Integra LifeSciences Holdings Corporation (NASDAQ: IART), a leading

global medical technology company, today reported financial results

for the third quarter ending September 30, 2023.

Third Quarter 2023

Highlights

- Third quarter revenues of $382.4 million declined 0.7% on a

reported basis and declined 0.4% on an organic basis compared to

the prior year and increased 7.1% on an organic basis excluding

Boston

- Third quarter GAAP earnings per diluted share of $0.24,

compared to $0.60 in the prior year; adjusted earnings per diluted

share of $0.76, compared to $0.86 in the prior year

- Successfully completed all interim external inspections in

preparation for the Boston manufacturing facility restart and

remain on track to committed timelines

- Relaunched CereLink® ICP Monitor in select international

markets and submitted a 510(k) premarket notification in the

U.S.

- Completed $125 million accelerated share repurchase initiated

in the third quarter

- Updating full-year 2023 revenue and adjusted earnings per share

guidance with a range of $1.541 billion to $1.547 billion and $3.10

to $3.14 respectively, which reflects the impact of third quarter

Boston recall returns, strong organic growth of the business

excluding Boston, strengthening U.S. dollar and tax

favorability

"Although the Boston returns weighed further on

our third quarter results, we are on track to restart the Boston

facility by the end of the year, and we also met two significant

CereLink milestones with the relaunch in international markets and

submission for regulatory approval in the U.S.," said Jan De Witte,

Integra LifeSciences' president and chief executive officer. "At

the same time, our strong organic growth performance in the Codman

Specialty Surgical and Tissue Technologies businesses, excluding

Boston, plus advances across our product pipeline, give us

confidence in our long-range growth

commitments."

Third Quarter 2023 Consolidated

Performance

Total reported revenues of $382.4 million

declined 0.7% on a reported basis and declined 0.4% on an organic

basis compared to the prior year.

The Company reported GAAP gross margin of 57.1%,

compared to 61.5% in the third quarter of 2022. Adjusted gross

margin was 64.6%, compared to 66.7% in the prior year.

Adjusted EBITDA for the third quarter of 2023

was $88.1 million, or 23.0% of revenue, compared to $105.3 million,

or 27.3% of revenue, in the prior year.

The Company reported GAAP net income of $19.5

million, or $0.24 per diluted share, in the third quarter of 2023,

compared to a GAAP net income of $49.9 million, or $0.60 per

diluted share, in the prior year.

Adjusted net income for the third quarter of

2023 was $60.5 million, or $0.76 per diluted share, compared to

$71.7 million or $0.86 per diluted share, in the prior year.

Third Quarter 2023

Segment Performance

Codman Specialty Surgical

(~70% of Revenues)

- Total revenues were $268.2 million, representing reported

growth of 7.4% and organic growth of 7.4% compared to the third

quarter of 2022, attributable to low-double digit growth in CSF

management and Neuro Monitoring driven by Certas® Plus valves,

BactiSeal® catheters and ICP microsensors; high-single-digit growth

in Dural Access and Repair driven by DuraGen® DuraSeal® and

Mayfield®; low single-digit decline in Advanced Energy due to

timing of CUSA® capital orders; and mid single-digit growth in

Instruments.

Tissue Technologies

(~30% of Revenues)

- Total revenues were $114.2 million, representing reported

decline of 15.6% and organic decline of 15.1% compared to the third

quarter of 2022, due to the impact of the lost revenue and increase

in the return provision related to the Boston product recall which

was partially offset by double digit growth from MicroMatrix®,

Cytal®, Gentrix® and amniotics.

- Tissue Technologies organic growth excluding Boston products

was 6.7%.

Key Products and Business

Highlights

- Boston Restart

- Project team driving progress on Boston remediation plan with

external inspections confirming quality of execution

- Expect to restart manufacturing in Boston by end of Q4’23 and

resume commercial distribution in mid-to late Q2’24

- Advancing our portfolio

- Relaunched CereLink in select international markets and

submitted a 510(k) premarket notification to the U.S. Food and Drug

Administration for CereLink.

