Form 8-K - Current report

November 28 2023 - 6:04AM

Edgar (US Regulatory)

0001424929false00014249292023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

November 27, 2023

Date of Report (date of earliest event reported)

Fox Factory Holding Corp.

(Exact name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36040 | | 26-1647258 |

| (State or Other Jurisdiction of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

2055 Sugarloaf Circle, Suite 300

Duluth, GA 30097

(Address of Principal Executive Offices) (Zip Code)

(831) 274-6500

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | FOXF | The NASDAQ Stock Market LLC |

| (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

In connection with the previously announced closing of the acquisition of Marucci Sports, LLC (“Marucci”) on November 14, 2023 (the “Marucci Acquisition”), members of management of Fox Factory Holding Corp. (the “Company”) expect to begin making presentations using slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.1 (the “Marucci Acquisition Presentation”). In addition, members of management of the Company expect to begin making presentations using slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.2 (the “Q3 Investor Presentation,” and together with the Marucci Acquisition Presentation, the “Management Presentations”). The Company expects to use the Management Presentations, in whole or in part, in connection with presentations to investors, analysts and others. A copy of each of the Marucci Acquisition Presentation and the Q3 Investor Presentation will be available on the “Events and Presentations” section of the Company’s website at https://investor.ridefox.com/investor-relations/default.aspx.

The information contained in each of the Management Presentations is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. Each of the Management Presentations speaks only as of the date of this Current Report on Form 8-K. Except as required by law, the Company undertakes no duty or obligation to publicly update or revise the information contained in the Management Presentations, although it may do so from time to time. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

This Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements with regard to the expectations related to the Marucci Acquisition. Words such as “believes”, “expects”, “anticipates”, “intends”, “projects”, “assuming”, and “future” or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements, including, but not limited to, the risk that the anticipated benefits of the Marucci Acquisition may not be realized fully or may take longer to realize than expected and the Company may incur additional and unforeseen expenses in connection with the integration of Marucci. Certain other factors are enumerated in the risk factor discussion in the Form 10-K filed by the Company with the SEC for the year ended December 30, 2022, the Form 10-Q filed by the Company with the SEC for the quarter ended September 29, 2023 and other filings with the SEC. Except as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The information contained in this Item 7.01 (including the Marucci Acquisition Presentation furnished as Exhibit 99.1 attached hereto and the Q3 Investor Presentation furnished as Exhibit 99.2 attached hereto) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished herewith: | | | | | |

| |

| Exhibit Number | Description |

| Marucci Presentation - November 2023 |

| Investor Presentation - November 2023 |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | |

| | | | Fox Factory Holding Corp. |

| Date: | November 28, 2023 | | By: | /s/ Michael C. Dennison |

| | | | |

| | | | Michael C. Dennison |

| | | | Chief Executive Officer |

Acquires Marucci Sports November 2023

Safe Harbor Statement Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends that all such statements be subject to the “safe-harbor” provisions contained in those sections. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or other similar terms or expressions and such forward-looking statements include, but are not limited to, statements with regard to expectations related to the acquisition of Marucci, the future performance of Fox and Marucci, as well as statements about the impact of the global outbreak of COVID-19 on the Company’s business and operations; the Company’s continued growing demand for its products; the Company’s execution on its strategy to improve operating efficiencies; the Company’s optimism about its operating results and future growth prospects; the Company’s expected future sales and future adjusted earnings per diluted share; and any other statements in this presentation that are not of a historical nature. Many important factors may cause the Company’s actual results, events or circumstances to differ materially from those discussed in any such forward-looking statements, including but not limited to: the Company’s ability to complete any acquisition and/or incorporate any acquired assets into its business including, but not limited to, the possibility that the expected synergies and value creation from the Marucci acquisition will not be realized, or will not be realized within the expected time period or the risk that unexpected costs will be incurred in connection with the completion of the Marucci acquisition; the Company’s ability to maintain its suppliers for materials, product parts and vehicle chassis without significant supply chain disruptions; the Company’s ability to improve operating and supply chain efficiencies; the Company’s ability to enforce its intellectual property rights; the Company’s future financial performance, including its sales, cost of sales, gross profit or gross margin, operating expenses, ability to generate positive cash flow and ability to maintain profitability; the Company’s ability to adapt its business model to mitigate the impact of certain changes in tax laws; changes in the relative proportion of profit earned in the numerous jurisdictions in which the Company does business and in tax legislation, case law and other authoritative guidance in those jurisdictions; factors which impact the calculation of the weighted average number of diluted shares of common stock outstanding, including the market price of the Company’s common stock, grants of equity-based awards and the vesting schedules of equity-based awards; the Company’s ability to develop new and innovative products in its current end-markets and to leverage its technologies and brand to expand into new categories and end-markets; the Company’s ability to increase its aftermarket penetration; the Company’s exposure to exchange rate fluctuations; the loss of key customers; strategic transformation costs; the outcome of pending litigation; the possibility that the Company may not be able to accelerate its international growth; the Company’s ability to maintain its premium brand image and high-performance products; the Company’s ability to maintain relationships with the professional athletes and race teams that it sponsors; the possibility that the Company may not be able to selectively add additional dealers and distributors in certain geographic markets; the overall growth of the markets in which the Company competes; the Company’s expectations regarding consumer preferences and its ability to respond to changes in consumer preferences; changes in demand for high-end suspension and ride dynamics products; the Company’s loss of key personnel, management and skilled engineers; the Company’s ability to successfully identify, evaluate and manage potential acquisitions and to benefit from such acquisitions; product recalls and product liability claims; the impact of change in China-Taiwan relations on our business, our operations or our supply chain, the impact of the Russian invasion of Ukraine or rising tension in the Middle East on the global economy, energy supplies and raw materials; future economic or market conditions, including the impact of inflation or the U.S. Federal Reserve’s interest rate increases in response thereto; and the other risks and uncertainties described in “Risk Factors” contained in its Annual Report on Form 10-K for the fiscal year ended December 30, 2022 and filed with the Securities and Exchange Commission on February 23, 2023, its Quarterly Report on Form 10-Q for the quarter ended September 29, 2023 and filed with the Securities and Exchange Commission on November 3, 2023 or otherwise described in the Company’s other filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 2

