Form 8-K - Current report

January 31 2024 - 4:34PM

Edgar (US Regulatory)

0000933974false00009339742024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2024

Azenta, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 0-25434 | | 04-3040660 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File

Number) | | (IRS Employer

Identification No.) |

| | |

200 Summit Drive, Burlington, MA 01803 |

(Address of principal executive offices and Zip Code) |

(978) 262-2400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | AZTA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01Regulation FD Disclosure.

As previously announced, effective October 1, 2023, Azenta, Inc. (the “Company”) realigned its organizational structure to three principal business segments to enhance its commercial strategy for accelerating growth and to enable additional profitability initiatives. The Company’s operating and reportable segments effective in the first quarter of fiscal 2024 (which align with how the Company’s Chief Operating Decision Maker manages the business, allocates resources, and assesses performance) consist of the following:

| ● | Multiomics. The Multiomics business resources operate under a single business unit that provides genomic and other sample analysis services, including gene sequencing and gene synthesis. |

| ● | Sample Management Solutions. Sample & Repository Solutions, Ultracold Systems, and Consumables and Instruments resources operate as a single business unit offering end-to-end sample management services and products. |

| ● | B Medical Systems. B Medical Systems business resources operate as a single business unit focused on the manufacturing and distribution of temperature-controlled storage and transportation solutions in international markets to governments, health institutions, and non-government organizations. |

For informational purposes, included in Exhibit 99.1 to this report, and incorporated into this Item 7.01 by reference, is the Company’s historical recast of segment information that reflects the segment changes noted above for fiscal years 2023 and 2022 and the quarters therein.

Limitation on Incorporation by Reference. The information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| AZENTA, INC. |

| |

| /s/ Jason W. Joseph |

Date: January 31, 2024 | Jason W. Joseph |

| Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Notes on Non-GAAP Financial Measures

Non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial measures. Management adjusts the GAAP results for the impact of amortization of intangible assets, purchase price accounting adjustments, tariff adjustments, restructuring charges, rebranding and transformation costs, contingent consideration adjustments, and merger, acquisition, and costs related to share repurchases to provide investors better perspective on the results of operations which the Company believes is more comparable to the similar analysis provided by its peers. Management also excludes special charges and gains, such as impairment losses, gains and losses from the sale of assets, certain tax benefits and charges, as well as other gains and charges that are not representative of the normal operations of the business. Management strongly encourages investors to review our financial statements and publicly filed reports in their entirety and not rely on any single measure.

Revenue from Continuing Operations – Fiscal 2023

| | | | | | | | | | | | | | | |

| | Quarter Ended | | Year Ended |

Dollars in millions | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Revenue from Continuing Operations | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

Sample Management Solutions | | $ | 82 | | $ | 75 | | $ | 71 | | $ | 75 | | $ | 304 |

Multiomics | | | 61 | | | 64 | | | 62 | | | 61 | | | 248 |

B Medical Systems | | | 29 | | | 27 | | | 15 | | | 42 | | | 113 |

Azenta Total | | $ | 172 | | $ | 166 | | $ | 148 | | $ | 178 | | $ | 665 |

Revenue from Continuing Operations – Fiscal 2022

| | | | | | | | | | | | | | | |

| | Quarter Ended | | Year Ended |

Dollars in millions | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Revenue from Continuing Operations | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

Sample Management Solutions | | $ | 75 | | $ | 73 | | $ | 81 | | $ | 76 | | $ | 305 |

Multiomics | | | 63 | | | 59 | | | 65 | | | 64 | | | 251 |

B Medical Systems | | | — | | | — | | | — | | | — | | | — |

Azenta Total | | $ | 138 | | $ | 133 | | $ | 146 | | $ | 140 | | $ | 555 |

Reconciliation of GAAP to Non-GAAP Gross Profit – Fiscal 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2023 | | | 2023 | | | 2023 | | | 2022 | | | 2023 | |

GAAP gross profit | | $ | 38,296 | | 46.8 | % | | $ | 34,930 | | 46.4 | % | | $ | 27,544 | | 38.8 | % | | $ | 32,035 | | 42.5 | % | | $ | 132,806 | | 43.7 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 867 | | 1.1 | | | | 744 | | 1.0 | | | | 933 | | 1.3 | | | | 429 | | 0.6 | | | | 2,973 | | 1.0 | |