- Submitted 510(k) premarket notification for next generation

Aurora® 8mm Surgiscope

- Continued international expansion of CUSA platform with the

launch of Clarity Stage 3, Laparoscopic tip and Single Sided Bone

Tip in Saudi Arabia

- Launched DuraGen Plus in China

- Completed international registrations of DuraGen, DuraSeal,

Mayfield, Duo LED lighting, electrosurgery and nerve products

primarily in LATAM and EMEA

- Extended the Urinary Bladder Matrix platform by obtaining

510(k) clearance for MicroMatrix Flex

- Progressed In-China-for-China strategy by beginning buildout of

leased manufacturing facility

- Issued 2022 ESG report

- Further strengthened executive leadership team with the

appointment of Chantal Veillon as chief human resources

officer

Balance Sheet, Cash Flow and Capital

Allocation

The Company generated cash flow from operations

of $26.8 million in the quarter. Total balance sheet debt and net

debt at the end of the quarter were $1.52 billion and $1.24

billion, respectively, and the consolidated total leverage ratio

was 3.0x.

As of quarter end, the Company had total

liquidity of approximately $1.48 billion, including $273.7 million

in cash and the remainder available under its revolving credit

facility.

2023 Outlook

For the full year 2023, the Company is updating

its revenue and adjusted EPS expectations to $1.541 to $1.547

billion and $3.10 to $3.14, respectively. The revenue range

represents reported growth of -1.1% to -0.7%, with organic growth

of 0.1% to 0.5%, reflecting the impact of higher-than-expected

Boston recall returns, strong organic growth excluding Boston, the

strength of the U.S. dollar, and an updated tax rate.

For the fourth quarter 2023, the Company expects

reported revenues in the range of $397 million to $403 million,

representing reported growth of -0.4% to +1.1% and organic growth

of -0.8% to +0.7%. Adjusted earnings per diluted share are expected

to be in the range of $0.89 to $0.93, including the impact of the

Boston recall, the strength of the U.S. dollar, and an updated tax

rate.

The Company’s guidance for the fourth quarter

and full-year organic sales growth excludes acquisitions and

divestitures, the effects of foreign currency and the

year-over-year change in revenue from discontinued products.

Organic growth excludes sales from the divestiture of the Company’s

traditional wound care (TWC) business as of September 1, 2022, and

sales from the acquisition of Surgical Innovation Associates, Inc.

(SIA) through December 1, 2023. Adjusted earnings per share

guidance reflects the impacts of the divestiture of the TWC

business, the SIA acquisition, and foreign currency.

Conference Call and Presentation

Available Online

Integra has scheduled a conference call for 8:30

a.m. ET on Wednesday, October 25, 2023, to discuss third quarter

2023 financial results and forward-looking financial guidance. The

conference call will be hosted by Integra's senior management team

and will be open to all listeners. Additional forward-looking

information may be discussed in a question-and-answer session

following the call. Integra's management team will reference a

presentation during the conference call, which can be found on the

Investor section of the website at investor.integralife.com.

A live webcast will be available on the

Investors section of the Company’s website at

investor.integralife.com. For those planning to participate on the

call, register here to receive dial-in details and an individual

pin. While not required, it is recommended to join 10 minutes prior

to the event’s start. A webcast replay of the conference call will

be available on the Investors section of the Company’s website

following the call.

About Integra

At Integra LifeSciences, we are driven by our

purpose of restoring patients’ lives. We innovate treatment

pathways to advance patient outcomes and set new standards of

surgical, neurologic and regenerative care. We offer a

comprehensive portfolio of high quality, leadership brands that

include AmnioExcel®, Aurora®, Bactiseal®, BioD™, CerebroFlo®,

CereLink® Certas® Plus, Codman®, CUSA®, Cytal®, DuraGen®,

DuraSeal®, DuraSorb®, Gentrix®, ICP Express®, Integra®, Licox®,

MAYFIELD®, MediHoney®, MicroFrance®, MicroMatrix®, NeuraGen®,

NeuraWrap™, PriMatrix®, SurgiMend®, TCC-EZ® and VersaTru®. For the

latest news and information about Integra and its products, please

visit www.integralife.com.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainties and reflect

the Company's judgment as of the date of this release. All

statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements. Some of

these forward-looking statements may contain words like “will,”

“believe,” “may,” “could,” “would,” “might,” “possible,” “should,”

“expect,” “intend,” "forecast," "guidance," “plan,” “anticipate,”

