UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40451

DLocal Limited

(Exact name of registrant as specified in its charter)

Dr. Luis Bonavita 1294

Montevideo

Uruguay 11300

+1 (424) 392-7437

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

TABLE OF CONTENTS

EXHIBIT

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

DLocal Limited |

|

|

|

|

|

|

By: |

/s/ Diego Cabrera Canay |

|

|

Name: |

Diego Cabrera Canay |

|

|

Title: |

Chief Financial Officer |

|

Date: November 22, 2023

dLocal Reports 2023 Third Quarter Financial Results

November 21, 2023

Third Quarter 2023

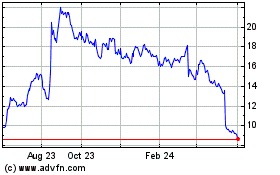

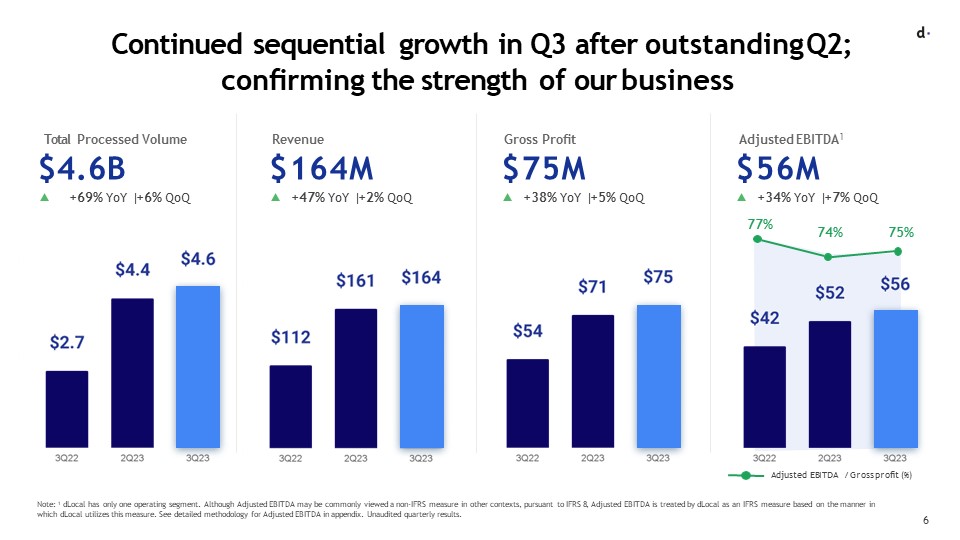

US$4.6 billion Total Payment Volume, up 69% year-over-year and 6% quarter-over-quarter

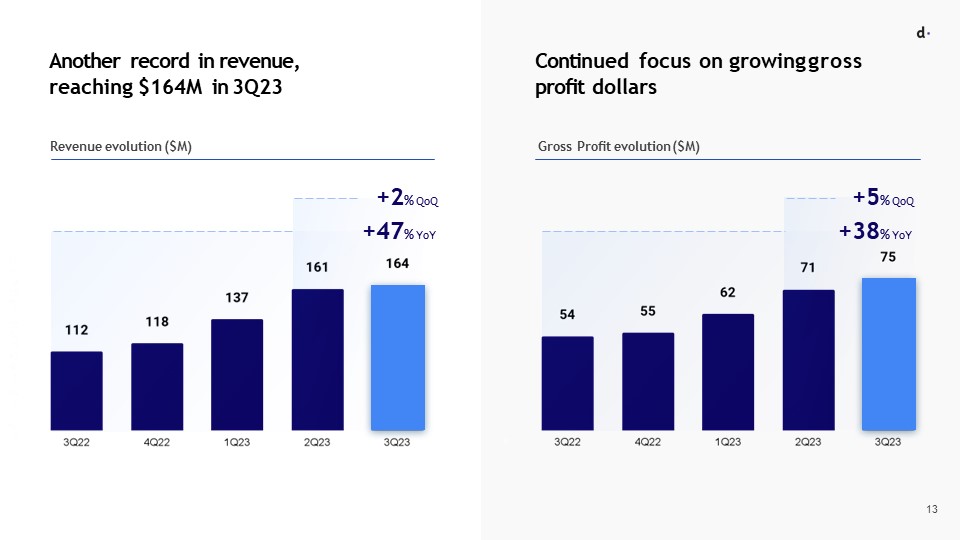

Revenue of US$164 million, up 47% year-over-year and 2% quarter-over-quarter

141% Net Revenue Retention Rate

Gross Profit of US$75 million, up 38% year-over-year and 5% quarter-over-quarter

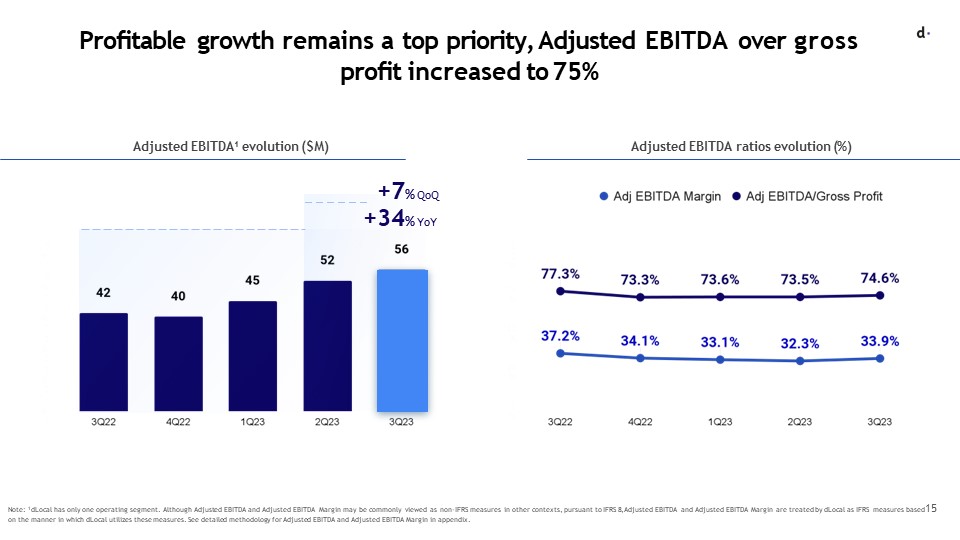

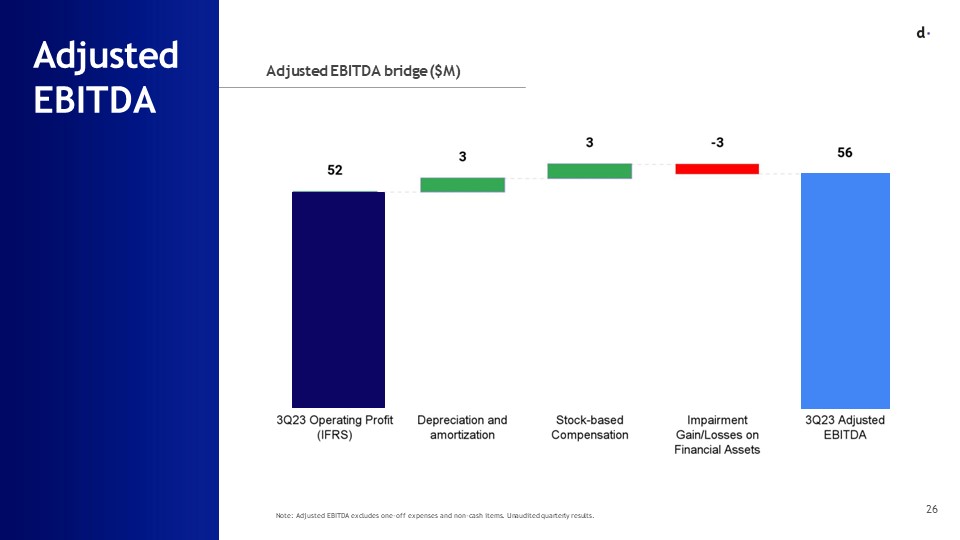

Adjusted EBITDA of US$56 million, up 34% year-over-year and 7% quarter-over-quarter

dLocal reports in US dollars and in accordance with IFRS as issued by the IASB

MONTEVIDEO, Uruguay, Nov. 21, 2023 — DLocal Limited (“dLocal”, “we”, “us”, and “our”) (NASDAQ:DLO), a technology - first payments platform today announced its financial results for the third quarter ended September 30, 2023.

“After my first quarter at dLocal, I am extremely enthusiastic about our future prospects and the promising opportunities that lie ahead.

I am pleased to share that we delivered another quarter of solid performance with very solid growth across all main parameters, compared to last year.

TPV growth continues to be supported by our well-diversified merchant base and geographic reach. Revenues increased close to 50% year-over-year even with the strong devaluation of the Nigerian Naira. This is a testament to the resilience and well-diversified business we are building. We remain focused on delivering sustained gross profit growth. In Q3 2023 we attained US$75 million gross profit. Our profitability continues to be among the best in our comparables group. Our ratio of Adjusted EBITDA to Gross Profit came in at 75% for the quarter.

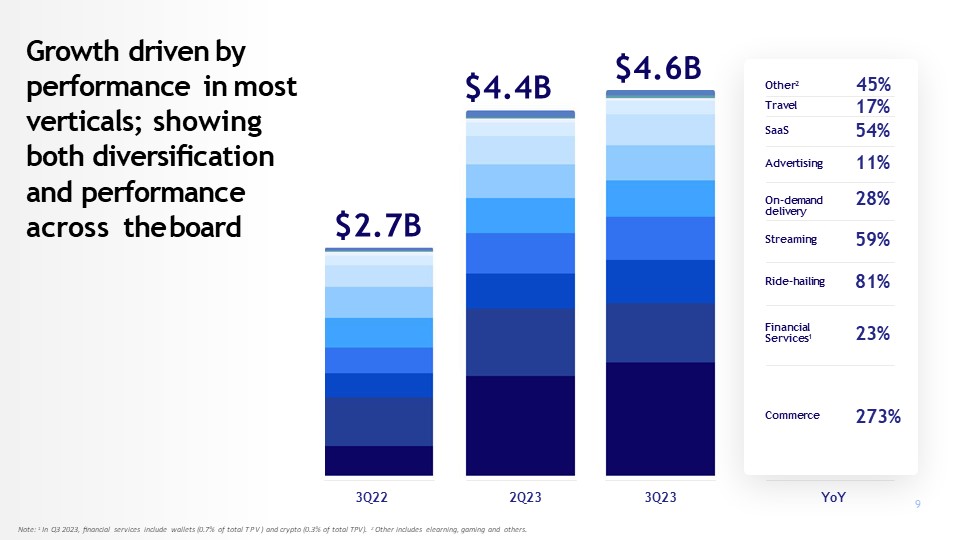

During Q3, we experienced sound growth across all verticals. We continue to see particularly strong traction with our platform solution.

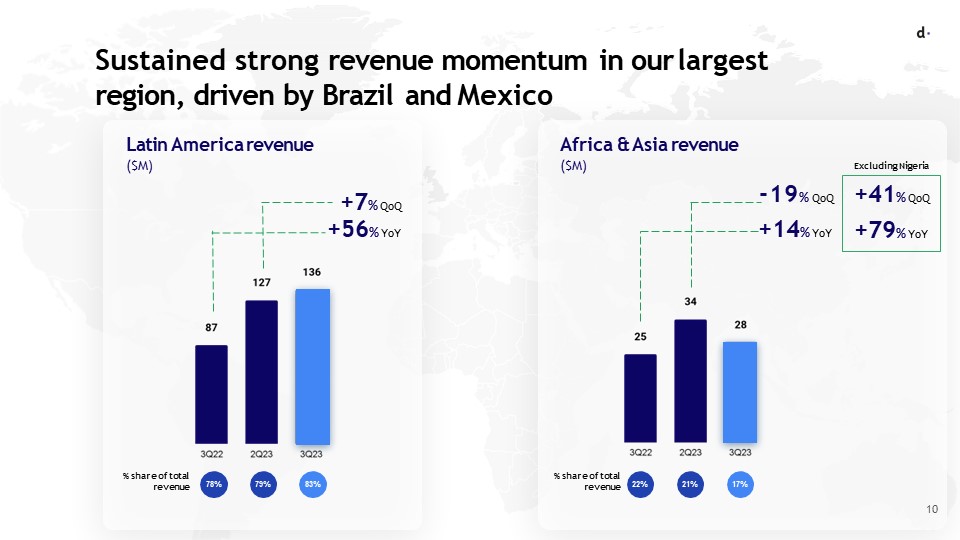

From a geographic standpoint, during Q3 we saw very strong performance in our key markets. We continue to experience sustained strong revenue momentum in Brazil and Mexico as we grow with our existing customers and gain share of wallet. In contrast to the strong performance in our larger and more stable markets, Argentina and Nigeria, less stable markets, now represent only 20% of our total revenues, down from 29% a year ago, negatively impacted by Nigerian currency devaluation and weak macro conditions in Argentina. In addition, our business in Africa and Asia continues to perform very well. Excluding Nigeria, this region grew 79% YoY.

Our investments remain focused on thoughtfully expanding our global team and building the appropriate processes, tools and governance mechanics to ensure our business grows efficiently, and scales appropriately.

We are proud of the strong results we delivered year-to-date. We reaffirm our guidance for the year of revenue between US$620 and US$640 million and Adjusted EBITDA between US$200 and US$220 million. We have not modified our mid-term guidance of 25%-35% gross profit CAGR and Adjusted EBITDA over gross profit >75%.

Our current performance, future pipeline, and market opportunity present a unique opportunity for sustained growth over a multi-year period, driven by the powerful secular trends behind emerging market adoption of digital products and services. We must remain focused on executing against that opportunity, while constructing the foundational blocks as a company to ensure we can scale at the pace our merchants will demand.

