Cintas Downgraded to Neutral - Analyst Blog

November 28 2011 - 10:00AM

Zacks

We have recently downgraded

Cintas Corporation (CTAS) from Outperform to

Neutral as the positives like solid organic growth and margin

expansion are undercut by headwinds from cotton and energy prices

and an uncertain economic environment.

In the first quarter of 2012,

Cintas reported earnings of 52 cents per share, comfortably

surpassing the Zacks Consensus Estimate of 47 cents and 30% higher

than the 40 cents earned in the year-ago quarter. Strong

performance across all its business segments helped the company to

deliver better-than-expected results.

Total revenue in the quarter under

review increased 10.1% to $1.02 billion, striding ahead of the

Zacks Consensus Estimate of $0.998 billion. The quarter marked the

second consecutive period of double-digit revenue growth.

Cintas, in fiscal 2012, expects to

generate revenue in the band of $4.0 billion to $4.1 billion and

EPS in the range of $1.97 to $2.05. The Zacks Consensus Estimates

for revenue and EPS are at $4.075 billion and $2.04,

respectively.

During the recession, Cintas

sharpened its operations by evaluating sales force productivity,

optimizing routes and streamlining labor overhead. The company

returned to year-over-year organic revenue growth in mid-2010 not

looking back since then. In the recently reported quarter, the

company posted solid organic growth of 7.6%, reflecting the sixth

consecutive quarter of a year-over-year rise. The organic growth of

7.6% was almost on par with a rise of 8% recorded in the fourth

quarter of 2011, marking a five-year high and a distinct

improvement over the 2.8% growth recorded in the year-ago quarter.

Though the macro environment can limit Cintas’ growth prospects,

the company has the wherewithal to drive growth by adding

additional salespersons and increasing sales productivity.

On the margin front, Cintas

continues to expand through better sales productivity and cost

efficiencies, offsetting the rising headwinds from higher energy

and other input costs. During the first quarter of fiscal 2012,

gross margin increased 60 basis points to 43.2% and operating

margin expanded an impressive 170 basis points to 12.6%, the third

consecutive quarter of strong operating margin expansion after

several years of declines. This performance was commendable

considering the ongoing headwinds from higher energy and garment

material prices.

Cintas recently raised its

quarterly dividend by 5 cents to 54 cents, the 29th straight year

of the company’s dividend hike, translating into a 10.2% increase

from the prior dividend of 49 cents. The company has religiously

hiked its dividend each year starting from 1983, the year it went

public. We believe Cintas’ solid balance sheet and cash flow

characteristics support a renewed repurchase authorization and a

dividend hike.

On the flipside, Cintas draws 70%

of revenue from its core uniform rental segment, which is in the

saturation stage. The company is constantly making efforts to

innovate and focus on its other businesses, including direct

uniform sales, first aid safety, fire protection and document

management. However, in doing so, the additional resources and time

involved in developing these growing segments may affect Cintas'

profitability.

The quarter was plagued by rising

costs such as cotton for uniforms and diesel fuel for trucks. These

costs could pressure profitability in 2012, particularly in the

Rental segment. Management reiterated expectations for a $15

million impact from higher cotton prices.

Cintas’ revenue largely depends

upon the service industry, including hotels, airlines, restaurants,

etc. Any drop in the employment rate can adversely impact the

company’s profitability.

We have thus downgraded our

recommendation on Cintas Corporation from Outperform to Neutral.

The quantitative Zacks #2 Rank (short-term Buy rating) for the

company indicates upward pressure on the stock over the near

term.

Cincinnati, Ohio-based Cintas

Corporation designs, manufactures and implements corporate identity

uniform programs, and provides entrance mats, restroom supplies,

promotional products, and first aid and safety products for

approximately 900,000 businesses. Cintas competes

with G&K Services Inc. (GKSR) and

privately held Alsco Inc. and ARAMARK Corporation.

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

Zacks Investment Research

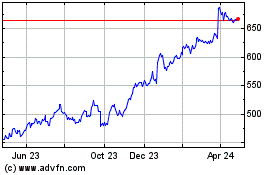

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

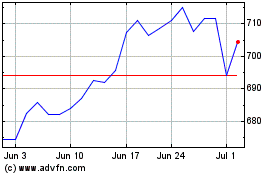

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024