"target," or “continue,” the negative of these words, other terms

of similar meaning or they may use future dates. Forward-looking

statements contained in this news release include, but are not

limited to, statements concerning future financial performance,

including projections for revenues, expected revenue growth (both

reported and organic), GAAP and adjusted net income, GAAP and

adjusted earnings per diluted share, non-GAAP adjustments such as

divestiture, acquisition and integration-related charges,

intangible asset amortization, structural optimization charges, EU

Medical Device Regulation-related charges, charges related to the

voluntary global recall of all products manufactured at the

Company’s facility in Boston, Massachusetts, and income tax expense

(benefit) related to non-GAAP adjustments and other items,

expectations and plans with respect to strategic initiatives,

product development and regulatory approvals, including the status

of the Company’s 510(k) premarket notification for Cerelink, and

expectations concerning the resumption of manufacturing at the

Company’s Boston, Massachusetts facility. It is important to note

that the Company’s goals and expectations are not predictions of

actual performance. Such forward-looking statements involve risks

and uncertainties that could cause actual results to differ

materially from predicted or expected results. Such risks and

uncertainties include, but are not limited, to the following: the

ongoing and possible future effects of global challenges, including

macroeconomic uncertainties, inflation, supply chain disruptions,

trade regulation and tariffs, other economic disruptions and U.S.

and global recession concerns, on the Company’s customers and on

the Company’s business, financial condition, results of operations

and cash flows; the Company's ability to execute its operating plan

effectively; the Company’s ability to successfully integrate

acquired businesses; the Company’s ability to achieve sales growth

in a timely fashion; the Company's ability to manufacture and ship

sufficient quantities of its products to meet its customers'

demands; the ability of third-party suppliers to supply us with raw

materials and finished products; global macroeconomic and political

conditions, including the war in Ukraine and the conflict in Israel

and Gaza; the Company's ability to manage its direct sales channels

effectively; the sales performance of third-party distributors on

whom the Company relies to generate revenue for certain products

and geographic regions; the Company's ability to access and

maintain relationships with customers of acquired entities and

businesses; physicians' willingness to adopt and third-party

payors' willingness to provide or maintain reimbursement for the

Company's recently launched, planned and existing products;

initiatives launched by the Company's competitors; downward pricing

pressures from customers; the Company's ability to secure

regulatory approval for products in development; the Company's

ability to remediate quality systems violations; fluctuations in

hospitals' spending for capital equipment; the Company's ability to

comply with regulations regarding products of human origin and

products containing materials derived from animal source;

difficulties in controlling expenses, including costs to procure

and manufacture our products; the impact of changes in management

or staff levels; the impact of goodwill and intangible asset

impairment charges if future operating results of acquired

businesses are significantly less than the results anticipated at

the time of the acquisitions, the Company's ability to leverage its

existing selling organizations and administrative infrastructure;

the Company's ability to increase product sales and gross margins,

and control non-product costs; the Company’s ability to achieve

anticipated growth rates, margins and scale and execute its

strategy generally; the amount and timing of divestiture,

acquisition and integration-related costs; the geographic

distribution of where the Company generates its taxable income; new

U.S. and foreign government laws and regulations, and changes in

existing laws, regulations and enforcement guidance, which affect

areas of our operations including, but not limited to, those

affecting the health care industry, including the EU Medical

Devices Regulation; the scope, duration and effect of additional

U.S. and international governmental, regulatory, fiscal, monetary

and public health responses to the COVID-19 pandemic and any future

public health crises; fluctuations in foreign currency exchange

rates; the amount of our bank borrowings outstanding and other

factors influencing liquidity; potential negative

impacts resulting from environmental, social and governance

matters; and the economic, competitive, governmental,

technological, and other risk factors and uncertainties identified

under the heading “Risk Factors” included in Item 1A of Integra's

Annual Report on Form 10-K for the year ended December 31, 2022 and

information contained in subsequent filings with the Securities and

Exchange Commission.

These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events, or otherwise.