Finally, I would like to share that our CFO, Diego Cabrera Canay, has decided to step down from his position to pursue new opportunities. Diego has played a significant role in our financial success during his period at dLocal. He will stay on through Q1 of next year to ensure a smooth transition. As one executive leaves, we are also strengthening our team with new hires in senior

positions, incorporating a new Principal Accounting Officer as well as an SVP of Government Relations and Strategic Partnerships” said Pedro Arnt, co-CEO of dLocal

Third quarter 2023 Financial Highlights

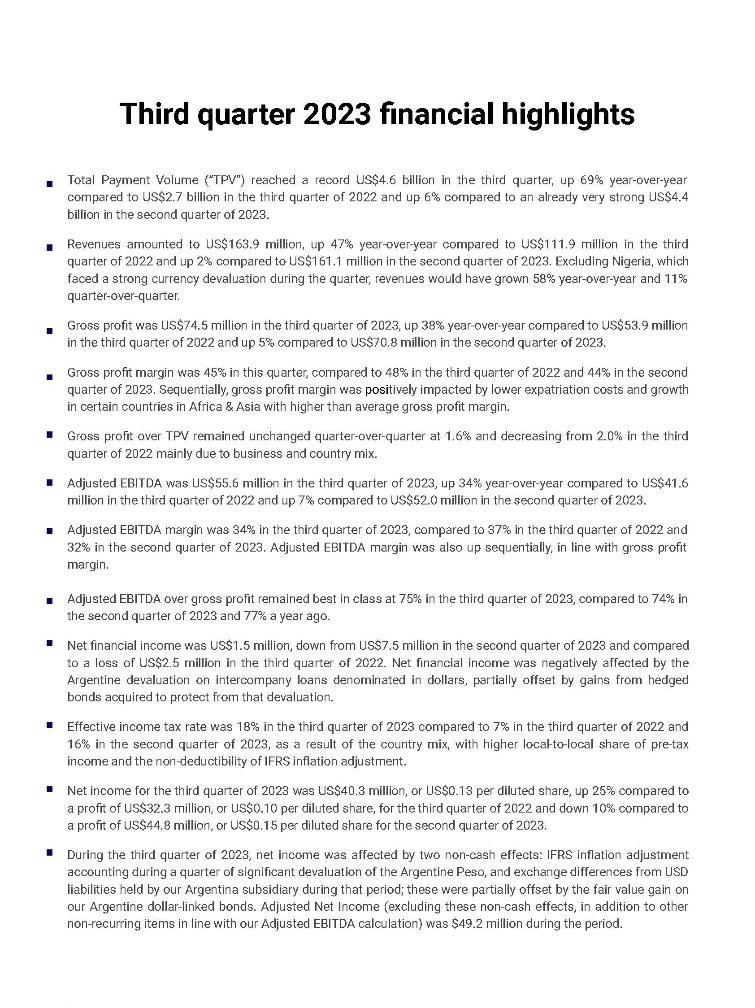

●Total Payment Volume (“TPV”) reached a record US$4.6 billion in the third quarter, up 69% year-over-year compared to US$2.7 billion in the third quarter of 2022 and up 6% compared to an already very strong US$4.4 billion in the second quarter of 2023.

●Revenues amounted to US$163.9 million, up 47% year-over-year compared to US$111.9 million in the third quarter of 2022 and up 2% compared to US$161.1 million in the second quarter of 2023. Excluding Nigeria, which faced a strong currency devaluation during the quarter, revenues would have grown 58% year-over-year and 11% quarter-over-quarter.

●Gross profit was US$74.5 million in the third quarter of 2023, up 38% year-over-year compared to US$53.9 million in the third quarter of 2022 and up 5% compared to US$70.8 million in the second quarter of 2023.

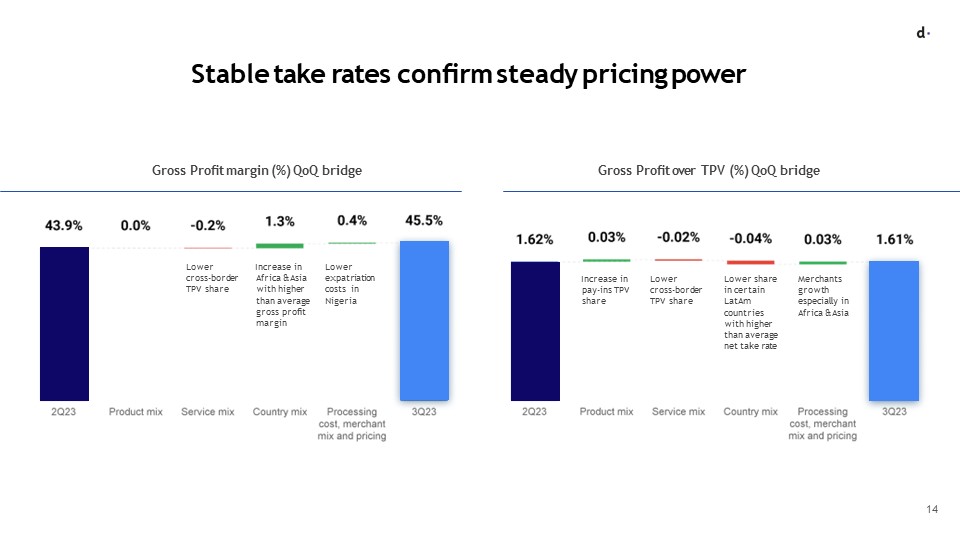

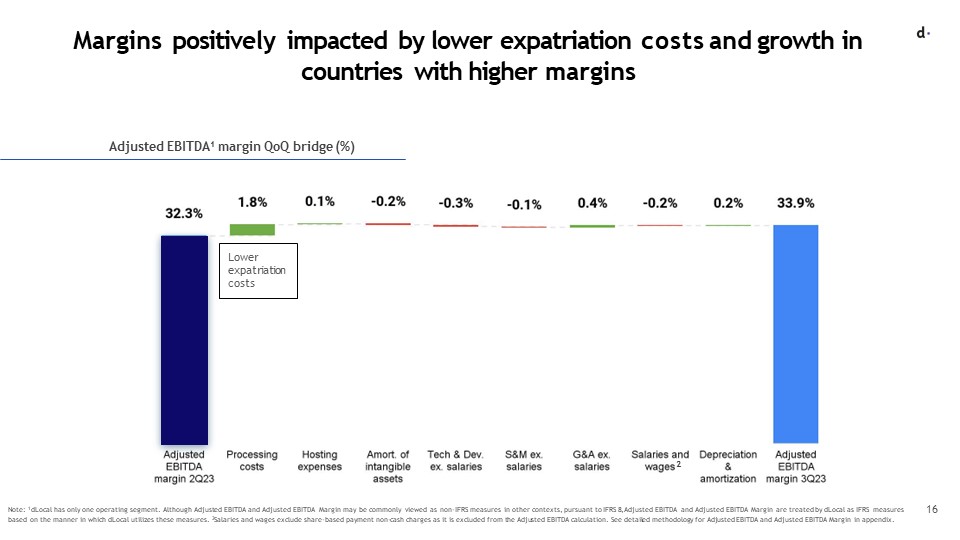

●Gross profit margin was 45% in this quarter, compared to 48% in the third quarter of 2022 and 44% in the second quarter of 2023. Sequentially, gross profit margin was positively impacted by lower expatriation costs and growth in certain countries in Africa & Asia with higher than average gross profit margin.

●Gross profit over TPV remained unchanged quarter-over-quarter at 1.6% and decreasing from 2.0% in the third quarter of 2022 mainly due to business and country mix.

●Adjusted EBITDA was US$55.6 million in the third quarter of 2023, up 34% year-over-year compared to US$41.6 million in the third quarter of 2022 and up 7% compared to US$52.0 million in the second quarter of 2023.

●Adjusted EBITDA margin was 34% in the third quarter of 2023, compared to 37% in the third quarter of 2022 and 32% in the second quarter of 2023. Adjusted EBITDA margin was also up sequentially, in line with gross profit margin.

●Adjusted EBITDA over gross profit remained best in class at 75% in the third quarter of 2023, compared to 74% in the second quarter of 2023 and 77% a year ago.

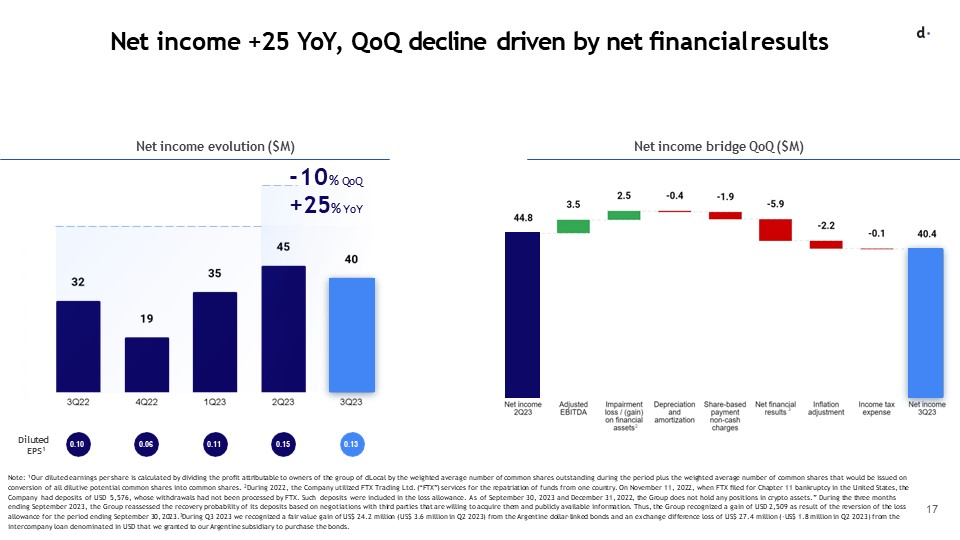

●Net financial income was US$1.5 million, down from US$7.5 million in the second quarter of 2023 and compared to a loss of US$2.5 million in the third quarter of 2022. Net financial income was negatively affected by the Argentine devaluation on intercompany loans denominated in dollars, partially offset by gains from hedged bonds acquired to protect from that devaluation.

●Effective income tax rate was 18% in the third quarter of 2023 compared to 7% in the third quarter of 2022 and 16% in the second quarter of 2023, as a result of the country mix, with higher local-to-local share of pre-tax income and the non-deductibility of IFRS inflation adjustment.

●Net income for the third quarter of 2023 was US$40.3 million, or US$0.13 per diluted share, up 25% compared to a profit of US$32.3 million, or US$0.10 per diluted share, for the third quarter of 2022 and down 10% compared to a profit of US$44.8 million, or US$0.15 per diluted share for the second quarter of 2023.

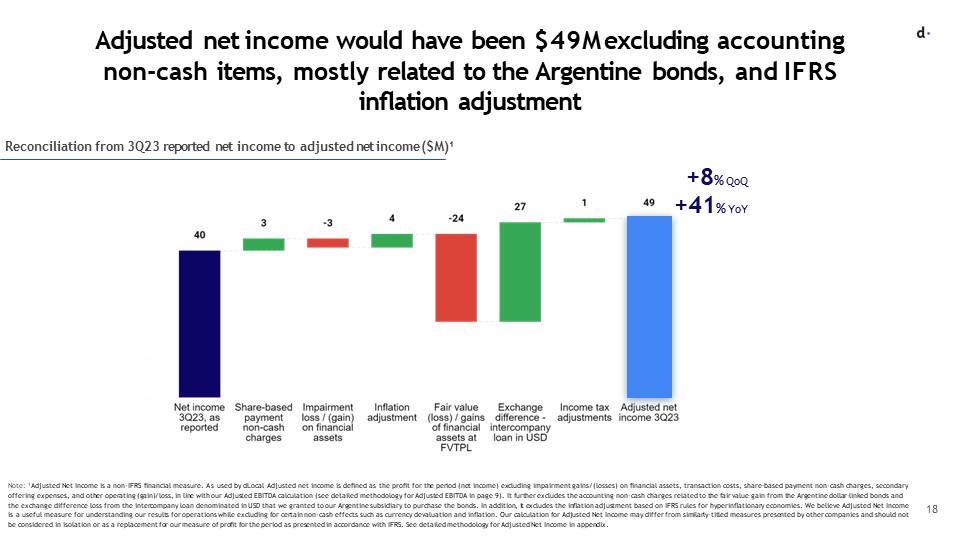

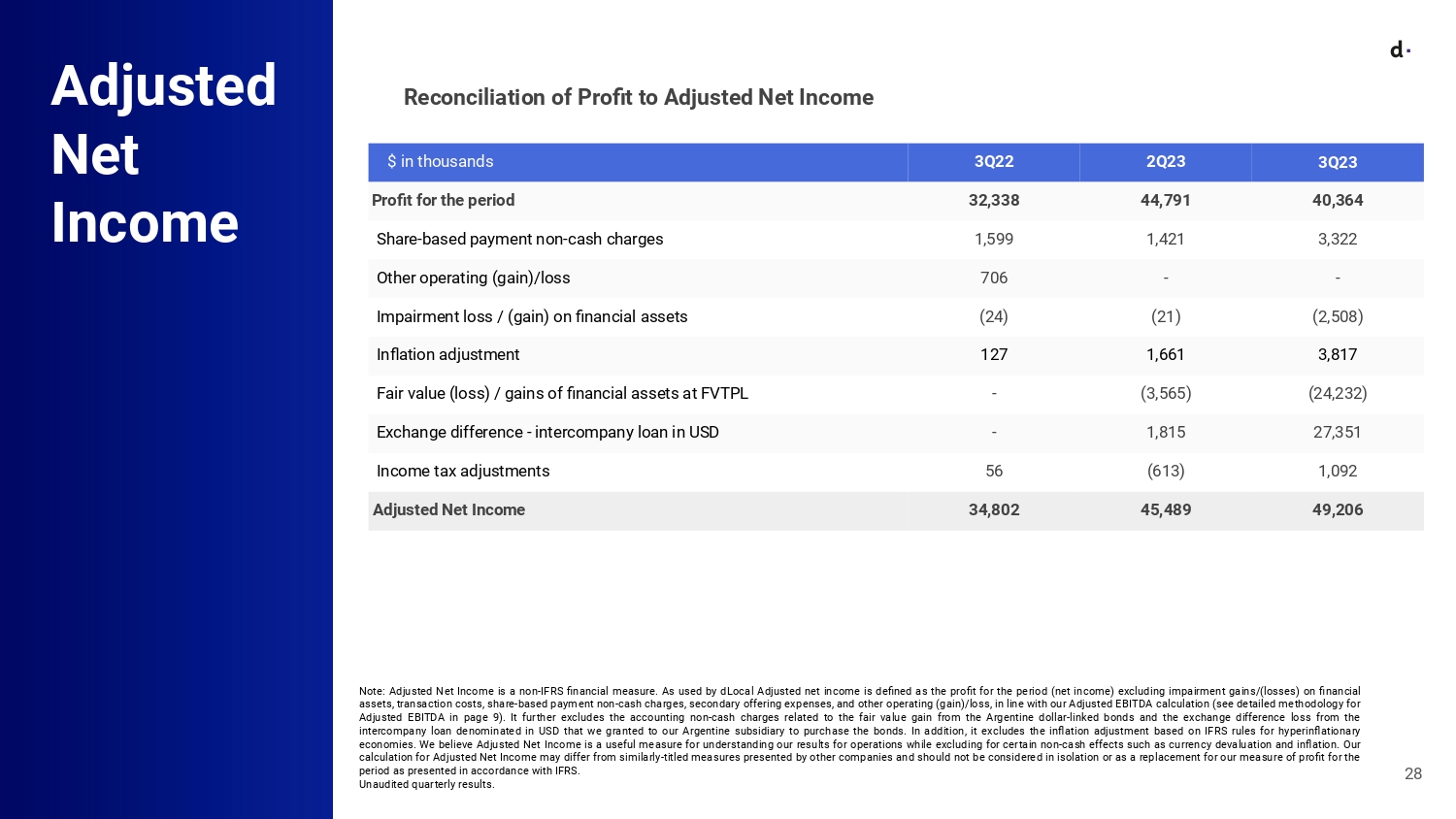

●During the third quarter of 2023, net income was affected by two non-cash effects: IFRS inflation adjustment accounting during a quarter of significant devaluation of the Argentine Peso, and exchange differences from USD liabilities held by our Argentina subsidiary during that period; these were partially offset by the fair value gain on our Argentine dollar-linked bonds. Adjusted Net Income (excluding these non-cash effects, in addition to other non-recurring items in line with our Adjusted EBITDA calculation) was $49.2 million during the period.

