UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number: 001-40487

HUT 8 MINING CORP.

(Exact Name of Registrant as Specified in Its Charter)

24 Duncan Street, Suite 500, Toronto, Ontario,

M5V 2B8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

¨ Form 40-F x

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

HUT 8 MINING CORP. |

| |

|

| |

By: |

/s/ Aniss Amdiss |

| |

|

Name: Aniss Amdiss |

| |

|

Title: Chief Legal Officer |

Date: December 6, 2023

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

| Item 1 | Name and Address of Company |

Hut 8 Mining Corp. ("Hut 8")

24 Duncan Street, Suite 500

Toronto, Ontario M5V 2B8

| Item 2 | Date of Material Change |

November 30, 2023.

Hut 8 issued a press release with respect

to the material change referred to in this report on November 30, 2023, which was disseminated through GlobeNewswire and filed on SEDAR

(www.sedar.com) and EDGAR (www.sec.gov) under Hut's issuer profile.

| Item 4 | Summary of Material Change |

On November 30, 2023, Hut 8, U.S. Data

Mining Group, Inc. ("USBTC") and Hut 8 Corp. ("New Hut") completed a business combination whereby, (i)

Hut 8 and its direct wholly-owned subsidiary, Hut 8 Holdings Inc. was, as part of a court-sanctioned plan of arrangement (the "Arrangement")

under the Business Corporations Act (British Columbia) (the "BCBCA"), amalgamated (the "Amalgamation")

to continue as one British Columbia corporation (the "Hut 8 Amalco"), (ii) following the Amalgamation, and pursuant to

the Arrangement, each common share of Hut 8 Amalco (other than dissenting shares) was exchanged for 0.2000 of a share of New Hut common

stock, and (iii) following the completion of the Arrangement, a newly-formed direct wholly-owned subsidiary of New Hut merged with and

into USBTC, with each share of common stock and preferred stock of USBTC being exchanged for 0.6716 of a share of New Hut common stock

in a merger executed under the laws of the State of Nevada (the "Merger", and together with the Arrangement, the "Transaction").

| Item 5.1 | Full Description of Material Change |

On February 6, 2023, Hut 8 entered into

a business combination agreement (the "Business Combination Agreement") by and among USBTC and New Hut, pursuant to which

Hut 8 and its direct wholly owned subsidiary, Hut 8 Holdings Inc., were amalgamated on November 30, 2023 (the "Effective Date")

as part of a court-sanctioned plan of arrangement under the BCBCA, with the capital of Hut Amalco being the same as the capital of Hut

8.

On the Effective Date, following the Amalgamation

and pursuant to the Arrangement, each common share of Hut Amalco was exchanged for 0.2000 (the "Exchange Ratio") of a

share of New Hut common stock (the "New Hut Shares").

On the Effective Date, following the completion

of the Arrangement, a newly-formed direct wholly-owned subsidiary of New Hut merged with and into USBTC, with each share of common stock

and preferred stock of USBTC being exchanged for 0.6716 of a New Hut Share in a merger executed under the laws of the State of Nevada.

As a result of the transactions completed

under the Business Combination Agreement, Hut 8 and USBTC became wholly-owned subsidiaries of New Hut, and the shareholders of Hut 8 and

the stockholders of USBTC collectively each, as a group, own approximately 50% of the New Hut Shares on a fully-diluted in-the-money basis.

Prior to the completion of the Transaction,

the common shares of Hut 8 were listed on the Toronto Stock Exchange and the Nasdaq Stock Market under the ticker symbol "HUT".

New Hut is a reporting issuer in all of

the provinces and territories of Canada and the New Hut Shares are listed on the Toronto Stock Exchange and the Nasdaq Stock Market under

the ticker symbol "HUT". The authorized capital of New Hut consists of 1,000,000,000 New Hut Shares with par value of

$0.01 per New Hut Share and 25,000,000 preferred stock with par value of $0.01 per preferred stock.