Discussion of Adjusted Financial

MeasuresIn addition to our GAAP results, we provide

certain non-GAAP measures, including organic revenues, organic

revenues excluding Boston, adjusted earnings before interest,

taxes, depreciation and amortization (EBITDA), adjusted net income,

adjusted earnings per diluted share, free cash flow, adjusted free

cash flow conversion, and net debt. Organic revenues consist

of total revenues excluding the effects of currency exchange rates,

revenues from current-period acquisitions and product divestitures

and discontinuances. Organic revenues excluding Boston consist of

total revenues, excluding (i) the effects of currency exchange

rates, revenues from current-period acquisitions and product

divestitures and discontinuances and (ii) revenues associated with

Boston produced products including sales reported prior to the

recall and the impact of sales return provisions recorded. Adjusted

EBITDA consists of GAAP net income excluding: (i) depreciation and

amortization; (ii) other income (expense); (iii) interest income

and expense; (iv) income tax expense (benefit); and (v) those

operating expenses also excluded from adjusted net

income. The measure of adjusted net income consists of

GAAP net income, excluding: (i) structural optimization charges;

(ii) divestiture, acquisition and integration-related charges;

(iii) EU Medical Device Regulation-related charges; (iv) charges

related to the voluntary global recall of products manufactured at

the Company’s Boston, Massachusetts facility; (v) intangible asset

amortization expense; and (vi) income tax impact from adjustments.

The adjusted earnings per diluted share measure is calculated by

dividing adjusted net income attributable to diluted shares by

diluted weighted average shares outstanding. The

measure of free cash flow consists of GAAP net cash provided by

operating activities less purchases of property and equipment. The

adjusted free cash flow conversion measure is calculated by

dividing free cash flow by adjusted net income. The measure of net

debt consists of GAAP total debt (excluding deferred financing

costs) less cash and cash equivalents.

Reconciliations of GAAP revenues to organic

revenues, GAAP revenues to organic revenues excluding Boston, GAAP

net income to adjusted EBITDA, and adjusted net income, GAAP total

debt to net debt and GAAP earnings per diluted share to adjusted

earnings per diluted share all for the quarter ended September 30,

2023 and 2022, and the free cash flow and adjusted free cash flow

conversion for the quarter ended September 30, 2023 and 2022,

appear in the financial tables in this release.

The Company believes that the presentation of

organic revenues and the other non-GAAP measures provide important

supplemental information to management and investors regarding

financial and business trends relating to the Company's financial

condition and results of operations. For further

information regarding why Integra believes that these non-GAAP

financial measures provide useful information to investors, the

specific manner in which management uses these measures, and some

of the limitations associated with the use of these measures,

please refer to the Company's Current Report on Form 8-K regarding

this earnings press release filed today with the Securities and

Exchange Commission. This Current Report on Form 8-K is available

on the SEC's website at www.sec.gov or on our website at

www.integralife.com.

Investor Relations

Contact:

Chris Ward(609) 772-7736chris.ward@integralife.com

Media Contact:

Laurene Isip(609) 208-8121laurene.isip@integralife.com

INTEGRA LIFESCIENCES HOLDINGS

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

(In thousands, except per share amounts)

| |

Three Months Ended Sept. 30, |

| |

2023 |

|

2022 |

|

Total revenues, net |

$ |

382,421 |

|

|

$ |

385,191 |

|

| |

|

|

|

| Costs and expenses: |

|

|

|

| Cost of goods sold |

|

164,076 |

|

|

|

148,445 |

|

| Research and development |

|

26,596 |

|

|

|

24,736 |

|

| Selling, general and

administrative |

|

161,948 |

|

|

|

143,820 |

|

| Intangible asset

amortization |

|

3,208 |

|

|

|

3,141 |

|

| Total costs and expenses |

|

355,828 |

|

|

|

320,142 |

|

| |

|

|

|

| Operating income |

|

26,593 |

|

|

|

65,049 |

|

| |

|

|

|

| Interest income |

|

4,607 |

|

|

|

3,264 |

|

| Interest expense |

|

(13,062 |

) |

|

|

(12,809 |

) |

| Gain from sale of

business |

|

— |

|

|

|

644 |

|

| Other income, net |

|

471 |

|

|

|

2,648 |

|

| Income before income

taxes |

|

18,609 |

|

|

|

58,796 |

|

| Income tax expense

(benefit) |

|

(888 |

) |

|

|

8,881 |

|

| Net income |

$ |

19,497 |

|

|

$ |

49,915 |

|

| |

|

|

|

| Net income per share: |

|

|

|

| Diluted net income per

share |

$ |

0.24 |

|

|

$ |

0.60 |

|

| |

|

|

|

| Weighted average common shares

outstanding for diluted net income per share |

|

79,811 |

|

|

|

83,399 |

|

The following table presents revenues

disaggregated by the major sources for the three months ended

September 30, 2023 and 2022 (amounts in thousands):