Purchase accounting impact on inventory | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Non-GAAP adjusted gross profit | | $ | 39,163 | | 47.9 | % | | $ | 35,674 | | 47.3 | % | | $ | 28,477 | | 40.1 | % | | $ | 32,465 | | 43.0 | % | | $ | 135,779 | | 44.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Multiomics | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2023 | | | 2023 | | | 2023 | | | 2022 | | | 2023 | |

GAAP gross profit | | $ | 26,808 | | 43.9 | % | | $ | 28,294 | | 44.3 | % | | $ | 27,003 | | 43.4 | % | | $ | 27,716 | | 45.4 | % | | $ | 109,820 | | 44.2 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,211 | | 2.0 | | | | 1,220 | | 1.9 | | | | 1,226 | | 2.0 | | | | 1,215 | | 2.0 | | | | 4,874 | | 2.0 | |

Purchase accounting impact on inventory | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Non-GAAP adjusted gross profit | | $ | 28,019 | | 45.8 | % | | $ | 29,514 | | 46.2 | % | | $ | 28,229 | | 45.4 | % | | $ | 28,931 | | 47.4 | % | | $ | 114,694 | | 46.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | B Medical Systems | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2023 | | | 2023 | | | 2023 | | | 2022 | | | 2023 | |

GAAP gross profit | | $ | 2,930 | | 10.0 | % | | $ | 4,781 | | 17.9 | % | | $ | (1,311) | | (8.7) | % | | $ | 14,114 | | 33.7 | % | | $ | 20,514 | | 18.1 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 2,691 | | 9.1 | | | | 2,692 | | 10.1 | | | | 2,742 | | 18.1 | | | | 2,523 | | 6.0 | | | | 10,647 | | 9.4 | |

Purchase accounting impact on inventory | | | 927 | | 3.1 | | | | 2,956 | | 11.0 | | | | 2,912 | | 19.3 | | | | 2,868 | | 6.9 | | | | 9,664 | | 8.5 | |

Non-GAAP adjusted gross profit | | $ | 6,548 | | 22.3 | % | | $ | 10,428 | | 39.0 | % | | $ | 4,343 | | 28.7 | % | | $ | 19,506 | | 46.6 | % | | $ | 40,824 | | 36.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Azenta Total | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2023 | | | 2023 | | | 2023 | | | 2022 | | | 2023 | |

GAAP gross profit | | $ | 68,034 | | 39.5 | % | | $ | 68,005 | | 41.0 | % | | $ | 53,236 | | 35.9 | % | | $ | 73,865 | | 41.4 | % | | $ | 263,140 | | 39.6 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 4,769 | | 2.8 | | | | 4,656 | | 2.8 | | | | 4,901 | | 3.3 | | | | 4,168 | | 2.3 | | | | 18,494 | | 2.8 | |

Purchase accounting impact on inventory | | | 927 | | 0.5 | | | | 2,956 | | 1.8 | | | | 2,912 | | 2.0 | | | | 2,869 | | 1.6 | | | | 9,664 | | 1.4 | |

Non-GAAP adjusted gross profit | | $ | 73,730 | | 42.8 | % | | $ | 75,617 | | 45.6 | % | | $ | 61,049 | | 41.1 | % | | $ | 80,902 | | 45.4 | % | | $ | 291,298 | | 43.8 | % |

Reconciliation of GAAP to Non-GAAP Gross Profit – Fiscal 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2022 | | | 2022 | | | 2022 | | | 2021 | | | 2022 | |

GAAP gross profit | | $ | 31,606 | | 42.2 | % | | $ | 33,709 | | 45.9 | % | | $ | 39,702 | | 49.3 | % | | $ | 35,929 | | 47.4 | % | | $ | 140,947 | | 46.3 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 528 | | 0.7 | | | | 378 | | 0.5 | | | | 394 | | 0.5 | | | | 330 | | 0.4 | | | | 1,631 | | 0.5 | |

Tariff adjustment | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Other adjustment | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Non-GAAP adjusted gross profit | | $ | 32,134 | | 42.9 | % | | $ | 34,088 | | 46.5 | % | | $ | 40,097 | | 49.8 | % | | $ | 36,259 | | 47.9 | % | | $ | 142,578 | | 46.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Multiomics | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2022 | | | 2022 | | | 2022 | | | 2021 | | | 2022 | |

