Kimball Electronics, Inc. Reports Second Quarter Fiscal Year 2021 Results

February 03 2021 - 4:05PM

Kimball Electronics, Inc. (Nasdaq: KE) today announced financial

results for the second quarter ended December 31, 2020.

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

December 31, |

| (Amounts in Thousands, except

EPS) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Net Sales |

$ |

320,604 |

|

|

$ |

307,084 |

|

|

$ |

652,353 |

|

|

$ |

620,469 |

|

| Operating Income |

$ |

16,179 |

|

|

$ |

8,684 |

|

|

$ |

33,986 |

|

|

$ |

19,799 |

|

| Adjusted Operating Income

(non-GAAP) (1)(2) |

$ |

16,990 |

|

|

$ |

9,186 |

|

|

$ |

35,006 |

|

|

$ |

20,279 |

|

| Operating Income % |

5.0 |

% |

|

2.8 |

% |

|

5.2 |

% |

|

3.2 |

% |

| Adjusted Operating Income

(non-GAAP) % |

5.3 |

% |

|

3.0 |

% |

|

5.4 |

% |

|

3.3 |

% |

| Net Income |

$ |

15,062 |

|

|

$ |

6,612 |

|

|

$ |

31,873 |

|

|

$ |

13,210 |

|

| Adjusted Net Income (non-GAAP)

(1) |

$ |

15,195 |

|

|

$ |

6,612 |

|

|

$ |

31,747 |

|

|

$ |

13,210 |

|

| Diluted EPS |

$ |

0.60 |

|

|

$ |

0.26 |

|

|

$ |

1.26 |

|

|

$ |

0.52 |

|

| Adjusted Diluted EPS

(non-GAAP) (1) |

$ |

0.60 |

|

|

$ |

0.26 |

|

|

$ |

1.25 |

|

|

$ |

0.52 |

|

(1) A reconciliation of GAAP and non-GAAP financial measures is

included below.

(2) Beginning in the first quarter of fiscal year 2021, adjusted

operating income excludes changes in the fair value of our

supplemental employee retirement plan, or SERP, liability which are

exactly offset by the revaluation to fair value of the SERP

investments in Other Income (Expense), net, and as a result have no

impact on net income. Prior reported periods have been revised

accordingly.

Donald D. Charron, Chairman and Chief Executive Officer, stated,

“We are very pleased with our operating results for the second

quarter of fiscal year 2021. Our team remains resilient, and I am

so proud of our collective response to the adversity that we have

faced during this pandemic. We again exceeded our goal of 4.5%

operating income and continued to deliver excellent cash flow from

operations.”

Mr. Charron continued, “Our strong results were primarily driven

by improved operating execution, favorable product mix, and a

weaker dollar. Looking ahead, we expect that our performance should

approximate our long-stated goal of 4.5% operating income. The

persistence of the pandemic continues to draw our attention, and

it’s difficult to predict what we will face in the future. However,

we are confident that our business will remain strong, and we are

optimistic about our new business opportunities funnel. We remain

committed to our goal of 8% organic growth and believe the goal is

well within our reach for fiscal year 2021.”

Second Quarter Fiscal Year 2021 Overview:

- Consolidated net sales increased 4% compared to the second

quarter of fiscal year 2020. Foreign currency had a favorable 3%

impact on net sales in the current quarter compared to the same

period a year ago.

- Operating activities provided cash of $51.6 million during the

quarter, which compares to cash used by operating activities of

$0.3 million in the second quarter of fiscal year 2020.

- Cash conversion days (“CCD”) for the quarter ended

December 31, 2020 were 75 days, down from 76 days both in the

first quarter of fiscal year 2021 and the quarter ended December

31, 2019. CCD is calculated as the sum of days sales outstanding

plus contract asset days plus production days supply on hand less

accounts payable days.

- Investments in capital expenditures were $6.1 million during

the quarter.

- $3.0 million was returned to Share Owners during the quarter in

the form of common stock repurchases.

- Cash and cash equivalents were $93.6 million and borrowings

outstanding on credit facilities were $86.1 million at December 31,

2020, including $61.0 million classified as long term.

