0001046025False00010460252024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities and Exchange Act of 1934

Date of Report (Dated of earliest event reported): January 25, 2024

HERITAGE FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

Commission File Number 000-29480

| | | | | | | | | | | | | | |

| Washington | | 91-1857900 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 201 Fifth Avenue SW, | Olympia | WA | | 98501 |

| (Address of principal executive offices) | | (Zip Code) |

(360) 943-1500

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12 (b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

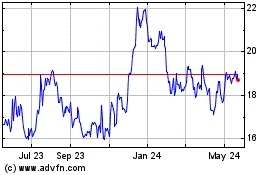

| Common stock, no par value | HFWA | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 25, 2024, Heritage Financial Corporation (“Heritage”) issued a press release announcing its financial results for the quarter ended December 31, 2023.

A copy of the release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

Heritage is filing an investor slide presentation that it reviewed in conjunction with its earnings release conference call on January 25, 2024.

A copy of the presentation materials is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

Item 8.01 Other Events

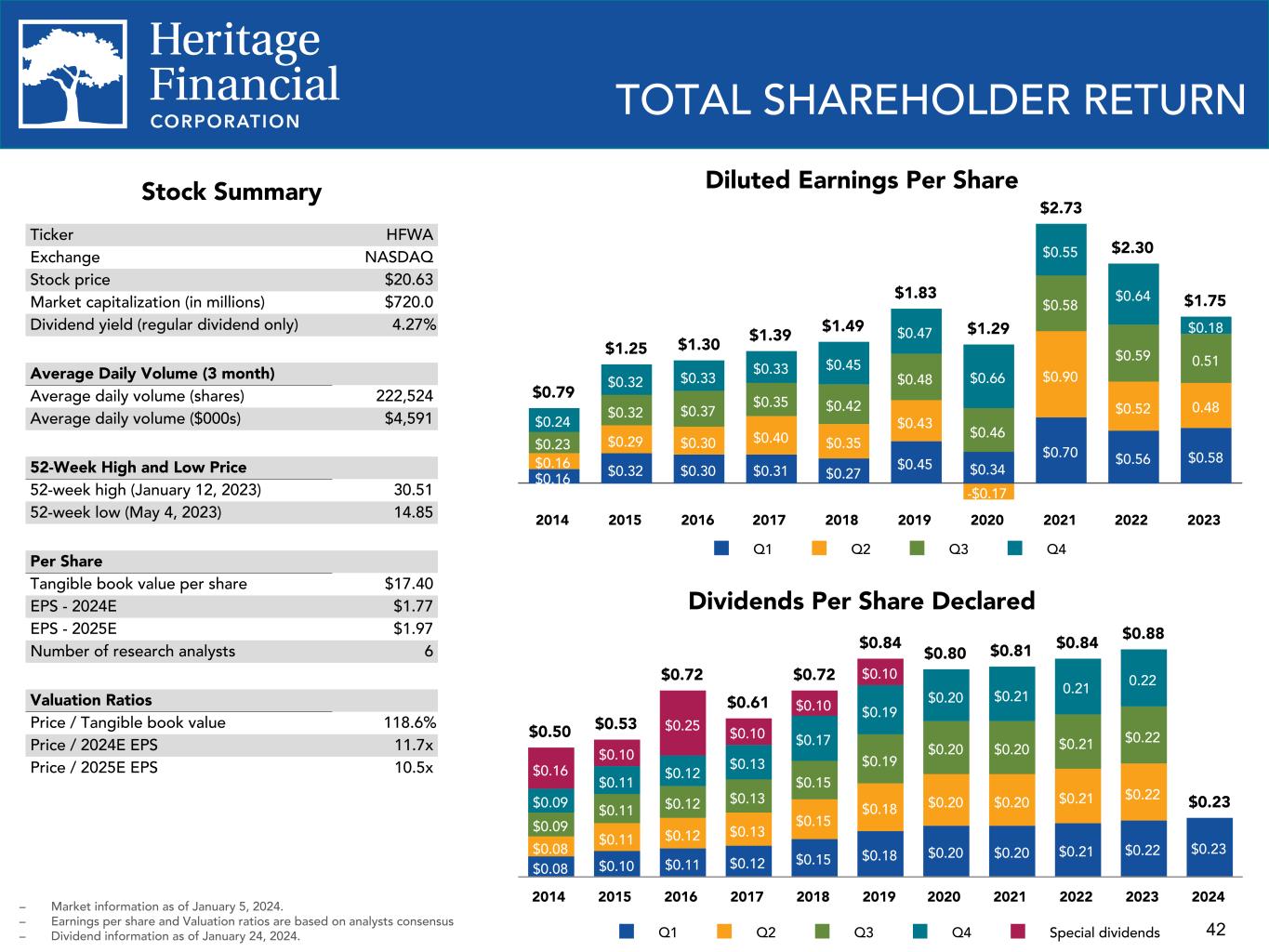

On January 25, 2024, Heritage issued a press release announcing a regular quarterly cash dividend of $0.23 per common share. The dividend will be paid on February 22, 2024 to shareholders of record at the close of business on February 8, 2024.

A copy of the release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibit is being filed herewith and this list shall constitute the exhibit index:

| | | | | | | | |

| Exhibit 99.1 | | |

| | |

| Exhibit 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | HERITAGE FINANCIAL CORPORATION |

| | |

| Date: | | |

| January 25, 2024 | | /S/ JEFFREY J. DEUEL |

| | Jeffrey J. Deuel |

| | President and Chief Executive Officer |

| | (Duly Authorized Officer) |

FOR IMMEDIATE RELEASE

DATE: January 25, 2024

HERITAGE FINANCIAL ANNOUNCES FOURTH QUARTER AND ANNUAL 2023 RESULTS AND DECLARES REGULAR CASH DIVIDEND

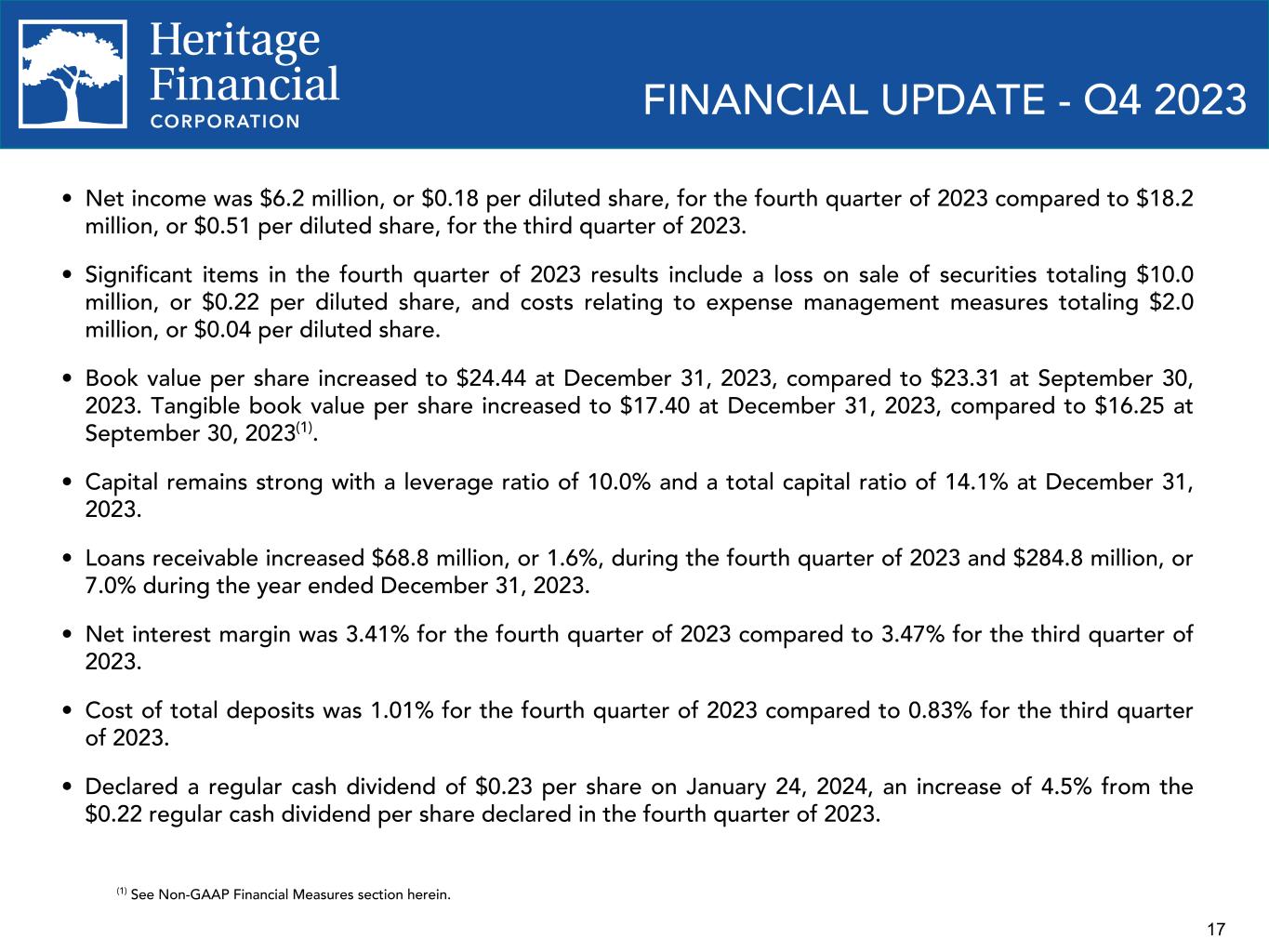

•Net income was $6.2 million, or $0.18 per diluted share, for the fourth quarter of 2023 compared to $18.2 million, or $0.51 per diluted share, for the third quarter of 2023.

•Significant items in the fourth quarter of 2023 results include a loss on sale of securities totaling $10.0 million, or $0.22 per diluted share, and costs relating to expense management measures totaling $2.0 million, or $0.04 per diluted share.

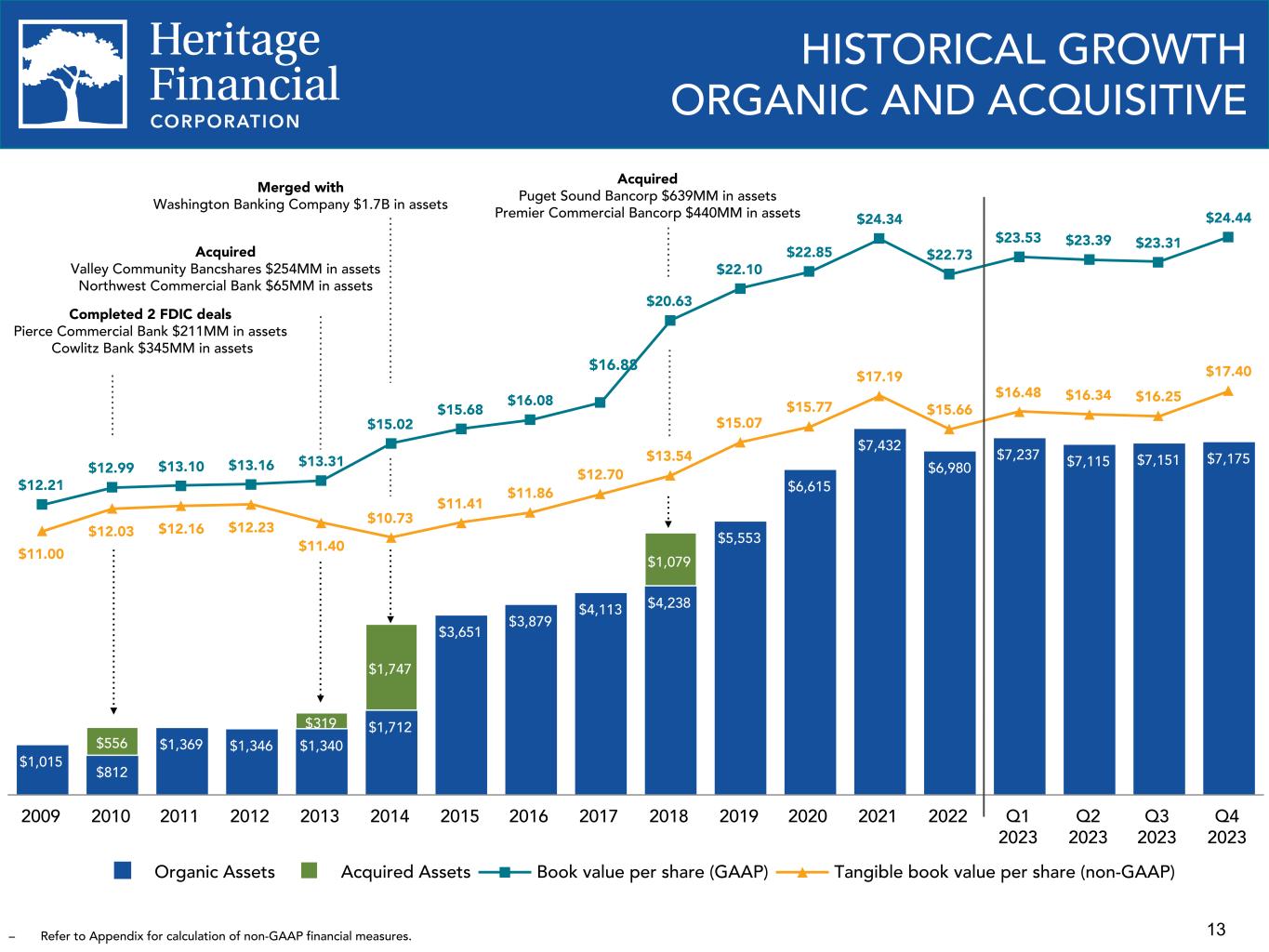

•Book value per share increased to $24.44 at December 31, 2023, compared to $23.31 at September 30, 2023. Tangible book value per share increased to $17.40 at December 31, 2023, compared to $16.25 at September 30, 2023(1).

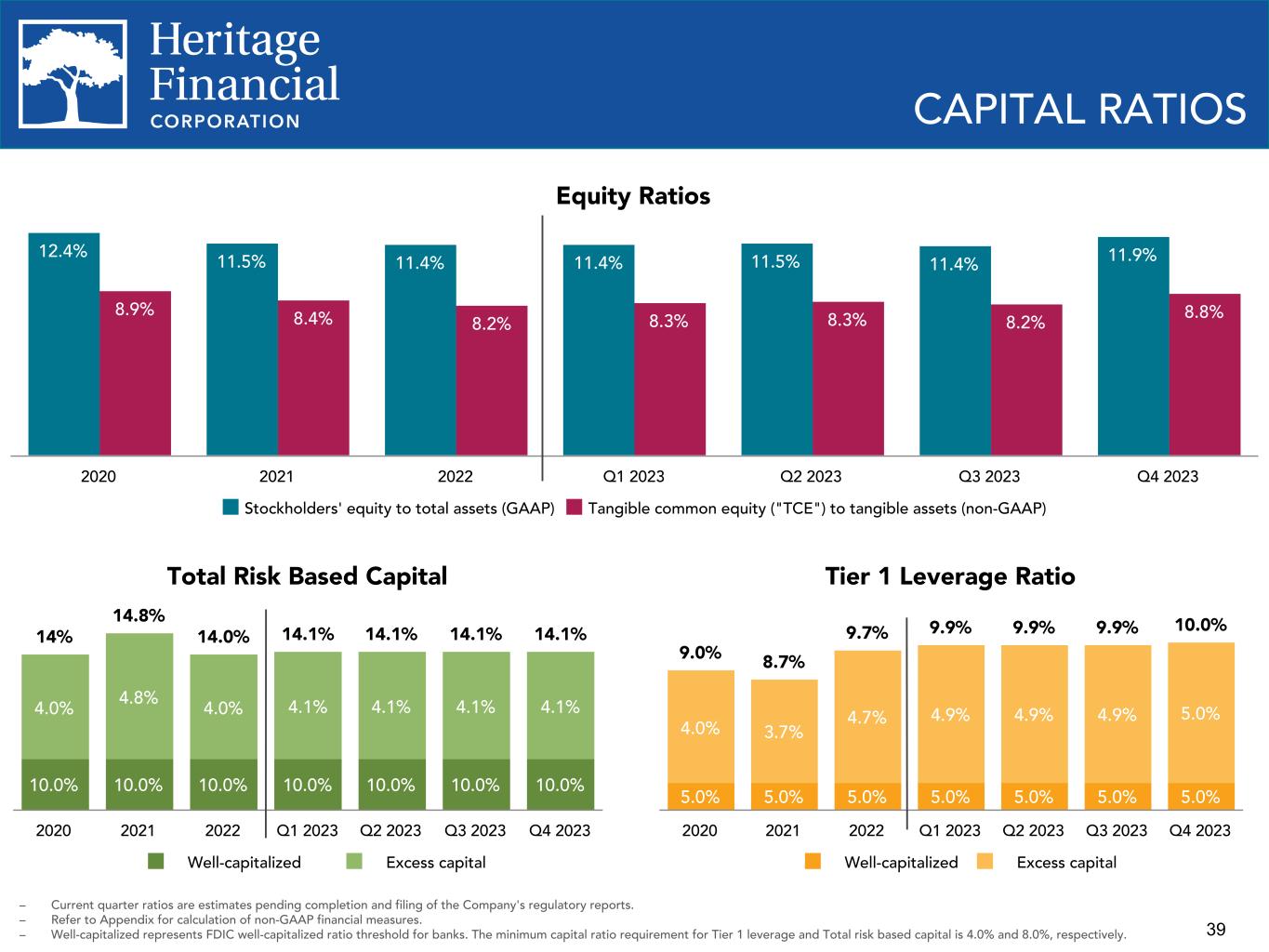

•Capital remains strong with a leverage ratio of 10.0% and a total capital ratio of 14.1% at December 31, 2023.

