Filed pursuant to Rule 424(b)(5)

Registration No. 333-235674

PROSPECTUS SUPPLEMENT

(to Prospectus dated January 10, 2020)

Up to $75,000,000

Common Shares

We previously entered into an Open Market Sale AgreementSM, or, as amended, the Sale Agreement, with Jefferies LLC, or Jefferies, relating to our common shares, without par value per common share, offered by this prospectus supplement. In accordance with the terms of the Sale Agreement, we may offer and sell our common shares having an aggregate offering price of up to $75,000,000, from time to time through Jefferies, acting as sales agent.

Sales of our common shares, if any, under this prospectus supplement will be made by any method permitted that is deemed an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Jefferies is not required to sell any specific amount, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Jefferies will be entitled to compensation at a commission rate of 3.0% of the gross sales price of the shares sold under the Sale Agreement. See “Plan of Distribution” beginning on page S-11 for additional information regarding the compensation to be paid to Jefferies. In connection with the sale of common shares on our behalf, Jefferies will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Jefferies will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Jefferies with respect to certain liabilities, including civil liabilities under the Securities Act.

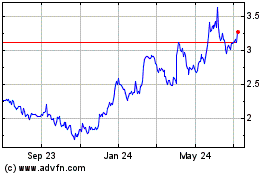

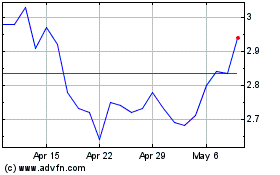

Our common shares trade on the Nasdaq Global Select Market under the symbol “ABUS”. On August 6, 2020, the last reported sale price for our common shares on the Nasdaq Global Select Market was $4.37 per common share.

__________________________________________

INVESTING IN OUR COMMON SHARES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE S-6 OF THIS PROSPECTUS SUPPLEMENT, AS WELL AS THE OTHER INFORMATION CONTAINED IN OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS SUPPLEMENT BEFORE MAKING A DECISION TO INVEST IN OUR SECURITIES.

__________________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement and the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Jefferies

The date of this prospectus supplement is August 7, 2020

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

|

|

|

|

|

|

|

Page

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

ii

|

|

FORWARD-LOOKING STATEMENTS

|

S-1

|

|

SUMMARY

|

S-3

|

|

RISK FACTORS

|

S-6

|

|

USE OF PROCEEDS

|

S-8

|

|

DILUTION

|

S-9

|

|

PLAN OF DISTRIBUTION

|

S-11

|

|

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

|

S-13

|

|

LEGAL MATTERS

|

S-20

|

|

EXPERTS

|

S-20

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

S-20

|

|

|

|

|

|

|

|

|

PROSPECTUS

|

|

|

|

Page

|

|

ABOUT THIS PROSPECTUS

|

1

|

|

FORWARD-LOOKING STATEMENTS

|

2

|

|

THE COMPANY

|

4

|

|

RISK FACTORS

|

5

|

|

USE OF PROCEEDS

|

6

|

|

GENERAL DESCRIPTION OF OUR SECURITIES

|

7

|

|

DESCRIPTION OF OUR CAPITAL STOCK

|

8

|

|

DESCRIPTION OF OUR WARRANTS

|

11

|

|

DESCRIPTION OF OUR DEBT SECURITIES

|

13

|

|

DESCRIPTION OF OUR UNITS

|

18

|

|

PLAN OF DISTRIBUTION

|

19

|

|

LEGAL MATTERS

|

22

|

|

EXPERTS

|

22

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

22

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement relates to the offering of our common shares. Before buying any of the common shares that we are offering, we urge you to carefully read this prospectus supplement, together with the information incorporated by reference as described under the headings “Where You Can Find Additional Information” in the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering. These documents contain important information that you should consider when making your investment decision.

This prospectus supplement describes the terms of this offering of common shares and also adds to and updates information contained in the documents incorporated by reference into this prospectus supplement. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in any document incorporated by reference into this prospectus supplement that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus supplement, on the other hand, or the information contained in any free writing prospectus prepared by us or on our behalf that we have authorized for use in connection with this offering, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and any free writing prospectus prepared by or on our behalf that we have authorized for use in connection with this offering. We have not, and Jefferies has not, authorized any dealer, salesperson or other person to provide any information or to make any representation other than those contained or incorporated by reference into this prospectus supplement or into any free writing prospectus prepared by or on our behalf or to which we have referred you. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and Jefferies take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and Jefferies is not, making an offer to sell the common shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing or incorporated by reference into this prospectus supplement and in any free writing prospectus prepared by or on our behalf that we have authorized for use in connection with this offering is accurate only as of the date of each such respective document. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, including the documents incorporated by reference, and any free writing prospectus prepared by or on our behalf that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find More Information.”

