Form 8-K - Current report

September 05 2023 - 8:18AM

Edgar (US Regulatory)

0001538263FALSE00015382632023-09-052023-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2023

HOMETRUST BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35593 | | 45-5055422 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

10 Woodfin Street, Asheville, North Carolina | | | | 28801 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | |

Registrant's telephone number, including area code: (828) 259-3939 |

| | | | | | | | | | | | | | |

| | Not Applicable | | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | HTBI | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 8.01 Other Events

On September 5, 2023, HomeTrust Bancshares, Inc. (the "Company"), the holding company for HomeTrust Bank (the "Bank"), issued the press release attached hereto as Exhibit 99.1 and incorporated herein by reference announcing that Lora Jex assumed the position of Chief Risk Officer of both the Company and the Bank effective August 31, 2023.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Press release dated September 5, 2023 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | HOMETRUST BANCSHARES, INC. |

| | | |

| | | |

| Date: September 5, 2023 | | By: | /s/ Tony J. VunCannon |

| | | Tony J. VunCannon |

| | | Executive Vice President, Chief Financial Officer, Corporate Secretary and Treasurer |

News Release

| | | | | | |

| Date: | September 5, 2023 | |

| Contact: | C. Hunter Westbrook | |

| President and Chief Executive Officer | |

| HomeTrust Bank | |

| 828.259.3939 | |

| | |

| | |

| | |

| | |

| | |

Lora Jex Appointed Executive Vice President & Chief Risk Officer

Asheville, N.C., September 5, 2023 – The board of directors of HomeTrust Bancshares, Inc. (NASDAQ: HTBI) (“Company”), the holding company of HomeTrust Bank (“Bank” or “HTB”), today announced that Lora Jex assumed the position of Executive Vice President and Chief Risk Officer ("CRO") of both the Company and the Bank effective August 31, 2023. Ms. Jex will lead the HTB teams responsible for monitoring and mitigating risk for the Bank related to compliance, operations, balance sheet management, and strategy. As such she will have oversight of assessing and maturing HTB’s risk appetite to further advance the Bank’s enterprise risk management approach. Ms. Jex will serve as a member of the Operating Committee and report functionally to the Bank’s Audit Committee and administratively to C. Hunter Westbrook, President & Chief Executive Officer of HTB.

Jex’s experience spans over 20 years of banking and financial industry experience at institutions ranging from $3B - $30B in assets. She has demonstrated skill at formulating action plans, resolving complex situations, managing large teams, and achieving strong regulatory ratings.

“As the events of the past few years have demonstrated, risk comes at financial institutions in many different forms and directions, that now include world-wide pandemics and deposit/liquidity runs on banks. Finding a CRO who could elevate HTB’s already strong enterprise risk management culture was imperative.” says C. Hunter Westbrook, President & Chief Executive Officer. “I am eager to collaborate with Lora as HomeTrust continues to grow and serve the needs of our customers and shareholders in a prudent yet accelerated manner. Lora has the experience and skill set to lead our risk management as we navigate these uncertain times.”

Jex is a graduate of Troy State University with a Bachelor of Science in Accounting & Business Administration. Prior to joining HTB, she served as Chief Compliance Officer at Southern First Bank in Greenville, SC and at South State Bank in Columbia, SC. She has also held positions at The Savannah Bancorp, Dixon Hughes Goodman LLP, Crowe Chizek & Company, and Troy Bank & Trust.

About HomeTrust Bancshares, Inc.

HomeTrust Bancshares, Inc. is the holding company for HomeTrust Bank. As of June 30, 2023, the Company had assets of $4.6 billion. The Bank, founded in 1926, is a North Carolina state chartered, community-focused financial institution committed to providing value added relationship banking with over 30 locations as well as online/mobile channels. Locations include: North Carolina (including the Asheville metropolitan area, the "Piedmont" region, Charlotte, and Raleigh/Cary), South Carolina (Greenville and Charleston), East Tennessee (including Kingsport/Johnson City, Knoxville, and Morristown), Southwest Virginia (including the Roanoke Valley) and Georgia (Greater Atlanta).

Forward-Looking Statements

This press release may include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, but instead are based on certain assumptions including statements with respect to the Company's beliefs, plans, objectives, goals, expectations, assumptions, and statements about future economic performance and projections of financial items. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated or implied by forward-looking statements. The factors that could result in material differentiation include, but are not limited to the impact of bank failures or adverse developments of other banks and related negative press about the banking industry in general on investor and depositor sentiment; the remaining effect of the COVID-19 pandemic on general economic and financial market conditions and on public health, both nationally and in the Company's market areas; expected revenues, cost savings, synergies and other benefits from merger and acquisition activities, including the Company's recent merger with Quantum Capital Corp., might not be realized to the extent anticipated, within the anticipated time frames, or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; goodwill impairment charges might be incurred; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and the effects of inflation, a potential recession, and other factors described in the Company's latest annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other documents filed with or furnished to the Securities and Exchange Commission - which are available on the Company's website at www.htb.com and on the SEC's website at www.sec.gov. Any of the forward-looking statements that the Company makes in this press release or the documents they file with or furnish to the SEC are based upon management's beliefs and assumptions at the time they are made and may turn out to be wrong because of inaccurate assumptions they might make, because of the factors described above or because of other factors that they cannot foresee. The Company does not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

www.htb.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

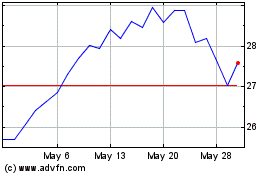

HomeTrust Bancshares (NASDAQ:HTBI)

Historical Stock Chart

From Apr 2024 to May 2024

HomeTrust Bancshares (NASDAQ:HTBI)

Historical Stock Chart

From May 2023 to May 2024