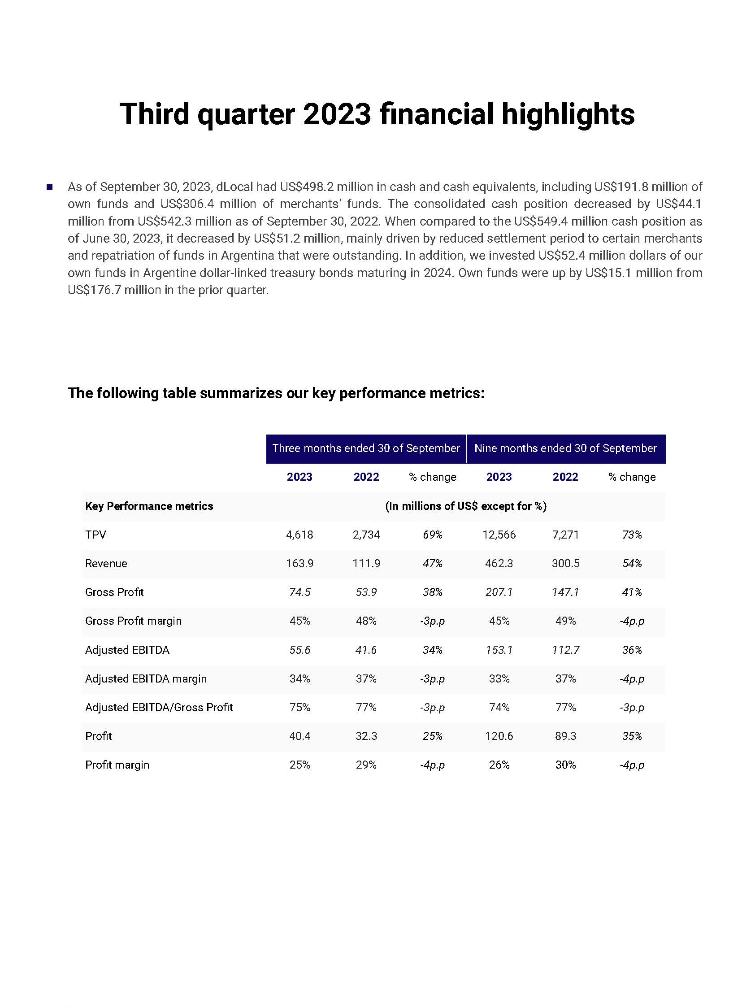

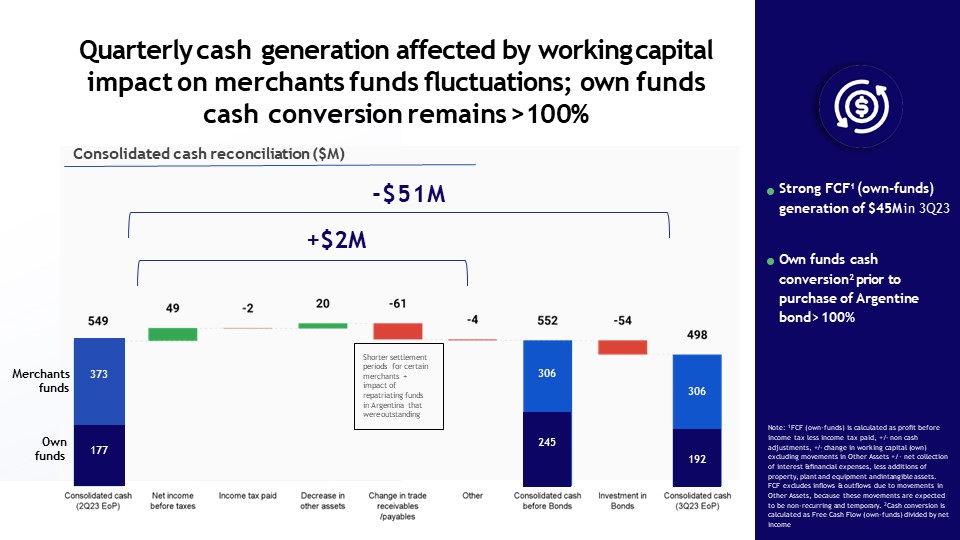

●As of September 30, 2023, dLocal had US$498.2 million in cash and cash equivalents, including US$191.8 million of own funds and US$306.4 million of merchants’ funds. The consolidated cash position decreased by US$44.1 million from US$542.3 million as of September 30, 2022. When compared to the US$549.4 million cash position as of June 30, 2023, it decreased by US$51.2 million, mainly driven by reduced settlement period to certain merchants and repatriation of funds in Argentina that were outstanding. In addition, we invested US$52.4 million dollars of our own funds in Argentine dollar-linked treasury bonds maturing in 2024. Own funds were up by US$15.1 million from US$176.7 million in the prior quarter.

The following table summarizes our key performance metrics:

|

|

|

|

|

|

|

|

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

% change |

2023 |

2022 |

% change |

Key Performance metrics |

(In millions of US$ except for %) |

TPV |

4,618 |

2,734 |

69% |

12,566 |

7,271 |

73% |

Revenue |

163.9 |

111.9 |

47% |

462.3 |

300.5 |

54% |

Gross Profit |

74.5 |

53.9 |

38% |

207.1 |

147.1 |

41% |

Gross Profit margin |

45% |

48% |

-3p.p |

45% |

49% |

-4p.p |

Adjusted EBITDA |

55.6 |

41.6 |

34% |

153.1 |

112.7 |

36% |

Adjusted EBITDA margin |

34% |

37% |

-3p.p |

33% |

37% |

-4p.p |

Adjusted EBITDA/Gross Profit |

75% |

77% |

-3p.p |

74% |

77% |

-3p.p |

Profit |

40.4 |

32.3 |

25% |

120.6 |

89.3 |

35% |

Profit margin |

25% |

29% |

-4p.p |

26% |

30% |

-4p.p |

Third quarter 2023 Business Highlights

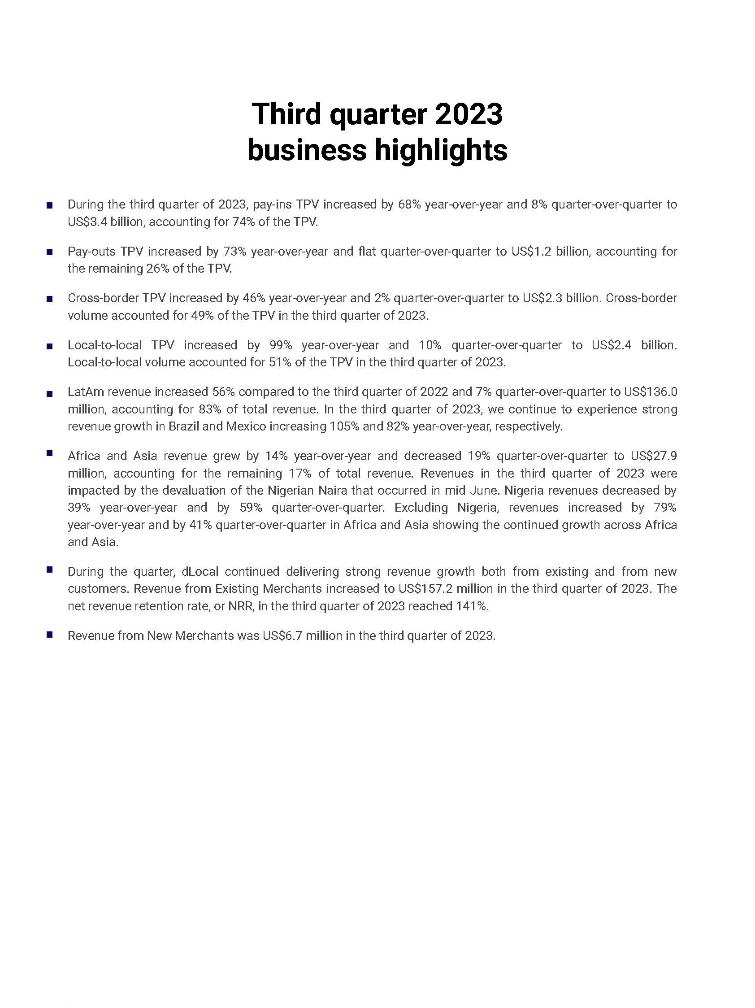

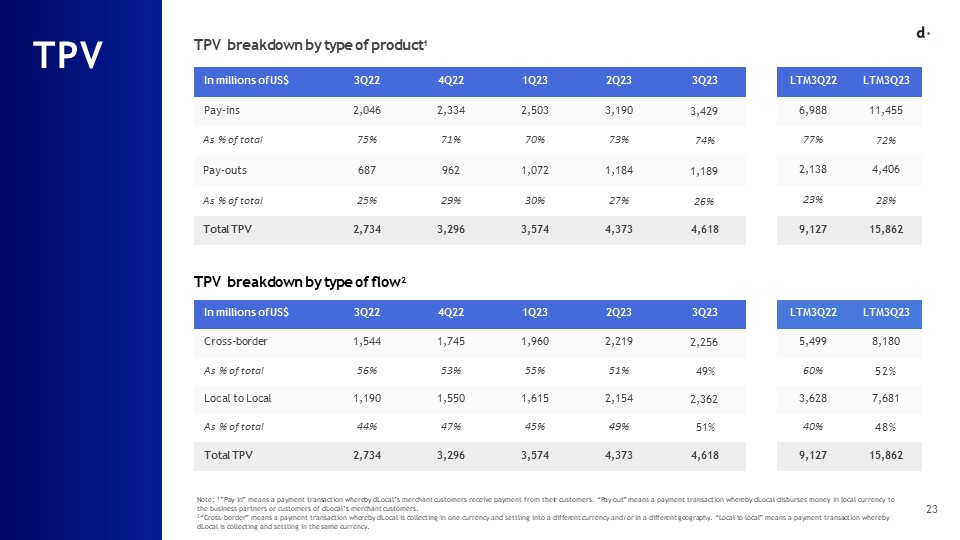

●During the third quarter of 2023, pay-ins TPV increased by 68% year-over-year and 8% quarter-over-quarter to US$3.4 billion, accounting for 74% of the TPV.

●Pay-outs TPV increased by 73% year-over-year and flat quarter-over-quarter to US$1.2 billion, accounting for the remaining 26% of the TPV.

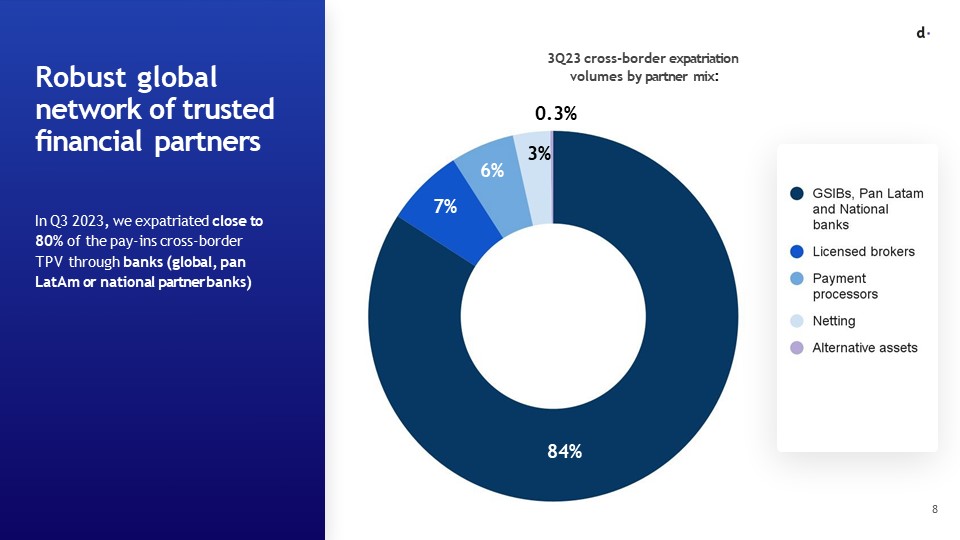

●Cross-border TPV increased by 46% year-over-year and 2% quarter-over-quarter to US$2.3 billion. Cross-border volume accounted for 49% of the TPV in the third quarter of 2023.

●Local-to-local TPV increased by 99% year-over-year and 10% quarter-over-quarter to US$2.4 billion. Local-to-local volume accounted for 51% of the TPV in the third quarter of 2023.