Transaction Summary • Disruptive brands and cutting-edge technologies with long runway and potential to take dramatic share • Revenue synergies underpinned by strong cross-over demographics • Strategic diversification to gain more control over outcomes (e.g. shift from OEM to AM) • Deep competitive moats support long term growth and pricing power Rationale • Historical revenue CAGR of 29.7% from 2019 to LTM 9/30/2023, EBITDA CAGR of 45.0% • Immediately accretive to Fox Factory(1) across all key metrics: Revenue, Adjusted EBITDA, and Adjusted EPS • Strong double-digit topline and EBITDA growth from 2019 – 9/30/2023 supported by deep innovation pipeline • Fox benefits from one-time ~$30M tax benefit recognized over multiple years Financial Summary • Term Loan A of $600M, co-terminus with revolver • Pro forma leverage of ~2.1 times by end of 2024 • Interest rate 50 basis points higher than current revolver rate Financing 1) Per CODI public filings. 3

Creating a Shared Brand Halo of Professionals and Performance Enthusiasts Professional Demand the best product for competitive edge College Athletes / Elite Players Look up to the Professional Athletes and wish to use the same leading innovative products Sport Enthusiasts Wish to only use the best, technologically advanced products available to them Professional Athletes Demand the best product for competitive edge Ultra & Performance Enthusiasts Desire for the same performance as the professional athletes they admire Affluent Consumers Fulfill their dream of living the affluent adventurer lifestyle, where only the best of the best matters Pros Elite Everyday Enthusiasts 4

Marucci at a Glance Pro/Enthusiast Brand with Clear Market Leadership in Baseball and Grips Unmatched Usage by the World’s Best Players (unpaid) Creates Brand Halo and Provides Valuable Data to Develop Market Leading Products Proven Ability to Penetrate Adjacent Product Categories Technology-Driven Product Development and Innovation Strategy Competitive Moat Through Know-How, Proprietary IP, and Supply Chain Omnichannel Distribution with Leading DTC Platform (e-commerce, direct-to-team, experiential retail) Compelling Financial Profile with Rapid Organic Growth, High Margins & Strong FCF Generation 56% MLB Market Share $187M LTM Q3’23 Revenue $52M LTM Q3’23 Adj. EBITDA 29% ’19A –LTM 9/30/23 Revenue CAGR 45% ’19A – LTM 9/30/23 EBITDA CAGR 5 24% OF REVENUE IS DIRECT TO CONSUMER

Pro Forma Financials Accretive to Revenue Growth and Margins Key Financial Rationale 19.7% 29.7% 20.6% Pro Forma 19.4% 27.7% 20.3% Pro Forma 2019A – LTM 9/30/23 Revenue CAGR LTM 9/30/23 Adjusted EBITDA % Margin(1) Source: FOXF and CODI Public filings. 1) Excludes synergies. Accretive to growth and margins even without the impact of synergies Counter seasonal sales cycle and revenue diversity Opportunity to leverage combined scale and operational efficiencies Manufacturing synergies with aluminum and composite products Innovation, R&D collaboration to unlock potential new product designs 6 Established brand with multiple growth categories and markets in motion (1+1=3)

Multiple Vectors of Continued Growth 7 Utilize Cutting Edge Innovation and Technology to Disrupt the Game Expand Offering in Bats Across Brands and Customer Segments Capitalize on Significant International Momentum Grow Penetration in SoftballStrategically drive expansion of Hitter’s House Locations Grow Offering in Grips by Continuing to Enter New Markets Beyond Sports 1 Expand Proven Fielding Glove Opportunity 2 3 4 5 6 7 Continue to Create Differentiated On-Field Apparel & Develop Performance Footwear 8

