Kimball Electronics, Inc. Reports Third Quarter Fiscal Year 2021 Results

May 05 2021 - 4:05PM

Kimball Electronics, Inc. (Nasdaq: KE) today announced financial

results for the third quarter ended March 31, 2021.

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| (Amounts in Thousands, except

EPS) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Net Sales |

$ |

310,329 |

|

|

$ |

293,925 |

|

|

$ |

962,682 |

|

|

$ |

914,394 |

|

| Operating Income |

$ |

14,638 |

|

|

$ |

10,588 |

|

|

$ |

48,624 |

|

|

$ |

30,387 |

|

| Adjusted Operating Income

(non-GAAP) (1)(2) |

$ |

14,426 |

|

|

$ |

9,674 |

|

|

$ |

49,432 |

|

|

$ |

29,953 |

|

| Operating Income % |

4.7 |

% |

|

3.6 |

% |

|

5.1 |

% |

|

3.3 |

% |

| Adjusted Operating Income

(non-GAAP) % |

4.6 |

% |

|

3.3 |

% |

|

5.1 |

% |

|

3.3 |

% |

| Net Income |

$ |

10,472 |

|

|

$ |

6,259 |

|

|

$ |

42,345 |

|

|

$ |

19,469 |

|

| Adjusted Net Income (non-GAAP)

(1) |

$ |

9,933 |

|

|

$ |

6,259 |

|

|

$ |

41,680 |

|

|

$ |

19,469 |

|

| Diluted EPS |

$ |

0.41 |

|

|

$ |

0.25 |

|

|

$ |

1.67 |

|

|

$ |

0.76 |

|

| Adjusted Diluted EPS

(non-GAAP) (1) |

$ |

0.39 |

|

|

$ |

0.25 |

|

|

$ |

1.65 |

|

|

$ |

0.76 |

|

(1) A reconciliation of GAAP and non-GAAP financial

measures is included below.

(2) Beginning in the first quarter of fiscal year 2021,

adjusted operating income excludes changes in the fair value of our

supplemental employee retirement plan, or SERP, liability which are

exactly offset by the revaluation to fair value of the SERP

investments in Other Income (Expense), net, and as a result have no

impact on net income. Prior reported periods have been

revised accordingly.

Donald D. Charron, Chairman and Chief Executive Officer, stated,

“We are very pleased with our operating results for the third

quarter of fiscal year 2021. Our team remains resilient as we

work through the ongoing challenges caused by the pandemic and the

global semiconductor shortage. Despite the adversity, we

again delivered solid operating income exceeding our goal of 4.5%,

and we continued to deliver excellent cash flow from operations,

which on a year-to-date basis has more than doubled from the prior

year.”

Mr. Charron continued, “Due to the global semiconductor

shortage, a significant amount of our shippable backlog shifted out

of Q3 and Q4 of fiscal year 2021 to the first half of fiscal year

2022. Many industry experts are forecasting the global

semiconductor shortage will remain with us for most of this

calendar year. However, when considering the semiconductor

delivery commitments that we currently have from our suppliers, we

are still expecting a very strong fourth quarter of fiscal year

2021 both sequentially and year-over-year.”

Third Quarter Fiscal Year 2021 Overview:

- Consolidated net sales increased 6% compared to the third

quarter of fiscal year 2020. Foreign currency had a favorable

3% impact on net sales in the current quarter compared to the same

period a year ago.

- Operating activities provided cash of $31.5 million during the

quarter, which compares to cash provided by operating activities of

$12.0 million in the third quarter of fiscal year 2020.

- Cash conversion days (“CCD”) for the quarter ended

March 31, 2021 were 66 days, down from 75 days in the second

quarter of fiscal year 2021 and 81 days in the quarter ended March

31, 2020. CCD is calculated as the sum of days sales

outstanding plus contract asset days plus production days supply on

hand less accounts payable days.

- Investments in capital expenditures were $8.7 million during

the quarter.

- Cash and cash equivalents were $89.7 million and borrowings

outstanding on credit facilities were $60.5 million at March 31,

2021, including $40.0 million classified as long term.