GAAP gross profit | | $ | 26,523 | | 42.3 | % | | $ | 25,890 | | 43.6 | % | | $ | 31,123 | | 47.9 | % | | $ | 31,115 | | 48.7 | % | | $ | 114,650 | | 45.7 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,373 | | 2.2 | | | | 1,433 | | 2.4 | | | | 1,445 | | 2.2 | | | | 1,443 | | 2.3 | | | | 5,693 | | 2.3 | |

Tariff adjustment | | | 2 | | — | | | | — | | — | | | | (486) | | (0.7) | | | | — | | — | | | | (484) | | (0.2) | |

Other adjustment | | | 289 | | 0.5 | | | | — | | — | | | | — | | — | | | | — | | — | | | | 289 | | 0.1 | |

Non-GAAP adjusted gross profit | | $ | 28,187 | | 45.0 | % | | $ | 27,322 | | 46.0 | % | | $ | 32,081 | | 49.4 | % | | $ | 32,558 | | 51.0 | % | | $ | 120,148 | | 47.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | B Medical Systems | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2022 | | | 2022 | | | 2022 | | | 2021 | | | 2022 | |

GAAP gross profit | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Tariff adjustment | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Other adjustment | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | | | | — | | — | |

Non-GAAP adjusted gross profit | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % | | $ | — | | — | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Azenta Total | |

| | Quarter Ended | | | Year Ended | |

| | September 30, | | | June 30, | | | March 31, | | | December 31, | | | September 30, | |

Dollars in thousands | | 2022 | | | 2022 | | | 2022 | | | 2021 | | | 2022 | |

GAAP gross profit | | $ | 58,129 | | 42.3 | % | | $ | 59,600 | | 44.9 | % | | $ | 70,825 | | 48.7 | % | | $ | 67,044 | | 48.0 | % | | $ | 255,597 | | 46.0 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,901 | | 1.4 | | | | 1,812 | | 1.4 | | | | 1,840 | | 1.3 | | | | 1,773 | | 1.3 | | | | 7,324 | | 1.3 | |

Tariff adjustment | | | 2 | | 0.0 | | | | — | | — | | | | (486) | | (0.3) | | | | — | | — | | | | (484) | | (0.1) | |

Other adjustment | | | 289 | | 0.2 | | | | — | | — | | | | — | | — | | | | — | | — | | | | 289 | | 0.1 | |

Non-GAAP adjusted gross profit | | $ | 60,321 | | 43.8 | % | | $ | 61,412 | | 46.3 | % | | $ | 72,179 | | 49.6 | % | | $ | 68,817 | | 49.3 | % | | $ | 262,726 | | 47.3 | % |

Reconciliation of GAAP to Non-GAAP Operating (Loss) Profit – Fiscal 2023

| | | | | | | | | | | | | | | |

| | Sample Management Solutions |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

GAAP operating (loss) profit | | $ | 4,992 | | $ | 70 | | $ | (7,221) | | $ | (3,476) | | $ | (5,633) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 867 | | | 744 | | | 933 | | | 429 | | | 2,973 |

Purchase accounting impact on inventory | | | — | | | — | | | — | | | — | | | — |

Amortization of other intangibles | | | 51 | | | (1) | | | 212 | | | 48 | | | 311 |

Other Adjustment | | | — | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | 5,910 | | $ | 813 | | $ | (6,076) | | $ | (2,998) | | $ | (2,349) |

| | | | | | | | | | | | | | | |

| | Multiomics |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

GAAP operating (loss) profit | | $ | (4,502) | | $ | (4,632) | | $ | (5,037) | | $ | (4,481) | | $ | (18,652) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,211 | | | 1,220 | | | 1,226 | | | 1,215 | | | 4,874 |

Purchase accounting impact on inventory | | | — | | | — | | | — | | | — | | | — |

Amortization of other intangibles | | | — | | | — | | | — | | | — | | | — |

Other Adjustment | | | — | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | (3,291) | | $ | (3,412) | | $ | (3,810) | | $ | (3,265) | | $ | (13,779) |

| | | | | | | | | | | | | | | |

| | B Medical Systems |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

GAAP operating (loss) profit | | $ | (7,153) | | $ | (4,129) | | $ | (9,021) | | $ | (454) | | $ | (20,757) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 2,691 | | | 2,692 | | | 2,742 | | | 2,523 | | | 10,647 |

Purchase accounting impact on inventory | | | 927 | | | 2,956 | | | 2,912 | | | 2,869 | | | 9,664 |

