Business First Bancshares, Inc. (Nasdaq: BFST) (Business First),

parent company of b1BANK, today announced its unaudited results for

the quarter ended March 31, 2023, including net income available to

common shareholders of $13.7 million, or $0.54 per diluted common

share, decreases of $2.9 million and $0.13, respectively, from the

linked quarter, and increases of $5.0 million and $0.13,

respectively, from the quarter ended March 31, 2022. On a non-GAAP

basis, core net income for the quarter ended March 31, 2023, which

excludes certain income and expenses, was $13.8 million, or $0.55

per diluted common share, decreases of $2.6 million and $0.11,

respectively, from the linked quarter, and increases of $3.5

million and $0.06, respectively, from the quarter ended March 31,

2022.

“With over 100,000 clients spread out over

diverse MSAs, a successful record of growing organically and

through acquisition, and a history of taking care of clients

through multiple years of crises, we have laid the foundation of a

franchise built to last,” said b1BANK President & CEO Jude

Melville. “Our first quarter results both demonstrate our

resilience as a company and illustrate opportunities to continue

improving efficiency, profitability and capital allocation over the

coming years. We are here for our partners as we together navigate

the current uncertainty and are positioned to help them thrive once

the economy heals.”

On April 27, 2023, Business First’s board

of directors declared a quarterly preferred dividend in the amount

of $18.75 per share, which is the full quarterly dividend of 1.875%

based on the per annum rate of 7.50%. Additionally, the board of

directors declared a quarterly common dividend based upon financial

performance for the first quarter in the amount of $0.12 per share,

same as the prior quarter. The preferred and common dividends will

be paid on May 31, 2023, or as soon thereafter as practicable, to

the shareholders of record as of May 15, 2023.

Quarterly Highlights

- Return on

Assets and Equity. Return to common shareholders on

average assets and common equity, each on an annualized basis, were

0.91% and 10.73%, respectively, for the quarter ended March 31,

2023, compared to 1.12% and 13.56%, respectively, for the linked

quarter, and 0.72% and 7.94% for the quarter ended March 31, 2022.

Non-GAAP core return on average assets and common equity, each on

an annualized basis, were 0.91% and 10.81%, respectively, for the

quarter ended March 31, 2023, compared to 1.10% and 13.37%,

respectively, for the linked quarter, and 0.85% and 9.33% for the

quarter ended March 31, 2022.

- Shareholder

Value. Total shareholders’ equity increased $17.2 million

from the linked quarter due to $6.2 million improvement in

accumulated other comprehensive income (AOCI) and $13.7 million in

net income available to common shareholders, offset by $3.0 million

in common dividends. Book value per share increased $0.52, or

2.53%, and non-GAAP tangible book value per share increased $0.56,

or 3.51% from the linked quarter. AOCI has improved $16.7 million

from its low of $(84.7) million at September 30, 2022, to $(68.0)

million as of March 31, 2023.

-

Deposits. Branch deposits remained stable,

increasing $2.4 million from the linked quarter, with new account

openings continuing to outpace 2022 trends. Other corporate

deposits (comprised of financial institution group (FIG), brokered,

and listed certificates of deposits) decreased $16.6 million from

the linked quarter. Overall, total deposits decreased $14.2 million

or 0.29%, 1.19% annualized, for the quarter ended March 31, 2023,

due to a $29.0 million decrease in the financial institutions group

(FIG) deposit base. As of March 31, 2023, Business

First held approximately 103,020 deposit accounts with an average

balance of approximately $46,650, of which $1.5 billion or 30.65%

were uninsured by the FDIC. Excluding public funds, which are

secured by securities or Federal Home Loan Bank (FHLB) letters of

credit, the unsecured deposit total is approximately $1.0 billion,

or 21.33% of total deposits.

- Access to

Liquidity. As of March 31, 2023, Business First had

approximately $1.8 billion of primary and secondary liquidity. On

April 11, 2023, Business First opened lines of credit through the

Federal Reserve Discount Window totaling $949.5 million, increasing

current liquidity to approximately $2.7 billion.

- Credit

Quality. Credit performance remains strong from linked

quarter and year-over-year comparisons. The ratios of nonperforming

loans compared to loans held for investment and nonperforming

assets compared to total assets were 0.29% and 0.23%, respectively,

at March 31, 2022, 0.25% and 0.21%, respectively, at December 31,

2022, and 0.36% and 0.29% at March 31, 2023. The increases for the

quarter ended March 31, 2023, were attributable to accounting

guidance no longer applicable which previously excluded certain

acquired impaired loans from nonperforming ratios.

- ASU 2016-13

Adoption (i.e., Current Expected Credit Loss). On January

1st, 2023, Business First adopted the Current Expected Credit Loss

(CECL) model. The adoption of CECL increased the allowance for loan

losses and reserve for unfunded commitments, collectively called

the allowance for credit losses, by $2.7 million and $3.2 million,

respectively. The increases were offset by a $4.8 million

reclassification of loan discount to allowance for loan losses for

previously acquired impaired loans, resulting in a net $1.1 million

pre-tax decrease to shareholder’s equity on the date of

adoption.

Statement of Financial

Condition

Loans

Loans held for investment increased $196.9

million or 4.27%, 17.33% annualized, from the linked quarter. Loan

growth from the linked quarter was attributed to originations in

the commercial, $85.5 million, real estate construction, $65.6

million, and real estate commercial, $35.1 million, portfolios.

Approximately $60.7 million of the $65.6 million growth, 92.56%, in

the real estate construction portfolio was attributable to fundings

associated with commitments made in 2022. These three loan

portfolios accounted for 94.53% of the loan growth for the quarter

ended March 31, 2023.

The Dallas Fort Worth region produced 53.52% of

total loan growth from the linked quarter based on unpaid principal

balance, while Business First also continued to originate growth

from several other key strategic markets, 14.62% from the Greater

New Orleans region and 13.82% from the Houston region. Based on

unpaid principal balances, Texas-based loans represent

approximately 37% of the overall loan portfolio as of March 31,

2023.

Credit Quality

The ratios of nonperforming loans compared to

loans held for investment and nonperforming assets compared to

total assets increased from 0.25% and 0.21%, respectively, at

December 31, 2022, to 0.36% and 0.29% at March 31, 2023. The

increases were attributable to accounting guidance no longer

applicable, which previously excluded certain acquired impaired

loans from nonperforming ratios.

During the quarter ended March 31, 2023,

Business First resolved a lending relationship which resulted in a

$1.9 million charge-off attributable to previously acquired

impaired loans. Prior to the adoption of CECL on January 1, 2023,

the $1.9 million individual allowance for loan loss reserve was

within the loans’ amortized cost basis, as a loan discount.

Business First’s resolution of the loans resulted in a net gain of

$190,000 compared to the amortized cost basis as of the quarter

ended December 31, 2022. Excluding the $1.9 million charge-off on

the acquired impaired loan relationship, charge-offs on

non-acquired loans were low and consistent with historical

percentages.