The Best Brands in Baseball & Beyond RAPIDLY GROWING LEADERSHIP IN Metal Bat #1 Bat Grip #1 Wood Composite Bat CATX OFFICIAL GRIP OF THE Product Leadership Across All Core Categories 8 #1 & #2 Most Used Wood Bat in Big Leagues

DESIGN DRIVEN CRAFTMANSHIP AND UNPRECEDENTED COMMITMENT TO PERFORMANCE-BASED QUALITY

WE KNOW GRIP WOOD-LIKE PERFORMANCE W/ UNMATCHED DURABILITY

We Are Authentic, We Live and Breathe Our Brands 11 BOTH BRANDS ARE LED BY ENTHUSIASTS WHO DESIGN PRODUCTS FOR THEIR ENTHUSIAST CUSTOMERS Marucci was Created and Continues to Be Led by Passionate Diamond Sports Players

The Best Players Use Marucci, Victus and Lizard Skins Marucci products are manufactured to the highest specification with the most advanced analytics & technology Professional players purchase products at full price – no bat is free – the pros trust Marucci when it counts the most 14 MVP Award Winners 111 Silver Slugger Award Winners 56% of Big Leaguers use Marucci or Victus Bats 254 All Stars since 2009 10 Rookie of the Year Winners 12 Trea Turner Austin Riley Alex Bregman Tim Anderson

Why Marucci & Victus? – Performance Matters 231 194 136 50 33 21 21 15 6 5 5 3 2 0 50 100 150 200 250 Source: Management Estimates 2023 Post Season Hits

Attention to Detail, Quality and Continuous Product Improvement in all Aspects of the Game Expertise & Craftsmanship with Meticulous Attention to Detail Like Fox, All Marucci Products are Player-Tested, Field-Tested and Lab-Tested Before Ever Reaching the Consumer With 20 Years of Experience Leading Innovation Driving Premium Performance Utilizing Technology and Feedback from the Best to Change the Game 14

New Product Innovation Sets Marucci Up For Long Term Sustainable Growth We Will Never Be Complacent – Marucci is Always Looking for the Next Market DISRUPTOR Across Categories Bringing Success and Differentiated Product to Areas Where Others Have Failed Fielding Gloves Introduced in 2019 Cleats & Trainers Coming Soon in 2024 Puck Knob Introduced in 2019, BPL in 2020, CATX in 2022, CATX2 in 2024 Opportunity to Achieve Rapid Growth in the International Market Since Introducing Fielding Gloves in 2019, Marucci is Growing Fielding Glove SKU Count at Key Retailers 15

Marucci Has Unparalleled Relationships Across the Game Leading Relationships Across Sales Channels - Similar to Fox where both brand’s OEM and Retail Partners Need Marucci and Fox Products for their Own Success Both and aaa have a Shared Passion for Connecting with Our Consumers through Events and Other Grassroots Engagements Celebrating the Game with those That Love it 24/7 Access for Those who Live and Breathe the Game Always Showing Up. No Excuses. MOBILE TOUR 100+ Tournaments Attended 5K+ Players and Coaches 9 Current Locations Leading Relationships with Teams from Collegiate to Youth Providing Retailers with the Best Product and the Best Service 16

Balanced Distribution Catering to All Levels of the Sport Allowing Marucci to Meet Customers Where They Want to Buy 1) Represents channel breakdown for TTM May 2023A. 2) L.E.K. Research. 14% 8%2% 38% 38% WINNING ACROSS ALL CHANNELS EARLY INNINGS OF EXPANDING PRESENCE IN GAME CHANGERS FOR THE MARUCCI BRAND JAPAN & KOREA HITTER’S HOUSE BPL BIG BOX Tailored offering with sports focused retailers reaching the elite athlete (not in mass) E-COMMERCE & RESELLERS Allows Marucci to be wherever its consumers currently purchase diamond sports products DTC WEBSITES, PRO & MOBILE TOUR Owned distribution drives brand loyalty and awareness DIRECT-TO-TEAM Connecting directly to teams, players and parents through in-house, online sales platform HITTER’S HOUSE Authentic in-store engagement generating sales and awareness $800M Japan TAM(1) $300M Korea TAM(1) 9 Units Today 60+ Potential Opportunity to leverage in all Hitter’s House locations, bringing the technology to all levels of play 24% TOTAL DTC (1) L.E.K. research. Market size represents manufacturing dollars (not retail) and on-field apparel only (not fanwear).

