UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 27, 2023 (November 20, 2023)

Innovative International Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40964 |

|

N/A |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

24681 La Plaza Ste 300

Dana Point, CA 92629

(Address of principal executive offices, including

zip code)

Registrant’s telephone number,

including area code: (805) 907-0597

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one Class A ordinary share, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

IOACU |

|

The Nasdaq Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share, included as part of the Units |

|

IOAC |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each exercisable for one Class A ordinary share for $11.50 per share, included as part of the Units |

|

IOACW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.01 Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On November 20,

2023, Innovative International Acquisition Corp. (“Innovative”), received a written notice (the “Letter”)

from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, because Innovative

has not regained compliance with the Market Value of Listed Securities (“MVLS”) Standard, Innovative’s securities

(units, ordinary shares and warrants) will be suspended from The Nasdaq Global Market on November 29, 2023, unless Innovative

requests a hearing to appeal this determination by 4:00 p.m. Eastern Time on November 27, 2023, and Innovative has requested such

hearing. The market value of Innovative’s listed securities was below the $50,000,000 minimum MVLS requirement for continued

listing on Nasdaq Global under Nasdaq Listing Rule 5450(b)(2)(A) (the “MLVS Rule”) and had not been at least $50,000,000

for the proceeding 30 consecutive trading days. As previously reported by Innovative on its Current Report on Form 8-K filed with

the Securities and Exchange Commission (the “SEC”) on April 6, 2023, the Nasdaq initially notified Innovative on March

31, 2023 that the minimum MVLS for Innovative’s was below the $50,000,000 minimum MVLS requirement for the previous 30

consecutive trading days, and in accordance with the Nasdaq Listing Rules, Innovative was provided 180 calendar days, or until

September 27, 2023 to regain compliance with the MVLS Rule.

Additionally, as previously

reported by Innovative on its Current Report on Form 8-K filed with the SEC on October 13, 2023, Nasdaq notified Innovaitve

on October 9, 2023 that it failed to comply with the total shareholder requirement as set forth in Listing Rule 5450(a)(2). Nasdaq advised

that this deficiency serves as an additional and separate basis for delisting.

Pursuant to the Letter, unless Innovative requests

a hearing to appeal this determination by 4:00 p.m. Eastern Time on November 27, 2023, Innovative’s securities will be suspended at

the opening of business on November 29, 2023, and a Form 25-NSE will be filed with the SEC, which will remove Innovative’s securities

from listing and registration on The Nasdaq Global Market.

Innovative has requested a hearing

to stay the suspension of trading of the its securities, and Innovative’s securities will continue to trade on Nasdaq Global Market

until the hearing process concludes and the Nasdaq hearings panel (the “Panel”) issues a written decision. There can be no

assurance that the Panel will grant Innovative’s request for a suspension of delisting.

Item 7.01 Regulation FD Disclosure.

On November 18, 2023, Zoomcar, Inc. (“Zoomcar”),

a party to the previously-disclosed Agreement and Plan of Merger and Reorganization, dated as of October 13, 2022 (as may be amended or

supplemented, the “Merger Agreement”), with Innovative International Acquisition Corp., a Cayman Islands exempted company

(together with its successors, including continuation by way of transfer out of the Cayman Islands and into the State of Delaware in connection

with the proposed Business Combination, “Innovative”, also referred to as “New Zoomcar,” following the consummation,

if any, of the proposed Business Combination) and other parties thereto (the transactions contemplated by Merger Agreement, including

the issuance by Innovative of securities in connection therewith, the “Business Combination”), distributed, through its Solicitation

Agent (defined below), distributed to its stockholders and stockholders of Zoomcar’s Indian subsidiary, Zoomcar India Private Limited

(collectively, “Zoomcar Stockholders”), revised written consent solicitation materials, as further described below, for the

purpose of consents to the proposed Business Combination from stockholders of record as of the previously-determined record date of September

30, 2023 (such materials, the “Revised Consent Solicitation Materials”). Subsequently, on November 24, 2023, Zoomcar, through

its Solicitation Agent, distributed a supplemental communication to Zoomcar Stockholders extending the deadline for Zoomcar Stockholders

to provide written consents to 5:00 p.m., Eastern Time, on Tuesday, November 28, 2023 (the “November 24 Communication” and

the “Updated Consent Return Date”).