Immediately prior to the effective time

on the Effective Date, Hut 8 had the following outstanding securities: (i) 221,730,042 common shares (the "Hut 8 Shares"),

(ii) 7,335,324 restricted share units (the "RSUs"), (iii) 430,978 deferred share units (the "DSUs"),

(iv) 115,000 options to purchase Hut 8 Shares (the "Options"), and (v) 9,477 warrants to purchase Hut 8 Shares (the "Warrants").

Notice of the special meeting of holders

of Hut 8 Shares to consider the transactions contemplated under the Business Combination Agreement was delivered to holders of Hut 8 Shares,

RSUs, DSUs, Options, and Warrants in accordance with the requirements set out in the Interim Order of the Supreme Court of British Columbia

dated August 11, 2023.

Pursuant to the Arrangement, and in addition

to the share exchange described above, the following occurred as of the effective time on the Effective Date:

| a) | each Option was exchanged for a replacement option of New Hut to purchase that number of New Hut Shares

equal to the product obtained when the number of Hut 8 Shares subject to such Options immediately prior to the effective time on the Effective

Date is multiplied by the Exchange Ratio; |

| b) | the terms of each RSU outstanding immediately prior to the effective time on the Effective Date was adjusted

so that upon settlement the holder of a RSU shall be entitled to receive either a cash payment equal to the product obtained when the

market value of a New Hut Share is multiplied by the Exchange Ratio, (ii) that number of New Hut Shares equal to the Exchange Ratio or

(iii) a combination of cash and New Hut Shares; |

| c) | the terms of each DSU outstanding immediately prior to the effective time on Effective Date was adjusted

so that upon settlement the holder of a DSU shall be entitled to receive either a cash payment equal to the product obtained when the

market value of a New Hut Share is multiplied by the Exchange Ratio, (ii) that number of New Hut Shares equal to the Exchange Ratio or

(iii) a combination of cash and New Hut Shares; and |

| d) | each holder of a Warrant became entitled to receive upon the exercise of such holder's Warrant, in lieu

of Hut 8 Shares to which such holder was theretofore entitled upon such exercise, that number of New Hut Shares equal to the product obtained

when the number of Hut 8 Shares subject to such Warrant immediately prior to the effective time on the Effective Date is multiplied by

the Exchange Ratio, at an exercise price for each New Hut Share equal to the quotient obtained when the exercise price per Hut 8 Share

under the Warrant is divided by the Exchange Ratio. |

Upon the exercise of

Options and Warrants or upon the vesting of DSUs and RSUs, only New Hut Shares are issuable. No Hut 8 Shares are issuable upon the exercise

of Options and Warrants or upon the vesting of RSUs and DSUs.

The treatment of the

RSUs, DSUs and Options is consistent with the terms of Hut 8's omnibus equity incentive plan, and the treatment of Warrants is consistent

with the terms of the agreement governing such Warrants.

All of the issued and

outstanding Hut 8 Shares were delisted from the Toronto Stock Exchange and the Nasdaq Stock Market effective at the close of business

on December 1, 2023.

The common stock of

New Hut will begin trading on the Nasdaq Stock Market and the Toronto Stock Exchange under the ticker symbol "HUT" on

December 4, 2023.

As a result of the transaction,

Hut 8 and USBTC became wholly-owned subsidiaries of New Hut. Hut 8 has made an application to cease to be a reporting issuer in all jurisdictions

where it is a reporting issuer, being all of the provinces and territories of Canada.

| Item 5.2 | Disclosure of Restructuring Transactions |

Not applicable.

| Item 6 | Reliance on subsection 7.1(2) of National Instrument 51-102 Continuous Disclosure Obligations |

Not applicable.

| Item 7 | Omitted Information |

Not applicable.

The following senior officer of Hut 8

is knowledgeable about the material change and this material change report, and may be contacted as follows:

Jaime Leverton, Chief Executive Officer

Telephone: (647) 521-7433

Email: info@hut8mining.com

December 6, 2023.

