Filed by Focus Impact Acquisition Corp. pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Focus Impact Acquisition Corp. (File No. 001-40977)

‘Being The First And Only Carbon Company On The NASDAQ Puts Us In A Leadership Position’ – Sunny Trinh, CEO of DevvStream

byVasil Velev

byVasil VelevOctober 27, 2023

8 minute read

DevvStream is one of the unique companies

operating in the carbon credits industry. Focused on projects that reduce emissions through technology, it has become one of the fastest growing players in the sector and is well on its way to scaling its team and operations.

The company has just announced a business

combination agreement with Focus Impact Acquisition Corp. – a transaction valuing it at $213 million – that will lead to DevvStream shares being listed on the

NASDAQ exchange.

This was one of the topics we talked about with CEO Sunny Trinh, as well as the origins of the company, its blockchain-based approach, how he sees the prospects for

technology-based carbon credits and his opinion on the current state of play in the compliance and voluntary carbon markets.

This interview has been edited for brevity.

Can you tell us a bit more about DevvStream and its business model?

I’ll start with the bigger picture. Global climate change is a big issue and in order for us to address it, we have to lower greenhouse gases, with carbon dioxide being the

main focus. It’s estimated that by 2030, we’ll need to reduce roughly 23 billion tons CO2 annually. Out of that 23 billion, roughly about 12 and a half billion or so needs to come from carbon credits. This is why carbon credits are so critical,

because it creates a bridge for the world to address these issues.

Up to this point the majority of carbon credits have come from nature-based [sources], which are extremely important. You need forestry, the mangroves, and so forth. But

there have been studies that nature based will only address up to 20% of the reductions necessary in order for us to meet our net zero goals. The other 80% needs to come from technology.

This is where DevvStream comes in. We focus on technology because that’s our background. My team and I have an engineering background, we have four PhDs on our team and a combination of engineers and physicists. We identify

technologies or activities that companies, municipalities, governments and organizations are doing and that are eligible for carbon credits. We help them generate and monetize these credits and by doing that we provide another stream of revenue to

help advance them further.

For example, we have a wastewater treatment partner that reduces energy consumption in plants by up to 83%. There’s a cost to do that but with the [emission] reduction you can generate carbon credits that help bridge that

gap to encourage municipalities to use this technology.

How did you reach the point at which technology-based credits were your focus? Did you see a bigger market opportunity for them?

It’s more around our background than anything else. As I mentioned, my team and I are all technologists – some come from power generation companies, while I come from semiconductors. We’ve worked with two of the largest

distributors of chips in the world, that have millions of B2B customers and the projects there were focused either on renewable energy or energy efficiency technologies, so we already had that network.

I spent a lot of time with the ESG teams for these companies back when it was called corporate social responsibility. I found that these companies were struggling because they couldn’t compete against fossil fuels. They

were was just too inexpensive.

Source: DevvStream investor presentation

I’ve always had a passion to help these types of companies to address climate change issues. As I got to know them I realized that carbon credits can be a really interesting vehicle to help bridge that gap. I started

talking to them and said: “you know nothing about carbon credits, why don’t we come in and help you generate them and you’d pay us a portion of the credits.” And literally, every single one of them said yes! To them it’s a new stream of revenue

that’s going to help advance their technology further.

We are actually starting to work on nature based [credits] and addressing some of the issues with them by using technologies like satellite imaging, LiDAR, computer imaging and AI.

Is there a sector in which DevvStream resides? Do you have any direct competitors?

The majority of project developers and companies that are in the space focus on nature-based because carbon credits have always been around forestry and a few new technologies that have come up like direct air capture. It’s

very limited.

For what we do, we don’t see any other competitors at all. Because when we go and talk to these large organizations, there’s nobody else even going in and bidding for it.

DevvStream CEO Sunny Trinh. Image: DevvStream

Here is an example – we engaged with a $2

billion Japanese company called Ryoden, a Mistubishi subsidiary that distributes electronic products like HVAC and EV chargers. I met with them and shared that all their products and activities are eligible for carbon credits. And they knew

nothing about that. After our meeting they said they wanted to engage with us because they couldn’t find other alternatives, or that they couldn’t do it themselves.

