East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, one of the nation’s premier regional banks, today

reported financial results for the third quarter of 2010. For the

third quarter of 2010, net income was $47.0 million and net income

available to common stockholders was $0.27 per diluted share.

“We are pleased to report strong third quarter earnings of $47.0

million, an increase of 29% from the second quarter of 2010. East

West has consistently improved core profitability each and every

quarter in 2010,” stated Dominic Ng, Chairman and Chief Executive

Officer of East West. “During the third quarter we grew non-covered

commercial and trade finance loan balances by $167.3 million or 11%

to $1.7 billion. We grew core deposits by $290.3 million or 4% to a

record $8.5 billion and total deposits to a record high of $15.3

billion.”

“For East West, credit costs have now declined for the past four

consecutive quarters. Quarter over quarter, net charge-offs

decreased $10.1 million or 18%, provision for loan losses decreased

$16.6 million or 30% and nonperforming assets remained under 1% of

total assets.”

Ng concluded, “Last week we seamlessly completed the core

systems integration of Washington First International Bank. With

the integrations of both United Commercial Bank and Washington

First International Bank behind us, East West is 100% focused on

profitably growing our core business and serving our

customers.”

2010 Quarterly Results Summary

For the three months ended, % Change Dollars in millions, except

per share

September 30,2010

June 30,2010

March 31,2010

Q3 vs. Q2 2010 Net income (loss) $ 47.0 $ 36.3 $ 24.9 29 % Net

income (loss) available to common shareholders 40.2 30.2 18.8 33 %

Earnings per share (diluted) 0.27 0.21 0.13 29 % Return on

average assets 0.93 % 0.73 % 0.49 % 27 % Return on average common

equity 8.11 % 6.26 % 4.71 % 30 %

Tier 1 risk-based capital ratio

17.9 % 18.9 % 18.9 % -5 % Total risk-based capital ratio 19.7 %

20.8 % 20.9 % -5 %

East West has increased profitability each quarter of 2010,

growing net income 46% in the second quarter to $36.3 million and

29% in the third quarter to $47.0 million. Quarter over quarter,

diluted earnings per share grew $0.08 or 62% in the second quarter

and $0.06 or 29% in the third quarter.

Third Quarter 2010 Highlights

- Third Quarter Earnings –

For the third quarter 2010, net income was $47.0 million, an

increase of $10.6 million over net income of $36.3 million reported

in the second quarter of 2010 and an increase of $115.5 million

over a net loss of $68.5 million reported in the third quarter of

2009.

- Strong Net Interest Margin – The

core net interest margin, excluding the net impact to interest

income of $5.5 million resulting from the disposition of covered

loans, totaled 3.98% for the quarter. The third quarter core net

interest margin of 3.98% reflected no change from the second

quarter and an increase from 3.20% in the third quarter of 2009.

(See reconciliation of the GAAP financial measure to this non-GAAP

financial measure in the tables attached.)

- Strong C&I Loan Growth –

Quarter to date, non-covered commercial and trade finance loans

grew $167.3 million or 11% to $1.7 billion.

- Significant Deposit Growth –

Core deposits grew to a record $8.5 billion as of September 30,

2010, an increase of $290.3 million or 4% from June 30, 2010.

Additionally, time deposits grew $89.0 million or 1% resulting in

total deposits of a record $15.3 billion as of September 30,

2010.

- Net Charge-offs Down 18% from Q2

2010, Down 70% from Q3 2009 – Net charge-offs declined to $45.1

million, a decrease of $10.1 million or 18% from the prior quarter

and a decrease of $106.2 million or 70% from the third quarter of

2009.

- Nonperforming Assets Remains Below

1% – Nonperforming assets remain low at $196.3 million,

or 0.96% of total assets. This is the fourth consecutive quarter

East West has reported a nonperforming assets to total assets ratio

under 1.00%.

- Reduction in Noninterest Expense

– Total noninterest expense excluding expenses to be reimbursed

by the FDIC, totaled $92.1 million in the third quarter, a decrease

of $10.2 million or 10% as compared to the second quarter of 2010.

This figure represents an improvement from our noninterest expense

guidance of $105 million. (See reconciliation of the GAAP financial

measure to this non-GAAP financial measure in the tables

attached.)

- Strong Capital Levels – As of

September 30, 2010, East West’s Tier 1 risk-based capital and total

risk-based capital ratios were 17.9% and 19.7%, respectively,

significantly higher than the well-capitalized requirements of 6%

and 10%, respectively.

Management Guidance

The Company is providing guidance for the fourth quarter and the

full year of 2010. Management currently estimates that fully

diluted earnings per share for the fourth quarter of 2010 will

range from $0.28 to $0.31 per diluted share resulting in earnings

per share for the full year 2010 of $0.89 to $0.92. This EPS

guidance is based on the following assumptions:

- Stable balance sheet with an increase

in average earning assets to $17.9 billion,

- A stable interest rate environment and

a net interest margin between 4.00% and 4.10%,

- Provision for loan losses of

approximately $25 million to $30 million for the quarter,

- Total noninterest expense of

approximately $95 million, net of amounts to be reimbursed by the

FDIC,

- Effective tax rate of approximately

36%.

Balance Sheet Summary

At September 30, 2010, total assets were $20.4 billion as

compared to $20.0 billion at June 30, 2010. During the third

quarter, total loans decreased $157.8 million or 1% to $13.6

billion as a result of a decrease in covered loan balances of

$300.0 million, offset by an increase in non-covered loans of

$142.2 million. Investment securities increased $830.3 million or

40% during the quarter to $2.9 billion as a result of purchases of

$1.7 billion of short-term corporate securities and agency

securities, offset by sales of $177.4 million, as well as normal

maturities, calls and paydowns. Deposits increased $379.3 million

or 3% to $15.3 billion. During the quarter, we continued to deploy

cash and short-term investments into shorter duration investment

securities.