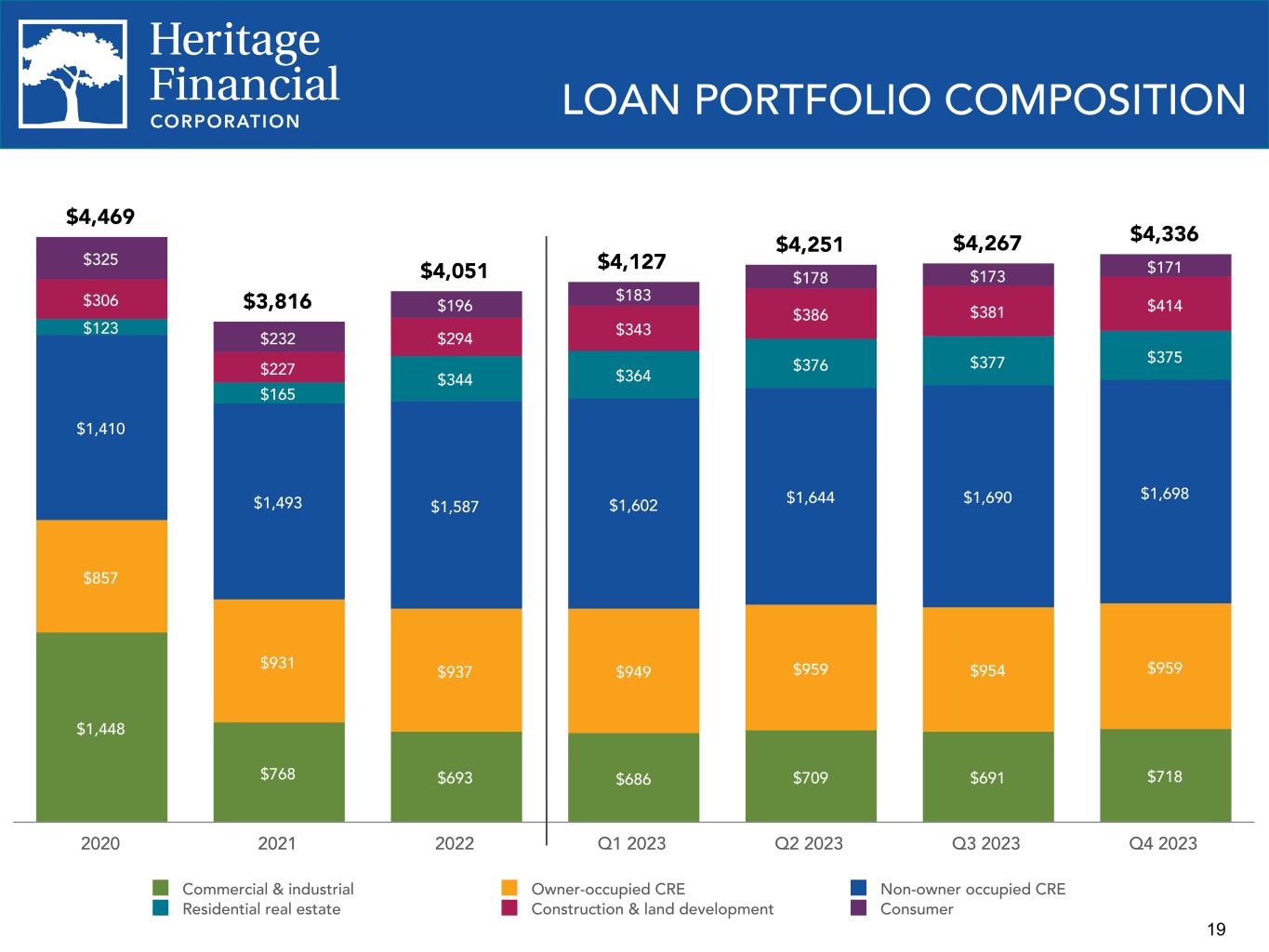

•Loans receivable increased $68.8 million, or 1.6%, during the fourth quarter of 2023 and $284.8 million, or 7.0% during the year ended December 31, 2023.

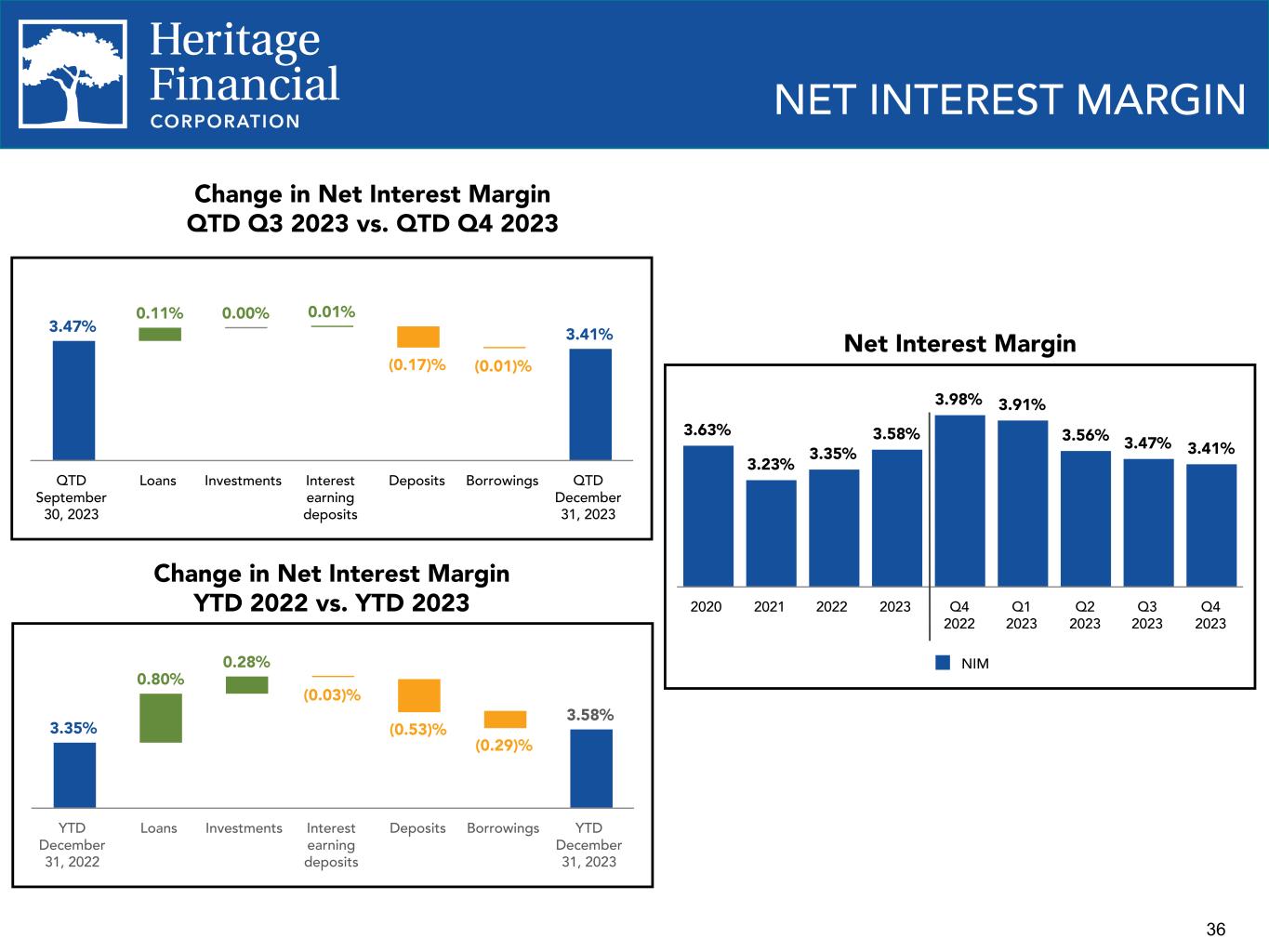

•Net interest margin was 3.41% for the fourth quarter of 2023 compared to 3.47% for the third quarter of 2023.

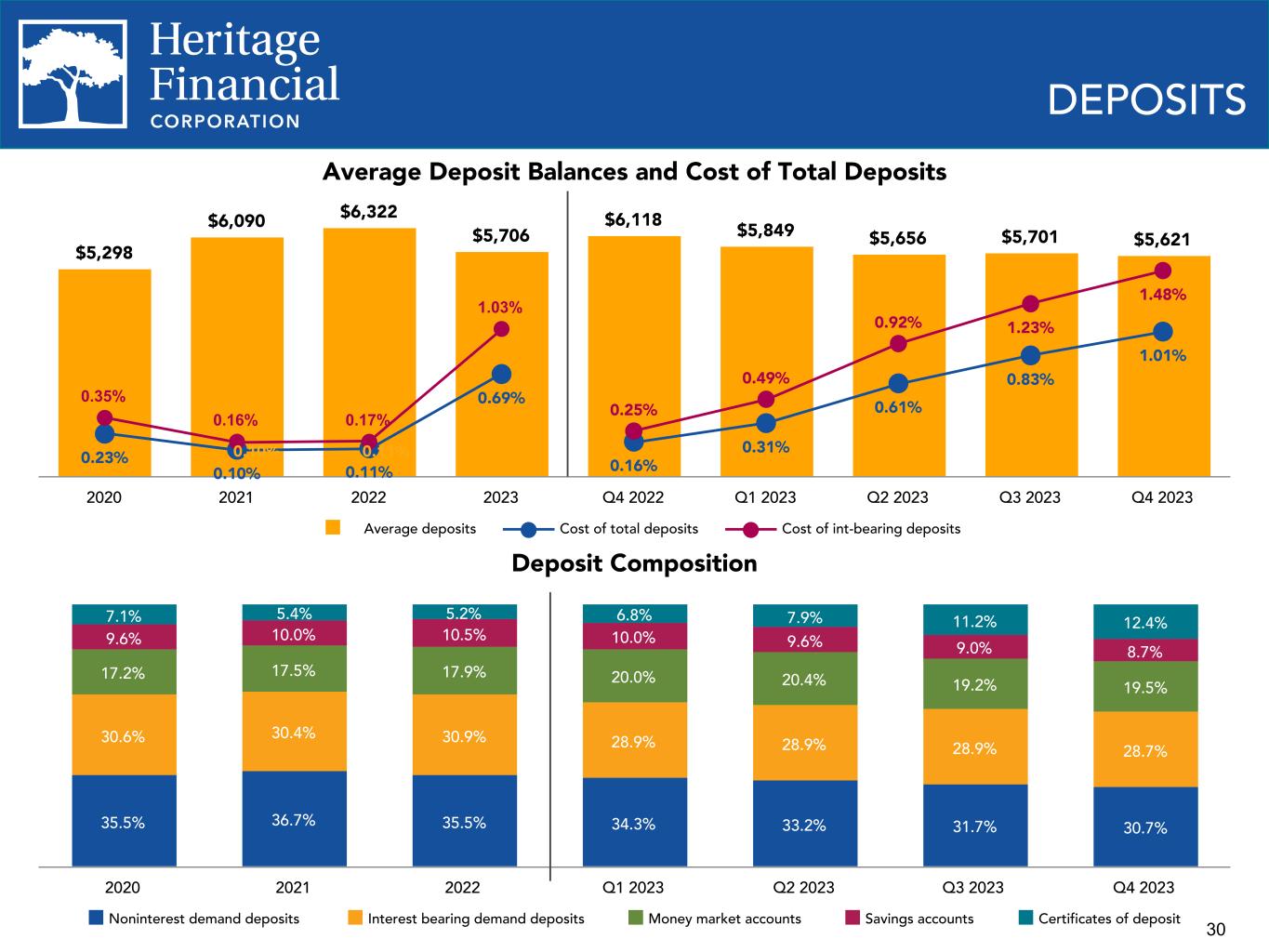

•Cost of total deposits was 1.01% for the fourth quarter of 2023 compared to 0.83% for the third quarter of 2023.

•Declared a regular cash dividend of $0.23 per share on January 24, 2024, an increase of 4.5% from the $0.22 regular cash dividend per share declared in the fourth quarter of 2023.

(1) See Non-GAAP Financial Measures section herein.

Olympia, WA - Heritage Financial Corporation (NASDAQ GS: HFWA) (the “Company” or “Heritage”), the parent company of Heritage Bank (the "Bank"), today reported net income of $6.2 million for the fourth quarter of 2023 compared to $18.2 million for the third quarter of 2023 and $22.5 million for the fourth quarter of 2022. Diluted earnings per share for the fourth quarter of 2023 were $0.18 compared to $0.51 for the third quarter of 2023 and $0.64 for the fourth quarter of 2022. Net income for the year ended 2023 totaled $61.8 million, or $1.75 per diluted share as compared to $81.9 million, or $2.31 per diluted share for 2022.

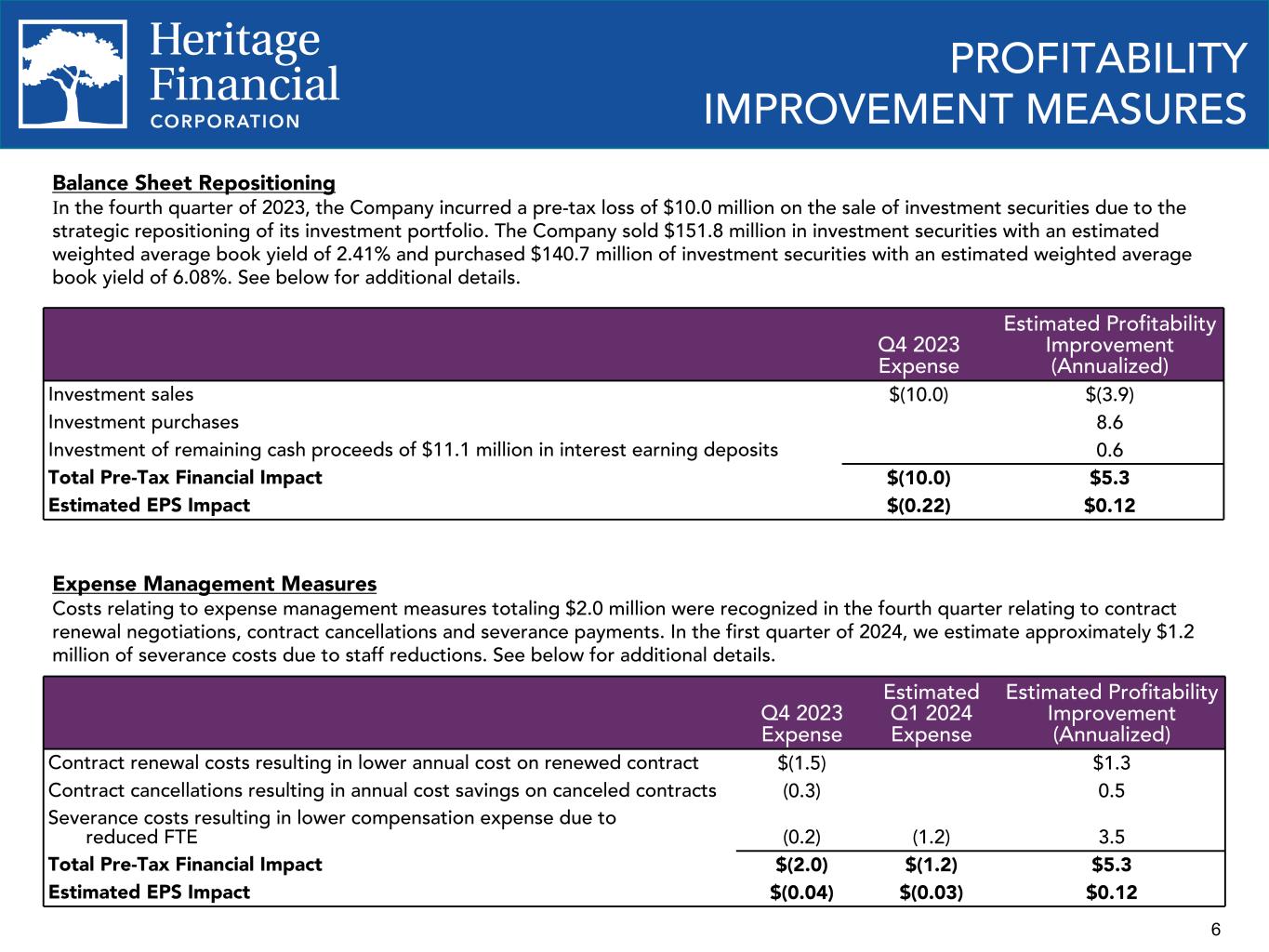

In the fourth quarter of 2023, the Company incurred a pre-tax loss of $10.0 million on the sale of investment securities due to the strategic repositioning of its investment portfolio, which affected diluted earnings per share by $0.22 for the quarter. The Company sold $151.8 million in investment securities with an estimated weighted average book yield of 2.41% and purchased $140.7 million of investment securities with an estimated weighted average book yield of 6.08%. The remaining proceeds from sales were invested in interest earning deposits. As a result of these actions, we anticipate an estimated annualized improvement of $5.3 million in interest income.

Further, costs relating to expense management measures totaling $2.0 million were recognized in the fourth quarter relating to contract renewal negotiations, contract cancellations and severance payments which were undertaken to improve future earnings. These noninterest expenses impacted diluted earnings per share by $0.04 for the quarter. These costs, in addition to approximately $1.2 million of severance costs incurred in the first quarter of 2024 due to staff reductions, are expected to provide annualized costs savings of approximately $5.3 million in future periods.

Jeffrey J. Deuel, President and Chief Executive Officer of Heritage, commented, "We are pleased with our accomplishments in the fourth quarter which included strong loan growth, expense management measures and repositioning of our investment portfolio. Although costs related to these activities are impacting current earnings, we expect enhanced earnings in future periods. We believe these actions, coupled with our strong balance sheet, will provide sustainable long-term returns for our shareholders.