Your platform relies on blockchain technology provided by Devvio. What is their role in DevvStream’s business model?

Devvio is a sister company and is a significant owner in Devstream. It’s a blockchain company that has the greenest blockchain in the world, the one with the lowest energy consumption. So it really fits this type of

application.

The reason we created a platform using blockchain is the lack of transparency in carbon credit markets. A lot of times when an organization goes and buys a carbon credit it’s not always clear how the quantification data is

generated. And did the impact it’s saying it had truly happen. At the same time, when carbon credits are being traded and sold, especially from developing nations, brokers will come in and take 90% of the profits, and that’s not transparent.

We’re putting all the data onto the blockchain, so that way everyone can see how the data is generated and quantified and if it created the impact it says it did.

Relevant: DevvStream Launches First-Ever Blockchain-Based Carbon Offset Program Platform

Once the credits are issued you can see all the transactions. [Then] it becomes very clear that the majority of the money is going to the project developers, to help further advance that technology, as opposed to just the

middleman.

The quantification is also extremely important and the technology inherently makes it easier because it’s very precise.

For nature-nased [credits] without using LiDAR or other technologies it’s always been with models that expect trees to grow at a linear rate. But there is opportunity for overestimation and that’s what is happening with

some projects.

Are there specific carbon accounting standards you adhere to?

We adhere to ISO 14064-2:2020 and GHG Protocol for quantification purposes. In addition, for each project, we use recognized GHG quantification methodologies from VCS, Gold Standard, ACR, CDM, and more.

Who do you sell the credits to? Do you work with partners for that?

We expect to sell to corporations and organizations directly. We recently announced an offtake agreement with a large global energy company for up to 650,000 credits over the next three years. We also work

with partners like CBL Xpansiv, so we will be using a combination of both [sales channels].

DevvStream recently signed up to the Core Carbon Principles benchmark. Is that a prelude to working on voluntary markets, or is your focus on compliance markets?

We expect to work on both because they are, in our mind, equally important. The reason that we embrace The Core Carbon Principles is that they create a bar that ensures the quality of the credits. All these issues I

mentioned are addressed, as well as the impact additionality. It also allows the buyers to have certainty that these aren’t junk credits.

What’s happening now is that there are companies being sued because they’re buying these junk credits that aren’t creating the [desired] impacts. This helps address a lot of that and we only want to generate the highest

quality credits possible.

What is your sense of the current situation in both the compliance and voluntary market?

What we’re seeing is that the pricing is very polar. You have your high quality credits and you have your low quality credits. The value of the low quality credits is declining and the value of the high quality credits is

increasing. Unfortunately the majority of credits in the market right now are of low quality and they are getting dumped.

We’ve spoken to quite a few organizations and they’ve commented that there’s just not enough high quality credits out there. There’s a demand for them.

There is also demand for trade between countries and those will also have a certain level of criteria that need to be met. So when you when you take those types of credits, you’re gonna get a premium over the lower quality.

Source: DevvStream investor presentation

As far as the regulatory compliance market, we expect that to increase as well. In Canada, for example, under their OBPS program, the carbon tax is $65 today. We have $15 every year to hit $170 by 2030, so that’s going to

provide a steady increase.

You’ll soon be listed on the NASDAQ. What do you hope that will provide?

Like any growing company we’re always in a fundraising mode. We are growing significantly with over 140 projects on our pipeline, (at least) seven under contract with a handful more than ready to switch over to contract.

These projects are very scalable and just one example are building efficiency programs across North America. How many buildings and campuses and hotel chains will this be applicable for? We need additional people to run

these programs, we need to really build out our platform. All this requires capital as well.

Getting on the NASDAQ gives us access to a much larger capital pool than what we have now in Canada. The SPAC route seems to be a very efficient way and part of it is finding the right SPAC.