Securities

The securities portfolio increased $13.2 million

or 1.48%, from the linked quarter. The increase was the net impact

of positive fair value adjustments, $7.9 million, and the remainder

of the increase was attributable to net security purchases during

the quarter.

Deposits

Deposits decreased $14.2 million or 0.29%, 1.19%

annualized, for the quarter ended March 31, 2023; however, branch

deposits remained stable, increasing $2.4 million from the linked

quarter, with new account openings continuing to outpace 2022

trends. Other corporate deposits decreased $16.6 million from the

linked quarter, with the FIG deposit base decreasing $29.0

million.

Noninterest-bearing deposits decreased $73.6

million or 4.75%, and interest-bearing deposits increased $59.4

million or 1.82%, compared to the linked quarter. The net growth in

interest-bearing deposits was attributable to growth in the

certificate of deposit (CD) portfolio of $181.3 million compared to

a decrease in transactional accounts of $121.9 million, of which

$37.5 million of the decrease was attributable to the FIG deposit

base. A significant portion of the transactional deposit decrease

was attributable to existing client relationships transitioning

funds to the CD portfolio.

As of March 31, 2023, Business First held

approximately 103,020 deposit accounts with an average balance of

approximately $46,650, of which $1.5 billion or 30.65% were

uninsured by the FDIC. Excluding public funds, which are secured by

securities or Federal Home Loan Bank (FHLB) letters of credit, the

unsecured deposit total is approximately $1.0 billion, or 21.33% of

total deposits.

Borrowings

Borrowings increased $291.9 million or 52.11%,

from the linked quarter, largely to fund loan growth. During March

2023, Business First utilized the Bank Term Funding Program (BTFP)

offered by the Federal Reserve to pay off some of the outstanding

short-term seven-day rolling FHLB borrowings which were priced at

approximately 5.00%. On March 24, 2023, Business First executed a

$310 million fixed one-year loan at 4.38% through the BTFP. The

Bank chose to utilize this source of funding due to its lower yield

and the ability to prepay the loan without penalty compared to FHLB

borrowings. On April 11, 2023, Business First opened two new lines

of credit for additional contingent liquidity, totaling $949.5

million, through the Federal Reserve discount window. As of April

27, 2023, Business First has not yet drawn on either of the lines

of credit.

Shareholders’ Equity

AOCI improved $6.2 million due to favorable

after-tax fair value changes in the securities portfolio, improving

$16.7 million from the low of $(84.7) million at September 30,

2022. Book value per common share was $20.77 at March 31, 2023,

compared to $20.25 at December 31, 2022, increasing $0.52 or 2.53%

from the linked quarter. On a non-GAAP basis, tangible book value

per common share was $16.73 at March 31, 2023, compared to $16.17

at December 31, 2022, increasing $0.56 or 3.51% from the linked

quarter.

Results of Operations

Net Interest Income

For the quarter ended March 31, 2023, net

interest income totaled $52.7 million, compared to $56.1 million

from the linked quarter, and was supported by strong loan and

interest-earning asset yields of 6.34% and 5.65%, respectively,

compared to 6.09% and 5.39%, respectively, from the linked quarter.

Net interest margin and net interest spread were 3.75% and 2.96%,

respectively, compared to 4.06% and 3.43%, respectively, for the

linked quarter. Interest income for the quarter ended December 31,

2022, included $1.3 million of additional loan discount accretion

due to a large, acquired loan payoff and accelerated accretion from

the purchased impaired portfolio. Overall costs of funds, which

include noninterest-bearing deposits, increased from 1.38% to 1.97%

or 59 basis points, from the linked quarter.

Non-GAAP net interest income totaled $49.8

million for the quarter ended March 31, 2023, compared to $51.8

million from the linked quarter. Non-GAAP net interest margin and

net interest spread (excluding loan discount accretion of $2.9

million) were 3.54% and 2.75%, respectively, for the quarter ended

March 31, 2023, compared to 3.75% and 3.13% (excluding loan

discount accretion of $4.2 million) for the linked quarter.

Excluding loan discount accretion, loan yields increased 37 basis

points from 5.72% to 6.09% and interest earning asset yields

increased 35 basis points from 5.09% to 5.44%, compared to the

linked quarter. The compression of net interest margin and net

interest spread was largely attributed to the continued increases

in funding costs during the quarter ended March 31, 2023.

Provision for Credit Losses

During the quarter ended March 31, 2023,

Business First recorded a provision for credit losses of $3.2

million, compared to $3.1 million for the linked quarter. The

provision for credit losses for the quarter ended March 31, 2023,

was impacted by the resolution of an acquired impaired lending

relationship in March 2023, which resulted in a charge-off of $1.9

million. Prior to implementation of CECL, the credit reserve was

embedded within the loan discount. The charge-off was offset by

reserves on new loan originations during the quarter and

application of qualitative factors within the CECL model.

Other Income

For the quarter ended March 31, 2023, other

income increased $110,000, or 1.33%, compared to the linked

quarter. The net increase was largely attributable to a $552,000

increase in gain on sales of loans during the quarter from SBA

loans and loan participations, offset by $435,000 less income from

equity investments. Year-over-year, other income increased $2.5

million or 42.27%, partially attributable to the successful

integration of Texas Citizens on March 1, 2023. On a non-GAAP

basis, other income increased $1.7 million or 26.23%, after

removing the $717,000 loss on disposal of former premises and

equipment and $31,000 loss on sales of securities which occurred

during the quarter ended March 31, 2022.

Other Expenses

For the quarter ended March 31, 2023, other

expenses increased by $333,000, or 0.87%, compared to the linked

quarter. The net increase was largely attributable to a $971,000

increase in salaries and expenses (salary increases and payroll

taxes) and $322,000 increase in estimated FDIC premiums (rate

increases will become effective for the quarter ended March 31,

2023). These were offset by reductions in data processing of

$716,000, largely due to approximately $453,000 credit adjustments

from prior period overbillings, and advertising and promotions of

$423,000.

Return on Assets and Common Equity

Return to common shareholders on average assets

and common equity, each on an annualized basis, were 0.91% and

10.73%, respectively, for the quarter ended March 31, 2023,

compared to 1.12% and 13.56%, respectively, for the linked quarter.

Non-GAAP return to common shareholders on average assets and common

equity, each on an annualized basis, were 0.91% and 10.81%,

respectively, for the quarter ended December 31, 2022, compared to

1.10% and 13.37%, respectively, for the linked quarter.

Conference Call and Webcast

Executive management will host a conference call

and webcast to discuss results on Thursday, April 27, at 4:30

p.m. CDT. Interested parties may attend the call by dialing

toll-free 1-800-715-9871 (North America only), conference ID

8276536, or asking for the Business First Bancshares

conference call. The live webcast can be found at

https://edge.media-server.com/mmc/p/x6vwyp8q. The corresponding

slide presentation can be accessed the day of the presentation

on b1BANK’s website

at https://www.b1bank.com/shareholder-info.

About Business First Bancshares,

Inc.