2004A 2017A 2018A 2019A 2020A 2021A 2022A 2023E Note: 2017 & 2018 inclusive of Marucci & Victus net revenue, not pro forma for Lizard Skins and Baum net revenue. 1) Inclusive of Hitter’s House, Baseball Performance Lab and Other revenue. A Long History of Continued Growth (Net Revenue, $ Millions) Founded as Marucci Bat Company Acquired Carpenter Trade, securing game-changing Carpenter MODified technology Launched Marucci Japan office Acquired Victus Sports #4 Bat in MLB at acquisition, now #1 Acquired Lizard Skins Acquired Baum Bat Vertically integrated wood mills 29.7% CAGR @ LTM 9/30/23 BPL Research leads to the most successful bat launch in history: CATX Introduced Fielding Gloves Formed Baseball Performance Lab Shortened season due to COVID Marucci(1) Victus Lizard Skins Baum

Japan and South Korea ~$1.1B U.S. & Canada ~$1.9B ~6% Huge Runway to Continue Disrupting US Market Large Opportunity Internationally Where Marucci has Proven Traction Marucci is well positioned to continue disrupting the large and growing Diamond Sports market MARUCCI IS BEST POSITIONED TO CAPTURE THE OPPORTUNITYTOTAL ADDRESSABLE MARKET & POTENTIAL PARTICIPATION Higher Income, Core Athlete Participation Growth Outpaces the Broader Population SPECIALIZATION / INTENSITY Drives higher spend as athletes purchase more gear & seek continual upgrades for better equipment PREMIUMIZATION & CUSTOMIZATION Heightened athlete sophistication and desire for more premium, personalized options DIAMOND SPORTS EQUIPMENT & APPAREL(1) Marucci is Delivering the Most Highly Customized, Premium Products on the Market through Leading Customization Capabilities, Unique Features and Advanced Technology Marucci has the Most Technical Products on the Market Driving a High Annual Average Spend of ~$500 Plus on Bats for Marucci’s Core Athlete / Enthusiast Customer(2) ~$3B Total TAM Marucci’s Strategic Focus is Elite Players, Who Are Choosing to Play More Baseball Each Year Marucci Global Market Share Incremental TAM from Potential Services including Hitter’s House, BPL Services and BPL Licensing (1) L.E.K. research. Market size represents manufacturing dollars (not retail) and on-field apparel only (not fanwear). (2) $500 annual average spend represents an estimate from Locker Room, with typical player packages ranging between $400-$600 for uniforms, helmets, batting gloves and bags

WHY MARUCCI 1 DISRUPTIVE BRAND WITH LEADING MARKET SHARE AND AN EXPANDING PRODUCT OFFERING 5 LARGE AND GROWING MARKET EXPERIENCING POSITIVE TAILWINDS 2 LEADING INNOVATION AND PROPRIETARY SUPPLY UNDERLYING BEST-IN-CLASS PRODUCTS 6 MULTIPLE GROWTH OPPORTUNITIES WITH PROVEN MOMENTUM 3 OMNI-CHANNEL DISTRIBUTION SERVES PLAYERS AT EVERY LEVEL OF THE SPORT 7 WORLD-CLASS LEADERSHIP TEAM WITH DEEP BENCH OF EXPERTISE 4 WELL INVESTED PLATFORM TO SUPPORT FUTURE GROWTH 8 COMPELLING FINANCIAL PROFILE

APPENDIX

Professional ~56% Market Share(1) of Big League Players Grassroots to Pro: years of targeting the best players at all levels has created a deeply-entrenched halo 22 P ro H al o College Exclusive partnership with LSU Baseball (2023 CWS National Champions) and other top D-1 programs Unparalleled Innovation Through BPL and Marucci Performance Center Bespoke analysis to maximize performance Product feedback, custom requests Field tested prior to new launches; real-time feedback Marucci is central to baseball career Most technologically-advanced product offering in the industry Paul Skenes and Dylan Crews (#1 and #2 overall draft picks) “…Marucci has done a better job of being on the field with the kid compared to us or [competitor] … what they excel in is creating an emotional connection with their bat and the player to create loyalty…” - Competitor Leadership Grassroots Engagement Through Mobile Tour, Hitters House & Founders Clubs 1) Represents total MLB wood bat market share for 2022A. Top Talent Top Talent Elite Youth Baseball ~25K of the best young diamond sports players in Marucci Founders and Franchise Club Programs

Leveraging the BPL to Keep Marucci’s Products and Processes Ahead of the Curve for the Next 20 Years Innovation in action: baseball performance lab’s data-driven approachMarucci Balance Point Index (BPI)TM Baseball Performance Lab (“BPL”) Contains Technology That Allows for Independent Measurements of the Bat, the Ball, the Body and Ground Reaction Forces – Creating Precise Bat Optimization for Each Player Profile BPL Refines the Bat Optimization Process for All Levels of the Sport and Validates Existing and New Product Lines Under Development To date, 100+ MLB players have trained in the lab providing valuable data and insights BatRX App Team Services Proprietary single index that allows players to describe how individual bats swing Allows the bat fitter and athlete to access real time key data and equipment recommendations Work with teams from high school to MLB to help players track data and results and ultimately, help them optimize their game 23

