terminating our independent auditors and pre-approving all audit and non-audit services permitted to be performed by the independent auditors;

● discussing with management and the independent auditors our annual audited financial statements, our internal control over financial reporting, and related matters;

● reviewing and approving any related party transactions;

● meeting separately, periodically, with management, the internal auditors and the independent auditors;

● annually reviewing and reassessing the adequacy of our Audit Committee charter;

● such other matters that are specifically delegated to our Audit Committee by our Board of Directors from time to time; and

● reporting regularly to the Board of Directors.

During the fiscal year ended December 31, 2022, the Audit Committee met four times.

Compensation Committee

Our Compensation Committee consists of Peyton Boswell (Chair), Richard Meeusen, Alexander Buehler and Martin Kunz, each of whom is an independent director as defined under the NASDAQ rules, a “non-employee director” under Rule 16b-3 promulgated under the Exchange Act, and an “outside director” for purposes of Section 162(m) of the Code. We have implemented a written charter for our Compensation Committee, available at www.liqtech.com, which provides that our Compensation Committee is responsible for:

● reviewing and making recommendations to the Board regarding our compensation policies and forms of compensation provided to our directors and officers;

● reviewing and making recommendations to the Board regarding bonuses for our officers and other employees;

● reviewing and making recommendations to the Board regarding stock-based compensation for our directors and officers;

● annually reviewing and reassessing the adequacy of the Compensation Committee Charter;

● administering any stock option plans in accordance with the terms thereof; and

● such other matters that are specifically delegated to the Compensation Committee by the Board from time to time.

The Compensation Committee has the principal responsibility for the compensation plans of the Company, particularly as applied to the compensation of executive officers and directors. The Compensation Committee Charter sets forth the authority and responsibilities of the Compensation Committee for the performance evaluation and compensation of the Company’s CEO, executive officers and directors, and significant compensation arrangements, plans, policies and programs of the Company. The Compensation Committee has authority to retain such outside counsel, experts and other advisors as it determines to be necessary to carry out its responsibilities, including the authority to approve an external advisor’s fees and other retention terms on behalf of the Company. Pursuant to the Compensation Committee Charter, the Company shall provide appropriate funding to the Compensation Committee, as determined by the Compensation Committee in its capacity as a Committee of the Board, for payment of compensation to any outside advisors engaged by the Compensation Committee.

The Compensation Committee annually reviews and approves the corporate goals and objectives relevant to CEO compensation and evaluates the CEO’s performance in light of such goals and objectives. Based on this evaluation, the Compensation Committee makes and annually reviews decisions regarding: (i) salary paid to the CEO; (ii) the grant of all cash-based bonuses and equity compensation to the CEO; (iii) the entering into or amendment or extension of any employment contract or similar arrangement with the CEO; (iv) any CEO severance or change in control arrangement; and (v) any other CEO compensation matters as from time to time may be directed by the Board. In determining the long-term incentive component(s) of the CEO’s compensation, the Compensation Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at companies that the Compensation Committee determines comparable based on factors it selects and the incentive awards given to the Company’s CEO in prior years.

The Compensation Committee also meets with the CEO after the commencement of each fiscal year to discuss the compensation programs to be in effect for the Company’s executive officers for such fiscal year and to review and approve the corporate goals and objectives relevant to those programs. In light of these goals and objectives, the Compensation Committee makes and annually reviews decisions regarding: (i) salary paid to the executive officers; (ii) the grant of cash-based bonuses and equity compensation provided to the executive officers; (iii) performance targets for executive officers; (iv) the entering into or amendment or extension of any employment contract or similar arrangement with the executive officers; (v) executive officers’ severance or change in control arrangements; and (vi) any other executive officer compensation matters as from time to time may be directed by the Board. In determining the long-term incentive component(s) of the executive officer’s compensation, the Compensation Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to executive officers at companies that the Compensation Committee determines comparable based on factors it selects and the incentive awards given to the Company’s executive officers in prior years.

