0001651052

false

0001651052

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 3, 2023

FOCUS

FINANCIAL PARTNERS INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-38604 |

47-4780811 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| |

|

|

| |

875

Third Avenue, 28th

Floor |

|

| |

New

York, NY

10022 |

|

| |

|

|

| |

(Address of principal executive

offices) |

|

| |

(Zip Code) |

|

| |

(646)

519-2456 |

|

| |

Registrant’s Telephone

Number, Including Area Code |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share |

|

FOCS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On August 3, 2023, Focus Financial Partners

Inc. (the “Company”) issued a press release reporting results for its second quarter ended June 30, 2023. A copy of the

press release is furnished with this Current Report on Form 8-K (this “Current Report”) as Exhibit 99.1.

| Item 7.01 | Regulation FD Disclosure. |

The information set forth under Item 2.02 is incorporated

by reference as if fully set forth herein.

The information in this Current Report, being

furnished pursuant to Items 2.02, 7.01 and 9.01, shall not be deemed to be “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

and is not incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly

set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FOCUS FINANCIAL PARTNERS INC. |

| |

|

|

| |

By: |

/s/ J. Russell

McGranahan |

| |

|

J. Russell McGranahan |

| |

|

General Counsel |

Dated: August 3, 2023

Exhibit 99.1

Focus Financial Partners Reports Second Quarter

2023 Results

New

York, New York – August 3, 2023 – Focus Financial Partners Inc. (Nasdaq: FOCS) (“Focus Inc.”,

“Focus”, the “Company”, “we”, “us” or “our”), a leading partnership of independent,

fiduciary wealth management firms, today reported results for its second quarter ended June 30, 2023.

Second Quarter 2023 Highlights

| · | Total revenues of $583.8 million, 8.3% growth year over year |

| · | Organic revenue growth(1) rate of 4.9% year over year |

| · | GAAP net income of $29.1 million |

| · | GAAP basic income and diluted loss per share of Class A common stock of $0.49 and ($0.10), respectively |

| · | Adjusted Net Income Excluding Tax Adjustments(2) of $61.3 million and Tax Adjustments(3) of

$17.6 million |

| · | Adjusted Net Income Excluding Tax Adjustments Per Share(2) of $0.70 and Tax Adjustments(3) Per

Share(2) of $0.20 |

| · | Net Leverage Ratio(4) of 4.36x |

| |

(1) | Please see footnote 2 under “How We Evaluate Our Business” later in this press release. |

| |

(2) | Non-GAAP financial measures. Please see “Reconciliation

of Non-GAAP Financial Measures” later in this press release for a reconciliation and more information on these measures. |

| |

(3) | Please see footnote 6 under “How We Evaluate Our Business” later in this press release. |

| |

(4) | Please see footnote 7 under “How We Evaluate Our Business” later in this press release. |

Second Quarter 2023 Financial Highlights

Total revenues were $583.8 million, 8.3%, or $44.6

million higher than the 2022 second quarter. The increase was primarily attributable to $18.2 million of revenues from new partner firms

acquired during the last twelve months. Our year-over-year organic revenue growth rate(1) was 4.9%.

An estimated 74.3%, or $434.0 million, of total

revenues in the quarter were correlated to the financial markets. Of this amount, 65.1%, or $282.6 million, were generated from advance

billings generally based on market levels in the 2023 first quarter. The remaining 25.7%, or $149.8 million, were not correlated to the

markets. These revenues typically consist of family office type services, tax advice and fixed fees for investment advice, primarily for

high and ultra-high net worth clients.

GAAP net income was $29.1 million compared to

$49.3 million in the prior year quarter. GAAP basic income and diluted loss per share of Class A common stock was $0.49 and ($0.10),

respectively, as compared to $0.51 and $0.50 for basic and diluted income per share of Class A common stock, respectively, in the

prior year quarter.

Adjusted

EBITDA(2) was $136.0 million, (0.7)%, or ($1.0) million, lower than the prior year period. Our Adjusted EBITDA margin(3) was

23.3%, Adjusted Net Income Excluding Tax Adjustments(2) was $61.3 million, and Tax Adjustments(4) was

$17.6 million. Adjusted Net Income Excluding Tax Adjustments Per Share(2) was $0.70, down (29.3)% compared to the prior

year period primarily reflecting the effect of higher interest expense on our borrowings. Tax Adjustments Per Share(2) was

$0.20, up 5.3% compared to the prior year period reflecting the tax efficiency of our acquisition activity.

| (1) | Please see footnote 2 under “How We Evaluate Our Business” later in this press release. |

| (2) | Non-GAAP financial measures. Please see “Reconciliation of Non-GAAP Financial Measures” later

in this press release for a reconciliation and more information on these measures. |

| (3) | Calculated as Adjusted EBITDA divided by Revenues. |

| (4) | Please see footnote 6 under “How We Evaluate Our Business” later in this press release. |

Balance Sheet and Liquidity

As of June 30, 2023, cash and cash equivalents

were $137.0 million and debt outstanding under our credit facilities was approximately $2.7 billion. Our Net Leverage Ratio(1) as

of June 30, 2023 was 4.36x.

As of June 30, 2023, $850 million, or 32.1%,

of our debt outstanding under our credit facilities had SOFR swapped from a floating rate to a fixed weighted average interest rate of

53 basis points plus a spread of 325 basis points. The residual amount of approximately $1.8 billion remains at floating rates, with $904.0

million at an interest rate of SOFR (subject to a 50 basis point floor) plus 250 basis points spread, and $896.8 million at an interest

rate of SOFR (subject to a 50 basis point floor) plus 325 basis points spread. We typically use 30-day Term SOFR for our term loans.

Our net cash provided by operating activities

for the trailing four quarters ended June 30, 2023 was $266.1 million compared to $291.3 million for the comparable prior year period.