Best in class management team in place to drive growth 1) Includes tenure at Victus. TEAM TITLE YEARS AT MARUCCI PRIOR EXPERIENCE Kurt Ainsworth Founder & CEO 19 Michael Uffman CFO 10 Mark Barry EVP of Global Sales 9 Jared Smith GM,Co-Founder of Victus 11(1) Jim Lunney COO 1

25 Marucci financial summary

26 Adjusted EBITDA Reconciliation LTM ($ in Millions) 2019 2020 2021 2022 As of 9/30/2023 Net Income (Loss) $5.5 ($18.3) $10.2 $11.5 $19.3 Management Fees and Board Compensation 1 - 1.3 1.6 0.6 0.6 Depreciation & Amortization 2.0 11.5 8.6 12.6 12.9 Interest Expense, Net 0.6 1.9 3.1 7.0 9.3 Income Tax (Benefit) Expense - (1.3) 3.1 4.3 6.6 Stock Option Compensation 0.3 0.7 1.1 1.5 1.7 Transaction Costs 2 3.2 17.7 1.0 1.1 1.4 Other Expense3 0.1 0.4 2.2 (1.8) 0.0 Adjusted EBITDA $11.7 $14.0 $30.9 $36.8 $51.7 Sales $66.1 $65.9 $118.2 $165.4 $187.0 Adjusted EBITDA Margin 17.7% 21.3% 26.1% 22.3% 27.7% 1 Represents fees paid for management fees to former owners and additional board compensation to independent directors. 2 Represents various acquisition related costs and expenses required to integrate entities into the Company's operations. 3 Represents other expenses associated with historical flood damage and repairs needed, COVID-related expenses to maintain operations and other non-recurring expenses. Fiscal Year

Safe Harbor Statement This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. This presentation contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward- looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. These forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by Fox Factory Holding Corp. (the “Company”) and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, future economic or market conditions and the other risks and uncertainties described in “Risk Factors” contained in the Company’s Annual Report on Form 10-K or Quarterly Reports on Form 10-Q or otherwise described in the Company’s other filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. This presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). We use non-GAAP financial measures, including “Adjusted EBITDA,” as useful measures of the Company’s core operating performance and trends and period-to-period comparisons of the Company’s core business. These non-GAAP financial measures have limitations as analytical tools and should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the appendix to this presentation. 2

Fox Factory Introduction Our people play to win in all they do Their passion and diverse experiences make us the best of the best Who We Are Our purpose is to challenge the impossible and lead in the never-ending pursuit of maximum performance Why We Exist Fox Factory delivers performance- defining products that dominate their respective markets through innovative solutions and technologies What We Do 3

Innovation leader Undisputed leader in ideation and technological advancement, creating a multi-year pipeline of performance defining products Premium component manufacturer Best in class manufacturer backed by a disciplined continuous improvement mindset Aspirational brands unparalleled in space Sought after by professional athletes, desired by performance enthusiasts and mass markets Unique growth and diversification strategy 1+1=3 growth mindset unlocks top and bottom line expansion opportunities How We Win 4

2013 2014 2015 2017 2019 2020 2021 2023 1+1=3 Mindset Leads To Transformational Growth Proven Performance Through • Expansion into adjacencies • Geographic expansion • New products • Highly accretive M&A • Synergistic with brands • Strong ROI on Capex investments Fox Factory has outperformed consumer IPOs since 2013 FOXF Source: FactSet as of 24-Nov-2023, Publicly available information 5

Professional Athletes Demand the best product for a competitive edge Ultra & Performance Enthusiasts Desire for the same performance as the professional athletes they admire Affluent Consumers Fulfill their dream of living the affluent adventurer lifestyle, where only the best of the best matters PROS ELITE EVERYDAY ENTHUSIASTS Core Consumer Transformational Growth Opportunity Brand Halo Drives Loyalty Across The Consumer Landscape Dominant Aspirational Brands Drive Growth 6

Halo Effect Enthusiasts around the globe want to identify with and have what "the best" in the industry are using Personalization We design product offerings so consumers can customize their gear Affluent Customer Spending Higher wealth consumers continue to spend through challenging macro environments Outdoor Living Consumers are enjoying more time outdoors and want the best performing products Strong Secular Trends Underpin Our Strategy 7

Three Growing Groups Group 2019 2020 2021 2022 Q3 YTD 2023 Group Description SSG $300 $367 $579 $681 $440* *Bike OE + AM + Marucci Q3 YTD of $144 PVG $306 $279 $361 $432 $406 OEM Auto + PS + Small AM Channel AAG $145 $245 $359 $489 $430 Automotive AM Total $751 $891 $1,299 $1,602 $1,276* *Includes Marucci YTD Q3'23 Numbers of $144 Diversification Is Our Strength OEM 47% AM 53% Pro Forma w/ Marucci Q3'23 TTM AM 47% OEM 53% Q3'23 TTM AM 43%OEM 57% 2022 Fox will drive end consumer adoption and brand value by entering new markets in the aftermarket channel, ultimately leading to OEM specification wins. Maintaining a healthy balance between the two channels will sustain long term growth and drive more predictability. 8