We are also pleased to report that Heritage Bank is partnering with Community Roots Housing on the renovation of the historic Devonshire Apartments. This project will preserve 62 units of affordable housing in Seattle’s Belltown Neighborhood. Heritage provided a $16.9 million construction loan and $2.6 million permanent loan to update the building, which was originally built in 1925. The renovations will provide significant seismic upgrades, make the building more energy efficient and improve

living conditions for residents, all while preserving the historic brickwork façade. The project will continue to provide affordable housing, serving residents earning 50% to 60% of the Area Median Income. Heritage is proud to be a partner in preserving aging affordable housing stock in Seattle."

Financial Highlights

The following table provides financial highlights at the dates and for the periods indicated:

| | | | | | | | | | | | | | | | | |

| As of or for the Quarter Ended |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 |

| (Dollars in thousands, except per share amounts) |

| Net income | $ | 6,233 | | | $ | 18,219 | | | $ | 22,544 | |

Pre-tax, pre-provision income(1) | $ | 8,001 | | | $ | 20,919 | | | $ | 29,299 | |

| Diluted earnings per share | $ | 0.18 | | | $ | 0.51 | | | $ | 0.64 | |

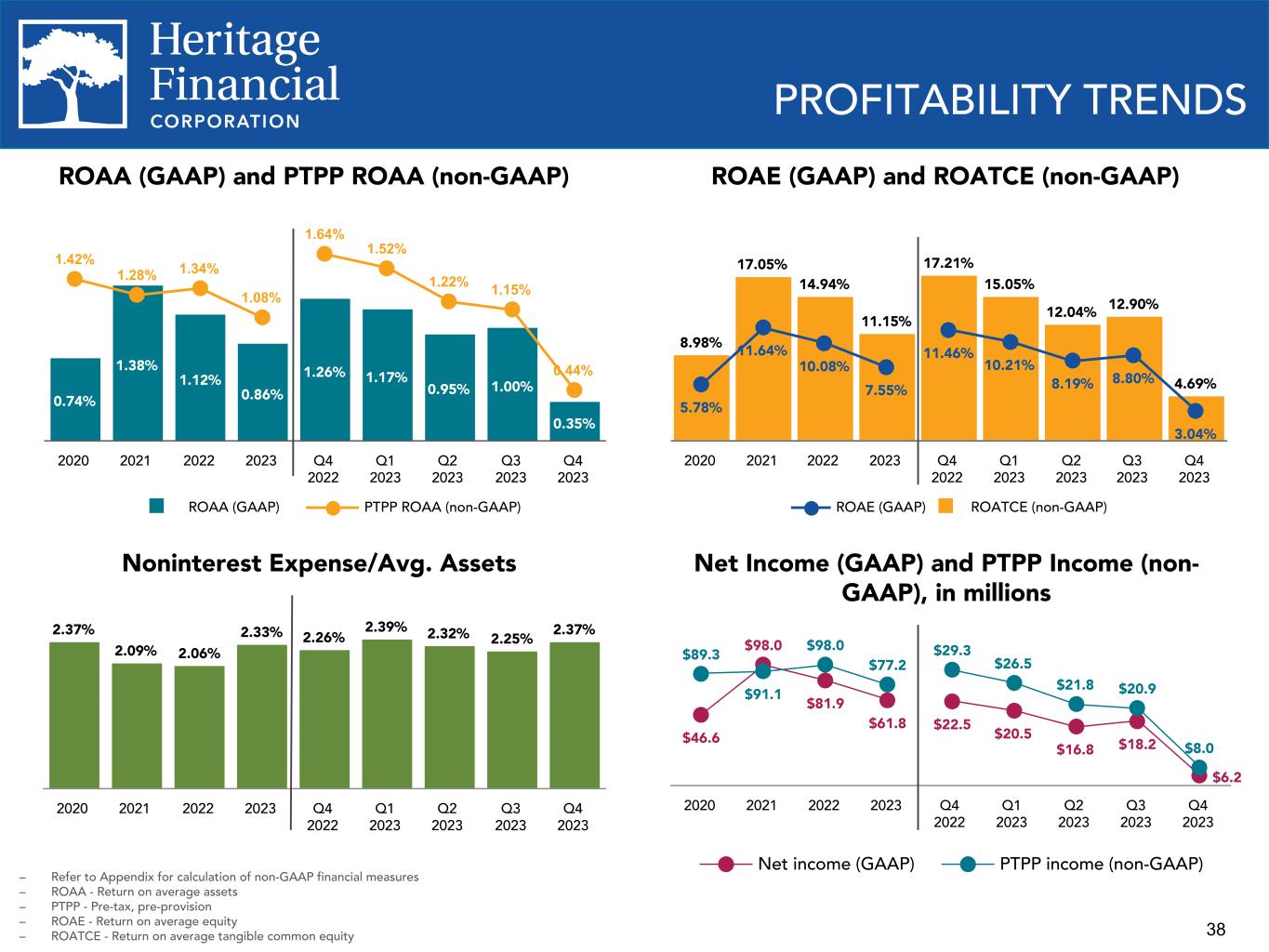

Return on average assets(2) | 0.35 | % | | 1.00 | % | | 1.26 | % |

Pre-tax, pre-provision return on average assets(1)(2) | 0.44 | % | | 1.15 | % | | 1.64 | % |

Return on average common equity(2) | 3.04 | % | | 8.80 | % | | 11.46 | % |

Return on average tangible common equity(1)(2) | 4.69 | % | | 12.90 | % | | 17.21 | % |

Net interest margin(2) | 3.41 | % | | 3.47 | % | | 3.98 | % |

Cost of total deposits(2) | 1.01 | % | | 0.83 | % | | 0.16 | % |

| Efficiency ratio | 84.2 | % | | 66.2 | % | | 58.0 | % |

Noninterest expense to average total assets(2) | 2.37 | % | | 2.25 | % | | 2.26 | % |

| Total assets | $ | 7,174,957 | | | $ | 7,150,588 | | | $ | 6,980,100 | |

| Loans receivable, net | $ | 4,287,628 | | | $ | 4,219,911 | | | $ | 4,007,872 | |

| Total deposits | $ | 5,599,872 | | | $ | 5,635,187 | | | $ | 5,924,840 | |

Loan to deposit ratio(3) | 77.4 | % | | 75.7 | % | | 68.4 | % |

| Book value per share | $ | 24.44 | | | $ | 23.31 | | | $ | 22.73 | |

Tangible book value per share(1) | $ | 17.40 | | | $ | 16.25 | | | $ | 15.66 | |

(1) See Non-GAAP Financial Measures section herein.

(2) Annualized.

(3) Loans receivable divided by total deposits.

Balance Sheet

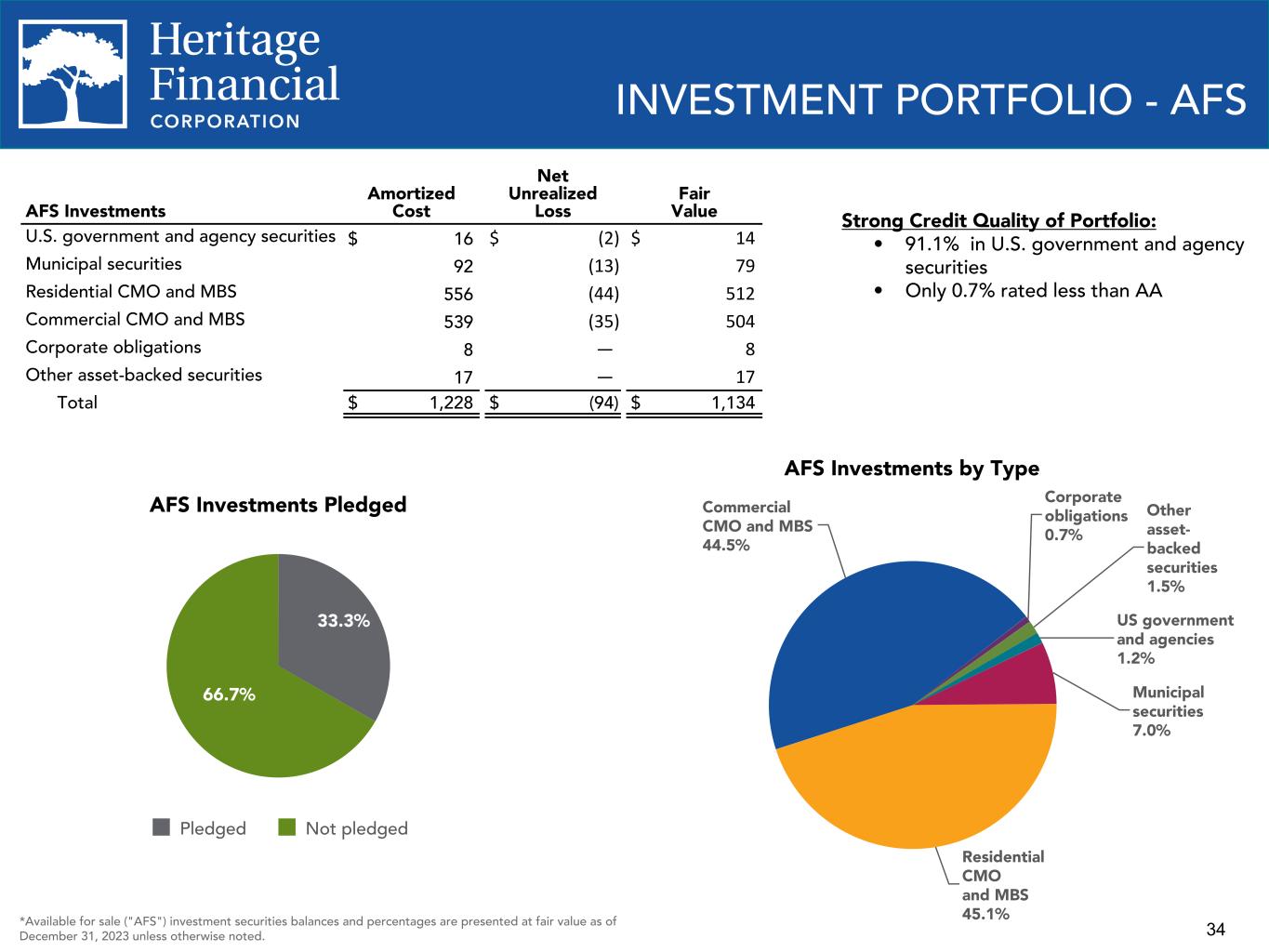

Total investment securities decreased $20.6 million, or 1.1%, to $1.87 billion at December 31, 2023 from $1.89 billion at September 30, 2023. As previously discussed, the Company sold $151.8 million in investment securities at a loss of $10.0 million during the fourth quarter of 2023. These funds were redeployed in investment purchases of $140.7 million and interest earning deposits.

The following table summarizes the Company's investment securities at the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 | | | | $ Change in Fair Value |

| | Amortized Cost | | Net Unrealized Loss | | Fair Value | | Amortized Cost | | Net Unrealized Loss | | Fair Value | | | |

| | (Dollars in thousands) |

| Investment securities available for sale: |

| U.S. government and agency securities | $ | 16,047 | | | $ | (2,297) | | | $ | 13,750 | | | $ | 23,533 | | | $ | (3,109) | | | $ | 20,424 | | | | | $ | (6,674) | |

| Municipal securities | 92,231 | | | (12,706) | | | 79,525 | | | 126,763 | | | (19,958) | | | 106,805 | | | | | (27,280) | |

Residential CMO and MBS(1) | 555,518 | | | (43,469) | | | 512,049 | | | 468,174 | | | (66,993) | | | 401,181 | | | | | 110,868 | |

Commercial CMO and MBS(1) | 538,910 | | | (34,652) | | | 504,258 | | | 651,713 | | | (54,500) | | | 597,213 | | | | | (92,955) | |

| Corporate obligations | 7,745 | | | (132) | | | 7,613 | | | 4,000 | | | (220) | | | 3,780 | | | | | 3,833 | |

| Other asset-backed securities | 17,336 | | | (178) | | | 17,158 | | | 18,317 | | | (173) | | | 18,144 | | | | | (986) | |

| Total | $ | 1,227,787 | | | $ | (93,434) | | | $ | 1,134,353 | | | $ | 1,292,500 | | | $ | (144,953) | | | $ | 1,147,547 | | | | | $ | (13,194) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | | | $ Change in Amortized Cost |

| Amortized Cost | | Net

Unrecognized Loss | | Fair Value | | Amortized Cost | | Net

Unrecognized Loss | | Fair Value | | | |

| (Dollars in thousands) |

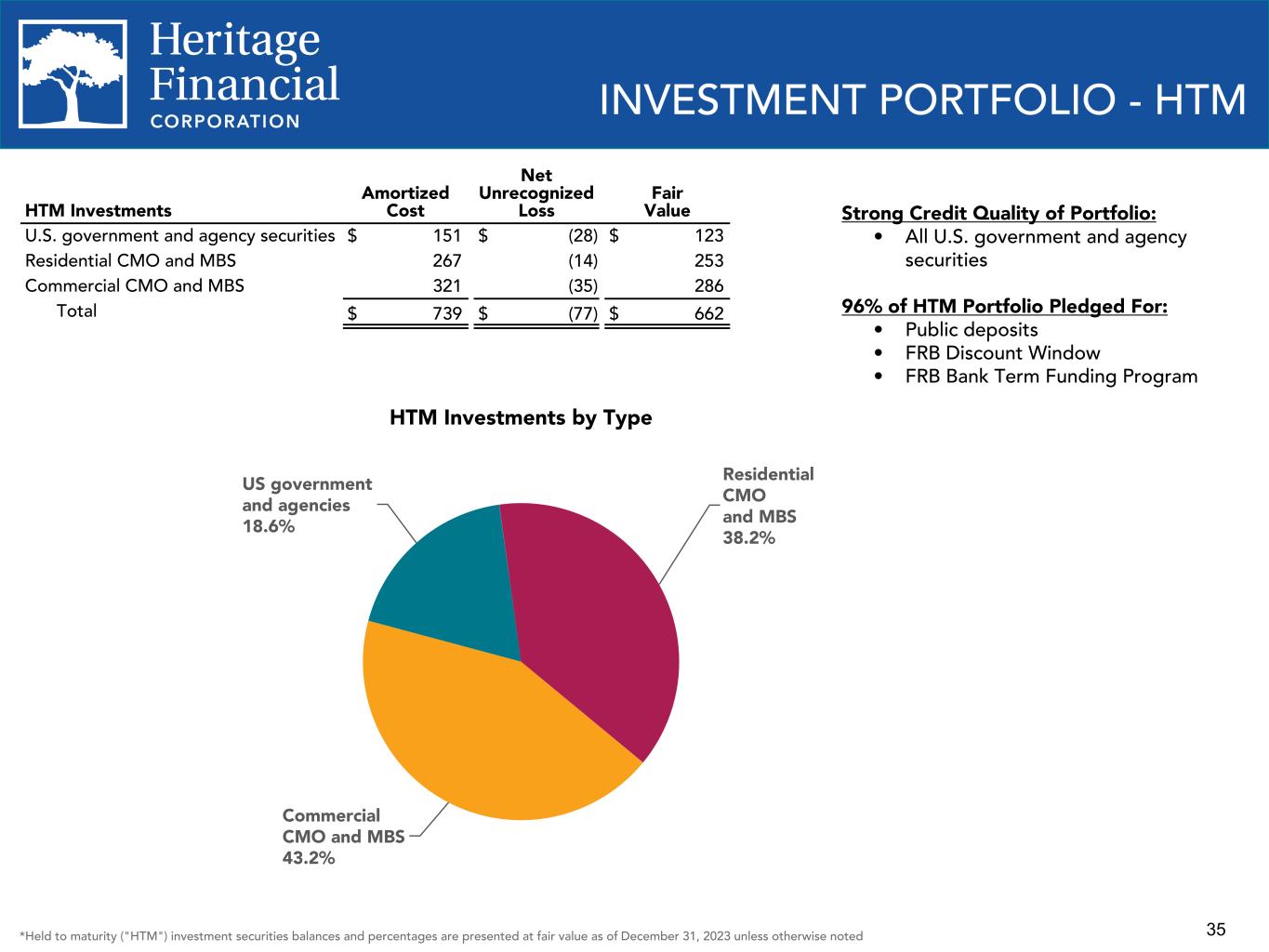

| Investment securities held to maturity: |

| U.S. government and agency securities | $ | 151,075 | | | $ | (27,701) | | | $ | 123,374 | | | $ | 151,040 | | | $ | (35,221) | | | $ | 115,819 | | | | | $ | 35 | |

| | | | | | | | | | | | | | | |

Residential CMO and MBS(1) | 267,204 | | | (14,101) | | | 253,103 | | | 273,609 | | | (27,445) | | | 246,164 | | | | | (6,405) | |

Commercial CMO and MBS(1) | 321,163 | | | (35,190) | | | 285,973 | | | 322,196 | | | (47,922) | | | 274,274 | | | | | (1,033) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total | $ | 739,442 | | | $ | (76,992) | | | $ | 662,450 | | | $ | 746,845 | | | $ | (110,588) | | | $ | 636,257 | | | | | $ | (7,403) | |

| | | | | | | | | | | | | | | |

| Total investment securities | $ | 1,967,229 | | | $ | (170,426) | | | $ | 1,796,803 | | | $ | 2,039,345 | | | $ | (255,541) | | | $ | 1,783,804 | | | | | |

(1) U.S. government agency and government-sponsored enterprise mortgage-backed securities and collateralized mortgage obligations.