During the fiscal year ended December 31, 2022, the Compensation Committee met three times.

Governance and Nominating Committee

Our Governance and Nominating Committee consists of Alexander Buehler (Chair), Peyton Boswell, Richard Meeusen and Martin Kunz, each of whom is an independent director as defined under the NASDAQ rules. We have implemented corporate governance guidelines as well as a written charter for our Governance and Nominating Committee, available at www.liqtech.com, which provides that our Governance and Nominating Committee is responsible for:

●overseeing the process by which individuals may be nominated to our Board of Directors;

●identifying potential directors and making recommendations as to the size, functions and composition of our Board of Directors and its committees;

●considering nominees proposed by our stockholders;

●establishing and periodically assessing the criteria for the selection of potential directors;

●making recommendations to the Board of Directors on new candidates for Board membership; and

●overseeing corporate governance matters.

In making nominations, the Governance and Nominating Committee intends to submit candidates who have high personal and professional integrity, who have demonstrated exceptional ability and judgment and who are effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the stockholders. In evaluating nominees, the Governance and Nominating Committee intends to take into consideration attributes such as leadership, independence, interpersonal skills, financial acumen, business experiences and industry knowledge.

One of the primary responsibilities of the Governance and Nominating Committee is to make appropriate recommendations to the Board for the appointment or re-appointment of directors. The Company seeks to have directors who, in addition to relevant technical, commercial and securities expertise, meet the highest standards of personal integrity, judgment and critical thinking, and demonstrate an ability to work in an open environment with other directors to further the interests of the Company and its stockholders. In recommending appointments to the Board, the Governance and Nominating Committee is mindful of the overall balance of the skills, knowledge and experience of Board members against the current and future requirements of the Company and of the benefits of diversity. The Company recognizes the importance of diversity at all levels of the Company as well as on the Board and considers overall Board balance and diversity when appointing new directors. Board appointments are, in the final analysis, based on merit.

The Company employs multiple strategies in identifying director nominees, including the obtaining of recommendations from security holders, from current directors, and from the Company’s corporate advisors. The Company also utilizes professional recruitment firms, as may be required, in seeking qualified director nominees. The qualifications of director nominees are evaluated by the Governance and Nominating Committee to determine if the director nominees have the requisite technical and commercial expertise to maintain a proper balance of skills required by the Board. There are no differences in the evaluation of director nominees recommended by security holders. Director nominees are interviewed in depth by the Governance and Nominating Committee and the Board to further qualify the director nominees and evaluate the personal integrity and character of the candidate.

During the fiscal year ended December 31, 2022, the Governance and Nominating Committee met one time.

Director Independence

The Board has determined that on the date of the Meeting, Messrs. Buehler, Boswell, Meeusen and Kunz are independent as that term is defined in the listing standards of The Nasdaq Capital Market. Pursuant to the Nasdaq Rules, Mr. Buehler was not independent while serving as the Interim Chief Executive Officer, but such service on an interim basis did not disqualify him from being considered independent following such service, as the interim service did not last longer than one year. In addition, the compensation Mr. Buehler received for his CEO transition services after the termination of his service as Interim Chief Executive Officer was less than $120,000. In making its determinations, our Board has concluded that none of our independent directors has an employment, business, family or other relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. We expect that our independent directors will meet in executive session (without the participation of executive officers or other non-independent directors) at least two times each year, and Mr. Buehler presides over such meetings of independent directors.

Board Leadership Structure and Risk Oversight

The Board does not have a policy as to whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. Each year, the Governance and Nominating Committee assesses these roles and the board leadership structure to ensure the interests of the Company and its stockholders are best served. Currently, the independent non-executive Chairman position is held by Alexander Buehler, and the Chief Executive Officer is Fei Chen.