| |

Three Months Ended Sept 30, |

| |

2023 |

2022 |

Change |

|

Neurosurgery |

|

209,229 |

|

|

193,848 |

|

7.9 |

% |

| Instruments |

|

58,976 |

|

|

55,948 |

|

5.4 |

% |

| Total Codman Specialty

Surgical |

|

268,205 |

|

|

249,796 |

|

7.4 |

% |

| |

|

|

|

| Wound Reconstruction and

Care |

|

88,071 |

|

|

104,625 |

|

(15.8 |

)% |

| Private Label |

|

26,145 |

|

|

30,770 |

|

(15.0 |

)% |

| Total Tissue Technologies |

|

114,216 |

|

|

135,395 |

|

(15.6 |

)% |

| Total reported revenues |

|

382,421 |

|

|

385,191 |

|

(0.7 |

)% |

| |

|

|

|

| Impact of changes in currency

exchange rates |

|

(994 |

) |

|

0 |

|

|

| Less contribution of revenues

from acquisitions |

|

(2,934 |

) |

|

— |

|

|

| Less contribution of revenues

from divested products |

|

(13 |

) |

|

(4,556 |

) |

|

| Less contribution of revenues

from discontinued products |

|

(1,403 |

) |

|

(1,933 |

) |

|

| Total organic revenues(1) |

$ |

377,077 |

|

$ |

378,702 |

|

(0.4 |

)% |

| |

|

|

|

| Boston Revenue impact |

$ |

6,232 |

|

$ |

(20,952 |

) |

|

|

Total organic revenues(1) excl. Boston |

$ |

383,309 |

|

$ |

357,750 |

|

7.1 |

% |

(1) Organic revenues have been adjusted to

exclude foreign currency (current period), acquisitions and to

account for divested and discontinued products.

Items included in GAAP net income and location where each item

is recorded are as follows:

(In thousands)

Three Months Ended September 30, 2023

|

Item |

Total Amount |

COGS(a) |

SG&A(b) |

R&D(c) |

Amort (d) |

OI&E(e) |

Tax(f) |

|

Acquisition, divestiture and integration-related charges |

5,832 |

|

407 |

6,638 |

(1,090 |

) |

— |

(123 |

) |

— |

|

| Structural Optimization

charges |

5,893 |

|

4,011 |

1,909 |

(27 |

) |

— |

— |

|

— |

|

| EU Medical Device Regulation

charges |

13,490 |

|

1,263 |

5,661 |

6,565 |

|

— |

— |

|

— |

|

| Boston Recall |

5,636 |

|

5,542 |

94 |

— |

|

— |

— |

|

— |

|

| Intangible asset amortization

expense |

20,869 |

|

17,661 |

— |

— |

|

3,208 |

— |

|

— |

|

| Estimated income tax impact

from above adjustments and other items |

(10,677 |

) |

— |

— |

— |

|

— |

— |

|

(10,677 |

) |

| Depreciation expense |

9,670 |

|

— |

— |

— |

|

— |

— |

|

— |

|

| |

|

|

|

|

|

|

|

a) COGS - Cost of goods

soldb) SG&A - Selling, general and

administrativec) R&D - Research &

developmentd) Amort. - Intangible asset

amortizatione) OI&E - Other income &

expensef) Tax - Income tax expense (benefit)

Items included in GAAP net income and location where each item

is recorded are as follows:

(In thousands)