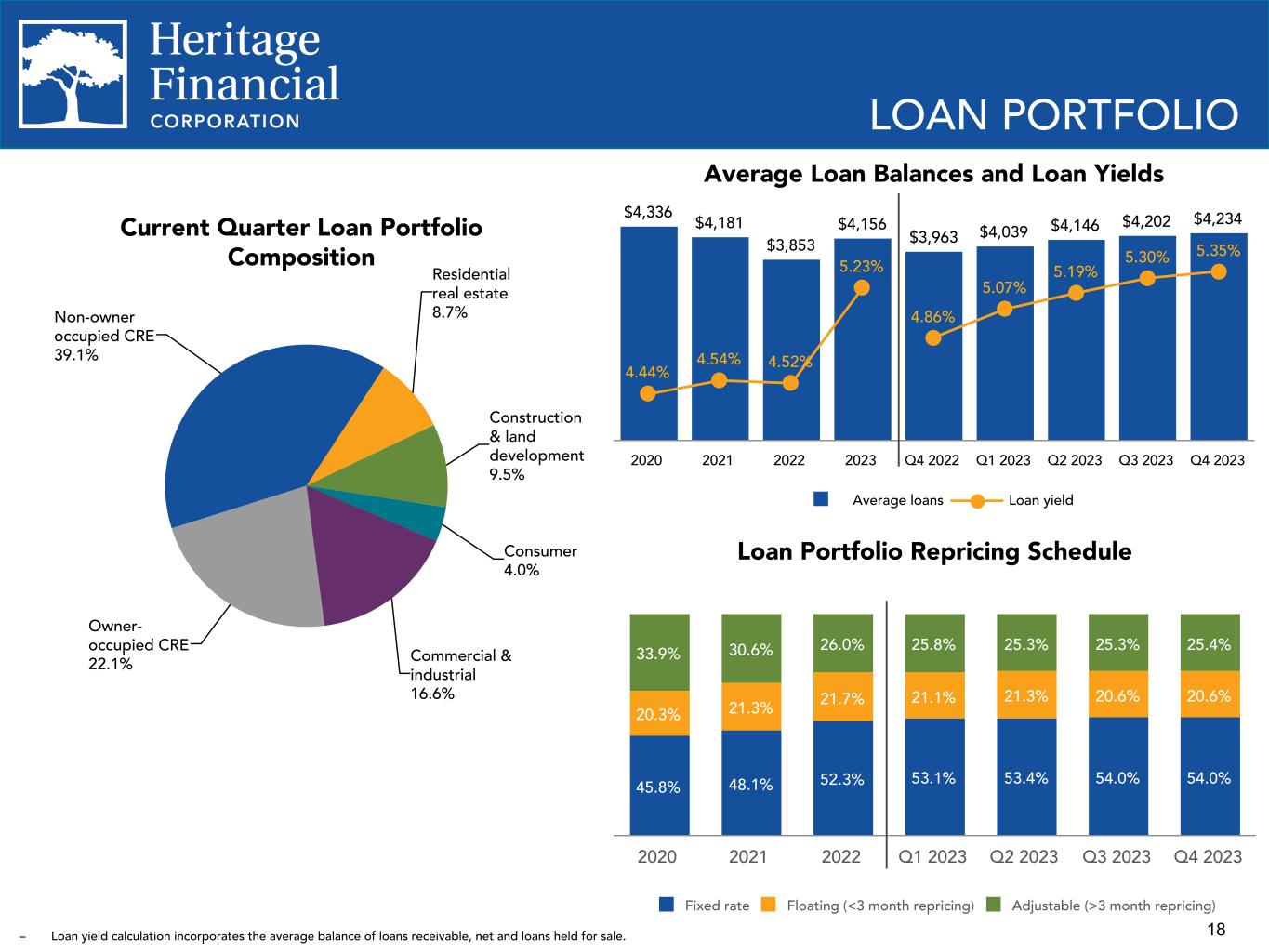

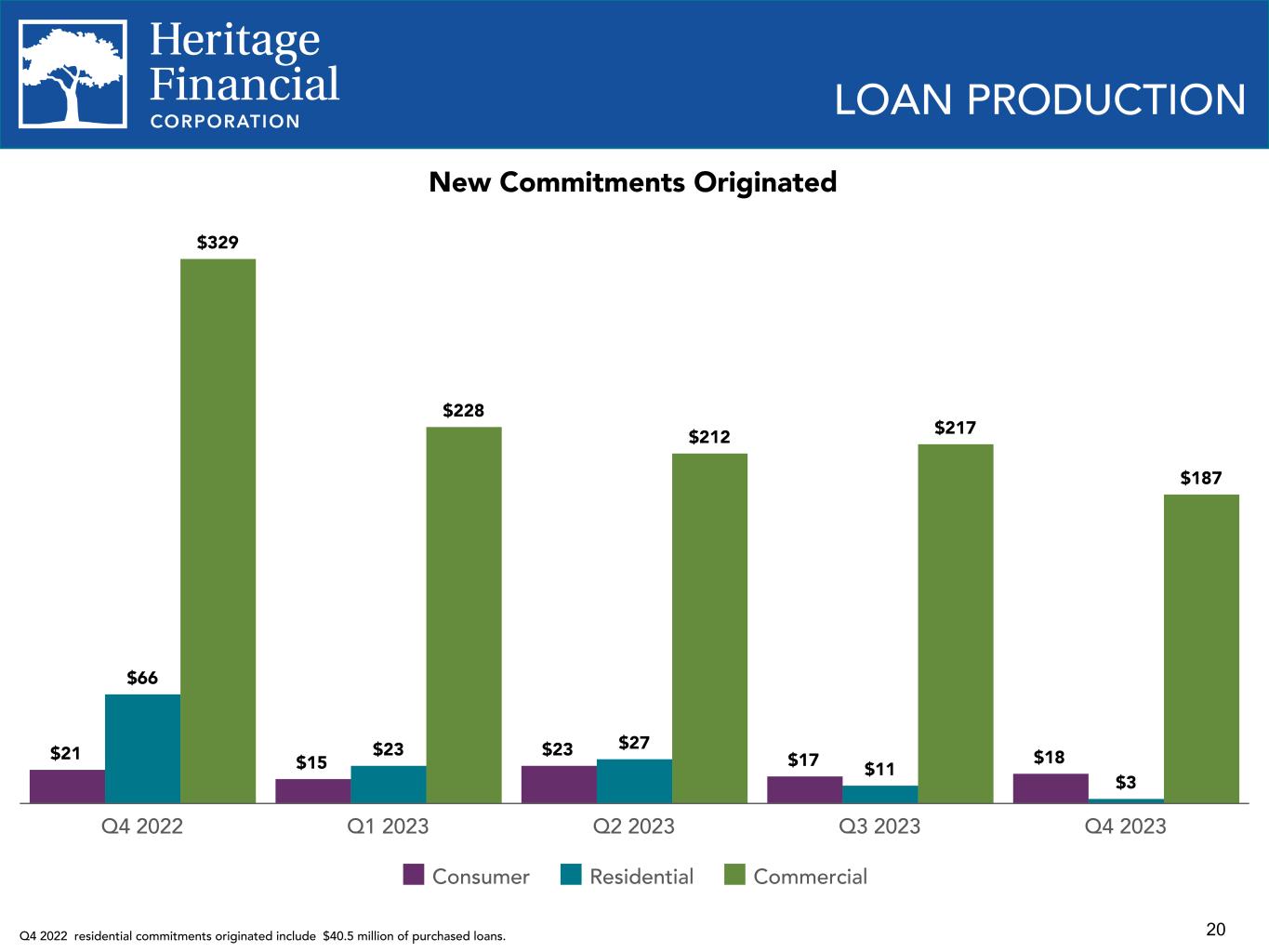

Loans receivable increased $68.8 million, or 1.6%, to $4.34 billion at December 31, 2023 from $4.27 billion at September 30, 2023. New loans funded in the fourth quarter of 2023 and third quarter of 2023 totaled $113.4 million and $98.5 million, respectively. Loan prepayments decreased slightly during the fourth quarter of 2023 to $42.8 million, compared to $60.6 million during the third quarter of 2023.

Commercial and industrial loans increased $27.0 million, or 3.9%, due primarily to new loan production of $54.1 million during the fourth quarter of 2023 offset partially by repayments. Commercial and multifamily construction loans increased $25.8 million, or 8.3% due primarily to advances on outstanding commitments.

The following table summarizes the Company's loans receivable, net at the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | Change |

| Balance | | % of Total | | Balance | | % of Total | | $ | | % |

| (Dollars in thousands) |

| Commercial business: | | | | | | | | | | | |

| Commercial and industrial | $ | 718,291 | | | 16.6 | % | | $ | 691,318 | | | 16.2 | % | | $ | 26,973 | | | 3.9 | % |

| Owner-occupied commercial real estate ("CRE") | 958,620 | | | 22.1 | | | 953,779 | | | 22.4 | | | 4,841 | | | 0.5 | |

| Non-owner occupied CRE | 1,697,574 | | | 39.1 | | | 1,690,099 | | | 39.5 | | | 7,475 | | | 0.4 | |

| Total commercial business | 3,374,485 | | | 77.8 | | | 3,335,196 | | | 78.1 | | | 39,289 | | | 1.2 | |

Residential real estate | 375,342 | | | 8.7 | | | 377,448 | | | 8.8 | | | (2,106) | | | (0.6) | |

| Real estate construction and land development: | | | | | | | | | | | |

Residential | 78,610 | | | 1.8 | | | 70,804 | | | 1.7 | | | 7,806 | | | 11.0 | |

Commercial and multifamily | 335,819 | | | 7.7 | | | 310,024 | | | 7.3 | | | 25,795 | | | 8.3 | |

| Total real estate construction and land development | 414,429 | | | 9.5 | | | 380,828 | | | 9.0 | | | 33,601 | | | 8.8 | |

| Consumer | 171,371 | | | 4.0 | | | 173,386 | | | 4.1 | | | (2,015) | | | (1.2) | |

| Loans receivable | 4,335,627 | | | 100.0 | % | | 4,266,858 | | | 100.0 | % | | 68,769 | | | 1.6 | |

| Allowance for credit losses on loans | (47,999) | | | | | (46,947) | | | | | (1,052) | | | 2.2 | |

| Loans receivable, net | $ | 4,287,628 | | | | | $ | 4,219,911 | | | | | $ | 67,717 | | | 1.6 | % |

Total deposits decreased $35.3 million, or 0.6%, to $5.60 billion at December 31, 2023 from $5.64 billion at September 30, 2023. Certificates of deposit increased $64.4 million, or 10.2%, from September 30, 2023 primarily due to transfers from non-maturity deposit accounts as customers moved balances to higher yielding accounts.

The following table summarizes the Company's total deposits at the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | Change |

| Balance | | % of Total | | Balance | | % of Total | | $ | | % |

| (Dollars in thousands) |

| Noninterest demand deposits | $ | 1,715,847 | | | 30.7 | % | | $ | 1,789,293 | | | 31.7 | % | | $ | (73,446) | | | (4.1) | % |

| Interest bearing demand deposits | 1,608,745 | | | 28.7 | | | 1,630,007 | | | 28.9 | | | (21,262) | | | (1.3) | |

| Money market accounts | 1,094,351 | | | 19.5 | | | 1,081,253 | | | 19.2 | | | 13,098 | | | 1.2 | |

| Savings accounts | 487,956 | | | 8.7 | | | 506,028 | | | 9.0 | | | (18,072) | | | (3.6) | |

| Total non-maturity deposits | 4,906,899 | | | 87.6 | | | 5,006,581 | | | 88.8 | | | (99,682) | | | (2.0) | |

| Certificates of deposit | 692,973 | | | 12.4 | | | 628,606 | | | 11.2 | | | 64,367 | | | 10.2 | |

| Total deposits | $ | 5,599,872 | | | 100.0 | % | | $ | 5,635,187 | | | 100.0 | % | | $ | (35,315) | | | (0.6) | % |

The Company discontinued offering securities sold under agreement to repurchase during the fourth quarter of 2023. Total securities sold under agreements to repurchase were $23.2 million at September 30, 2023.

Total borrowings were $500.0 million at December 31, 2023 compared to $450.0 million at September 30, 2023. Borrowings of $50.0 million at a rate 5.09% were paid off and were offset by advances of $100.0 million at a rate of 4.89% during the fourth quarter of 2023. All borrowings were from the Federal Reserve Bank ("FRB") Bank Term Funding Program (“BTFP”). The BTFP offers loans of up to one year in length to institutions pledging eligible investment securities. The advance rate on the collateral is at par value.

Total stockholders' equity increased $39.7 million, or 4.9%, to $853.3 million at December 31, 2023 compared to $813.5 million at September 30, 2023 due primarily to a decrease of $40.2 million in accumulated other comprehensive loss as a result of increasing fair values of investment securities available for sale and $6.2 million of net income recognized for the quarter offset partially by $7.7 million in dividends paid to common shareholders.

The Company and Bank continue to maintain capital levels in excess of the applicable regulatory requirements for them both to be categorized as “well-capitalized”.

The following table summarizes capital ratios for the Company at the dates indicated:

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30,

2023 | | Change |

| Stockholders' equity to total assets | 11.9 | % | | 11.4 | % | | 0.5 | % |

Tangible common equity to tangible assets (1) | 8.8 | | | 8.2 | | | 0.6 | |

Common equity tier 1 capital ratio (2) | 12.9 | | | 12.9 | | | — | |

Leverage ratio (2) | 10.0 | | | 9.9 | | | 0.1 | |

Tier 1 capital ratio (2) | 13.3 | | | 13.3 | | | — | |

Total capital ratio (2) | 14.1 | | | 14.1 | | | — | |

(1) See Non-GAAP Financial Measures section herein.

(2) Current quarter ratios are estimates pending completion and filing of the Company’s regulatory reports.