The Committees of the Board, each comprised entirely of independent directors, play an active role in risk management and oversight for the Company. The Audit Committee assists the Board with respect to risk assessment and risk management related to financial reporting and other matters that could affect the Company’s financial statements. The Governance and Nominating Committee is charged with assisting the Board in corporate governance matters, conflicts of interest, the Company’s Code of Conduct and Ethics and other risk mitigation activities. The Compensation Committee is charged with assisting the Board in reviewing the Company’s overall compensation policies and practices for all employees as they relate to the Company’s risk.

Board Meetings

The Board held nineteen meetings during the fiscal year ended December 31, 2022. Each incumbent director attended greater than seventy-five percent (75%) of the aggregate of the total number of meetings of the Board (held during the period for which each director has been a director) and the total number of meetings held by all committees of the Board on which each director served (during the period for which each director has been a director).

The Board encourages all of its members to attend its Board meetings.

Board Diversity Matrix

|

Total Number of Directors: 5

|

| |

Female

|

Male

|

Non-Binary

|

Did Not Disclose

Gender

|

|

Directors’ Gender:

|

1

|

4

|

-

|

-

|

|

Number of Directors who identify in any of the categories below:

|

| |

|

|

|

|

|

African American or Black

|

-

|

-

|

-

|

-

|

|

Alaskan Native

|

-

|

-

|

-

|

-

|

|

Asian

|

1

|

-

|

-

|

-

|

|

Hispanic

|

-

|

-

|

-

|

-

|

|

Native Hawaiian or Pacific Islander

|

-

|

-

|

-

|

-

|

|

White

|

-

|

3

|

-

|

-

|

|

Two or More Races or Ethnicities

|

-

|

1

|

-

|

-

|

|

LGBTQ+

|

-

|

|

-

|

-

|

|

Did Not Disclose

Demographic Background

|

|

|

|

|

Code of Ethics

Effective January 1, 2012, the Board adopted a Code of Conduct and Ethics with the purpose of assuring that all employees and officers of the Company and its subsidiaries understand and adhere to high ethical standards of conduct. The Code of Conduct and Ethics emphasizes employees’ obligations of civil responsibility, loyalty to the Company, compliance with applicable laws, non-disclosure of trade secrets, and abstinence from improper political payments and activity. A copy of the Code of Conduct and Ethics is available on the Company website at https://liqtech.com/media/afijs2es/code_of_conduct_and_ethics.pdf.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires a company’s officers and directors, and persons who own more than ten percent (10%) of a registered class of a company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors, and greater than ten percent (10%) stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us, we believe that all filing requirements applicable to our directors, executive officers, and persons who own more than 10% of our common stock were complied with during 2022, except for the following filings:

| |

1.

|

Larry Lytton, a greater than 10% stockholder, filed a late Form 4 on January 25, 2022.

|

| |

2.

|

Fei Chen filed a late Form 4 on September 15, 2022 for a RSU grant made on September 12, 2022.

|

EXECUTIVE OFFICERS

General

Certain information concerning our executive officers as of the date of this Proxy Statement is set forth below. Each officer of the Company shall be elected by the Board, may be classified by the Board as an executive officer or a non-executive officer (or as a non-officer) at any time, and shall serve at the pleasure of the Board. None of our executive officers or directors are related by blood, marriage or adoption.

|

Name

|

|

Age

|

|

Titles

|

|

Fei Chen

|

|

59

|

|

Director, Chief Executive Officer (Principal Executive Officer)

|

|

Simon Stadil

|

|

40

|

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

A brief biography of the executive officer who is not also a Nominee is set forth below:

Simon Stadil. Mr. Stadil has served as Chief Financial Officer of LiqTech International, Inc. since November 15, 2021. Prior to such time, he served as Director of Treasury & Investor Relations (2013-2016), Regional CFO Americas and Africa (2017-2019), and Vice President of Global Finance (2019-2021) of Welltec, an international provider of robotic well solutions for the oil and gas industry with approximately $250 million in annual revenue. Additionally, Mr. Stadil served as Assistant Funding Manager within the Danish renewable & utility company of Ørsted from 2008 to 2009, as well as Assistant Vice President within the Nordic Investment Banking Division at Barclays Capital in London from 2010 to 2012. Mr. Stadil holds a Bsc. in Business Administration and a Msc. in Economics and Finance (Cand.Merc.Fir) from Copenhagen Business School. Mr. Stadil’s substantial experience within corporate finance, risk management, and capital markets, his in-depth management experience from a variety of advisory positions, and his experience with vertically integrated technology-driven companies within the global oil & energy sector made him an attractive candidate for the position of Chief Financial Officer of the Company.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

The following table sets forth certain information with respect to compensation for the years ended December 31, 2022 and 2021 earned by or paid to our Chief Executive Officers and our Chief Financial Officer.

Summary Compensation Table

|

Name and Principal

Position

|

Year

|

|

Salary

($)

(1)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

Option

Awards

($)

|

|

Nonequity

Incentive Plan

Compensation

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

Other

($)

(5)

|

|

|

Total

|

|

|

Fei Chen, President &

Chief Executive Officer (2)

|

2022

|

|

$ |

386,105 |

|

|

|

|

|

|

$ |

350,000 |

|

|

|

|

|

|

|

$ |

35,857 |

|

|

$ |

771,962 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alexander Buehler,

Interim Chief Executive Officer (3)

|

2022

|

|

$ |

224,790 |

|

|

|

|

|

|

$ |

549,164 |

|

|

|

|

|

|

|

|

|

|

|

$ |

792,454 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sune Mathiesen, Chief Executive Officer (4)

|

2022

|

|

$ |

370,758 |

|

|

|

|

|

|

$ |

41,600 |

|

|

|

|

|

|

|

$ |

12,908 |

|

|

$ |

425,266 |

|

| |

2021

|

|

$ |

365,787 |

|

|

$ |

100,000 |

|

|

$ |

397,587 |

|

|

|

|

|

|

|

$ |

36,655 |

|

|

$ |

900,029 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simon Stadil, Chief Financial Officer (6)

|

2022

|

|

$ |

271,363 |

|

|

$ |

100,000 |

|

|

$ |

375,000 |

|

|

|

|

|

|

|

$ |

24,383 |

|

|

$ |

770,746 |

|

| |

2021

|

|

$ |

259,099 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

25,909 |

|

|

$ |

285,008 |

|

|

(1)

|

Total salaries for Messrs. Mathiesen and Stadil for 2021 are reported on an as-converted basis from Danish Krone (DKK) to U.S. dollars ($) based on the currency exchange rate of $1.00 = DKK 6.5612, as of December 31, 2021. Total salaries for Ms. Chen and Messrs. Mathiesen and Stadil for 2022 are reported on an as-converted basis from Danish Krone (DKK) to U.S. dollars ($) based on the currency exchange rate of $1.00 = DKK 6.9722, as of December 31, 2022. We do not make any representation that the Danish Krone amounts could have been, or could be, converted into U.S. dollars at such rate on December 31, 2021 or December 31, 2022, or at any other rate.

|

|

(2)

|

Ms. Chen became our President & Chief Executive Officer in September 2022. Pursuant to her employment agreement, Ms. Chen is entitled to an annual base salary of approximately $358,567 based on the currency exchange rate of $1.00 = DKK 6.9722, as of December 31, 2022.

|

|

(3)

|

Mr. Buehler became our Interim Chief Executive Officer in March 2022. Pursuant to the interim agreement, Mr. Buehler was entitled to an annual base salary of approximately $415,000. However, the agreement was terminated in September 2022 due to the appointment of Ms. Chen as President & Chief Executive Officer. Mr. Buehler also received $18,500 during 2022 for his services on the Board of Directors.