Amortization of other intangibles | | | — | | | 1 | | | — | | | 1,365 | | | 1,366 |

Other Adjustment | | | (1) | | | — | | | — | | | — | | | (1) |

Non-GAAP adjusted operating profit (loss) | | $ | (3,537) | | $ | 1,520 | | $ | (3,367) | | $ | 6,303 | | $ | 919 |

| | | | | | | | | | | | | | | |

| | Corporate |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

GAAP operating (loss) profit | | $ | (9,964) | | $ | (7,145) | | $ | 8,302 | | $ | (19,274) | | $ | (28,083) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of other intangibles | | | 7,430 | | | 7,522 | | | 7,297 | | | 5,959 | | | 28,207 |

Restructuring Charges | | | 804 | | | 812 | | | 1,499 | | | 1,462 | | | 4,577 |

Rebranding and transformation costs | | | (15) | | | 21 | | | 10 | | | (65) | | | (49) |

Contingent consideration adjustment | | | — | | | (1,404) | | | (17,145) | | | — | | | (18,549) |

Merger and acquisition costs & costs related to share repurchase | | | 1,767 | | | 219 | | | 19 | | | 11,838 | | | 13,842 |

Other Adjustment | | | — | | | (2) | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | 22 | | $ | 23 | | $ | (18) | | $ | (80) | | $ | (55) |

| | | | | | | | | | | | | | | |

| | Azenta Total |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 |

GAAP operating (loss) profit | | $ | (16,628) | | $ | (15,836) | | $ | (12,977) | | $ | (27,684) | | $ | (73,126) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 4,769 | | | 4,656 | | | 4,901 | | | 4,168 | | | 18,494 |

Purchase accounting impact on inventory | | | 927 | | | 2,956 | | | 2,912 | | | 2,869 | | | 9,664 |

Amortization of other intangibles | | | 7,481 | | | 7,522 | | | 7,509 | | | 7,372 | | | 29,884 |

Restructuring Charges | | | 804 | | | 812 | | | 1,499 | | | 1,462 | | | 4,577 |

Rebranding and transformation costs | | | (15) | | | 21 | | | 10 | | | (65) | | | (49) |

Contingent consideration adjustment | | | — | | | (1,404) | | | (17,145) | | | — | | | (18,549) |

Merger and acquisition costs & costs related to share repurchase | | | 1,767 | | | 219 | | | 19 | | | 11,838 | | | 13,842 |

Other Adjustment | | | (1) | | | (2) | | | — | | | — | | | (1) |

Non-GAAP adjusted operating profit (loss) | | $ | (896) | | $ | (1,056) | | $ | (13,272) | | $ | (40) | | $ | (15,264) |

Reconciliation of GAAP to Non-GAAP Operating (Loss) Profit – Fiscal 2022

| | | | | | | | | | | | | | | |

| | Sample Management Solutions |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

GAAP operating (loss) profit | | $ | 2,513 | | $ | 5,402 | | $ | 7,805 | | $ | 6,613 | | $ | 22,335 |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 528 | | | 379 | | | 395 | | | 330 | | | 1,631 |

Tariff adjustment | | | — | | | — | | | — | | | — | | | — |

Amortization of other intangibles | | | — | | | — | | | 5 | | | — | | | 5 |

Other Adjustment | | | (1) | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | 3,041 | | $ | 5,781 | | $ | 8,205 | | $ | 6,943 | | $ | 23,970 |

| | | | | | | | | | | | | | | |

| | Multiomics |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

GAAP operating (loss) profit | | $ | (2,642) | | $ | (2,749) | | $ | 985 | | $ | 3,888 | | $ | (518) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,373 | | | 1,434 | | | 1,445 | | | 1,443 | | | 5,693 |

Tariff adjustment | | | 2 | | | — | | | (486) | | | — | | | (484) |

Amortization of other intangibles | | | 339 | | | — | | | (5) | | | — | | | 340 |

Other Adjustment | | | (1) | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | (930) | | $ | (1,315) | | $ | 1,939 | | $ | 5,331 | | $ | 5,032 |

| | | | | | | | | | | | | | | |

| | B Medical Systems |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

GAAP operating (loss) profit | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | — | | | — | | | — | | | — | | | — |

Tariff adjustment | | | — | | | — | | | — | | | — | | | — |

Amortization of other intangibles | | | — | | | — | | | — | | | — | | | — |

Other Adjustment | | | — | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

| | | | | | | | | | | | | | | |

| | Corporate |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

GAAP operating (loss) profit | | $ | (14,490) | | $ | (7,726) | | $ | (13,499) | | $ | (10,826) | | $ | (46,552) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of other intangibles | | | 6,561 | | | 5,745 | | | 6,047 | | | 6,272 | | | 24,620 |

Restructuring Charges | | | 393 | | | 25 | | | 122 | | | 173 | | | 712 |

Rebranding and transformation costs | | | 536 | | | 289 | | | 1,297 | | | 619 | | | 2,741 |

Contingent consideration adjustment | | | — | | | — | | | 600 | | | — | | | 600 |

Merger and acquisition costs & costs related to share repurchase | | | 6,959 | | | 1,662 | | | 4,989 | | | 3,719 | | | 17,329 |

Other Adjustment | | | — | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | (41) | | $ | (5) | | $ | (444) | | $ | (43) | | $ | (550) |

| | | | | | | | | | | | | | | |

| | Azenta Total |

| | Quarter Ended | | Year Ended |

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

Dollars in thousands | | 2022 | | 2022 | | 2022 | | 2021 | | 2022 |

GAAP operating (loss) profit | | $ | (14,619) | | $ | (5,073) | | $ | (4,708) | | $ | (325) | | $ | (24,735) |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of completed technology | | | 1,901 | | | 1,813 | | | 1,840 | | | 1,773 | | | 7,324 |

Amortization of other intangibles | | | 6,900 | | | 5,745 | | | 6,047 | | | 6,272 | | | 24,965 |

Tariff adjustment | | | 2 | | | — | | | (486) | | | — | | | (484) |

Restructuring Charges | | | 393 | | | 25 | | | 122 | | | 173 | | | 712 |

Rebranding and transformation costs | | | 536 | | | 289 | | | 1,297 | | | 619 | | | 2,741 |

Contingent consideration adjustment | | | — | | | — | | | 600 | | | — | | | 600 |

Merger and acquisition costs & costs related to share repurchase | | | 6,959 | | | 1,662 | | | 4,989 | | | 3,719 | | | 17,329 |

Other Adjustment | | | (2) | | | — | | | — | | | — | | | — |

Non-GAAP adjusted operating profit (loss) | | $ | 2,070 | | $ | 4,461 | | $ | 9,701 | | $ | 12,231 | | $ | 28,452 |

Organic Revenue – Fiscal 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | |

Dollars in millions | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Revenue | | $ | 82 | | $ | 75 | | 9 | % | | $ | 61 | | $ | 63 | | (2) | % | | $ | 29 | | $ | — | | — | % | | $ | 172 | | $ | 138 | | 25 | % |

Acquisitions/divestitures | | | 1 | | | — | | (1) | % | | | — | | | — | | — | % | | | 29 | | | — | | — | % | | | 30 | | | — | | (22) | % |

Currency exchange rates | | | 2 | | | — | | (3) | % | | | (0) | | | — | | 0 | % | | | — | | | — | | — | % | | | 2 | | | — | | (1) | % |

Organic revenue | | $ | 79 | | $ | 75 | | 5 | % | | $ | 61 | | $ | 63 | | (2) | % | | $ | — | | $ | — | | — | % | | $ | 140 | | $ | 138 | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | June 30, | | June 30, | | | | | June 30, | | June 30, | | | | | June 30, | | June 30, | | | | | June 30, | | June 30, | | | |

Dollars in millions | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Revenue | | $ | 75 | | $ | 73 | | 3 | % | | $ | 64 | | $ | 59 | | 8 | % | | $ | 27 | | $ | — | | — | % | | $ | 166 | | $ | 133 | | 25 | % |

Acquisitions/divestitures | | | 5 | | | — | | (7) | % | | | — | | | — | | — | % | | | 27 | | | — | | — | % | | | 32 | | | — | | (24) | % |

Currency exchange rates | | | (0) | | | — | | 0 | % | | | (1) | | | — | | 1 | % | | | — | | | — | | — | % | | | (1) | | | — | | 0 | % |

Organic revenue | | $ | 70 | | $ | 73 | | (4) | % | | $ | 64 | | $ | 59 | | 8 | % | | $ | — | | $ | — | | — | % | | $ | 135 | | $ | 133 | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | March 31, | | March 31, | | | | | March 31, | | March 31, | | | | | March 31, | | March 31, | | | | | March 31, | | March 31, | | | |

