Cintas Beats, Ups 2012 Guidance - Analyst Blog

December 21 2011 - 11:02AM

Zacks

Cintas Corporation (CTAS) reported earnings of

57 cents per share for fiscal second quarter 2012 ending November

30. Results comfortably surpassed the Zacks Consensus Estimate of

48 cents and were 50% higher than the 38 cents earned in the

year-ago quarter.

Strong performance at all the segments except Document

Management Services helped in the better-than-forecast results.

However, the Document Management Services segment was affected by a

steep drop in recycled paper prices and poor results at its

European business due to the difficult economic environment.

Operational Update

Total revenue in the quarter under review increased 9% to a

record $1.02 billion, striding ahead of the Zacks Consensus

Estimate of $1 billion. Organic growth in the quarter was 7.0%.

Cost of rental uniforms and ancillary products increased 9% year

over year to $410 million and cost of services rose 6% to $179

million during the quarter. Selling general and administrative

expenses flared 3% on a year-over-year basis to $297 million.

Operating income during the quarter improved 25% to $133

million. Operating margin expanded 200 basis points year over year

to 13%.

Segment Update

Rental uniform and ancillary products revenue of $722.8 million

in the quarter increased 10% from $657.8 million in the year-ago

quarter. Uniform Direct Sales revenue grossed $111.9 million, up 3%

from $108.8 million in the year-ago quarter.

First Aid, Safety and Fire Protection revenue was $101.7

million, up 9% from the year-earlier quarter. Document Management

revenue of $82.75 million in the quarter increased 8% from $77

million in the year-ago quarter.

Financial Position

Cintas exited the quarter with cash and cash equivalent of

$207.8 million, an improvement from $150.3 million at first quarter

end. Long-term debt, at $1.06 billion, was flat sequentially. As of

November 30, 2011, the debt-to-capitalization ratio increased

marginally to 37.9% from 37.8% as of August 31, 2011.

Cash flow from operations was $176 million during the first half

of fiscal 2012, up from $109 million in the year-ago comparable

period. Free cash flow improved substantially to $96.2 million in

the fiscal first half from $21 million in the first half of

2011.

Cintas’ Board of Directors approved a new $500 million share

buyback authorization in October, but the company has not made any

purchases under the program during the quarter.

Looking Ahead

Cintas, in fiscal 2012, expects to generate revenue in the band

of $4.075 billion to $4.125 billion, up from the previous

expectation of $4.0 billion to $4.1 billion. Earnings are now

projected in the range of $2.16 to $2.20 per share in place of the

prior range of $1.97 to $2.05 per share.

The company expects capital expenditure to be between $180

million and $200 million in fiscal 2012.

Our Take

We are encouraged by the solid organic growth and margin

expansion displayed by Cintas. Furthermore, Cintas’ solid balance

sheet and cash flow characteristics support a renewed repurchase

authorization and a dividend hike. However, cost headwinds from

cotton and energy and the uncertain economic environment remain

concerns.

We retain our Neutral rating on Cintas Corporation. The

quantitative Zacks #3 Rank (short term Hold rating) for the company

indicates no clear directional pressure on the shares over

the near term.

Cincinnati, Ohio-based Cintas Corporation designs, manufactures

and implements corporate identity uniform programs, and provides

entrance mats, restroom supplies, promotional products, and first

aid and safety products for approximately 900,000 businesses.

Cintas competes with G&K Services Inc. (GKSR)

and privately held Alsco Inc. and ARAMARK Corporation.

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

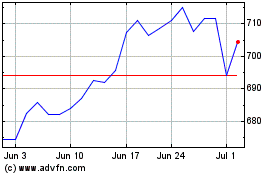

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

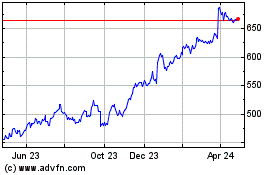

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024