Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-234353

Prospectus Supplement dated April 15, 2020

(To Prospectus Dated November 14, 2019)

1,715,240 Shares of Common Stock

We are offering 1,715,240 shares of our Common Stock to institutional and accredited investors pursuant to this prospectus supplement, the

accompanying prospectus and a securities purchase agreement with such investors. In a concurrent private placement, we are selling to such investors warrants to purchase 100% of the number of shares

of Common Stock purchased by such investors in this offering, or the Warrants. The Warrants and the Common Stock issuable upon the exercise of the Warrants are not being registered under the

Securities Act of 1933, as amended, or the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus, and are being offered pursuant to the exemption

provided in Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder.

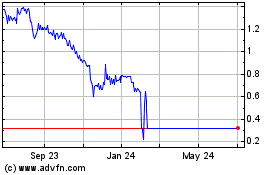

Our

Common Stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol "NVIV." On April 14, 2020, the last reported sale price of our Common Stock as reported on

Nasdaq was $1.80 per share.

As

of April 14, 2020, the aggregate market value of our outstanding common stock held by non-affiliates was $23,937,884, which was calculated based on 3,116,912 shares of

outstanding common stock held by non-affiliates and a price per share of $7.68, which was the average of the bid and asked prices of our common stock on February 18, 2020. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell, pursuant to the registration statement of which this prospectus supplement forms a part, securities in a public primary

offering with a value exceeding one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding

common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus supplement, we have offered and sold $840,000 of

securities pursuant to General Instruction I.B.6 of Form S-3.

We

engaged H.C. Wainwright & Co., LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase shares of our Common Stock in

this offering. The placement agent has no obligation to purchase any of the shares of our Common Stock from us or to arrange for the purchase or sale of any specific number or dollar amount of the

shares. We have agreed to pay the placement agent the placement agent fees set forth in the table below and to provide certain other compensation to the placement agent. See "Plan of Distribution"

beginning on page S-18 of this prospectus supplement for more information regarding these arrangements.

Investing in the offered securities involves a high degree of risk. See "Risk Factors" beginning on page S-7 of this prospectus supplement

for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

|

Public offering price

|

|

$1.75

|

|

$3,001,670.00

|

|

|

|

Placement agent's cash fees(1)

|

|

$0.13125

|

|

$225,125.25

|

|

|

|

Proceeds, before expenses, to us

|

|

$1.61875

|

|

$2,776,544.75

|

|

|

-

(1)

-

We

have agreed to issue common stock purchase warrants to the placement agent, to pay a management fee equal to 1% of the gross proceeds of the offering to the

placement agent and to reimburse the placement agent for certain of its expenses. See "Plan of Distribution" on page S-20 of this prospectus supplement for a description of the compensation

payable to the placement agent.

-

(2)

-

The

amount of the offering proceeds to us presented in this table does not give effect to any exercise of the Warrants being issued in the concurrent private

placement.

We

expect that delivery of the shares being offered pursuant to this prospectus supplement and the accompanying prospectus will be made on or about April 17, 2020, subject to

satisfaction of customary closing conditions.

H.C. Wainwright & Co.

The date of this prospectus supplement is April 15, 2020.

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to

this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all information

incorporated by reference herein and therein, as well as the additional information described under "Where You Can Find Additional Information" on page S-27 of this prospectus supplement. These

documents contain information you should consider when making your investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To

the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document

incorporated by reference therein filed prior to the date of this prospectus supplement, on the other hand, you should rely on the

information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document filed

after the date of this prospectus supplement and incorporated by reference in this prospectus supplement and the accompanying prospectus—the statement in the document having the later date

modifies or supersedes the earlier statement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectuses we may

provide to you in connection with this offering. We have not, and the placement agent has not, authorized any other person to provide you with any information that is different. If anyone provides you

with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted.

The distribution of this prospectus supplement and the offering of securities covered hereby in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of securities covered hereby and the distribution of this prospectus

supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities

offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this

prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

the context otherwise requires, the terms "InVivo," "the Company," "our company," "we," "us," "our" and similar names refer collectively to InVivo Therapeutics Holdings Corp. and

its subsidiaries.

All

trademarks, trade names and service marks appearing in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein are the

property of their respective owners. Use or display by us of other parties' trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or

sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus supplement, the accompanying prospectus or the

documents incorporated by reference herein or therein appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not

assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

S-1

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or

incorporated by reference into this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein. This summary is not complete and does not

contain all of the information that you should consider before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage you to

read and consider carefully the entire prospectus supplement and the accompanying prospectus, including "Risk Factors" beginning on page S-7 of this prospectus supplement, along with our

consolidated financial statements and notes to those consolidated financial statements and the other documents incorporated by reference in this prospectus supplement and the accompanying

prospectus.

Business Overview

Overview

We are a research and clinical-stage biomaterials and biotechnology company with a focus on treatment of spinal cord injuries, or SCIs. Our

approach to treating acute SCIs is based on our investigational Neuro-Spinal Scaffold™ implant, a bioresorbable polymer scaffold that is

designed for implantation at the site of injury within a spinal cord and is intended to treat acute SCI. The Neuro-Spinal Scaffold implant incorporates

intellectual property licensed under an exclusive, worldwide license from Boston Children's Hospital, or BCH, and the Massachusetts Institute of Technology, or MIT. We also plan to evaluate other

technologies and therapeutics that may be complementary to our development of the Neuro-Spinal Scaffold implant or offer the potential to bring us

closer to our goal of redefining the life of the SCI patient.

The

current standard of care for acute management of spinal cord injuries focuses on preventing further injury to the spinal cord. However, the current standard of care does not address

repair of the spinal cord.

Our Clinical Program

We currently have one clinical development program for the treatment of acute SCI.