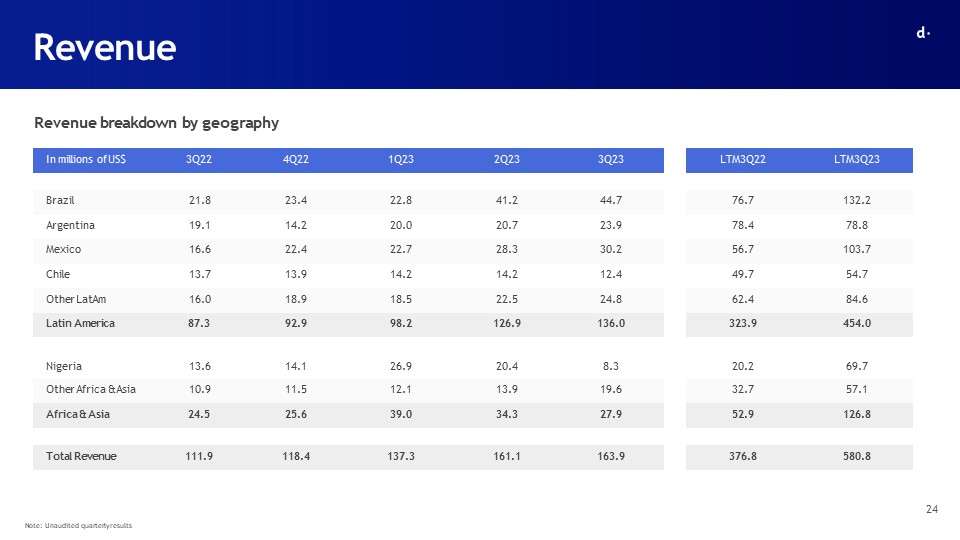

●LatAm revenue increased 56% compared to the third quarter of 2022 and 7% quarter-over-quarter to US$136.0 million, accounting for 83% of total revenue. In the third quarter of 2023, we continue to experience strong revenue growth in Brazil and Mexico increasing 105% and 82% year-over-year, respectively.

●Africa and Asia revenue grew by 14% year-over-year and decreased 19% quarter-over-quarter to US$27.9 million, accounting for the remaining 17% of total revenue. Revenues in the third quarter of 2023 were impacted by the devaluation of the Nigerian Naira that occurred in mid June. Nigeria revenues decreased by 39% year-over-year and by 59% quarter-over-quarter. Excluding Nigeria, revenues increased by 79% year-over-year and by 41% quarter-over-quarter in Africa and Asia showing the continued growth across Africa and Asia.

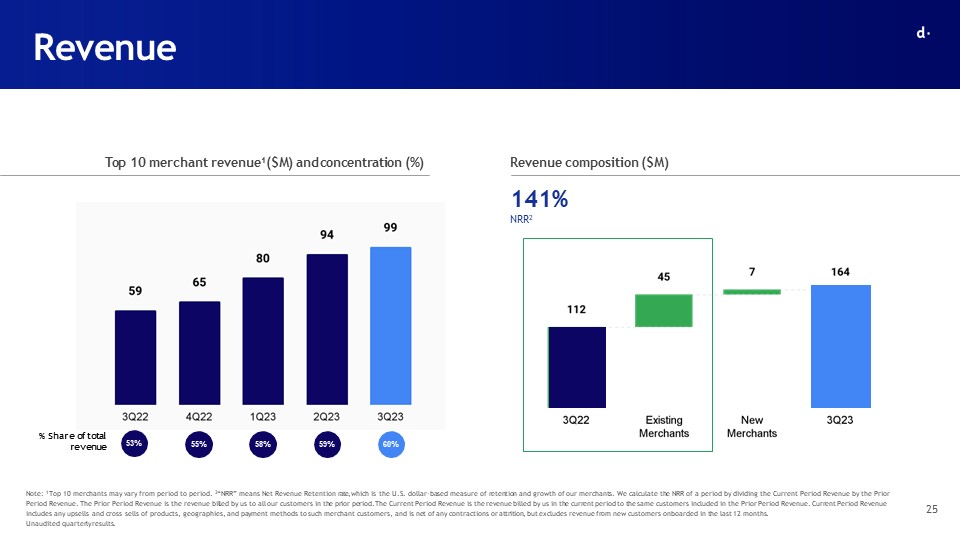

●During the quarter, dLocal continued delivering strong revenue growth both from existing and from new customers. Revenue from Existing Merchants increased to US$157.2 million in the third quarter of 2023. The net revenue retention rate, or NRR, in the third quarter of 2023 reached 141%.

●Revenue from New Merchants was US$6.7 million in the third quarter of 2023.

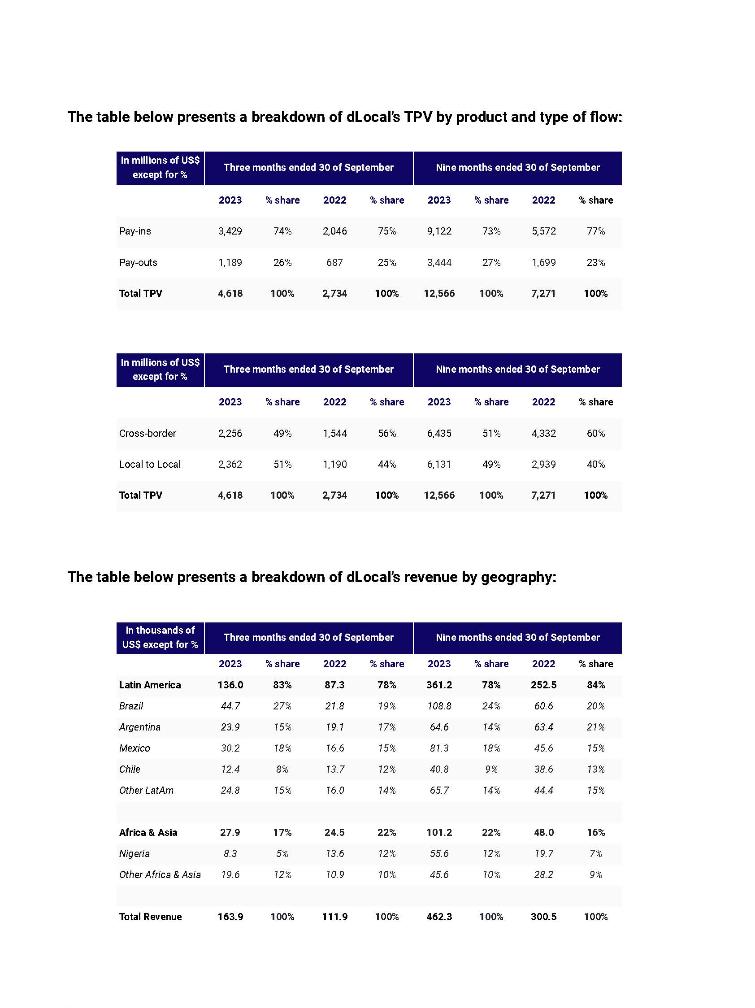

The table below presents a breakdown of dLocal’s TPV by product and type of flow:

|

|

|

|

|

|

|

|

|

In millions of US$ except for % |

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

% share |

2022 |

% share |

2023 |

% share |

2022 |

% share |

Pay-ins |

3,429 |

74% |

2,046 |

75% |

9,122 |

73% |

5,572 |

77% |

Pay-outs |

1,189 |

26% |

687 |

25% |

3,444 |

27% |

1,699 |

23% |

Total TPV |

4,618 |

100% |

2,734 |

100% |

12,566 |

100% |

7,271 |

100% |

|

|

|

|

|

|

|

|

|

In millions of US$ except for % |

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

% share |

2022 |

% share |

2023 |

% share |

2022 |

% share |

Cross-border |

2,256 |

49% |

1,544 |

56% |

6,435 |

51% |

4,332 |

60% |

Local-to-local |

2,362 |

51% |

1,190 |

44% |

6,131 |

49% |

2,939 |

40% |

Total TPV |

4,618 |

100% |

2,734 |

100% |

12,566 |

100% |

7,271 |

100% |

The table below presents a breakdown of dLocal’s revenue by geography:

|

|

|

|

|

|

|

|

|

In thousands of US$ except for % |

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

% share |

2022 |

% share |

2023 |

% share |

2022 |

% share |

Latin America |

136.0 |

83% |

87.3 |

78% |

361.2 |

78% |

252.5 |

84% |

Brazil |

44.7 |

27% |

21.8 |

19% |

108.8 |

24% |

60.6 |

20% |

Argentina |

23.9 |

15% |

19.1 |

17% |

64.6 |

14% |

63.4 |

21% |

Mexico |

30.2 |

18% |

16.6 |

15% |

81.3 |

18% |

45.6 |

15% |

Chile |

12.4 |

8% |

13.7 |

12% |

40.8 |

9% |

38.6 |

13% |

Other LatAm |

24.8 |

15% |

16.0 |

14% |

65.7 |

14% |

44.4 |

15% |

|

|

|

|

|

|

|

|

|

Africa & Asia |

27.9 |

17% |

24.5 |

22% |

101.2 |

22% |

48.0 |

16% |

Nigeria |

8.3 |

5% |

13.6 |

12% |

55.6 |

12% |

19.7 |

7% |

Other Africa & Asia |

19.6 |

12% |

10.9 |

10% |

45.6 |

10% |

28.2 |

9% |

|

|

|

|

|

|

|

|

|

Total Revenue |

163.9 |

100% |

111.9 |

100% |

462.3 |

100% |

300.5 |

100% |

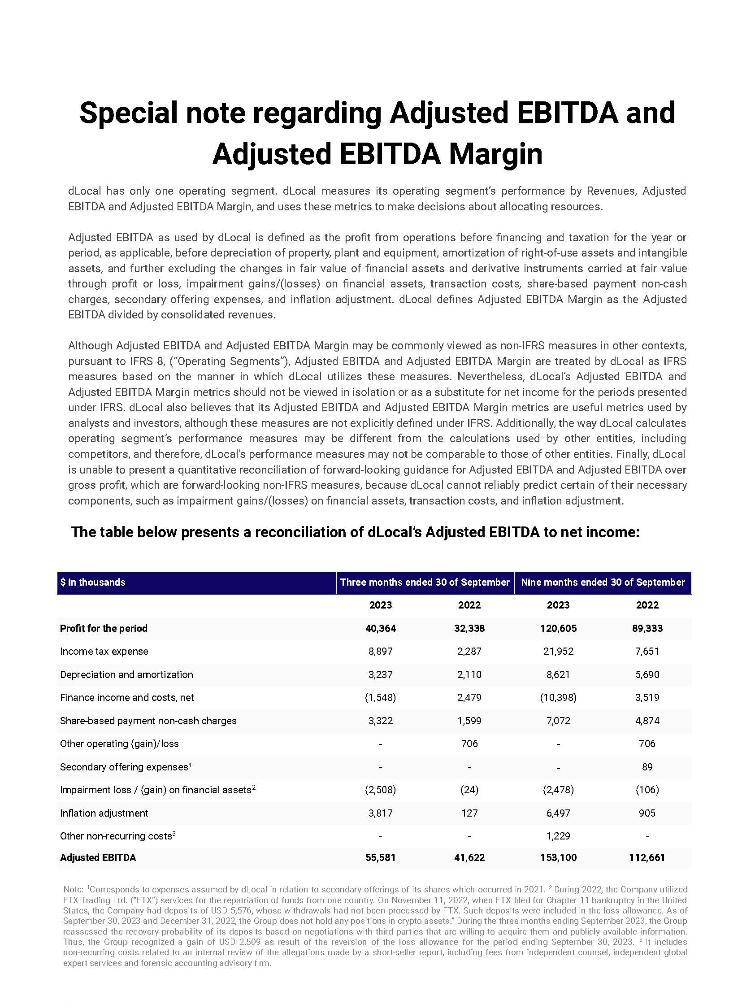

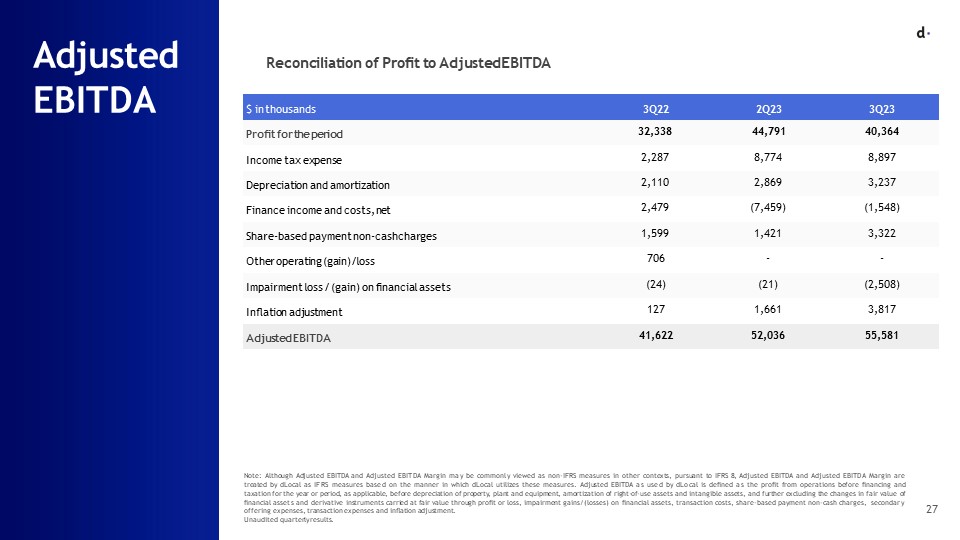

Special note regarding Adjusted EBITDA and Adjusted EBITDA Margin

dLocal has only one operating segment. dLocal measures its operating segment’s performance by Revenues, Adjusted EBITDA and Adjusted EBITDA Margin, and uses these metrics to make decisions about allocating resources.

Adjusted EBITDA as used by dLocal is defined as the profit from operations before financing and taxation for the year or period, as applicable, before depreciation of property, plant and equipment, amortization of right-of-use assets and intangible assets, and further excluding the changes in fair value of financial assets and derivative instruments carried at fair value through profit or loss, impairment gains/(losses) on financial assets, transaction costs, share-based payment non-cash charges, secondary offering expenses, and inflation adjustment. dLocal defines Adjusted EBITDA Margin as the Adjusted EBITDA divided by consolidated revenues.