Focus Impact, who we’re meging with, have the same goal of creating impact on the world in a positive way. They have a great management team run by Carl Stanton, their CEO. Our management teams just clicked and sometimes

you just kind of know when there’s a match.

[The public listing] gives us access to capital and being the first and the only current carbon company on the NASDAQ puts us in a leadership position as well. It gives us access to a lot of institutions who are looking to

invest in companies like us.

How do you see the role of SMBs in the credit markets going forward? From what I understand they are part of your business model?

I think they’re critically important because there’s many of them. And it works with our model because we’re able to aggregate activities across even smaller organizations. A small building by itself, it doesn’t warrant a

carbon credit project, because it’s just too timely, too expensive. But we can aggregate them and roll them into our program, so there’s almost zero additional costs. And we can turn them on fairly quickly as well. And that’s kind of the beauty of

our technology and what we’re able to do.

About DevvStream

Founded in 2021, DevvStream is a technology-based sustainability company that advances the development and monetization of environmental assets, with an initial focus on carbon markets. DevvStream works

with governments and corporations worldwide to achieve their sustainability goals through the implementation of curated green technology projects that generate renewable energy, improve energy efficiencies, eliminate or reduce emissions, and

sequester carbon directly from the air—creating carbon credits in the process.

About Focus Impact Acquisition Corp.

Focus Impact is a special purpose acquisition company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with

one or more businesses. Focus Impact is sponsored by Focus Impact Sponsor, LLC. Focus Impact intends to focus its search on businesses that are, or seek to be positioned as, a “Social-Forward Company,” which are companies that marry operating

excellence with the desire to create social good, with the benefit of increasing attention and capital flows to such companies while amplifying their social impact.

DevvStream Media Contacts

DevvStream@icrinc.com and info@fcir.ca

Phone: (332) 242-4316

Disclaimers

Certain statements in this transcript may be considered forward-looking statements. Forward-looking statements that are statements that are not historical facts and generally relate to future events or

Focus Impact’s or DevvStream’s future financial or other performance metrics. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. These forward-looking statements, including, without limitation, Focus Impact’s, DevvStream’s and the combined company’s

expectations with respect to future performance and anticipated financial impacts of the proposed transactions, the satisfaction of the closing conditions to the proposed transactions and the timing of the completion of the proposed transactions,

are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while

considered reasonable by Focus Impact and its management, and Devvstream and its management, as the case may be, are inherently uncertain and subject to material change. New risks and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. certain other risks are identified and discussed in. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the occurrence of any

event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the proposed transactions; (2) the outcome of any legal proceedings that may be instituted against

Focus Impact, DevvStream, the combined company or others; (3) the inability to complete the proposed transactions due to the failure to obtain approval of the stockholders of Focus Impact and DevvStream or to satisfy other conditions to closing;

(4) changes to the proposed structure of the proposed transactions that may be required or appropriate as a result of applicable laws or regulations; (5) the ability to meet Nasdaq’s or another stock exchange’s listing standards following the

consummation of the proposed transactions; (6) the risk that the proposed transactions disrupts current plans and operations of Focus Impact or DevvStream as a result of the announcement and consummation of the proposed transactions; (7) the

ability to recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers

and retain its management and key employees; (8) costs related to the proposed transactions; (9) changes in applicable laws or regulations; (10) the possibility that Focus Impact, DevvStream or the combined company may be adversely affected by

other economic, business, and/or competitive factors; (11) Focus Impact’s estimates of expenses and profitability and underlying assumptions with respect to stockholder redemptions and purchase price and other adjustments; (12) various factors

beyond management’s control, including general economic conditions and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Focus Impact’s final

prospectus relating to its initial public offering, filed with the SEC on October 27, 2021, and other filings with the SEC, including the Registration Statement and (13) certain other risks identified and discussed in DevvStream’s Annual

Information Form for the year ended July 31, 2022, and DevvStream’s other public filings with Canadian securities regulatory authorities, available on DevvStream’s profile on SEDAR at www.sedarplus.ca.