Specialty Sports Group 9

$366 $433 $697 $864 $642 2019 2020 2021 2022 Q3'23 LTM $300 $367 $579 $681 $455 2019 2020 2021 2022 Q3'23 LTM $66 $66 $118 $165 $187 2019 2020 2021 2022 Q3'23 LTM We expect SSG w/o Marucci to grow in the mid-single digits over the long term We expect Marucci to grow in the mid teens over the near term before achieving a mid single digit run rate over the longer term SSG w/ MarucciMarucciSSG w/o Marucci CAGR: 31.5% CAGR: 35.8% CAGR: 32.3% SSG Pro Forma Growth Pro Forma Growth (Fox SSG and Marucci) *$ IN MILLIONS 10

M TB -N E WS. DE 2023 Suspension Fork Brand of the year 2023 Shock brand of the year V I TA L M TB 2022 R E A DE R SUR VE Y FOX #1 Shock (11 years running), #2 Fork, #4 Seatpost to buy. V I TA L M TB STA R S 4.5 Stars - FLOAT Shock 4.5 Stars - FOX 38 Factory Fork 4.5 Stars - FOX 34 GRIP2 Factory Fork P I N KB I KE 2022 E DI TOR S C HOI C E VA LUE GE A R FOX GRIP P I N KB I KE R E A DE R SUR VE Y FOX #1 Fork + Shock to Purchase Next + #1 Fork + Shock on Current Bike FLOW M OUN TA I N B I KE Best XC Fork – FOX 34 SC E N DUR O M TB 2022 Best Brand Suspension Forks and Rear Shock – FOX Best in Test FOX 38 BI KE R A DA R FOX 38 Best in Test - 5/5 Stars FOX 36 - 4.5/5 Stars M BR . C O. UK Best Damping - FOX 36 Factory GRIP2 Best Enduro Fork - FOX 38 Perf. Elite Best Trail Fork - FOX 34 Factory Grip2 DE S I GN A N D I N N OVA TI ON A WA R D 32 Taper Cast OUTS I DE M A GA ZI N E Best MTB Accessories - FOX DHX Facotry Shock B I KE R A DA R Marzocchi Z1 4.5/5 Stars M BR . C O. UK Best Value Fork – Marzocchi Z1 V I TA L M TB STA R S 4.5 Stars – Bomber Air 4.5 Stars – Bomber DJ 4.5 Stars – Bomber Z1 + Z1 Coil A Portfolio Of Performance Defining Brands & Products MOUNTAIN B IKE GRAVEL & ROAD 11

Rapidly Growing Leadership In Metal Bat #1 Bat Grip #1 Wood Composite Bat CATX OFFICIAL GRIP OF THE #1 & #2 Most Used Wood Bat in Big Leagues The Best Brands in Baseball & Beyond Product Leadership Across All Core Categories 12

A Portfolio Of Performance Defining Products 13

Growth Driver SSG Legacy (e.g. Bike) Marucci Market Expansion: Forks and Suspensions Softball, Grips Emerging Segments: E MTB and Gravel International, Shoes, Gloves Innovative Segment: Live Valve Puck Knob & Carpenter Gloves Integrated System: Live Valve w/ Crank Sensor Pro Lab to fit Pros with Bats After Sales Service: Expansion Through Loyalty Hitter's House Growth Opportunity & White Space 14

Multiple Vectors of Continued Growth Utilize Cutting Edge Innovation and Technology to Disrupt the Game Expand Offering in Bats Across Brands and Customer Segments Capitalize on Significant International Momentum Grow Penetration in Softball Strategically drive expansion of Hitter’s House Locations Grow Offering in Grips by Continuing to Enter New Markets Beyond Sports 1 Expand Proven Fielding Glove Opportunity 2 3 4 5 6 7 Continue to Create Differentiated On-Field Apparel & Develop Performance Footwear 8 15

SSG w/o Marucci YTD Q3’23 OEM 81% AM 19% OEM 54% AM 46% SSG w/ Marucci YTD Q3’23 Diversification of SSG After Market (AM) allows Fox to have more control over outcomes 16

Powered Vehicles Group 17

$306 $279 $361 $432 $300 $406 2019 2020 2021 2022 Q3'22 YTD Q3'23 YTD *$ IN MILLIONS 20% FY’22 Growth 35% FY’23 YTD Growth 12% 3-Year CAGR FOX has exceeded our low double-digit long-term growth target due to strong growth in off-road-capable powered vehicles (including those used in on-road sport/recreational markets) Q3. PVG Sales 18