Gross loans at September 30, 2010 totaled $13.6 billion compared

to $13.7 billion at June 30, 2010. During the quarter non-covered

loan balances increased $142.2 million or 2%, to $8.6 billion at

September 30, 2010. This increase in non-covered loans was largely

driven by a $167.3 million increase in commercial and trade finance

loans and a $111.4 million increase in consumer loans. The

increases in the commercial and trade finance and consumer

portfolios were partially offset by reduction in the commercial

real estate, construction and land portfolios. The net increase in

non-covered loans was offset by decreases in the covered loan

portfolio. Covered loans totaled $5.0 billion at September 30,

2010, as compared to $5.3 billion at June 30, 2010. The decrease in

the covered loan portfolio was due to expected amortization

paydowns, payoff and charge-off activity.

Deposit balances increased to a record $15.3 billion at

September 30, 2010, compared to $14.9 billion at June 30, 2010.

Total core deposits increased to a record $8.5 billion as of

September 30, 2010, or an increase of $290.3 million or 4% from

June 30, 2010. The increase in core deposits was largely driven by

a $175.7 million or 7% increase in noninterest-bearing demand

deposits which grew to a record $2.6 billion as of September 30,

2010.

Third Quarter 2010 Operating Results

Net Interest Income

Although the low interest rate environment continues to be a

challenge for the industry, our net interest income has remained

solid. Throughout 2010, East West has focused on maintaining a

strong loan yield, improving the yield on other earning assets and

growing low-cost core deposits. East West reduced the cost of

deposits to 0.75% for the third quarter of 2010, down from 0.80% in

the second quarter of 2010 and 1.24% in the third quarter of 2009.

Further, through strategic actions taken earlier in 2010 to lower

borrowing costs, East West has reduced the costs of funds to 1.11%

for the third quarter of 2010, as compared to 1.17% for the second

quarter of 2010 and 1.88% in the third quarter of 2009.

The core net interest margin, excluding the net impact to

interest income of $5.5 million resulting from the disposition of

covered loans, totaled 3.98% for the quarter, reflecting no change

from the second quarter and an increase compared to 3.20% in the

third quarter of 2009. The net impact of $5.5 million relates to

dispositions of covered loans including early payoffs as well as

charge-offs. (See reconciliation of the GAAP financial measure to

this non-GAAP financial measure in the tables attached.) Management

believes that this adjusted net interest margin provides more

clarity on the core net interest income and net interest margin,

comparability to prior periods and the ongoing performance of the

Company.

Noninterest Income

Noninterest income for the third quarter totaled $29.3 million,

compared to noninterest income of $35.7 million in the second

quarter of 2010 and a loss of $11.9 million in the third quarter of

2009. Noninterest income for the second quarter of 2010 included a

purchase accounting gain of $19.5 million from the acquisition of

Washington First International Bank (WFIB). The loss in the third

quarter of 2009 was primarily due to impairment losses on

investment securities.

Included within noninterest income for the third quarter is an

increase in the FDIC indemnification asset and receivable of $5.8

million. This amount is primarily comprised of an increase of $7.8

million due to expenses reimbursable by the FDIC offset by a

decrease of $5.5 million due to the disposition of covered loans.

Of the $7.8 million of expenses reimbursable by the FDIC, $4.6

million is related to net writedowns and expenses on other real

estate owned, and $3.2 million is related to legal and other loan

related expenses. Additionally, we recorded a net increase of $3.5

million related to discount accretion on the FDIC indemnification

asset, settlement adjustments and recoveries.

During the third quarter we recorded $4.2 million in gains on

sales of loans, primarily from the sale of student loans. We also

sold $177.4 million in investment securities at a gain of $2.8

million and recorded impairment losses on investment securities

totaling $888 thousand related to pooled trust preferred

securities.

As compared to the third quarter of 2009, branch fees increased

by $3.3 million or 70%, letters of credit fees and commissions

increased $904 thousand or 46%, and ancillary loan fees increased

$1.1 million or 93%, primarily due to the acquisition of United

Commercial Bank (UCB). In total, fees and other operating income

increased $7.2 million or 71% for the third quarter of 2010 as

compared to third quarter of 2009. A summary of these fees and

other operating income items is detailed below:

Quarter Ended Quarter Ended % Change

September 30, 2010 September 30, 2009 (Yr/Yr)

Noninterest income: Branch fees

$

7,976

$

4,679 70 % Letters of credit fees and commissions 2,888 1,984 46 %

Ancillary loan fees 2,367 1,227 93 % Other operating income

4,178 2,294 82 % Total fees & other operating income

$

17,409 $ 10,184 71 %

Noninterest Expense

Noninterest expense totaled $99.9 million for the third quarter

of 2010 compared to $125.3 million for the second quarter of 2010.

The primary reason for the decrease in noninterest expense was due

to a decrease in other real estate owned expenses to $5.7 million

in the third quarter, compared to $21.0 million in the second

quarter. In the second quarter, other real estate owned expenses

were largely related to writedowns on covered assets which were

foreclosed on. Additionally, in the third quarter, we recorded

gains on sale of other real estate owned of $3.4 million, largely

related to one asset, which reduced the net other real estate owned

expenses to $5.7 million. Further, we recorded prepayment penalties

of $3.9 million on FHLB advances in the second quarter which were

included in other operating expenses. There were no FHLB advance

prepayments in the third quarter.

A summary of the noninterest expenses for the third quarter,

compared to the second quarter is detailed below:

Quarter Ended

Quarter Ended

($ in thousands)

September 30, 2010

June 30, 2010

Total noninterest expense: $ 99,945

$

125,318

Amounts to be reimbursed on covered assets (80% of actual expense

amount) 7,834

19,103

Prepayment penalty for FHLB advances

-

3,900

Noninterest expense excluding

reimbursement amounts and prepayment penalty for FHLB advances

$ 92,111

$

102,315

Under the loss share agreements with the FDIC, 80% of eligible

expenses on covered assets are reimbursable from the FDIC. In the

third quarter, we incurred $9.8 million in expenses on covered

loans and other real estate owned, 80% or $7.8 million of which we

expect to be reimbursed by the FDIC and which is recorded as an

increase to the FDIC receivable as noninterest income.

