UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2015

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-37348 |

|

46-4348039 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

| 100 River Ridge Drive, Norwood, MA |

|

02062 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 963-0100

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

Corbus Pharmaceuticals Holdings, Inc.

(the “Company”) issued a press release on November 11, 2015, disclosing financial information and operating metrics for its fiscal quarter ended September 30, 2015, and discussing its business outlook. A copy of the

Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

See “Item 2.02 Results of Operations and Financial

Condition” above.

The information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained

in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of

that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by a specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

| (d) |

The following exhibit is furnished with this report: |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release issued by Corbus Pharmaceuticals Holdings, Inc. dated November 11, 2015. |

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CORBUS PHARMACEUTICALS HOLDINGS, INC. |

|

|

|

|

| Dated: November 12, 2015 |

|

|

|

By: |

|

/s/ Yuval Cohen |

|

|

|

|

|

|

Name: |

|

Yuval Cohen |

|

|

|

|

|

|

Title: |

|

Chief Executive Officer |

-3-

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release issued by Corbus Pharmaceuticals Holdings, Inc. dated November 11, 2015. |

-4-

Exhibit 99.1

Corbus Pharmaceuticals Reports 2015 Third Quarter Financial Results

- Company Launched Three Separate Phase 2 Studies with Top-line Data Expected Starting at the End of 2016 -

- U.S. Orphan Drug and Fast Track Designations Granted for Resunab™ for both Cystic Fibrosis and Systemic Sclerosis -

Norwood, MA (November 11, 2015) – Corbus Pharmaceuticals Holdings, Inc. (NASDAQ: CRBP) (“Corbus” or the “Company”), a

clinical stage drug development company targeting rare, chronic, and serious inflammatory and fibrotic diseases, announced today its financial results for the quarter ended September 30, 2015.

The Company also provided a corporate update and announced anticipated milestones related to the advancement of its Resunab™ clinical trial

programs. Resunab is a novel synthetic oral drug intended to resolve chronic inflammation and halt fibrosis. The drug is currently being evaluated in three separate Phase 2 clinical studies in cystic fibrosis (“CF”), diffuse

cutaneous systemic sclerosis, and skin-predominant dermatomyositis.

Recent Corporate Highlights

| |

• |

|

Received U.S. FDA Orphan Drug Designation, as well as a Fast Track development program designation, for Resunab for the treatments of both CF and systemic sclerosis; |

| |

• |

|

Commenced enrollment and dosing in an international, multi-center, Phase 2 double-blinded, randomized, placebo-control Resunab clinical study for the treatment of CF supported by a $5 million

development award from Cystic Fibrosis Foundation Therapeutics, Inc.; |

| |

• |

|

Commenced enrollment and dosing in a multi-center, double-blinded, randomized, placebo-control Phase 2 U.S. clinical study of Resunab for the treatment of systemic sclerosis; |

| |

• |

|

Commenced enrollment and dosing in the Phase 2 Resunab clinical study for the treatment of dermatomyositis being conducted at the University of Pennsylvania School of Medicine and supported by a grant from the

National Institute of Health; |

| |

• |

|

Presented additional data in October of 2015 at the North American Cystic Fibrosis Conference demonstrating that Resunab provided a benefit in treating lung inflammation and infection in a CF pre-clinical murine

model from the ongoing collaboration with Case Western Reserve University; and |

| |

• |

|

Successfully raised $11.3 million in total gross proceeds from 100% exercise of callable warrants. |

“I am very pleased to report that we continue to successfully execute and deliver on our milestones,”

stated Yuval Cohen, Ph.D., Chief Executive Officer of the Company. “We have successfully launched three Phase 2 studies of Resunab in three rare inflammatory diseases with significant unmet needs and have positioned the Company for performance

in 2016.”