Strong market share & runway for growth ATVTruck & SUV Off-Road SNOWUTV Growth Opportunities & White Space OEM market expansion through newer platforms and product innovation Additional opportunities Defense International Expansion Military market expansion through dedicated facility operations in Southern California International catalog and proprietary applications for vehicles not offered in the US 19

OE customers find software defined suspension (SDS) provides performance advantages across a wider set of uses, which differentiates the OEM to end customers Average price per SDS creates a higher average sale price compared to analog suspension (ASPs) Volume growth driven by accelerated adoption of SDS within Ford and Toyota and expanded market share at other OE customers Product Innovation, Software Defined Suspension Matters 20

Expanding Internationally KEY ACTIONS Finalize international catalog and proprietary applications for vehicles not offered in the US Place a regionally based business development team member in each of the largest truck and powersport regions (Europe, Middle East and Australia/New Zealand) and enter Brazil market now that we have obtained INMETRO Certification (awarded in 2023) 21

Aftermarket Applications Group FPO 22

$145 $245 $359 $489 $373 $430 2019 2020 2021 2022 Q3'22 YTD Q3'23 YTD AAG Sales 36% FY’22 Growth 16% FY’23 YTD Growth 50% 3-Year CAGR Continued demonstration of our 1+1=3 strategy has enabled FOX to create a synergistic product portfolio, helping us expand our TAM, enter adjacent or new markets and deliver low double-digit long-term growth target AAG *$ IN MILLIONS 23

System of Synergies PREMIUM, RACE-PROVEN PRODUCT INNOVATION MANUFACTURED AT SCALE DELIVERING CREDIBLE & ASPIRATIONAL VEHICLE EXPERIENCES THAT ACHIEVE MAXIMUM PERFORMANCE Strong growth in off-road-capable powered vehicles (including those used in on-road sport/recreational markets) and acquisitions have enabled FOX to grow and provide premium packages to consumers who want to immediately blaze their own path 24

Enthusiast defined performance, demonstrated in use case specific applications deliberately released to market FOX Factory Vehicles Strategic Partnership Easy to Buy Selling in a manner we haven’t before: Integrated solutions, experience (not-gear head) based Expanding reach into new use cases, channels and market opportunities with established leaders in the space Deliberate Go-to-Market Direct Customer Relationship Limited Run (pre-pay) Integrated Solutions / Individual Brands AM Innovation Lab Experience Base, Community Development Range of Engagements Expanded Applications New Media Experience is KeyHalo Level Performance Common Marketplace Portfolio Sales (max revenue per relationship) International AAG Growth Strategy of 1+1 = 3 25

Vertical Integration Strategy In Action P R IC E /F E A T U R E S AAG Upfitted Vehicles PVG Shock AAG Lift Kit HALO PREMIUM ENTRY PREMIUM Custom suspension FOX Adventure Series 26

Financial Review 27

FY’ 21 $1,299M Q3’ 22 YTD $1,194M FY’ 22 $1,602M Q3’ 23 YTD $1,132M +23% -5% FY’ 21 $264M Q3’ 22 YTD $245M FY’ 22 $322M Q3’ 23 YTD $222M +22% -9% *FOX defines adjusted EBITDA as net income adjusted for interest expense, net other expense, income taxes, amortization of pu rchased intangibles, depreciation, stock-based compensation, offering expense, strategic transformation costs, contingent consideration valuation adjustments, acquisition-related compensation expense, litigation-related costs, and certain other acquisition-related costs that are more fully described in the appendix. Sales Adjusted EBITDA* Financial Highlights (ex Marucci) 28

Sales Growth (ex Marucci) FY’22 GROWTH 3-YEAR CAGR FY’23 YTD GROWTH 23% 29% -5% PVG 3-YEAR CAGR SSG 3-YEAR CAGR 12% 31% Consolidated Major Market AAG 3-YEAR CAGR 50% SSG 42% PVG 27% AAG 31% 2022 $751 $891 $1,299 $1,602 $1,194 $1,132 2019 2020 2021 2022 Q3'22 YTD Q3'23 YTD SSG 30% PVG 35% AAG 36% Q3'23 TTM 29

OEM 57% AM 43% Original Equipment & Aftermarket Segments (ex Marucci) 2022 Q3’23 TTM Leveraging aftermarket strength to drive OEM spec growth and expand customer base FOX typically enters new markets in the aftermarket channel to drive end-consumer adoption and brand value, which often leads to OEM spec wins Focused on maintaining a healthy balance between the two channels to sustain long-term growth and competitive advantage OEM 53% AM 47% 30