Management anticipates that in the fourth quarter of 2010,

noninterest expense will be approximately $95 million, net of

amounts reimbursable from the FDIC.

The effective tax rate for the third quarter was 36.1% compared

to 38.1% in the prior quarter and 43.5% in the prior year period.

The effective tax rate is reduced from the statutory tax rate

primarily due to the utilization of tax credits related to

affordable housing investments.

Credit Management

Credit metrics continue to improve. For the fourth consecutive

quarter, both net charge-offs and the provision for loan losses

have declined. The provision for loan losses was $38.6 million for

the third quarter of 2010, a decrease of $16.6 million or 30%

compared to the previous quarter and a decrease of $120.6 million

or 76% from the third quarter of 2009. Total net charge-offs

decreased to $45.1 million for the third quarter, a decrease of

$10.1 million or 18% from the previous quarter and a decrease of

$106.2 million or 70% from the third quarter of 2009. Management

expects that the provision for loan losses will continue to

decrease and range from $25 million to $30 million for the fourth

quarter of 2010.

Nonperforming assets, excluding covered assets have remained low

at $196.3 million or 0.96% of total assets at September 30, 2010.

This compares to 1.84% of total assets at September 30, 2009.

Nonperforming assets, excluding covered assets, as of September 30,

2010 included nonaccrual loans totaling $179.4 million and REO

assets totaling $16.9 million.

Credit quality has remained stable in our commercial real estate

portfolio. Net charge-offs on commercial real estate loans were low

at 1.36%, annualized, of total average commercial real estate loans

for the third quarter. Nonperforming commercial real estate loans

increased by $41.2 million, but still remain low at 1.74% of total

non-covered commercial real estate loans. Land and construction

loan balances have declined even further during the quarter to less

than 3% of total assets at September 30, 2010.

Notwithstanding the improvements noted above, we have maintained

a strong allowance for non-covered loan losses at $240.3 million or

2.79% of non-covered loans receivable at September 30, 2010, to

cover inherent losses in the portfolio. This compares to an

allowance for loan losses of $249.5 million or 2.94% at June 30,

2010 and $230.7 million or 2.74% of outstanding loans at September

30, 2009.

As discussed above, all loans acquired from UCB and WFIB were

recorded at estimated fair value as of the acquisition dates. East

West entered into loss sharing agreements with the FDIC that cover

future losses incurred on nearly all the UCB and WFIB legacy

loans.

Capital Strength

Capital Strength (Dollars in millions)

September 30, 2010

Well

CapitalizedRegulatoryRequirement

Total Excess AboveWell

CapitalizedRequirement

Tier 1 leverage capital ratio 10.8 % 5.00 % $ 1,131 Tier 1

risk-based capital ratio 17.9 % 6.00 %

1,407

Total risk-based capital ratio 19.7 % 10.00 %

1,145

Tangible common equity to tangible asset 7.96 % N/A N/A Tangible

common equity to risk weighted assets ratio 13.5 % 4.00 % * 1,121

As there is no stated regulatory guideline for this ratio,

the SCAP guideline of 4.00% tangible common equity has been used.

East West remains committed to maintaining strong capital levels

that exceed regulatory requirements. As of the end of the third

quarter of 2010, our Tier 1 leverage capital ratio totaled 10.8%,

Tier 1 risk-based capital ratio totaled 17.9% and the total

risk-based capital ratio totaled 19.7%. East West exceeds well

capitalized requirements for all regulatory guidelines by over $1.0

billion.

Dividend Payout

East West’s Board of Directors has declared fourth quarter

dividends on the common stock and Series A Preferred Stock. The

common stock cash dividend of $0.01 is payable on or about November

24, 2010 to shareholders of record on November 10, 2010. The

dividend on the Series A Preferred Stock of $20.00 per share is

payable on November 1, 2010 to shareholders of record on October

15, 2010.

About East West

East West Bancorp is a publicly owned company with $20.4 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol “EWBC”. The Company’s wholly owned subsidiary, East West

Bank, is one of the largest independent commercial banks

headquartered in California with over 130 locations worldwide,

including the U.S. markets of California, New York, Georgia,

Massachusetts, Texas and Washington. In Greater China, East West’s

presence includes a full service branch in Hong Kong and

representative offices in Beijing, Shanghai, Shenzhen and Taipei.

Through a wholly-owned subsidiary bank, East West’s presence in

Greater China also includes full service branches in Shanghai and

Shantou and representative offices in Beijing and Guangzhou. For

more information on East West Bancorp, visit the Company's website

at www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2009 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank’s expectations of results or any change in event.

EAST WEST BANCORP, INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (In thousands, except per share amounts)

(unaudited) September 30, 2010

June 30, 2010 December 31, 2009 Assets Cash and cash

equivalents $ 934,694 $ 1,185,944 $ 835,141 Short-term investments

381,799 447,168 510,788 Securities purchased under resale

agreements 350,000 230,000 227,444 Investment securities 2,907,349

2,077,011 2,564,081

Loans receivable, excluding covered loans

(net of allowance for loan losses of $240,286, $249,462 and

$238,833)