Our Cash Flow Available for Capital Allocation(2) for the trailing four quarters ended June 30, 2023 was $271.2 million

compared to $323.2 million for the comparable prior year period. In the 2023 second quarter, we paid $18.0 million in cash earn-out obligations

and $6.7 million of required installments under our First Lien Term Loans.

| (1) | Please see footnote 7 under “How We Evaluate Our Business” later in this press release. |

| (2) | Non-GAAP financial measure. See ‘‘Reconciliation of Non-GAAP Financial Measures—Cash

Flow Available for Capital Allocation” later in this press release. |

The Merger

On February 27, 2023, Focus Inc. entered

into the Merger Agreement for Focus to be acquired by affiliates of CD&R in an all-cash transaction (the “Merger”). Funds

managed by Stone Point Capital LLC (“Stone Point”) will retain a portion of their investment in Focus and provide new equity

financing as part of the Merger. If the Merger is consummated, Focus will cease to be publicly-traded. At a Special Meeting held on July 14,

2023, the shareholders of the Company, including a majority in voting power of the outstanding shares of common stock held by Unaffiliated

Stockholders (as defined in the Merger Agreement), adopted and approved the Merger Agreement. Completion of the Merger is subject to other

customary closing conditions. The Merger is expected to close in the third quarter of 2023. However, the Company cannot assure completion

of the Merger by any particular date, if at all or that, if completed, it will be completed on the terms set forth in the Merger Agreement.

For more information see Current Report on Form 8-K filed on February 28, 2023.

Due to the pending Merger, Focus will not be hosting

an earnings conference call or take questions from the investment community.

About Focus Financial Partners Inc.

Focus Financial Partners Inc. is a leading partnership

of independent, fiduciary wealth management firms. Focus provides access to best practices, resources, and continuity planning for its

partner firms who serve individuals, families, employers and institutions with comprehensive wealth management services. Focus partner

firms maintain their operational independence, while they benefit from the synergies, scale, economics and best practices offered by Focus

to achieve their business objectives.

Cautionary Note Concerning Forward-Looking

Statements

The foregoing information contains certain forward-looking

statements that reflect the Company’s current views with respect to certain current and future events, including with respect to

the Merger and the expected timing of closing of the Merger, and financial performance. These forward-looking statements are and will

be, as the case may be, subject to many risks, uncertainties and factors, including relating to the Company’s operations and business

environment, which may cause the Company’s actual results to be materially different from any future results, expressed or implied,

in these forward-looking statements. Any forward-looking statements in this release are based upon information available to the Company

on the date of this release. The Company does not undertake to publicly update or revise its forward-looking statements even if experience

or future changes make it clear that any statements expressed or implied therein will not be realized. Additional information on risk

factors that could potentially affect the Company’s financial results may be found in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2022 filed and our other filings with the Securities and Exchange Commission.

Investor and Media Contact

Tina Madon

Senior Vice President

Head of Investor Relations & Corporate

Communications

Tel: (646) 813-2909

tmadon@focuspartners.com

How We Evaluate Our Business

We focus on several key financial metrics in evaluating

the success of our business, the success of our partner firms and our resulting financial position and operating performance. Key metrics

for the three and six months ended June 30, 2022 and 2023 include the following:

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(dollars in thousands, except per share data) | |

| Revenue Metrics: | |

| | | |

| | | |

| | | |

| | |

| Revenues | |

$ | 539,211 | | |

$ | 583,805 | | |

$ | 1,075,778 | | |

$ | 1,141,312 | |

| Revenue growth (1) from prior period | |

| 26.8 | % | |

| 8.3 | % | |

| 31.3 | % | |

| 6.1 | % |

| Organic revenue growth (2) from prior period | |

| 15.0 | % | |

| 4.9 | % | |

| 18.6 | % | |

| 2.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Management Fees Metrics (operating expense): | |

| | | |

| | | |

| | | |

| | |

| Management fees | |

$ | 136,802 | | |

$ | 139,035 | | |

$ | 274,641 | | |

$ | 263,629 | |

| Management fees growth (3) from prior period | |

| 17.7 | % | |

| 1.6 | % | |

| 25.8 | % | |

| (4.0 | )% |

| Organic management fees growth (4) | |

| | | |

| | | |

| | | |

| | |

| from prior period | |

| 8.4 | % | |

| 0.5 | % | |

| 14.5 | % | |

| (5.4 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) Metrics: | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 49,318 | | |

$ | 29,082 | | |

$ | 88,400 | | |

$ | 22,105 | |

| Net income growth from prior period | |

| | * | |

| (41.0 | )% | |

| | * | |

| (75.0 | )% |

| Income (loss) per share of Class A common stock: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.51 | | |

$ | 0.49 | | |

$ | 0.95 | | |

$ | 0.48 | |

| Diluted | |

$ | 0.50 | | |

$ | (0.10 | ) | |

$ | 0.95 | | |

$ | (0.32 | ) |

| Income (loss) per share of Class A common stock growth from prior period: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| | * | |

| (3.9 | )% | |

| | * | |

| (49.5 | )% |

| Diluted | |

| | * | |

| (120.0 | )% | |

| | * | |

| (133.7 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA Metrics: | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA (5) | |

$ | 137,021 | | |

$ | 136,022 | | |

$ | 272,101 | | |

$ | 268,540 | |

| Adjusted EBITDA growth (5) from prior period | |

| 27.1 | % | |

| (0.7 | )% | |

| 30.3 | % | |

| (1.3 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net Income Excluding Tax Adjustments Metrics: | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net Income Excluding Tax Adjustments (5) | |

$ | 81,679 | | |

$ | 61,347 | | |

$ | 164,752 | | |

$ | 121,471 | |

| Adjusted Net Income Excluding Tax Adjustments | |

| | | |

| | | |

| | | |

| | |

| growth (5) from prior period | |

| 20.5 | % | |

| (24.9 | )% | |

| 25.5 | % | |

| (26.3 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Tax Adjustments | |

| | | |

| | | |

| | | |

| | |

| Tax Adjustments (5)(6) | |

$ | 15,977 | | |

$ | 17,637 | | |

$ | 30,790 | | |

$ | 35,015 | |

| Tax Adjustments growth from prior period (5)(6) | |

| 44.7 | % | |

| 10.4 | % | |

| 43.0 | % | |

| 13.7 | % |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(dollars in thousands, except per share data) | |

| Adjusted Net Income Excluding Tax Adjustments Per Share and Tax Adjustments Per Share Metrics: | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net Income Excluding Tax

Adjustments Per Share (5) | |

$ | 0.99 | | |

$ | 0.70 | | |

$ | 2.01 | | |

$ | 1.39 | |

| Tax Adjustments Per Share (5)(6) | |

$ | 0.19 | | |

$ | 0.20 | | |

$ | 0.37 | | |

$ | 0.40 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net Income Excluding Tax Adjustments Per Share

growth | |

| 17.9 | % | |

| (29.3 | )% | |

| 24.1 | % | |

| (30.8 | )% |

| (5) from prior period | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Tax Adjustments Per Share growth from prior period