Our

Neuro-Spinal Scaffold implant is an investigational bioresorbable polymer scaffold that is designed for implantation at the site of

injury within a spinal cord. The Neuro-Spinal Scaffold implant is intended to promote appositional, or side-by-side, healing by supporting the

surrounding tissue after injury, minimizing expansion of areas of necrosis, and providing a biomaterial substrate for the body's own healing/repair processes following injury. We believe this form of

appositional healing may spare white matter, increase neural sprouting, and diminish post-traumatic cyst formation.

The

Neuro-Spinal Scaffold implant is composed of two biocompatible and bioresorbable polymers that are cast to form a highly porous

investigational product:

-

•

-

Poly lactic-co-glycolic acid, a polymer that is widely used in resorbable sutures and provides the biocompatible support for Neuro-Spinal

Scaffold implant; and

-

•

-

Poly-L-Lysine, a positively charged polymer commonly used to coat surfaces in order to promote cellular attachment.

INSPIRE 2.0 Study

Our Neuro-Spinal Scaffold implant has been approved to be studied under our approved Investment

Device Exemption, or IDE, in the INPSIRE 2.0 Study, which is titled the "Randomized, Controlled, Single-blind Study of Probable Benefit of the Neuro-Spinal

Scaffold™ for Safety and Neurologic Recovery in Subjects with Complete Thoracic AIS A Spinal Cord Injury as Compared to

S-2

Table of Contents

Standard

of Care." The purpose of the INSPIRE 2.0 Study is to assess the overall safety and probable benefit of the Neuro-Spinal Scaffold for the

treatment of neurologically complete thoracic traumatic acute SCI. The INSPIRE 2.0 Study is designed to enroll 10 subjects into each of the two study arms, which we refer to as the Scaffold Arm and

the Comparator Arm. Patients in the Comparator Arm will receive the standard of care, which is spinal stabilization without dural opening or myelotomy. The INSPIRE 2.0 Study is a single blind study,

meaning that the patients and assessors are blinded to treatment assignments. The U.S. Food and Drug Administration, or FDA, approved the enrollment of up to 35 patients in this study so that there

would be at least 20 evaluable patients (10 in each study arm) at the primary endpoint analysis, accounting for events such as screen failures or deaths that would prevent a patient from reaching the

primary endpoint visit. We estimate that enrollment in the INSPIRE 2.0 Study will be complete in the fourth quarter of 2020, with the final patient enrolled in the INSPIRE 2.0 study reaching their

six-month primary endpoint visit in the second quarter of 2021.

The

primary endpoint is defined as the proportion of patients achieving an improvement of at least one AIS grade at six months post-implantation. Assessments of AIS grade are at hospital

discharge, three months, six months, 12 months and 24 months. The definition of study success for INSPIRE 2.0 is that the difference in the proportion of subjects who demonstrate an

improvement of at least one grade on AIS assessment at the six-month primary endpoint follow-up visit between the Scaffold Arm and the Comparator Arm must be equal to or greater than 20%. In one

example, if 50% of subjects in the Scaffold Arm have an improvement of AIS grade at the six-month primary endpoint and 30% of subjects in the Comparator Arm have an improvement, then the difference in

the proportion of subjects who demonstrated an improvement is equal to 20% (50% minus 30% equals 20%) and the definition of study success would be met. In another example, if 40% of subjects in the

Scaffold Arm have an improvement of AIS grade at the six-month primary endpoint and 30% of subjects in the Comparator Arm have an improvement, then the difference in the proportion of subjects who

demonstrated an improvement is equal to 10% (40% minus 30% equals 10%) and the definition of study success would not be met. Additional endpoints include measurements of changes in NLI, sensory levels

and motor scores, bladder, bowel and sexual function, pain, Spinal Cord Independence Measure, and quality of life.

Although

The INSPIRE Study is structured with an Objective Performance Criterion, or OPC, as the primary component for demonstrating probable benefit, the OPC is not the only variable

that the FDA would evaluate when reviewing a future HDE application. Similarly, while our INSPIRE 2.0 Study is

structured with a definition of study success requiring a minimum difference between study arms in the proportion of subjects achieving improvement, that success definition is not the only factor that

the FDA would evaluate in the future HDE application. Approval is not guaranteed if the OPC is met for our prior clinical trial, The INSPIRE Study, or the definition of study success is met for the

INSPIRE 2.0 Study, and even if the OPC or definition of study success are not met, the FDA may approve a medical device if probable benefit is supported by a comprehensive review of all clinical

endpoints and preclinical results, as demonstrated by the sponsor's body of evidence.

In

2016, the FDA accepted our proposed HDE modular shell submission and review process for the Neuro-Spinal Scaffold implant. The HDE

modular shell is comprised of three modules: a preclinical studies module, a manufacturing module, and a clinical data module. As part of its review process, the FDA reviews each module, which are

individual sections of the HDE submission, on a rolling basis. Following the submission of each module, the FDA reviews and provides feedback, typically within 90 days, allowing the applicant

to receive feedback and potentially resolve any deficiencies during the review process. Upon receipt of all three modules, which constitutes the complete HDE submission, the FDA makes a filing

decision that may trigger the review clock for an approval decision. We submitted the first module in March 2017 and received feedback in June 2017. We submitted an updated first module in the fourth

quarter of 2019. The HDE submission will not be complete until the manufacturing and clinical modules are also submitted.

S-3

Table of Contents

Corporate Information

We were incorporated on April 2, 2003, under the name of Design Source, Inc. On October 26, 2010, we acquired the business

of InVivo Therapeutics Corporation, which was founded in 2005, and we are continuing the existing business operations of InVivo Therapeutics Corporation as our wholly-owned subsidiary.