Net Sales by Vertical Market:

| |

Three Months Ended |

|

|

| |

March 31, |

|

|

| (Amounts in Millions) |

2021 |

|

2020 |

|

PercentChange |

|

Automotive |

$ |

139.6 |

|

$ |

124.4 |

|

12% |

| Medical |

85.4 |

|

87.1 |

|

(2)% |

| Industrial |

69.2 |

|

65.6 |

|

5% |

| Public Safety |

13.5 |

|

12.5 |

|

9% |

| Other |

2.6 |

|

4.3 |

|

(41)% |

|

Total Net Sales |

$ |

310.3 |

|

$ |

293.9 |

|

6% |

Forward-Looking StatementsCertain statements

contained within this release are considered forward-looking under

the Private Securities Litigation Reform Act of 1995. The

statements may be identified by the use of words such as “expect,”

“should,” “goal,” “predict,” “will,” “future,” “optimistic,”

“confident,” and “believe.” These forward-looking statements

are subject to risks and uncertainties including, without

limitation, global economic conditions, geopolitical environment,

global health emergencies including the COVID-19 pandemic,

availability or cost of raw materials and components, foreign

exchange rate fluctuations, and our ability to convert new business

opportunities into customers and revenue. Additional

cautionary statements regarding other risk factors that could have

an effect on the future performance of the Company are contained in

its Annual Report on Form 10-K for the year ended June 30,

2020.

Non-GAAP Financial Measures This press release

contains non-GAAP financial measures. The non-GAAP financial

measures contained herein include adjusted operating income,

adjusted net income, and adjusted diluted EPS.

Reconciliations of the reported GAAP numbers to these non-GAAP

financial measures are included in the Reconciliation of Non-GAAP

Financial Measures section below. Management believes these

measures are useful and allow investors to meaningfully trend,

analyze, and benchmark the performance of the Company’s core

operations. The Company’s non-GAAP financial measures are not

necessarily comparable to non-GAAP information used by other

companies.

| Conference

Call / Webcast |

|

|

|

| Date: |

May 6, 2021 |

| Time: |

10:00 AM Eastern Time |

| Live Webcast: |

investors.kimballelectronics.com/events-presentations |

| Dial-In #: |

800-992-4934 (International

Calls - 937-502-2251) |

| Conference ID: |

5958058 |

For those unable to participate in the live webcast, the call

will be archived at investors.kimballelectronics.com.

About Kimball Electronics, Inc.Kimball

Electronics is a multifaceted manufacturing solutions provider of

electronics and diversified contract manufacturing services to

customers around the world. From our operations in the United

States, China, India, Japan, Mexico, Poland, Romania, Thailand, and

Vietnam, our teams are proud to provide manufacturing services for

a variety of industries. Recognized for a reputation of

excellence, we are committed to a high-performance culture that

values personal and organizational commitment to quality,

reliability, value, speed, and ethical behavior. Kimball

Electronics, Inc. (Nasdaq: KE) is headquartered in Jasper,

Indiana.

To learn more about Kimball Electronics, visit:

www.kimballelectronics.com.

Lasting relationships. Global

success.

Financial highlights for the third quarter and year-to-date

period ended March 31, 2021 are as follows:

| Condensed

Consolidated Statements of Income |

| (Unaudited) |

Three Months Ended |

| (Amounts in Thousands, except

Per Share Data) |

March 31, 2021 |

|

March 31, 2020 |

|

Net Sales |

$ |

310,329 |

|

100.0% |

|

$ |

293,925 |

|

100.0% |

| Cost of Sales |

284,323 |

|

91.6% |

|

273,713 |

|

93.1% |

| Gross Profit |

26,006 |

|

8.4% |

|

20,212 |

|

6.9% |

| Selling and Administrative

Expenses |

11,744 |

|

3.8% |

|

9,624 |

|

3.3% |

| Other General Income |

(376) |

|

(0.1)% |

|

— |

|

—% |

| Operating Income |

14,638 |

|

4.7% |

|

10,588 |

|

3.6% |

| Other Income (Expense),

net |

(641) |

|

(0.2)% |

|

(1,893) |

|

(0.6)% |

| Income Before Taxes on

Income |

13,997 |

|

4.5% |

|

8,695 |

|

3.0% |

| Provision for Income

Taxes |

3,525 |

|

1.1% |

|

2,436 |

|

0.9% |

| Net Income |

$ |

10,472 |

|

3.4% |

|

$ |

6,259 |

|

2.1% |

| |

|

|

|

|

|

|

|

| Earnings Per Share of Common

Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.42 |

|

|

|

$ |

0.25 |

|

|

|

Diluted |

$ |

0.41 |

|

|

|

$ |

0.25 |

|

|

| |

|

|

|

|

|

|

|

| Average Number of Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,049 |

|

|

|

25,181 |

|

|

|

Diluted |

25,217 |

|

|

|

25,287 |

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

Nine Months Ended |

|

(Amounts in Thousands, except Per Share Data) |

March 31, 2021 |

|

March 31, 2020 |

|

Net Sales |

$ |

962,682 |

|

100.0% |

|

$ |

914,394 |

|

100.0% |

|

Cost of Sales |

876,428 |

|

91.0% |

|

851,478 |

|

93.1% |

|

Gross Profit |

86,254 |

|

9.0% |

|

62,916 |

|

6.9% |

|

Selling and Administrative Expenses |

38,347 |

|

4.0% |

|

32,529 |

|

3.6% |

|

Other General Income |

(717) |

|

(0.1)% |

|

— |

|

—% |

|

Operating Income |

48,624 |

|

5.1% |

|

30,387 |

|

3.3% |

|

Other Income (Expense), net |

3,905 |

|

0.4% |

|

(4,152) |

|

(0.4)% |

|

Income Before Taxes on Income |

52,529 |

|

5.5% |

|

26,235 |

|

2.9% |

|

Provision for Income Taxes |

10,184 |

|

1.1% |

|

6,766 |

|

0.8% |

|

Net Income |

$ |

42,345 |

|

4.4% |

|

$ |

19,469 |

|

2.1% |

|

|

|

|

|

|

|

|

|

|

Earnings Per Share of Common Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.68 |

|

|

|

$ |

0.77 |

|

|

|

Diluted |

$ |

1.67 |

|

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

|

|

|

|

Average Number of Shares Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,101 |