Although Adjusted EBITDA and Adjusted EBITDA Margin may be commonly viewed as non-IFRS measures in other contexts, pursuant to IFRS 8, (“Operating Segments”), Adjusted EBITDA and Adjusted EBITDA Margin are treated by dLocal as IFRS measures based on the manner in which dLocal utilizes these measures. Nevertheless, dLocal’s Adjusted EBITDA and Adjusted EBITDA Margin metrics should not be viewed in isolation or as a substitute for net income for the periods presented under IFRS. dLocal also believes that its Adjusted EBITDA and Adjusted EBITDA Margin metrics are useful metrics used by analysts and investors, although these measures are not explicitly defined under IFRS. Additionally, the way dLocal calculates operating segment’s performance measures may be different from the calculations used by other entities, including competitors, and therefore, dLocal’s performance measures may not be comparable to those of other entities. Finally, dLocal is unable to present a quantitative reconciliation of forward-looking guidance for Adjusted EBITDA and Adjusted EBITDA over gross profit, which are forward-looking non-IFRS measures, because dLocal cannot reliably predict certain of their necessary components, such as impairment gains/(losses) on financial assets, transaction costs, and inflation adjustment.

The table below presents a reconciliation of dLocal’s Adjusted EBITDA and Adjusted EBITDA Margin to net income:

|

|

|

|

|

$ in thousands |

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

2023 |

2022 |

Profit for the period |

40,364 |

32,338 |

120,605 |

89,333 |

Income tax expense |

8,897 |

2,287 |

21,952 |

7,651 |

Depreciation and amortization |

3,237 |

2,110 |

8,621 |

5,690 |

Finance income and costs, net |

(1,548) |

2,479 |

(10,398) |

3,519 |

Share-based payment non-cash charges |

3,322 |

1,599 |

7,072 |

4,874 |

Other operating (gain)/loss |

- |

706 |

- |

706 |

Secondary offering expenses¹ |

- |

- |

- |

89 |

Impairment loss / (gain) on financial assets |

(2,508) |

(24) |

(2,478) |

(106) |

Inflation adjustment |

3,817 |

127 |

6,497 |

905 |

Other non-recurring costs³ |

- |

- |

1,229 |

- |

Adjusted EBITDA |

55,581 |

41,622 |

153,100 |

112,661 |

Note: 1Corresponds to expenses assumed by dLocal in relation to secondary offerings of its shares which occurred in 2021. 2 During 2022, the Company utilized FTX Trading Ltd. (“FTX”) services for the repatriation of funds from one country. On November 11, 2022, when FTX filed for Chapter 11 bankruptcy in the United States, the Company had deposits of USD 5,576, whose withdrawals had not been processed by FTX. Such deposits were included in the loss allowance. As of September 30, 2023 and December 31, 2022, the Group does not hold any positions in crypto assets.” During the three months ending September 2023, the Group reassessed the recovery probability of its deposits based on negotiations with third parties that are willing to acquire them and publicly available information. Thus, the Group recognized a gain of USD 2,509 as result of the reversion of the loss allowance for the period ending September 30, 2023. 3 It includes non-recurring costs related to an internal review of the allegations made by a short-seller report, including fees from independent counsel, independent global expert services and forensic accounting advisory firm.

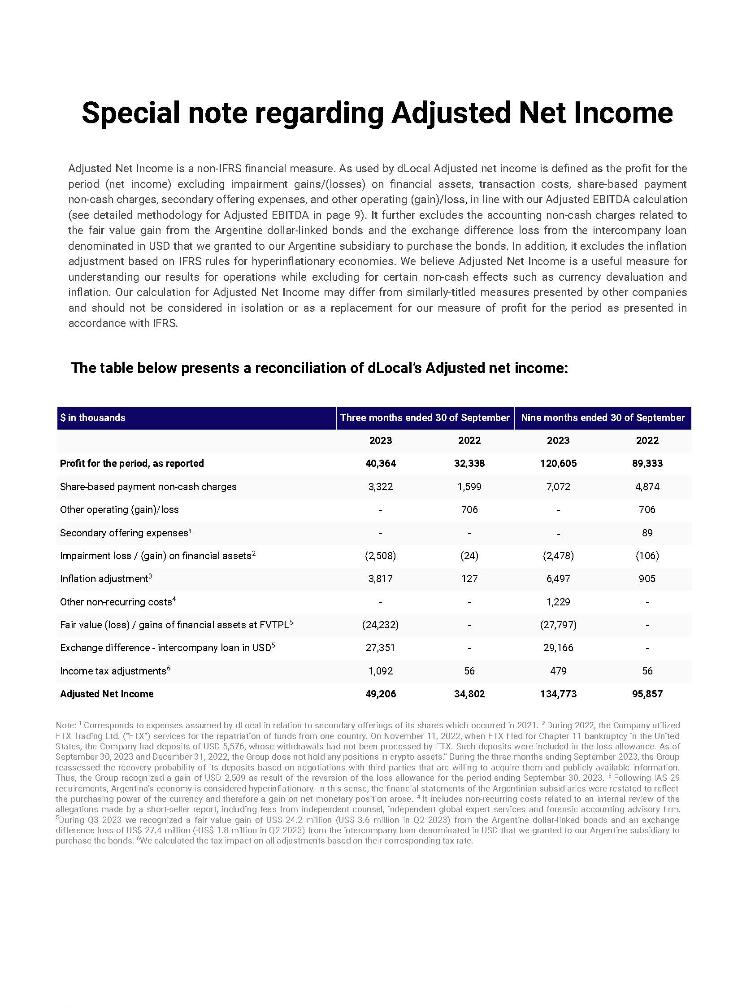

Special note regarding Adjusted Net Income

Adjusted Net Income is a non-IFRS financial measure. As used by dLocal Adjusted net income is defined as the profit for the period (net income) excluding impairment gains/(losses) on financial assets, transaction costs, share-based payment non-cash charges, secondary offering expenses, and other operating (gain)/loss, in line with our Adjusted EBITDA calculation (see detailed methodology for Adjusted EBITDA in page 9). It further excludes the accounting non-cash charges related to the fair value gain from the Argentine dollar-linked bonds and the exchange difference loss from the intercompany loan denominated in USD that we granted to our Argentine subsidiary to purchase the bonds. In addition, it excludes the inflation adjustment based on IFRS rules for hyperinflationary economies. We believe Adjusted Net Income is a useful measure for understanding our results for operations while excluding for certain non-cash effects such as currency devaluation and inflation. Our calculation for Adjusted Net Income may differ from similarly-titled measures presented by other companies and should not be considered in isolation or as a replacement for our measure of profit for the period as presented in accordance with IFRS.

The table below presents a reconciliation of dLocal’s Adjusted net income:

|

|

|

|

|

In thousands of US$ |

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

2023 |

2022 |

Net income, as reported |

40,364 |

32,338 |

120,605 |

89,333 |

Share-based payment non-cash charges |

3,322 |

1,599 |

7,072 |

4,874 |

Other operating (gain)/loss |

- |

706 |

- |

706 |

Secondary offering expenses¹ |

- |

- |

- |

89 |

Impairment loss / (gain) on financial assets² |

(2,508) |

(24) |

(2,478) |

(106) |

Inflation adjustment³ |

3,817 |

127 |

6,497 |

905 |

Other non-recurring costs4 |

- |

- |

1,229 |

- |

Fair value (loss) / gains of financial assets at FVTPL5 |

(24,232) |

- |

(27,797) |

- |

Exchange difference - intercompany loan in USD5 |

27,351 |

- |

29,166 |

- |

Income tax adjustments6 |

1,092 |

56 |

479 |

56 |

Adjusted net income |

49,206 |

34,802 |

134,773 |

95,857 |

Note: 1Corresponds to expenses assumed by dLocal in relation to secondary offerings of its shares which occurred in 2021. 2 During 2022, the Company utilized FTX Trading Ltd. (“FTX”) services for the repatriation of funds from one country. On November 11, 2022, when FTX filed for Chapter 11 bankruptcy in the United States, the Company had deposits of USD 5,576, whose withdrawals had not been processed by FTX. Such deposits were included in the loss allowance. As of September 30, 2023 and December 31, 2022, the Group does not hold any positions in crypto assets.” During the three months ending September 2023, the Group reassessed the recovery probability of its deposits based on negotiations with third parties that are willing to acquire them and publicly available information. Thus, the Group recognized a gain of USD 2,509 as result of the reversion of the loss allowance for the period ending September 30, 2023. 3 Following IAS 29 requirements, Argentina’s economy is considered hyperinflationary. In this sense, the financial statements of the Argentinian subsidiaries were restated to reflect the purchasing power of the currency and therefore a gain on net monetary position arose. 4 It includes non-recurring costs related to an internal review of the allegations made by a short-seller report, including fees from independent counsel, independent global expert services and forensic accounting advisory firm. 5During Q3 2023 we recognized a fair value gain of US$ 24.2 million (US$ 3.6 million in Q2 2023) from the Argentine dollar-linked bonds and an exchange difference loss of US$ 27.4 million (-US$ 1.8 million in Q2 2023) from the intercompany loan denominated in USD that we granted to our Argentine subsidiary to purchase the bonds. 6We calculated the tax impact on all adjustments based on their corresponding tax rate.

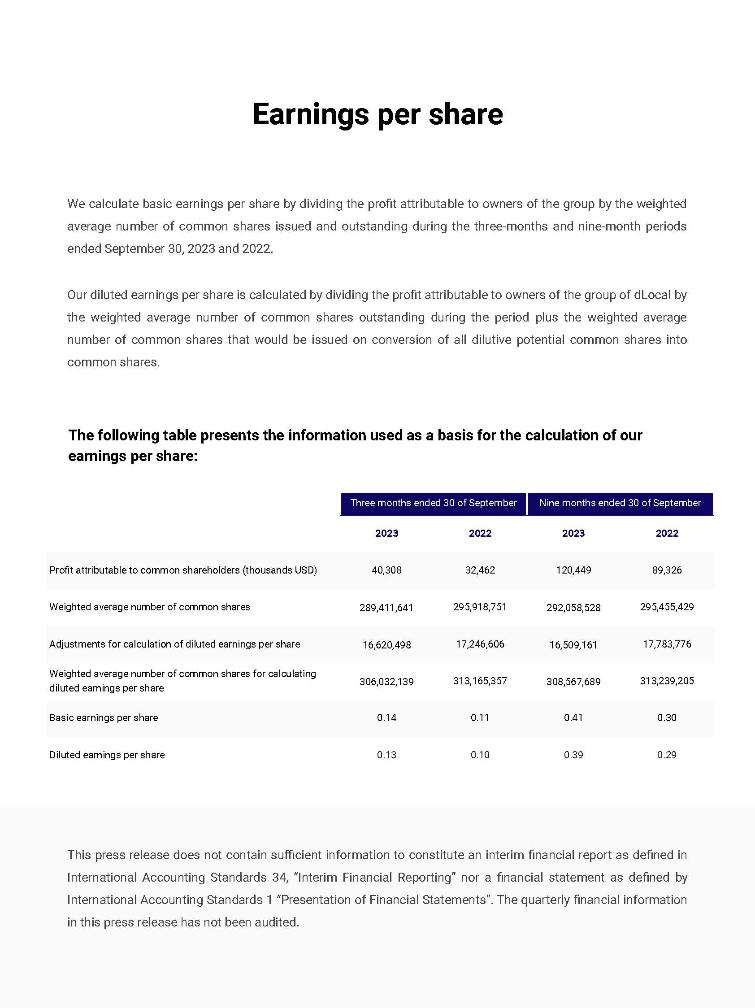

Earnings per share

We calculate basic earnings per share by dividing the profit attributable to owners of the group by the weighted average number of common shares issued and outstanding during the three-months and nine-month periods ended September 30, 2023 and 2022.

Our diluted earnings per share is calculated by dividing the profit attributable to owners of the group of dLocal by the weighted average number of common shares outstanding during the period plus the weighted average number of common shares that would be issued on conversion of all dilutive potential common shares into common shares.

The following table presents the information used as a basis for the calculation of our earnings per share:

|

|

|

|

|

|

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

2023 |

2022 |

Profit attributable to common shareholders (thousands USD) |

40,308 |

32,462 |

120,449 |

89,326 |

Weighted average number of common shares |

289,411,641 |

295,918,751 |

292,058,528 |

295,455,429 |

Adjustments for calculation of diluted earnings per share |

16,620,498 |

17,246,606 |

16,509,161 |

17,783,776 |

Weighted average number of common shares for calculating diluted earnings per share |

306,032,139 |

313,165,357 |

308,567,689 |

313,239,205 |

Basic earnings per share |

0.14 |

0.11 |

0.41 |

0.30 |

Diluted earnings per share |

0.13 |

0.10 |

0.39 |

0.29 |

This press release does not contain sufficient information to constitute an interim financial report as defined in International Accounting Standards 34, “Interim Financial Reporting” nor a financial statement as defined by International Accounting Standards 1 “Presentation of Financial Statements”. The quarterly financial information in this press release has not been audited.

Conference call and webcast

dLocal’s management team will host a conference call and audio webcast on November 22nd, 2023 at 8:00 a.m. Eastern Time. Please click here to pre-register for the conference call and obtain your dial in number and passcode.

The live conference call can be accessed via audio webcast at the investor relations section of dLocal’s website, at https://investor.dlocal.com/. An archive of the webcast will be available for a year following the conclusion of the conference call. The investor presentation will also be filed on EDGAR at www.sec.gov.

About dLocal

dLocal powers local payments in emerging markets, connecting global enterprise merchants with billions of emerging market consumers in more than 40 countries across APAC, the Middle East, Latin America, and Africa. Through the “One dLocal” platform (one direct API, one platform, and one contract), global companies can accept payments, send pay-outs and settle funds globally without the need to manage separate pay-in and pay-out processors, set up numerous local entities, and integrate multiple acquirers and payment methods in each market.

Definition of selected operational metrics

“API” means application programming interface, which is a general term for programming techniques that are available for software developers when they integrate with a particular service or application. In the payments industry, APIs are usually provided by any party participating in the money flow (such as payment gateways, processors, and service providers) to facilitate the money transfer process.