(5)(6) | |

| 35.7 | % | |

| 5.3 | % | |

| 37.0 | % | |

| 8.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Adjusted Shares Outstanding (5) | |

| 82,312,683 | | |

| 87,533,867 | | |

| 82,123,532 | | |

| 87,238,409 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Metrics: | |

| | | |

| | | |

| | | |

| | |

| Net Leverage Ratio (7) at period end | |

| 3.90 | x | |

| 4.36 | x | |

| 3.90 | x | |

| 4.36 | x |

| Acquired Base Earnings (8) | |

$ | 11,450 | | |

$ | 11,066 | | |

$ | 11,450 | | |

$ | 12,797 | |

| Number of partner firms at period end (9) | |

| 85 | | |

| 90 | | |

| 85 | | |

| 90 | |

* Not

meaningful

| (1) | Represents period-over-period growth in our GAAP revenue. |

| (2) | Organic revenue growth represents the period-over-period growth in revenue related to partner firms, including

growth related to acquisitions of wealth management practices and customer relationships by our partner firms, including Connectus, and

partner firms that have merged, that for the entire periods presented, are included in our consolidated statements of operations for each

of the entire periods presented. We believe these growth statistics are useful in that they present full-period revenue growth of partner

firms on a “same store” basis exclusive of the effect of the partial period results of partner firms that are acquired during

the comparable periods. |

| (3) | The terms of our management agreements entitle the management companies to management fees typically consisting

of all Earnings Before Partner Compensation (“EBPC”) in excess of Base Earnings up to Target Earnings, plus a percentage of

any EBPC in excess of Target Earnings. Management fees growth represents the period-over-period growth in GAAP management fees earned

by management companies. While an expense, we believe that growth in management fees reflect the strength of the partnership. |

| (4) | Organic management fees growth represents the period-over-period growth in management fees earned by management

companies related to partner firms, including growth related to acquisitions of wealth management practices and customer relationships

by our partner firms and partner firms that have merged, that for the entire periods presented, are included in our consolidated statements

of operations for each of the entire periods presented. We believe that these growth statistics are useful in that they present

full-period growth of management fees on a “same store” basis exclusive of the effect of the partial period results of partner

firms that are acquired during the comparable periods. |

| (5) | For additional information regarding Adjusted EBITDA, Adjusted Net Income Excluding Tax Adjustments, Adjusted

Net Income Excluding Tax Adjustments Per Share, Tax Adjustments, Tax Adjustments Per Share and Adjusted Shares Outstanding, including

a reconciliation of Adjusted EBITDA, Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per

Share to the most directly comparable GAAP financial measure, please read “—Adjusted EBITDA” and “—Adjusted

Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share.” |

| (6) | Tax Adjustments represent the tax benefits of intangible assets, including goodwill, associated with deductions

allowed for tax amortization of intangible assets in the respective periods based on a pro forma 27% income tax rate. Such amounts were

generated from acquisitions completed where we received a step-up in basis for tax purposes. Acquired intangible assets may be amortized

for tax purposes, generally over a 15-year period. Due to our acquisitive nature, tax deductions allowed on acquired intangible assets

provide additional significant supplemental economic benefit. The tax benefit from amortization is included to show the full economic

benefit of deductions for acquired intangible assets with the step-up in tax basis. As of June 30, 2023, estimated Tax Adjustments

from intangible asset related income tax benefits from closed acquisitions based on a pro forma 27% income tax rate for the next 12 months

is $70.8 million. |

| (7) | Net Leverage Ratio represents the First Lien Leverage Ratio (as defined in the Credit Facility), and means

the ratio of amounts outstanding under the First Lien Term Loan A, First Lien Term Loan B and First Lien Revolver plus other outstanding

debt obligations secured by a lien on the assets of Focus LLC (excluding letters of credit other than unpaid drawings thereunder) minus

unrestricted cash and cash equivalents to Consolidated EBITDA (as defined in the Credit Facility). |

| (8) | The terms of our management agreements entitle the management companies to management fees typically consisting

of all future EBPC of the acquired wealth management firm in excess of Base Earnings up to Target Earnings, plus a percentage of any EBPC

in excess of Target Earnings. Acquired Base Earnings is equal to our collective preferred position in Base Earnings or comparable measures.

We are entitled to receive these earnings notwithstanding any earnings that we are entitled to receive in excess of Target Earnings. Base

Earnings may change in future periods for various business or contractual matters. For example, from time to time when a partner firm

consummates an acquisition, the management agreement among the partner firm, the management company and the principals is amended to adjust

Base Earnings and Target Earnings to reflect the projected post-acquisition earnings of the partner firm. |

| (9) | Represents the number of partner firms on the last day of the period presented. |

Unaudited Condensed Consolidated Financial Statements

FOCUS FINANCIAL PARTNERS INC.

Unaudited Condensed Consolidated Statements

of Operations

(in thousands, except share and per share amounts)

| | |

For the three months ended | | |

For the six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| REVENUES: | |

| | |

| | |

| | |

| |

| Wealth management fees | |

$ | 517,421 | | |

$ | 555,574 | | |

$ | 1,032,600 | | |

$ | 1,089,463 | |

| Other | |

| 21,790 | | |

| 28,231 | | |

| 43,178 | | |

| 51,849 | |

| Total revenues | |

| 539,211 | | |

| 583,805 | | |

| 1,075,778 | | |

| 1,141,312 | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Compensation and related expenses | |