Business First Bancshares, Inc., (Nasdaq: BFST)

through its banking subsidiary b1BANK, has $6.3 billion in assets,

$6.5 billion in assets under management through b1BANK’s affiliate

Smith Shellnut Wilson, LLC (SSW) (excludes $0.9 billion of b1BANK

assets managed by SSW) and operates Banking Centers and Loan

Production Offices in markets across Louisiana and the Dallas and

Houston, Texas areas, providing commercial and personal banking

products and services. Commercial banking services include

commercial loans and letters of credit, working capital lines and

equipment financing, and treasury management services. b1BANK was

awarded #1 Best-In-State Bank, Louisiana, by Forbes and Statista,

and is a multiyear winner of American Banker’s “Best Banks to Work

For.” Visit b1BANK.com for more information.

Non-GAAP Financial Measures

This press release includes certain non-GAAP

financial measures (e.g., referenced as “core” or “tangible”)

intended to supplement, not substitute for, comparable GAAP

measures. “Core” measures typically adjust income available to

common shareholders for certain significant activities or

transactions that, in management’s opinion, can distort

period-to-period comparisons of Business First’s performance.

Transactions that are typically excluded from non-GAAP “core”

measures include realized and unrealized gains/losses on former

bank premises and equipment, investment sales, acquisition-related

expenses (including, but not limited to, legal costs, system

conversion costs, severance and retention payments, etc.).

“Tangible” measures adjust common equity by subtracting goodwill,

core deposit intangibles, and customer intangibles, net of

accumulated amortization. Management believes presentations of

these non-GAAP financial measures provide useful supplemental

information that is essential to a proper understanding of the

operating results of Business First’s core business. These non-GAAP

disclosures are not necessarily comparable to non-GAAP measures

that may be presented by other companies. Reconciliations of

non-GAAP financial measures to GAAP financial measures are provided

at the end of the tables below.

Special Note Regarding Forward-Looking

Statements

Certain statements contained in this release may

not be based on historical facts and are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements may be

identified by their reference to a future period or periods or by

the use of forward-looking terminology such as “anticipate,”

“believe,” “estimate,” “expect,” “may,” “might,” “will,” “would,”

“could,” or “intend.” We caution you not to place undue reliance on

the forward-looking statements contained in this news release, in

that actual results could differ materially from those indicated in

such forward-looking statements as a result of a variety of

factors, including those factors specified in our Annual Report on

Form 10-K and other public filings. We undertake no obligation to

update these forward-looking statements to reflect events or

circumstances that occur after the date of this news release.

Additional Information

For additional information about Business First,

you may obtain Business First’s reports that are filed with the

Securities and Exchange Commission (SEC) free of charge by using

the SEC’s EDGAR service on the SEC’s website at www.SEC.gov or by

contacting the SEC for further information at 1-800-SEC-0330.

Alternatively, these documents can be obtained free of charge from

Business First by directing a request to: Business First

Bancshares, Inc., 500 Laurel Street, Suite 101, Baton Rouge,

Louisiana 70801, Attention: Corporate Secretary.

No Offer or Solicitation

This release does not constitute or form part of

any offer to sell, or a solicitation of an offer to purchase, any

securities of Business First. There will be no sale of securities

in any jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

|

|

|

Business First Bancshares, Inc. |

|

Selected Financial Information |

|

(Unaudited) |

| |

Three Months Ended |

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Balance Sheet Ratios |

|

|

|

|

|

|

|

|

|

Loans (HFI) to Deposits |

|

99.94 |

% |

|

95.56 |

% |

|

80.48 |

% |

|

Shareholders' Equity to Assets Ratio |

|

9.50 |

% |

|

9.69 |

% |

|

8.52 |

% |

| |

|

|

|

|

Loans Receivable Held for Investment (HFI) |

|

|

|

| |

|

|

|

|

Commercial |

$ |

1,239,333 |

|

$ |

1,153,873 |

|

$ |

891,063 |

|

|

Real Estate: |

|

|

|

|

Commercial |

|

2,055,500 |

|

|

2,020,406 |

|

|

1,630,316 |

|

|

Construction |

|

787,634 |

|

|

722,074 |

|

|

581,661 |

|

|

Residential |

|

659,967 |

|

|

656,378 |

|

|

594,840 |

|

|

Total Real Estate |

|

3,503,101 |

|

|

3,398,858 |

|

|

2,806,817 |

|

|

Consumer and Other |

|

60,626 |

|

|

53,445 |

|

|

50,618 |

|

|

Total Loans (Held for Investment) |

$ |

4,803,060 |

|

$ |

4,606,176 |

|

$ |

3,748,498 |

|

| |

|

|

|

|

Allowance for Loan Losses |

|

|

|

| |

|

|

|

|

Balance, Beginning of Period |

$ |

38,178 |

|

$ |

35,201 |

|

$ |

29,112 |

|

|

CECL Adoption/Implementation |

|

2,660 |

|

$ |

- |

|

$ |

- |

|

|

Charge-offs – Quarterly |

|

(2,278 |

) |

|

(387 |

) |

|

(1,668 |

) |

|

Recoveries – Quarterly |

|

103 |

|

|

313 |

|

|

184 |

|

|

Provision for Loan Losses – Quarterly |

|

3,167 |

|

|

3,051 |

|

|

1,617 |

|

|

Balance, End of Period |

$ |

41,830 |

|

$ |

38,178 |

|

$ |

29,245 |

|

| |

|

|

|

|

Allowance for Loan Losses to Total Loans (HFI) |

|

0.87 |

% |

|

0.83 |

% |

|

0.78 |

% |

|

Allowance for Credit Losses to Total Loans (HFI) (2) |

|

0.95 |

% |

|

0.84 |

% |

|

0.80 |

% |

|

Net Charge-offs (Recoveries) to Average Quarterly Total Loans |

|

0.05 |

% |

|

0.00 |

% |

|

0.04 |

% |

| |

|

|

|

|

Remaining Loan Purchase Discount |

$ |

19,234 |

|

$ |

27,000 |

|

$ |

40,623 |

|

| |

|

|

|

|

Nonperforming Assets |

|

|

|

| |

|

|

|

|

Nonperforming Loans: |

|

|

|

|

Nonaccrual Loans (1) |

$ |

16,952 |

|

$ |

11,054 |

|

$ |

10,784 |

|

|

Loans Past Due 90 Days or More (1) |

|

127 |

|

|

335 |

|

|

26 |

|

|

Total Nonperforming Loans |

|

17,079 |

|

|

11,389 |

|

|

10,810 |

|

|

Other Nonperforming Assets: |

|

|

|

|

Other Real Estate Owned |

|

1,365 |

|

|

1,372 |

|

|

1,369 |

|

|

Other Nonperforming Assets |

|

57 |

|

|

62 |

|

|

84 |

|

|

Total Other Nonperforming Assets |

|

1,422 |

|

|

1,434 |

|

|

1,453 |

|

|

Total Nonperforming Assets |

$ |

18,501 |

|

$ |

12,823 |

|

$ |

12,263 |

|

| |

|

|

|

|

Nonperforming Loans to Total Loans (HFI) |

|

0.36 |

% |

|

0.25 |

% |

|

0.29 |

% |

|

Nonperforming Assets to Total Assets |

|

0.29 |

% |

|

0.21 |

% |

|

0.23 |

% |

| |

|

|

|

| |

|

|

|

|

(1) Past due and nonaccrual loan amounts exclude acquired impaired

loans, even if contractually past due or if the Company does

not expect to receive payment in full, as the Company was currently

accreting interest income over the expected life of the loans

for periods ended December 31, 2022, and March 31, 2022, in

accordance with ASC 310-30. |

|

|

|

(2) Allowance for Credit Losses includes the Allowance for Loan

Loss and Reserve for Unfunded Commitments |

| |

|

|

|

|

Business First Bancshares, Inc. |

|

Selected Financial Information |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended |

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Per Share Data |

|

|

|

|

|

|

|

|

|

Basic Earnings per Common Share |

$ |

0.55 |

|

$ |

0.68 |

|

$ |

0.42 |

|

|

Diluted Earnings per Common Share |

|

0.54 |

|

|

0.67 |

|

|

0.41 |

|

|

Dividends per Common Share |

|

0.12 |

|

|

0.12 |

|

|

0.12 |

|

|

Book Value per Common Share |

|

20.77 |

|

|

20.25 |

|

|

20.25 |

|

| |

|

|

|

| |

|

|

|

|

Average Common Shares Outstanding |

|

24,979,955 |

|

|

24,542,120 |

|

|

21,019,716 |

|

|

Average Diluted Common Shares Outstanding |

|

25,222,308 |

|

|

24,757,143 |

|

|

21,162,482 |

|

|

End of Period Common Shares Outstanding |

|

25,319,520 |

|

|

25,110,313 |

|

|

22,564,607 |

|

| |

|

|

|

| |

|

|

|

|

Annualized Performance Ratios |

|

|

|

| |

|

|

|

|

Return to Common Shareholders on Average Assets (1) |

|

0.91 |

% |

|

1.12 |

% |

|

0.72 |

% |

|

Return to Common Shareholders on Average Common Equity (1) |

|

10.73 |

% |

|

13.56 |

% |

|

7.94 |

% |

|

Net Interest Margin (1) |

|

3.75 |

% |

|

4.06 |

% |

|

3.56 |

% |

|

Net Interest Spread (1) |

|

2.96 |

% |

|

3.43 |

% |

|

3.40 |

% |

|

Efficiency Ratio (2) |

|

63.27 |

% |

|

59.60 |

% |

|

72.67 |

% |

| |

|

|

|

|

Total Quarterly Average Assets |

$ |

6,123,063 |

|

$ |

5,899,972 |

|

$ |

4,920,105 |

|

|

Total Quarterly Average Common Equity |

|

516,659 |

|

|

486,338 |

|

|

446,003 |

|

| |

|

|

|

|

Other Expenses |

|

|

|

| |

|

|

|

|

Salaries and Employee Benefits |

$ |

23,176 |

|

$ |

22,205 |

|

$ |

19,703 |

|

|

Occupancy and Bank Premises |

|

2,297 |

|

|

2,285 |

|

|

2,052 |

|

|

Depreciation and Amortization |

|

1,710 |

|

|

1,700 |

|

|

1,569 |

|

|

Data Processing |

|

1,485 |

|

|

2,201 |

|

|

2,116 |

|

|

FDIC Assessment Fees |

|

933 |

|

|

611 |

|

|

743 |

|

|

Legal and Other Professional Fees |

|

613 |

|

|

462 |

|

|

543 |

|

|

Advertising and Promotions |

|

1,148 |

|

|

1,571 |

|

|

531 |

|

|

Utilities and Communications |

|

721 |

|

|

759 |

|

|

779 |

|

|

Ad Valorem Shares Tax |

|

965 |

|

|

962 |

|

|

813 |

|

|

Directors' Fees |

|

269 |

|

|

270 |

|

|

202 |

|

|

Other Real Estate Owned Expenses and Write-Downs |

|

130 |

|

|

11 |

|

|

14 |

|

|

Merger and Conversion-Related Expenses |

|

103 |

|

|

138 |

|

|

811 |

|

|

Other |

|

5,129 |

|

|

5,171 |

|

|

3,844 |

|

|

Total Other Expenses |

$ |

38,679 |

|

$ |

38,346 |

|

$ |

33,720 |

|

|

|

|

|

|

|

Other Income |

|

|

|

|

|

|

|

|

|

Service Charges on Deposit Accounts |

$ |

2,281 |

|

$ |

2,265 |

|

$ |

1,805 |

|

|

(Loss) on Sales of Securities |

|

(1 |

) |

|

(2 |

) |

|

(31 |

) |

|

Debit Card and ATM Fee Income |

|

1,570 |

|

|

1,582 |

|

|

1,501 |

|

|

Bank-Owned Life Insurance Income |

|

524 |

|

|

526 |

|

|

369 |

|

|

Gain on Sales of Loans |

|

611 |

|

|

59 |

|

|

65 |

|

|

Mortgage Origination Income |

|

74 |

|

|

105 |

|

|

209 |

|

|

Fees and Brokerage Commission |

|

1,813 |

|

|

1,760 |

|

|

1,835 |

|

|

Gain on Sales of Other Real Estate Owned |

|

209 |

|

|

3 |

|

|

8 |

|

|

(Loss) on Disposal of Other Assets |

|

(5 |

) |

|

(1 |

) |

|

(717 |

) |

|

Pass-Through Income from Other Investments |

|

173 |

|

|

608 |

|

|

115 |

|

|

Other |

|

1,139 |

|

|

1,373 |

|

|

737 |

|

|

Total Other Income |

$ |

8,388 |

|

$ |

8,278 |

|

$ |

5,896 |

|

| |

|

|

|

| |

|

|

|

|

(1) Average outstanding balances are determined utilizing monthly

averages and average yield/rate is calculated utilizing an

Actual/365 day count convention. |

|

(2) Noninterest expense (excluding provision for loan losses)

divided by noninterest income plus net interest income less

gain/loss on sales of securities. |

| |

|

|

|

|

Business First Bancshares, Inc. |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

