0000895126false00008951262023-08-112023-08-110000895126us-gaap:CommonStockMember2023-08-112023-08-110000895126chk:ClassAWarrantsToPurchaseCommonStockMember2023-08-112023-08-110000895126chk:ClassBWarrantsToPurchaseCommonStockMember2023-08-112023-08-110000895126chk:ClassCWarrantsToPurchaseCommonStockMember2023-08-112023-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 11, 2023

| | | | | | | | | | | | | | | | | | | | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| (Exact name of Registrant as specified in its Charter) |

| Oklahoma | | 1-13726 | | 73-1395733 |

(State or other jurisdiction of

incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

| 6100 North Western Avenue | Oklahoma City | OK | | 73118 |

| (Address of principal executive offices) | | (Zip Code) |

| | (405) | 848-8000 | | | |

| (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | CHK | | The Nasdaq Stock Market LLC |

| Class A Warrants to purchase Common Stock | | CHKEW | | The Nasdaq Stock Market LLC |

| Class B Warrants to purchase Common Stock | | CHKEZ | | The Nasdaq Stock Market LLC |

| Class C Warrants to purchase Common Stock | | CHKEL | | The Nasdaq Stock Market LLC |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 8.01 Other Events.

On August 11, 2023, Chesapeake, through its wholly owned subsidiaries Chesapeake Exploration, L.L.C., Chesapeake Operating, L.L.C., Chesapeake Energy Marketing, L.L.C. and Chesapeake Royalty, L.L.C., entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with SilverBow Resources Operating, LLC, a subsidiary of SilverBow Resources, Inc. (“Buyer”) to sell the remaining portion of its Eagle Ford assets (the “Transaction”). Under the terms of the Purchase Agreement, Chesapeake has agreed to sell approximately 42,000 net acres and approximately 540 wells, along with related property, plant and equipment.

Under the terms and conditions of the Purchase Agreement, which has an economic effective date of February 1, 2023, the aggregate consideration to be paid to Chesapeake in the Transaction will consist of $700,000,000, comprised of (i) cash in the amount of $650,000,000, due at the closing of the Transaction, subject to certain purchase price adjustments and (ii) cash in the amount of $50,000,000 due on the first anniversary of the closing of the Transaction. Subject to satisfaction of certain commodity price triggers, Chesapeake may also receive additional cash consideration in an amount up to $50,000,000 shortly following the first anniversary of closing of the Transaction. Pursuant to the Purchase Agreement, upon the execution of the Purchase Agreement, Buyer deposited $50,000,000 into escrow, which will be credited toward the cash consideration payable at the closing of the Transaction.

The Purchase Agreement provides that the closing of the Transaction is subject to the satisfaction or waiver of customary closing conditions, including, among others, (i) the accuracy of the representations and warranties of each party (subject to specified materiality standards and customary qualifications), (ii) compliance by each party in all material respects with their respective covenants, (iii) the receipt of third party consents; (iv) the absence of any governmental litigation related to the Transaction and (v) the expiration or termination of all waiting periods imposed under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

Exhibit No. | | Document Description |

| | Chesapeake Energy Corporation press release dated August 14, 2023. |

104.0 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| |

| |

| By: | /s/ MOHIT SINGH |

| Mohit Singh |

| Executive Vice President and Chief Financial Officer |

Date: August 14, 2023

| | | | | |

| Exhibit 99.1 |

| N E W S R E L E A S E | |

FOR IMMEDIATE RELEASE

AUGUST 14, 2023

CHESAPEAKE ENERGY CORPORATION ANNOUNCES SALE OF FINAL EAGLE FORD PACKAGE FOR $700 MILLION

Total Proceeds from Eagle Ford Exit to Top $3.5 billion

OKLAHOMA CITY, August 14, 2023 – Chesapeake Energy Corporation (NASDAQ:CHK) today announced that it has executed an agreement to sell its remaining Eagle Ford assets to SilverBow Resources, Inc. (NYSE:SBOW) for $700 million, bringing the total proceeds from its Eagle Ford exit to more than $3.5 billion.

“We are pleased to have successfully completed the exit of our Eagle Ford asset, allowing us to focus our capital and team on the premium rock, returns and runway of our Marcellus and Haynesville positions,” said Chesapeake President and Chief Executive Officer Nick Dell’Osso. “I want to thank our employees who built a culture of safety and excellence, which made this a powerful and attractive asset.”

Chesapeake has agreed to sell approximately 42,000 net acres and approximately 540 wells in the condensate rich portion of its Eagle Ford asset located in Dimmit and Webb counties, along with related property, plant and equipment. During the second quarter of 2023, average net daily production from these properties was approximately 29,000 barrels of oil equivalent (boe) (60% liquid) which generated approximately $50 million of EBITDAX. As of December 31, 2022, net proved reserves associated with these properties were approximately 124 million barrels of oil equivalent (mmboe).