Our

principal executive offices are located in leased premises at One Kendall Square, Suite B14402, Cambridge, Massachusetts 02139. Our telephone number is (617) 863-5500.

We maintain a website at www.invivotherapeutics.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus

supplement or the accompanying prospectus.

S-4

Table of Contents

THE OFFERING

|

|

|

|

|

Securities offered by us:

|

|

1,715,240 shares of our common stock

|

|

Offering price:

|

|

$1.75 per share of Common Stock

|

|

Common stock outstanding after this offering

|

|

4,847,370 shares of common stock

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for working capital business development activities, and general

corporate purposes. See "Use of Proceeds" on page S-13 of this prospectus supplement.

|

|

Risk factors

|

|

See "Risk Factors" beginning on page S-7 of this prospectus supplement and the other information included or

incorporated by reference elsewhere in this prospectus supplement and the accompanying prospectus, for a discussion of factors you should carefully consider before deciding to invest in our securities.

|

|

Nasdaq Capital Market symbol

|

|

Our common stock is listed on the Nasdaq Capital Market under the symbol "NVIV."

|

|

Concurrent private placement

|

|

In a concurrent private placement, we are selling to the purchasers of our Common Stock in this offering Warrants to

purchase 100% of the number of our Common Stock purchased by such investors in this offering, or Warrants to purchase up to 1,715,240 shares of Common Stock. We will receive proceeds from the concurrent private placement transaction of Warrants to be

purchased by any investor in the concurrent private placement of Warrants solely to the extent such Warrants are exercised for cash. The Warrants will be immediately exercisable at an exercise price of $1.62 per share and will expire on

October 17, 2025. The Warrants and the Common Stock issuable upon the exercise of the Warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder. There is no established public trading market for the Warrants being issued in the concurrent private placement, and we do not expect a market to develop.

We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited. See "Private Placement of

Warrants."

|

S-5

Table of Contents

The

number of shares of common stock to be outstanding immediately after this offering is based on 3,132,130 shares of our common stock outstanding as of April 14, 2020, and

excludes:

-

•

-

2,953,603 shares of common stock issuable upon the exercise of warrants outstanding as of April 14, 2020 at a weighted average exercise

price of $10.36 per share;

-

•

-

4,187 shares of common stock issuable upon the exercise of options at a weighted average exercise price of $1,077.78 per share and 200 shares

of common stock issuable upon vesting of restricted stock units outstanding as of April 14, 2020 pursuant to our stock incentives plans, which we refer to collectively as the Incentive Plans;

-

•

-

26,872 shares of common stock available for future awards under the Incentive Plans and for future issuance our 401(k) plan as of

April 14, 2020; and

-

•

-

264 shares of common stock reserved for future sale under our employee stock purchase plan as of April 14, 2020.

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of the outstanding options or warrants described in the bullets above and no exercise of the

Warrants.

S-6

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you

should consider carefully the risks and uncertainties described below and under the section captioned "Risk Factors" contained in our most recent

Annual Report on Form 10-Q for the year ended December 31, 2019

and other filings we make with the Securities and Exchange Commission, or SEC, from time to time, which are incorporated by reference herein in their entirety, together with other

information in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein and in any free writing prospectus that we may authorize for use

in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such event, the trading price

of our common stock could decline and you might lose all or part of your investment.

Risks Related to This Offering

We have broad discretion over the use of our cash and cash equivalents, including the net proceeds we receive

in this offering, and may not use them effectively.

Our management has broad discretion to use our cash and cash equivalents, including the net proceeds we receive in this offering, to fund our

operations and could spend these funds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively

could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our product candidates. Pending

their use to fund operations, we may invest our cash and cash equivalents in a manner that does not produce income or that loses value.

Sales of our Common Stock by shareholders may have an adverse effect on the then prevailing market price of

our Common Stock.

Sales of a substantial number of our Common Stock in the public market following this offering could cause the market price of our Common Stock

to decline and could impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our Common Stock or other equity-related

securities would have on the market price of our Common Stock.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or

exchangeable for our common stock at prices that may not be the same as the public offering price for the securities in this offering. We may sell shares or other securities in any other offering at

prices that are less than the price paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

In the foreseeable future, we do not intend to pay cash dividends on shares of our common stock so any

investor gains will be limited to the value of our shares.

We currently anticipate that we will retain future earnings for the development, operation, and expansion of our business and do not anticipate

declaring or paying any cash dividends for the foreseeable future. Any gains to stockholders will therefore be limited to the increase, if any, in our share price.

S-7

Table of Contents

Risks Related to Our Business and Common Stock

The COVID-19 pandemic, which began in late 2019 and has had impacts worldwide, may delay our ability to

complete our ongoing clinical trial or delay the initiation of future clinical trials, disrupt regulatory activities, or have other adverse effects on our business and operations. In addition, this

pandemic has caused substantial disruption in the financial markets and may adversely impact economies worldwide, both of which could result in adverse effects on our business and operations.