|

|

|

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Assets |

|

|

|

| |

|

|

|

|

Cash and Due From Banks |

$ |

159,767 |

|

$ |

152,740 |

|

$ |

282,074 |

|

|

Federal Funds Sold |

|

104,250 |

|

|

15,606 |

|

|

67,822 |

|

|

Securities Available for Sale, at Fair Values |

|

903,945 |

|

|

890,751 |

|

|

961,358 |

|

|

Loans Held for Sale |

|

- |

|

|

- |

|

|

13,559 |

|

|

Mortgage Loans Held for Sale |

|

423 |

|

|

304 |

|

|

1,354 |

|

|

Loans and Lease Receivable |

|

4,803,060 |

|

|

4,606,176 |

|

|

3,748,498 |

|

|

Allowance for Loan Losses |

|

(41,830 |

) |

|

(38,178 |

) |

|

(29,245 |

) |

|

Net Loans and Lease Receivable |

|

4,761,230 |

|

|

4,567,998 |

|

|

3,719,253 |

|

|

Premises and Equipment, Net |

|

64,065 |

|

|

63,177 |

|

|

63,003 |

|

|

Accrued Interest Receivable |

|

25,446 |

|

|

25,666 |

|

|

20,146 |

|

|

Other Equity Securities |

|

36,739 |

|

|

37,467 |

|

|

23,034 |

|

|

Other Real Estate Owned |

|

1,365 |

|

|

1,372 |

|

|

1,369 |

|

|

Cash Value of Life Insurance |

|

94,755 |

|

|

91,958 |

|

|

72,896 |

|

|

Deferred Taxes, Net |

|

28,680 |

|

|

31,194 |

|

|

23,040 |

|

|

Goodwill |

|

88,543 |

|

|

88,543 |

|

|

89,911 |

|

|

Core Deposit and Customer Intangibles |

|

13,517 |

|

|

14,042 |

|

|

15,617 |

|

|

Other Assets |

|

7,256 |

|

|

9,642 |

|

|

7,799 |

|

| |

|

|

|

|

Total Assets |

$ |

6,289,981 |

|

$ |

5,990,460 |

|

$ |

5,362,235 |

|

| |

|

|

|

| |

|

|

|

|

Liabilities |

|

|

|

| |

|

|

|

|

Deposits |

|

|

|

|

Noninterest-Bearing |

$ |

1,475,782 |

|

$ |

1,549,381 |

|

$ |

1,544,197 |

|

|

Interest-Bearing |

|

3,330,396 |

|

|

3,270,964 |

|

|

3,113,541 |

|

|

Total Deposits |

|

4,806,178 |

|

|

4,820,345 |

|

|

4,657,738 |

|

| |

|

|

|

|

Securities Sold Under Agreements to Repurchase |

|

16,669 |

|

|

20,208 |

|

|

23,345 |

|

|

Fed Funds Purchased |

|

14,622 |

|

|

14,057 |

|

|

- |

|

|

Short-Term Borrowings |

|

9 |

|

|

9 |

|

|

20 |

|

|

Bank Term Funding Program |

|

310,000 |

|

|

- |

|

|

- |

|

|

Federal Home Loan Bank Borrowings |

|

395,134 |

|

|

410,100 |

|

|

79,957 |

|

|

Subordinated Debt |

|

110,596 |

|

|

110,749 |

|

|

111,209 |

|

|

Subordinated Debt - Trust Preferred Securities |

|

5,000 |

|

|

5,000 |

|

|

5,000 |

|

|

Accrued Interest Payable |

|

3,513 |

|

|

2,092 |

|

|

895 |

|

|

Other Liabilities |

|

30,570 |

|

|

27,419 |

|

|

27,234 |

|

| |

|

|

|

|

Total Liabilities |

|

5,692,291 |

|

|

5,409,979 |

|

|

4,905,398 |

|

| |

|

|

|

|

Shareholders' Equity |

|

|

|

| |

|

|

|

|

Preferred Stock |

|

71,930 |

|

|

71,930 |

|

|

- |

|

|

Common Stock |

|

25,320 |

|

|

25,110 |

|

|

22,565 |

|

|

Additional Paid-In Capital |

|

394,677 |

|

|

393,690 |

|

|

345,858 |

|

|

Retained Earnings |

|

173,761 |

|

|

163,955 |

|

|

128,168 |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

(67,998 |

) |

|

(74,204 |

) |

|

(39,754 |

) |

| |

|

|

|

|

Total Shareholders' Equity |

|

597,690 |

|

|

580,481 |

|

|

456,837 |

|

| |

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

6,289,981 |

|

$ |

5,990,460 |

|

$ |

5,362,235 |

|

| |

|

|

|

|

Business First Bancshares, Inc. |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended |

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Interest Income: |

|

|

|

|

Interest and Fees on Loans |

$ |

73,768 |

|

$ |

69,364 |

|

$ |

40,183 |

|

|

Interest and Dividends on Securities |

|

4,782 |

|

|

4,316 |

|

|

3,844 |

|

|

Interest on Federal Funds Sold and Due From Banks |

|

942 |

|

|

825 |

|

|

95 |

|

|

Total Interest Income |

|

79,492 |

|

|

74,505 |

|

|

44,122 |

|

| |

|

|

|

|

Interest Expense: |

|

|

|

|

Interest on Deposits |

|

18,928 |

|

|

13,307 |

|

|

2,263 |

|

|

Interest on Borrowings |

|

7,815 |

|

|

5,138 |

|

|

1,384 |

|

|

Total Interest Expense |

|

26,743 |

|

|

18,445 |

|

|

3,647 |

|

| |

|

|

|

|

Net Interest Income |

|

52,749 |

|

|

56,060 |

|

|

40,475 |

|

| |

|

|

|

|

Provision for Credit Losses: |

|

3,222 |

|

|

3,051 |

|

|

1,617 |

|

| |

|

|

|

|

Net Interest Income After Provision for Loan Losses |

|

49,527 |

|

|

53,009 |

|

|

38,858 |

|

| |

|

|

|

|

Other Income: |

|

|

|

|

Service Charges on Deposit Accounts |

|

2,281 |

|

|

2,265 |

|

|

1,805 |

|

|

(Loss) on Sales of Securities |

|

(1 |

) |

|

(2 |

) |

|

(31 |

) |

|

Gain on Sales of Loans |

|

611 |

|

|

59 |

|

|

65 |

|

|

Other Income |

|

5,497 |

|

|

5,956 |

|

|

4,057 |

|

|

Total Other Income |

|

8,388 |

|

|

8,278 |

|

|

5,896 |

|

| |

|

|

|

|

Other Expenses: |

|

|

|

|

Salaries and Employee Benefits |

|

23,176 |

|

|

22,205 |

|

|

19,703 |

|

|

Occupancy and Equipment Expense |

|

5,001 |

|

|

4,918 |

|

|

4,413 |

|

|

Merger and Conversion-Related Expense |

|

103 |

|

|

138 |

|

|

811 |

|

|

Other Expenses |

|

10,399 |

|

|

11,085 |

|

|

8,793 |

|

|

Total Other Expenses |

|

38,679 |

|

|

38,346 |

|

|

33,720 |

|

| |

|

|

|

|

Income Before Income Taxes: |

|

19,236 |

|

|

22,941 |

|

|

11,034 |

|

| |

|

|

|

|

Provision for Income Taxes: |

|

4,211 |

|

|

4,974 |

|

|

2,303 |

|

|

|

|

|

|

|

Net Income: |

|

15,025 |

|

|

17,967 |

|

|

8,731 |

|

|

|

|

|

|

|

Preferred Stock Dividends: |

|

(1,350 |

) |

|

(1,350 |

) |

|

- |

|

|

|

|

|

|

|

Net Income Available to Common Shareholders |

$ |

13,675 |

|

$ |

16,617 |

|

$ |

8,731 |

|

| |

|

|

|

|

Business First Bancshares, Inc. |

|

Consolidated Net Interest Margin |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