Three Months Ended Sept 30, 2022

|

Item |

Total Amount |

COGS(a) |

SG&A(b) |

R&D(c) |

Amort.(d) |

OI&E(e) |

Tax(f) |

|

Acquisition, divestiture and integration-related charges |

(13,841 |

) |

177 |

(12,151 |

) |

(547 |

) |

— |

(1,320 |

) |

— |

|

| Structural Optimization

charges |

10,112 |

|

2,765 |

7,356 |

|

(9 |

) |

— |

— |

|

— |

|

| EU Medical Device Regulation

charges |

13,208 |

|

1,257 |

5,672 |

|

6,279 |

|

— |

— |

|

— |

|

| Intangible asset amortization

expense |

19,192 |

|

16,051 |

— |

|

— |

|

3,141 |

— |

|

— |

|

| Estimated income tax impact

from above adjustments and other items |

(6,892 |

) |

— |

— |

|

— |

|

— |

— |

|

(6,892 |

) |

| Depreciation expense |

10,275 |

|

— |

— |

|

— |

|

— |

— |

|

— |

|

a) COGS - Cost of goods

soldb) SG&A - Selling, general and

administrativec) R&D - Research &

developmentd) Amort. - Intangible asset

amortizatione) OI&E - Other income &

expensef) Tax - Income tax expense (benefit)

RECONCILIATION OF NON-GAAP ADJUSTMENTS - GAAP NET

INCOME TO ADJUSTED EBITDA(UNAUDITED)

(In thousands)

| |

Three Months Ended Sept 30, |

| |

2023 |

|

2022 |

| |

|

|

|

|

GAAP net income |

|

19,497 |

|

|

|

49,915 |

|

| Non-GAAP adjustments: |

|

|

|

| Depreciation and intangible

asset amortization expense |

|

30,538 |

|

|

|

29,467 |

|

| Other (income) expense,

net |

|

(348 |

) |

|

|

(1,972 |

) |

| Interest expense, net |

|

8,455 |

|

|

|

9,545 |

|

| Income tax expense |

|

(888 |

) |

|

|

8,881 |

|

| Structural optimization

charges |

|

5,893 |

|

|

|

10,112 |

|

| EU Medical Device Regulation

charges |

|

13,490 |

|

|

|

13,208 |

|

| Boston Recall |

|

5,636 |

|

|

|

— |

|

| Acquisition, divestiture and

integration-related charges |

|

5,832 |

|

|

|

(13,842 |

) |

| Total of non-GAAP

adjustments |

|

68,608 |

|

|

|

55,400 |

|

| Adjusted EBITDA |

$ |

88,105 |

|

|

$ |

105,315 |

|

| |

|

|

|

RECONCILIATION OF NON-GAAP ADJUSTMENTS - GAAP NET

INCOME TO MEASURES OF ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER

SHARE(UNAUDITED)

(In thousands, except per share amounts)

| |

Three Months Ended Sept 30, |

| |

2023 |

|

2022 |

| |

|

|

|

|

GAAP net income |

|

19,497 |

|

|

|

49,915 |

|

| Non-GAAP adjustments: |

|

|

|

| Structural optimization

charges |

|

5,893 |

|

|

|

10,112 |

|

| Acquisition, divestiture and

integration-related charges(1) |

|

5,832 |

|

|

|

(13,841 |

) |

| EU Medical Device Regulation

charges |

|

13,490 |

|

|

|

13,208 |

|

| Boston Recall |

|

5,636 |

|

|

|

— |

|

| Intangible asset amortization

expense |

|

20,869 |

|

|

|

19,192 |

|

| Estimated income tax impact

from adjustments and other items |

|

(10,677 |

) |

|

|

(6,892 |

) |

| Total of non-GAAP

adjustments |

|

41,042 |

|

|

|

21,779 |

|

| Adjusted net income |

$ |

60,539 |

|

|

$ |

71,694 |

|

| |

|

|

|

| Adjusted diluted net income

per share |

$ |

0.76 |

|

|

$ |

0.86 |

|

| Weighted average common shares

outstanding for diluted net income per share |

|

79,811 |

|

|

|

83,399 |

|

| |

|

|

|

|

|

|

|

CONDENSED BALANCE SHEET DATA(UNAUDITED)

(In thousands)

| |

September 30,2023 |

|

December 31,2022 |

| |

|

|

|

|

Cash and cash equivalents |

$ |

273,732 |

|

$ |

456,661 |

| Trade accounts receivable,

net |

|

256,270 |

|

|

263,465 |

| Inventories, net |

|

366,251 |

|

|

324,583 |

| |

|

|

|

| Current and long-term

borrowing under senior credit facility |

|

859,776 |

|

|

771,274 |

| Borrowings under

securitization facility |

|

75,700 |

|

|

104,700 |

| Long-term convertible

securities |

|

569,527 |

|

|

567,341 |

| |

|

|

|

| |

|

|

|

| Stockholders' equity |

$ |

1,579,221 |

|

$ |

1,804,403 |

| |

|

|

|

| |

|

|

|

CONDENSED STATEMENT OF CASH FLOWS(UNAUDITED)