8,323,684 8,177,966 8,246,685 Covered loans, net 4,975,502

5,275,492 5,598,155 Total loans

receivable, net 13,299,186 13,453,458 13,844,840 Federal Home Loan

Bank and Federal Reserve stock 216,738 223,395 217,002 FDIC

indemnification asset 874,759 947,011 1,091,814 Other real estate

owned, net 16,936 16,562 13,832 Other real estate owned covered,

net 137,353 113,999 44,273 Premiums on deposits acquired, net

82,755 86,106 89,735 Goodwill 337,438 337,438 337,438 Other assets

878,239 849,229 782,824

Total assets $ 20,417,246 $ 19,967,321 $ 20,559,212

Liabilities and Stockholders' Equity Deposits $

15,297,971 $ 14,918,694 $ 14,987,613 Federal Home Loan Bank

advances 1,018,074 1,022,011 1,805,387 Securities sold under

repurchase agreements 1,045,664 1,051,192 1,026,870 Subordinated

debt and trust preferred securities 235,570 235,570 235,570 Other

borrowings 28,328 35,504 67,040 Accrued expenses and other

liabilities 406,879 365,386

152,073 Total liabilities 18,032,486 17,628,357 18,274,553

Stockholders' equity 2,384,760 2,338,964

2,284,659 Total liabilities and stockholders'

equity $ 20,417,246 $ 19,967,321 $ 20,559,212

Book value per common share $ 13.75 $ 13.31 $ 14.47 Number of

common shares at period end 146,508 147,939 109,963

Ending Balances September 30, 2010 June 30,

2010 December 31, 2009 Loans receivable Real estate -

single family $ 1,059,913 $ 1,033,155 $ 930,840 Real estate -

multifamily 971,155 985,194 1,025,849 Real estate - commercial

3,425,852 3,500,273 3,606,179 Real estate - land 259,979 297,364

370,394 Real estate - construction 317,165 354,547 458,292

Commercial 1,696,173 1,528,863 1,512,709 Consumer 886,124

774,746 624,784 Total loans

receivable, excluding covered loans 8,616,361 8,474,142 8,529,047

Covered loans, net 4,975,502 5,275,492

5,598,155 Total loans receivable 13,591,863

13,749,634 14,127,202 Unearned fees, premiums and discounts (52,391

) (46,714 ) (43,529 ) Allowance for loan losses on non-covered

loans (240,286 ) (249,462 ) (238,833 ) Net

loans receivable $ 13,299,186 $ 13,453,458 $ 13,844,840

Deposits Noninterest-bearing demand $ 2,571,750 $ 2,396,087 $

2,291,259 Interest-bearing checking 762,633 685,572 667,177 Money

market 4,190,448 4,162,129 3,138,866 Savings 955,278

946,043 991,520 Total core deposits

8,480,109 8,189,831 7,088,822 Time deposits 6,817,862

6,728,863 7,898,791 Total deposits $

15,297,971 $ 14,918,694 $ 14,987,613

EAST WEST BANCORP,

INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In

thousands, except per share amounts) (unaudited)

Quarter Ended September 30, 2010

June 30, 2010 September 30, 2009

Interest and dividend income $ 231,400 $ 253,533 $ 147,924 Interest

expense (48,595 ) (49,910 ) (52,044 ) Net

interest income before provision for loan losses 182,805 203,623

95,880 Provision for loan losses (38,648 ) (55,256 )

(159,244 ) Net interest income (loss) after provision for

loan losses 144,157 148,367 (63,364 ) Noninterest income (loss)

29,315 35,685 (11,880 ) Noninterest expense (99,945 )

(125,318 ) (46,064 ) Income (loss) before benefit for income

taxes 73,527 58,734 (121,308 ) Provision (benefit) for income taxes

26,576 22,386 (52,777 ) Net

income (loss) 46,951 36,348 (68,531 ) Preferred stock dividend,

inducement, and amortization of preferred stock discount

(6,732 ) (6,147 ) (10,620 ) Net income (loss)

available to common stockholders $ 40,219 $ 30,201 $ (79,151 ) Net

income (loss) per share, basic $ 0.27 $ 0.21 $ (0.91 ) Net income

(loss) per share, diluted $ 0.27 $ 0.21 $ (0.91 ) Shares used to

compute per share net income (loss): - Basic 146,454 146,372 86,538

- Diluted 147,113 147,131 86,538

Quarter Ended

September 30, 2010 June 30, 2010 September 30,

2009 Noninterest income (loss): Branch fees $ 7,976 $ 8,219 $

4,679 Increase (decrease) in FDIC indemnification asset and FDIC

receivable 5,826 (9,424 ) - Net gain on sale of loans 4,177 8,073 8

Letters of credit fees and commissions 2,888 2,865 1,984 Net gain

on sale of investment securities 2,791 5,847 2,177 Impairment loss

on investment securities (888 ) (4,642 ) (24,249 ) Ancillary loan

fees 2,367 2,369 1,227 Gain on acquisition - 19,476 - Other

operating income 4,178 2,902

2,294

Total noninterest income (loss)

$ 29,315 $ 35,685 $ (11,880 ) Noninterest expense:

Compensation and employee benefits $ 38,693 $ 41,579 $ 15,875

Occupancy and equipment expense 13,963 13,115 6,262 Loan related

expenses 6,316 5,254 2,197 Other real estate owned expense 5,694

20,983 767 Deposit insurance premiums and regulatory assessments

5,676 4,528 6,057 Legal expense 5,301 6,183 1,323 Amortization of

premiums on deposits acquired 3,352 3,310 1,069 Data processing

2,646 3,046 1,079 Consulting expense 1,612 1,919 759 Amortization

of investments in affordable housing partnerships 1,442 2,638 1,709

Other operating expense 15,250 22,763

8,967 Total noninterest expense $ 99,945 $ 125,318 $

46,064

EAST WEST BANCORP, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per

share amounts) (unaudited) Year To

Date September 30, 2010 September 30, 2009

Interest and dividend income $ 803,636 $ 439,180 Interest

expense (155,484 ) (175,359 ) Net interest income

before provision for loan losses 648,152 263,821 Provision for loan

losses (170,325 ) (388,666 ) Net interest income

(loss) after provision for loan losses 477,827 (124,845 )