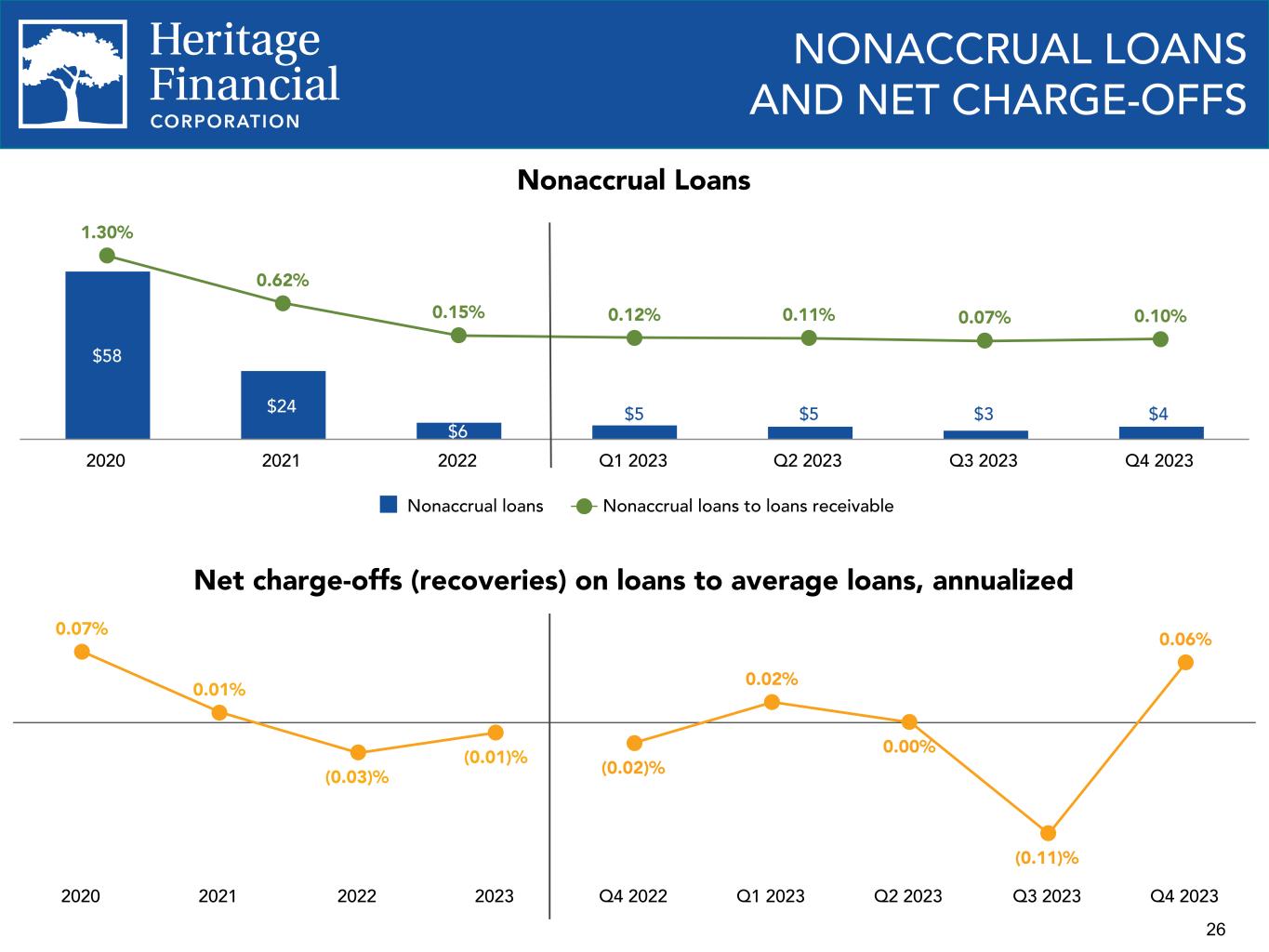

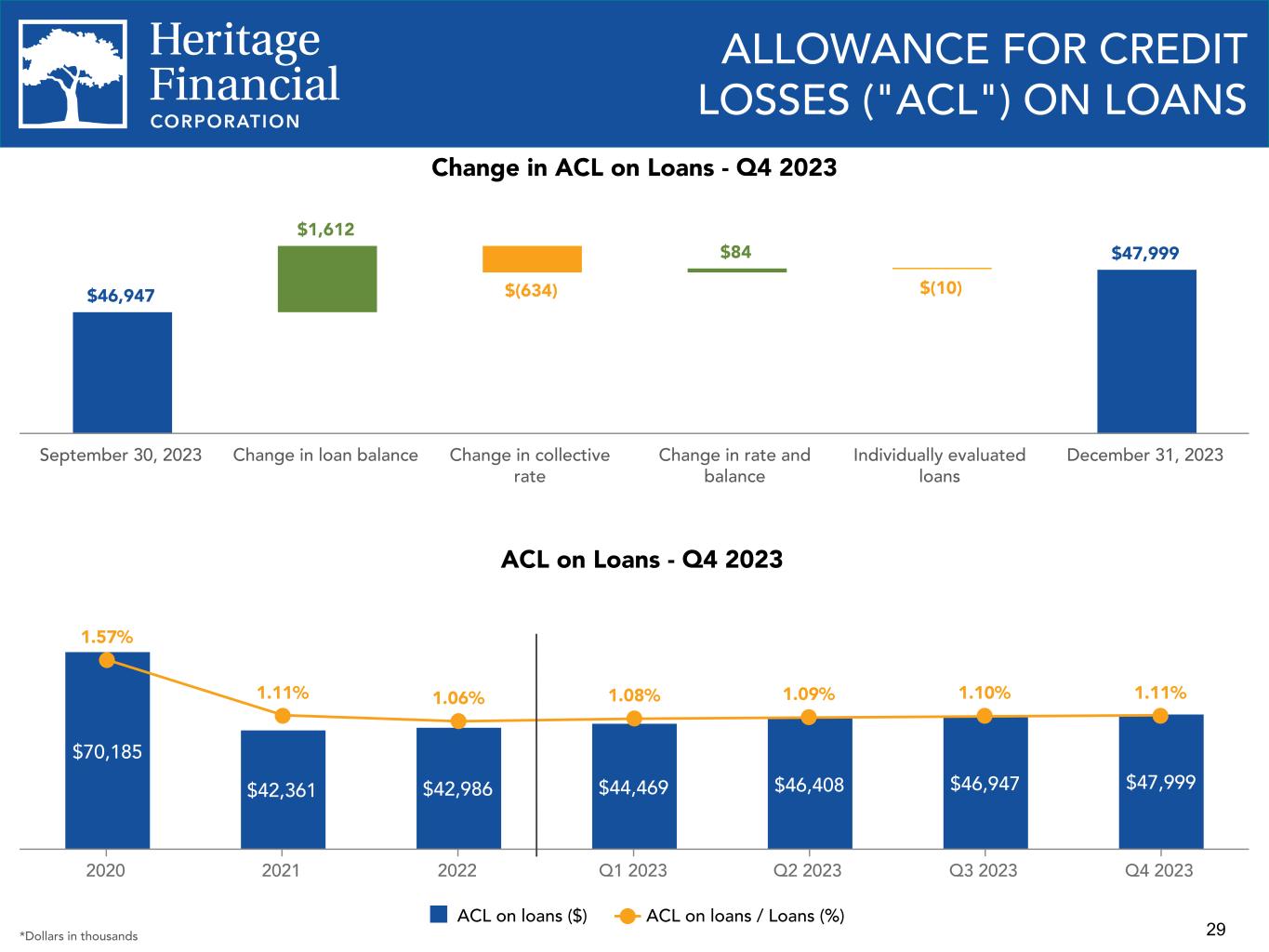

Allowance for Credit Losses and Provision for Credit Losses

The allowance for credit losses ("ACL") on loans as a percentage of loans receivable was 1.11% at December 31, 2023 compared to 1.10% at September 30, 2023. During the fourth quarter of 2023, the Company recorded a $1.7 million provision for credit losses on loans, compared to a $635,000 reversal of provision for credit losses on loans during the third quarter of 2023. The provision for credit losses on loans during the fourth quarter of 2023 was primarily driven by loan growth during the quarter.

During the fourth quarter of 2023, the Company recorded a $246,000 reversal of provision for credit losses on unfunded commitments compared to a $243,000 reversal of provision for credit losses on unfunded commitments during the third quarter of 2023. The reversal of provision for credit losses on unfunded commitments during the fourth quarter of 2023 was due primarily to a $39.0 million decrease in the unfunded exposure on construction loans.

The following table provides detail on the changes in the ACL on loans and the ACL on unfunded, and the related provision for (reversal of) credit losses for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of or for the Quarter Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| ACL on Loans | | ACL on Unfunded | | Total | | ACL on Loans | | ACL on Unfunded | | Total | | ACL on Loans | | ACL on Unfunded | | Total |

| (Dollars in thousands) |

| Balance, beginning of period | $ | 46,947 | | | $ | 1,534 | | | $ | 48,481 | | | $ | 46,408 | | | $ | 1,777 | | | $ | 48,185 | | | $ | 42,089 | | | $ | 1,023 | | | $ | 43,112 | |

| Provision for (reversal of) credit losses | 1,670 | | | (246) | | | 1,424 | | | (635) | | | (243) | | | (878) | | | 689 | | | 721 | | | 1,410 | |

| (Net charge-offs) net recoveries | (618) | | | — | | | (618) | | | 1,174 | | | — | | — | | 1,174 | | | 208 | | | — | | | 208 | |

| Balance, end of period | $ | 47,999 | | | $ | 1,288 | | | $ | 49,287 | | | $ | 46,947 | | | $ | 1,534 | | | $ | 48,481 | | | $ | 42,986 | | | $ | 1,744 | | | $ | 44,730 | |

Credit Quality

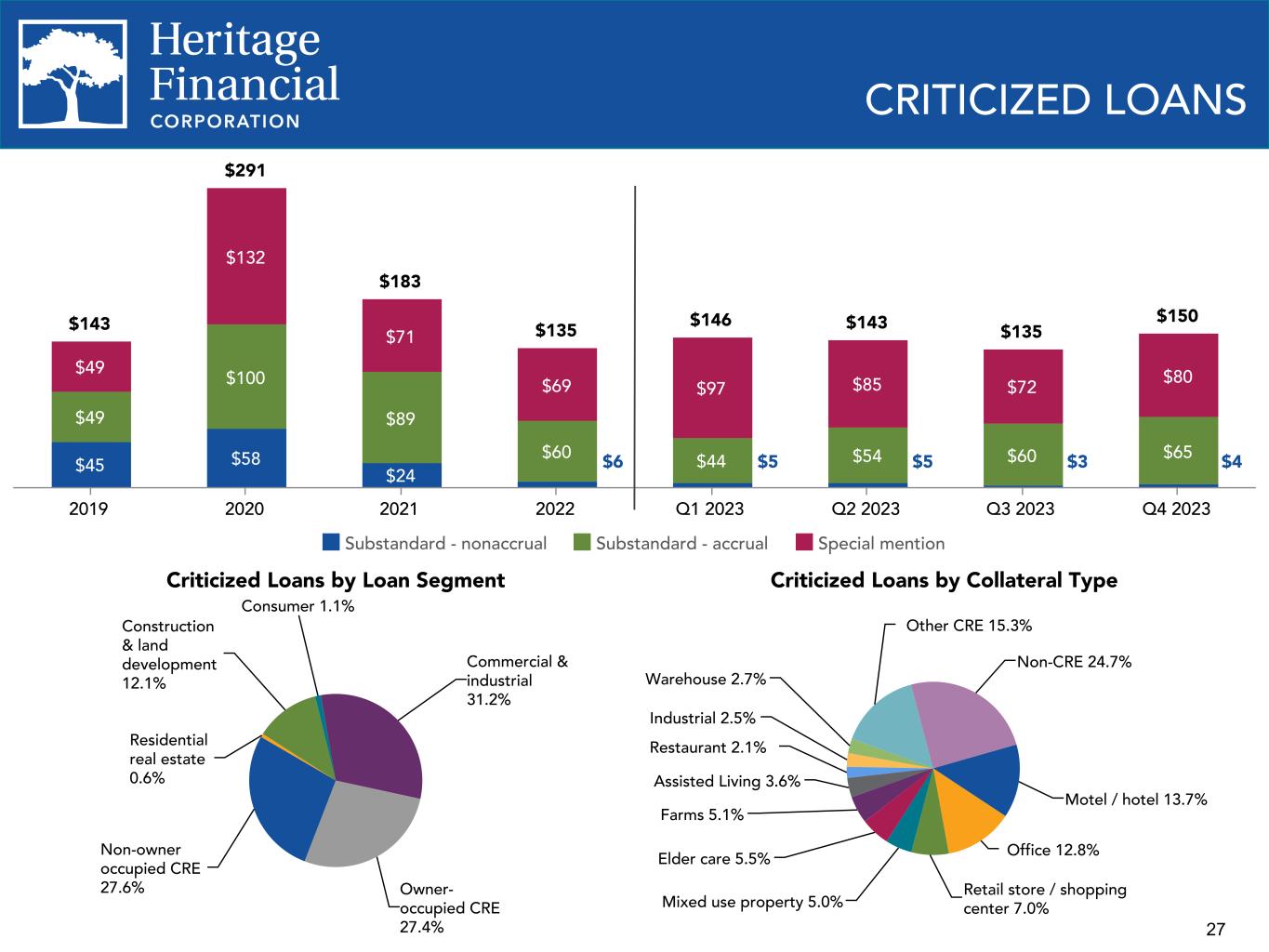

The percentage of classified loans to loans receivable increased slightly to 1.61% at December 31, 2023, compared to 1.47% at September 30, 2023. Classified loans include loans rated substandard or worse. Total classified loans and loans designated as special mention increased by $14.9 million to $149.7 million at December 31, 2023, compared to $134.8 million at September 30, 2023. This increase was primarily due to the transfer of a $7.1 million commercial and industrial loan to special mention and a $6.0 million commercial and industrial lending relationship to substandard offset partially by repayments and transfers of previously classified and special mention loans to a pass rating.

The following table illustrates total loans by risk rating and their respective percentage of total loans at the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 |

| Balance | | % of Total | | Balance | | % of Total |

| (Dollars in thousands) |

| Risk Rating: | | | | | | | |

| Pass | $ | 4,185,893 | | | 96.6 | % | | $ | 4,132,053 | | | 96.8 | % |

| Special Mention | 79,977 | | | 1.8 | | | 72,152 | | | 1.7 | |

| Substandard | 69,757 | | | 1.6 | | | 62,653 | | | 1.5 | |

| Total | $ | 4,335,627 | | | 100.0 | % | | $ | 4,266,858 | | | 100.0 | % |

Nonaccrual loans to loans receivable was 0.10% and 0.07% at December 31, 2023 and September 30, 2023, respectively. Nonaccrual loans increased primarily due to the addition of a $2.1 million commercial and industrial loan during the fourth quarter of 2023 which is 100% government guaranteed. Changes in nonaccrual loans during the periods indicated were as follows:

| | | | | | | | | | | | | | | | | |

| Quarter Ended |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 |

| (In thousands) |

| Balance, beginning of period | $ | 3,065 | | | $ | 4,630 | | | $ | 6,234 | |

| Additions | 2,149 | | | 440 | | | 605 | |

| Net principal payments and transfers to accruing status | (333) | | | (81) | | | (828) | |

| Payoffs | (413) | | | (1,924) | | | (105) | |

| | | | | |

| | | | | |

| Balance, end of period | $ | 4,468 | | | $ | 3,065 | | | $ | 5,906 | |

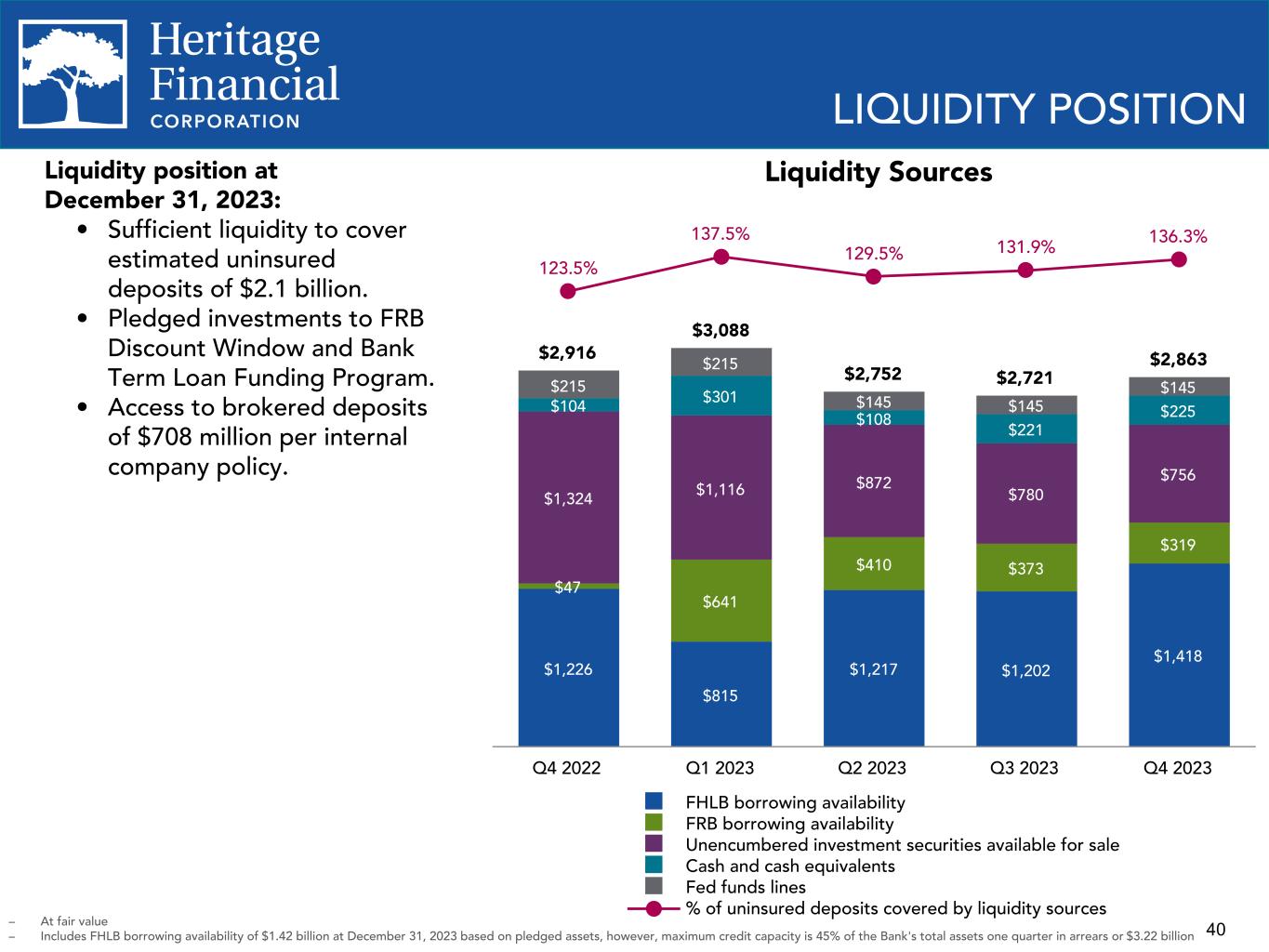

Liquidity

Total liquidity sources available at December 31, 2023 were $2.86 billion. This includes internal as well as external sources of liquidity. The Company has access to FHLB advances, the FRB Discount Window and BTFP. The Company's available liquidity sources at December 31, 2023 represented a coverage ratio of 51.1% of total deposits and 136.3% of estimated uninsured deposits.

The following table summarizes the Company's available liquidity:

| | | | | | | | | | | |

| Quarter Ended |

| December 31, 2023 | | September 30,

2023 |

| (Dollars in thousands) |

| FRB borrowing availability | $ | 819,492 | | | $ | 823,117 | |

FHLB borrowing availability(1) | 1,417,518 | | | 1,202,172 | |

Unencumbered investment securities available for sale(2) | 756,258 | | | 779,871 | |

| Cash and cash equivalents | 224,973 | | | 220,503 | |

| Fed funds line borrowing availability with correspondent banks | 145,000 | | | 145,000 | |

| Total sources of liquidity | 3,363,241 | | | 3,170,663 | |

| Less: Borrowings outstanding | (500,000) | | | (450,000) | |

Total available liquidity | $ | 2,863,241 | | | $ | 2,720,663 | |

(1) Includes FHLB total borrowing availability of $1.42 billion at December 31, 2023 based on pledged assets, however, maximum credit capacity is 45% of the Bank's total assets one quarter in arrears or $3.22 billion.

(2) Investment securities available for sale at fair value.

Net Interest Income and Net Interest Margin

Net interest income decreased $1.7 million, or 3.1%, during the fourth quarter of 2023 compared to the third quarter of 2023 due primarily to an increase of $2.5 million in interest expense partially offset by a $795,000 increase in interest income. Net interest margin decreased six basis points to 3.41% during the fourth quarter of 2023 from 3.47% during the third quarter of 2023.

The cost of interest bearing deposits increased 25 basis points to 1.48% for the fourth quarter of 2023 from 1.23% for the third quarter of 2023.

This increase was primarily due to customers transferring balances from non-maturity deposits to higher rate certificates of deposit. The yield on interest earning assets increased 12 basis points to 4.70% for the fourth quarter of 2023 compared to 4.58% for the third quarter of 2023. The yield on loans receivable, net increased five basis points to 5.35% during the fourth quarter of 2023 compared to 5.30% during the third quarter of 2023 due to higher rates on new and renewed loans and recoveries of interest on loans classified as nonaccrual loans that paid off during the quarter which contributed three basis points to the yield on loans receivable. The yield on taxable securities increased 15 basis points to 3.15% during the fourth quarter of 2023 compared to 3.00% during the third quarter of 2023 due to sales of $151.8 million of lower yielding investments with a weighted average yield of 2.41% offset by purchases of $140.7 million of higher yielding investments with a weighted average yield of 6.08%.

Net interest income decreased $9.2 million, or 14.6%, during the fourth quarter of 2023 compared to the fourth quarter of 2022 and the net interest margin decreased 57 basis points from 3.98% during this same period. The decrease was due primarily to an increase in interest expense due to an increase in deposit rates and borrowing expense partially offset by an increase in yields earned on interest earning assets following increases in market interest rates.