Cautionary note regarding

Forward–Looking Information

This material change report

includes "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities

laws and United States securities laws, respectively (collectively, "forward looking information"). All information,

other than statements of historical facts, included in this material change report that address activities, events or developments that

Hut 8 expects or anticipates will or may occur in the future, including such things as future business strategy, competitive strengths,

goals, expansion and growth of Hut's businesses, operations, plans and other such matters is forward-looking information. Forward looking

information is often identified by the words "may", "would", "could", "should", "will",

"intend", "plan", "anticipate", "allow", "believe", "estimate", "expect",

"predict", "can", "might", "potential", "predict", "is designed to", "likely"

or similar expressions. In addition, any statements in this material change report that refer to expectations, projections or other characterizations

of future events or circumstances contain forward-looking information and include, among others, statements with relating to the anticipated

complementary strengths of the parties to the Transaction, combined valuation of New Hut and the expectation that it will exceed the sum

of its parts, pipeline of greenfield, brownfield and integration opportunities, trading of New Hut, and future growth in economical mining

operations, high performance computing, extensive hosting operations, and the managed services business.

Statements containing forward-looking

information are not historical facts, but instead represent management's expectations, estimates and projections regarding future events

based on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 and New Hut

as of the date of this material change report, such statements are subject to known and unknown risks, uncertainties, assumptions and

other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those

expressed or implied by such forward-looking information, including but not limited to, the ability to realize the anticipated benefits

of the Transaction or implement the business plan for New Hut, including as a result of difficulty in integrating the businesses of the

companies involved (including the retention of key employees); the ability to realize synergies and cost savings, and to the extent, anticipated;

the potential impact of the Transaction on mining activities; the potential impact of the announcement of consummation of the Transaction

on relationships, including with regulatory bodies, employees, suppliers, customers, competitors and other key stakeholders; security

and cybersecurity threats and hacks; malicious actors or botnet obtaining control of processing power on the Bitcoin network; further

development and acceptance of the Bitcoin network; changes to Bitcoin mining difficulty; loss or destruction of private keys; increases

in fees for recording transactions in the Blockchain; internet and power disruptions; geopolitical events; uncertainty in the development

of cryptographic and algorithmic protocols; uncertainty about the acceptance or widespread use of digital assets; failure to anticipate

technology innovations; climate change; currency risk; lending risk and recovery of potential losses; litigation risk; business integration

risk; changes in market demand; changes in network and infrastructure; system interruption; changes in leasing arrangements; failure to

achieve intended benefits of power purchase agreements; potential for interrupted delivery, or suspension of the delivery, of energy to

mining sites; failure of the Celsius transaction to receive the necessary legal approvals or failure of the Celsius transaction to otherwise

close; failure to achieve the intended benefits of the Celsius transaction; failure to implement business plans, forecasts, and other

expectations; and failure to identify and realize additional opportunities and other risks related to the digital asset mining and data

centre business. For a complete list of the factors that could affect New Hut, please see the “Risk Factors” section of New

Hut’s Registration Statement on Form S-4 dated November 7, 2023, available under New Hut’s EDGAR profile at www.sec.gov, in

addition to the “Risk Factors” section of Hut 8’s Annual Information Form dated March 9, 2023, and Hut 8’s other

continuous disclosure documents which are available under Hut 8 SEDAR+ profile at www.sedarplus.ca and under Hut 8’s EDGAR profile

at www.sec.gov.

Exhibit 99.2

NOTICE OF CHANGE IN CORPORATE STRUCTURE

Pursuant to Section 4.9 of National Instrument

51-102 –

Continuous Disclosure Obligations

| 1. | Names of the parties to the transaction |

Hut 8 Mining Corp. ("Hut 8")

U.S. Data Mining Group, Inc. ("USBTC")

Hut 8 Corp. ("New Hut")

| 2. | Description of the transaction |

On February 6, 2023, Hut 8 entered into

a business combination agreement (the "Business Combination Agreement") by and among USBTC and New Hut, pursuant to which

Hut 8 and its direct wholly owned subsidiary, Hut 8 Holdings Inc., were amalgamated on November 30, 2023 (the "Effective Date")

as part of a court-sanctioned plan of arrangement under the BCBCA (the "Arrangement"), with the capital of the resulting

entity ("Hut Amalco") being the same as the capital of Hut 8.

