0001612630

true

Form 8-K/A date of report 08-30-23

0001612630

2023-08-30

2023-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): August 30, 2023

The Joint Corp.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36724 |

90-0544160 |

| (State or other jurisdiction of incorporation) |

(Commission file number) |

(IRS employer identification number) |

16767 N. Perimeter Drive, Suite 110

Scottsdale, AZ 85260

(Address of principal executive offices)

Registrant's telephone number, including area code:

(480) 245-5960

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 Par Value Per Share |

JYNT |

The NASDAQ Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

| Item 4.02 | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

The Joint Corp. (the “Company”) is filing this amendment to

its Current Report on Form 8-K (this “8-K/A”) filed with the SEC on September 6, 2023 (the “Original 8-K”) to

update the disclosures made on the Original 8-K. Other than as modified by the disclosures made in this 8-K/A, no changes have been made

to the Original 8-K.

(a) As previously disclosed in

the Original 8-K, on August 30, 2023, the Chief Financial Officer of The Joint Corp. (the “Company”), after meeting with the

members of the Audit Committee to discuss the matters disclosed in this Item 4.02 and in consultation with BDO USA, P.C. (“BDO”),

the Company’s independent registered public accounting firm, concluded that the Company’s previously issued audited financial

statements as of and for the year ending December 31, 2022 contained in the Annual Report on Form 10-K for the year ended December 31,

2022 and the unaudited interim financial statements contained in the Quarterly Reports on Form 10-Q for the quarters and cumulative periods

ended June 30, 2022, and September 30, 2022 (the “2022 Previously Issued Financial Statements”) contained material errors

and should be restated, which the conclusion was thereafter formally ratified by the Audit Committee and the Board of Directors of the

Company. This determination occurred following discussions of the matter among BDO, officers of the Company and members of the Company’s

Board of Directors.

On September 11, 2023, after additional discussions among officers of the

Company, members of the Company’s Board of Directors, and BDO, the Board of Directors of the Company concluded that the Company’s

previously issued audited financial statements as of and for the year ending December 31, 2021 contained in the Annual Report on Form

10-K for the year ended December 31, 2022 and the unaudited interim financial statements contained in the Quarterly Reports on Form 10-Q

for the quarters and cumulative periods ended March 31, 2022 and 2021, June 30, 2021, and September 30, 2021 (the “Additional Previously

Issued Financial Statements,” together with the 2022 Previously Issued Financial Statements, the “Previously Issued Financial

Statements”) contained material errors and should be restated.

Accordingly, investors and all other persons should no longer rely upon

the Previously Issued Financial Statements included in the Company’s previously filed Form 10-Ks and Form 10-Qs for the periods

listed above. In addition, any previously issued or filed earnings releases, investor presentations or other communications describing

the Previously Issued Financial Statements and other related financial information covering these periods should no longer be relied upon.

The Company’s management and the Audit Committee have discussed the

matters disclosed in this report with BDO.

Forward Looking Statements.

This Periodic Report on Form 8-K contains statements about future events

and expectations that constitute forward-looking statements. Forward-looking statements, including expectations about the timing of the

completion and filing of the 10-K/A, the Quarterly Report on Form 10-Q for the period ended June 30, 2023, the Quarterly Report on Form

10-Q/A for the period ended March 31, 2023, and the anticipated effects of the errors on the Previously Issued Financial Statements, are

based on our beliefs, assumptions and expectations of industry trends, our future financial and operating performance and our growth plans,

taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking

statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results

we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could

contribute to these differences include, but are not limited to, the breach of certain covenants in our credit facility arising out of

our SEC filing delinquency, which could result in an event of default if we fail to file our Quarterly Report on Form10-Q for the period

ended June 30, 2023 on or before September 30, 2023, the extended date agreed to by the lender in the lender’s one-time waiver of

the default, allowing our lender to terminate its commitments under the credit facility and require the immediate payment of all principal

and interest due if we fail to secure a waiver from the lender; increases in our borrowing costs under our credit facility, given that

borrowings under the credit facility bear interest at rates tied to certain rising benchmark interest rates; state laws limiting the use

our business model, including prohibitions on advance payment for chiropractic services, which recently caused us to elect not to offer

franchises in South Dakota and Wyoming; increased costs to comply with a new SEC reporting rule enhancing and standardizing disclosures

regarding cybersecurity incidents and cybersecurity risk management, the factors described in our filings with the SEC, including in the

section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC

on March 10, 2023 and subsequently-filed current and quarterly reports. Words such as, "anticipates," "believes,"

"continues," "estimates," "expects," "goal," "objectives," "intends," "may,"

"opportunity," "plans," "potential," "near-term," "long-term," "projections,"

"assumptions," "projects," "guidance," "forecasts," "outlook," "target," "trends,"

"should," "could," "would," "will," and similar expressions are intended to identify such forward-looking

statements. We qualify any forward-looking statements entirely by these cautionary factors. We assume no obligation to update or revise

any forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in

these forward-looking statements, even if new information becomes available in the future. Comparisons of results for current and any

prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should

only be viewed as historical data.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 15, 2023.

| |

The Joint Corp. |

| |

By |

/s/ Peter D. Holt |

| |

|

Peter D. Holt |

| |

|

President and Chief Executive Officer |

v3.23.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

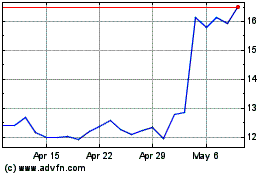

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Apr 2024 to May 2024

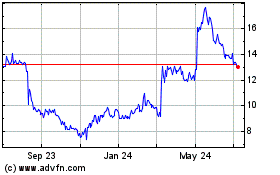

Joint (NASDAQ:JYNT)

Historical Stock Chart

From May 2023 to May 2024