CORRECT: For-Profit Schools Could See Bigger Hit From Debt Rule

August 16 2010 - 1:12PM

Dow Jones News

Some for-profit colleges, whose shares were being pummeled

Monday, are objecting to U.S. Department of Education data that

suggests students are paying back loans at surprisingly low

rates.

Some of the schools are arguing their internal estimates of loan

repayment rates are better than the department's findings and are

expressing frustration with what they say is the agency's

unwillingness to share data supporting the calculations. The

schools could face tough new regulations stripping them of access

to federal funds if their students are found to have heavy debt

burdens. Some argue the department is punishing schools for having

graduates enroll in loan deferment programs that the government

itself supports.

Earlier this summer, the department proposed a rule intended to

measure how well for-profit schools train students for gainful

employment in a recognized occupation. Late Friday, the department

issued its calculations on loan repayment rates for more than 8,000

schools in an attempt to preview the rule's potential impact were

it to be implemented. Schools could "pass" based on student loan

repayment rates, or by maintaining a debt-to-income ratio below a

certain percent.

The rule would also apply to non-profit schools with vocational

programs, though the government expects for-profit schools to bear

the brunt of any penalties.

"Community colleges are subject to the rule, but we don't

believe that they're going to be impacted by the rule because the

vast majority of community college students do not borrow," said

David Bergeron, acting deputy assistant secretary for policy,

planning and innovation at the department's Office of Postsecondary

Education.

Shares of for-profit schools sank Monday as investors digested

the data.

Strayer Education Inc. (STRA), considered among the most

shielded from the proposed rule because of its large proportion of

students in bachelor's and graduate degree programs and

historically low loan default rate, was trading off 12.3% to

$175.2. Corinthian Colleges Inc. (COCO) was down 20.3% to $5.31,

ITT Educational Services Inc. (ESI) was off 12% to $56.59 and

Capella Education Co. (CPLA) was down 12.3% to $61.59. Washington

Post Co. (WPO) was off 7.8% to $316.82.

Strayer, Corinthian, ITT, Capella and Washington Post all hit

52-week lows earlier Monday.

Strayer, which late last month said it believed its programs

would clear the department's highest proposed hurdle of loan

repayment by 45% of graduates, scored a 25% school-wide. The

company had noted last month that it was difficult to measure rates

exactly because loan consolidation complicates the measure of

repayment.

The school said on a conference call early Monday that it would

file a Freedom of Information Act request to see some of the data

on which the Department based its calculations, calling the data

"inaccurate," "nonsensical" and "arbitrary."

"This discrepancy has significant operational, financial, and

public policy implications," Strayer said in a statement

Saturday.

"The fact that [Strayer] had among the lowest repayment rates

among the publicly held group despite having relatively low cohort

default rates leads us to question the validity of this data

series," said Jeff Silber of BMO Capital Markets.

Kelly Flynn of Credit Suisse agreed, calling the data "odd," and

noting that she is "not completely confident the figures are 100%

correct."

Still, given the stock reaction, Flynn cut her price targets on

ITT Education to $57 from $78, Education Management to $11 from $21

and Strayer to $180 from $220.

Capella Education also questioned the data, saying the 40%

repayment rate across its schools was inconsistent with findings

from an internal analysis it had conducted of its larger programs.

According to that calculation, the programs would have a repayment

rate above the 45% threshold. Capella said it has requested to see

the Department's underlying data and methodology.

Washington Post Co., whose Kaplan unit had a weighted average

repayment rate of 28%, expressed concern Monday about the

implications of the department's data. The company said if

program-level repayment rates are similar to the data provided

Friday, a significant number of Kaplan schools could become

ineligible for federal student aid, which "could have a materially

adverse effect on the future results of the Company's higher

education division."

Based on Friday's data, Universal Technical Institute Inc.

(UTI), Grand Canyon Education Inc. (LOPE), American Public

Education Inc. (APEI) and Bridgepoint Education Inc. (BPI) had the

highest repayment rates among publicly traded for-profit schools,

all above the 45% threshold. Corinthian, Washington Post Co.'s

Kaplan and ITT were among the lowest performers.

Apollo Group Inc. (APOL) shares were up 6.5% as the company's

University of Phoenix posted a repayment rate of 44.2%, higher than

most analysts expected, and Universal Technical Institute shares

rose 9.7% to $16.28 as its 52% repayment rate also pleased

investors.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

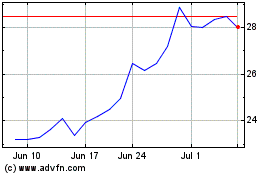

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From May 2024 to Jun 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2023 to Jun 2024