On the Effective Date, following the

amalgamation and pursuant to the Arrangement, each common share of Hut Amalco was exchanged for 0.2000 (the "Exchange Ratio")

of a share of New Hut common stock (the "New Hut Shares").

On the Effective Date, following the

completion of the Arrangement, a newly-formed direct wholly-owned subsidiary of New Hut merged with and into USBTC, with each share of

common stock and preferred stock of USBTC being exchanged for 0.6716 of a New Hut Share in a merger executed under the laws of the State

of Nevada (the "Merger", together with the Arrangement, the "Transaction").

As a result of the transactions completed

under the Business Combination Agreement, Hut 8 and USBTC became wholly-owned subsidiaries of New Hut, and the shareholders of Hut 8 and

the stockholders of USBTC collectively each, as a group, own approximately 50% of the New Hut Shares on a fully-diluted in-the-money basis.

Prior to the completion of the Transaction,

the common shares of Hut 8 were listed on the Toronto Stock Exchange and the Nasdaq Stock Market under the ticker symbol "HUT".

New Hut is a reporting issuer in all

of the provinces and territories of Canada and the New Hut Shares are listed on the Toronto Stock Exchange and the Nasdaq Stock Market

under the ticker symbol "HUT". The authorized capital of New Hut consists of 1,000,000,000 New Hut Shares with par value

of $0.01 per New Hut Share and 25,000,000 preferred stock with par value of $0.01 per preferred stock.

Immediately prior to the effective time

on the Effective Date, Hut 8 had the following outstanding securities: (i) 221,730,042 common shares (the "Hut 8 Shares"),

(ii) 7,335,324 restricted share units (the "RSUs"), (iii) 430,978 deferred share units (the "DSUs"),

(iv) 115,000 options to purchase Hut 8 Shares (the "Options"), and (v) 9,477 warrants to purchase Hut 8 Shares (the "Warrants").

Notice of the special meeting of holders

of Hut 8 Shares to consider the transactions contemplated under the Business Combination Agreement was delivered to holders of Hut 8 Shares,

RSUs, DSUs, Options, and Warrants in accordance with the requirements set out in the Interim Order of the Supreme Court of British Columbia

dated August 11, 2023.

Pursuant to the Arrangement, and in

addition to the share exchange described above, the following occurred as of the effective time on the Effective Date:

| (a) | each Option was exchanged for a replacement option of New Hut to purchase that number of New Hut Shares

equal to the product obtained when the number of Hut 8 Shares subject to such Options immediately prior to the effective time on the Effective

Date is multiplied by the Exchange Ratio; |

| (b) | the terms of each RSU outstanding immediately prior to the effective time on the Effective Date was adjusted

so that upon settlement the holder of a RSU shall be entitled to receive either a cash payment equal to the product obtained when the

market value of a New Hut Share is multiplied by the Exchange Ratio, (ii) that number of New Hut Shares equal to the Exchange Ratio or

(iii) a combination of cash and New Hut Shares; |

| (c) | the terms of each DSU outstanding immediately prior to the effective time on Effective Date was adjusted

so that upon settlement the holder of a DSU shall be entitled to receive either a cash payment equal to the product obtained when the

market value of a New Hut Share is multiplied by the Exchange Ratio, (ii) that number of New Hut Shares equal to the Exchange Ratio or

(iii) a combination of cash and New Hut Shares; and |

| (d) | each holder of a Warrant became entitled to receive upon the exercise of such holder's Warrant, in lieu

of Hut 8 Shares to which such holder was theretofore entitled upon such exercise, that number of New Hut Shares equal to the product obtained

when the number of Hut 8 Shares subject to such Warrant immediately prior to the effective time on the Effective Date is multiplied by

the Exchange Ratio, at an exercise price for each New Hut Share equal to the quotient obtained when the exercise price per Hut 8 Share

under the Warrant is divided by the Exchange Ratio. |

Upon the exercise

of Options and Warrants or upon the vesting of DSUs and RSUs, only New Hut Shares are issuable. No Hut 8 Shares are issuable upon the

exercise of Options and Warrants or upon the vesting of RSUs and DSUs.