Other than in the United States, no action has been taken by us or Jefferies that would permit a public offering of the common shares offered by this prospectus supplement in any jurisdiction where action for that purpose is required. The common shares offered by this prospectus supplement may not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements in connection with the offer and sale of the common shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus supplement comes are advised to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy the common shares offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

Unless stated otherwise or the context otherwise requires, references in this prospectus supplement to “Arbutus,” the “Company,” “we,” “us,” or “our” refer to Arbutus Biopharma Corporation and our wholly-owned subsidiaries through which we conduct our business. The Arbutus logo and all other Arbutus product names are trademarks of Arbutus in the United States and in other select countries. The Arbutus logo is a trademark of Arbutus in Canada. We may indicate U.S. trademark registrations and U.S. trademarks with the symbols “®” and “™”, respectively. Other third-party logos and product/trade names are registered trademarks or trade names of their respective owners.

FORWARD-LOOKING STATEMENTS

This prospectus supplement contains “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws (we collectively refer to these items as “forward-looking statements”). Forward-looking statements are generally identifiable by use of the words “believes,” “may,” “plans,” “will,” “anticipates,” “intends,” “budgets,” “could,” “estimates,” “expects,” “forecasts,” “projects” and similar expressions that are not based on historical fact or that are predictions of or indicate future events and trends, and the negative of such expressions. Forward-looking statements in this prospectus supplement, including the documents incorporated by reference, include statements about, among other things:

•our strategy, future operations, pre-clinical research, pre-clinical studies, clinical trials, prospects and the plans of management;

•the potential impact of the COVID-19 pandemic on our business;

•the discovery, development and commercialization of a curative combination regimen for chronic hepatitis B infection, a disease of the liver caused by the hepatitis B virus, or HBV;

•our beliefs and development path and strategy to achieve a curative combination regimen for HBV;

•obtaining necessary regulatory approvals;

•obtaining adequate financing through a combination of financing activities and operations;

•using the results from our HBV studies to adaptively design additional clinical trials to test the efficacy of the combination therapy and the duration of the result in patients;

•the expected timing of and amount for payments related to the Enantigen Therapeutics, Inc.’s transaction and its programs;

•the potential of our drug candidates to improve upon the standard of care and contribute to a curative combination treatment regimen;

•the potential benefits of the reversion of the Ontario Municipal Employees Retirement System, or OMERS, royalty monetization transaction for our ONPATTRO® (Patisiran), or ONPATTRO, royalty interest;

•developing a suite of products that intervene at different points in the viral life cycle, with the potential to reactivate the host immune system;

•using pre-clinical results to adaptively design clinical trials for additional cohorts of patients, testing the combination and the duration of therapy;

•selecting combination therapy regimens and treatment durations to conduct Phase 3 clinical trials intended to ultimately support regulatory filings for marketing approval;

•expanding our HBV drug candidate pipeline through internal development, acquisitions and in-licenses;

•our expectation for AB-729 for preliminary results from a single-dose 90 mg cohort and multi-dose 60 mg cohorts in our Phase 1a/1b trial to be available in the second half of 2020;

•our expectation for AB-729 for preliminary results from a 90 mg single-dose cohort in HBV DNA positive subjects to be available in the second half of 2020:

•our expectation to dose two 90 mg multi-dose cohorts in the second half of 2020;

•our expectation that AB-729 could be combined with our lead capsid inhibitor candidate, AB-836, and approved NAs, in our first combination therapy for HBV patients;

•the potential for an oral HBsAg-reducing agent and potential all-oral combination therapy;

•our objective to complete IND/CTA-enabling studies for AB-836 by the end of 2020;

•the potential for AB-836 to be low-dose regimen with a wide therapeutic window and to address known capsid resistant variants T33N and 1105T;

•the potential for AB-836 to have increased potency and an enhanced resistance profile, compared to our previous capsid inhibitor candidate, AB-506;

•the potential for AB-836 to be once-daily dosing;

•our expectation to pursue development of a next generation oral HBV RNA-destabilizer;

•payments from our license agreement with Gritstone Oncology, Inc.;

•the expected return from strategic alliances, licensing agreements, and research collaborations;

•statements with respect to revenue and expense fluctuation and guidance;

•having sufficient cash resources to fund our operations through mid-2022;

•obtaining funding to maintain and advance our business from a variety of sources including public or private equity or debt financing, collaborative arrangements with pharmaceutical companies, other non-dilutive commercial arrangements and government grants and contracts; and

•our use of proceeds from this offering.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus supplement under the heading “Risk Factors”, and in the documents incorporated by reference into this prospectus supplement, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make.

Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially and adversely from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus supplement and the documents incorporated by reference in this prospectus supplement with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. We qualify all forward-looking statements by these cautionary statements.

SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding to invest in our common shares. For a more complete understanding of our company and this offering, you should read carefully this entire prospectus supplement, including the information incorporated by reference into this prospectus supplement, and any free writing prospectus prepared by or on our behalf that we have authorized for use in connection with this offering, including the “Risk Factors” section beginning on page S-6 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement.

Company Overview

Arbutus Biopharma Corporation (“Arbutus”, the “Company”, “we”, “us”, and “our”) is a publicly traded (Nasdaq Global Select Market: ABUS) clinical-stage biopharmaceutical company primarily focused on developing a cure for people with HBV infection. We are advancing multiple drug product candidates that may be combined into a potentially curative regimen for chronic HBV infection. Arbutus has also initiated a drug discovery and development effort for treating coronaviruses, including COVID-19.

Our focus is on developing new HBV treatment regimens with finite treatment durations and higher cure rates. We define a cure as a functional cure where HBV DNA replication and hepatitis B surface antigen expression are reduced to undetectable levels and this level of expression is sustained six months after a finite duration of therapy. Our HBV product pipeline includes RNA interference therapeutics, oral capsid inhibitors, oral compounds that inhibit PD-L1 and oral HBV RNA destabilizers. We believe a combination of these product candidates could lead to a curative treatment regimen with a finite duration for patients with chronic HBV infection.

Corporate Information

Arbutus was incorporated pursuant to the British Columbia Business Corporations Act, or BCBCA, on October 6, 2005, and commenced active business on April 30, 2007, when Arbutus and its parent company, Inex Pharmaceuticals Corporation, or Inex, were reorganized under a statutory plan of arrangement, or the Plan of Arrangement, completed under the provisions of the BCBCA. The Plan of Arrangement saw Inex's entire business transferred to and continued by Arbutus.

On March 4, 2015, we completed a business combination pursuant to which OnCore Biopharma, Inc., or OnCore, became our wholly-owned subsidiary. Arbutus Inc. contributed many of the assets in our HBV pipeline. Effective July 31, 2015, our corporate name changed from Tekmira Pharmaceuticals Corporation to Arbutus Biopharma Corporation. Also effective July 31, 2015, the corporate name of our wholly owned subsidiary, OnCore Biopharma, Inc. changed to Arbutus Biopharma, Inc., or Arbutus Inc. We had two wholly owned subsidiaries: Arbutus Inc. and Protiva Biotherapeutics Inc., or Protiva. Effective January 1, 2018, Protiva was amalgamated with Arbutus.

Arbutus' head office and principal place of business is located at 701 Veterans Circle, Warminster, Pennsylvania 18974 and our telephone number is (267) 469-0914. We maintain a website at www.arbutusbio.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus supplement. We have included our website address in this prospectus supplement solely as an inactive textual reference.

THE OFFERING

|

|

|

|

|

|

|

|

Common shares offered by us:

|

Common shares having an aggregate offering price of up to $75.0 million.

|

|

|

|

|

Common shares to be outstanding following the offering

|

Up to 97,967,830 shares (as more fully described in the notes following this table), assuming sales of 17,162,471 of our common shares in this offering at an offering price of $4.37 per share, which was the last reported sale price of our common shares on the Nasdaq Global Select Market on August 6, 2020. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

|

|

|

Plan of Distribution:

|

“At the market offering” that may be made from time to time on the Nasdaq Global Select Market or other existing trading markets for our common shares through our sales agent, Jefferies. See “Plan of Distribution” on page S-11 of this prospectus supplement

|

|

|

|

|

Use of Proceeds:

|

We currently intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures, research and development expenditures, preclinical study and clinical trial expenditures, acquisitions or new technologies and investments and business combinations. We reserve the right, at the sole discretion of our management, to reallocate the proceeds of this offering in response to developments in our business and other factors. See “Use of Proceeds” on page S-8 of this prospectus supplement.

|

|

|

|

|

Risk Factors:

|

Investing in our common shares involves a high degree of risk. Please read the information contained in and incorporated by reference under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in our common shares.

|

|

|

|

|

Nasdaq Global Select Market symbol:

|

“ABUS”.