|

|

(4)

|

Mr. Mathiesen became our Chief Executive Officer in August 2014. Pursuant to his employment agreement, Mr. Mathiesen was entitled to an annual base salary of approximately $387,252 based on the currency exchange rate of $1.00 = DKK 6.9722, as of December 31, 2022. Total income for the year ended December 31, 2022 also reflects terms agreed in the separation and release agreement.

|

|

(5)

|

Pursuant to Ms. Chen’s employment agreement, Ms. Chen received $35,857 of contribution from the Company to her individual retirement account in 2022. Pursuant to Mathiesen’s employment agreement, Mr. Mathiesen received $12,908 and $36,655 of contributions from the Company to his individual retirement account in 2022 and 2021, respectively. Pursuant to Mr. Stadil’s employment agreement, Mr. Stadil received $24,383 and $25,909 of contributions from the Company to his retirement account in 2022 and 2021, respectively.

|

|

(6)

|

Mr. Stadil became our Chief Financial Officer in November 2021. Pursuant to his employment agreement, Mr. Stadil is entitled to an annual base salary of approximately $243,825 based on the currency exchange rate of $1.00 = DKK 6.9722, as of December 31, 2022.

|

Employment Arrangements

During the year ended December 31, 2022, we had employment agreements with Ms. Chen and Messrs. Buehler, Mathiesen and Stadil. A description of each agreement is set forth below.

Chen Agreement

Effective September 12, 2022, the Company’s Board of Directors appointed Ms. Fei Chen to serve as President and Chief Executive Officer of the Company and as a Director of the Company pursuant to an Executive Services Agreement, dated July 26, 2022, by and between Ms. Chen and LiqTech Holding (the “Chen Agreement”). The Chen Agreement provided, as of December 31, 2022, for an annual base salary of DKK 2,500,000 (or approximately $358,567 based on the currency exchange rate of $1 = DKK 6.9722 as of December 31, 2022), a taxable car allowance of DKK 192,000 (or approximately $27,538 based on the currency exchange rate of $1 = DKK 6.9722 as of December 31, 2022), and an annual cash bonus of up to 150% of her annual salary if certain performance targets are met, as determined annually by the Company’s Compensation Committee. During 2022, Ms. Chen was eligible for a performance bonus of DKK 48,077 (approx. $6,600) for each week of employment. Ms. Chen is entitled to an annual grant of up to 100% of the base salary payable in restricted stock units vesting over a 3-year period. The Chen Agreement also provides that Ms. Chen received on her employment start date a grant of restricted stock equal to $350,000, which shall vest in three equal annual installments over the next three years so long as Ms. Chen remains employed by the Company. Ms. Chen is entitled to six weeks of vacation, home internet service, a Company mobile phone, a Company laptop and reimbursement of Company-related travel expenses. The Company may terminate the Chen Agreement upon not less than twelve months’ prior notice, and Ms. Chen may terminate the Chen Agreement with six months’ prior notice.

Buehler Agreement

On March 18, 2022, Mr. Alexander Buehler was appointed Interim Chief Executive Officer of the Company. Pursuant to the terms of the interim agreement, in consideration for his services, Mr. Buehler received an annual base salary of $415,000, earned and paid pro-rata for the number of weeks served as Interim Chief Executive Officer. Mr. Buehler was entitled to an annual share grant of $933,750, earned pro-rata for the number of weeks served as Interim Chief Executive Officer, which vested on January 1, 2023. Furthermore, Mr. Buehler received a share grant of $47,753 for transition services provided after his tenure as interim Chief Executive Officer, which vested on January 1, 2023. Mr. Buehler was also entitled to reimbursement of Company-related travel expenses.