The treatment of the

RSUs, DSUs and Options is consistent with the terms of Hut 8's omnibus equity incentive plan, and the treatment of Warrants is consistent

with the terms of the agreement governing such Warrants.

All of the issued

and outstanding Hut 8 Shares were delisted from the Toronto Stock Exchange and the Nasdaq Stock Market effective at the close of business

on December 1, 2023.

The common stock of

New Hut will begin trading on the Nasdaq Stock Market and the Toronto Stock Exchange under the ticker symbol "HUT" on

December 4, 2023.

| 3. | Effective date of the transaction |

The Effective Date of the Transaction

is November 30, 2023.

| 4. | Name of each party, if any, that ceased to be a reporting issuer after the transaction and of each continuing

entity |

As

a result of the transaction, Hut 8 and USBTC became wholly-owned subsidiaries of New Hut. Hut 8 has made an application to cease to be

a reporting issuer in all jurisdictions where it is a reporting issuer, being all of the provinces and territories of Canada.

| 5. | Date of the reporting issuer's first financial year-end, if applicable |

New Hut's first financial year-end subsequent

to the Transaction will be December 31, 2023.

| 6. | The periods, including comparative periods, if any, of the interim and annual financial statements required

to be filed for the reporting issuer's first financial year after the transaction, if applicable |

The financial statements

for New Hut for the financial year ended December 31, 2023.

| 7. | Documents filed under NI 51-102 that describe the transaction and where those documents can be found in

electronic format |

Further information regarding the Transaction

is contained in (i) the management information circular of Hut 8 dated August 11, 2023 and (ii) the press release dated November 30,

2023, copies of which is available on New Hut's SEDAR+ profile at www.sedarplus.ca.

DATED this 6th day of December, 2023.

Exhibit 99.3

FORM 62-103F1

REQUIRED DISCLOSURE UNDER

THE EARLY WARNING REQUIREMENTS

Item 1 – Security and Reporting Issuer

| 1.1 | State the designation of securities to which this report relates and the name

and address of the head office of the issuer of the securities. |

This report relates to common

shares ("Hut 8 Shares") in the capital of Hut 8 Mining Corp. ("Hut 8").

Hut 8's head office is as follows:

24 Duncan Street, Suite 500

Toronto, Ontario M5V 2B8

| 1.2 | State the name of the market in which the transaction or other occurrence that

triggered the requirement to file this report took place. |

Completion of the business combination by and among Hut

8, U.S. Data Mining Group, Inc. ("USBTC") and Hut 8 Corp. ("New Hut").

Item 2 – Identity of the Acquiror

| 2.1 | State the name and address of the acquiror. |

Hut 8 Corp.

1221 Brickell Avenue, Suite 900

Miami, FL, 33131

| 2.2 | State the date of the transaction or other occurrence that triggered the requirement

to file this report and briefly describe the transaction or other occurrence. |

On November 30, 2023, Hut 8, USBTC

and New Hut completed a business combination whereby, (i) Hut 8 and its direct wholly-owned subsidiary, Hut 8 Holdings Inc. was, as part

of a court-sanctioned plan of arrangement (the "Arrangement") under the Business Corporations Act (British Columbia)

(the "BCBCA"), amalgamated (the "Amalgamation") to continue as one British Columbia corporation (the

"Hut 8 Amalco"), (ii) following the Amalgamation, and pursuant to the Arrangement, each common share of Hut 8 Amalco

(other than dissenting shares) was exchanged for 0.2000 of a share of New Hut common stock ("New Hut Shares"), and (iii)

following the completion of the Arrangement, a newly-formed direct wholly-owned subsidiary of New Hut merged with and into USBTC, with

each share of common stock and preferred stock of USBTC being exchanged for 0.6716 of a share of New Hut common stock in a merger executed

under the laws of the State of Nevada (the "Merger", and together with the Arrangement, the "Transaction").