As described in the Current Report on Form 8-K

filed by Innovative with the SEC on October 25, 2023, Zoomcar previously commenced soliciting written consents from Zoomcar Stockholders

to the proposed Business Combination and other matters described in the consent solicitation materials. The Revised Consent Solicitation

Materials were distributed because Zoomcar has not, as of date of this Current Report, received consents from holders of requisite Zoomcar

shares to the matters described in the consent materials.

The Revised Consent Solicitation Materials, as further described below,

consisted of, with respect to the Business Combination, the Joint Proxy Statement for Extraordinary General Meeting of Shareholders of

Innovative International Acquisition Corp./Consent Solicitation Statement for Stockholders of Zoomcar, Inc. and Prospectus of Innovative

International Acquisition Corp. dated October 2, 2023, Supplement No. 1 to Joint Proxy Statement for Extraordinary General Meeting of

Shareholders of Innovative International Acquisition Corp./Consent Solicitation Statement for Stockholders of Zoomcar, Inc. and Prospectus

of Innovative International Acquisition Corp. dated October 20, 2023, and Supplement No. 2 (“Supplement No. 2”) to Joint Proxy

Statement for Extraordinary General Meeting of Shareholders of Innovative International Acquisition Corp./Consent Solicitation Statement

for Stockholders of Zoomcar, Inc. and Prospectus of Innovative International Acquisition Corp., dated November 17, 2023 (together, and

as may be further amended or supplemented, the “Joint Proxy/Written Consent Solicitation Statement”), and also incorporate

other information about Innovative and about the proposed Business Combination contained in public filings, including future public filings,

by Innovative with the SEC (collectively, “Public Filings”).

The Revised Consent Solicitation Materials also

included revised materials and information about stockholder consents being solicited by Zoomcar to a proposed amendment (the “Charter

Amendment”) to Zoomcar’s existing certificate of incorporation and a revised proposed amendment to Zoomcar’s investor

rights agreement to which holders of Zoomcar preferred shares are party (the “Revised IRA Amendment”, and together with the

IRA Amendment, the “Pre-Closing Amendments”), as contained certain information regarding prospective additional investments

by Ananda Small Business Trust, a Nevada trust and an affiliate of the sponsor of Innovative (“Ananda Trust”), each as further

described in the Joint Proxy Statement/Written Consent Solicitation Statement filed with the SEC. The structure and terms of the additional

investments by Ananda Trust are subject to agreement by Ananda Trust, in its discretion, and may include investments in additional Innovative

securities, prior to the consummation of the proposed Business Combination, and future securities that may be issued by New Zoomcar, after

the Business Combination, as further described in Supplement No. 2. The Revised IRA Amendment included and as described in the Revised

Consent Solicitation Materials includes restrictive trading provisions that would apply to holders of Zoomcar preferred shares, if the

Revised IRA Amendment is adopted, that are more favorable to such holders than the previously-proposed restrictive trading provisions

incorporated in the IRA Amendment distributed as part of Zoomcar’s prior written consent solicitation process.

Each Pre-Closing Amendment requires approval by

holders of certain series of outstanding preferred shares, among other approval thresholds; these requirements may not be satisfied timely

or at all. Approval of the Pre-Closing Amendments is not a required condition to consummating the Business Combination but Zoomcar believes

their adoption is important and, in the case of the Charter Amendment, because timely consummation of the proposed Business Combination

may not be achievable unless the amendments regarding automatic conversion of preferred to common shares immediately prior to the proposed

Business Combination are effected. Zoomcar cannot assure that either Pre-Closing Amendment will be approved by the requisite number of

Zoomcar shares, timely or at all.