|

|

|

25,308 |

|

|

|

Diluted |

25,288 |

|

|

|

25,466 |

|

|

| Condensed Consolidated

Statements of Cash Flows |

Nine Months Ended |

| (Unaudited) |

March 31, |

| (Amounts in Thousands) |

2021 |

|

2020 |

|

Net Cash Flow provided by Operating Activities |

$ |

103,755 |

|

$ |

51,318 |

| Net Cash Flow used for

Investing Activities |

(22,972) |

|

(27,602) |

| Net Cash Flow used for

Financing Activities |

(58,729) |

|

(13,489) |

| Effect of Exchange Rate Change

on Cash and Cash Equivalents |

2,607 |

|

(1,191) |

| Net Increase in Cash and Cash

Equivalents |

24,661 |

|

9,036 |

| Cash and Cash Equivalents at

Beginning of Period |

64,990 |

|

49,276 |

| Cash and Cash Equivalents at

End of Period |

$ |

89,651 |

|

$ |

58,312 |

| |

(Unaudited) |

|

|

| Condensed Consolidated

Balance Sheets |

March 31, 2021 |

|

June 30, 2020 |

| (Amounts in Thousands) |

| ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

89,651 |

|

|

$ |

64,990 |

|

|

Receivables, net |

197,769 |

|

|

180,133 |

|

| Contract

assets |

53,171 |

|

|

70,350 |

|

|

Inventories |

181,131 |

|

|

219,043 |

|

| Prepaid

expenses and other current assets |

31,959 |

|

|

23,891 |

|

| Property

and Equipment, net |

154,409 |

|

|

154,529 |

|

|

Goodwill |

12,011 |

|

|

12,011 |

|

| Other

Intangible Assets, net |

17,590 |

|

|

19,343 |

|

| Other

Assets |

37,542 |

|

|

30,539 |

|

|

Total Assets |

$ |

775,233 |

|

|

$ |

774,829 |

|

| |

|

|

|

| LIABILITIES AND SHARE

OWNERS’ EQUITY |

|

|

|

| Current

portion of borrowings under credit facilities |

$ |

20,518 |

|

|

$ |

26,638 |

|

| Accounts

payable |

208,281 |

|

|

203,703 |

|

| Accrued

expenses |

49,985 |

|

|

42,264 |

|

| Long-term

debt under credit facilities, less current portion |

40,000 |

|

|

91,500 |

|

| Long-term

income taxes payable |

8,854 |

|

|

9,765 |

|

| Other |

22,630 |

|

|

21,594 |

|

| Share

Owners’ Equity |

424,965 |

|

|

379,365 |

|

|

Total Liabilities and

Share Owners’ Equity |

$ |

775,233 |

|

|

$ |

774,829 |

|

|

Reconciliation of Non-GAAP Financial Measures |

| (Unaudited) |

| (Amounts in

Thousands, except Per Share Data) |

| |

|

|

|

|

|

|

|

| Operating Income

excluding SERP and Lawsuit Proceeds |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Operating Income, as reported |

$ |

14,638 |

|

$ |

10,588 |

|

$ |

48,624 |

|

$ |

30,387 |

| Add: SERP (1) |

164 |

|

(914) |

|

1,525 |

|

(434) |

| Less: Settlement Proceeds from

Lawsuit |

376 |

|

— |

|

717 |

|

— |

| Adjusted Operating Income |

$ |

14,426 |

|

$ |

9,674 |

|

$ |

49,432 |

|

$ |

29,953 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net Income excluding

Adjustments After Measurement Period on GES Acquisition and Lawsuit

Proceeds |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Net Income, as reported |

$ |

10,472 |

|

$ |

6,259 |

|

$ |

42,345 |

|

$ |

19,469 |

| Less: After-Tax Adjustments

After Measurement Period on GES Acquisition |

254 |

|

— |

|

121 |

|

— |

| Less: After-Tax Settlement

Proceeds from Lawsuit |

285 |

|

— |

|

544 |

|

— |

| Adjusted Net Income |

$ |

9,933 |

|

$ |

6,259 |

|

$ |

41,680 |

|

$ |

19,469 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Diluted Earnings per

Share excluding Adjustments After Measurement Period on GES

Acquisition and Lawsuit Proceeds |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Diluted Earnings per Share, as

reported |

$ |

0.41 |

|

$ |

0.25 |

|

$ |

1.67 |

|

$ |

0.76 |

| Less: After-Tax Adjustments

After Measurement Period on GES Acquisition |

0.01 |

|

— |

|

— |

|

— |

| Less: Impact of Settlement

Proceeds from Lawsuit |

0.01 |

|

— |

|

0.02 |

|

— |

| Adjusted Diluted Earnings per

Share |

$ |

0.39 |

|

$ |

0.25 |

|

$ |

1.65 |

|

$ |

0.76 |

| |

|

|

|

|

|

|

|

(1) Beginning in the first quarter of fiscal year 2021,

adjusted operating income excludes changes in the fair value of our

supplemental employee retirement plan, or SERP, liability which are

exactly offset by the revaluation of the fair value of the SERP

investments in Other Income (Expense), net, and as a result have no

impact on net income. Prior reported periods have been

revised accordingly. CONTACT:Andy RegrutHead of Investor

RelationsTelephone: 812.827.4151E-mail:

Investor.Relations@kimballelectronics.com

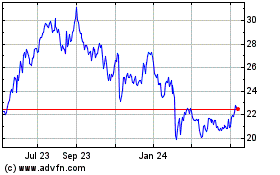

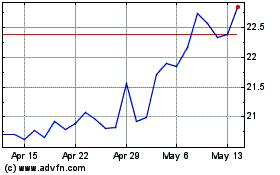

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From May 2024 to Jun 2024

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jun 2023 to Jun 2024