(In thousands)

| |

Nine Months Ended Sept 30, |

| |

2023 |

|

2022 |

| |

|

|

|

|

Net cash provided by operating activities |

$ |

81,205 |

|

|

$ |

179,135 |

|

| Net cash used in investing

activities |

|

(36,949 |

) |

|

|

(3,760 |

) |

| Net cash used by financing

activities |

|

(223,035 |

) |

|

|

(154,254 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(4,150 |

) |

|

|

(22,632 |

) |

| |

|

|

|

| Net decrease in cash and cash

equivalents |

$ |

(182,929 |

) |

|

$ |

(1,511 |

) |

| |

|

|

|

RECONCILIATION OF NON-GAAP ADJUSTMENTS - GAAP

OPERATING CASH FLOW TO MEASURES OF FREE CASH FLOW AND ADJUSTED FREE

CASH FLOW CONVERSION(UNAUDITED)(In thousands)

| |

Three Months Ended Sept 30, |

| |

2023 |

2022 |

|

Net cash provided by operating activities |

$ |

26,770 |

|

$ |

68,310 |

|

| |

|

|

| |

|

|

| Purchases of property and

equipment |

$ |

(13,063 |

) |

$ |

(9,157 |

) |

| Free cash flow |

|

13,707 |

|

|

59,153 |

|

| |

|

|

| Adjusted net income(1) |

$ |

60,539 |

|

$ |

71,694 |

|

| Adjusted free cash flow

conversion |

|

22.6 |

% |

|

82.5 |

% |

| |

|

|

| |

|

|

| |

Twelve Months Ended Sept 30, |

| |

2023 |

2022 |

| Net cash provided by operating

activities |

$ |

166,539 |

|

$ |

248,418 |

|

| |

|

|

| Purchases of property and

equipment |

|

(56,868 |

) |

|

(55,315 |

) |

| Free cash flow |

$ |

109,671 |

|

$ |

193,103 |

|

| |

|

|

| Adjusted net income(1) |

$ |

257,514 |

|

$ |

274,183 |

|

| Adjusted free cash flow

conversion |

|

42.6 |

% |

|

70.4 |

% |

| |

|

|

(1) Adjusted net income for quarters ended

September 30, 2023 and 2022 are reconciled above. Adjusted net

income for remaining quarters in the trailing twelve months

calculation have been previously reconciled and are publicly

available in the Quarterly Earnings Call Presentations on our

website at investor.integralife.com under Events &

Presentations.

The Company calculates adjusted free cash flow

conversion by dividing its free cash flow by adjusted net income.

The Company believes this measure is useful in evaluating the

significance of the cash special charges in its adjusted earnings

measures.

RECONCILIATION OF NON-GAAP ADJUSTMENTS - NET DEBT

CALCULATION(UNAUDITED)

| (In thousands) |

|

| |

September 30,2023 |

December 31,2022 |

|

Short-term borrowings under senior credit facility |

|

9,687 |

|

$ |

38,125 |

|

| Long-term borrowings under

senior credit facility |

|

850,089 |

|

|

733,149 |

|

| Borrowings under

securitization facility |

|

75,700 |

|

|

104,700 |

|

| Long-term convertible

securities |

|

569,527 |

|

|

567,341 |

|

| Deferred financing costs

netted in the above |

|

10,697 |

|

|

11,385 |

|

| Cash & Cash

Equivalents |

|

(273,732 |

) |

|

(456,661 |

) |

| Net Debt |

$ |

1,241,968 |

|

$ |

998,039 |

|

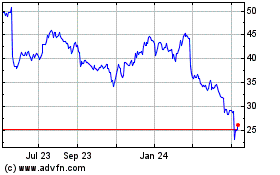

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Apr 2024 to May 2024

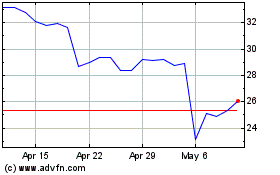

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From May 2023 to May 2024