The COVID-19 pandemic, which began in December 2019, has had impacts worldwide, causing many governments to implement measures to slow the

spread of the outbreak through quarantines, travel restrictions, heightened border scrutiny, and other measures. The outbreak and government measures taken in response, including widespread emergency

orders requiring business and residents to curtail non-essential activities, have also had a significant impact, both direct and indirect, on businesses and commerce, as worker shortages have

occurred; supply chains have been disrupted; facilities and production have been suspended; and demand for certain goods and services, such as medical services and supplies, has spiked, while demand

for other goods and services, such as travel, has fallen. The future progression of the outbreak and its effects on our business and operations are uncertain. We and our clinical research

organizations, as well as clinical trial sites, may face disruptions related to the INSPIRE 2.0 clinical trial arising from suspension of activity at clinical trial

sites due to hospital staff shortages or state or city "stay at home" or "shelter in place" orders, delays in the ability to obtain necessary institutional review board, or IRB, or other necessary

site approvals, as well as other delays at clinical trial sites. For example, we are aware that a limited number of our clinical sites have temporarily suspended the INSPIRE 2.0 Study at their

institution due to the coronavirus pandemic. The response to the COVID-19 pandemic may redirect resources of regulators in a way that would adversely impact our ability to progress regulatory

approvals. In addition, we may face impediments to regulatory meetings and approvals due to measures intended to limit in-person interactions. Any of these factors could adversely impact our ability

to enroll, or delay enrollment in, the INSPIRE 2.0 clinical trial. Additionally, the pandemic has already caused significant disruptions in the financial markets, and may continue to cause such

disruptions, which could impact our ability to raise additional funds through public offerings and may also impact the volatility of our stock price and trading in our stock. Moreover, it is possible

the pandemic will significantly impact economies worldwide, which could result in adverse effects on our business and operations. We cannot be certain what the overall impact of the COVID-19 pandemic

will be on our business and it has the potential to adversely affect our business, financial condition, results of operations, and prospects.

Even if this offering is successful, we will need additional funding to continue our operations. If we are

unable to raise capital when needed, we could be forced to delay, reduce, or eliminate our product development programs or commercialization efforts, engage in one or more potential transactions, or

cease our operations entirely.

Even if this offering is successful, we will need to secure additional resources to support our continued operations, and to complete clinical

development of our Neuro-Spinal Scaffold, including resources needed to complete enrollment in our INSPIRE 2.0 Study or to reach submission of the HDE application to the FDA, plus resources for

engaging in potential business development activities. In addition, we expect that our expenses will increase in connection with our ongoing activities, particularly as we conduct our INSPIRE 2.0

Study, and as we seek regulatory approval for our Neuro-Spinal Scaffold implant. If we obtain regulatory approval for any of our current or future product candidates, we expect to incur significant

commercialization expenses related to manufacturing, marketing, sales, and distribution. Accordingly, we will need to obtain substantial additional funding in connection with our continuing

operations. If we are unable to raise additional capital, we may seek to engage in one or more potential transactions, such as the sale of our company, a strategic partnership with one or more parties

or the licensing, sale or divestiture of some of our assets or proprietary

S-8

Table of Contents

technologies,

or we may be forced to cease our operation entirely. There can be no assurance that we will be able to enter into such a transaction or transactions on a timely basis or on terms that

are favorable to us. If we are unable to raise capital when needed or on attractive terms, or should we engage in one or more potential strategic transactions, we could be forced to delay, reduce, or

eliminate our research and development programs or any future commercialization efforts. If we determine to change our business strategy or to seek to engage in a strategic transaction, our future

business, prospects, financial position and operating results could be significantly different than those in historical periods or projected by our management. Because of the significant uncertainty

regarding these events, we are not able to accurately predict the impact of any potential changes in our existing business strategy.

Our

future funding requirements, both near- and long-term, will depend on many factors, including, but not limited to:

-

•

-

the scope, progress, results, and costs of preclinical development, laboratory testing, and clinical trials for our Neuro-Spinal Scaffold

implant and any other product candidates that we may develop or acquire, including our INSPIRE 2.0 Study;

-

•

-

future clinical trial results of our Neuro-Spinal Scaffold implant;

-

•

-

the timing of, and the costs involved in, obtaining regulatory approvals for the Neuro-Spinal Scaffold implant, and the outcome of regulatory

review of the Neuro-Spinal Scaffold implant;

-

•

-

the cost and timing of future commercialization activities for our products if any of our product candidates are approved for marketing,

including product manufacturing, marketing, sales, and distribution costs;

-

•

-

the revenue, if any, received from commercial sales of our product candidates for which we receive marketing approval;

-

•

-

the cost of having our product candidates manufactured for clinical trials in preparation for regulatory approval and in preparation for

commercialization;

-

•

-

the cost and delays in product development as a result of any changes in regulatory oversight applicable to our product candidates;

-

•

-

our ability to establish and maintain strategic collaborations, licensing, or other arrangements and the financial terms of such agreements;

-

•

-

the cost and timing of establishing sales, marketing, and distribution capabilities;

-

•

-

the costs involved in preparing, filing, prosecuting, maintaining, defending, and enforcing our intellectual property portfolio;

-

•

-

the efforts and activities of competitors and potential competitors;

-

•

-

the effect of competing technological and market developments; and

-

•

-

the extent to which we acquire or invest in businesses, products, and technologies.

Identifying

potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive, and uncertain process that takes years to complete, and we

may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. In addition, our product candidates, if approved, may not achieve commercial success.

Our commercial revenues, if any, will be derived from sales of products that we do not expect to be commercially available for several years, if at all. Accordingly, we will need to continue to rely

on additional financing to achieve our business objectives. Adequate additional financing may not be available to us

S-9

Table of Contents

on

acceptable terms, or at all and if we are not successful in raising additional capital, we may not be able to continue as a going concern.

There is substantial doubt about our ability to continue as a going concern, which will affect our ability to

obtain future financing and may require us to curtail our operations.

Our consolidated financial statements as of December 31, 2019 were prepared under the assumption that we will continue as a going

concern. At December 31, 2019, we had cash and cash equivalents of $6.6 million. We estimate that our existing cash resources, together with the proceeds of our registered offering in

March 2020 and anticipated proceeds of this offering, will be sufficient to fund our operations into the second quarter of 2021. This estimate is based on assumptions that may prove to be wrong;

expenses could prove to be significantly higher, leading to a more rapid consumption of our existing resources.

Our

ability to continue as a going concern will depend on our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce or contain

expenditures, and, ultimately, to generate revenue.

