Cintas and NFCC Issue Annual Top 11 Tips for Protecting Personal Data in 2011 in Honor of Data Privacy Day

January 27 2011 - 12:01PM

Business Wire

The Federal Trade Commission estimates that more than 9 million

Americans fall victim to identity fraud each year. Identity theft

can cost a consumer thousands of dollars and severely damage their

credit report. In honor of Data Privacy Day, observed on Jan. 28,

Cintas Corporation (NASDAQ: CTAS) and the National Foundation for

Credit Counseling (NFCC) today issued a list of top 11 data

protection tips to help consumers avoid identity theft.

“Identity theft is a serious issue and anyone who doesn’t take

precaution is putting themselves at risk of becoming the next

victim,” said Gail Cunningham, spokesperson for the NFCC. “Being

aware and proactively protecting yourself from identity theft is

much easier than cleaning up the pieces after being exploited.”

The top 11 tips to protect personal information include:

1. Shred all documents containing confidential

information. A home office strip shredder may not fully protect

you. Identity thieves can simply use tape to put the pieces back

together or reconstruct your documents using software. Instead,

consider using a secure document management provider to shred all

documents and files. Ensure your provider is AAA NAID Certified and

PCI DSS compliant. These organizations verify adherence to

stringent security practices and standards defined by the

specialists in the information destruction industry.

2. Guard your Social Security card. Your Social Security

number is the gateway to your identity. Never carry it in your

wallet. Also, check to see if your number is printed on any other

cards you routinely carry with you.

3. Routinely monitor accounts online. Monitoring accounts

on a regular basis enables you to notice suspicious or irregular

activity before receiving your statements or bills in the mail.

4. Keep personal information private. Secure your

personal data at work and educate yourself on your company’s

personal information policies. Keep your information private at

home as well, especially if you have roommates or employ outside

help.

5. Suggest a “shred-all” policy at work. Many companies

are now implementing shred-all policies in the work environment to

protect confidential business and personal information.

Organizations can implement a program by partnering with a secure

document management provider. The right provider will place secure,

locked bins throughout a facility for easy accessibility. Employees

can drop business and personal documents that need to be destroyed

in the certified bins. A provider will visit the facility on a

routine basis to securely remove, destroy and recycle the

documents.

6. Check credit reports regularly. The three major credit

bureaus offer annual free credit reports. Space out your free

reports to monitor your credit activity throughout the year. Visit

www.annualcreditreport.com to learn more information and request a

free report.

7. Use unique passwords. Avoid using obvious passwords,

such as a birth date, maiden name or Social Security number.

8. Practice safe online habits. Social networking sites

often contain outside links and applications that ask for personal

information. Use caution when revealing any information on such

links or Web sites sent from unsolicited emails. Keep firewalls,

anti-spyware and anti-virus software up to date on your

computer.

9. Protect personal information while on vacation. Keep

track of items in your wallet or purse and be sure you return from

vacation with everything you left with. Prepare for the worst by

copying the front and back of all credit cards and placing the copy

in a safe place. This way, you’ll have the name of the issuer,

account number and customer service number at your fingertips.

Prior to leaving, keep personal plans to yourself or a limited

number of friends. Broadcasting travel plans and the dates you will

be away through social networks gives identity thieves an

opportunity to search your information.

10. Explain cautions to children. Children may not

realize the risk of revealing personal information on social media

sites such as Facebook.

11. Use a secure mailbox. Make sure your mailbox is

approved by the United States Post Office. Another secure option is

to mail items directly from a post office location. Also, never

clip outgoing mail to your mailbox and always have new checks

delivered to a post office box or the bank.

“As consumers, we are all at risk of identity theft during

numerous points throughout the day,” said Karen Carnahan, President

and COO, Cintas Document Management. “By following these simple

tips and being informed of the risks associated with improper

document management, consumers can greatly reduce their chance of

becoming a victim.”

Cintas is the first North American AAA NAID-certified and PCI

DSS compliant document management provider. It provides

cost-effective document shredding, storage and imaging programs.

Cintas’ services are designed to provide businesses with data

privacy and security, compliance with regulatory requirements and

greater control and access to information.

For more information about Cintas Document Management services,

please visit www.cintas.com/documentmanagement.

About Cintas Corporation:

Headquartered in Cincinnati, Ohio, Cintas Corporation provides

highly specialized services to businesses of all types. Cintas

designs, manufactures and implements corporate identity uniform

programs, and provides entrance mats, restroom supplies,

promotional products, first aid and safety products, fire

protection services and document management services to

approximately 800,000 businesses. Cintas is a publicly held company

traded over the Nasdaq National Market under the symbol CTAS, and

is a component of the Standard & Poor's 500 Index.

About the National Foundation for Credit Counseling

The National Foundation for Credit Counseling (NFCC), founded in

1951, is the nation’s largest and longest serving national

nonprofit credit counseling organization. The NFCC’s mission is to

promote the national agenda for financially responsible behavior

and build capacity for its Members to deliver the highest quality

financial education and counseling services. NFCC Members annually

help four million consumers through close to 800 community-based

offices nationwide. For free and affordable confidential advice

through a reputable NFCC Member, call (800) 388-2227, (en Español

(800) 682-9832) or visit www.nfcc.org. Visit us on Facebook at

http://www.facebook.com/NFCCDebtAdvice and on Twitter at

http://twitter.com/NFCCDebtAdvice.

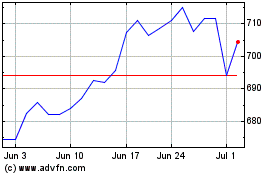

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

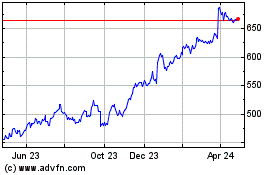

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024