Noninterest income (loss) 56,549 (24,285 ) Noninterest expense

(364,173 ) (155,382 ) Income (loss) before benefit

for income taxes 170,203 (304,512 ) Provision (benefit) for income

taxes 61,988 (126,790 ) Net income (loss)

before extraordinary item 108,215 (177,722 ) Extraordinary item,

net of tax - (5,366 ) Net income (loss) after

extraordinary item $ 108,215 $ (183,088 ) Preferred stock dividend,

inducement, and amortization of preferred stock discount

(19,017 ) (42,986 ) Net income (loss) available to common

stockholders $ 89,198 $ (226,074 ) Net income (loss) per share,

basic $ 0.66 $ (3.19 ) Net income (loss) per share, diluted $ 0.61

$ (3.19 ) Shares used to compute per share net income (loss): -

Basic 134,396 70,967 - Diluted 146,993 70,967

Year

To Date September 30, 2010 September 30, 2009

Noninterest income (loss): Decrease in FDIC indemnification asset

and FDIC receivable $ (47,170 ) $ - Impairment loss on investment

securities (10,329 ) (61,896 ) Net gain on sale of investment

securities 24,749 7,378 Gain on acquisition 27,571 - Branch fees

24,953 14,463 Net gain on sale of loans 12,250 19 Letters of credit

fees and commissions 8,493 5,768 Ancillary loan fees 6,425 4,812

Other operating income 9,607 5,171

Total noninterest income (loss) $ 56,549 $ (24,285 )

Noninterest expense: Compensation and employee benefits $ 131,051 $

49,492 Other real estate owned expense 44,689 16,480 Occupancy and

equipment expense 39,022 19,950 Deposit insurance premiums and

regulatory assessments 21,785 18,950 Loan related expenses 14,567

5,274 Legal expense 14,391 4,856 Prepayment penalty for FHLB

advances 13,832 - Amortization of premiums on deposits acquired

10,046 3,286 Data processing 8,174 3,362 Amortization of

investments in affordable housing partnerships 7,117 5,121

Consulting expense 5,672 1,879 Other operating expense

53,827 26,732 Total noninterest expense $

364,173 $ 155,382

EAST WEST BANCORP, INC. SELECTED

FINANCIAL INFORMATION (In thousands) (unaudited)

Average Balances Quarter Ended

September 30, 2010 June 30, 2010

September 30, 2009 Loans receivable Real estate - single

family $ 1,051,914 $ 989,744 $ 888,106 Real estate - multifamily

984,589 998,090 1,036,080 Real estate - commercial 3,452,114

3,530,045 3,552,897 Real estate - land 273,571 317,291 460,256 Real

estate - construction 342,388 383,846 855,446 Commercial 1,591,042

1,492,560 1,360,223 Consumer 803,430 845,104

318,758 Total loans receivable, excluding

covered loans 8,499,048 8,556,680 8,471,766 Covered loans

5,105,793 5,137,863 - Total

loans receivable 13,604,841 13,694,543 8,471,766 Investment

securities 2,482,951 2,202,676 2,327,346 Earning assets 17,692,002

17,525,796 11,911,186 Total assets 20,097,142 19,886,269 12,635,277

Deposits Noninterest-bearing demand $ 2,436,031 $ 2,300,228

$ 1,335,131 Interest-bearing checking 731,267 663,936 342,922 Money

market 4,162,847 3,968,293 2,160,722 Savings 960,927

961,374 421,844 Total core deposits

8,291,072 7,893,831 4,260,619 Time deposits 6,719,637

6,714,972 4,398,704 Total deposits

15,010,709 14,608,803 8,659,323 Interest-bearing liabilities

14,910,922 14,874,635 9,625,524 Stockholders' equity 2,360,025

2,310,623 1,543,822

Selected Ratios Quarter

Ended September 30, 2010 June 30, 2010

September 30, 2009 For The Period Return on average assets

0.93 % 0.73 % -2.17 % Return on average common equity 8.11 % 6.26 %

-27.12 % Interest rate spread (2) 3.90 % 4.45 % 2.78 % Net interest

margin (2) 4.10 % 4.66 % 3.20 % Yield on earning assets (2) 5.19 %

5.80 % 4.93 % Cost of deposits 0.75 % 0.80 % 1.24 % Cost of funds

1.11 % 1.17 % 1.88 % Noninterest expense/average assets (1) 1.89 %

2.32 % 1.37 % Efficiency ratio (3) 47.64 % 56.56 % 39.99 %

(1) Excludes the amortization of intangibles, amortization and

impairment loss of premiums on deposits acquired, amortization of

investments in affordable housing partnerships and prepayment

penalty for FHLB advances. (2) Yields on certain securities

have been adjusted upward to a "fully taxable equivalent" basis in

order to reflect the effect of income which is exempt from federal

income taxation at the current statutory tax rate. (3)

Represents noninterest expense, excluding the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, investments in affordable housing partnerships

and prepayment penalty for FHLB advances, divided by the aggregate

of net interest income before provision for loan losses, excluding

nonrecurring adjustments and noninterest income, excluding

impairment loss on investment securities and gain on acquisition

and the decrease in FDIC indemnification asset and FDIC receivable.

EAST WEST BANCORP, INC. SELECTED FINANCIAL

INFORMATION (In thousands) (unaudited)

Average Balances Year To Date

September 30, 2010 September 30, 2009

Loans receivable Real estate - single family $ 990,806 $ 695,034

Real estate - multifamily 1,017,883 852,216 Real estate -

commercial 3,519,178 3,511,979 Real estate - land 315,618 521,696

Real estate - construction 391,444 1,051,940

Commercial 1,496,885 1,411,609 Consumer 793,670

261,128 Total loans receivable, excluding covered

loans 8,525,484 8,305,602 Covered loans 5,175,251

-

Total loans receivable 13,700,735 8,305,602 Investment securities

2,291,588 2,546,488

Earning assets 17,584,474 11,874,514 Total assets 20,049,938

12,584,000 Deposits Noninterest-bearing demand $ 2,323,950 $

1,292,852 Interest-bearing checking 672,817 351,933 Money market

3,868,588 1,826,626 Savings 971,381 416,011

Total core deposits 7,836,736 3,887,422 Time deposits

6,914,615 4,586,027 Total deposits 14,751,351

8,473,449 Interest-bearing liabilities 15,191,062 9,627,681

Stockholders' equity 2,321,690 1,538,284

Selected

Ratios Year To Date

September 30, 2010 September 30, 2009

For The Period Return on average assets 0.72 % -1.94 %

Return on average common equity 6.47 % -27.46 %

Interest rate spread (2) 4.74 % 2.51 % Net interest margin (2) 4.93

% 2.97 % Yield on earning assets (2) 6.11 % 4.95 % Cost of deposits

0.83 % 1.50 %

Cost of funds 1.19 % 2.15 %

Noninterest expense/average assets (1) 2.22 % 1.56 % Efficiency

ratio (3) 54.30 % 48.67 % (1) Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, amortization of investments in affordable

housing partnerships and prepayment penalty for FHLB advances.