Expected Near-Term Milestones

| |

• |

|

Continue to screen and enroll patients in both the Phase 2 studies in CF and in systemic sclerosis to remain on track for top-line safety and efficacy results by the end of 2016; |

| |

• |

|

Continue to collaborate with the University of Pennsylvania School of Medicine on the Phase 2 dermatomyositis study, which is expected to be completed during the first half of 2017; |

| |

• |

|

File for an EU Investigational Medicinal Products authorization for Resunab with the European Medicines Agency in the fourth quarter of 2015; and |

| |

• |

|

Conduct additional mechanism of action studies with Resunab in relevant pre-clinical models. |

“For the

remainder of 2015 and over the course of 2016 we will be focused on the solid execution of our clinical programs. Resunab continues to show its potential in offering a novel therapeutic approach to resolving chronic inflammation and halting

fibrosis, both of which are central to disease progression in CF, scleroderma and dermatomyositis,” stated Dr. Cohen. “We look forward to reporting top-line safety and efficacy results from our Phase 2 studies starting at the end of

2016.”

Summary of Financial Results for Third Quarter 2015

For the three months ended September 30, 2015, the Company reported a net loss of approximately $2,254,000 or $0.06 per diluted share, compared to a net

loss of approximately $660,000 or $0.03 per diluted share for the three months ended September 30, 2014. For the nine months ended September 30, 2015, the Company reported a net loss of approximately $6,352,000 or $0.22 per diluted share,

compared to a net loss of approximately $1,280,000 or $0.07 per diluted share for the nine months ended September 30, 2014. The increase in the net loss for the three and nine months ended September 30, 2015 is attributable to spending on

clinical trials for systemic sclerosis and cystic fibrosis and the costs associated with being a public company.

For the nine months ended

September 30, 2015, the Company received proceeds of approximately $11.3 million from the exercise of warrants. The Company’s cash balance increased by approximately $4 million during the third quarter of 2015 and the Company had

approximately $13.2 million of cash and cash equivalents on hand as of September 30, 2015. Following the dosing of the first patient in the CF trial in October 2015, the Company became eligible for a $1,250,000 milestone from Cystic Fibrosis

Foundation Therapeutics, Inc. under the terms of its developmental award. An additional $2.5 million in milestone payments remain available under the development award upon the Company’s achievement of certain milestones.

Based on management’s current projections, it believes the Company has sufficient financial resources to

fund operations into the fourth quarter of 2016.

About Resunab™

Resunab™ is a novel synthetic oral endocannabinoid-mimetic drug that preferentially binds to the CB2 receptor expressed on activated immune cells and

fibroblasts. CB2 activation triggers endogenous pathways that resolve inflammation and halt fibrosis. Pre-clinical and Phase 1 studies have shown Resunab to have a favorable safety, tolerability and pharmacokinetic profile. It has also demonstrated

promising potency in pre-clinical models of inflammation and fibrosis. Resunab triggers the production of “Specialized Pro-resolving Lipid Mediators” that activate an endogenous cascade responsible for the resolution of inflammation and

fibrosis, while reducing production of pro-inflammatory eicosanoids and cytokines. Resunab has direct effects on fibroblasts to halt tissue scarring. In effect, Resunab triggers endogenous pathways to turn “off” chronic inflammation and

fibrotic processes, without causing immunosuppression.

About Corbus

Corbus Pharmaceuticals Holdings, Inc. is a clinical stage pharmaceutical company focused on the development and commercialization of novel therapeutics to

treat rare, chronic and serious inflammatory and fibrotic diseases. Our lead product candidate, Resunab™ is a novel synthetic oral endocannabinoid-mimetic drug that resolves chronic inflammation, bacterial infections, and fibrotic processes.

Resunab is currently in Phase 2 studies for the treatment of cystic fibrosis, diffuse cutaneous systemic sclerosis and skin-predominant dermatomyositis.

For more information, please visit www.CorbusPharma.com and connect with the Company on Twitter, LinkedIn, Google+ and

Facebook.

Forward-Looking Statements

This

press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended,

including those relating to the Company’s product development, clinical and regulatory timelines, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities

and other statement that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s current beliefs and

assumptions.

These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,”

“anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential,” “predict,” “project,” “should,” “would” and similar expressions and the negatives

of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors which may cause actual results, performance or achievements to be materially different from

any future results, performance or achievements expressed or implied by the

forward-looking statements. Such factors include those set forth in the Company’s filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or

otherwise.

Investor Contact

Jenene Thomas

Jenene Thomas Communications, LLC

Phone: +1

(908) 938-1475

Email: jenene@jenenethomascommunications.com

Media Contact

David Schull or Marissa Goberdhan

Russo Partners, LLC

Phone: +1 (858) 717-2310

Email: david.schull@russopartnersllc.com

Email:

marissa.goberdhan@russopartnersllc.com

Source: Corbus Pharmaceuticals Holdings, Inc.