| 178,131 | | |

| 208,532 | | |

| 359,931 | | |

| 414,948 | |

| Management fees | |

| 136,802 | | |

| 139,035 | | |

| 274,641 | | |

| 263,629 | |

| Selling, general and administrative | |

| 94,771 | | |

| 114,991 | | |

| 183,421 | | |

| 227,807 | |

| Intangible amortization | |

| 64,649 | | |

| 74,623 | | |

| 124,925 | | |

| 146,409 | |

| Non-cash changes in fair value of estimated | |

| | | |

| | | |

| | | |

| | |

| contingent consideration | |

| (42,757 | ) | |

| 6,076 | | |

| (51,742 | ) | |

| 22,564 | |

| Depreciation and other amortization | |

| 3,805 | | |

| 4,053 | | |

| 7,438 | | |

| 8,020 | |

| Total operating expenses | |

| 435,401 | | |

| 547,310 | | |

| 898,614 | | |

| 1,083,377 | |

| INCOME FROM OPERATIONS | |

| 103,810 | | |

| 36,495 | | |

| 177,164 | | |

| 57,935 | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 17 | | |

| 639 | | |

| 20 | | |

| 1,103 | |

| Interest expense | |

| (19,892 | ) | |

| (48,341 | ) | |

| (37,508 | ) | |

| (92,270 | ) |

| Amortization of debt financing costs | |

| (949 | ) | |

| (1,115 | ) | |

| (2,050 | ) | |

| (2,220 | ) |

| Other expense—net | |

| (1,451 | ) | |

| (229 | ) | |

| (1,487 | ) | |

| (2,954 | ) |

| Income from equity method investments | |

| 11 | | |

| 354 | | |

| 106 | | |

| 529 | |

| Total other expense—net | |

| (22,264 | ) | |

| (48,692 | ) | |

| (40,919 | ) | |

| (95,812 | ) |

| INCOME (LOSS) BEFORE INCOME TAX | |

| 81,546 | | |

| (12,197 | ) | |

| 136,245 | | |

| (37,877 | ) |

| INCOME TAX EXPENSE (BENEFIT) | |

| 32,228 | | |

| (41,279 | ) | |

| 47,845 | | |

| (59,982 | ) |

| NET INCOME | |

| 49,318 | | |

| 29,082 | | |

| 88,400 | | |

| 22,105 | |

| Non-controlling interest | |

| (16,235 | ) | |

| 3,095 | | |

| (26,215 | ) | |

| 9,440 | |

| NET INCOME ATTRIBUTABLE TO | |

| | | |

| | | |

| | | |

| | |

| COMMON SHAREHOLDERS | |

$ | 33,083 | | |

$ | 32,177 | | |

$ | 62,185 | | |

$ | 31,545 | |

| Income (loss) per share of Class A | |

| | | |

| | | |

| | | |

| | |

| common stock: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.51 | | |

$ | 0.49 | | |

$ | 0.95 | | |

$ | 0.48 | |

| Diluted | |

$ | 0.50 | | |

$ | (0.10 | ) | |

$ | 0.95 | | |

$ | (0.32 | ) |

| Weighted average shares of Class A | |

| | | |

| | | |

| | | |

| | |

| common stock outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 65,389,642 | | |

| 65,999,323 | | |

| 65,360,667 | | |

| 65,969,827 | |

| Diluted | |

| 65,596,377 | | |

| 85,668,061 | | |

| 65,682,081 | | |

| 85,144,280 | |

FOCUS FINANCIAL

PARTNERS INC.

Unaudited Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | |

December 31, | | |

June 30, | |

| | |

2022 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 139,973 | | |

$ | 137,040 | |

| Accounts receivable less allowances of $3,862 at 2022 and $4,349 at 2023 | |

| 217,219 | | |

| 236,790 | |

| Prepaid expenses and other assets | |

| 151,356 | | |

| 206,983 | |

| Fixed assets—net | |

| 54,748 | | |

| 56,796 | |

| Operating lease assets | |

| 258,697 | | |

| 269,592 | |

| Debt financing costs—net | |

| 7,590 | | |

| 6,818 | |

| Deferred tax assets—net | |

| 230,130 | | |

| 238,677 | |

| Goodwill | |

| 2,167,917 | | |

| 2,310,675 | |

| Other intangible assets—net | |

| 1,639,124 | | |

| 1,757,799 | |

| TOTAL ASSETS | |

$ | 4,866,754 | | |

$ | 5,221,170 | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 12,213 | | |

$ | 13,605 | |

| Accrued expenses | |

| 80,679 | | |

| 97,443 | |

| Due to affiliates | |

| 70,974 | | |

| 40,999 | |

| Deferred revenue | |

| 10,726 | | |

| 9,826 | |

| Contingent consideration and other liabilities | |

| 335,033 | | |

| 523,568 | |

| Deferred tax liabilities | |

| 29,579 | | |

| 46,587 | |

| Operating lease liabilities | |

| 288,895 | | |

| 302,861 | |

| Borrowings under credit facilities (stated value of $2,563,970 and | |

| | | |

| | |

| $2,650,818 at December 31, 2022 and June 30, 2023, respectively) | |

| 2,510,749 | | |

| 2,600,437 | |

| Tax receivable agreements obligations | |

| 224,611 | | |

| 215,013 | |

| TOTAL LIABILITIES | |

| 3,563,459 | | |

| 3,850,339 | |

| EQUITY | |

| | | |

| | |

| Class A common stock, par value $0.01, 500,000,000 shares authorized; | |

| | | |

| | |

| 65,929,644 and 66,015,587 shares issued and outstanding at | |

| | | |

| | |

| December 31, 2022 and June 30, 2023, respectively | |

| 659 | | |

| 660 | |

| Class B common stock, par value $0.01, 500,000,000 shares authorized; | |

| | | |

| | |

| 11,827,321 and 12,540,262 shares issued and outstanding at | |

| | | |

| | |

| December 31, 2022 and June 30, 2023, respectively | |

| 118 | | |

| 125 | |

| Additional paid-in capital | |

| 918,044 | | |

| 913,612 | |

| Retained earnings | |

| 116,779 | | |

| 148,324 | |

| Accumulated other comprehensive income | |

| 18,318 | | |

| 18,606 | |

| Total shareholders' equity | |

| 1,053,918 | | |

| 1,081,327 | |

| Non-controlling interest | |

| 249,377 | | |

| 289,504 | |

| Total equity | |

| 1,303,295 | | |

| 1,370,831 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 4,866,754 | | |

$ | 5,221,170 | |

FOCUS FINANCIAL PARTNERS INC.