Mathiesen Agreement

Effective July 30, 2014, the Company’s Board of Directors appointed Mr. Sune Mathiesen to serve as Chief Executive Officer of the Company and as a Director of the Company pursuant to a Director Contract, dated July 15, 2014 (updated on October 15, 2018), by and between Mr. Mathiesen and LiqTech Holding (the “Mathiesen Director Agreement”). The Mathiesen Director Agreement provided, as of December 31, 2021, for an annual base salary of DKK 2,400,000 (or approximately $344,224 based on the currency exchange rate of $1 = DKK 6.9722 as of December 31, 2022) and an annual cash bonus of 100% to 150% of the Director’s annual salary if certain performance targets are met, as determined annually by the Company’s Compensation Committee. Mr. Mathiesen was entitled to five weeks of vacation, home internet service, a Company car or equivalent taxable allowance, a Company mobile phone, a Company laptop and reimbursement of Company-related travel expenses. The Company could terminate the Mathiesen Director Agreement upon not less than twelve months’ prior notice, and Mr. Mathiesen could terminate the Mathiesen Director Agreement with twelve months’ prior notice. Mr. Mathiesen began a leave of absence on March 17, 2022, and on May 12, 2022, resigned from the role of Chief Executive Officer. Effective from May 12, 2022, the Company and Mr. Mathiesen entered a separation agreement and release that terminated the Director Agreement.

Stadil Agreement

On November 23, 2021, Mr. Simon Stadil was appointed to serve as Chief Financial Officer of the Company. Pursuant to the terms of his executive services contract (the “Stadil Executive Agreement”), in consideration for his services, Mr. Stadil was provided a base salary of DKK 1,700,000 (or approximately $243,825 based on the currency exchange rate of $1 = DKK 6.9722 as of December 31, 2022), a taxable car allowance of DKK 192,000 (or approximately $27,538 based on the currency exchange rate of $1 = DKK 6.9722 as of December 31, 2022), and a discretionary annual performance bonus of up to 75% of base salary if certain performance targets are met. Mr. Stadil is entitled to an annual grant of up to 50% of the base salary payable in restricted stock units vesting over a 3-year period. Mr. Stadil is entitled to six weeks of vacation, home internet service, a Company car, a mobile phone, laptop and reimbursement of travel expenses. The Company may terminate the Stadil Executive Agreement upon not less than five months’ prior notice, and Mr. Stadil may terminate the Stadil Executive Agreement with three months’ prior notice.

Outstanding Equity Awards at Last Fiscal Year End

The following table sets forth all outstanding equity awards held by our named executive officers as of December 31, 2022.

| |

|

Option Awards

|

|

|

|

|

|

|

|

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Exercisable

(#)

|

|

|

Number of

Securities

Underlying

Unexercised

Unexercisable

(#)

|

|

|

Equity

Incentive

Plan

Awards:

No. of

Securities

Underlying

Unexercised

Unearned

Options

|

|

|

Option

Exercise

Price

|

|

|

Option

Expiration

Date

|

|

Number

of Shares

or Units

of Stock

That

Have

Not

Vested

|

|

|

Market

Value of

Shares

or Units

of Stock

That

Have Not

Vested

|

|

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units, or

Other

Rights

That

Have Not

Vested

|

|

|

Equity

Incentive

Plan

Awards:

Market

or

Payout

Value of

Unearned

Shares,

Units, or

Other

Rights

That

Have

Not

Vested

|

|

|

Fei Chen, CEO

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

- |

|

|

|

- |

|

|

|

|

78,125 |

|

|

$ |

350,000 |

|

|

|

- |

|

|

|

- |

|

|

Alexander Buehler, Interim CEO

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

- |

|

|

|

- |

|

|

|

|

127,694 |

|

|

$ |

549,164 |

|

|

|

- |

|

|

|

- |

|

|

Simon Stadil, CFO

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

$ |

- |

|

|

|

- |

|

|

|

|

91,912 |

|

|

$ |

375,000 |

|

|

|

- |

|

|

|

- |

|

Compensation of Directors

For 2022, the Chairman of the Board was entitled to an annual fee of $63,000, each non-executive director was entitled to $31,500 for services on the Board of Directors, the Audit Committee Chairman was paid an additional annual fee of $11,000 per year, and the Compensation Committee Chairman was paid an additional annual fee of $6,500. The Chairman of the Board also receives an automatic annual stock grant in the amount of $73,500 in January each year, vesting over one year. Each qualifying non-executive director receives an automatic annual stock grant in January each year in the amount of $36,750, vesting over one year. The Company has not entered into any agreements with the Directors of any special compensation in relation to retirement, resignation, change of control or other events that might lead to the Director leaving the Board of LiqTech International, Inc.