“Cross-border” means a payment transaction whereby dLocal is collecting in one currency and settling into a different currency and/or in a different geography.

“Local payment methods” refers to any payment method that is processed in the country where the end user of the merchant sending or receiving payments is located, which include credit and debit cards, cash payments, bank transfers, mobile money, and digital wallets.

“Local-to-local” means a payment transaction whereby dLocal is collecting and settling in the same currency.

“Net Revenue Retention Rate” or “NRR” is a U.S. dollar-based measure of retention and growth of dLocal’s merchants. NRR is calculated for a period or year by dividing the Current Period/Year Revenue by the Prior Period/Year Revenue. The Prior Period/Year Revenue is the revenue billed by us to all our customers in the prior period. The Current Period/Year Revenue is the revenue billed by us in the current period to the same customers included in the Prior Period/Year Revenue. Current Period/Year Revenue includes revenues from

any upselling and cross-selling across products, geographies, and payment methods to such merchant customers, and is net of any contractions or attrition, in respect of such merchant customers, and excludes revenue from new customers on-boarded in the preceding twelve months. As most of dLocal revenues come from existing merchants, the NRR rate is a key metric used by management, and we believe it is useful for investors in order to assess our retention of existing customers and growth in revenues from our existing customer base.

“Pay-in” means a payment transaction whereby dLocal’s merchant customers receive payment from their customers.

“Pay-out” means a payment transaction whereby dLocal disburses money in local currency to the business partners or customers of dLocal’s merchant customers.

“Revenue from New Merchants” means the revenue billed by us to merchant customers that we did not bill revenues in the same quarter (or period) of the prior year.

“Revenue from Existing Merchants” means the revenue billed by us in the last twelve months to the merchant customers that we billed revenue in the same quarter (or period) of the prior year.

“TPV” dLocal presents total payment volume, or TPV, which is an operating metric of the aggregate value of all payments successfully processed through dLocal’s payments platform. Because revenue depends significantly on the total value of transactions processed through the dLocal platform, management believes that TPV is an indicator of the success of dLocal’s global merchants, the satisfaction of their end users, and the scale and growth of dLocal’s business.

Forward-looking statements

This press release contains certain forward-looking statements. These forward-looking statements convey dLocal’s current expectations or forecasts of future events, including guidance in respect of revenue, Adjusted EBITDA, gross profit CAGR and Adjusted EBITDA over gross profit. Forward-looking statements regarding dLocal and amounts stated as guidance are based on current management expectations and involve known and unknown risks, uncertainties and other factors that may cause dLocal’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” “Forward-Looking Statements” and “Cautionary Statement Regarding Forward-Looking Statements” sections of dLocal’s filings with the U.S. Securities and Exchange Commission. Unless required by law, dLocal undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. In addition, dLocal is unable to present a quantitative reconciliation of forward-looking guidance for Adjusted EBITDA and Adjusted EBITDA over gross profit, which are forward-looking non-IFRS measures, because dLocal cannot reliably predict certain of their necessary components, such as impairment gains/(losses) on financial assets, transaction costs, and inflation adjustment.

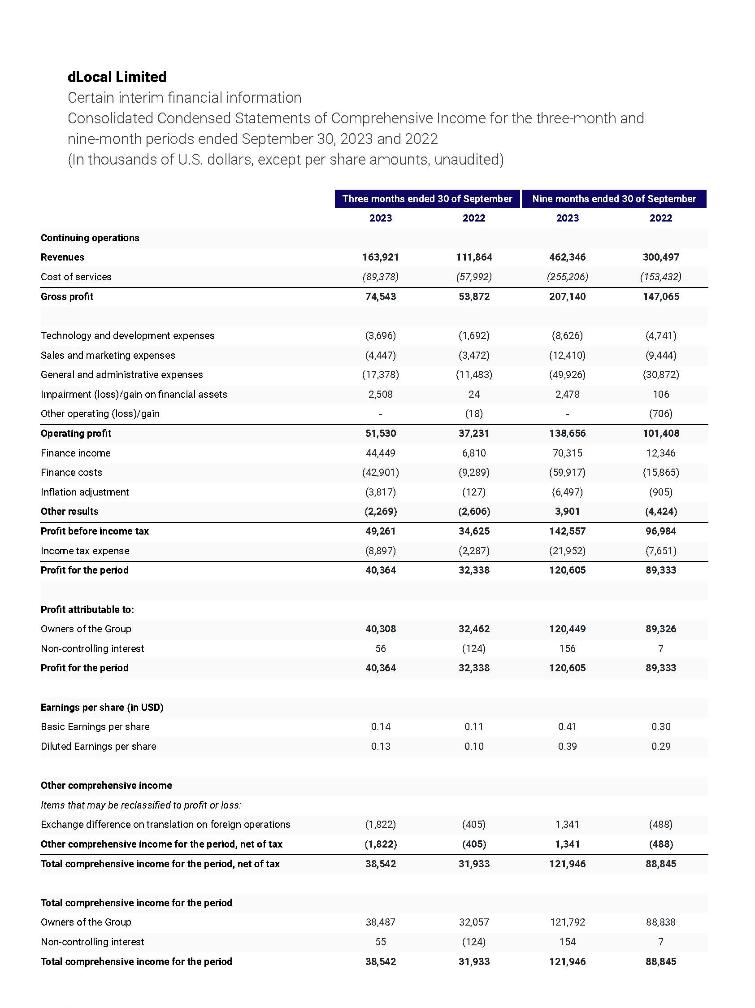

dLocal Limited

Certain interim financial information

Consolidated Condensed Statements of Comprehensive Income for the three-month and nine-month periods ended September 30, 2023 and 2022

(In thousands of U.S. dollars, except per share amounts, unaudited)

|

|

|

|

|

|

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

2023 |

2022 |

|

|

|

|

|

Revenues |

163,921 |

111,864 |

462,346 |

300,497 |

Cost of services |

(89,378) |

(57,992) |

(255,206) |

(153,432) |

Gross profit |

74,543 |

53,872 |

207,140 |

147,065 |

|

|

|

|

|

Technology and development expenses |

(3,696) |

(1,692) |

(8,626) |

(4,741) |

Sales and marketing expenses |

(4,447) |

(3,472) |

(12,410) |

(9,444) |

General and administrative expenses |

(17,378) |

(11,483) |

(49,926) |

(30,872) |

Impairment (loss)/gain on financial assets |

2,508 |

24 |

2,478 |

106 |

Other operating (loss)/gain |

- |

(18) |

- |

(706) |

Operating profit |

51,530 |

37,231 |

138,656 |

101,408 |

Finance income |

44,449 |

6,810 |

70,315 |

12,346 |

Finance costs |

(42,901) |

(9,289) |

(59,917) |

(15,865) |

Inflation adjustment |

(3,817) |

(127) |

(6,497) |

(905) |

Other results |

(2,269) |

(2,606) |

3,901 |

(4,424) |

Profit before income tax |

49,261 |

34,625 |

142,557 |

96,984 |

Income tax expense |

(8,897) |

(2,287) |

(21,952) |

(7,651) |

Profit for the period |

40,364 |

32,338 |

120,605 |

89,333 |

|

|

|

|

|

Profit attributable to: |

|

|

|

|

Owners of the Group |

40,308 |

32,462 |

120,449 |

89,326 |

Non-controlling interest |

56 |

(124) |

156 |

7 |

Profit for the period |

40,364 |

32,338 |

120,605 |

89,333 |

|

|

|

|

|

Earnings per share (in USD) |

|

|

|

|

Basic Earnings per share |

0.14 |

0.11 |

0.41 |

0.30 |

Diluted Earnings per share |

0.13 |

0.10 |

0.39 |

0.29 |

|

|

|

|

|

Other comprehensive income |

|

|

|

|

Items that may be reclassified to profit or loss: |

|

|

|

|

Exchange difference on translation on foreign operations |

(1,822) |

(405) |

1,341 |

(488) |

Other comprehensive income for the period, net of tax |

(1,822) |

(405) |

1,341 |

(488) |

Total comprehensive income for the period, net of tax |

38,542 |

31,933 |

121,946 |

88,845 |

|

|

|

|

|

Total comprehensive income for the period |

|

|

|

|

Owners of the Group |

38,487 |

32,057 |

121,792 |

88,838 |

Non-controlling interest |

55 |

(124) |

154 |

7 |

Total comprehensive income for the period |

38,542 |

31,933 |

121,946 |

88,845 |

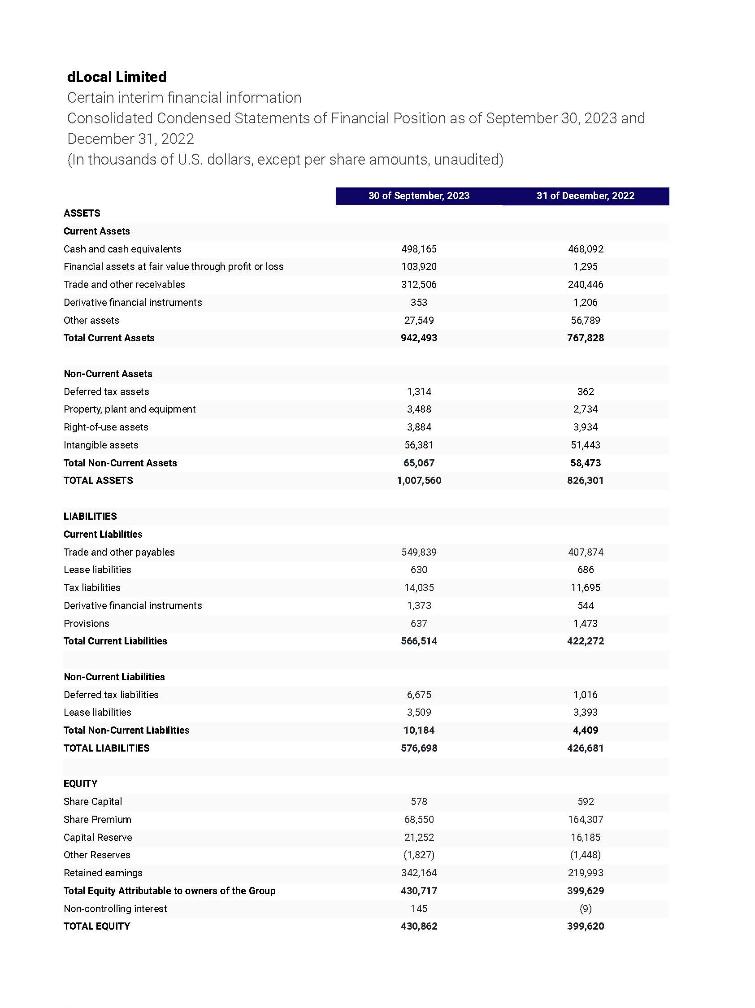

dLocal Limited

Certain interim financial information

Consolidated Condensed Statements of Financial Position as of September 30, 2023 and December 31, 2022

(In thousands of U.S. dollars, except per share amounts, unaudited)

|

|

|

|

30 of September, 2023 |

31 of December, 2022 |

ASSETS |

|

|

Current Assets |

|

|

Cash and cash equivalents |

498,165 |

468,092 |

Financial assets at fair value through profit or loss |

103,920 |

1,295 |

Trade and other receivables |

312,506 |

240,446 |

Derivative financial instruments |

353 |

1,206 |

Other assets |

27,549 |

56,789 |

Total Current Assets |

942,493 |

767,828 |

|

|

|

Non-Current Assets |

|

|

Deferred tax assets |

1,314 |

362 |

Property, plant and equipment |

3,488 |

2,734 |

Right-of-use assets |

3,884 |

3,934 |

Intangible assets |

56,381 |

51,443 |

Total Non-Current Assets |

65,067 |

58,473 |

TOTAL ASSETS |

1,007,560 |

826,301 |

|

|

|

LIABILITIES |

|

|

Current Liabilities |

|

|

Trade and other payables |

549,839 |

407,874 |

Lease liabilities |

630 |

686 |

Tax liabilities |

14,035 |

11,695 |

Derivative financial instruments |

1,373 |

544 |

Provisions |

637 |

1,473 |

Total Current Liabilities |

566,514 |

422,272 |

|

|

|

Non-Current Liabilities |

|

|

Deferred tax liabilities |

6,675 |

1,016 |

Lease liabilities |

3,509 |

3,393 |

Total Non-Current Liabilities |

10,184 |

4,409 |

TOTAL LIABILITIES |

576,698 |

426,681 |

|

|

|

EQUITY |

|

|

Share Capital |

578 |

592 |

Share Premium |

68,550 |

164,307 |

Capital Reserve |

21,252 |

16,185 |

Other Reserves |

(1,827) |

(1,448) |

Retained earnings |

342,164 |

219,993 |

Total Equity Attributable to owners of the Group |

430,717 |

399,629 |

Non-controlling interest |

145 |

(9) |

TOTAL EQUITY |

430,862 |

399,620 |

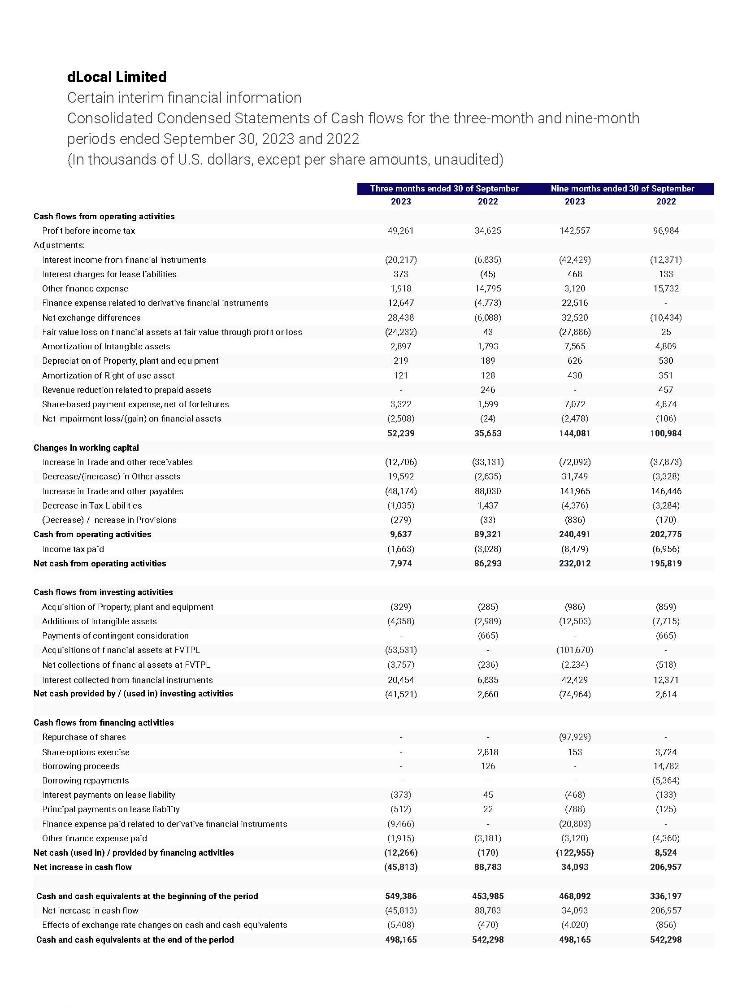

dLocal Limited

Certain interim financial information

Consolidated Condensed Statements of Cash flows for three-month and nine-month period ended September 30, 2023 and 2022