Our

independent registered public accounting firm expressed substantial doubt as to our ability to continue as a going concern in its report dated February 20, 2020 included in

our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which we filed with the SEC on February 20, 2020. Our management has determined that there continues to

be substantial doubt regarding our ability to continue as a going concern. Even if this offering is successful, we expect that there will continue to be substantial doubt about our ability to continue

as a going concern. If we are unable to continue as a going concern, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our audited

consolidated financial statements, and it is likely that investors will lose all or part of their investment. If we seek additional financing to fund our business

activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us

on commercially reasonable terms or at all.

S-10

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein, contain and

incorporate "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. These statements include statements made regarding our commercialization strategy, future operations, cash requirements and liquidity, capital

requirements, and other statements on our business plans and strategy, financial position, and market trends. In some cases, you can identify forward-looking statements by terms such as "may,"

"might," "will," "should," "believe," "plan," "intend," "anticipate," "target," "estimate," "expect," and other similar expressions. These forward-looking statements are subject to risks and

uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements, including factors such as our ability to raise

substantial additional capital to finance our planned operations and to continue as a going concern; our ability to execute our strategy and business plan; our ability to obtain regulatory approvals

for our products, including the Neuro-Spinal Scaffold™; our ability to successfully commercialize our current and future product candidates,

including the Neuro-Spinal Scaffold; the progress and timing of our development programs; market acceptance of our products; our ability to retain

management and other key personnel; our ability to promote, manufacture, and sell our products, either directly or through collaborative and other arrangements with third parties; and other factors

detailed under "Risk Factors" in this prospectus supplement, our most recent Annual Report on Form 10-K. These forward-looking statements are only predictions, are uncertain, and involve

substantial known and unknown risks, uncertainties, and other factors which may cause our actual results, levels of activity, or performance to be materially different from any future results, levels

of activity, or performance expressed or implied by these forward-looking statements. Such factors include, among others, the following:

-

•

-

our limited operating history and history of net losses;

-

•

-

our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern;

-

•

-

our ability to complete the INSPIRE 2.0 Study to support our existing Humanitarian Device Exemption application;

-

•

-

our ability to execute our strategy and business plan;

-

•

-

our ability to obtain regulatory approvals for our current and future product candidates, including our Neuro-Spinal

Scaffold implant;

-

•

-

our ability to successfully commercialize our current and future product candidates, including our Neuro-Spinal

Scaffold implant;

-

•

-

the impact of the COVID-19 economy on our business;

-

•

-

the progress and timing of our current and future development programs;

-

•

-

our ability to successfully open, enroll and complete clinical trials and obtain and maintain regulatory approval of our current and future

product candidates;

-

•

-

our ability to protect and maintain our intellectual property and licensing arrangements;

-

•

-

our reliance on third parties to conduct testing and clinical trials;

-

•

-

market acceptance and adoption of our current and future technology and products;

S-11

Table of Contents

-

•

-

our ability to promote, manufacture and sell our current and future products, either directly or through collaborative and other arrangements

with third parties; and

-

•

-

our ability to attract and retain key personnel.

We

cannot guarantee future results, levels of activity, or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the respective

dates as of which they were made. You are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are referenced in the

section of this prospectus

supplement entitled "Risk Factors." You should also carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC, specifically

our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances, or to reflect the

occurrence of unanticipated events.

S-12

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds from this offering and the concurrent private placement will be approximately $2.6 million after

deducting the placement agent fees and estimated offering expenses payable by us.

We

intend to use the net proceeds from this offering for working capital, business development activities, and general corporate purposes. We cannot predict with certainty all of the

particular uses for the net proceeds to be received upon the completion of this offering. Accordingly, our management will have broad discretion and flexibility in applying the net proceeds from the

sale of securities sold pursuant to this prospectus supplement. Pending the uses described above, we intend to invest the net proceeds from this offering in a variety of capital preservation

investments, including short-term, investment-grade and interest-bearing instruments.

S-13

Table of Contents

DIVIDEND POLICY

We have never declared or paid cash dividends. We do not intend to pay cash dividends on our common stock for the foreseeable future, but

currently intend to retain any future earnings to fund the development and growth of our business. The payment of cash dividends, if any, on our common stock, will rest solely within the discretion of

our board of directors and will depend, among other things, upon our earnings, capital requirements, financial condition, and other relevant factors.

S-14

Table of Contents

PRIVATE PLACEMENT OF WARRANTS

Concurrently with the closing of the sale of Common Stock in this offering, we also expect to issue and sell to the investors Warrants to

purchase an aggregate of up to 1,715,240 of shares of our Common Stock at an initial exercise price equal to $1.62 per share.

The

Warrants and the shares of Common Stock issuable upon the exercise of the Warrants are not being registered under the Securities Act, are not being offered pursuant to this

prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated

thereunder. Accordingly, the purchaser may only sell shares of Common Stock issued upon exercise of the Warrants pursuant to an effective registration statement under the Securities Act covering the

resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Exercisability. The Warrants are immediately exercisable, and at any time thereafter up to the five and one-half year anniversary of

the initial

exercise date. The Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement

registering the issuance of the Common Stock underlying the Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the

Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of Common Stock purchased upon such exercise. If at the time of exercise

there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of the Common Stock underlying the Warrants, then the Warrants may also

be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of Common Stock determined according to the

formula set forth in the Warrant.

Exercise Limitation. A holder will not have the right to exercise any portion of the Warrant if the holder (together with its

affiliates) would

beneficially own in excess of 4.99% (or 9.99% upon the request of the investor) of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage

ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the

61st day after such election.

Exercise Price. The Warrants will have an exercise price of $1.62 per share. The exercise price is subject to appropriate adjustment in

the event of

certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash,

stock or other property to our stockholders.