Chesapeake expects the transaction will close, subject to certain regulatory approvals and consents, in 2023, with an effective transaction date of February 1, 2023. The company will receive $650 million upon closing, subject to customary adjustments, with the final $50 million installment paid one year from the closing date. SilverBow has also agreed to pay Chesapeake an additional contingent payment of $25 million should oil prices average between $75 and $80 per barrel WTI NYMEX or $50 million should WTI NYMEX prices average above $80 during the year following the close of the transaction, which could increase total proceeds of the deal to $750 million. Chesapeake anticipates the proceeds will be available to further strengthen its balance sheet and for its share repurchase program.

RBC Capital Markets, Citi, and Evercore are serving as financial advisors, Haynes and Boone, LLP is serving as legal advisor, and DrivePath Advisors is serving as communications advisor to Chesapeake.

Headquartered in Oklahoma City, Chesapeake Energy Corporation is powered by dedicated and innovative employees who are focused on discovering and responsibly developing leading positions in top U.S. oil and gas plays. With a goal to achieve net zero GHG emissions (Scope 1 and 2) by 2035, Chesapeake is committed to safely answering the call for affordable, reliable, lower carbon energy.

| | | | | | | | |

| | |

| INVESTOR CONTACT: | MEDIA CONTACT: | CHESAPEAKE ENERGY CORPORATION |

Chris Ayers (405) 935-8870 ir@chk.com | Brooke Coe (405) 935-8878 media@chk.com | 6100 North Western Avenue P.O. Box 18496 Oklahoma City, OK 73154 |

This news release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements other than statements of historical fact. They include statements that give our current expectations, management’s outlook guidance or forecasts of future events, expected natural gas and oil growth trajectory, projected cash flow and liquidity, our ability to enhance our cash flow and financial flexibility, dividend plans, future production and commodity mix, plans and objectives for future operations, ESG initiatives, the ability of our employees, portfolio strength and operational leadership to create long-term value, and the assumptions on which such statements are based. Although we believe the expectations and forecasts reflected in our forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time.

Factors that could cause actual results to differ materially from expected results include those described under “Risk Factors” in Item 1A of our annual report on Form 10-K and any updates to those factors set forth in Chesapeake’s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K (available at http://www.chk.com/investors/sec-filings). These risk factors include: the risk that we may not be able to successfully close the divestiture transaction with SilverBow; the volatility of oil, natural gas and NGL prices; the limitations our level of indebtedness may have on our financial flexibility; our inability to access the capital markets on favorable terms; the availability of cash flows from operations and other funds to fund cash dividends, to finance reserve replacement costs or satisfy our debt obligations; write-downs of our oil and natural gas asset carrying values due to low commodity prices; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil, natural gas and NGL reserves and projecting future rates of production and the amount and timing of development expenditures; our ability to generate profits or achieve targeted results in drilling and well operations; leasehold terms expiring before production can be established; commodity derivative activities resulting in lower prices realized on oil, natural gas and NGL sales; the need to secure derivative liabilities and the inability of counterparties to satisfy their obligations; adverse developments or losses from pending or future litigation and regulatory proceedings, including royalty claims; charges incurred in response to market conditions; drilling and operating risks and resulting liabilities; effects of environmental protection laws and regulations on our business; legislative and regulatory initiatives further regulating hydraulic fracturing; our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used; impacts of potential legislative and regulatory actions addressing climate change; federal and state tax proposals affecting our industry; potential OTC derivatives regulation limiting our ability to hedge against commodity price fluctuations; competition in the oil and gas exploration and production industry; a deterioration in general economic, business or industry conditions; negative public perceptions of our industry; limited control over properties we do not operate; pipeline and gathering system capacity constraints and transportation interruptions; terrorist activities and cyber-attacks adversely impacting our operations; and an interruption in operations at our headquarters due to a catastrophic event.

In addition, disclosures concerning the estimated contribution of derivative contracts to our future results of operations are based upon market information as of a specific date. These market prices are subject to significant volatility. Our production forecasts are also dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. We caution you not to place undue reliance on our forward-looking statements that speak only as of the date of this news release, and we undertake no obligation to update any of the information provided in this news release, except as required by applicable law. In addition, this news release contains time-sensitive information that reflects management’s best judgment only as of the date of this news release.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassAWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassBWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassCWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

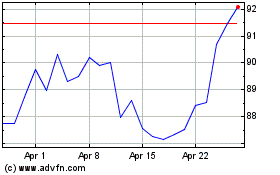

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2024 to May 2024

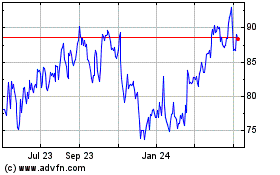

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From May 2023 to May 2024