(2) Yields on certain securities have been adjusted upward

to a "fully taxable equivalent" basis in order to reflect the

effect of income which is exempt from federal income taxation at

the current statutory tax rate. (3) Represents noninterest

expense, excluding the amortization of intangibles, amortization

and impairment loss of premiums on deposits acquired, investments

in affordable housing partnerships and prepayment penalty for FHLB

advances, divided by the aggregate of net interest income before

provision for loan losses, excluding nonrecurring adjustments and

noninterest income, excluding impairment loss on investment

securities and gain on acquisition and the decrease in FDIC

indemnification asset and FDIC receivable.

EAST WEST

BANCORP, INC. QUARTER TO DATE AVERAGE BALANCES, YIELDS AND

RATES PAID (In thousands) (unaudited)

Quarter

Ended September 30, 2010 September 30,

2009

AverageVolume

Interest Yield (1)

AverageVolume

Interest Yield (1)

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 736,658 $ 2,362 1.27 % $ 897,527

$ 1,856 0.82 % Securities purchased under resale agreements 648,136

2,410 1.46 % 91,033 2,153 9.25 % Investment securities (2)

2,482,951 15,725 2.51 % 2,327,346 28,567 4.87 % Loans receivable

8,499,048 116,029 5.42 % 8,471,766 114,512 5.36 % Loans receivable

- covered 5,105,793 94,057 7.31 % - - - Federal Home Loan Bank and

Federal Reserve Bank stocks 219,416 817

1.49 % 123,514 918

2.97 % Total interest-earning assets 17,692,002

231,400 5.19 % 11,911,186

148,006 4.93 %

Noninterest-earning

assets: Cash and due from banks 668,277 124,708 Allowance for

loan losses (253,078 ) (244,542 ) Other assets 1,989,941

843,925 Total assets $ 20,097,142 $

12,635,277

LIABILITIES AND

STOCKHOLDERS' EQUITY

Interest-bearing liabilities: Checking accounts 731,267 550

0.30 % 342,922 286 0.33 % Money market accounts 4,162,847 7,103

0.68 % 2,160,722 6,830 1.25 % Savings deposits 960,927 818 0.34 %

421,844 608 0.57 % Time deposits 6,719,637 20,028 1.18 % 4,398,704

19,246 1.74 % Federal Home Loan Bank advances 1,020,640 5,725 2.23

% 1,046,056 11,172 4.24 % Securities sold under repurchase

agreements 1,047,697 12,189 4.55 % 1,018,321 12,140 4.66 %

Subordinated debt and trust preferred securities 235,570 1,685 2.80

% 235,570 1,760 2.92 % Other borrowings 32,337

497 6.01 % 1,385 2

0.57 % Total interest-bearing liabilities 14,910,922

48,595 1.29 % 9,625,524

52,044 2.15 %

Noninterest-bearing liabilities: Demand deposits 2,436,031

1,335,131 Other liabilities 390,164 130,800 Stockholders' equity

2,360,025 1,543,822 Total liabilities

and stockholders' equity $ 20,097,142 $ 12,635,277

Interest rate spread 3.90 % 2.78 % Net interest

income and net interest margin $ 182,805 4.10 % $ 95,962 3.20 %

Net interest income and net interest

margin, adjusted (3)

$ 177,294 3.98 % (1) Annualized (2) Amounts calculated on a

fully taxable equivalent basis using the current statutory federal

tax rate.

(3) Amounts exclude the net impact of

covered loan dispositions of $5.5 million.

EAST WEST BANCORP, INC. YEAR TO DATE

AVERAGE BALANCES, YIELDS AND RATES PAID (In thousands)

(unaudited)

Year To Date September 30,

2010 September 30, 2009

AverageVolume

Interest Yield (1)

AverageVolume

Interest Yield (1)

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 914,471 $ 7,405 1.08 % $ 835,769

$ 7,341 1.17 % Securities purchased under resale agreements 455,824

11,303 3.27 % 64,286 4,695 9.63 % Investment securities (2)

2,291,588 50,656 2.96 % 2,546,488 88,472 4.65 % Loans receivable

8,525,484 354,973 5.57 % 8,305,602 336,997 5.42 % Loans receivable

- covered 5,175,251 376,840 9.74 % - - - Federal Home Loan Bank and

Federal Reserve Bank stocks 221,856

2,473 1.49 % 122,369

1,969 2.15 % Total interest-earning assets 17,584,474

803,650 6.11 % 11,874,514

439,474 4.95 %

Noninterest-earning assets: Cash and due from banks 547,403

120,493 Allowance for loan losses (254,153 ) (210,015 ) Other

assets 2,172,214 799,008 Total assets $

20,049,938 $ 12,584,000

LIABILITIES AND

STOCKHOLDERS' EQUITY

Interest-bearing liabilities: Checking accounts 672,817

1,691 0.34 % 351,933 1,003 0.38 % Money market accounts 3,868,588

23,405 0.81 % 1,826,626 18,664 1.37 % Savings deposits 971,381

3,234 0.45 % 416,011 1,969 0.63 % Time deposits 6,914,615 62,749

1.21 % 4,586,027 73,297 2.14 % Federal Home Loan Bank advances

1,427,903 20,905 1.96 % 1,200,713 38,191 4.25 % Securities sold

under repurchase agreements 1,039,636 36,775 4.66 % 1,007,912

36,016 4.71 % Subordinated debt and trust preferred securities

235,570 4,823 2.70 % 235,570 6,211 3.48 % Other borrowings

60,552 1,902 4.14 % 2,889

8 0.37 % Total interest-bearing

liabilities 15,191,062 155,484

1.37 % 9,627,681 175,359

2.44 %

Noninterest-bearing liabilities: Demand

deposits 2,323,950 1,292,852 Other liabilities 213,236 125,183

Stockholders' equity 2,321,690 1,538,284

Total liabilities and stockholders' equity $ 20,049,938

$ 12,584,000 Interest rate spread 4.74 % 2.51

% Net interest income and net interest margin $ 648,166 4.93

% $ 264,115 2.97 %

Net interest income and net interest

margin adjusted (3)

$ 551,080 4.19 % (1) Annualized (2) Amounts calculated on a

fully taxable equivalent basis using the current statutory federal

tax rate.

