Cintas Enables Companies to Comply with the New FTC Red Flags Rule

May 27 2010 - 6:00AM

Business Wire

Effective June 1, 2010, the Federal Trade Commission (FTC) will

begin enforcing its Red Flags Rule. This regulation requires

creditors and financial institutions that maintain one or more

covered accounts to adopt written identity theft programs. The

program was implemented as part of the Fair and Accurate Credit

Transactions Act of 2003 (FACTA), to help prevent and reduce harm

from identity theft. Cintas, the leader in secure document

management, advises clients about the new rule and offers services

to help companies achieve compliance and better serve their

customers.

“According to the Javelin 2010 Identity Fraud Survey Report,

identity fraud reached an all-time high in 2009,” said Karen

Carnahan, President and COO of Cintas Document Management. “Now

more than ever, it’s important for companies to take a proactive

approach and comply with the Red Flags Rule to protect their

customers from the damaging effects of identity theft.”

The Red Flags Rule program was designed to help recognize and

detect warning signs before identity theft occurs. Companies that

do not comply may face civil penalties of up to $3,500 per

violation. Creditors, which are considered to be any entity that

regularly extends, renews or continues credit, and financial

institutions such as banks and credit unions, must meet the terms

if they maintain one or more covered accounts. A covered account is

an account used for personal, family or household purposes that

involve multiple payments or transactions, such as credit card

accounts, mortgage loans and utility accounts.

To achieve compliance, companies are required to develop and

maintain an appropriate written identity theft prevention program;

based on its size and potential risk of identity theft. Each

company must have the appropriate mechanisms to identify and detect

relevant red flags and have the ability to eliminate and mitigate

identity theft. Companies must also review and update their

programs regularly to provide optimal protection.

To help companies comply with the new Red Flags Rule and other

regulations, Cintas offers personalized document management

consultation, as well as secure document shredding, storage and

imaging programs. Its services are designed to provide businesses

with data privacy and security, compliance with regulatory

requirements and more efficient control and access to information.

Cintas is the first NAID-certified and PCI DSS compliant document

management provider in North America.

“The Red Flags Rule serves as a catalyst that will help

companies maintain trustworthy business practices and provide

customers with maximum protection from fraud,” added Carnahan. “By

utilizing Cintas’ document management services, companies will not

only reach compliance but will have a customized, secure solution

that will ensure all business information remains safe and

confidential.”

For more information on Cintas’ document management programs,

please visit www.cintas.com/documentmanagement.

About Cintas Corporation:

Headquartered in Cincinnati, Ohio, Cintas Corporation provides

highly specialized services to businesses of all types. Cintas

designs, manufactures and implements corporate identity uniform

programs, and provides entrance mats, restroom supplies,

promotional products, first aid and safety products, fire

protection services and document management services to

approximately 800,000 businesses. Cintas is a publicly held company

traded over the Nasdaq National Market under the symbol CTAS, and

is a Nasdaq-100 company and component of the Standard & Poor's

500 Index.

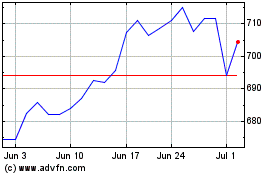

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

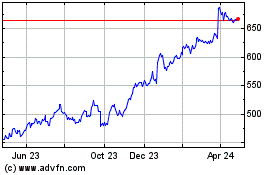

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024