The following table provides relevant net interest income information for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) | | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) | | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) |

| (Dollars in thousands) |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | |

Loans receivable, net (2)(3) | $ | 4,233,743 | | | $ | 57,092 | | | 5.35 | % | | $ | 4,201,554 | | | $ | 56,119 | | | 5.30 | % | | $ | 3,963,042 | | | $ | 48,513 | | | 4.86 | % |

| Taxable securities | 1,824,205 | | | 14,488 | | | 3.15 | | | 1,931,649 | | | 14,590 | | | 3.00 | | | 1,983,178 | | | 14,655 | | | 2.93 | |

Nontaxable securities (3) | 37,382 | | | 300 | | | 3.18 | | | 60,654 | | | 448 | | | 2.93 | | | 123,430 | | | 843 | | | 2.71 | |

| Interest earning deposits | 174,475 | | | 2,382 | | | 5.42 | | | 169,186 | | | 2,310 | | | 5.42 | | | 222,538 | | | 2,010 | | | 3.58 | |

| Total interest earning assets | 6,269,805 | | | 74,262 | | | 4.70 | % | | 6,363,043 | | | 73,467 | | | 4.58 | % | | 6,292,188 | | | 66,021 | | | 4.16 | % |

| Noninterest earning assets | 871,071 | | | | | | | 849,689 | | | | | | | 808,656 | | | | | |

| Total assets | $ | 7,140,876 | | | | | | | $ | 7,212,732 | | | | | | | $ | 7,100,844 | | | | | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | |

| Certificates of deposit | $ | 638,101 | | | $ | 6,261 | | | 3.89 | % | | $ | 553,015 | | | $ | 4,585 | | | 3.29 | % | | $ | 299,364 | | | $ | 455 | | | 0.60 | % |

| Savings accounts | 497,484 | | | 231 | | | 0.18 | | | 523,882 | | | 172 | | | 0.13 | | | 632,536 | | | 107 | | | 0.07 | |

| Interest bearing demand and money market accounts | 2,713,482 | | | 7,846 | | | 1.15 | | | 2,764,251 | | | 7,120 | | | 1.02 | | | 2,946,425 | | | 1,895 | | | 0.26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) | | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) | | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) |

| (Dollars in thousands) |

| Total interest bearing deposits | 3,849,067 | | | 14,338 | | | 1.48 | | | 3,841,148 | | | 11,877 | | | 1.23 | | | 3,878,325 | | | 2,457 | | | 0.25 | |

| Junior subordinated debentures | 21,729 | | | 553 | | | 10.10 | | | 21,649 | | | 540 | | | 9.90 | | | 21,430 | | | 410 | | | 7.59 | |

| Securities sold under agreement to repurchase | 17,511 | | | 5 | | | 0.11 | | | 31,729 | | | 38 | | | 0.48 | | | 43,694 | | | 41 | | | 0.37 | |

| Borrowings | 459,784 | | | 5,495 | | | 4.74 | | | 451,032 | | | 5,394 | | | 4.74 | | | 543 | | | 6 | | | 4.38 | |

| Total interest bearing liabilities | 4,348,091 | | | 20,391 | | | 1.86 | % | | 4,345,558 | | | 17,849 | | | 1.63 | % | | 3,943,992 | | | 2,914 | | | 0.29 | % |

| Noninterest demand deposits | 1,772,261 | | | | | | | 1,859,374 | | | | | | | 2,239,806 | | | | | |

| Other noninterest bearing liabilities | 207,141 | | | | | | | 186,306 | | | | | | | 136,645 | | | | | |

| Stockholders’ equity | 813,383 | | | | | | | 821,494 | | | | | | | 780,401 | | | | | |

| Total liabilities and stockholders’ equity | $ | 7,140,876 | | | | | | | $ | 7,212,732 | | | | | | | $ | 7,100,844 | | | | | |

| Net interest income and spread | | | $ | 53,871 | | | 2.84 | % | | | | $ | 55,618 | | | 2.95 | % | | | | $ | 63,107 | | | 3.87 | % |

| Net interest margin | | | | | 3.41 | % | | | | | | 3.47 | % | | | | | | 3.98 | % |

(1)Annualized; average balances are calculated using daily balances.

(2) Average loans receivable, net includes loans held for sale and loans classified as nonaccrual, which carry a zero yield. Interest earned on loans receivable, net includes the amortization of net deferred loan fees of $832,000, $940,000 and $723,000 for the fourth quarter of 2023, third quarter of 2023 and fourth quarter of 2022, respectively.

(3) Yields on tax-exempt loans and securities have not been stated on a tax-equivalent basis.

Noninterest Income

Noninterest income decreased $9.4 million during the fourth quarter of 2023 from the third quarter of 2023 and decreased $9.7 million from the same period in 2022 due primarily to a $10.0 million pre-tax loss on the sale of investment securities available for sale. Card revenue decreased during the fourth quarter of 2023 compared to the third quarter of 2023 due to annual incentives of $250,000 recognized in the third quarter of 2023 as well as general declines in income due to lower transaction account volume. Other income decreased during the fourth quarter of 2023 compared to the third quarter of 2023 due to a $610,000 gain on sale of the Ellensburg branch which was recognized in the third quarter of 2023.

The following table presents the key components of noninterest income and the change for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Quarter Over Quarter Change | | Prior Year Quarter Change |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 | | $ | | % | | $ | | % |

| (Dollars in thousands) |

| Service charges and other fees | $ | 2,804 | | | $ | 2,856 | | | $ | 2,651 | | | $ | (52) | | | (1.8) | % | | $ | 153 | | | 5.8 | % |

| Card revenue | 1,944 | | | 2,273 | | | 2,111 | | | (329) | | | (14.5) | | | (167) | | | (7.9) | |

| Loss on sale of investment securities | (10,005) | | | (1,940) | | | (256) | | | (8,065) | | | 415.7 | | | (9,749) | | | 3808.2 | |

| Gain on sale of loans, net | 36 | | | 157 | | | 40 | | | (121) | | | (77.1) | | | (4) | | | (10.0) | |

| Interest rate swap fees | — | | | 62 | | | 19 | | | (62) | | | (100.0) | | | (19) | | | (100.0) | |

| Bank owned life insurance income | 654 | | | 734 | | | 565 | | | (80) | | | (10.9) | | | 89 | | | 15.8 | |

| | | | | | | | | | | | | |

| Other income | 1,420 | | | 2,129 | | | 1,454 | | | (709) | | | (33.3) | | | (34) | | | (2.3) | |

| Total noninterest income | $ | (3,147) | | | $ | 6,271 | | | $ | 6,584 | | | $ | (9,418) | | | (150.2) | % | | $ | (9,731) | | | (147.8) | % |

Noninterest Expense

Noninterest expense increased $1.8 million, or 4.3%, during the fourth quarter of 2023 from the third quarter of 2023. Compensation and employee benefits expenses decreased primarily due to a reduction in employees and included $148,000 in severance costs. Data processing expenses increased due primarily to a $320,000 accrual for the early termination of a technology-related contract. Marketing expenses increased due to an increase in marketing efforts during the fourth quarter of 2023. Professional services increased due primarily to a $1.5 million expense related to renewal of the core vendor contract during the fourth quarter of 2023.

Noninterest expense increased $2.3 million, or 5.8%, during the fourth quarter of 2023 compared to the same period in 2022. Occupancy and equipment expense increased due primarily to our expansion into Boise, Idaho and annual increases in

lease expenses. Federal deposit insurance premiums increased due to the increase in the assessment rate starting in January 2023. Data processing expenses and professional services increased primarily due to the same reasons stated above.

The following table presents the key components of noninterest expense and the change for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Quarter Over Quarter Change | | Prior Year Quarter Change |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 | | $ | | % | | $ | | % |

| (Dollars in thousands) |

| Compensation and employee benefits | $ | 24,758 | | | $ | 25,008 | | | $ | 24,856 | | | $ | (250) | | | (1.0) | % | | $ | (98) | | | (0.4) | % |

| Occupancy and equipment | 4,784 | | | 4,814 | | | 4,541 | | | (30) | | | (0.6) | | | 243 | | | 5.4 | |

| Data processing | 4,863 | | | 4,366 | | | 4,369 | | | 497 | | | 11.4 | | | 494 | | | 11.3 | |

| Marketing | 698 | | | 389 | | | 675 | | | 309 | | | 79.4 | | | 23 | | | 3.4 | |

| Professional services | 2,266 | | | 582 | | | 630 | | | 1,684 | | | 289.3 | | | 1,636 | | | 259.7 | |

State/municipal business and use taxes | 909 | | | 1,088 | | | 1,008 | | | (179) | | | (16.5) | | | (99) | | | (9.8) | |

| Federal deposit insurance premium | 847 | | | 818 | | | 490 | | | 29 | | | 3.5 | | | 357 | | | 72.9 | |

| | | | | | | | | | | | | |

| Amortization of intangible assets | 593 | | | 595 | | | 671 | | | (2) | | | (0.3) | | | (78) | | | (11.6) | |

| Other expense | 3,005 | | | 3,310 | | | 3,152 | | | (305) | | | (9.2) | | | (147) | | | (4.7) | |

| Total noninterest expense | $ | 42,723 | | | $ | 40,970 | | | $ | 40,392 | | | $ | 1,753 | | | 4.3 | % | | $ | 2,331 | | | 5.8 | % |

Income Tax Expense

Income tax expense decreased during the fourth quarter of 2023 compared to the third quarter of 2023, primarily due to a decrease in income before income taxes. Additionally, the effective income tax rate was lower during the fourth quarter of 2023, resulting from a decrease in annual pre-tax income for the year ended 2023 which increased the impact of favorable permanent tax items such as tax-exempt investments, investments in bank owned life insurance and tax credits. The effective income tax rate for the year ended December 31, 2023 was 15.3% as compared to 17.7% for the year ended December 31, 2022.

The following table presents the income tax expense and related metrics and the change for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 | | Quarter Over Quarter | Prior Year Quarter |

| (Dollars in thousands) |

| Income before income taxes | $ | 6,577 | | | $ | 21,797 | | | $ | 27,889 | | | $ | (15,220) | | | $ | (21,312) | |

| Income tax expense | $ | 344 | | | $ | 3,578 | | | $ | 5,345 | | | $ | (3,234) | | | $ | (5,001) | |

| Effective income tax rate | 5.2 | % | | 16.4 | % | | 19.2 | % | | (11.2) | % | | (14.0) | % |

Dividends

On January 24, 2024, the Company’s Board of Directors declared a quarterly cash dividend of $0.23 per share. The dividend is payable on February 22, 2024 to shareholders of record as of the close of business on February 8, 2024.

Earnings Conference Call

The Company will hold a telephone conference call to discuss this earnings release on Thursday, January 25, 2024 at 10:00 a.m. Pacific time. To access the call, please dial (833) 470-1428 -- access code 290327 a few minutes prior to 10:00 a.m. Pacific time. The call will be available for replay through February 1, 2024 by dialing (866) 813-9403 -- access code 301843.

About Heritage Financial

Heritage Financial Corporation is an Olympia-based bank holding company with Heritage Bank, a full-service commercial bank, as its sole wholly-owned banking subsidiary. Heritage Bank has a branch network of 50 banking offices in Washington, Oregon and Idaho. Heritage Bank does business under the Whidbey Island Bank name on Whidbey Island. Heritage’s stock is traded on the NASDAQ Global Select Market under the symbol “HFWA”. More information about Heritage Financial Corporation can be found on its website at www.hf-wa.com and more information about Heritage Bank can be found on its website at www.heritagebanknw.com.

Contact

Jeffrey J. Deuel, President and Chief Executive Officer, (360) 943-1500

Donald J. Hinson, Executive Vice President and Chief Financial Officer, (360) 943-1500

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often include words such as "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could," or "may." Forward-looking statements are not historical facts but instead represent management's current expectations and forecasts regarding future events, many of which are inherently uncertain and outside of our control. Actual results may differ, possibly materially, from those currently expected or projected in these forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements, include but are not limited to, the following: changes in general economic conditions nationally or in our local market areas, other markets where the Company has lending relationships, or other aspects of the Company’s business operations or financial markets including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a potential recession or slowed economic growth, or increased political instability due to acts of war; changes in the interest rate environment, including prior increases in the Board of Governors of the Federal Reserve System (the “Federal Reserve”) benchmark rate and duration at which such increased interest rate levels are maintained, which could adversely affect our revenues and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; the impact of continuing inflation and the current and future monetary policies of the Federal Reserve in response thereto; the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment; the effects of any federal government shutdown; changes in the interest rate environment; the quality and composition of our securities portfolio and the impact of any adverse changes including market liquidity within the securities markets; legislative and regulatory changes, including changes in banking, securities and tax law, in regulatory policies and principles, or the interpretation of regulatory capital or other rules; credit and interest rate risks associated with the Company’s businesses, customers, borrowings, repayment, investment, and deposit practices; fluctuations in deposits; liquidity issues, including our ability to borrow funds or raise additional capital, if necessary; disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform several of our critical processing functions; effects of critical accounting policies and judgments, including the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and other factors described in Heritage's latest Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”) which are available on our website at www.heritagebanknw.com and on the SEC's website at www.sec.gov. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, any of the forward-looking statements that we make in this press release or the documents we file with or furnish to the SEC are based only on information then actually known to the Company and upon management's beliefs and assumptions at the time they are made which may turn out to be wrong because of inaccurate assumptions we might make, because of the factors described above or because of other factors that we cannot foresee. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

HERITAGE FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited)

(Dollars in thousands, except shares)

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30,

2023 | | December 31, 2022 |

| Assets | | | | | |

| Cash on hand and in banks | $ | 55,851 | | | $ | 61,568 | | | $ | 74,295 | |

| Interest earning deposits | 169,122 | | | 158,935 | | | 29,295 | |

| Cash and cash equivalents | 224,973 | | | 220,503 | | | 103,590 | |

Investment securities available for sale, at fair value (amortized cost of $1,227,787, $1,292,500 and $1,460,033, respectively) | 1,134,353 | | | 1,147,547 | | | 1,331,443 | |

Investment securities held to maturity, at amortized cost (fair value of $662,450, $636,257 and $673,434, respectively) | 739,442 | | | 746,845 | | | 766,396 | |

| Total investment securities | 1,873,795 | | | 1,894,392 | | | 2,097,839 | |

| Loans held for sale | — | | | 263 | | | — | |

| Loans receivable | 4,335,627 | | | 4,266,858 | | | 4,050,858 | |

| Allowance for credit losses on loans | (47,999) | | | (46,947) | | | (42,986) | |

| Loans receivable, net | 4,287,628 | | | 4,219,911 | | | 4,007,872 | |

| | | | | |

| Premises and equipment, net | 74,899 | | | 76,436 | | | 76,930 | |

| Federal Home Loan Bank stock, at cost | 4,186 | | | 8,373 | | | 8,916 | |

| Bank owned life insurance | 125,655 | | | 123,639 | | | 122,059 | |

| Accrued interest receivable | 19,518 | | | 18,794 | | | 18,547 | |

| Prepaid expenses and other assets | 318,571 | | | 341,952 | | | 296,181 | |

| Other intangible assets, net | 4,793 | | | 5,386 | | | 7,227 | |

| Goodwill | 240,939 | | | 240,939 | | | 240,939 | |

| Total assets | $ | 7,174,957 | | | $ | 7,150,588 | | | $ | 6,980,100 | |

| | | | | |

| Liabilities and Stockholders' Equity | | | | | |

| Deposits | $ | 5,599,872 | | | $ | 5,635,187 | | | $ | 5,907,420 | |

| Deposits held for sale | — | | | — | | | 17,420 | |

| Total deposits | 5,599,872 | | | 5,635,187 | | | 5,924,840 | |

| Borrowings | 500,000 | | | 450,000 | | | — | |

| Junior subordinated debentures | 21,765 | | | 21,692 | | | 21,473 | |

| Securities sold under agreement to repurchase | — | | | 23,158 | | | 46,597 | |

| Accrued expenses and other liabilities | 200,059 | | | 207,005 | | | 189,297 | |

| Total liabilities | 6,321,696 | | | 6,337,042 | | | 6,182,207 | |

| | | | | |

| Common stock | 549,748 | | | 548,652 | | | 552,397 | |

| Retained earnings | 375,989 | | | 377,522 | | | 345,346 | |

| Accumulated other comprehensive loss, net | (72,476) | | | (112,628) | | | (99,850) | |

| Total stockholders' equity | 853,261 | | | 813,546 | | | 797,893 | |

| Total liabilities and stockholders' equity | $ | 7,174,957 | | | $ | 7,150,588 | | | $ | 6,980,100 | |

| | | | | |

| Shares outstanding | 34,906,233 | | | 34,901,076 | | | 35,106,697 | |

HERITAGE FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | September 30,

2023 | | December 31, 2022 | | December 31,

2023 | | December 31,

2022 |

| Interest Income | | | | | | | | | |

| Interest and fees on loans | $ | 57,092 | | | $ | 56,119 | | | $ | 48,513 | | | $ | 217,284 | | | $ | 174,275 | |

| Taxable interest on investment securities | 14,488 | | | 14,590 | | | 14,655 | | | 58,509 | | | 40,627 | |

| Nontaxable interest on investment securities | 300 | | | 448 | | | 843 | | | 1,854 | | | 3,488 | |

| Interest on interest earning deposits | 2,382 | | | 2,310 | | | 2,010 | | | 6,818 | | | 9,067 | |

| Total interest income | 74,262 | | | 73,467 | | | 66,021 | | | 284,465 | | | 227,457 | |

| Interest Expense | | | | | | | | | |

| Deposits | 14,338 | | | 11,877 | | | 2,457 | | | 39,350 | | | 6,772 | |

| Junior subordinated debentures | 553 | | | 540 | | | 410 | | | 2,074 | | | 1,156 | |

| Securities sold under agreement to repurchase | 5 | | | 38 | | | 41 | | | 153 | | | 138 | |

| Borrowings | 5,495 | | | 5,394 | | | 6 | | | 17,733 | | | 6 | |

| Total interest expense | 20,391 | | | 17,849 | | | 2,914 | | | 59,310 | | | 8,072 | |

| Net interest income | 53,871 | | | 55,618 | | | 63,107 | | | 225,155 | | | 219,385 | |