Net Sales by Vertical Market:

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

| (Amounts in Millions) |

2020 |

|

2019 |

|

Percent Change |

|

Automotive |

$ |

151.9 |

|

|

$ |

134.9 |

|

|

13 |

% |

| Medical |

87.1 |

|

|

85.7 |

|

|

2 |

% |

| Industrial |

67.7 |

|

|

66.4 |

|

|

2 |

% |

| Public Safety |

10.5 |

|

|

14.6 |

|

|

(28 |

)% |

| Other |

3.4 |

|

|

5.5 |

|

|

(38 |

)% |

|

Total Net Sales |

$ |

320.6 |

|

|

$ |

307.1 |

|

|

4 |

% |

Forward-Looking StatementsCertain statements

contained within this release are considered forward-looking under

the Private Securities Litigation Reform Act of 1995. The

statements may be identified by the use of words such as “expect,”

“should,” “goal,” “predict,” “will,” “future,” “optimistic,”

“confident,” and “believe.” These forward-looking statements are

subject to risks and uncertainties including, without limitation,

global economic conditions, geopolitical environment, global health

emergencies including the COVID-19 pandemic, availability or cost

of raw materials and components, foreign exchange rate

fluctuations, and our ability to convert new business opportunities

into customers and revenue. Additional cautionary statements

regarding other risk factors that could have an effect on the

future performance of the Company are contained in its Annual

Report on Form 10-K for the year ended June 30, 2020.

Non-GAAP Financial Measures This press release

contains non-GAAP financial measures. A non-GAAP financial measure

is a numerical measure of a company’s financial performance that

excludes or includes amounts so as to be different than the most

directly comparable measure calculated and presented in accordance

with Generally Accepted Accounting Principles (“GAAP”) in the

United States in the statement of income, statement of

comprehensive income, balance sheet, statement of cash flows, or

statement of share owners’ equity of the Company. The non-GAAP

financial measures contained herein include adjusted operating

income, adjusted net income, and adjusted diluted EPS. These

measures include adjustments for the three and six months ended

December 31, 2020 for settlement charges after the measurement

period on the GES acquisition, and for the six months ended

December 31, 2020, proceeds from lawsuit settlements. For all

periods presented, adjusted operating income excludes changes in

the fair value of our SERP liability. Reconciliations of the

reported GAAP numbers to these non-GAAP financial measures are

included in the Reconciliation of Non-GAAP Financial Measures

section below. Management believes it is useful for investors to

understand how its core operations performed without the effects of

the settlement charges after the measurement period on the GES

acquisition, proceeds from lawsuit settlements, and changes in the

fair value of our SERP liability. Excluding these amounts allows

investors to meaningfully trend, analyze, and benchmark the

performance of the Company’s core operations.

| Conference

Call / Webcast |

| |

|

|

| Date: |

|

February 4, 2021 |

| Time: |

|

10:00 AM Eastern Time |

| Live Webcast: |

|

investors.kimballelectronics.com/events-presentations |

| Dial-In #: |

|

800-992-4934 (International

Calls - 937-502-2251) |

| Conference ID: |

|

7896947 |

For those unable to participate in the live webcast, the call

will be archived at investors.kimballelectronics.com.

About Kimball Electronics, Inc.Kimball

Electronics is a multifaceted manufacturing solutions provider of

electronics and diversified contract manufacturing services to

customers around the world. From our operations in the United

States, China, India, Japan, Mexico, Poland, Romania, Thailand, and

Vietnam, our teams are proud to provide manufacturing services for

a variety of industries. Recognized for a reputation of excellence,

we are committed to a high-performance culture that values personal

and organizational commitment to quality, reliability, value,

speed, and ethical behavior. Kimball Electronics, Inc. (Nasdaq: KE)

is headquartered in Jasper, Indiana.

To learn more about Kimball Electronics, visit:

www.kimballelectronics.com.

Lasting relationships. Global

success.

Financial highlights for the second quarter and year-to-date

period ended December 31, 2020 are as follows:

| Condensed

Consolidated Statements of Income |

|

|

|

|

|

|

| (Unaudited) |

Three Months Ended |

| (Amounts in Thousands, except

Per Share Data) |

December 31, 2020 |

|

December 31, 2019 |

|

Net Sales |

$ |

320,604 |

|

|

100.0 |

% |

|

$ |

307,084 |

|

|

100.0 |

% |

| Cost of Sales |

290,939 |

|

|

90.7 |

% |

|

286,573 |

|

|

93.3 |

% |

| Gross Profit |

29,665 |

|

|

9.3 |

% |

|

20,511 |

|

|

6.7 |

% |

| Selling and Administrative

Expenses |

13,486 |

|

|

4.3 |

% |

|

11,827 |

|

|

3.9 |

% |

| Operating Income |

16,179 |

|

|

5.0 |

% |

|

8,684 |

|

|

2.8 |

% |

| Other Income (Expense),

net |

2,411 |

|

|

0.8 |

% |

|

143 |

|

|

0.1 |

% |

| Income Before Taxes on

Income |

18,590 |

|

|

5.8 |

% |

|

8,827 |

|

|

2.9 |

% |

| Provision for Income

Taxes |

3,528 |

|

|

1.1 |

% |

|

2,215 |

|

|

0.7 |

% |

| Net Income |

$ |

15,062 |

|

|

4.7 |

% |

|

$ |

6,612 |

|

|

2.2 |

% |

| |

|

|

|

|

|

|

|

| Earnings Per Share of Common

Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.60 |

|

|

|

|

$ |

0.26 |

|

|

|

|

Diluted |

$ |

0.60 |

|

|

|

|

$ |

0.26 |

|

|

|

| |

|

|

|

|

|

|

|

| Average Number of Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,101 |

|

|

|

|

25,247 |

|

|

|

|

Diluted |

25,171 |

|

|

|

|

25,330 |

|

|

|

| |

|

|

|

|

|

|

|

| (Unaudited) |

Six Months Ended |

| (Amounts in Thousands, except

Per Share Data) |

December 31, 2020 |

|

December 31, 2019 |

|

Net Sales |

$ |

652,353 |

|

|

100.0 |

% |

|

$ |

620,469 |

|

|

100.0 |

% |

| Cost of Sales |

592,105 |

|

|

90.8 |

% |

|

577,765 |

|

|

93.1 |

% |

| Gross Profit |

60,248 |

|

|

9.2 |

% |

|

42,704 |

|

|

6.9 |

% |

| Selling and Administrative

Expenses |

26,603 |

|

|

4.1 |

% |

|

22,905 |

|

|

3.7 |

% |

| Other General Income |

(341 |

) |

|

(0.1 |

)% |

|

— |

|

|

— |

% |

| Operating Income |

33,986 |

|

|

5.2 |

% |

|

19,799 |

|

|

3.2 |

% |

| Other Income (Expense),

net |

4,546 |

|

|

0.7 |

% |

|

(2,259 |

) |

|

(0.4 |

)% |

| Income Before Taxes on

Income |

38,532 |

|

|

5.9 |

% |

|

17,540 |

|

|

2.8 |

% |

| Provision for Income

Taxes |

6,659 |

|

|

1.0 |

% |

|

4,330 |

|

|

0.7 |

% |

| Net Income |

$ |

31,873 |

|

|

4.9 |

% |

|

$ |

13,210 |

|

|

2.1 |

% |

| |

|

|

|

|

|

|

|

| Earnings Per Share of Common

Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.27 |

|

|

|

|

$ |

0.52 |

|

|

|

|

Diluted |

$ |

1.26 |

|

|

|

|

$ |

0.52 |

|

|

|

| |

|

|

|

|

|

|

|

| Average Number of Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,127 |

|

|

|

|

25,371 |

|

|

|

|

Diluted |

25,265 |

|

|

|

|

25,503 |

|

|

|

| Condensed Consolidated

Statements of Cash Flows |

Six Months Ended |

| (Unaudited) |

December 31, |

| (Amounts in Thousands) |

2020 |

|

2019 |

|

Net Cash Flow provided by Operating Activities |

$ |

72,256 |

|

|

$ |

39,282 |

|

| Net Cash Flow used for

Investing Activities |

(14,417 |

) |

|

(21,974 |

) |

| Net Cash Flow used for

Financing Activities |

(33,433 |

) |

|

(13,903 |

) |

| Effect of Exchange Rate Change

on Cash and Cash Equivalents |

4,222 |

|

|

(478 |

) |

| Net Increase in Cash and Cash

Equivalents |

28,628 |

|

|

2,927 |

|

| Cash and Cash Equivalents at

Beginning of Period |

64,990 |

|

|

49,276 |

|

| Cash and Cash Equivalents at

End of Period |

$ |

93,618 |

|

|

$ |

52,203 |

|

| |

(Unaudited) |

|

|

| Condensed Consolidated

Balance Sheets |

December 31,2020 |

|

June 30,2020 |

| (Amounts in Thousands) |

| ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