(3) Amounts exclude the net impact of

covered loan dispositions of $97.1 million.

EAST WEST BANCORP, INC. QUARTERLY ALLOWANCE

FOR LOAN LOSSES RECAP (In thousands) (unaudited)

Quarter Ended 9/30/2010

6/30/2010

3/31/2010 12/31/2009

9/30/2009 LOANS

Allowance balance, beginning of period $ 249,462 $

250,517 $ 238,833 $ 230,650 $ 223,700 Allowance for unfunded loan

commitments and letters of credit 1,133 (1,115 ) (808 ) (1,161 )

(1,051 ) Provision for loan losses 38,648 55,256 76,421 140,000

159,244 Net Charge-offs: Real estate - single family 14,620

3,257 3,426 7,083 8,034 Real estate - multifamily 7,526 7,552 4,860

8,425 7,231 Real estate - commercial 11,779 11,836 8,201 13,305

23,105 Real estate - land 4,236 9,765 26,828 20,390 39,988 Real

estate - residential construction 3,087 3,086 11,642 48,919 32,535

Real estate - commercial construction 977 8,548 2,029 21,355 23,051

Commercial 2,546 10,563 6,422 5,789 14,956 Trade finance (7 ) (88 )

(54 ) 2,569 2,256 Consumer 293 677

575 2,821

87 Total net charge-offs (recovery) 45,057

55,196 63,929

130,656 151,243 Allowance

balance, end of period (3) $ 244,186 $ 249,462

$ 250,517 $ 238,833 $ 230,650

UNFUNDED LOAN COMMITMENTS AND LETTERS OF

CREDIT: Allowance balance, beginning of period $ 10,042 $ 8,927

$ 8,119 $ 6,958 $ 5,907 Provision for unfunded loan commitments and

letters of credit (1,133 ) 1,115

808 1,161 1,051

Allowance balance, end of period $ 8,909 $

10,042 $ 8,927 $ 8,119 $

6,958 GRAND TOTAL, END OF PERIOD $ 253,095 $

259,504 $ 259,444 $ 246,952

$ 237,608 Nonperforming assets to total assets

(1) 0.96 % 0.98 % 0.89 % 0.91 % 1.84 % Allowance for loan losses on

non-covered loans to total gross non-covered loans at end of period

2.79 % 2.94 % 2.93 % 2.80 % 2.74 % Allowance for loan losses on

non-covered loans and unfunded loan commitments to total gross

non-covered loans at end of period 2.89 % 3.06 % 3.03 % 2.90 % 2.82

% Allowance on non-covered loans to non-covered nonaccrual loans at

end of period 133.95 % 139.31 % 143.62 % 137.91 % 112.82 %

Nonaccrual loans to total loans (2) 1.32 % 1.30 % 1.27 % 1.23 %

2.43 % (1) Nonperforming assets excludes covered loans and

covered REOs. Total assets includes covered assets. (2)

Nonaccrual loans excludes covered loans. Total loans includes

covered loans.

(3) Included in the allowance is $3.9

million related to covered loans. This allowance is related to

drawdowns on commitments that were in existence as of the

acquisition dates and therefore, are covered under the loss share

agreements with the FDIC. Allowance on these subsequent drawdowns

is accounted for as part of our general allowance.

EAST WEST BANCORP, INC TOTAL NON-PERFORMING ASSETS,

EXCLUDING COVERED ASSETS (in thousands)

