Iconix Secures New Credit Facility - Analyst Blog

November 25 2011 - 12:23PM

Zacks

In order to enhance liquidity and boost the capital structure,

Iconix Brand Group, Inc. (ICON) has agreed to a

$150 million secured revolving credit facility of two years.

Iconix h with

Barclays Capital, a unit of Barclays Plc (BCS),

Goldman Sachs Bank USA, a wing of The Goldman Sachs Group,

Inc. (GS), and GE Capital Markets, a part

of General

Electric (GE). The facility will thus offer capital at

a low cost.

Iconix’s board has recently authorized a program to repurchase

up to $200 million of its common stock over a four year period,

replacing the current share repurchase program expiring October 30,

2011.

On the same day, Iconix planned to acquire The Sharper Image

brand and intellectual property assets for approximately $65.6

million from Sharper Image Acquisition, LLC.

Iconix’s first steps in the consumer electronics sector will

benefit the company as Sharper Image operates under a licensing

business model. Further, the company expects the Sharper Image

brand to bring in approximately $12-13 million in annual royalty

revenue.

Iconix posted third quarter 2011 earnings in line with the Zacks Consensus

Estimate and the prior-year estimate of 40 cents per share, on the

back of steady organic strength across its portfolio of

brands.

Iconix has also reaffirmed

its fiscal 2011 reported earnings forecast at $1.61 - $1.66 per

share. On an adjusted basis, Iconix reaffirmed its earnings of

$1.63-$1.68.

For fiscal 2012, the company expects its reported earnings to

lie in the range of $1.62-$1.69 and expects its adjusted earnings

guidance to be $1.77-$1.84.

Further, the company expects Sharper Image to be earnings

neutral in 2011 due to the timing of the close and transaction

costs.

Iconix exited the year with free cash flow of $44.9 million, up

9% from the prior-year quarter. Capital expenditures for the

quarter were $280 million.

For fiscal 2011, the company reiterates its free cash flow in

the range of $167.0 million to $172.0 million, and provides a free

cash flow guidance of $187.0 million to $194.0 million in 2012.

Currently, we maintain a long-term Neutral recommendation on the

shares. Additionally, the quantitative Zacks Rank for Iconix is #3,

which implies a short-term Hold rating.

BARCLAY PLC-ADR (BCS): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

ICONIX BRAND GP (ICON): Free Stock Analysis Report

Zacks Investment Research

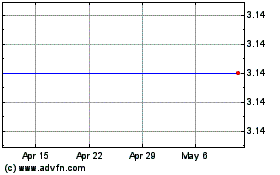

Iconix Brand (NASDAQ:ICON)

Historical Stock Chart

From May 2024 to Jun 2024

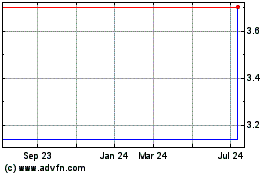

Iconix Brand (NASDAQ:ICON)

Historical Stock Chart

From Jun 2023 to Jun 2024