(In thousands of U.S. dollars, except per share amounts, unaudited)

|

|

|

|

|

|

Three months ended 30 of September |

Nine months ended 30 of September |

|

2023 |

2022 |

2023 |

2022 |

Cash flows from operating activities |

|

|

|

|

Profit before income tax |

49,261 |

34,625 |

142,557 |

96,984 |

Adjustments: |

|

|

|

|

Interest income from financial instruments |

(20,217) |

(6,835) |

(42,429) |

(12,371) |

Interest charges for lease liabilities |

373 |

(45) |

468 |

133 |

Other finance expense |

1,918 |

14,795 |

3,120 |

15,732 |

Finance expense related to derivative financial instruments |

12,647 |

(4,773) |

22,516 |

- |

Net exchange differences |

28,438 |

(6,088) |

32,520 |

(10,434) |

Fair value loss on financial assets at fair value through profit or loss |

(24,232) |

43 |

(27,886) |

25 |

Amortization of Intangible assets |

2,897 |

1,793 |

7,565 |

4,809 |

Depreciation of Property, plant and equipment |

219 |

189 |

626 |

530 |

Amortization of Right-of-use asset |

121 |

128 |

430 |

351 |

Revenue reduction related to prepaid assets |

- |

246 |

- |

457 |

Share-based payment expense, net of forfeitures |

3,322 |

1,599 |

7,072 |

4,874 |

Net Impairment loss/(gain) on financial assets |

(2,508) |

(24) |

(2,478) |

(106) |

|

52,239 |

35,653 |

144,081 |

100,984 |

Changes in working capital |

|

|

|

|

Increase in Trade and other receivables |

(12,706) |

(33,131) |

(72,092) |

(37,873) |

Decrease/(increase) in Other assets |

19,592 |

(2,635) |

31,749 |

(3,328) |

Increase in Trade and other payables |

(48,174) |

88,030 |

141,965 |

146,446 |

Decrease in Tax Liabilities |

(1,035) |

1,437 |

(4,376) |

(3,284) |

(Decrease) / Increase in Provisions |

(279) |

(33) |

(836) |

(170) |

Cash from operating activities |

9,637 |

89,321 |

240,491 |

202,775 |

Income tax paid |

(1,663) |

(3,028) |

(8,479) |

(6,956) |

Net cash from operating activities |

7,974 |

86,293 |

232,012 |

195,819 |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Acquisition of Property, plant and equipment |

(329) |

(285) |

(986) |

(859) |

Additions of Intangible assets |

(4,358) |

(2,989) |

(12,503) |

(7,715) |

Payments of contingent consideration |

- |

(665) |

- |

(665) |

Acquisitions of financial assets at FVTPL |

(53,531) |

- |

(101,670) |

- |

Net collections of financial assets at FVTPL |

(3,757) |

(236) |

(2,234) |

(518) |

Interest collected from financial instruments |

20,454 |

6,835 |

42,429 |

12,371 |

Net cash provided by / (used in) investing activities |

(41,521) |

2,660 |

(74,964) |

2,614 |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Repurchase of shares |

- |

- |

(97,929) |

- |

Share-options exercise |

- |

2,818 |

153 |

3,724 |

Borrowing proceeds |

- |

126 |

- |

14,782 |

Borrowing repayments |

- |

- |

- |

(5,364) |

Interest payments on lease liability |

(373) |

45 |

(468) |

(133) |

Principal payments on lease liability |

(512) |

22 |

(788) |

(125) |

Finance expense paid related to derivative financial instruments |

(9,466) |

- |

(20,803) |

- |

Other finance expense paid |

(1,915) |

(3,181) |

(3,120) |

(4,360) |

Net cash (used in) / provided by financing activities |

(12,266) |

(170) |

(122,955) |

8,524 |

Net increase in cash flow |

(45,813) |

88,783 |

34,093 |

206,957 |

|

|

|

|

|

Cash and cash equivalents at the beginning of the period |

549,386 |

453,985 |

468,092 |

336,197 |

Net increase in cash flow |

(45,813) |

88,783 |

34,093 |

206,957 |

Effects of exchange rate changes on cash and cash equivalents |

(5,408) |

(470) |

(4,020) |

(856) |

Cash and cash equivalents at the end of the period |

498,165 |

542,298 |

498,165 |

542,298 |

dLocal was incorporated on February 10, 2021, as a Cayman Islands exempted company with limited liability, duly registered with the Cayman Islands Registrar of Companies. The contribution of dLocal Group Limited (a limited liability company incorporated in Malta, the former holding entity or “dLocal Malta”) shares to dLocal was finalized as of April 14, 2021. Until the contribution of dLocal Malta shares to it, dLocal had not commenced operations, consequently the historical information previous to that date presented herein corresponds to dLocal Malta, our predecessor. This reorganization was done, among other reasons, to facilitate the initial public offering of the Group. dLocal had no prior assets, holdings or operations.

Investor Relations Contact:

investor@dlocal.com

Media Contact:

marketing@dlocal.com

Exhibit 99.2

DLocal Limited

Unaudited Consolidated Condensed Interim Financial Statements as of September 30, 2023 and for the nine-month and three-month periods ended September 30, 2023 and 2022

DLocal Limited

Consolidated Condensed Interim Statements of Comprehensive Income

For the nine-month and three-month periods ended September 30, 2023 and 2022

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended |

|

|

Three months ended |

|

|

|

Notes |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

Continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

6 |

|

|

462,346 |

|

|

|

300,497 |

|

|

|

163,921 |

|

|

|

111,864 |

|

Cost of services |

|

6 |

|

|

(255,206 |

) |

|

|

(153,432 |

) |

|

|

(89,378 |

) |

|

|

(57,992 |

) |

Gross profit |

|

|

|

|

207,140 |

|

|

|

147,065 |

|

|

|

74,543 |

|

|

|

53,872 |

|

Technology and development expenses |

|

7 |

|

|

(8,626 |

) |

|

|

(4,741 |

) |

|

|

(3,696 |

) |

|

|

(1,692 |

) |

Sales and marketing expenses |

|

8 |

|

|

(12,410 |

) |

|

|

(9,444 |

) |

|

|

(4,447 |

) |

|

|

(3,472 |

) |

General and administrative expenses |

|

8 |

|

|

(49,926 |

) |

|

|

(30,872 |

) |

|

|

(17,378 |

) |

|

|

(11,483 |

) |

Impairment reversal on financial assets |

|

16, 17 |

|

|

2,478 |

|

|

|

106 |

|

|

|

2,508 |

|

|

|

24 |

|

Other operating loss |

|

|

|

|

— |

|

|

|

(706 |

) |

|

|

— |

|

|

|

(18 |

) |

Operating profit |

|

|

|

|

138,656 |

|

|

|

101,408 |

|

|

|

51,530 |

|

|

|

37,231 |

|

Finance income |

|

11 |

|

|

70,315 |

|

|

|

12,346 |

|

|

|

44,449 |

|

|

|

6,810 |

|

Finance costs |

|

11 |

|

|

(59,917 |

) |

|

|

(15,865 |

) |

|

|

(42,901 |

) |

|

|

(9,289 |

) |

Inflation adjustment |

|

11 |

|

|

(6,497 |

) |

|

|

(905 |

) |

|

|

(3,817 |

) |

|

|

(127 |

) |

Other results |

|

|

|

|

3,901 |

|

|

|

(4,424 |

) |

|

|

(2,269 |

) |

|

|

(2,606 |

) |

Profit before income tax |

|

|

|

|

142,557 |

|

|

|

96,984 |

|

|

|

49,261 |

|

|

|

34,625 |

|

Income tax expense |

|

12 |

|

|

(21,952 |

) |

|

|

(7,651 |

) |

|

|

(8,897 |

) |

|

|

(2,287 |

) |

Profit for the period |

|

|

|

|

120,605 |

|

|

|

89,333 |

|

|

|

40,364 |

|

|

|

32,338 |

|

Profit attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Group |

|

|

|

|

120,449 |

|

|

|

89,326 |

|

|

|

40,308 |

|

|

|

32,462 |

|

Non-controlling interest |

|

|

|

|

156 |

|

|

|

7 |

|

|

|

56 |

|

|

|

(124 |

) |

Profit for the period |

|

|

|

|

120,605 |

|

|

|

89,333 |

|

|

|

40,364 |

|

|

|

32,338 |

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per share |

|

13 |

|

|

0.41 |

|

|

|

0.30 |

|

|

|

0.14 |

|

|

|

0.11 |

|

Diluted Earnings per share |

|

13 |

|

|

0.39 |

|

|

|

0.29 |

|

|

|

0.13 |

|

|

|

0.10 |

|

Other comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items that may be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange difference on translation on foreign operations |

|

|

|

|

1,341 |

|

|

|

(488 |

) |

|

|

(1,822 |

) |

|

|

(405 |

) |

Other comprehensive income for the period, net of tax |

|

|

|

|

1,341 |

|

|

|

(488 |

) |

|

|

(1,822 |

) |

|

|

(405 |

) |

Total comprehensive income for the period |

|

|

|

|

121,946 |

|

|

|

88,845 |

|

|

|

38,542 |

|

|

|

31,933 |

|

Total comprehensive income for the period is attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Group |

|

|

|

|

121,792 |

|

|

|

88,838 |

|

|

|

38,487 |

|

|

|

32,057 |

|

Non-controlling interest |

|

|

|

|

154 |

|

|

|

7 |

|

|

|

55 |

|

|

|

(124 |

) |

Total comprehensive income for the period |

|

|

|

|

121,946 |

|

|

|

88,845 |

|

|

|

38,542 |

|

|

|

31,933 |

|

The accompanying notes are an integral part of these Consolidated Condensed Interim Financial Statements.

DLocal Limited

Consolidated Condensed Interim Statements of Financial Position

As of September 30, 2023 and December 31, 2022

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

|

|

|

|

|

|

|

|

Notes |

|

September 30, 2023 |

|

December 31, 2022 |

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

14 |

|

498,165 |

|

468,092 |

Financial assets at fair value through profit or loss |

|

15 |

|

103,920 |

|

1,295 |

Trade and other receivables |

|

16 |

|

312,506 |

|

240,446 |

Derivative financial instruments |

|

21 |

|

353 |

|

1,206 |

Other assets |

|

17 |

|

27,549 |

|

56,789 |

Total Current Assets |

|

|

|

942,493 |

|

767,828 |

Non-Current Assets |

|

|

|

|

|

|

Deferred tax assets |

|

|

|

1,314 |

|

362 |

Property, plant and equipment |

|

|

|

3,488 |

|

2,734 |

Right-of-use assets |

|

|

|

3,884 |

|

3,934 |

Intangible assets |

|

18 |

|

56,381 |

|

51,443 |

Total Non-Current Assets |

|

|

|

65,067 |

|

58,473 |

TOTAL ASSETS |

|

|

|

1,007,560 |

|

826,301 |

LIABILITIES |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Trade and other payables |

|

19 |

|

549,839 |

|

407,874 |

Lease liabilities |

|

|

|

630 |

|

686 |

Tax liabilities |

|

20 |

|

14,035 |

|

11,695 |

Derivative financial instruments |

|

21 |

|

1,373 |

|

544 |

Provisions |

|

22 |

|

637 |

|

1,473 |

Total Current Liabilities |

|

|

|

566,514 |

|

422,272 |

Non-Current Liabilities |

|

|

|

|

|

|

Deferred tax liabilities |

|

|

|

6,675 |

|

1,016 |

Lease liabilities |

|

|

|

3,509 |

|

3,393 |

Total Non-Current Liabilities |

|

|

|

10,184 |

|

4,409 |

TOTAL LIABILITIES |

|

|

|

576,698 |

|

426,681 |

EQUITY |

|

13 |

|

|

|

|

Share Capital |

|

|

|

578 |

|

592 |

Share Premium |

|

|

|

68,550 |

|

164,307 |

Capital Reserve |

|

|

|

21,252 |

|

16,185 |

Other Reserves |

|

|

|

(1,827) |

|

(1,448) |

Retained earnings |

|

|

|

342,164 |

|

219,993 |

Total Equity Attributable to owners of the Group |

|

|

|

430,717 |

|

399,629 |

Non-controlling interest |

|

|

|

145 |

|

(9) |

TOTAL EQUITY |

|

|

|

430,862 |

|

399,620 |

TOTAL LIABILITIES AND EQUITY |

|

|

|

1,007,560 |

|

826,301 |

The accompanying notes are an integral part of these Consolidated Condensed Interim Financial Statement