| Provision for (reversal of) credit losses | 1,424 | | | (878) | | | 1,410 | | | 4,280 | | | (1,426) | |

| Net interest income after provision for (reversal of) credit losses | 52,447 | | | 56,496 | | | 61,697 | | | 220,875 | | | 220,811 | |

| Noninterest Income | | | | | | | | | |

| Service charges and other fees | 2,804 | | | 2,856 | | | 2,651 | | | 10,966 | | | 10,390 | |

| Card revenue | 1,944 | | | 2,273 | | | 2,111 | | | 8,340 | | | 8,885 | |

| Loss on sale of investment securities, net | (10,005) | | | (1,940) | | | (256) | | | (12,231) | | | (256) | |

| Gain on sale of loans, net | 36 | | | 157 | | | 40 | | | 343 | | | 633 | |

| Interest rate swap fees | — | | | 62 | | | 19 | | | 230 | | | 402 | |

| Bank owned life insurance income | 654 | | | 734 | | | 565 | | | 2,934 | | | 3,747 | |

| Gain on sale of other assets, net | — | | | — | | | — | | | 2 | | | 469 | |

| Other income | 1,420 | | | 2,129 | | | 1,454 | | | 8,079 | | | 5,321 | |

| Total noninterest income | (3,147) | | | 6,271 | | | 6,584 | | | 18,663 | | | 29,591 | |

| Noninterest Expense | | | | | | | | | |

| Compensation and employee benefits | 24,758 | | | 25,008 | | | 24,856 | | | 100,083 | | | 92,092 | |

| Occupancy and equipment | 4,784 | | | 4,814 | | | 4,541 | | | 19,156 | | | 17,465 | |

| Data processing | 4,863 | | | 4,366 | | | 4,369 | | | 18,071 | | | 16,800 | |

| Marketing | 698 | | | 389 | | | 675 | | | 1,930 | | | 1,643 | |

| Professional services | 2,266 | | | 582 | | | 630 | | | 4,227 | | | 2,497 | |

| State/municipal business and use taxes | 909 | | | 1,088 | | | 1,008 | | | 4,059 | | | 3,634 | |

| Federal deposit insurance premium | 847 | | | 818 | | | 490 | | | 3,312 | | | 2,015 | |

| | | | | | | | | |

| Amortization of intangible assets | 593 | | | 595 | | | 671 | | | 2,434 | | | 2,750 | |

| Other expense | 3,005 | | | 3,310 | | | 3,152 | | | 13,351 | | | 12,070 | |

| Total noninterest expense | 42,723 | | | 40,970 | | | 40,392 | | | 166,623 | | | 150,966 | |

| Income before income taxes | 6,577 | | | 21,797 | | | 27,889 | | | 72,915 | | | 99,436 | |

| Income tax expense | 344 | | | 3,578 | | | 5,345 | | | 11,160 | | | 17,561 | |

| Net income | $ | 6,233 | | | $ | 18,219 | | | $ | 22,544 | | | $ | 61,755 | | | $ | 81,875 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | September 30,

2023 | | December 31, 2022 | | December 31,

2023 | | December 31,

2022 |

| Basic earnings per share | $ | 0.18 | | | $ | 0.52 | | | $ | 0.64 | | | $ | 1.76 | | | $ | 2.33 | |

| Diluted earnings per share | $ | 0.18 | | | $ | 0.51 | | | $ | 0.64 | | | $ | 1.75 | | | $ | 2.31 | |

| Dividends declared per share | $ | 0.22 | | | $ | 0.22 | | | $ | 0.21 | | | $ | 0.88 | | | $ | 0.84 | |

| Average shares outstanding - basic | 34,902,029 | | 35,022,676 | | 35,104,701 | | 35,022,247 | | 35,103,465 |

| Average shares outstanding - diluted | 35,084,635 | | 35,115,165 | | 35,480,848 | | 35,258,189 | | 35,463,896 |

HERITAGE FINANCIAL CORPORATION

FINANCIAL STATISTICS (Unaudited)

(Dollars in thousands)

Nonperforming Assets and Credit Quality Metrics:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| Allowance for Credit Losses on Loans: | | | | |

| Balance, beginning of period | $ | 46,947 | | | $ | 46,408 | | | $ | 42,089 | | | $ | 42,986 | | | $ | 42,361 | |

| Provision for (reversal of) credit losses on loans | 1,670 | | | (635) | | | 689 | | | 4,736 | | | (563) | |

| Charge-offs: | | | | | | | | | |

| Commercial business | (543) | | | (15) | | | — | | | (719) | | | (316) | |

Residential real estate | — | | | — | | | — | | | — | | | (30) | |

| Real estate construction and land development | — | | | — | | | — | | | — | | | — | |

| Consumer | (166) | | | (123) | | | (151) | | | (586) | | | (547) | |

| Total charge-offs | (709) | | | (138) | | | (151) | | | (1,305) | | | (893) | |

| Recoveries: | | | | | | | | | |

| Commercial business | 30 | | | 1,253 | | | 53 | | | 1,372 | | | 929 | |

Residential real estate | — | | | — | | | — | | | — | | | 3 | |

| Real estate construction and land development | — | | | — | | | 210 | | | — | | | 384 | |

| Consumer | 61 | | | 59 | | | 96 | | | 210 | | | 765 | |

| Total recoveries | 91 | | | 1,312 | | | 359 | | | 1,582 | | | 2,081 | |

| Net (charge-offs) / recoveries | (618) | | | 1,174 | | | 208 | | | 277 | | | 1,188 | |

| Balance, end of period | $ | 47,999 | | | $ | 46,947 | | | $ | 42,986 | | | $ | 47,999 | | | $ | 42,986 | |

Net charge-offs (recoveries) on loans to average loans receivable, net(1) | 0.06 | % | | (0.11) | % | | (0.02) | % | | (0.01) | % | | (0.03) | % |

(1) Annualized.

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30,

2023 | | December 31, 2022 |

| Nonperforming Assets: | | | | | |

| Nonaccrual loans: | | | | | |

| Commercial business | $ | 4,468 | | | $ | 3,065 | | | $ | 5,869 | |

| | | | | |

| Real estate construction and land development | — | | | — | | | 37 | |

| | | | | |

| Total nonaccrual loans | 4,468 | | | 3,065 | | | 5,906 | |

Accruing loans past due 90 days or more | 1,293 | | | 2,158 | | | 1,615 | |

Total nonperforming loans | 5,761 | | | 5,223 | | | 7,521 | |

| Other real estate owned | — | | | — | | | — | |

| Nonperforming assets | $ | 5,761 | | | $ | 5,223 | | | $ | 7,521 | |

| | | | | |

| | | | | |

| ACL on loans to: | | | | | |

| Loans receivable | 1.11 | % | | 1.10 | % | | 1.06 | % |

| Nonaccrual loans | 1,074.28 | % | | 1,531.71 | % | | 727.84 | % |

Nonaccrual loans to loans receivable | 0.10 | % | | 0.07 | % | | 0.15 | % |

Nonperforming loans to loans receivable | 0.13 | % | | 0.12 | % | | 0.19 | % |

| Nonperforming assets to total assets | 0.08 | % | | 0.07 | % | | 0.11 | % |

HERITAGE FINANCIAL CORPORATION

FINANCIAL STATISTICS (Unaudited)

(Dollars in thousands)

Average Balances, Yields, and Rates Paid:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) | | Average

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate (1) |

| Interest Earning Assets: | | | | | | | | | | | |

Loans receivable, net(2)(3) | $ | 4,155,722 | | | $ | 217,284 | | | 5.23 | % | | $ | 3,852,604 | | | $ | 174,275 | | | 4.52 | % |

| Taxable securities | 1,937,603 | | | 58,509 | | | 3.02 | | | 1,646,058 | | | 40,627 | | | 2.47 | |

Nontaxable securities(3) | 63,051 | | | 1,854 | | | 2.94 | | | 135,004 | | | 3,488 | | | 2.58 | |

| Interest earning deposits | 129,807 | | | 6,818 | | | 5.25 | | | 913,374 | | | 9,067 | | | 0.99 | |

| Total interest earning assets | 6,286,183 | | | 284,465 | | | 4.53 | % | | 6,547,040 | | | 227,457 | | | 3.47 | % |

| Noninterest earning assets | 853,841 | | | | | | | 774,415 | | | | | |

| Total assets | $ | 7,140,024 | | | | | | | $ | 7,321,455 | | | | | |

| Interest Bearing Liabilities: | | | | | | | | | | | |

| Certificates of deposit | $ | 491,653 | | | $ | 14,554 | | | 2.96 | % | | $ | 313,712 | | | $ | 1,407 | | | 0.45 | % |

| Savings accounts | 543,096 | | | 701 | | | 0.13 | | | 646,565 | | | 381 | | | 0.06 | |

| Interest bearing demand and money market accounts | 2,771,981 | | | 24,095 | | | 0.87 | | | 3,036,031 | | | 4,984 | | | 0.16 | |

| Total interest bearing deposits | 3,806,730 | | | 39,350 | | | 1.03 | | | 3,996,308 | | | 6,772 | | | 0.17 | |

| Junior subordinated debentures | 21,615 | | | 2,074 | | | 9.60 | | | 21,322 | | | 1,156 | | | 5.42 | |

| Securities sold under agreement to repurchase | 32,976 | | | 153 | | | 0.46 | | | 46,209 | | | 138 | | | 0.30 | |

| Borrowings | 369,665 | | | 17,733 | | | 4.80 | % | | 137 | | | 6 | | | 4.38 | % |

| Total interest bearing liabilities | 4,230,986 | | | 59,310 | | | 1.40 | % | | 4,063,976 | | | 8,072 | | | 0.20 | % |

| Noninterest demand deposits | 1,899,317 | | | | | | | 2,326,178 | | | | | |

| Other noninterest bearing liabilities | 191,679 | | | | | | | 119,359 | | | | | |

| Stockholders’ equity | 818,042 | | | | | | | 811,942 | | | | | |

| Total liabilities and stockholders’ equity | $ | 7,140,024 | | | | | | | $ | 7,321,455 | | | | | |

| Net interest income and spread | | | $ | 225,155 | | | 3.13 | % | | | | $ | 219,385 | | | 3.27 | % |

| Net interest margin | | | | | 3.58 | % | | | | | | 3.35 | % |

(1)Average balances are calculated using daily balances.

(2)Average loans receivable, net includes loans held for sale and loans classified as nonaccrual, which carry a zero yield. Interest earned on loans receivable, net includes the amortization of net deferred loan fees of $3.3 million and $7.4 million for the years ended December 31, 2023 and 2022, respectively.

(3)Yields on tax-exempt loans and securities have not been stated on a tax-equivalent basis.

HERITAGE FINANCIAL CORPORATION

QUARTERLY FINANCIAL STATISTICS (Unaudited)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Earnings: | | | | | | | | | |

| Net interest income | $ | 53,871 | | | $ | 55,618 | | | $ | 55,824 | | | $ | 59,842 | | | $ | 63,107 | |

| Provision for (reversal of) credit losses | 1,424 | | | (878) | | | 1,909 | | | 1,825 | | | 1,410 | |

| Noninterest income | (3,147) | | | 6,271 | | | 7,281 | | | 8,258 | | | 6,584 | |

| Noninterest expense | 42,723 | | | 40,970 | | | 41,325 | | | 41,605 | | | 40,392 | |

| Net income | 6,233 | | | 18,219 | | | 16,846 | | | 20,457 | | | 22,544 | |

Pre-tax, pre-provision net income (3) | 8,001 | | | 20,919 | | | 21,780 | | | 26,495 | | | 29,299 | |

| Basic earnings per share | $ | 0.18 | | | $ | 0.52 | | | $ | 0.48 | | | $ | 0.58 | | | $ | 0.64 | |

| Diluted earnings per share | $ | 0.18 | | | $ | 0.51 | | | $ | 0.48 | | | $ | 0.58 | | | $ | 0.64 | |

| Average Balances: | | | | | | | | | |

Loans receivable, net (1) | $ | 4,233,743 | | | $ | 4,201,554 | | | $ | 4,145,556 | | | $ | 4,039,395 | | | $ | 3,963,042 | |

| Total investment securities | 1,861,587 | | | 1,992,303 | | | 2,061,100 | | | 2,090,232 | | | 2,106,608 | |

| Total interest earning assets | 6,269,805 | | | 6,363,043 | | | 6,297,410 | | | 6,213,003 | | | 6,292,188 | |

| Total assets | 7,140,876 | | | 7,212,732 | | | 7,142,865 | | | 7,061,959 | | | 7,100,844 | |

| Total interest bearing deposits | 3,849,067 | | | 3,841,148 | | | 3,755,005 | | | 3,780,570 | | | 3,878,325 | |

| Total noninterest demand deposits | 1,772,261 | | | 1,859,374 | | | 1,900,640 | | | 2,068,688 | | | 2,239,806 | |

| Stockholders' equity | 813,383 | | | 821,494 | | | 824,742 | | | 812,500 | | | 780,401 | |

| Financial Ratios: | | | | | | | | | |

Return on average assets (2) | 0.35 | % | | 1.00 | % | | 0.95 | % | | 1.17 | % | | 1.26 | % |

Pre-tax, pre-provision return on average assets (2)(3) | 0.44 | | | 1.15 | | | 1.22 | | | 1.52 | | | 1.64 | |

Return on average common equity (2) | 3.04 | | | 8.80 | | | 8.19 | | | 10.21 | | | 11.46 | |

Return on average tangible common equity (2) (3) | 4.69 | | | 12.90 | | | 12.04 | | | 15.05 | | | 17.21 | |

| Efficiency ratio | 84.2 | | | 66.2 | | | 65.5 | | | 61.1 | | | 58.0 | |

Noninterest expense to average total assets (2) | 2.37 | | | 2.25 | | | 2.32 | | | 2.39 | | | 2.26 | |

Net interest spread (2) | 2.84 | | | 2.95 | | | 3.11 | | | 3.66 | | | 3.87 | |

Net interest margin (2) | 3.41 | | | 3.47 | | | 3.56 | | | 3.91 | | | 3.98 | |

(1) Average loans receivable, net includes loans held for sale.

(2) Annualized.

(3) See Non-GAAP Financial Measures section herein.

HERITAGE FINANCIAL CORPORATION

QUARTERLY FINANCIAL STATISTICS (Unaudited)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of or for the Quarter Ended |

| | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Select Balance Sheet: | | | | | | | | | |

| Total assets | $ | 7,174,957 | | | $ | 7,150,588 | | | $ | 7,115,410 | | | $ | 7,236,806 | | | $ | 6,980,100 | |

| Loans receivable, net | 4,287,628 | | | 4,219,911 | | | 4,204,936 | | | 4,083,003 | | | 4,007,872 | |

| Total investment securities | 1,873,795 | | | 1,894,392 | | | 2,030,826 | | | 2,078,235 | | | 2,097,839 | |

| Deposits | 5,599,872 | | | 5,635,187 | | | 5,595,543 | | | 5,789,022 | | | 5,924,840 | |

| Noninterest demand deposits | 1,715,847 | | | 1,789,293 | | | 1,857,492 | | | 1,982,909 | | | 2,099,464 | |

| Stockholders' equity | 853,261 | | | 813,546 | | | 819,733 | | | 826,082 | | | 797,893 | |

| Financial Measures: | | | | | | | | | |

| Book value per share | $ | 24.44 | | | $ | 23.31 | | | $ | 23.39 | | | $ | 23.53 | | | $ | 22.73 | |

Tangible book value per share (1) | 17.40 | | | 16.25 | | | 16.34 | | | 16.48 | | | 15.66 | |

| Stockholders' equity to total assets | 11.9 | % | | 11.4 | % | | 11.5 | % | | 11.4 | % | | 11.4 | % |

Tangible common equity to tangible assets (1) | 8.8 | | | 8.2 | | | 8.3 | | | 8.3 | | | 8.2 | |

| Loans to deposits ratio | 77.4 | | | 75.7 | | | 76.0 | | | 71.3 | | | 68.4 | |

Regulatory Capital Ratios:(2) | | | | | | | | | |

Common equity tier 1 capital ratio | 12.9 | % | | 12.9 | % | | 12.8 | % | | 12.9 | % | | 12.8 | % |

Leverage ratio | 10.0 | | | 9.9 | | | 9.9 | | | 9.9 | | | 9.7 | |

Tier 1 capital ratio | 13.3 | | | 13.3 | | | 13.2 | | | 13.3 | | | 13.2 | |

Total capital ratio | 14.1 | | | 14.1 | | | 14.1 | | | 14.1 | | | 14.0 | |

| Credit Quality Metrics: | | | | | | | | | |

ACL on loans to: | | | | | | | | | |

| Loans receivable | 1.11 | % | | 1.10 | % | | 1.09 | % | | 1.08 | % | | 1.06 | % |

| Nonperforming loans | 1,074.3 | | | 1,531.7 | | | 1,002.3 | | | 923.6 | | | 727.8 | |

Nonaccrual loans to loans receivable | 0.10 | | | 0.07 | | | 0.11 | | | 0.12 | | | 0.15 | |

| Nonperforming loans to loans receivable | 0.13 | | | 0.12 | | | 0.16 | | | 0.17 | | | 0.19 | |

| Nonperforming assets to total assets | 0.08 | | | 0.07 | | | 0.10 | | | 0.10 | | | 0.11 | |

Net charge-offs (recoveries) on loans to average loans receivable, net(3) | 0.06 | | | (0.11) | | | — | | | 0.02 | | | (0.02) | |

| Criticized Loans by Credit Quality Rating: |

| Special mention | $ | 79,977 | | | $ | 72,152 | | | $ | 84,623 | | | $ | 96,832 | | | $ | 69,449 | |

| Substandard | 69,757 | | | 62,653 | | | 58,653 | | | 48,824 | | | 65,765 | |

| Other Metrics: | | | | | | | | | |

| Number of banking offices | 50 | | | 50 | | | 51 | | | 51 | | | 50 | |

| Deposits per branch | $ | 111,997 | | | $ | 112,704 | | | $ | 109,717 | | | $ | 113,510 | | | $ | 118,497 | |

| Average number of full-time equivalent employees | 803 | | | 821 | | | 813 | | | 809 | | | 806 | |

| Average assets per full-time equivalent employee | 8,893 | | | 8,785 | | | 8,786 | | | 8,729 | | | 8,810 | |

(1) See Non-GAAP Financial Measures section herein.