Initiatives Include: Powered Vehicle manufacturing optimization R&D platform expansion Supply chain optimization in North America Expansion of upfitting dealer network and content per truck Profitability (ex Marucci) 3-Year CAGR GROWTH FY’23 YTD GROWTH 30% 22% -9% Opportunity exists to achieve sustainable Adjusted EBITDA Margins of 25% by 2025 through continued improvement initiatives MARGIN FY‘22 ADJUSTED EBITDA 20.1% NOTE: See appendix for reconciliation of Adjusted EBITDA to its most comparable GAAP measure. EBITDA Highlights $146 $176 $264 $322 $245 $222 2019 2020 2021 2022 Q3'22 YTD Q3'23 YTD 31

Solid Liquidity & Cash Generation Flexibility on capital allocation (1) Net leverage ratio is calculated using debt, less cash, to trailing 12-month adjusted EBITDA, including pro forma for recent acquisitions Expected long-term annual capex target of ~3.0-4.0% of sales. 0.5x Net Leverage Ratio(1) Q3 FY’23 <=3.0x LONG TERM $143 $44 $187 $- $50 $100 $150 $200 Free Cash Flow Less: Capex Operating Cash Flow 2022 $MILLIONS Positive cash flow from operations provides additional flexibility Q3’23 YTD Cash Flow from Operations $127M Paid down $170M of debt YTD Q3’23 2.3x Q4 FY’23 Estimate* 2.1x Q4 FY’24 Estimate* * Leverage estimates include impact of Marucci 32

Flexible Capital Structure Cash position along with capacity on revolver provides adequate near-term liquidity Strong cash position and credit facility Cash management Organic & Inorganic Growth Focused on imperative operational and strategic initiatives Leveraging the lessons learned to improve our cash management moving forward Continued expansion of our core business M&A screen for possible future acquisitions Share Repurchase Initiated ~$300M share repurchase program Primary purpose to offset any dilution 33

Strong History of Creating Value Through Inorganic Growth 2013 2014 2015 2017 2019 2020 2021 2023 34

Finding New Opportunities For Transformational Growth M&A Objectives Synergistic with our vision and brand New product technologies Adjacent markets Geographic expansion 35

Appendix 36

Adjusted EBITDA Reconciliation (ex Marucci) *Amounts may not sum due to rounding. ($ in Millions) 2019 2020 2021 2022 Q3'22 Q3'23 Net Income $94.5 $91.7 $163.8 $205.3 $152.3 $116.8 Provision for Income Taxes 14.1 12.8 24.6 28.5 28.3 21.0 Depreciation & Amortization 17.6 33.9 43.4 49.2 36.8 43.5 Non-Cash Stock-Based Compensation 6.9 8.6 13.9 16.4 11.4 14.0 Litigation and Settlement-Related Expenses 4.4 2.0 0.8 4.2 1.6 2.3 Other Acquisition and Integration Related Expenses (1) 2.7 14.9 5.5 1.7 1.6 11.7 Organizational restructuring expenses (2) - - - - - 1.8 Strategic Transformation Costs (3) 1.7 2.8 3.4 2.8 2.8 - Non-Recurring Property Tax Assessment (4) - - - 0.8 0.8 - Tax reform implementation costs 0.2 - - - - - Interest and Other Expense, Net 4.1 9.6 8.5 12.9 9.4 11.1 Adjusted EBITDA $146.2 $176.3 $263.9 $321.8 $245.0 $222.2 Divided by Sales $751.0 $890.6 $1,299.1 $1,602.5 $1,193.9 $1,131.7 Adjusted EBITDA margin 19.5% 19.8% 20.3% 20.1% 20.5% 19.6% ($ in Millions) Q3'22 Q3'23 Acquisition Related Costs and Expenses 1.6 1.8 Finished Goods Inventory Valuation Adjustment - 9.9 Other Acquisiton and Integration-Related Expenses 1.6 11.7 Fiscal Year Year To Date (2) Represents expenses associated with various restructuring initiatives, including the reduction of our Specialty Sports Group workforce. (3) Represents costs associated with various strategic initiatives including the expansion of the Powered Vehicles Group’s manufacturing operations. (4) Represents amounts paid for a non-recurring property tax assessment. Year To Date (1) Represents various acquisition-related costs and expenses incurred to integrate acquired entities into the Company’s operations, excluding $114 in stock-based compensation for the nine month period ended September 30, 2022, and the impact of the finished goods inventory valuation adjustment recorded in connection with the purchase of acquired assets, per period as follows: 37

RIDEFOX.COM WE’RE NEVER DONE Thank You

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

foxf_CoverPage.Abstract |

| Namespace Prefix: |

foxf_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

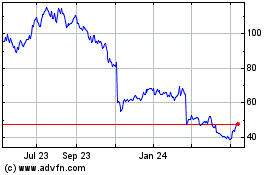

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From Apr 2024 to May 2024

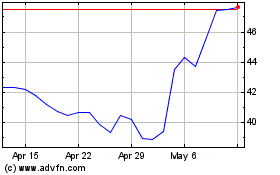

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From May 2023 to May 2024