Dollars in millions | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Revenue | | $ | 71 | | $ | 81 | | (12) | % | | $ | 62 | | $ | 65 | | (4) | % | | $ | 15 | | $ | — | | — | % | | $ | 148 | | $ | 146 | | 2 | % |

Acquisitions/divestitures | | | 4 | | | — | | (5) | % | | | — | | | — | | — | % | | | 15 | | | — | | — | % | | | 19 | | | — | | (13) | % |

Currency exchange rates | | | (2) | | | — | | 3 | % | | | (2) | | | — | | 3 | % | | | — | | | — | | — | % | | | (4) | | | — | | 3 | % |

Organic revenue | | $ | 70 | | $ | 81 | | (14) | % | | $ | 64 | | $ | 65 | | (1) | % | | $ | — | | $ | — | | — | % | | $ | 134 | | $ | 146 | | (8) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | December 31, | | December 31, | | | | | December 31, | | December 31, | | | | | December 31, | | December 31, | | | | | December 31, | | December 31, | | | |

Dollars in millions | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change |

Revenue | | $ | 75 | | $ | 76 | | (0) | % | | $ | 61 | | $ | 64 | | (4) | % | | $ | 42 | | $ | — | | — | % | | $ | 178 | | $ | 140 | | 28 | % |

Acquisitions/divestitures | | | 4 | | | — | | (5) | % | | | — | | | — | | — | % | | | 42 | | | — | | — | % | | | 46 | | | — | | (33) | % |

Currency exchange rates | | | (3) | | | — | | 4 | % | | | (3) | | | — | | 5 | % | | | — | | | — | | — | % | | | (6) | | | — | | 4 | % |

Organic revenue | | $ | 75 | | $ | 76 | | (1) | % | | $ | 64 | | $ | 64 | | 0 | % | | $ | — | | $ | — | | — | % | | $ | 139 | | $ | 140 | | (1) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Year Ended | | Year Ended | | Year Ended | | Year Ended |

| | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | |

Dollars in millions | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Revenue | | $ | 304 | | $ | 305 | | (0) | % | | $ | 248 | | $ | 251 | | (1) | % | | $ | 113 | | $ | — | | — | % | | $ | 665 | | $ | 555 | | 20 | % |

Acquisitions/divestitures | | | 14 | | | — | | (4) | % | | | — | | | — | | — | % | | | 113 | | | — | | — | % | | | 127 | | | — | | (23) | % |

Currency exchange rates | | | (4) | | | — | | 1 | % | | | (6) | | | — | | 2 | % | | | — | | | — | | — | % | | | (9) | | | — | | 2 | % |

Organic revenue | | $ | 294 | | $ | 305 | | (4) | % | | $ | 254 | | $ | 251 | | 1 | % | | $ | — | | $ | — | | — | % | | $ | 547 | | $ | 555 | | (1) | % |

Organic Revenue – Fiscal 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | |

Dollars in millions | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change |

Revenue | | $ | 75 | | $ | 78 | | (3) | % | | $ | 63 | | $ | 59 | | 6 | % | | $ | — | | $ | — | | — | % | | $ | 138 | | $ | 137 | | 0 | % |

Acquisitions/divestitures | | | 4 | | | — | | (5) | % | | | — | | | — | | — | % | | | — | | | — | | — | % | | | 4 | | | — | | (3) | % |

Currency exchange rates | | | (4) | | | — | | 5 | % | | | (2) | | | — | | 4 | % | | | — | | | — | | — | % | | | (6) | | | — | | 4 | % |

Organic revenue | | $ | 75 | | $ | 78 | | (4) | % | | $ | 65 | | $ | 59 | | 9 | % | | $ | — | | $ | — | | — | % | | $ | 139 | | $ | 137 | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | June 30, | | June 30, | | | | | June 30, | | June 30, | | | | | June 30, | | June 30, | | | | | June 30, | | June 30, | | | |

Dollars in millions | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change |

Revenue | | $ | 73 | | $ | 70 | | 4 | % | | $ | 59 | | $ | 59 | | 1 | % | | $ | — | | $ | — | | — | % | | $ | 133 | | $ | 129 | | 3 | % |

Acquisitions/divestitures | | | — | | | — | | — | % | | | — | | | — | | — | % | | | — | | | — | | — | % | | | — | | | — | | — | % |