As a result of the Transaction, Hut 8 and USBTC became wholly-owned subsidiaries of New Hut, and the shareholders of Hut 8 and the stockholders

of USBTC collectively each, as a group, own approximately 50% of the New Hut Shares on a fully-diluted in-the-money basis. The Hut 8 Shares

were delisted on the Toronto Stock Exchange and Nasdaq Stock Market LLC on the close of business on December 1, 2023. The New Hut Shares

began trading on the Nasdaq Stock Market LLC and the Toronto Stock Exchange under the ticker symbol "HUT" on December 4, 2023

| 2.3 | State the names of any joint actors. |

Not applicable.

Item 3 – Interest in Securities of the Reporting

Issuer

| 3.1 | State the designation and number or principal amount of securities acquired

or disposed of that triggered the requirement to file the report and the change in the acquiror’s securityholding percentage in

the class of securities. |

All of the issued and outstanding

Hut 8 Shares, being 221,730,042, were exchanged for 44,346,008 New Hut Shares. New Hut owns all of the issued and outstanding Hut 8 Shares.

| 3.2 | State whether the acquiror acquired or disposed ownership of, or acquired or

ceased to have control over, the securities that triggered the requirement to file the report. |

See Item 3.1.

| 3.3 | If the transaction involved a securities lending arrangement, state that fact. |

Not applicable.

| 3.4 | State the designation and number or principal amount of securities and the acquiror’s

securityholding percentage in the class of securities, immediately before and after the transaction or other occurrence that triggered

the requirement to file this report. |

Immediately prior to the completion

of the Transaction, New Hut did not hold any Hut 8 Shares. Immediately following the completion of the Transaction, New Hut acquired ownership

and control over an aggregate of 221,730,042 Hut 8 Shares, representing all of the issued and outstanding Hut 8 shares.

| 3.5 | State the designation and number or principal amount of securities and the

acquiror’s securityholding percentage in the class of securities referred to in Item 3.4 over which |

(a) the acquiror,

either alone or together with any joint actors, has ownership and control,

See Item 3.4.

(b) the acquiror,

either alone or together with any joint actors, has ownership but control is held by persons or companies other than the acquiror or any

joint actor, and

Not applicable.

(c) the acquiror, either

alone or together with any joint actors, has exclusive or shared control but does not have ownership.

Not applicable.

| 3.6 | If the acquiror or any of its joint actors has an interest in, or right or obligation

associated with, a related financial instrument involving a security of the class of securities in respect of which disclosure is required

under this item, describe the material terms of the related financial instrument and its impact on the acquiror’s securityholdings. |

Not applicable.

| 3.7 | If the acquiror or any of its joint actors is a party to a securities lending

arrangement involving a security of the class of securities in respect of which disclosure is required under this item, describe the material

terms of the arrangement including the duration of the arrangement, the number or principal amount of securities involved and any right

to recall the securities or identical securities that have been transferred or lent under the arrangement. |

Not applicable.

State if the securities lending arrangement is subject

to the exception provided in section 5.7 of NI 62-104.

Not applicable.

| 3.8 | If the acquiror or any of

its joint actors is a party to an agreement, arrangement or understanding that has the effect

of altering, directly or indirectly, the acquiror’s economic exposure to the security

of the class of securities to which this report relates, describe the material terms of the

agreement, arrangement or understanding. |

Not applicable.

Item 4 – Consideration

Paid

| 4.1 | State the value, in Canadian dollars, of any consideration paid or received

per security and in total. |

See Item 2.2 and Item 3.1.

| 4.2 | In the case of a transaction or other occurrence that did not take place on

a stock exchange or other market that represents a published market for the securities, including an issuance from treasury, disclose

the nature and value, in Canadian dollars, of the consideration paid or received by the acquiror. |

See Item 2.2 and Item 3.1.

| 4.3 | If the securities were acquired or disposed of other than by purchase or sale,

describe the method of acquisition or disposition. |

See item 2.2.