The following table provides information regarding compensation that was earned or paid to the individuals who served as non-employee directors during the year ended December 31, 2022.

|

Name

|

|

Fees

earned

or

paid in

cash

(1)($)

|

|

|

Stock

Awards

(2)($)

|

|

|

Option

awards

(2)

|

|

|

Non-equity

incentive

plan

compensation

|

|

|

Non-

qualified

deferred

compensation

earnings

|

|

|

All other

compensation

|

|

|

Total($)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Vernon

|

|

|

63,000 |

|

|

|

73,500 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

136,500 |

|

|

Peyton Boswell

|

|

|

31,500 |

|

|

|

36,750 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

68,250 |

|

|

Richard Meeusen

|

|

|

46,248 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

46,248 |

|

|

(1)

|

Our independent directors are entitled to cash compensation of $31,500 per year, the Chairman of our Board is entitled to an additional $31,500 per year, the Chairman of our Audit Committee is entitled to an additional $11,000 per year and the Chairman of our Compensation Committee is entitled to an additional $6,500 per year.

|

| |

|

|

(2)

|

These amounts represent the aggregate grant date fair value for stock awards granted in 2022, computed in accordance with FASB ASC Topic 718. As such, these amounts do not correspond to the compensation actually realized by each director for the period.

|

Our Bylaws, which were adopted effective January 1, 2012, state that the Board may pay to directors a fixed sum for attendance at each meeting of the Board or of a standing or special committee, a stated retainer for services as a director, a stated fee for serving as a chair of a standing or special committee and such other compensation, including benefits, as the Board or any standing committee thereof shall determine from time to time. Additionally, the Directors may be paid their expenses of attendance at each meeting of the Board or of a standing or special committee.

2022 PAY VERSUS PERFORMANCE TABLE AND SUPPORTING NARRATIVE

The following table and supporting narrative contain information regarding “compensation actually paid” to our named executive officers and the relationship to company performance.

Pay Versus Performance Table

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of $100 fixed investment |

|

|

|

|

|

Year

|

|

Summary Compensation Table Total for PEO ($) (1)

|

|

|

Compensation Actually Paid to PEO ($) (1)

|

|

|

Summary Compensation table Total for PEO ($) (2)

|

|

|

Compensation Actually Paid to PEO ($) (2)

|

|

|

Summary Compensation Table Total for PEO ($) (3)

|

|

|

Compensation Actually Paid to PEO ($) (3)

|

|

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($) (4)

|

|

|

Average Compensation Actually Paid to Non-PEO Named Executive Officers ($) (4)

|

|

|

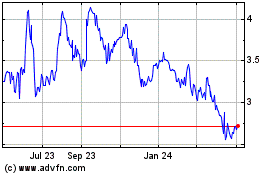

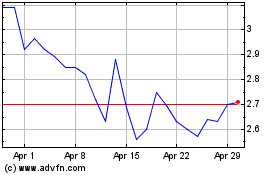

Total Shareholder Return ($)

|

|

|

Net Income

|

|

|

2022

|

|

$ |

425,266 |

|

|

$ |

(2,671,605 |

) |

|

$ |

773,954 |

|

|

$ |

3,333,456 |

|

|

$ |

771,962 |

|

|

$ |

2,321,962 |

|

|

$ |

770,746 |

|

|

$ |

2,631,040 |

|

|

$ |

6 |

|

|

$ |

-8 |

|

|

2021

|

|

$ |

900,029 |

|

|

$ |

2,019,186 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

$ |

282,228 |

|

|

$ |

227,348 |

|

|

$ |

98 |

|

|

$ |

-11 |

|

| |

(1)

|

Reflects compensation for our former Chief Executive Officer, Sune Mathiesen, who served as our Principal Executive Officer (PEO) in 2021 and part of 2022.