DLocal Limited

Consolidated Condensed Interim Statements of Changes in Equity

For the nine-month periods ended September 30, 2023 and 2022

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes |

|

Share

Capital |

|

Share

Premium |

|

Capital

Reserve |

|

Other Reserves |

|

Retained

Earnings |

|

Total |

|

Non-

controlling

interest |

|

Total

equity |

Balance as of January 1st, 2023 |

|

|

|

592 |

|

164,307 |

|

16,185 |

|

(1,448) |

|

219,993 |

|

399,629 |

|

(9) |

|

399,620 |

Comprehensive Income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period |

|

|

|

— |

|

— |

|

— |

|

— |

|

120,449 |

|

120,449 |

|

156 |

|

120,605 |

Exchange difference on translation on foreign operations |

|

|

|

— |

|

— |

|

— |

|

(379) |

|

1,722 |

|

1,343 |

|

(2) |

|

1,341 |

Total Comprehensive Income for the period |

|

|

|

— |

|

— |

|

— |

|

(379) |

|

122,171 |

|

121,792 |

|

154 |

|

121,946 |

Transactions with Group owners in their capacity as owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-options exercise |

|

13 |

|

— |

|

2,158 |

|

(2,005) |

|

— |

|

— |

|

153 |

|

— |

|

153 |

Share-based payments net of forfeitures |

|

9 |

|

— |

|

— |

|

7,072 |

|

— |

|

— |

|

7,072 |

|

— |

|

7,072 |

Repurchase of shares |

|

13 |

|

(14) |

|

(97,915) |

|

— |

|

— |

|

— |

|

(97,929) |

|

— |

|

(97,929) |

Transactions with Group owners in their capacity as owners |

|

|

|

(14) |

|

(95,757) |

|

5,067 |

|

— |

|

— |

|

(90,704) |

|

— |

|

(90,704) |

Balance as of September 30, 2023 |

|

|

|

578 |

|

68,550 |

|

21,252 |

|

(1,827) |

|

342,164 |

|

430,717 |

|

145 |

|

430,862 |

Balance as of January 1st, 2022 |

|

|

|

590 |

|

157,151 |

|

12,741 |

|

(30) |

|

109,867 |

|

280,319 |

|

(18) |

|

280,301 |

Comprehensive Income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period |

|

|

|

— |

|

— |

|

— |

|

— |

|

89,326 |

|

89,326 |

|

7 |

|

89,333 |

Exchange difference on translation on foreign operations |

|

|

|

— |

|

— |

|

— |

|

(1,755) |

|

1,267 |

|

(488) |

|

— |

|

(488) |

Total Comprehensive Income for the period |

|

|

|

— |

|

— |

|

— |

|

(1,755) |

|

90,593 |

|

88,838 |

|

7 |

|

88,845 |

Transactions with Group owners in their capacity as owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-options exercise |

|

13 |

|

2 |

|

8,167 |

|

(4,445) |

|

— |

|

— |

|

3,724 |

|

— |

|

3,724 |

Forfeitures |

|

13 |

|

— |

|

— |

|

(720) |

|

— |

|

— |

|

(720) |

|

— |

|

(720) |

Share-based payments |

|

9 |

|

— |

|

— |

|

5,594 |

|

— |

|

— |

|

5,594 |

|

— |

|

5,594 |

Transactions with Group owners in their capacity as owners |

|

|

|

2 |

|

8,167 |

|

429 |

|

— |

|

— |

|

8,598 |

|

— |

|

8,598 |

Balance as of September 30, 2022 |

|

|

|

592 |

|

165,318 |

|

13,170 |

|

(1,785) |

|

200,460 |

|

377,755 |

|

(11) |

|

377,744 |

The accompanying notes are an integral part of these Consolidated Condensed Interim Financial Statements.

DLocal Limited

Consolidated Condensed Interim Statements of Cash Flows

For the nine-month periods ended September 30, 2023 and 2022

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

|

|

|

|

|

|

|

|

|

|

Nine months ended |

|

|

Notes |

|

September 30, 2023 |

|

September 30, 2022 |

Cash flows from operating activities |

|

|

|

|

|

|

Profit before income tax |

|

|

|

142,557 |

|

96,984 |

Adjustments: |

|

|

|

|

|

|

Interest income from financial instruments |

|

11 |

|

(42,429) |

|

(12,371) |

Interest charges for lease liabilities |

|

11 |

|

468 |

|

133 |

Other finance expense |

|

|

|

3,120 |

|

15,732 |

Finance expense related to derivative financial instruments |

|

|

|

22,516 |

|

— |

Net exchange differences |

|

|

|

32,520 |

|

(10,434) |

Fair value gain on financial assets at fair value through profit or loss |

|

11 |

|

(27,886) |

|

25 |

Amortization of Intangible assets |

|

10 |

|

7,565 |

|

4,809 |

Depreciation of Property, plant and equipment |

|

10 |

|

626 |

|

530 |

Amortization of Right-of-use asset |

|

10 |

|

430 |

|

351 |

Revenue reduction related to prepaid assets |

|

6 |

|

— |

|

457 |

Share-based payment expense, net of forfeitures |

|

9 |

|

7,072 |

|

4,874 |

Net Impairment loss/(gain) on financial assets |

|

16, 17 |

|

(2,478) |

|

(106) |

|

|

|

|

144,081 |

|

100,984 |

Changes in working capital |

|

|

|

|

|

|

Increase in Trade and other receivables |

|

16 |

|

(72,092) |

|

(37,873) |

Decrease/(increase) in Other assets |

|

17 |

|

31,749 |

|

(3,328) |

Increase in Trade and other payables |

|

19 |

|

141,965 |

|

146,446 |

Decrease in Tax Liabilities |

|

20 |

|

(4,376) |

|

(3,284) |

Decrease in Provisions |

|

22 |

|

(836) |

|

(170) |

Cash from operating activities |

|

|

|

240,491 |

|

202,775 |

Income tax paid |

|

|

|

(8,479) |

|

(6,956) |

Net cash from operating activities |

|

|

|

232,012 |

|

195,819 |

Cash flows from investing activities |

|

|

|

|

|

|

Acquisitions of Property, plant and equipment |

|

|

|

(986) |

|

(859) |

Additions of Intangible assets |

|

18 |

|

(12,503) |

|

(7,715) |

Payments of contingent consideration |

|

|

|

— |

|

(665) |

Acquisition of financial assets at FVPL |

|

|

|

(101,670) |

|

— |

Net collections of financial assets at FVPL |

|

|

|

(2,234) |

|

(518) |

Interest collected from financial instruments |

|

|

|

42,429 |

|

12,371 |

Net cash used in investing activities |

|

|

|

(74,964) |

|

2,614 |

Cash flows from financing activities |

|

|

|

|

|

|

Repurchase of shares |

|

13 |

|

(97,929) |

|

— |

Share-options exercise |

|

|

|

153 |

|

3,724 |

Borrowings proceeds |

|

|

|

— |

|

14,782 |

Borrowings repayments |

|

|

|

— |

|

(5,364) |

Interest payments on lease liability |

|

|

|

(468) |

|

(133) |

Principal payments on lease liability |

|

|

|

(788) |

|

(125) |

Finance expense paid related to derivative financial instruments |

|

|

|

(20,803) |

|

— |

Other finance expense paid |

|

|

|

(3,120) |

|

(4,360) |

Net cash (used in)/provided by financing activities |

|

|

|

(122,955) |

|

8,524 |

Net increase in cash flow |

|

|

|

34,093 |

|

206,957 |

Cash and cash equivalents at the beginning of the period |

|

|

|

468,092 |

|

336,197 |

Effects of exchange rate changes on cash and cash equivalents |

|

|

|

(4,020) |

|

(856) |

Cash and cash equivalents at the end of the period |

|

|

|

498,165 |

|

542,298 |

The accompanying notes are an integral part of these Consolidated Condensed Interim Financial Statements.

DLocal Limited

Notes to the Consolidated Condensed Interim Financial Statements

At September 30, 2023

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

1. General information and Significant Events during the period

1.1. General information

DLocal Limited (“dLocal” or the “Company”) is a holding company, referred to together with its subsidiaries as the “Group”. dLocal is a limited liability company. The Group was established on October 5, 2016, under the holding company dLocal Group Limited, domiciled and incorporated in Malta, and on April 14, 2021 it was reorganized under dLocal, domiciled and incorporated in the Cayman Islands. The Company is the ultimate controlling party of the Group.

The Group processes payment transactions, enabling merchants located in developed economies (mainly United States, Europe and China) to get paid (“payins”) from customers in emerging markets and to make payments (“payouts”) to customers in emerging markets. As of the date of issuance of these Consolidated Condensed Interim Financial Statements, the Group continued to focus on its expansion efforts bringing the total number of countries in the geographic network to 40.

In order to conduct its business, the Group has direct connections with banks, acquirers and payments processors to process payments locally in emerging markets. It also operates with financial institutions to expatriate/repatriate the funds to/from the developed economies where the merchant customers elect to settle their funds in the currency of their preference (mainly U.S. Dollar and Euro). These Consolidated Condensed Interim Financial Statements include dLocal’s subsidiaries and details of the structure are included under Note 4: Consolidation of subsidiaries.

The Group is licensed and regulated in the EU as an Electronic Money Issuer, or EMI, and Payment Institution, or PI, and registered as a Money Service Business with the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, or FinCEN, and operates and may be licensed, as applicable, in 40 countries in emerging markets, primarily in the Americas, Asia and Africa.

In addition, the Group is subject to laws aimed at preventing money laundering, corruption and the financing of terrorism. This regulatory landscape is constantly changing, including as a consequence of the implementation of the Fifth Anti-Money Laundering Directive (Directive (EU) 2018/843, “MLD5”) and the amended texts of the proposed Anti-Money Laundering Regulation (“AMLR”).

1.2. Significant events during the period

Class action lawsuits

On February 23 and February 28, 2023, respectively, DLocal Limited was named, along with several of its senior executives and/or directors, as defendant in certain putative class action lawsuits filed in the Supreme Court of the State of New York, New York County, asserting claims under Sections 11, 12, and 15 of the Securities Act of 1933 based in significant part on the short-seller report mentioned in note 1.3.e). These matters, captioned Zappia et al. v. DLocal Limited et al., Index No. 151778/2023 (Sup. Ct. N.Y. Cty.), and Hunt et al. v. DLocal Limited et al., Index No. 651058/2023 (Sup. Ct. N.Y. Cty.), allege, among other things, that the registration statement for our June 2021 initial public offering reflected certain material misstatements or omissions.

On March 3, 2023, plaintiffs in the two Actions filed a stipulation and proposed order consolidating the cases and appointing putative lead counsel, which application remains pending. The parties also agreed to a schedule for plaintiffs’ filing of an amended complaint and a subsequent briefing schedule for a motion to dismiss the amended complaint.

On May 12, 2023, plaintiffs in the Zappia and Hunt actions jointly filed a consolidated amended complaint. On July 11, 2023, Dlocal filed a motion to dismiss the complaint. Plaintiffs filed their opposition brief on August 15, 2023, and DLO filed its reply in further support of its motion to dismiss on September 22, 2023. The motion to dismiss has now been fully briefed and is awaiting further action of the court. No other proceedings are currently ongoing or scheduled.

On October 6, 2023, DLO was named as a defendant, along with its Co-CEO, Sebastián Kanovich, and CFO, Diego Cabrera Canay, in a new putative class action lawsuit filed in the U.S. District Court for the Eastern District of New York, asserting claims under Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and SEC Rule 10b-5, as well as control person claims against the individual defendants under Section 20(a) of the Exchange Act. This lawsuit, captioned Francis v. dLocal Ltd., et al., 1:23-cv-07501 (E.D.N.Y.), alleges misstatements and omissions in various public filings during the period of May 2, 2022 to May 25, 2023 relating to regulatory foreign exchange control risks in Argentina, and dLocal’s compliance controls and procedures. This lawsuit is in an early phase of litigation, and DLO anticipates jointly proposing a schedule for responding to any amended or designated-operative complaint after the court appoints a lead plaintiff and lead counsel for the proposed class.

Due to the preliminary posture of the above described lawsuits as of the date of issuance of these consolidated condensed interim financial statements, the Management and its legal advisors are unable to evaluate the likelihood of an adverse outcome or estimate a range of potential losses and no provision for contingencies have been recorded for the aforementioned matters. DLocal Limited intends to defend itself vigorously in these actions. As of the date of issuance of the Company’s financial statements there were no further updates in this regard.

Developments in Argentina

On April 20, 2023, the Central Bank in Argentina issued Comunicacion “A” 7746, which amends certain foreign exchange regulations and establishes procedures to obtain foreign currency for the settlement of certain professional, advertising services and other business services. On April 27, 2023, General Resolution No. 5351 was published, modifying Argentina’s System for Imports and Payments of Services Abroad (Sistema de Importaciones de la República Argentina y Pagos de Servicios al Exterior) (“SIRASE”) regime and establishing that all SIRASE applications must be approved by the Secretary of Commerce. The approval of certain of the Company’s expatriation requests submitted after April 20, 2023 are outstanding as of the date of the issuance of these condensed interim financial statements. Management continues to monitor the situation in close communication with our merchants.

In addition, during 2023 certain administrative and judicial inquiries have been initiated against DLocal Argentina S.A. These inquiries do not seek financial penalties at this stage. The Management and its legal advisors consider that the activities of the Company and its representatives were carried out in compliance with applicable laws and regulations, including compliance with foreign exchange market and tax regulations. Because of this and given the incipient nature of the inquiry, no provision for contingencies have been recorded for the aforementioned matters.

In June 2023, the Company announced that given the magnitude of dLocal’s business in Argentina, dLocal intended to show additional economic substance with its plan to hire approximately 100 people over the next year and 300 people in the medium-term in the country and to make an aggregate investment over time of up to USD100 million in Argentina, including through locally issued Argentinian federal government bonds US Dollar linked that may be used locally to fulfill operating expenses and local investments according to the company's strategy. On June 14, 2023, the Company acquired with own funds an amount of 48,540 bonds issued by the Treasury department of Argentina through a public bidding process (see note 15 Financial Assets at Fair Value through profit or loss). On July 31, 2023, the Company made a second purchase of bonds issued by the Treasury department of Argentina through a public bidding process, for a total amount of 47,607. These bonds are U.S. linked (payable in pesos but at the official spot exchange rate at the time of payment) with a coupon rate of 0.4% and a maturity date of April 2024.

2. Presentation and preparation of the Consolidated Condensed Interim Financial Statements and significant accounting policies

2.1. Basis of preparation of consolidated condensed interim financial information

These Consolidated Condensed Interim Financial Statements for the nine months ended September 30, 2023 have been prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting” as issued by the International Accounting Standard Board.

These Consolidated Condensed Interim Financial Statements do not include all the notes of the type normally included in an annual consolidated financial statement. Accordingly, this report should be read in conjunction with the annual consolidated financial statements for the year ended December 31, 2022 (the “Annual Financial Statements”).