(2) Current quarter ratios are estimates pending completion and filing of the Company’s regulatory reports.

(3) Annualized.

HERITAGE FINANCIAL CORPORATION

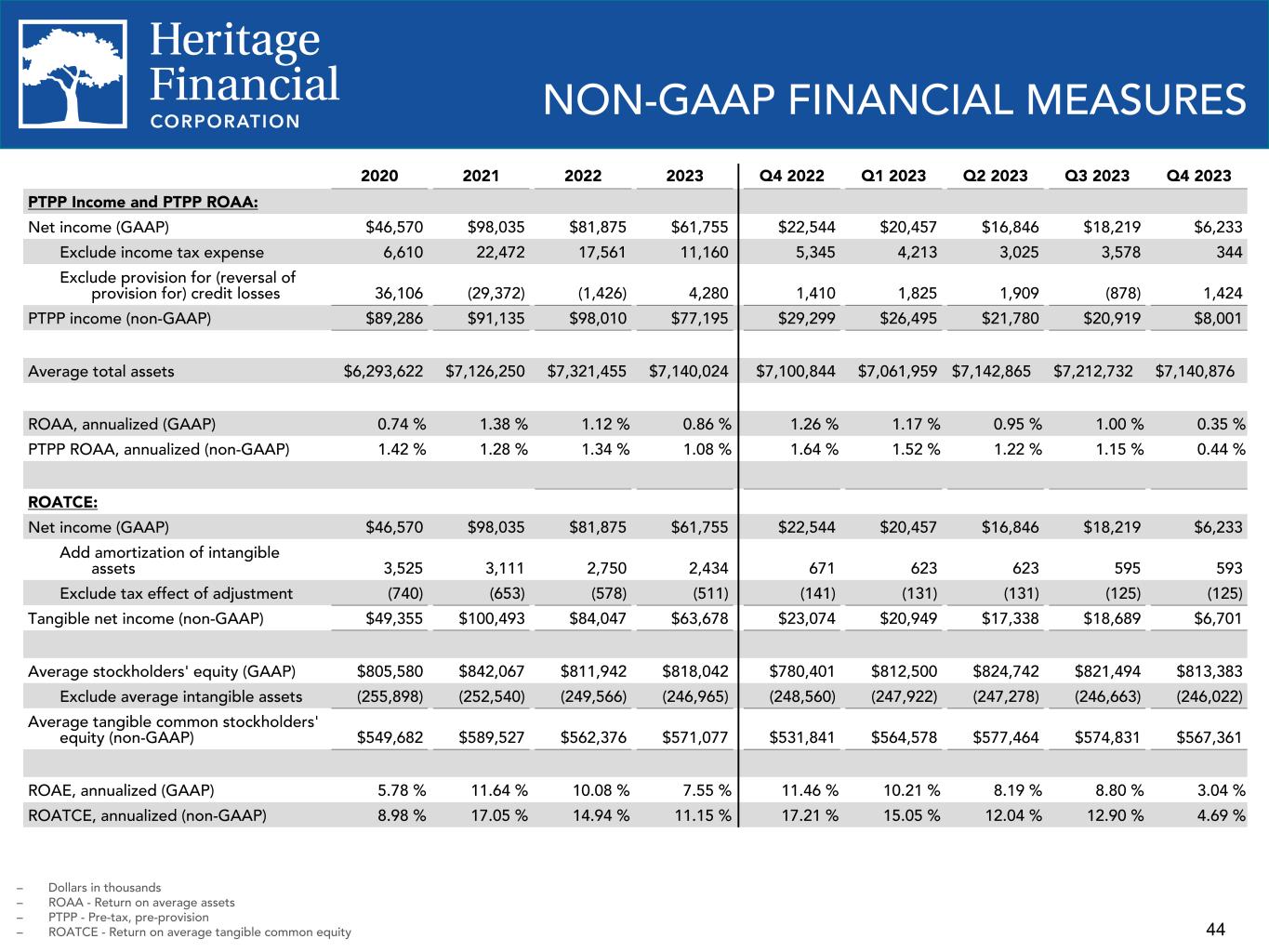

NON-GAAP FINANCIAL MEASURES (Unaudited)

(Dollars in thousands, except per share amounts)

This earnings release contains certain financial measures not presented in accordance with Generally Accepted Accounting Principles ("GAAP") in addition to financial measures presented in accordance with GAAP. The Company has presented these non-GAAP financial measures in this earnings release because it believes that they provide useful and comparative information to assess trends in the Company’s capital, performance and asset quality reflected in the current quarter and comparable period results and to facilitate comparison of its performance with the performance of its peers. These non-GAAP measures have inherent limitations, are not required to be uniformly applied and are not audited. They should not be considered in isolation or as a substitute for financial measures presented in accordance with GAAP. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. Reconciliations of the GAAP and non-GAAP financial measures are presented below.

The Company considers the tangible common equity to tangible assets ratio and tangible book value per share to be useful measurements of the adequacy of the Company’s capital levels.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Tangible Common Equity to Tangible Assets and Tangible Book Value Per Share: |

| Total stockholders' equity (GAAP) | $ | 853,261 | | | $ | 813,546 | | | $ | 819,733 | | | $ | 826,082 | | | $ | 797,893 | |

| Exclude intangible assets | (245,732) | | | (246,325) | | | (246,920) | | | (247,543) | | | (248,166) | |

| Tangible common equity (non-GAAP) | $ | 607,529 | | | $ | 567,221 | | | $ | 572,813 | | | $ | 578,539 | | | $ | 549,727 | |

| | | | | | | | | |

| Total assets (GAAP) | $ | 7,174,957 | | | $ | 7,150,588 | | | $ | 7,115,410 | | | $ | 7,236,806 | | | $ | 6,980,100 | |

| Exclude intangible assets | (245,732) | | | (246,325) | | | (246,920) | | | (247,543) | | | (248,166) | |

| Tangible assets (non-GAAP) | $ | 6,929,225 | | | $ | 6,904,263 | | | $ | 6,868,490 | | | $ | 6,989,263 | | | $ | 6,731,934 | |

| | | | | | | | | |

| Stockholders' equity to total assets (GAAP) | 11.9 | % | | 11.4 | % | | 11.5 | % | | 11.4 | % | | 11.4 | % |

Tangible common equity to tangible assets (non-GAAP) | 8.8 | % | | 8.2 | % | | 8.3 | % | | 8.3 | % | | 8.2 | % |

| | | | | | | | | |

| Shares outstanding | 34,906,233 | | | 34,901,076 | | | 35,047,800 | | | 35,108,120 | | | 35,106,697 | |

| | | | | | | | | |

| Book value per share (GAAP) | $ | 24.44 | | | $ | 23.31 | | | $ | 23.39 | | | $ | 23.53 | | | $ | 22.73 | |

| Tangible book value per share (non-GAAP) | $ | 17.40 | | | $ | 16.25 | | | $ | 16.34 | | | $ | 16.48 | | | $ | 15.66 | |

HERITAGE FINANCIAL CORPORATION

NON-GAAP FINANCIAL MEASURES (Unaudited)

(Dollars in thousands, except per share amounts)

The Company considers the return on average tangible common equity ratio to be a useful measurement of the Company’s ability to generate returns for its common shareholders. By removing the impact of intangible assets and their related amortization and tax effects, the performance of the Company's ongoing business operations can be evaluated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended |

| December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Return on Average Tangible Common Equity, annualized: |

| Net income (GAAP) | $ | 6,233 | | | $ | 18,219 | | | $ | 16,846 | | | $ | 20,457 | | | $ | 22,544 | |

| Add amortization of intangible assets | 593 | | | 595 | | | 623 | | | 623 | | | 671 | |

| Exclude tax effect of adjustment | (125) | | | (125) | | | (131) | | | (131) | | | (141) | |

| Tangible net income (non-GAAP) | $ | 6,701 | | | $ | 18,689 | | | $ | 17,338 | | | $ | 20,949 | | | $ | 23,074 | |

| | | | | | | | | |

| Average stockholders' equity (GAAP) | $ | 813,383 | | | $ | 821,494 | | | $ | 824,742 | | | $ | 812,500 | | | $ | 780,401 | |

| Exclude average intangible assets | (246,022) | | | (246,663) | | | (247,278) | | | (247,922) | | | (248,560) | |

| Average tangible common stockholders' equity (non-GAAP) | $ | 567,361 | | | $ | 574,831 | | | $ | 577,464 | | | $ | 564,578 | | | $ | 531,841 | |

| | | | | | | | | |

| Return on average common equity, annualized (GAAP) | 3.04 | % | | 8.80 | % | | 8.19 | % | | 10.21 | % | | 11.46 | % |

| Return on average tangible common equity, annualized (non-GAAP) | 4.69 | % | | 12.90 | % | | 12.04 | % | | 15.05 | % | | 17.21 | % |

The Company believes that presenting pre-tax pre-provision income, which reflects its profitability before income taxes and provision for credit losses, and the pre-tax, pre-provision return on average assets are useful measurements in assessing its operating income and expenses by removing the volatility that may be associated with credit loss provisions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended |

| December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Pre-tax, Pre-provision Income and Pre-tax, Pre-provision Return on Average Assets, annualized: |

| Net income (GAAP) | $ | 6,233 | | | $ | 18,219 | | | $ | 16,846 | | | $ | 20,457 | | | $ | 22,544 | |

| Add income tax expense | 344 | | | 3,578 | | | 3,025 | | | 4,213 | | | 5,345 | |

| Add/(subtract) provision for (reversal of) credit losses | 1,424 | | | (878) | | | 1,909 | | | 1,825 | | | 1,410 | |

| Pre-tax, pre-provision income (non-GAAP) | $ | 8,001 | | | $ | 20,919 | | | $ | 21,780 | | | $ | 26,495 | | | $ | 29,299 | |

| | | | | | | | | |

| Average total assets (GAAP) | $ | 7,140,876 | | | $ | 7,212,732 | | | $ | 7,142,865 | | | $ | 7,061,959 | | | $ | 7,100,844 | |

| | | | | | | | | |

| Return on average assets, annualized (GAAP) | 0.35 | % | | 1.00 | % | | 0.95 | % | | 1.17 | % | | 1.26 | % |

| Pre-tax, pre-provision return on average assets (non-GAAP) | 0.44 | % | | 1.15 | % | | 1.22 | % | | 1.52 | % | | 1.64 | % |

INVESTOR PRESENTATION Q4 2023

2 This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, are based on certain assumptions and often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” These statements relate to Heritage Financial Corporation’s (“we”, “us”, “our”, or the “Company”) financial condition, results of operations, beliefs, plans, objectives, goals, expectations, assumptions and statements about future performance or business. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results for future periods to differ materially from those expressed in any forward-looking statements by, or on behalf of, the Company and could negatively affect the Company’s operating results and stock price performance. Factors that may cause such a difference include, but are not limited to: • potential adverse impacts to economic conditions nationally or in our local market areas, other markets where the Company has lending relationships, or other aspects of the Company’s business operations or financial markets, including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a potential recession or slowed economic growth; • changes in the interest rate environment, including the duration at which recent increased interest rate levels are maintained, which could adversely affect our revenues and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; • the impact of continuing inflation and the current and future monetary policies of the Board of Governors of the Federal Reserve System in response thereto; • the impact of bank failures or adverse developments at other banks and related negative publicity about the banking industry in general on investor and depositor sentiment regarding the stability and liquidity of banks; • the effects of any federal government shutdown; • legislative or regulatory changes that adversely affect our business, including changes in banking, securities and tax law, in regulatory policies and principles, or the interpretation of regulatory capital or other rules; • credit and interest rate risks associated with the Company’s businesses, customers, borrowings, repayment, investment, and deposit practices; • fluctuations in deposits; • liquidity issues, including our ability to borrow funds or raise additional capital, if necessary; • disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform several of our critical processing functions; • effects of critical accounting policies and judgments, including the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and • the effects of climate change, severe weather events, natural disasters, pandemics, epidemics and other public health crises, acts of war or terrorism, and other external events on our business. Further you should also consider the risks, assumptions and uncertainties set forth in the “Risk Factors” section in our Annual Report on Form 10-K for the year ended December 31, 2022, as well as those set forth in other reports we file with or furnish to the Securities and Exchange Commission. These risks, assumptions and uncertainties should be considered in evaluating any forward-looking statements, and undue reliance should not be placed on such statements. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise. Non-GAAP Financial Information The Company reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with GAAP. Slides containing a discussion and reconciliation of non-GAAP financial measures are contained at the end of this presentation. All dollars throughout the entire presentation are in millions unless otherwise noted, except per share amounts. FORWARD LOOKING STATEMENTS

COMPANY OVERVIEW

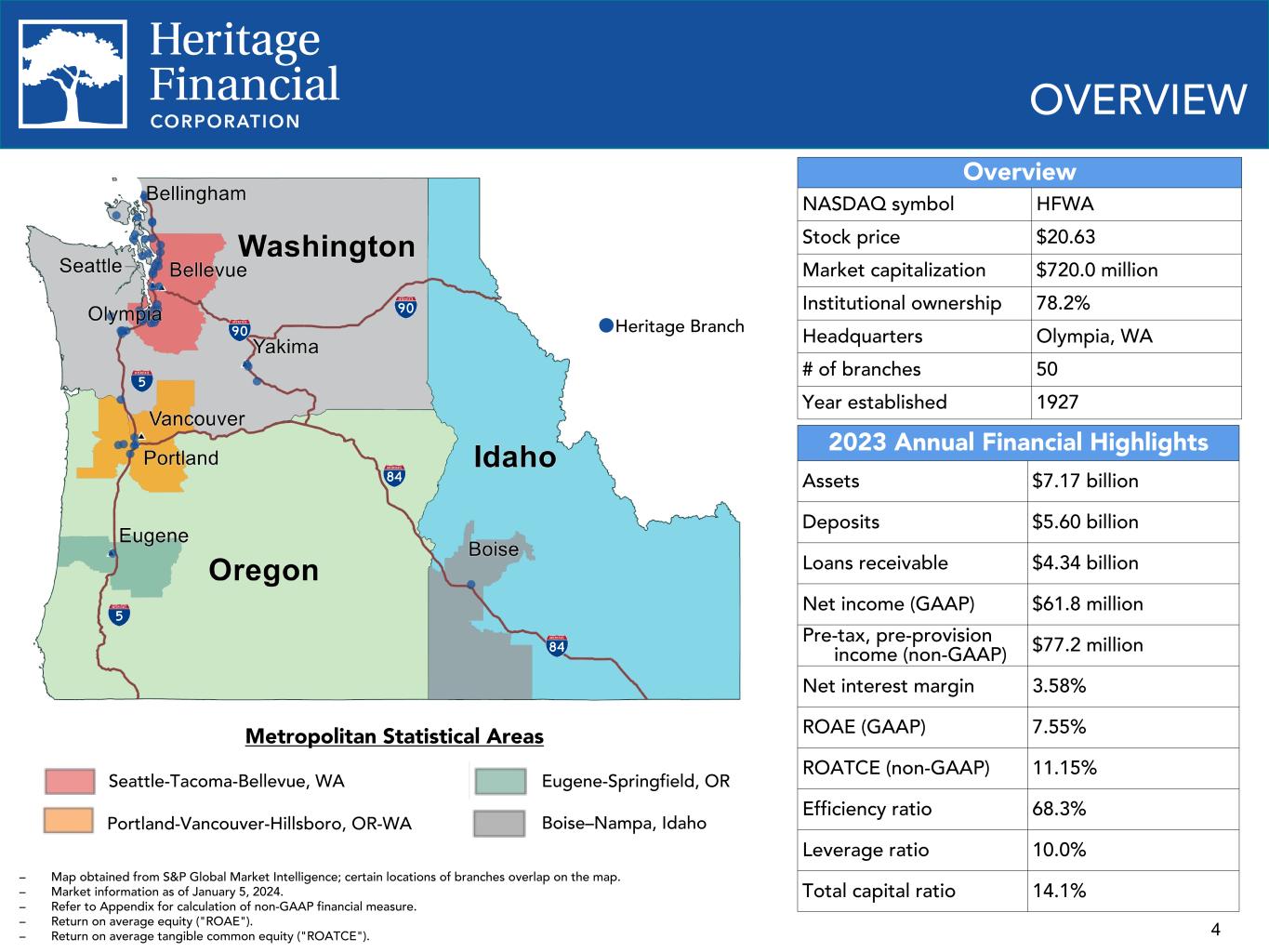

4 OVERVIEW Overview NASDAQ symbol HFWA Stock price $20.63 Market capitalization $720.0 million Institutional ownership 78.2% Headquarters Olympia, WA # of branches 50 Year established 1927 2023 Annual Financial Highlights Assets $7.17 billion Deposits $5.60 billion Loans receivable $4.34 billion Net income (GAAP) $61.8 million Pre-tax, pre-provision income (non-GAAP) $77.2 million Net interest margin 3.58% ROAE (GAAP) 7.55% ROATCE (non-GAAP) 11.15% Efficiency ratio 68.3% Leverage ratio 10.0% Total capital ratio 14.1% – Map obtained from S&P Global Market Intelligence; certain locations of branches overlap on the map. – Market information as of January 5, 2024. – Refer to Appendix for calculation of non-GAAP financial measure. – Return on average equity ("ROAE"). – Return on average tangible common equity ("ROATCE"). Metropolitan Statistical Areas Seattle-Tacoma-Bellevue, WA Portland-Vancouver-Hillsboro, OR-WA Eugene-Springfield, OR Boise–Nampa, Idaho Heritage Branch