The Revised Consent Solicitation Materials describe,

to the extent of information available as of the date thereof, certain prospective transactions and other transactions into which the

parties to the proposed Business Combination and other parties may enter in connection with the proposed Business Combination, subject

to various contingencies, including, in certain cases, the materialization of opportunities and agreement on terms and structures. Such

transactions, if they materialize, are likely to involve additional issuances of securities, which may include newly-issued Innovative

securities, Zoomcar securities or securities issued by New Zoomcar after the closing of the proposed Business Combination, if any, with

associated dilutive effects on investors, possible impact on New Zoomcar trading prices and other effects, some of which may be material

and negative; the potential scope and magnitude of such dilutive effects will increase if the terms and conditions of any such transactions

and arrangements result in obligations to issue additional securities to holders of the certain outstanding Zoomcar securities pursuant

to applicable “most favored nation” provisions, as further described in the Joint Proxy/Written Consent Solicitation Statement.

The descriptions of prospective transactions and associated future issuances of securities, if any, contained or incorporated into the

Revised Consent Solicitation Materials, and the potential risks, including, without limitation, the potential dilutive and other effects

that may be associated therewith, are not intended to be complete and are qualified entirely by the full text of applicable agreements,

if any, into which applicable parties may enter or anticipate entering. There may be other risks to New Zoomcar and its business, and

to investors, which may be material, that cannot, as of the date of the Revised Consent Solicitation Materials, be determined or estimated,

and can be further evaluated only if and when terms of such additional transactions and arrangements are determined and finalized by applicable

parties.

In addition to the Joint Proxy/Written Consent Solicitation Statement,

the Revised Consent Solicitation Materials also included a Letter to Stockholders, the terms of the proposed Pre-Closing Amendments and

information about appraisal rights that may be available to Zoomcar, Inc. stockholders under Section 262 of the Delaware General Corporation

Law. The Revised Consent Solicitation Materials also provide Zoomcar Stockholders with information as to where and how stockholders can

obtain additional information about the proposed Business Combination and about the matters that are the subject of the consents being

solicited from the Zoomcar Stockholders.

As previously disclosed, Zoomcar has engaged Advantage

Proxy, Inc. (the “Solicitation Agent”) to distribute the Consent Solicitation Materials and assist Zoomcar with the consent

solicitation process in connection with which the Solicitation Agent will receive aggregate compensation of at least $13,250.00.

The Revised Consent Solicitation Materials were

supplemented by the November 24 Communication, which extended the deadline for Zoomcar Stockholders to return written consents to the

Updated Consent Return Date of 5:00 p.m., Eastern Time, on Tuesday, November 28, 2023.

As set forth in the November 24 Communication

and Revised Consent Solicitation Materials, due to administrative constraints, Zoomcar Stockholders should not expect to be able to withdraw

previously-tendered consents at this time. The Revised Consent Solicitation Materials contain instructions on how to complete the consent

form; Zoomcar Stockholders may contact the Solicitation Agent or Zoomcar with any questions utilizing the contact information included

in the materials.

As of the date of this Current Report, the Zoomcar

Stockholders have not approved the proposed Business Combination or the Pre-Closing Amendments and it cannot be assured that the Zoomcar

Stockholders will approve such transactions and amendments by the date requested, or at all. Other conditions to consummating the Business

Combination have not yet been satisfied as of the date of this Current Report, including, without limitation, approval by Nasdaq of the

listing application submitted in connection with the Business Combination and approval of the proposed Business Combination and associated

required proposals by shareholders of Innovative at a special meeting of Innovative shareholders.

If the requisite numbers of shares held by Zoomcar

Stockholders do not approve the Business Combination, a required condition to the closing pursuant to the terms of the Merger Agreement

will not be satisfied and the proposed Business Combination will not be consummated.

The information set forth in this Item 7.01 is

intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as expressly set forth by specific reference in such filing.

Item 8.01 Other

Events

In order to mitigate the risk that Innovative could be deemed to be operating as an unregistered investment company under the Investment

Company Act of 1940, as amended, on November

24, 2023, Innovative instructed Equiniti Trust Company, LLC to hold the funds in the trust account established in connection with Innovative’s

initial public offering in a segregated, interest-bearing bank deposit account. Such deposit account carries a variable rate and we cannot

assure you that the initial rate will not decrease or increase significantly.

Forward-Looking

Statements

This document contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions

with respect to future operations, products and services; and other statements identified by words such as “will likely result,”

“are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,”

“intend,” “plan,” “projection,” “outlook” or words of similar meaning.