Corbus Pharmaceuticals Holdings, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Collaboration revenue |

|

$ |

170,454 |

|

|

$ |

— |

|

|

$ |

284,090 |

|

|

$ |

— |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

1,634,800 |

|

|

|

452,600 |

|

|

|

4,065,486 |

|

|

|

683,960 |

|

| General and administrative |

|

|

790,576 |

|

|

|

365,603 |

|

|

|

2,571,521 |

|

|

|

704,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

2,425,376 |

|

|

|

818,203 |

|

|

|

6,637,007 |

|

|

|

1,388,145 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(2,254,922 |

) |

|

|

(818,203 |

) |

|

|

(6,352,917 |

) |

|

|

(1,388,145 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

— |

|

|

|

(650 |

) |

|

|

(1,372 |

) |

|

|

(23,045 |

) |

| Interest income |

|

|

1,037 |

|

|

|

802 |

|

|

|

2,145 |

|

|

|

1,425 |

|

| Forgiveness of interest on note payable |

|

|

— |

|

|

|

7,466 |

|

|

|

— |

|

|

|

7,466 |

|

| Gain on the settlement of debt |

|

|

— |

|

|

|

145,006 |

|

|

|

— |

|

|

|

145,006 |

|

| Change in fair value of warrant liability |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(28,448 |

) |

| Foreign currency exchange loss |

|

|

— |

|

|

|

5,958 |

|

|

|

— |

|

|

|

5,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

1,037 |

|

|

|

158,582 |

|

|

|

773 |

|

|

|

107,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,253,885 |

) |

|

$ |

(659,621 |

) |

|

$ |

(6,352,144 |

) |

|

$ |

(1,280,208 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.07 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding, basic and diluted |

|

|

34,770,597 |

|

|

|

25,542,755 |

|

|

|

29,242,236 |

|

|

|

18,242,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corbus Pharmaceuticals Holdings, Inc.

Condensed Consolidated Balance Sheet

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

13,172,926 |

|

|

$ |

6,262,445 |

|

| Prepaid expenses |

|

|

98,376 |

|

|

|

270,556 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

13,271,302 |

|

|

|

6,533,001 |

|

|

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

13,730 |

|

|

|

13,728 |

|

| Property and equipment, net |

|

|

48,838 |

|

|

|

54,044 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

13,333,870 |

|

|

$ |

6,600,773 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Notes payable |

|

$ |

— |

|

|

$ |

144,389 |

|

| Accounts payable |

|

|

728,006 |

|

|

|

344,160 |

|

| Accrued expenses |

|

|

466,124 |

|

|

|

249,491 |

|

| Deferred revenue, current |

|

|

681,816 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,875,946 |

|

|

|

738,040 |

|

| Deferred revenue, non-current |

|

|

284,094 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

2,160,040 |

|

|

|

738,040 |

|

|

|

|

|

|

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

| Preferred Stock $0.0001 par value: 10,000,000 shares authorized, no shares issued and outstanding at September 30, 2015 and

December 31, 2014 |

|

|

— |

|

|

|

— |

|

|

|

|

| Common stock, $0.0001 par value; 150,000,000 shares authorized, 37,605,134 and 25,938,332 shares issued and outstanding at

September 30, 2015 and December 31, 2014 |

|

|

3,761 |

|

|

|

2,594 |

|

| Additional paid-in capital |

|

|

21,949,288 |

|

|

|

10,287,214 |

|

| Accumulated deficit |

|

|

(10,779,219 |

) |

|

|

(4,427,075 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

11,173,830 |

|

|

|

5,862,733 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

13,333,870 |

|

|

$ |

6,600,773 |

|

|

|

|

|

|

|

|

|

|

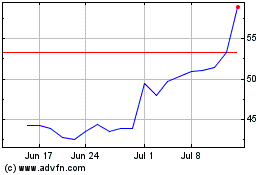

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

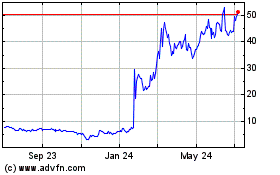

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Jul 2023 to Jul 2024