Unaudited Condensed Consolidated Statements

of Cash Flows

(in thousands)

| | |

For the six months ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income | |

$ | 88,400 | | |

$ | 22,105 | |

| Adjustments to reconcile net income to net cash provided by operating | |

| | | |

| | |

| activities—net of effect of acquisitions: | |

| | | |

| | |

| Intangible amortization | |

| 124,925 | | |

| 146,409 | |

| Depreciation and other amortization | |

| 7,438 | | |

| 8,020 | |

| Amortization of debt financing costs | |

| 2,050 | | |

| 2,220 | |

| Non-cash equity compensation expense | |

| 14,210 | | |

| 15,599 | |

| Non-cash changes in fair value of estimated contingent consideration | |

| (51,742 | ) | |

| 22,564 | |

| Income from equity method investments | |

| (106 | ) | |

| (529 | ) |

| Distributions received from equity method investments | |

| 776 | | |

| 681 | |

| Deferred taxes and other non-cash items | |

| 29,576 | | |

| (7,249 | ) |

| Changes in cash resulting from changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (9,398 | ) | |

| (16,985 | ) |

| Prepaid expenses and other assets | |

| (9,776 | ) | |

| (60,847 | ) |

| Accounts payable | |

| 4,778 | | |

| 818 | |

| Accrued expenses | |

| 21,446 | | |

| 17,551 | |

| Due to affiliates | |

| (51,962 | ) | |

| (30,000 | ) |

| Contingent consideration and other liabilities | |

| (40,201 | ) | |

| (11,420 | ) |

| Deferred revenue | |

| (1,122 | ) | |

| (2,116 | ) |

| Net cash provided by operating activities | |

| 129,292 | | |

| 106,821 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Cash paid for acquisitions and contingent consideration—net of cash acquired | |

| (252,056 | ) | |

| (140,265 | ) |

| Purchase of fixed assets | |

| (6,429 | ) | |

| (9,468 | ) |

| Investments | |

| (5,232 | ) | |

| (500 | ) |

| Net cash used in investing activities | |

| (263,717 | ) | |

| (150,233 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Borrowings under credit facilities | |

| 100,000 | | |

| 98,500 | |

| Repayments of borrowings under credit facilities | |

| (12,348 | ) | |

| (13,152 | ) |

| Payments in connection with tax receivable agreements | |

| (3,856 | ) | |

| (9,598 | ) |

| Contingent consideration paid | |

| (21,397 | ) | |

| (22,186 | ) |

| Payments of deferred cash consideration | |

| — | | |

| (12,505 | ) |

| Payments of debt financing costs | |

| (1,111 | ) | |

| — | |

| Proceeds from exercise of stock options | |

| 422 | | |

| 3,067 | |

| Equity awards withholding | |

| — | | |

| (704 | ) |

| Distributions for unitholders | |

| (15,956 | ) | |

| (3,172 | ) |

| Other | |

| 375 | | |

| — | |

| Net cash provided by financing activities | |

| 46,129 | | |

| 40,250 | |

| EFFECT OF EXCHANGE RATES ON CASH AND CASH EQUIVALENTS | |

| (1,339 | ) | |

| 229 | |

| CHANGE IN CASH AND CASH EQUIVALENTS | |

| (89,635 | ) | |

| (2,933 | ) |

| CASH AND CASH EQUIVALENTS: | |

| | | |

| | |

| Beginning of period | |

| 310,684 | | |

| 139,973 | |

| End of period | |

$ | 221,049 | | |

$ | 137,040 | |

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA

Adjusted

EBITDA is a non-GAAP measure. Adjusted EBITDA is defined as net income excluding interest income, interest expense, income tax expense

(benefit), amortization of debt financing costs, intangible amortization and impairments, if any, depreciation and other amortization,

non-cash equity compensation expense, non-cash changes in fair value of estimated contingent consideration, other expense—net

and Merger-related expenses, if any. We believe that Adjusted EBITDA, viewed in addition to and not in lieu of, our reported GAAP results,

provides additional useful information to investors regarding our performance and overall results of operations for various reasons, including

the following:

| · | non-cash equity grants made to employees or non-employees at a certain price and point in time do not

necessarily reflect how our business is performing at any particular time; stock-based compensation expense is not a key measure of our

operating performance; |

| · | contingent consideration or earn outs can vary substantially from company to company and depending upon

each company’s growth metrics and accounting assumption methods; the non-cash changes in fair value of estimated contingent consideration

is not considered a key measure in comparing our operating performance; and |

| · | amortization expenses can vary substantially from company to company and from period to period depending

upon each company’s financing and accounting methods, the fair value and average expected life of acquired intangible assets and

the method by which assets were acquired; the amortization of intangible assets obtained in acquisitions are not considered a key measure

in comparing our operating performance. |

We use Adjusted EBITDA:

| · | as a measure of operating performance; |

| · | for planning purposes, including the preparation of budgets and forecasts; |

| · | to allocate resources to enhance the financial performance of our business; |

| · | to evaluate the effectiveness of our business strategies; and |

| · | as a consideration in determining compensation for certain employees. |

Adjusted EBITDA does not purport to be an alternative

to net income or cash flows from operating activities. The term Adjusted EBITDA is not defined under GAAP, and Adjusted EBITDA is not

a measure of net income, operating income or any other performance or liquidity measure derived in accordance with GAAP. Therefore, Adjusted

EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results

as reported under GAAP. Some of these limitations are:

| · | Adjusted EBITDA does not reflect all cash expenditures, future requirements for capital expenditures or

contractual commitments; |

| · | Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; and |

| · | Adjusted EBITDA does not reflect the interest expense on our debt or the cash requirements necessary to

service interest or principal payments. |

In addition, Adjusted EBITDA can differ significantly

from company to company depending on strategic decisions regarding capital structure, the tax jurisdictions in which companies operate

and capital investments. We compensate for these limitations by relying also on the GAAP results and using Adjusted EBITDA as supplemental

information.

Set forth below is a reconciliation of net income

to Adjusted EBITDA for the three and six months ended June 30, 2022 and 2023:

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

(in thousands) | |

| Net income | |

$ | 49,318 | | |

$ | 29,082 | | |

$ | 88,400 | | |

$ | 22,105 | |

| Interest income | |

| (17 | ) | |

| (639 | ) | |

| (20 | ) | |

| (1,103 | ) |

| Interest expense | |

| 19,892 | | |

| 48,341 | | |

| 37,508 | | |

| 92,270 | |

| Income tax expense (benefit) | |

| 32,228 | | |

| (41,279 | ) | |

| 47,845 | | |

| (59,982 | ) |

| Amortization of debt financing costs | |

| 949 | | |

| 1,115 | | |

| 2,050 | | |

| 2,220 | |

| Intangible amortization | |

| 64,649 | | |

| 74,623 | | |

| 124,925 | | |

| 146,409 | |

| Depreciation and other amortization | |

| 3,805 | | |

| 4,053 | | |

| 7,438 | | |

| 8,020 | |

| Non-cash equity compensation expense | |

| 7,503 | | |

| 7,688 | | |

| 14,210 | | |

| 15,599 | |

| Non-cash changes in fair value of estimated | |

| | | |

| | | |

| | | |

| | |

| contingent consideration | |

| (42,757 | ) | |

| 6,076 | | |

| (51,742 | ) | |

| 22,564 | |

| Other expense—net | |

| 1,451 | | |

| 229 | | |

| 1,487 | | |

| 2,954 | |

| Merger-related expenses (1) | |

| — | | |

| 6,733 | | |

| — | | |

| 17,484 | |

| Adjusted EBITDA | |

$ | 137,021 | | |

$ | 136,022 | | |

$ | 272,101 | | |

$ | 268,540 | |

| (1) | Represents costs incurred in conjunction with the Merger. Refer to our SEC filings for additional information. |