Transferability. Subject to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent.

Trading Market. There is no established trading market for the Warrants being issued in the concurrent private placement, and we do not

expect a

market to develop. We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of

the Warrants will be limited.

Fundamental Transactions. In the event of a fundamental transaction, as described in the Warrants and generally including any

reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into

another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common

stock, the holders of the Warrants will be entitled to

S-15

Table of Contents

receive

upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Warrants immediately prior to such

fundamental transaction. In addition, in the event of a fundamental transaction which is approved by our Board, the holders of the Warrants have the right to require us or a successor entity to redeem

the Warrant for cash in the amount of the Black-Scholes value of the unexercised portion of the Warrant on the date of the consummation of the fundamental transaction. In the event of a fundamental

transaction which is not approved by our Board, the holders of the Warrants have the right to require us or a successor entity to redeem the Warrant for the consideration paid in the fundamental

transaction in the amount of the Black Scholes value of the unexercised portion of the Warrant on the date of the consummation of the fundamental transaction.

Rights as a Shareholder. Except as otherwise provided in the Warrants or by virtue of such holder's ownership of our Common Stock, the

holder of a

Warrant does not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the Warrant.

S-16

Table of Contents

DESCRIPTION OF SECURITIES WE ARE OFFERING

Common Stock

We have authorized 16,666,667 shares of capital stock, par value $0.00001 per share, all of which are shares of common stock. As of

April 14, 2020, there were 3,132,130 shares of common stock issued and outstanding. The authorized and unissued shares of common stock are available for issuance without further action by our

stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of our stockholders is so required, our board

of directors does not intend to seek stockholder approval for the issuance and sale of our common stock. All shares of common stock will, when issued, be duly authorized, fully paid and

non-assessable. Accordingly, the full price for the outstanding shares of common stock will have been paid at issuance and any holder of our common stock will not be later required to pay us any

additional money for such common stock.

The

holders of our common stock are entitled to one vote per share. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of

directors, by a plurality) of the votes entitled to be cast by all shares of common stock that are present in person or represented by proxy. Additionally, any alteration, amendment or appeal of any

provision of our bylaws would require the affirmative vote of the holders of at least 80% of the voting power of our then outstanding shares entitled to vote, voting together as a single class. Except

as otherwise provided by law, amendments to the articles of incorporation generally must be approved by a majority of the votes entitled to be cast by all outstanding shares of common stock. Our

articles of incorporation do not provide for cumulative voting in the election of directors. Our directors are divided into three classes. At each annual meeting of stockholders, directors elected to

succeed those directors whose terms expire are elected for a term of office to expire at the third succeeding annual meeting of stockholders after their election. The holders of our common stock are

entitled to receive ratably such dividends, if any, as may be declared by our board of directors out of legally available funds; however, the current policy of our board of directors is to retain

earnings, if any, for operations and growth. Upon liquidation, dissolution or winding-up, the holders of our common stock are entitled to share ratably in all assets that are legally available for

distribution after payment of our liabilities. The holders of our common stock have no preemptive, subscription, redemption or conversion rights.

The

foregoing description summarizes important terms of our capital stock, but is not complete. For the complete terms of our common stock, please refer to our articles of incorporation,

as amended, and our amended and restated bylaws, as may be amended from time to time.

The

transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company. Our common stock is listed on the Nasdaq Capital Market under the symbol

"NVIV."

S-17

Table of Contents

PLAN OF DISTRIBUTION

We have engaged H.C. Wainwright & Co., LLC, which we refer to in this prospectus supplement as H.C. Wainwright or the

placement agent, to act as our exclusive placement agent to solicit offers to purchase the securities offered by this prospectus supplement. H.C. Wainwright is not purchasing or selling any

securities, nor are they required to arrange for the purchase and sale of any specific number or dollar amount of securities, other than to use their reasonable best efforts to arrange for the sale of

the securities by us. Therefore, we may not sell the entire amount of the securities being offered. There is no minimum amount of proceeds that is a condition to closing of this offering. We will

enter into securities purchase agreements directly with institutional investors that purchase our securities in this offering. H.C. Wainwright may engage one or more sub-placement agents or selected

dealers to assist with the offering.

Fees and Expenses

The following table show the per share and total placement agent fees we will pay in connection with the sale of the securities in this

offering, assuming the purchase of all of the securities we are offering.

|

|

|

|

|

|

|

Per share placement agent cash fees

|

|

$

|

0.13125

|

|

|

Total placement agent cash fees

|

|

$

|

225,125.25

|

|

We

have agreed to pay the placement agent a total cash fee equal to 7.5% of the gross proceeds of this offering and a management fee equal to 1% of the gross proceeds raised in this

offering. We will also pay the placement agent a non-accountable expense allowance of $25,000 and will reimburse the placement agent's legal fees and clearing expenses in an aggregate amount of up to

$60,000. We estimate the total offering expenses of this offering that will be payable by us, excluding the placement agent fees and expenses, will be approximately $0.1 million. After

deducting the placement agent fees and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $2.6 million.

