American Superconductor Misses - Analyst Blog

November 10 2011 - 3:45AM

Zacks

Wind turbine technology company, American Superconductor

Corporation (AMSC) reported a loss for

its second quarter of fiscal year 2011 ending September 30, 2011.

In the reported quarter the company digested a net loss of $1.02

per share, far above the Zacks Consensus Estimate of a loss of 73

cents and the prior year's profit of 17 cents.

Operational Statistics

American Superconductor’s total revenue of $20.8 million in the

reported quarter was far lower than $98.1 million in the year-ago

period. Also, the quarterly revenue came in below the Zacks

Consensus Estimate of $22 million.

The year-over-year decline is due primarily to lack of revenue

from the company’s former customer, Sinovel Wind Group Co., Ltd.

Wind segment’s revenue was $13.4 million versus $89.3 million in

the year-ago period. Grid Segment’s revenue was $7.4 million versus

$8.8 million in the year-ago period.

Reported quarterly results included approximately $28.2 million

in charges related to the termination of American Superconductor’s

proposed acquisition of Finnish rival The Switch Engineering Oy.

The transaction was terminated due mainly to funding problems as

well as Sinovel litigation expenses and corporate restructuring

activities and impairments. Overall the company reported a net loss

of $51.71 million compared to the prior year's net income of $7.84

million.

Financial Update

Cash, cash equivalents, marketable securities and restricted

cash as on September 30, 2011 were $98.9 million versus $239.9

million as of fiscal year 2010 ending on March 31, 2011. Cash used

in operating activities during the first six months of fiscal 2011

was $106.9 million versus $1.9 million of cash used in operating

activities in the year-ago period.

Guidance

American Superconductor expects for the third quarter of fiscal

year 2011 ending December 31, 2011, its net loss will be less than

$30 million or $0.59 per share. The company also anticipated that

for the aforementioned period its revenues would exceed $15

million.

Our Take

Devens, Massachusetts-based American Superconductor offers an

array of proprietary technologies and solutions spanning the

electric power infrastructure, including generation to delivery to

end-use. The company is a lead player in megawatt-scale wind

turbine designs and electrical control systems.

American Superconductor’s performance was impacted by business

and contractual issues with its largest customer in China --

Sinovel Wind Group Co. Ltd. Earlier, American Superconductor’s

revenue growth largely depended on its customer Sinovel, China's

largest and the world's third largest wind turbine

manufacturer.

However, since April 2011, Sinovel bogged down by high inventory

levels refused to accept further shipments from the company.

Sinovel also was unable to pay for past shipments worth $56

million.

American Superconductor is currently suing Sinovel for payments

for past shipments, and compensation for infringement of

intellectual property rights. American Superconductor alleges that

Sinovel illegally obtained and used its proprietary technology to

upgrade its 1.5 megawatt wind turbines to meet proposed Chinese

grid codes.

Consequently, we advise investors not to take any new position

over the Neutral-rated American Superconductor stock. In the

near-term, its Zacks #5 Rank (Strong Sell) clearly suggests an exit

strategy. However, American Superconductor’s Zacks #1 Rank (Strong

Buy) peers, like CalAmp Corp.

(CAMP) and OSI Systems, Inc.

(OSIS) look attractive.

AMER SUPERCON (AMSC): Free Stock Analysis Report

CALAMP CORP (CAMP): Free Stock Analysis Report

OSI SYSTEMS INC (OSIS): Free Stock Analysis Report

Zacks Investment Research

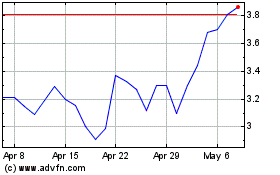

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From May 2024 to Jun 2024

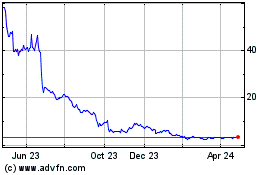

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2023 to Jun 2024