(Dollars in thousands) |

AverageOutstandingBalance |

InterestEarned /InterestPaid |

AverageYield /Rate |

|

AverageOutstandingBalance |

InterestEarned /InterestPaid |

AverageYield /Rate |

|

AverageOutstandingBalance |

InterestEarned /InterestPaid |

AverageYield /Rate |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Total Loans |

$ |

4,719,906 |

|

$ |

73,768 |

6.34 |

% |

|

$ |

4,519,643 |

|

$ |

69,364 |

6.09 |

% |

|

$ |

3,386,050 |

|

$ |

40,183 |

4.81 |

% |

|

Securities |

|

927,491 |

|

|

4,782 |

2.09 |

% |

|

|

901,236 |

|

|

4,316 |

1.90 |

% |

|

|

1,005,252 |

|

|

3,844 |

1.55 |

% |

|

Interest-Bearing Deposit in Other Banks |

|

57,478 |

|

|

942 |

6.65 |

% |

|

|

62,013 |

|

|

825 |

5.28 |

% |

|

|

221,148 |

|

|

95 |

0.17 |

% |

|

Total Interest-Earning Assets |

|

5,704,875 |

|

|

79,492 |

5.65 |

% |

|

|

5,482,892 |

|

|

74,505 |

5.39 |

% |

|

|

4,612,450 |

|

|

44,122 |

3.88 |

% |

|

Allowance for Loan Losses |

|

(41,533 |

) |

|

|

|

|

(35,951 |

) |

|

|

|

|

(29,260 |

) |

|

|

|

Noninterest-Earning Assets |

|

459,721 |

|

|

|

|

|

453,031 |

|

|

|

|

|

336,915 |

|

|

|

|

Total Assets |

$ |

6,123,063 |

|

$ |

79,492 |

|

|

$ |

5,899,972 |

|

$ |

74,505 |

|

|

$ |

4,920,105 |

|

$ |

44,122 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Bearing Deposits |

$ |

3,339,493 |

|

$ |

18,928 |

2.30 |

% |

|

$ |

3,157,513 |

|

$ |

13,307 |

1.67 |

% |

|

$ |

2,882,838 |

|

$ |

2,263 |

0.32 |

% |

|

Subordinated Debt |

|

110,647 |

|

|

1,389 |

5.09 |

% |

|

|

110,800 |

|

|

1,363 |

4.88 |

% |

|

|

91,354 |

|

|

1,115 |

4.95 |

% |

|

Subordinated Debt - Trust Preferred Securities |

|

5,000 |

|

|

98 |

7.95 |

% |

|

|

5,000 |

|

|

85 |

6.74 |

% |

|

|

5,000 |

|

|

42 |

3.41 |

% |

|

Bank Term Funding Program |

|

34,444 |

|

|

380 |

4.47 |

% |

|

|

- |

|

|

- |

0.00 |

% |

|

|

- |

|

|

- |

0.00 |

% |

|

Advances from Federal Home Loan Bank (FHLB) |

|

517,934 |

|

|

5,842 |

4.57 |

% |

|

|

436,233 |

|

|

3,555 |

3.23 |

% |

|

|

80,375 |

|

|

223 |

1.13 |

% |

|

First National Bankers Bank Line of Credit |

|

- |

|

|

- |

0.00 |

% |

|

|

1,667 |

|

|

30 |

7.14 |

% |

|

|

- |

|

|

- |

0.00 |

% |

|

Other Borrowings |

|

20,895 |

|

|

106 |

2.06 |

% |

|

|

25,815 |

|

|

105 |

1.61 |

% |

|

|

19,666 |

|

|

4 |

0.08 |

% |

|

Total Interest-Bearing Liabilities |

|

4,028,413 |

|

|

26,743 |

2.69 |

% |

|

|

3,737,028 |

|

|

18,445 |

1.96 |

% |

|

|

3,079,233 |

|

|

3,647 |

0.48 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-Bearing Deposits |

$ |

1,473,186 |

|

|

|

|

$ |

1,567,507 |

|

|

|

|

$ |

1,370,015 |

|

|

|

|

Other Liabilities |

|

32,875 |

|

|

|

|

|

37,138 |

|

|

|

|

|

24,854 |

|

|

|

|

Total Noninterest-Bearing Liabilities |

|

1,506,061 |

|

|

|

|

|

1,604,645 |

|

|

|

|

|

1,394,869 |

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

Common Shareholders' Equity |

|

516,659 |

|

|

|

|

|

486,338 |

|

|

|

|

|

446,003 |

|

|

|

|

Preferred Equity |

|

71,930 |

|

|

|

|

|

71,961 |

|

|

|

|

|

- |

|

|

|

|

Total Shareholder's Equity |

|

588,589 |

|

|

|

|

|

558,299 |

|

|

|

|

|

446,003 |

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

6,123,063 |

|

|

|

|

$ |

5,899,972 |

|

|

|

|

$ |

4,920,105 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Spread |

|

|

2.96 |

% |

|

|

|

3.43 |

% |

|

|

|

3.40 |

% |

|

Net Interest Income |

|

$ |

52,749 |

|

|

|

$ |

56,060 |

|

|

|

$ |

40,475 |

|

|

Net Interest Margin |

|

|

3.75 |

% |

|

|

|

4.06 |

% |

|

|

|

3.56 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Overall Cost of Funds |

|

|

1.97 |

% |

` |

|

1.38 |

% |

|

|

|

0.33 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Average outstanding balances are determined utilizing monthly

averages and average yield/rate is calculated utilizing an

Actual/365 day count convention. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Business First Bancshares, Inc. |