Adjusted Net Income Excluding Tax Adjustments

and Adjusted Net Income Excluding Tax Adjustments Per Share

We analyze our performance using Adjusted Net

Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share. Adjusted Net Income Excluding Tax Adjustments

and Adjusted Net Income Excluding Tax Adjustments Per Share are non-GAAP measures. We define Adjusted Net Income Excluding Tax Adjustments

as net income excluding income tax expense (benefit), amortization of debt financing costs, intangible amortization and impairments, if

any, non-cash equity compensation expense, non-cash changes in fair value of estimated contingent consideration and Merger-related expenses,

if any. The calculation of Adjusted Net Income Excluding Tax Adjustments also includes adjustments to reflect a pro forma 27% income tax

rate reflecting the estimated U.S. federal, state, local and foreign income tax rates applicable to corporations in the jurisdictions

we conduct business and is used for comparative purposes. The actual effective income tax rate, in current or future periods, may differ

significantly from the pro forma income tax rate of 27%.

Adjusted Net Income Excluding Tax Adjustments

Per Share is calculated by dividing Adjusted Net Income Excluding Tax Adjustments by the Adjusted Shares Outstanding. Adjusted Shares

Outstanding includes: (i) the weighted average shares of Class A common stock outstanding during the periods, (ii) the

weighted average incremental shares of Class A common stock related to stock options and restricted stock units outstanding during

the periods, (iii) the weighted average number of Focus LLC common units outstanding during the periods (assuming that 100% of such

Focus LLC common units, including contingently issuable Focus LLC common units, if any, have been exchanged for Class A common stock),

(iv) the weighted average number of Focus LLC restricted common units outstanding during the periods (assuming that 100% of such

Focus LLC restricted common units have been exchanged for Class A common stock) and (v) the weighted average number of common

unit equivalents of Focus LLC vested and unvested incentive units outstanding during the periods based on the closing price of our Class A

common stock on the last trading day of the periods (assuming that 100% of such Focus LLC common units have been exchanged for Class A

common stock).

We believe that Adjusted Net Income Excluding

Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share, viewed in addition to and not in lieu of, our reported GAAP

results, provide additional useful information to investors regarding our performance and overall results of operations for various reasons,

including the following:

| · | non-cash equity grants made to employees or non-employees at a certain price and point in time do not

necessarily reflect how our business is performing at any particular time; stock-based compensation expense is not a key measure of our

operating performance; |

| · | contingent consideration or earn outs can vary substantially from company to company and depending upon

each company’s growth metrics and accounting assumption methods; the non-cash changes in fair value of estimated contingent consideration

is not considered a key measure in comparing our operating performance; and |

| · | amortization expenses can vary substantially from company to company and from period to period depending

upon each company’s financing and accounting methods, the fair value and average expected life of acquired intangible assets and

the method by which assets were acquired; the amortization of intangible assets obtained in acquisitions are not considered a key measure

in comparing our operating performance. |

Adjusted Net Income Excluding Tax Adjustments

and Adjusted Net Income Excluding Tax Adjustments Per Share do not purport to be an alternative to net income or cash flows from operating

activities. The terms Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share are not

defined under GAAP, and Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share are

not a measure of net income, operating income or any other performance or liquidity measure derived in accordance with GAAP. Therefore,

Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share have limitations as an analytical

tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations

are:

| · | Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share

do not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments; |

| · | Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share

do not reflect changes in, or cash requirements for, working capital needs; and |

| · | Other companies in the financial services industry may calculate Adjusted Net Income Excluding Tax Adjustments

and Adjusted Net Income Excluding Tax Adjustments Per Share differently than we do, limiting its usefulness as a comparative measure. |

In addition, Adjusted Net Income Excluding Tax

Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share can differ significantly from company to company depending on

strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. We compensate

for these limitations by relying also on the GAAP results and use Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income

Excluding Tax Adjustments Per Share as supplemental information.

Tax Adjustments and Tax Adjustments Per

Share

Tax Adjustments represent the tax benefits of

intangible assets, including goodwill, associated with deductions allowed for tax amortization of intangible assets in the respective

periods based on a pro forma 27% income tax rate. Such amounts were generated from acquisitions completed where we received a step-up

in basis for tax purposes. Acquired intangible assets may be amortized for tax purposes, generally over a 15-year period. Due to our acquisitive

nature, tax deductions allowed on acquired intangible assets provide additional significant supplemental economic benefit. The tax benefit

from amortization is included to show the full economic benefit of deductions for acquired intangible assets with the step-up in tax basis.

Tax Adjustments Per Share is calculated by dividing

Tax Adjustments by the Adjusted Shares Outstanding.

Set forth below is a reconciliation of net income

to Adjusted Net Income Excluding Tax Adjustments and Adjusted Net Income Excluding Tax Adjustments Per Share for the three and six months

ended June 30, 2022 and 2023:

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

(dollars in thousands, except per share data) | |

| Net income | |

$ | 49,318 | | |

$ | 29,082 | | |

$ | 88,400 | | |

$ | 22,105 | |

| Income tax expense (benefit) | |

| 32,228 | | |

| (41,279 | ) | |

| 47,845 | | |

| (59,982 | ) |

| Amortization of debt financing costs | |

| 949 | | |

| 1,115 | | |

| 2,050 | | |

| 2,220 | |

| Intangible amortization | |

| 64,649 | | |

| 74,623 | | |

| 124,925 | | |

| 146,409 | |

| Non-cash equity compensation expense | |

| 7,503 | | |

| 7,688 | | |

| 14,210 | | |

| 15,599 | |

| Non-cash changes in fair value of estimated | |

| | | |

| | | |

| | | |

| | |

| contingent consideration | |

| (42,757 | ) | |

| 6,076 | | |

| (51,742 | ) | |

| 22,564 | |

| Merger-related expenses (1) | |

| — | | |

| 6,733 | | |

| — | | |

| 17,484 | |

| Subtotal | |

| 111,890 | | |

| 84,038 | | |

| 225,688 | | |

| 166,399 | |

| Pro forma income tax expense (27%) (2) | |

| (30,211 | ) | |

| (22,691 | ) | |

| (60,936 | ) | |

| (44,928 | ) |

| Adjusted Net Income Excluding Tax Adjustments | |

$ | 81,679 | | |

$ | 61,347 | | |

$ | 164,752 | | |

$ | 121,471 | |

| | |

| | | |

| | | |

| | | |

| | |

| Tax Adjustments (3) | |

$ | 15,977 | | |

$ | 17,637 | | |

$ | 30,790 | | |

$ | 35,015 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net Income Excluding Tax Adjustments Per Share | |

$ | 0.99 | | |

$ | 0.70 | | |

$ | 2.01 | | |

$ | 1.39 | |

| Tax Adjustments Per Share (3) | |

$ | 0.19 | | |

$ | 0.20 | | |

$ | 0.37 | | |

$ | 0.40 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Shares Outstanding | |

| 82,312,683 | | |

| 87,533,867 | | |

| 82,123,532 | | |

| 87,238,409 | |

| | |

| | | |

| | | |

| | | |

| | |

| Calculation of Adjusted Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares of Class A common | |

| | | |

| | | |

| | | |

| | |

| stock outstanding—basic (4) | |

| 65,389,642 | | |

| 65,999,323 | | |

| 65,360,667 | | |

| 65,969,827 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Weighted average incremental shares of | |

| | | |

| | | |

| | | |

| | |

| Class A common stock related to stock | |

| | | |

| | | |

| | | |

| | |

| options and restricted stock units (5) | |

| 206,735 | | |

| 516,151 | | |

| 321,414 | | |

| 479,847 | |

| Weighted average Focus LLC common units | |

| | | |

| | | |

| | | |

| | |

| outstanding (6) | |

| 12,175,282 | | |

| 12,540,262 | | |

| 11,900,077 | | |

| 12,307,867 | |

| Weighted average Focus LLC restricted | |

| | | |

| | | |

| | | |

| | |

| common units outstanding (7) | |

| 193,625 | | |

| 295,978 | | |

| 193,625 | | |

| 296,261 | |

| Weighted average common unit equivalent of | |

| | | |

| | | |

| | | |

| | |

| Focus LLC incentive units outstanding (8) | |

| 4,347,399 | | |

| 8,182,153 | | |

| 4,347,749 | | |

| 8,184,607 | |

| Adjusted Shares Outstanding | |

| 82,312,683 | | |

| 87,533,867 | | |

| 82,123,532 | | |

| 87,238,409 | |

| (1) | Represents costs incurred in conjunction with the Merger. Refer to our SEC filings for additional information. |

| (2) | The pro forma income tax rate of 27% reflects the estimated U.S. federal, state, local and foreign income

tax rates applicable to corporations in the jurisdictions we conduct business and is used for comparative purposes. The actual effective

income tax rate, in current or future periods, may differ significantly from the pro forma income tax rate of 27%. The actual effective

income tax rate is the percentage of income tax after taking into consideration various tax deductions, credits and limitations. Among

other things, periods of increased interest expense and limits on our ability to deduct interest expense may, in current or future periods,

contribute to an actual effective income tax rate that is less than or greater than the pro forma income tax rate of 27%. |

| (3) | Tax Adjustments represent the tax benefits of intangible assets, including goodwill, associated with deductions

allowed for tax amortization of intangible assets in the respective periods based on a pro forma 27% income tax rate. Such amounts were

generated from acquisitions completed where we received a step-up in basis for tax purposes. Acquired intangible assets may be amortized

for tax purposes, generally over a 15-year period. Due to our acquisitive nature, tax deductions allowed on acquired intangible assets

provide additional significant supplemental economic benefit. The tax benefit from amortization is included to show the full economic

benefit of deductions for acquired intangible assets with the step-up in tax basis. As of June 30, 2023, estimated Tax Adjustments

from intangible asset related income tax benefits from closed acquisitions based on a pro forma 27% income tax rate for the next 12 months

is $70.8 million. |

| (4) | Represents our GAAP weighted average Class A common stock outstanding—basic. |

| (5) | Represents the incremental shares related to stock options and restricted stock units as calculated under

the treasury stock method. |

| (6) | Assumes that 100% of the Focus LLC common units, including contingently issuable Focus LLC common

units, if any, were exchanged for Class A common stock. |

| (7) | Assumes that 100% of the Focus LLC restricted common units were exchanged for Class A common stock. |

| (8) | Assumes that 100% of the vested and unvested Focus LLC incentive units were converted into Focus LLC

common units based on the closing price of our Class A common stock at the end of the respective period and such Focus LLC common

units were exchanged for Class A common stock. |

Adjusted Free Cash Flow and Cash Flow Available for Capital Allocation

To supplement our statements of cash flows presented

on a GAAP basis, we use non-GAAP liquidity measures on a trailing 4-quarter basis to analyze cash flows generated from our operations.

We consider Adjusted Free Cash Flow and Cash Flow Available for Capital Allocation to be liquidity measures that provide useful information

to investors about the amount of cash generated by the business and are two factors in evaluating the amount of cash available to pay

contingent consideration and deferred cash consideration, make strategic acquisitions and repay outstanding borrowings. Adjusted Free

Cash Flow and Cash Flow Available for Capital Allocation do not represent our residual cash flow available for discretionary expenditures

as they do not deduct our mandatory debt service requirements and other non-discretionary expenditures. We define Adjusted Free Cash Flow

as net cash provided by operating activities, less purchase of fixed assets, distributions for Focus LLC unitholders and payments under

tax receivable agreements. We define Cash Flow Available for Capital Allocation as Adjusted Free Cash Flow plus the portions of contingent

consideration and deferred cash consideration paid which are classified as operating cash flows under GAAP. The balances of such contingent

consideration and deferred cash consideration are classified as investing or financing cash flows under GAAP; therefore, we add back the

amounts included in operating cash flows so that the full amount of contingent consideration and deferred cash consideration payments

are treated consistently. Adjusted Free Cash Flow and Cash Flow Available for Capital Allocation are not defined under GAAP and should

not be considered as alternatives to net cash from operating, investing or financing activities. In addition, Adjusted Free Cash Flow

and Cash Flow Available for Capital Allocation can differ significantly from company to company.