These forward-looking statements are expressed in good faith, and Focus Impact, DevvStream and the combined company believe there is a reasonable basis for them. However, there can be no assurance that the

events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and none of Focus Impact, DevvStream or the combined company is under any

obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review

the statements set forth in the reports, which Focus Impact has filed or will file from time to time with the SEC and DevvStream’s public filings with Canadian securities regulatory authorities. This transcript is not intended to be all-inclusive

or to contain all the information that a person may desire in considering an investment in Focus Impact or DevvStream and is not intended to form the basis of an investment decision in Focus Impact or DevvStream. All subsequent written and oral

forward-looking statements concerning Focus Impact and DevvStream, the proposed transaction or other matters and attributable to Focus Impact and DevvStream or any person acting on their behalf are expressly qualified in their entirety by the

cautionary statements above.

Additional Information and Where to Find It

In connection with the Business Combination, Focus Impact and DevvStream intend to prepare, and Focus Impact intends to file a Registration Statement containing a prospectus with respect to the combined

company’s securities to be issued in connection with the Business Combination, a proxy statement with respect to the stockholders’ meeting of Focus Impact to vote on the Business Combination and certain other related documents. Investors,

securityholders and other interested persons are urged to read, when available, the preliminary proxy statement/prospectus in connection with Focus Impact’s solicitation of proxies for its special meeting of stockholders to be held to approve the

Business Combination (and related matters) and general amendments thereto and the definitive proxy statement/prospectus because the proxy statement/prospectus will contain important information about Focus Impact, DevvStream and the Business

Combination. When available, Focus Impact will mail the definitive proxy statement/prospectus and other relevant documents to its stockholders as of a record date to be established for voting on the Business Combination. This communication is not a

substitute for the Registration Statement, the definitive proxy statement/prospectus or any other document that Focus Impact will send to its stockholders in connection with the Business Combination. Once the Registration Statement is declared

effective, copies of the Registration Statement, including the definitive proxy statement/prospectus and other documents filed by Focus Impact or DevvStream with the SEC, may be obtained, free of charge, by directing a request to Focus Impact

Acquisition Corp., 250 Park Avenue, Suite 911, New York, New York 10177. The preliminary and definitive proxy statement/prospectus to be included in the Registration Statement, once available, can also be obtained, without charge, at the SEC’s

website (www.sec.gov).

Participants in the Solicitation

Focus Impact and its directors, executive officers, other members of management, and employees, may be deemed to be participants in the solicitation of proxies of Focus Impact's stockholders in connection

with the Business Combination under SEC rules. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Focus Impact's stockholders in connection with the Business Combination will be in the

Registration Statement and the proxy statement/prospectus included therein, when it is to be filed with the SEC. To the extent that holdings of Focus Impact's securities have changed since the amounts printed in Focus Impact's registration

statement on Form S-1 relating to its initial public offering, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Investors and security holders may obtain more detailed information

regarding the names and interests in the Business Combination of Focus Impact's directors and officers in Focus Impact's filings with the SEC and such information will also be in the Registration Statement to be filed with the SEC, which will

include the proxy statement/prospectus of Focus Impact for the Business Combination.

DevvStream and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Focus Impact in connection with the Business Combination. A

list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be included in the proxy statement/prospectus of Focus Impact for the Business Combination when available. You may

obtain free copies of these documents as described above.

No Offer or Solicitation

This transcript is for informational purposes only and does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described

herein. This transcript shall also not constitute an offer to sell or the solicitation of an offer to buy the securities of Focus Impact, DevvStream or the combined company following consummation of the Business Combination, nor shall there be any

sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

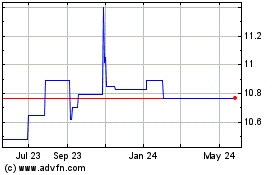

Focus Impact Acquisition (NASDAQ:FIACU)

Historical Stock Chart

From Apr 2024 to May 2024

Focus Impact Acquisition (NASDAQ:FIACU)

Historical Stock Chart

From May 2023 to May 2024