|

Non-GAAP Measures |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended |

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Interest Income: |

|

|

|

|

Interest income |

$ |

79,492 |

|

$ |

74,505 |

|

$ |

44,122 |

|

|

Core interest income |

|

79,492 |

|

|

74,505 |

|

|

44,122 |

|

|

Interest Expense: |

|

|

|

|

Interest expense |

|

26,743 |

|

|

18,445 |

|

|

3,647 |

|

|

Core interest expense |

|

26,743 |

|

|

18,445 |

|

|

3,647 |

|

|

Provision for Credit Losses: (b) |

|

|

|

|

Provision for credit losses |

|

3,222 |

|

|

3,051 |

|

|

1,617 |

|

|

Core provision expense |

|

3,222 |

|

|

3,051 |

|

|

1,617 |

|

| Other

Income: |

|

|

|

|

Other income |

|

8,388 |

|

|

8,278 |

|

|

5,896 |

|

|

Losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

717 |

|

|

Losses on sale of securities |

|

1 |

|

|

2 |

|

|

31 |

|

|

Insurance reimbursement of storm expenditures |

|

- |

|

|

(422 |

) |

|

- |

|

|

Core other income |

|

8,389 |

|

|

7,858 |

|

|

6,644 |

|

|

Other Expense: |

|

|

|

|

Other expense |

|

38,679 |

|

|

38,346 |

|

|

33,720 |

|

|

Acquisition-related expenses (2) |

|

(103 |

) |

|

(138 |

) |

|

(811 |

) |

|

Occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

(231 |

) |

|

Core other expense |

|

38,576 |

|

|

38,208 |

|

|

32,678 |

|

|

Pre-Tax Income: (a) |

|

|

|

|

Pre-tax income |

|

19,236 |

|

|

22,941 |

|

|

11,034 |

|

|

Losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

717 |

|

|

Losses on sale of securities |

|

1 |

|

|

2 |

|

|

31 |

|

|

Insurance reimbursment of storm expenditures |

|

- |

|

|

(422 |

) |

|

- |

|

|

Acquisition-related expenses (2) |

|

103 |

|

|

138 |

|

|

811 |

|

|

Occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

231 |

|

|

Core pre-tax income |

|

19,340 |

|

|

22,659 |

|

|

12,824 |

|

|

Provision for Income Taxes: (1) |

|

|

|

|

Provision for income taxes |

|

4,211 |

|

|

4,974 |

|

|

2,303 |

|

|

Tax on losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

151 |

|

|

Tax on losses on sale of securities |

|

- |

|

|

- |

|

|

7 |

|

|

Tax on insurance reimbursement of storm expenditures |

|

- |

|

|

(89 |

) |

|

- |

|

|

Tax on acquisition-related expenses (2) |

|

6 |

|

|

29 |

|

|

48 |

|

|

Tax on occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

49 |

|

|

Core provision for income taxes |

|

4,217 |

|

|

4,914 |

|

|

2,558 |

|

|

Preferred Dividends |

|

|

|

|

Preferred dividends |

|

1,350 |

|

|

1,350 |

|

|

- |

|

|

Core preferred dividends |

|

1,350 |

|

|

1,350 |

|

|

- |

|

|

Net Income Available to Common Shareholders: |

|

|

|

|

Net income available to common shareholders |

|

13,675 |

|

|

16,617 |

|

|

8,731 |

|

|

Losses on former bank premises and equipment, net of tax |

|

- |

|

|

- |

|

|

566 |

|

|

Losses on sale of securities, net of tax |

|

1 |

|

|

2 |

|

|

24 |

|

|

Insurance reimbursement of storm expenditures, net of tax |

|

- |

|

|

(333 |

) |

|

- |

|

|

Acquisition-related expenses (2), net of tax |

|

97 |

|

|

109 |

|

|

763 |

|

|

Occupancy and bank premises - storm repair, net of tax |

|

- |

|

|

- |

|

|

182 |

|

|

Core net income available to common shareholders |

$ |

13,773 |

|

$ |

16,395 |

|

$ |

10,266 |

|

|

|

|

|

|

|

Pre-tax, pre-provision earnings available to common shareholders

(a+b) |

$ |

22,458 |

|

$ |

25,992 |

|

$ |

12,651 |

|

|

Losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

717 |

|

|

Loss/(Gain) on sale of securities |

|

1 |

|

|

2 |

|

|

31 |

|

|

Insurance reimbursement of storm expenditures |

|

- |

|

|

(422 |

) |

|

- |

|

|

Acquisition-related expenses (2) |

|

103 |

|

|

138 |

|

|

811 |

|

|

Occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

231 |

|

|

Core pre-tax, pre-provision earnings |

$ |

22,562 |

|

$ |

25,710 |

|

$ |

14,441 |

|

|

|

|

|

|

|

Average Diluted Common Shares Outstanding |

|

25,222,308 |

|

|

24,757,143 |

|

|

21,162,482 |

|

|

|

|

|

|

|

Diluted Earnings Per Common Share: |

|

|

|

|

Diluted earnings per common share |

$ |

0.54 |

|

$ |

0.67 |

|

$ |

0.41 |

|

|

Losses on former bank premises and equipment, net of tax |

|

- |

|

|

- |

|

|

0.03 |

|

|

Loss/(Gain) on sale of securities, net of tax |

|

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

Insurance reimbursement of storm expenditures, net of tax |

|

- |

|

|

(0.01 |

) |

|

- |

|

|

Acquisition-related expenses (2), net of tax |

|

0.01 |

|

|

0.00 |

|

|

0.04 |

|

|

Occupancy and bank premises -storm repair, net of tax |

|

- |

|

|

- |

|

|

0.01 |

|

|

Core diluted earnings per common share |

$ |

0.55 |

|

$ |

0.66 |

|

$ |

0.49 |

|

|

|

|

|

|

|

Pre-tax, pre-provision profit diluted earnings per common

share |

$ |

0.89 |

|

$ |

1.05 |

|

$ |

0.60 |

|

|

Losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

0.03 |

|

|

Loss/(Gain) on sale of securities |

|

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

Insurance reimbursement of storm expenditures |

|

- |

|

|

(0.02 |

) |

|

- |

|

|

Acquisition-related expenses (2) |

|

0.00 |

|

|

0.01 |

|

|

0.04 |

|

|

Occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

0.01 |

|

|

Core pre-tax, pre-provision diluted earnings per common share |

$ |

0.89 |

|

$ |

1.04 |

|

$ |

0.68 |

|

|

|

|

|

|

|

(1) Tax rates, exclusive of certain nondeductible merger-related

expenses and goodwill, utilized were 21.00% for 2023 and 2022.