|

| |

(2)

|

Reflects compensation for our Chief Executive Officer, Alexander Buehler, who served as our Principal Executive Officer (PEO) for part of 2022.

|

| |

(3)

|

Reflects compensation for our Chief Executive Officer, Fei Chen, who served as our Principal Executive Officer (PEO) for part of 2022.

|

| |

(4)

|

Reflects compensation for Simon Stadil and Claus Toftegaard in 2021 and Simon Stadil in 2022, as shown in the Summary Compensation Table for each respective year.

|

To calculate “compensation actually paid” for our PEO and other NEOs the following adjustments were made to Summary Compensation Table total pay.

|

|

|

PEO - Mathiesen

|

|

|

PEO - Buehler

|

|

|

PEO - Chen

|

|

|

Other NEO Average

|

|

| Adjustments |

|

2022

|

|

|

2021

|

|

|

2022

|

|

|

2021

|

|

|

2022

|

|

|

2021

|

|

|

2022

|

|

|

2021

|

|

|

Summary Compensation Table Total

|

|

$ |

425,266 |

|

|

$ |

900,029 |

|

|

$ |

773,954 |

|

|

|

-- |

|

|

$ |

771,962 |

|

|

|

-- |

|

|

$ |

770,746 |

|

|

$ |

282,228 |

|

|

Deduction for amount reported in “Stock Awards” column of the Summary Compensation Table

|

|

$ |

(41,600 |

) |

|

$ |

(397,587 |

) |

|

$ |

(549,164 |

) |

|

|

-- |

|

|

$ |

(350,000 |

) |

|

|

-- |

|

|

$ |

(375,000 |

) |

|

$ |

0 |

|

|

Addition of fair value at fiscal year (FY) end, of equity awards granted during the FY that remained outstanding

|

|

$ |

243,200 |

|

|

$ |

2,422,580 |

|

|

$ |

3,105,497 |

|

|

|

-- |

|

|

$ |

1,900,000 |

|

|

|

-- |

|

|

$ |

2,235,294 |

|

|

$ |

0 |

|

|

Addition of change in fair value at FY end versus prior FY end for awards granted in prior FY that remained outstanding

|

|

$ |

(1,507,760 |

) |

|

$ |

(391,899 |

) |

|

$ |

0 |

|

|

|

-- |

|

|

$ |

0 |

|

|

|

-- |

|

|

$ |

0 |

|

|

$ |

(167,954 |

) |

|

Addition of change in fair value at vesting date versus prior FY end for awards granted in prior FY that vested during the FY

|

|

$ |

0 |

|

|

$ |

(513,937 |

) |

|

$ |

3,169 |

|

|

|

-- |

|

|

$ |

0 |

|

|

|

-- |

|

|

$ |

0 |

|

|

$ |

113,074 |

|

|

Reduction of fair value of awards granted during prior FY that were forfeited during applicable FY, determined as of prior FY end (1)

|

|

$ |

(1,790,711 |

) |

|

$ |

0 |

|

|

$ |

0 |

|

|

|

-- |

|

|

$ |

0 |

|

|

|

-- |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

Compensation Actually Paid

|

|

$ |

(2,671,605 |

) |

|

$ |

2,019,186 |

|

|

$ |

3,333,456 |

|

|

|

-- |

|

|

$ |

2,321,962 |

|

|

|

-- |

|

|

$ |

2,631,040 |

|

|

$ |

227,348 |

|

| |

(1)

|