Currency exchange rates | | | (2) | | | — | | 4 | % | | | (1) | | | — | | 2 | % | | | — | | | — | | — | % | | | (4) | | | — | | 3 | % |

Organic revenue | | $ | 76 | | $ | 70 | | 8 | % | | $ | 61 | | $ | 59 | | 3 | % | | $ | — | | $ | — | | — | % | | $ | 137 | | $ | 129 | | 6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | March 31, | | March 31, | | | | | March 31, | | March 31, | | | | | March 31, | | March 31, | | | | | March 31, | | March 31, | | | |

Dollars in millions | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change |

Revenue | | $ | 81 | | $ | 73 | | 11 | % | | $ | 65 | | $ | 57 | | 15 | % | | $ | — | | $ | — | | — | % | | $ | 146 | | $ | 130 | | 12 | % |

Acquisitions/divestitures | | | 2 | | | — | | (2) | % | | | — | | | — | | — | % | | | — | | | — | | — | % | | | 2 | | | — | | (1) | % |

Currency exchange rates | | | (1) | | | — | | 1 | % | | | (1) | | | — | | 1 | % | | | — | | | — | | — | % | | | (2) | | | — | | 1 | % |

Organic revenue | | $ | 80 | | $ | 73 | | 10 | % | | $ | 66 | | $ | 57 | | 16 | % | | $ | — | | $ | — | | — | % | | $ | 145 | | $ | 130 | | 12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Quarter Ended | | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | December 31, | | December 31, | | | | | December 31, | | December 31, | | | | | December 31, | | December 31, | | | | | December 31, | | December 31, | | | |

Dollars in millions | | 2021 | | 2020 | | Change | | 2021 | | 2020 | | Change | | 2021 | | 2020 | | Change | | 2021 | | 2020 | | Change |

Revenue | | $ | 76 | | $ | 68 | | 12 | % | | $ | 64 | | $ | 50 | | 27 | % | | $ | — | | $ | — | | — | % | | $ | 140 | | $ | 118 | | 18 | % |

Acquisitions/divestitures | | | 2 | | | — | | (3) | % | | | — | | | — | | — | % | | | — | | | — | | — | % | | | 2 | | | — | | (2) | % |

Currency exchange rates | | | 0 | | | — | | (1) | % | | | 0 | | | — | | (0) | % | | | — | | | — | | — | % | | | 0 | | | — | | (0) | % |

Organic revenue | | $ | 73 | | $ | 68 | | 8 | % | | $ | 64 | | $ | 50 | | 27 | % | | $ | — | | $ | — | | — | % | | $ | 137 | | $ | 118 | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sample Management Solutions | | Multiomics | | B Medical Systems | | Azenta Total |

| | Year Ended | | Year Ended | | Year Ended | | Year Ended |

| | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | | | September 30, | | September 30, | | | |

Dollars in millions | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change | | 2022 | | 2021 | | Change |

Revenue | | $ | 305 | | $ | 289 | | 6 | % | | $ | 251 | | $ | 225 | | 11 | % | | $ | — | | $ | — | | — | % | | $ | 555 | | $ | 514 | | 8 | % |

Acquisitions/divestitures | | | 8 | | | — | | (3) | % | | | — | | | — | | — | % | | | — | | | — | | — | % | | | 8 | | | — | | (2) | % |

Currency exchange rates | | | (7) | | | — | | 2 | % | | | (4) | | | — | | 2 | % | | | — | | | — | | — | % | | | (11) | | | — | | 2 | % |

Organic revenue | | $ | 303 | | $ | 289 | | 5 | % | | $ | 255 | | $ | 225 | | 13 | % | | $ | — | | $ | — | | — | % | | $ | 558 | | $ | 514 | | 9 | % |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

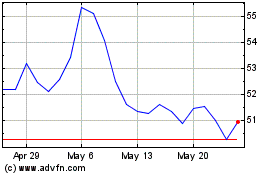

Azenta (NASDAQ:AZTA)

Historical Stock Chart

From Apr 2024 to May 2024

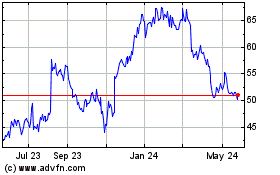

Azenta (NASDAQ:AZTA)

Historical Stock Chart

From May 2023 to May 2024