Placement Agent Warrants

We have agreed to grant compensation warrants to H.C. Wainwright, or its designees, (the "Placement Agent Warrants") to purchase a number of

shares of our common stock equal to 6.5% of the aggregate number of shares of common stock sold to the investors in this offering. The Placement Agent Warrants will have an exercise price of $2.1875

and will terminate on April 15, 2025. Pursuant to FINRA Rule 5110(g), the Placement Agent Warrants and any shares issued upon exercise of the Placement Agent Warrants will not be sold,

transferred, assigned, pledged, or hypothecated, or be the subject of any hedging, short sale, derivative, put, or call transaction that would result in the effective economic disposition of the

securities by any person for a period of 180 days immediately following the date of effectiveness or commencement of sales of this offering, except the transfer of any

security:

-

•

-

by operation of law or by reason of our reorganization;

-

•

-

to any FINRA member firm participating in the offering and the officers or partners thereof, if all securities so transferred remain subject to

the lock-up restriction set forth above for the remainder of the time period;

-

•

-

if the aggregate amount of our securities held by the placement agent or related persons do not exceed 1% of the securities being offered;

-

•

-

that is beneficially owned on a pro rata basis by all equity owners of an investment fund, provided that no participating member manages or

otherwise directs investments by the fund

S-18

Table of Contents

and

the exercise or conversion of any security, if all securities remain subject to the lock-up restriction set forth above for the remainder of the time period.

Right of First Refusal

In addition, we have granted a right of first refusal to the placement agent pursuant to which it has the right to act as the exclusive advisor,

manager or underwriter or agent, as applicable, if we or our subsidiaries sell or acquire a business, finance any indebtedness using an agent, or raise capital through a public or private offering of

equity or debt securities at any time prior to the 12 month anniversary of the date of this prospectus supplement.

Other Relationships

The placement agent may, from time to time, engage in transactions with or perform services for us in the ordinary course of its business and

may continue to receive compensation from us for such services.

Determination of Offering Price

The public offering price of the securities we are offering was negotiated between us and the investors, in consultation with the placement

agent based on the trading of our common stock prior to the offering, among other things. Other factors considered in determining the public offering price of the securities we are offering include

the history and prospects of our company, the stage of development of our business, our business plans for the future and the extent to which they have been implemented, an assessment of our

management, general conditions of the securities markets at the time of the offering and such other factors as were deemed relevant.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company.

Nasdaq Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol "NVIV."

Indemnification

We have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act, or to contribute to

payments the placement agent may be required to make with respect to any of these liabilities.

Regulation M

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act and any fees received

by it and any profit realized on the sale of the securities by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. The placement agent

will be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These

rules and regulations may limit the timing of purchases and sales of our securities by the placement agent. Under these rules and regulations, the placement agent may not (i) engage in any

stabilization activity in connection with our securities and (ii) bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as

permitted under the Exchange Act, until they have completed their participation in the distribution.

S-19

Table of Contents

LEGAL MATTERS

The validity of the securities offered by this prospectus supplement and the accompanying prospectus will be passed upon for us by Ballard

Spahr LLP, Las Vegas, Nevada, and certain other legal matters will be passed upon for us by Wilmer Cutler Pickering Hale and Dorr LLP, Boston, Massachusetts. Ellenoff Grossman &

Schole LLP, New York, New York, has acted as counsel for the placement agent in connection with certain legal matters related to this offering.

EXPERTS

The consolidated financial statements of InVivo Therapeutics Holdings Corp. and subsidiary as of December 31, 2019 and 2018 and for the

years then ended, incorporated in this prospectus supplement and the accompanying prospectus by reference from the InVivo Therapeutics Holdings Corp.'s Annual Report on Form 10-K for the year

ended December 31, 2019 have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon (which report expresses an unqualified

opinion and includes an explanatory paragraph relating to InVivo Therapeutics Holdings Corp.'s ability to continue as a going concern), incorporated herein by reference, and have been incorporated in

this prospectus supplement and the accompanying prospectus in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to you on the

SEC's Internet site at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.invivotherapeutics.com.

The information on our Internet website is not incorporated by reference in this prospectus or any prospectus supplement.

This

prospectus supplement is part of a registration statement that we filed with the SEC. This prospectus supplement does not contain all of the information included in the registration

statement, including certain exhibits and schedules. You should review the information and exhibits in the registration statement for further information about us and the securities we are offering.

Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are

qualified by reference to these filings. You should review the complete document to evaluate these statements. You can obtain a copy of the registration statement and exhibits from the SEC's Internet

site.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference into this prospectus supplement and the accompanying prospectus information and reports that we

file with the SEC. This means that we can disclose important information to you by referring to other documents that contain that information. Any information that we incorporate by reference is

considered part of this prospectus supplement and the accompanying prospectus. The documents and reports that we list below are incorporated by reference into this prospectus supplement and the

accompanying prospectus, other than any portion of any such documents that are not deemed "filed" under the Exchange Act in accordance with the Exchange Act and applicable SEC rules.

In

addition, all documents and reports which we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and prior to

the termination of the offering made hereby are incorporated by reference in this prospectus supplement and the accompanying prospectus as of the respective filing dates of these documents and

reports.

S-20

Table of Contents

We

have filed the following documents with the SEC. These documents are incorporated in this prospectus supplement and the accompanying prospectus by reference as of their respective

dates of filing:

-

(1)

-

Our Annual Report on Form 10-K for the fiscal

year ended December 31, 2019, filed with the SEC on February 20, 2020;

-

(2)

-

Our

Current Reports on Form 8-K filed with the SEC on

March 2, 2020,

March 11, 2020 and

April 16, 2020, and

our Current Report on Form 8-K/A filed with the SEC on February 24,

2020; and

-

(3)

-

The description of our common stock contained in our

Registration Statement on Form 8-A filed on April 15, 2015, including any amendments or reports filed for the purpose of updating such description.

You

may request a copy of these documents, which will be provided to you at no cost, by writing or telephoning us at:

InVivo

Therapeutics Holdings Corp.