These forward-looking

statements and factors that may cause actual results and the timing of events to differ materially from the anticipated results include,

but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the

Merger Agreement or could otherwise cause the transactions contemplated therein to fail to close; (2) the outcome of any legal proceedings

that may be instituted against Innovative, Zoomcar, the combined company or others following the announcement of the Business Combination

and any definitive agreements with respect thereto; (3) the inability to complete the Business Combination due to the failure to obtain

approval of the shareholders of Innovative or stockholders of Zoomcar; (4) the inability of Zoomcar to satisfy other conditions to closing;

(5) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or

regulations or as a condition to obtaining regulatory approval of the Business Combination; (6) the ability to meet stock exchange listing

standards in connection with and following the consummation of the Business Combination; (7) the risk that the Business Combination disrupts

current plans and operations of Zoomcar as a result of the announcement and consummation of the Business Combination; (8) the ability

to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability

of the combined company to grow and manage growth profitably, maintain its reputation, grow its customer base, maintain relationships

with customers and suppliers and retain its management and key employees; (9) the impact of the COVID-19 pandemic on the business of Zoomcar

and the combined company (including the effects of the ongoing global supply chain shortage); (10) Zoomcar’s limited operating history

and history of net losses; (11) Zoomcar’s customer concentration and reliance on a limited number of key technology providers and

payment processors facilitating payments to and by Zoomcar’s customers; (12) costs related to the Business Combination; (13) unfavorable

interpretations of laws or regulations or changes in applicable laws or regulations; (14) the possibility that Zoomcar or the combined

company may be adversely affected by other economic, business, regulatory, and/or competitive factors; (15) Zoomcar’s estimates

of expenses and profitability; (16) the evolution of the markets in which Zoomcar competes; (17) political instability associated with

operating in current and future emerging markets Zoomcar has entered or may later enter; (18) risks associated with Zoomcar maintaining

inadequate insurance to cover risks associated with business operations now or in the future; (19) the ability of Zoomcar to implement

its strategic initiatives and continue to innovate its existing products; (20) the ability of Zoomcar to adhere to legal requirements

with respect to the protection of personal data and privacy laws; (21) cybersecurity risks, data loss and other breaches of Zoomcar’s

network security and the disclosure of personal information or the infringement upon Zoomcar’s intellectual property by unauthorized

third parties; (22) risks associated with the performance or reliability of infrastructure upon which Zoomcar relies, including, but not

limited to, internet and cellular phone services; (23) the risk of regulatory lawsuits or proceedings relating to Zoomcar’s products

or services; (24) increased compliance risks associated with operating in multiple foreign jurisdictions at once, including regulatory

and accounting compliance issues; (25) Zoomcar’s exposure to operations in emerging markets where improper business practices may

be prevalent; and (26) Zoomcar’s ability to obtain additional capital when necessary.

The foregoing list of

factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the

“Risk Factors” section of the Registration Statement referenced above and other documents filed by Innovative from time to

time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking statements. There can be no assurance that the data contained herein

is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor

of future performance as projected financial information and other information are based on estimates and assumptions that are inherently

subject to various significant risks, uncertainties and other factors, many of which are beyond our control. Forward-looking statements

speak only as of the date they are made, and Innovative and Zoomcar disclaim any intention or obligation to update or revise any forward-looking

statements, whether as a result of developments occurring after the date of this communication. Forecasts and estimates regarding Zoomcar’s

industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates

will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only,

are not forecasts and may not reflect actual results.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVATIVE INTERNATIONAL ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Mohan Ananda |

| |

Name: |

Mohan Ananda |

| |

Title: |

Chief Executive Officer |

Dated: November 27, 2023

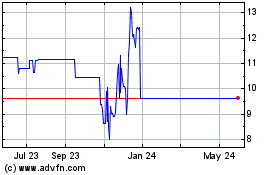

Innovative International... (NASDAQ:IOACU)

Historical Stock Chart

From Apr 2024 to May 2024

Innovative International... (NASDAQ:IOACU)

Historical Stock Chart

From May 2023 to May 2024