(unaudited) AS OF SEPTEMBER 30, 2010

Total Nonaccrual Loans

90+ DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 5,359 $ - $ 5,359 $

947 $ 6,306 Real estate - multifamily 10,386 6,263 16,649 3,088

19,737 Real estate - commercial 28,786 30,799 59,585 6,730 66,315

Real estate - land 32,443 14,760 47,203 4,680 51,883 Real estate -

residential construction 2,068 - 2,068 92 2,160 Real estate -

commercial construction 17,188 4,077 21,265 830 22,095 Commercial

6,653 20,084 26,737 223 26,960 Trade Finance - - - - - Consumer

427 91 518 346 864

Total

$ 103,310 $ 76,074 $

179,384 $ 16,936 $ 196,320

AS OF JUNE 30, 2010 Total Nonaccrual

Loans

90+ DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 14,835 $ - $ 14,835

$ 395 $ 15,230 Real estate - multifamily 13,180 5,521 18,701 3,131

21,832 Real estate - commercial 15,778 2,569 18,347 7,047 25,394

Real estate - land 43,775 5,292 49,067 2,541 51,608 Real estate -

residential construction 1,454 23,370 24,824 2,272 27,096 Real

estate - commercial construction 22,997 449 23,446 830 24,276

Commercial 19,310 8,994 28,304 - 28,304 Trade Finance - - - - -

Consumer 1,436 104 1,540 346

1,886

Total $ 132,765 $ 46,299

$ 179,064 $ 16,562 $

195,626 AS OF DECEMBER 31, 2009

Total Nonaccrual Loans

90+ DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 3,262 $ - $ 3,262 $

264 $ 3,526 Real estate - multifamily 10,631 - 10,631 2,118 12,749

Real estate - commercial 11,654 18,450 30,104 5,687 35,791 Real

estate - land 27,179 42,666 69,845 4,393 74,238 Real estate -

residential construction 17,179 - 17,179 540 17,719 Real estate -

commercial construction - 17,132 17,132 830 17,962 Commercial 8,002

16,765 24,767 - 24,767 Trade Finance - - - - - Consumer 114

146 260 - 260

Total $

78,021 $ 95,159 $ 173,180

$ 13,832 $ 187,012 AS OF

SEPTEMBER 30, 2009 Total Nonaccrual Loans

90+ DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 6,189 $ - $ 6,189 $

648 $ 6,837 Real estate - multifamily 11,211 652 11,863 1,147

13,010 Real estate - commercial 17,381 16,040 33,421 2,330 35,751

Real estate - land 23,568 33,610 57,178 4,020 61,198 Real estate -

residential construction 55,130 - 55,130 12,238 67,368 Real estate

- commercial construction 10,784 - 10,784 3,680 14,464 Commercial

11,783 13,227 25,010 122 25,132 Trade Finance 3,666 1,785 5,451 -

5,451 Consumer 293 676 969 - 969

Total $ 140,005 $ 65,990

$ 205,995 $ 24,185 $

230,180

EAST WEST BANCORP, INC.

GAAP TO NON-GAAP RECONCILIATION

(In thousands) (Unaudited) The tangible common

equity to risk weighted asset and tangible common equity to

tangible asset ratios is a non-GAAP disclosure. The Company uses

certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. As the use of tangible common equity to

tangible asset is more prevalent in the banking industry and with

banking regulators and analysts, we have included the tangible

common equity to risk-weighted assets and tangible common equity to

tangible asset ratios.

As of September 30,

2010 Stockholders' Equity $ 2,384,760 Less: Preferred Equity

(370,882 ) Goodwill and other intangible assets (421,309 )

Tangible common equity $ 1,592,569 Risk-weighted

assets 11,785,125 Tangible Common Equity to

risk-weighted assets 13.5 %

As of September

30, 2010 Total assets $ 20,417,246 Less: Goodwill and other

intangible assets (421,309 ) Tangible assets $ 19,995,937

Tangible common equity to tangible asset ratio 7.96 %

Operating noninterest income is a non-GAAP disclosure. The

Company uses certain non-GAAP financial measures to provide

supplemental information regarding the Company's performance to

provide additional disclosure. There are noninterest income line

items that are non-core in nature. Operating noninterest income

excludes such non-core noninterest income line items. The Company

believes that presenting the operating noninterest income provides

more clarity to the users of financial statements regarding the

core noninterest income amounts.

Quarter Ended

September 30, 2010 Noninterest income $ 29,315 Add:

Impairment loss on investment securities 888 Less: Net gain on sale

of investment securities (2,791 ) Net gain on sale of loans (4,177

) Increase in FDIC indemnification asset (5,826 ) Operating

noninterest income (non-GAAP) $ 17,409

Quarter Ended September 30, 2009 Noninterest income $

(11,880 ) Add: Impairment loss on investment securities 24,249

Less: Net gain on sale of investment securities (2,177 ) Net gain

on sale of loans (8 ) Operating noninterest income

(non-GAAP) $ 10,184

EAST WEST BANCORP, INC.

GAAP TO NON-GAAP RECONCILIATION (In thousands)

(Unaudited) Operating noninterest expense is a

non-GAAP disclosure. The Company uses certain non-GAAP financial

measures to provide supplemental information regarding the

Company's performance to provide additional disclosure. These are

noninterest expense line items that are non-core in nature.

Operating noninterest expense excludes such non-core noninterest

expense line items. The Company believes that presenting the

operating noninterest expense provides more clarity to the users of

financial statements regarding the core noninterest expense

amounts.

Quarter Ended ($ in thousands)

September

30, 2010 Total noninterest expense: $ 99,945 Amounts to be

reimbursed on covered assets (80% of actual expense amount)

7,834 Noninterest expense excluding reimbursement amounts $ 92,111

Quarter Ended ($ in thousands)

June 30, 2010

Total noninterest expense: $ 125,318 Amounts to be reimbursed on

covered assets (80% of actual expense amount) 19,103 Prepayment

penalty for FHLB advances 3,900 Noninterest expense

excluding reimbursement amounts and prepayment penalty for FHLB

advances $ 102,315

EAST WEST BANCORP, INC. GAAP TO

NON-GAAP RECONCILIATION (In thousands)

(Unaudited) The Company uses certain non-GAAP

financial measures to provide supplemental information regarding

the Company's performance to provide additional disclosure. The net

interest margin includes amounts that are non-core in nature. As

such, the Company believes that presenting the net interest income

and net interest margin excluding such non-core items provides

additional clarity to the users of financial statements regarding

the core net interest income and net interest margin, comparability

to prior periods and the ongoing performance of the Company.

Quarter Ended September 30, 2010 Average Volume

Interest Yield (1) Total interest-earning assets $

17,692,002 $ 231,400 5.19 % Net interest income and net interest

margin $ 182,805 4.10 % Less net impact of covered loan

dispositions (5,511 )

Net interest income and net interest

margin, excluding net impact of covered loan dispositions

$ 177,294 3.98 %

Year to Date September 30,

2010 Average Volume Interest Yield (1) Total interest-earning

assets $ 17,584,474 $ 803,650 6.11 % Net interest income and net

interest margin $ 648,166 4.93 % Less net impact of covered loan

dispositions (97,086 )

Net interest income and net interest

margin, excluding net impact of covered loan dispositions

$ 551,080 4.19 % (1) Annualized.

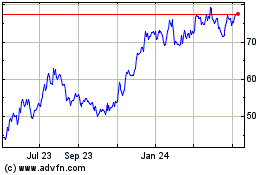

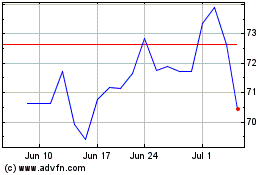

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024