93,618 |

|

|

$ |

64,990 |

|

|

Receivables, net |

209,054 |

|

|

180,133 |

|

|

Contract assets |

61,569 |

|

|

70,350 |

|

|

Inventories |

174,422 |

|

|

219,043 |

|

|

Prepaid expenses and other current assets |

25,791 |

|

|

23,891 |

|

|

Property and Equipment, net |

153,572 |

|

|

154,529 |

|

|

Goodwill |

12,011 |

|

|

12,011 |

|

|

Other Intangible Assets, net |

18,205 |

|

|

19,343 |

|

|

Other Assets |

37,606 |

|

|

30,539 |

|

|

Total Assets |

$ |

785,848 |

|

|

$ |

774,829 |

|

| |

|

|

|

| LIABILITIES AND SHARE

OWNERS’ EQUITY |

|

|

|

|

Current portion of borrowings under credit facilities |

$ |

25,083 |

|

|

$ |

26,638 |

|

|

Accounts payable |

199,382 |

|

|

203,703 |

|

|

Accrued expenses |

49,131 |

|

|

42,264 |

|

|

Long-term debt under credit facilities, less current portion |

61,000 |

|

|

91,500 |

|

|

Long-term income taxes payable |

8,854 |

|

|

9,765 |

|

|

Other |

22,760 |

|

|

21,594 |

|

|

Share Owners’ Equity |

419,638 |

|

|

379,365 |

|

|

Total Liabilities and Share Owners’ Equity |

$ |

785,848 |

|

|

$ |

774,829 |

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

| (Amounts in Thousands, except

Per Share Data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating

Income excluding SERP and Lawsuit Proceeds |

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Operating Income, as reported |

$ |

16,179 |

|

|

$ |

8,684 |

|

|

$ |

33,986 |

|

|

$ |

19,799 |

|

| Add: SERP (1) |

811 |

|

|

502 |

|

|

1,361 |

|

|

480 |

|

| Less: Pre-tax Settlement

Proceeds from Lawsuit |

— |

|

|

— |

|

|

341 |

|

|

— |

|

| Adjusted Operating Income |

$ |

16,990 |

|

|

$ |

9,186 |

|

|

$ |

35,006 |

|

|

$ |

20,279 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net

Income excluding Settlement Charges on GES Acquisition and Lawsuit

Proceeds |

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Net Income, as reported |

$ |

15,062 |

|

|

$ |

6,612 |

|

|

$ |

31,873 |

|

|

$ |

13,210 |

|

| Add: After-Tax Settlement

Charges on GES Acquisition |

133 |

|

|

— |

|

|

133 |

|

|

— |

|

| Less: After-tax Settlement

Proceeds from Lawsuit |

— |

|

|

— |

|

|

259 |

|

|

— |

|

| Adjusted Net Income |

$ |

15,195 |

|

|

$ |

6,612 |

|

|

$ |

31,747 |

|

|

$ |

13,210 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Diluted

Earnings per Share excluding Settlement Charges on GES Acquisition

and Lawsuit Proceeds |

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Diluted Earnings per Share, as

reported |

$ |

0.60 |

|

|

$ |

0.26 |

|

|

$ |

1.26 |

|

|

$ |

0.52 |

|

| Add: After-Tax Settlement

Charges on GES Acquisition |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Impact of Settlement

Proceeds from Lawsuit |

— |

|

|

— |

|

|

0.01 |

|

|

— |

|

| Adjusted Diluted Earnings per

Share |

$ |

0.60 |

|

|

$ |

0.26 |

|

|

$ |

1.25 |

|

|

$ |

0.52 |

|

| |

|

|

|

|

|

|

|

(1) Beginning in the first quarter of fiscal year 2021, adjusted

operating income excludes changes in the fair value of our

supplemental employee retirement plan, or SERP, liability which are

exactly offset by the revaluation of the fair value of the SERP

investments in Other Income (Expense), net, and as a result have no

impact on net income. Prior reported periods have been revised

accordingly.

CONTACT:Adam W. SmithTreasurerTelephone: 812.634.4000E-mail:

Investor.Relations@kimballelectronics.com

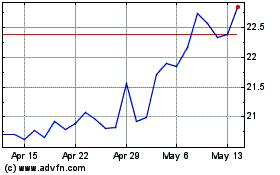

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From May 2024 to Jun 2024

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jun 2023 to Jun 2024