Item 5 – Purpose of the

Transaction

State the purpose or purposes

of the acquiror and any joint actors for the acquisition or disposition of securities of the reporting issuer. Describe any plans or future

intentions which the acquiror and any joint actors may have which relate to or would result in any of the following:

(a) the acquisition of

additional securities of the reporting issuer, or the disposition of securities of the reporting issuer;

(b) a corporate transaction,

such as a merger, reorganization or liquidation, involving the reporting issuer or any of its subsidiaries;

(c) a sale or transfer

of a material amount of the assets of the reporting issuer or any of its subsidiaries;

(d) a change in the

board of directors or management of the reporting issuer, including any plans or intentions to change the number or term of directors

or to fill any existing vacancy on the board;

(e) a material change

in the present capitalization or dividend policy of the reporting issuer;

(f) a material change in the reporting issuer’s business or corporate structure;

(g) a change in the

reporting issuer’s charter, bylaws or similar instruments or another action which might impede the acquisition of control of the

reporting issuer by any person or company;

(h) a class of securities

of the reporting issuer being delisted from, or ceasing to be authorized to be quoted on, a marketplace;

(i) the

issuer ceasing to be a reporting issuer in any jurisdiction of Canada;

(j) a

solicitation of proxies from securityholders;

(k) an

action similar to any of those enumerated above.

The

purpose of the Transaction was for New Hut to acquire ownership and control over 100% of the issued and outstanding Hut 8 Shares and

for Hut 8 and USBTC to become wholly-owned subsidiaries of New Hut. For a detailed summary of the Transaction and other information in

respect of the transactions thereunder, please refer to the management information circular of Hut 8 dated August 11, 2023, which is

available under Hut 8’s profile on SEDAR+ at www.sedarplus.ca. Hut 8 has made an application

to cease to be a reporting issuer in all jurisdictions where it is a reporting issuer, being all of the provinces and territories of

Canada.

Item 6 – Agreements, Arrangements, Commitments

or Understandings With Respect to Securities of the Reporting Issuer

Describe the material terms of any agreements,

arrangements, commitments or understandings between the acquiror and a joint actor and among those persons and any person with respect

to securities of the class of securities to which this report relates, including but not limited to the transfer or the voting of any

of the securities, finder’s fees, joint ventures, loan or option arrangements, guarantees of profits, division of profits or loss,

or the giving or withholding of proxies. Include such information for any of the securities that are pledged or otherwise subject to a

contingency, the occurrence of which would give another person voting power or investment power over such securities, except that disclosure

of standard default and similar provisions contained in loan agreements need not be included.

Not

applicable.

Item 7 – Change in material

fact

If applicable, describe any

change in a material fact set out in a previous report filed by the acquiror under the early warning requirements or Part 4 in respect

of the reporting issuer’s securities.

Not applicable.

Item 8 – Exemption

If the acquiror relies on

an exemption from requirements in securities legislation applicable to formal bids for the transaction, state the exemption being relied

on and describe the facts supporting that reliance.

Not applicable.

Item 9 – Certification

Certificate

I, as the acquiror, certify, or

I, as the agent filing the report on behalf of an acquiror, certify to the best of my knowledge, information and belief, that the statements

made in this report are true and complete in every respect.

December 6, 2023.

| |

HUT 8 MINING CORP. |

| |

|

| |

(signed)

"Aniss Amdiss" |

| |

Name: |

Aniss Amdiss |

| |

Title: |

Chief legal Officer |

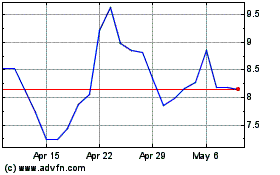

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Apr 2024 to May 2024

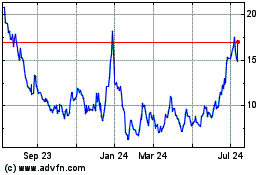

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From May 2023 to May 2024