One Kendall Square, Suite B14402

Cambridge, Massachusetts 02139

Attn: Investor Relations

(617) 863-5500

Statements

contained in documents that we file with the SEC and that are incorporated by reference in this prospectus supplement or the accompanying prospectus will automatically update

and supersede information contained in this prospectus supplement and the accompanying prospectus, including information in previously filed documents or reports that have been incorporated by

reference in this prospectus supplement or the accompanying prospectus, to the extent the new information differs from or is inconsistent with the old information. Any statement so modified or

superseded will not be deemed to be a part of this supplement or the accompanying prospectus, except as so modified or superseded. Because information that we later file with the SEC will update and

supersede previously incorporated information, you should look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus supplement or the

accompanying prospectus or in any documents previously incorporated by reference have been modified or superseded.

S-21

Table of Contents

PROSPECTUS

INVIVO THERAPEUTICS HOLDINGS CORP.

$20,000,000

Common Stock

Warrants

Units

This prospectus relates to common stock, warrants and units that we may sell from time to time in one or more offerings up to a total dollar

amount of $20,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any

supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

Our

common stock is listed on The Nasdaq Capital Market under the symbol "NVIV." On October 25, 2019, the last sales price of our common stock as reported on The Nasdaq Capital

Market was $0.44 per share.

These

securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See "Plan of

Distribution" in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or

dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus

supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

As

of September 15, 2019, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $5,766,788, which was calculated based on 9,301,271

shares of outstanding common stock held by non-affiliates and a price per share of $0.62. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell, pursuant to the

registration statement of which this prospectus forms a part, securities in a public primary offering with a value exceeding one-third of the aggregate market value of our common stock held by

non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million. During the 12 calendar months

prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in these securities involves certain risks. See "Risk Factors" included in any accompanying prospectus supplement and in the documents

incorporated by reference in

this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 14, 2019.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a "shelf"

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of

$20,000,000.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific

information about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update or change information contained in this prospectus. You should read

both this prospectus and any prospectus supplement together with the additional information described under the heading "Where You Can Find More Information" on page 3 of this prospectus

carefully before making an investment decision.

You

should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have not authorized any other person to

provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any

jurisdiction where the offer or sale is not permitted.

You

should not assume that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date on the front cover of this

prospectus or the applicable prospectus supplement, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. Our business, financial condition, results of operations and

prospects may have changed since such dates.

Unless

the context otherwise requires, the terms "InVivo," "the Company," "our company," "we," "us," "our" and similar names refer collectively to InVivo Therapeutics Holdings Corp. and

its subsidiaries.

1

Table of Contents

ABOUT INVIVO THERAPEUTICS HOLDINGS CORP.

We

are a research and clinical-stage biomaterials and biotechnology company with a focus on treatment of spinal cord injuries, or SCIs. Our mission is to redefine the life of the SCI

patient, and we seek to develop treatment options intended to provide meaningful improvement in patient outcomes following SCI. Our approach to treating acute SCIs is based on our investigational

Neuro-Spinal Scaffold™ implant, a bioresorbable polymer scaffold that is designed for implantation at the site of injury within a spinal cord and is intended to treat acute SCI. The

Neuro-Spinal Scaffold implant incorporates intellectual property licensed under an exclusive, worldwide license from Boston Children's Hospital, or BCH, and the Massachusetts Institute of Technology,

or MIT. We also plan to evaluate other technologies and therapeutics that may be complementary to our development of the Neuro-Spinal Scaffold implant or offer the potential to bring us closer to our

goal of redefining the life of the SCI patient.

InVivo

Therapeutics Corporation was incorporated on November 28, 2005 under the laws of the State of Delaware and on October 26, 2010 completed a reverse merger transaction

with and became a wholly-owned subsidiary of InVivo Therapeutics Holdings Corporation, a company incorporated under the laws of the State of Nevada.

Our

principal executive offices are located at One Kendall Square, Suite B14402, Cambridge, Massachusetts 02139, and our telephone number is (617) 863-5500. Our worldwide web

address is www.invivotherapeutics.com. The information on our web site is not incorporated by reference into this prospectus and should not be considered to be part of this prospectus.

2

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to you on the

SEC's Internet site at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.invivotherapeutics.com.

The information on our Internet website is not incorporated by reference in this prospectus or any prospectus supplement.

This

prospectus is part of a registration statement that we filed with the SEC. This prospectus does not contain all of the information included in the registration statement, including

certain exhibits and schedules. You should review the information and exhibits in the registration statement for further information about us and the securities we are offering. Statements in this

prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to

these filings. You should review the complete document to evaluate these statements. You can obtain a copy of the registration statement and exhibits from the SEC's Internet site.

3

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This

prospectus and each prospectus supplement contains and incorporates "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended

(the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements include statements made regarding our commercialization

strategy, future operations, cash requirements and liquidity, capital requirements, and other statements on our business plans and strategy, financial position, and market trends. In some cases, you

can identify forward-looking statements by terms such as "may," "might," "will," "should," "believe," "plan," "intend," "anticipate," "target," "estimate," "expect," and other similar expressions.

These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking

statements, including factors such as our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern; our ability to execute our strategy and

business plan; our ability to obtain regulatory approvals for our products, including the Neuro-Spinal Scaffold™; our ability to

successfully commercialize our current and future product candidates, including the Neuro-Spinal Scaffold; the progress and timing of our development

programs; market acceptance of our products; our ability to retain management and other key personnel; our ability to promote, manufacture, and sell our products, either directly or through

collaborative and other arrangements with third parties; and other factors detailed under "Risk Factors" in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on

Form 10-Q. These forward looking statements are only predictions, are uncertain, and involve substantial known and unknown risks, uncertainties, and other factors which may cause our actual

results, levels of activity, or performance to be materially different from any future results, levels of activity, or performance expressed or implied by these forward looking statements. Such

factors include, among others, the following:

-

•

-

our limited operating history and history of net losses;

-

•

-

our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern;

-

•

-

our ability to complete the INSPIRE 2.0 Study to support our existing Humanitarian Device Exemption application;