These rates approximated the marginal tax rates. |

|

(2) Includes merger and conversion-related expenses and salary and

employee benefits. |

|

|

| |

|

|

|

|

Business First Bancshares, Inc. |

|

Non-GAAP Measures |

|

(Unaudited) |

| |

|

|

|

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

Total Shareholders' (Common) Equity: |

|

|

|

|

Total shareholders' equity |

$ |

597,690 |

|

$ |

580,481 |

|

$ |

456,837 |

|

|

Preferred stock |

|

(71,930 |

) |

|

(71,930 |

) |

|

- |

|

|

Total common shareholders' equity |

|

525,760 |

|

|

508,551 |

|

|

456,837 |

|

|

Goodwill |

|

(88,543 |

) |

|

(88,543 |

) |

|

(89,911 |

) |

|

Core deposit and customer intangible |

|

(13,517 |

) |

|

(14,042 |

) |

|

(15,617 |

) |

|

Total tangible common equity |

$ |

423,700 |

|

$ |

405,966 |

|

$ |

351,309 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets: |

|

|

|

|

Total assets |

$ |

6,289,981 |

|

$ |

5,990,460 |

|

$ |

5,362,235 |

|

|

Goodwill |

|

(88,543 |

) |

|

(88,543 |

) |

|

(89,911 |

) |

|

Core deposit and customer intangible |

|

(13,517 |

) |

|

(14,042 |

) |

|

(15,617 |

) |

|

Total tangible assets |

$ |

6,187,921 |

|

$ |

5,887,875 |

|

$ |

5,256,707 |

|

|

|

|

|

|

|

Common shares outstanding |

|

25,319,520 |

|

|

25,110,313 |

|

|

22,564,607 |

|

|

|

|

|

|

|

Book value per common share |

$ |

20.77 |

|

$ |

20.25 |

|

$ |

20.25 |

|

|

Tangible book value per common share |

$ |

16.73 |

|

$ |

16.17 |

|

$ |

15.57 |

|

|

Common equity to total assets |

|

8.36 |

% |

|

8.49 |

% |

|

8.52 |

% |

|

Tangible common equity to tangible assets |

|

6.85 |

% |

|

6.89 |

% |

|

6.68 |

% |

|

|

|

|

|

|

Business First Bancshares, Inc. |

|

Non-GAAP Measures |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended |

| |

March 31, |

December 31, |

March 31, |

|

(Dollars in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

Total Quarterly Average Assets |

$ |

6,123,063 |

|

$ |

5,899,972 |

|

$ |

4,920,105 |

|

|

Total Quarterly Average Common Equity |

$ |

516,659 |

|

$ |

486,338 |

|

$ |

446,003 |

|

|

|

|

|

|

| Net Income Available

to Common Shareholders: |

|

|

|

|

Net income available to common shareholders |

$ |

13,675 |

|

$ |

16,617 |

|

$ |

8,731 |

|

|

Losses on former bank premises and equipment, net of tax |

|

- |

|

|

- |

|

|

566 |

|

|

Losses on sale of securities, net of tax |

|

1 |

|

|

2 |

|

|

24 |

|

|

Insurance reimbursement of storm expenditures, net of tax |

|

- |

|

|

(333 |

) |

|

- |

|

|

Acquisition-related expenses, net of tax |

|

97 |

|

|

109 |

|

|

763 |

|

|

Occupancy and bank premises - storm repair, net of tax |

|

- |

|

|

- |

|

|

182 |

|

|

Core net income available to common shareholders |

$ |

13,773 |

|

$ |

16,395 |

|

$ |

10,266 |

|

|

|

|

|

|

|

Return to common shareholders on average assets (annualized)

(2) |

|

0.91 |

% |

|

1.12 |

% |

|

0.72 |

% |

|

Core return on average assets (annualized) (2) |

|

0.91 |

% |

|

1.10 |

% |

|

0.85 |

% |

|

Return to common shareholders on average common equity (annualized)

(2) |

|

10.73 |

% |

|

13.56 |

% |

|

7.94 |

% |

|

Core return on average common equity (annualized) (2) |

|

10.81 |

% |

|

13.37 |

% |

|

9.33 |

% |

|

|

|

|

|

|

Interest Income: |

|

|

|

|

Interest income |

$ |

79,492 |

|

$ |

74,505 |

|

$ |

44,122 |

|

|

Core interest income |

|

79,492 |

|

|

74,505 |

|

|

44,122 |

|

|

Interest Expense: |

|

|

|

|

Interest expense |

|

26,743 |

|

|

18,445 |

|

|

3,647 |

|

|

Core interest expense |

|

26,743 |

|

|

18,445 |

|

|

3,647 |

|

|

Other Income: |

|

|

|

|

Other income |

|

8,388 |

|

|

8,278 |

|

|

5,896 |

|

|

Losses on former bank premises and equipment |

|

- |

|

|

- |

|

|

717 |

|

|

Loss on sale of securities |

|

1 |

|

|

2 |

|

|

31 |

|

|

Insurance reimbursement of storm expenditures |

|

- |

|

|

(422 |

) |

|

- |

|

|

Core other income |

|

8,389 |

|

|

7,858 |

|

|

6,644 |

|

|

Other Expense: |

|

|

|

|

Other expense |

|

38,679 |

|

|

38,346 |

|

|

33,720 |

|

|

Acquisition-related expenses |

|

(103 |

) |

|

(138 |

) |

|

(811 |

) |

|

Occupancy and bank premises - storm repair |

|

- |

|

|

- |

|

|

(231 |

) |

|

Core other expense |

$ |

38,576 |

|

$ |

38,208 |

|

$ |

32,678 |

|

|

|

|

|

|

|

Efficiency Ratio: |

|

|

|

|

Other expense (a) |

$ |

38,679 |

|

$ |

38,346 |

|

$ |

33,720 |

|

|

Core other expense (c) |

$ |

38,576 |

|

$ |

38,208 |

|

$ |

32,678 |

|

|

Net interest and other income (1) (b) |

$ |

61,138 |

|

$ |

64,340 |

|

$ |

46,402 |

|

|

Core net interest and other income (1) (d) |

$ |

61,138 |

|

$ |

63,918 |

|

$ |

47,119 |

|

|

Efficiency ratio (a/b) |

|

63.27 |

% |

|

59.60 |

% |

|

72.67 |

% |

|

Core efficiency ratio (c/d) |

|

63.10 |

% |

|

59.78 |

% |

|

69.35 |

% |

| |

|

|

|

|

Total Average Interest-Earnings Assets |

$ |

5,704,875 |

|

$ |

5,482,892 |

|

$ |

4,612,450 |

|

| |

|

|

|

|

Net Interest Income: |

|

|

|

|

Net interest income |

$ |

52,749 |

|

$ |

56,060 |

|

$ |

40,475 |

|

|

Loan discount accretion |

|

(2,912 |

) |

|

(4,212 |

) |

|

(920 |

) |

|

Net interest income excluding loan discount accretion |

$ |

49,837 |

|

$ |

51,848 |

|

$ |

39,555 |

|

|

|

|

|

|

|

Net interest margin (2) |

|

3.75 |

% |

|

4.06 |

% |

|

3.56 |

% |

|

Net interest margin excluding loan discount accretion (2) |

|

3.54 |

% |

|

3.75 |

% |

|

3.48 |

% |

|

Net interest spread (2) |

|

2.96 |

% |

|

3.43 |

% |

|

3.40 |

% |

|

Net interest spread excluding loan discount accretion (2) |

|

2.75 |

% |

|

3.13 |

% |

|

3.32 |

% |

| |

|

|

|

|

(1) Excludes gains/losses on sales of securities. |

|

(2) Calculated utilizing an Actual/365 day count convention. |

| |

|

|

|

Misty Albrechtb1BANK225.286.7879Misty.Albrecht@b1BANK.com

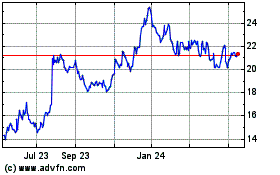

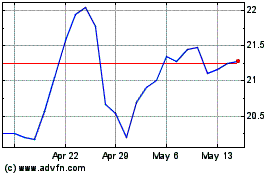

Business First Bancshares (NASDAQ:BFST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Business First Bancshares (NASDAQ:BFST)

Historical Stock Chart

From Apr 2023 to Apr 2024