Set forth below is a reconciliation of net cash

provided by operating activities to Adjusted Free Cash Flow and Cash Flow Available for Capital Allocation for the trailing 4-quarters

ended June 30, 2022 and 2023:

| | |

Trailing 4-Quarters Ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | |

| | |

(in thousands) | |

| Net cash provided by operating activities | |

$ | 291,250 | | |

$ | 266,128 | |

| Purchase of fixed assets | |

| (13,129 | ) | |

| (24,056 | ) |

| Distributions for unitholders | |

| (29,159 | ) | |

| (10,200 | ) |

| Payments under tax receivable agreements | |

| (3,856 | ) | |

| (9,598 | ) |

| Adjusted Free Cash Flow | |

$ | 245,106 | | |

$ | 222,274 | |

| Portion of contingent consideration paid included in operating activities (1) | |

| 78,105 | | |

| 48,621 | |

| Portion of deferred cash consideration paid included in operating activities (2) | |

| — | | |

| 304 | |

| Cash Flow Available for Capital Allocation (3) | |

$ | 323,211 | | |

$ | 271,199 | |

| (1) | A portion of contingent consideration paid is classified as operating cash outflows in accordance with

GAAP, with the balance reflected in investing or financing cash outflows. Contingent consideration paid classified as operating cash outflows

for each of the trailing 4-quarters ended June 30, 2022 was $20.4 million, $16.4 million, $23.1 million and $18.2 million, respectively,

totaling $78.1 million for the trailing 4-quarters ended June 30, 2022. Contingent consideration paid classified as operating cash

outflows for each of the trailing 4-quarters ended June 30, 2023 was $29.5 million, $6.1 million, $9.0 million and $4.0, respectively,

totaling $48.6 million for the trailing 4-quarters ended June 30, 2023. |

| (2) | A portion of deferred cash consideration paid is classified as operating cash outflows in accordance with

GAAP, with the balance reflected in financing cash outflows. Deferred cash consideration paid and classified as operating cash outflows

was $0.3 million for the trailing 4-quarters ended June 30, 2023. |

| (3) | Cash Flow Available for Capital Allocation excludes all contingent consideration and deferred cash consideration

that was included in either operating, investing or financing activities of our consolidated statements of cash flows. |

Supplemental Information

Economic Ownership

The following table provides supplemental information

regarding the economic ownership of Focus Financial Partners, LLC as of June 30, 2023:

| | |

June 30, 2023 | |

| Economic Ownership of Focus Financial Partners, LLC Interests: | |

Interest | | |

% | |

| Focus Financial Partners Inc. | |

| 66,015,587 | | |

| 75.9 | % |

| Non-Controlling Interests (1) | |

| 21,007,740 | | |

| 24.1 | % |

| Total | |

| 87,023,327 | | |

| 100.0 | % |

| (1) | Includes 8,172,603 Focus LLC common units issuable upon conversion of the outstanding 16,559,179 vested

and unvested incentive units (assuming vesting of the unvested incentive units and a June 30, 2023 period end value of the Focus

LLC common units equal to $52.51) and includes 294,875 Focus LLC restricted common units. |

Class A and Class B Common Stock Outstanding

The following table provides supplemental information

regarding the Company’s Class A and Class B common stock:

| | |

Number of Shares Outstanding at

June 30, 2023 | | |

Number of Shares Outstanding at

July 31, 2023 | |

| Class A | |

| 66,015,587 | | |

| 66,018,464 | |

| Class B | |

| 12,540,262 | | |

| 12,540,262 | |

Incentive Units

The following table provides supplemental information

regarding the outstanding Focus LLC vested and unvested Incentive Units (“IUs”) at June 30, 2023. The vested IUs in future

periods can be exchanged into shares of Class A common stock (after conversion into a number of Focus LLC common units that takes

into account the then-current value of common units and such IUs aggregate hurdle amount), and therefore, the Company calculates the Class A

common stock equivalent of such IUs for purposes of calculating per share data. The period-end share price of the Company’s Class A

common stock is used to calculate the intrinsic value of the outstanding Focus LLC IUs in order to calculate a Focus LLC common unit equivalent

of the Focus LLC IUs.

Hurdle

Rates | | |

Number

Outstanding | |

| $ | 1.42 | | |

| 421 | |

| $ | 5.50 | | |

| 798 | |

| $ | 6.00 | | |

| 386 | |

| $ | 7.00 | | |

| 1,081 | |

| $ | 9.00 | | |

| 708,107 | |

| $ | 11.00 | | |

| 813,001 | |

| $ | 12.00 | | |

| 513,043 | |

| $ | 13.00 | | |

| 540,000 | |

| $ | 14.00 | | |

| 10,098 | |

| $ | 16.00 | | |

| 45,191 | |

| $ | 17.00 | | |

| 20,000 | |

| $ | 19.00 | | |

| 527,928 | |

| $ | 21.00 | | |

| 3,017,692 | |

| $ | 22.00 | | |

| 796,417 | |

| $ | 23.00 | | |

| 524,828 | |

| $ | 26.26 | | |

| 12,500 | |

| $ | 27.00 | | |

| 12,484 | |

| $ | 27.90 | | |

| 1,885,166 | |

| $ | 28.50 | | |

| 1,424,225 | |

| $ | 30.48 | | |

| 30,000 | |

| $ | 33.00 | | |

| 3,587,500 | |

| $ | 36.64 | | |

| 30,000 | |

| $ | 37.59 | | |

| 506,745 | |

| $ | 43.07 | | |

| 60,000 | |

| $ | 43.50 | | |

| 30,000 | |

| $ | 44.71 | | |

| 803,165 | |

| $ | 58.50 | | |

| 658,403 | |

| | | | |

| 16,559,179 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

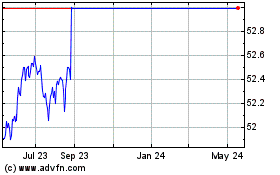

Focus Financial Partners (NASDAQ:FOCS)

Historical Stock Chart

From Apr 2024 to May 2024

Focus Financial Partners (NASDAQ:FOCS)

Historical Stock Chart

From May 2023 to May 2024