0000893847FALSE00008938472023-06-202023-06-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 20, 2023

Hawthorn Bancshares, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Missouri | 0-23636 | 43-1626350 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

132 East High Street, PO Box 688, Jefferson City, Missouri 65102 (Address of Principal Executive Offices) (Zip Code) |

573-761-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | HWBK | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.01 Change in Registrant's Certifying Accountant.

The Audit Committee (the "Audit Committee") of the Board of Directors (the "Board") of Hawthorn Bancshares, Inc. (the "Company") conducted a comprehensive, competitive process to determine the Company's independent registered public accounting firm for the Company's fiscal year ending December 31, 2024. The Audit Committee invited several firms to participate in this process, including KPMG LLP ("KPMG"), the Company's current independent registered public accounting firm.

(a) Dismissal of Independent Registered Public Accounting Firm

As a result of this process, following the review and evaluation of proposals from participating firms, on December 20, 2023, the Audit Committee and the Board approved the dismissal of KPMG as the Company's independent registered public accounting firm, effective upon completion of their audit of the Company's consolidated financial statements as of and for the year ending December 31, 2023, and the issuance of their reports thereon. The Company notified KPMG of the dismissal on December 21, 2023 (the "Notice Date").

The audit reports of KPMG on the consolidated financial statements of the Company for each of the two most recent fiscal years ended December 31, 2022 and 2021 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company's two most recent fiscal years ended December 31, 2022 and 2021 and during the subsequent interim period from January 1, 2023 through the Notice Date, there were (i) no disagreements between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the subject matter of the disagreement in connection with KPMG’s reports on the Company’s consolidated financial statements for 2022 and 2021, and (ii) no “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K and the related instructions.

The Company provided KPMG with a copy of the disclosures in this report prior to filing with the Securities and Exchange Commission (the “SEC”). A copy of KPMG's letter dated December 27, 2023 to the SEC, stating whether it agrees with the statements made in this report, is filed as Exhibit 16.1 to this report.

(b) Engagement of Independent Registered Public Accounting Firm

On the Notice Date, the Company notified FORVIS, LLP (“FORVIS”) that it had been selected to serve as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2024 (beginning with a review of the Company's quarterly consolidated financial statements for the first quarter of the 2024 fiscal year), subject to completion of FORVIS’s standard client acceptance procedures. The selection of FORVIS was approved by each of the Audit Committee and the Board on December 20, 2023.

During the Company’s two most recent fiscal years ended December 31, 2022 and 2021, and the subsequent interim period from January 1, 2023 through the Notice Date, neither the Company nor anyone on its behalf consulted FORVIS regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company that FORVIS concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement” (as defined in Regulation S-K Item 304(a)(1)(iv)) or a “reportable event” (as defined in Regulation S-K Item 304(a)(1)(v)).

Item 9.01 Financial Statements and Exhibits.

| | | | | |

| Exhibit No | Description |

| |

| 16.1 | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: December 27, 2023 | Hawthorn Bancshares, Inc. By: /s/ Brent M. Giles Name: Brent M. Giles Title: Chief Executive Officer |

Exhibit 16.1

December 27, 2023

Securities and Exchange Commission

Washington, D.C. 20549

Ladies and Gentlemen:

We are currently principal accountants for Hawthorn Bancshares, Inc (“the Company”) and, under the date of March 29, 2023, we reported on the consolidated financial statements of the Company as of and for the years ended December 31, 2022 and 2021, and the effectiveness of internal control over financial reporting as of December 31, 2022. On December 21, 2023, we were notified that the Company selected FORVIS LLP as its principal accountant for the year ending December 31, 2024 and that the auditor-client relationship with KPMG LLP will cease upon completion of the audit of the Company’s consolidated financial statements as of and for the year ended December 31, 2023, and the effectiveness of internal control over financial reporting as of December 31, 2023, and the issuance of our reports thereon. We have read the Company’s statements included under Item 4.01 of its Form 8-K dated December 27, 2023, and we agree with such statements, except that we are not in a position to agree or disagree with any statements in Item 4.01(b).

Very truly yours,

/s/ KPMG LLP

v3.23.4

Cover Page

|

Jun. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 20, 2023

|

| Entity Registrant Name |

Hawthorn Bancshares, Inc.

|

| Entity Incorporation, State or Country Code |

MO

|

| Entity File Number |

0-23636

|

| Entity Tax Identification Number |

43-1626350

|

| Entity Address, Address Line One |

132 East High Street

|

| Entity Address, Address Line Two |

PO Box 688

|

| Entity Address, City or Town |

Jefferson City

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

65102

|

| City Area Code |

573

|

| Local Phone Number |

761-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

HWBK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000893847

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

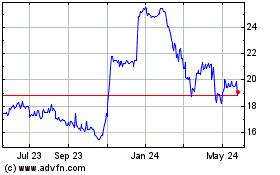

Hawthorn Bancshares (NASDAQ:HWBK)

Historical Stock Chart

From Apr 2024 to May 2024

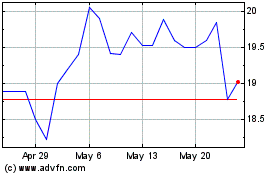

Hawthorn Bancshares (NASDAQ:HWBK)

Historical Stock Chart

From May 2023 to May 2024