|

Unless otherwise indicated, the number of common shares to be outstanding after this offering is based on 71,256,579 common shares outstanding as of June 30, 2020 plus 9,548,780 common shares issued under the Sale Agreement from June 30, 2020 to July 24, 2020 and excludes:

•approximately 20 million of our common shares issuable upon the conversion of our Series A participating convertible preferred shares, or the Preferred Shares, outstanding as of June 30, 2020, including accrued dividends thereon as of June 30, 2020;

•11,017,404 of our common shares issuable upon the exercise of stock options outstanding as of June 30, 2020, at a weighted average exercise price of $4.57 per common share, of which stock options to purchase 6,281,447 common shares were then exercisable (less 103,900 of our common shares issued upon the exercise of stock options subsequent to June 30, 2020, at a weighted average exercise price of $5.20 per common share);

•2,943,633 of our common shares reserved for future grants of stock options (or other similar equity instruments) under the 2016 Share and Omnibus Incentive Plan, or the 2016 Plan, as of June 30, 2020 (less 108,200 of our common shares issuable upon the exercise of stock options

granted under the 2016 Plan since June 30, 2020, at a weighted average exercise price of $1.87 per common share);

•2,250 of our common shares reserved for future grants of stock options (or other similar equity instruments) under the 2011 Omnibus Share Compensation Plan, or the 2011 Plan, as of June 30, 2020; and

•1,500,000 of our common shares reserved for future issuance under the 2020 Employee Stock Purchase Plan, or 2020 ESPP, as of June 30, 2020.

RISK FACTORS

Investing in our common shares is speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in this prospectus supplement and the documents incorporated by reference into this prospectus supplement, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2019, which is incorporated by reference into this prospectus supplement, as updated by annual, quarterly and other reports and documents we file with the SEC after the date of this prospectus supplement and that are incorporated by reference into this prospectus supplement. If any of these risks actually occurs, our business, financial condition or results of operations could be materially adversely affected. These risks and uncertainties are not the only ones faced by us. Additional risks and uncertainties, including those of which we are currently unaware or that are currently deemed immaterial, may also materially and adversely affect our business, financial condition, cash flows, prospects and the price of our common shares.

Risks Related to This Offering

A substantial number of common shares may be sold in the market following this offering, which may depress the market price for our common shares.

Sales of a substantial number of our common shares in the public market following this offering could cause the market price of our common shares to decline. Although there can be no assurance that any of the $75.0 million worth of common shares being offered under this prospectus supplement will be sold or the price at which any such shares might be sold, assuming that an aggregate of 17,162,471 of our common shares are sold during the term of the Sale Agreement with Jefferies, in each case, for example, at a price of $4.37 per share, the last reported sale price of our common shares on the Nasdaq Global Select Market on August 6, 2020, upon completion of this offering, based on 71,256,579 shares outstanding as of June 30, 2020 and 9,548,780 common shares issued between June 30, 2020 and July 24, 2020 under the Sale Agreement with Jefferies, we will have outstanding an aggregate of 97,967,830 common shares, assuming no exercise of outstanding options, and no conversion of the Preferred Shares. A substantial majority of our outstanding common shares are, and all of the common shares sold in this offering upon issuance will be, freely tradable without restriction or further registration under the Securities Act, unless these shares are owned or purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act.

In addition, as of June 30, 2020, we had outstanding Preferred Shares convertible for approximately 20 million common shares (including accrued interest thereon) and outstanding stock options exercisable for 11,017,404 common shares at a weighted average exercise price of $4.57 per share, of which stock options to purchase 6,281,447 common shares were then exercisable. Upon conversion of the Preferred Shares or exercise of the stock options, we would issue additional common shares. As a result, our current shareholders as a group would own a substantially smaller interest in us and may have less influence on our management and policies than they now have. Furthermore, the holders may sell these shares in the public markets from time to time, without limitations on the timing, amount or method of sale. Sales of these common shares in the market could cause the market price of our common shares to decline. Moreover, if we issue options to purchase or acquire our common shares in the future and those options are exercised or settled, you may experience further dilution.

Additional dilution may result from the issuance of our common shares in connection with collaborations or other financing efforts.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional common shares or other securities convertible into or exchangeable for our common shares at prices that may not be the same as the price per share in this offering. We may sell common shares or other securities convertible into or exchangeable for our common shares in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing common shares or other securities convertible into or exchangeable for our common shares in the future could have rights superior to existing shareholders. The price per share at which we sell additional

common shares or other securities convertible or exchangeable into our common shares, in future transactions may be higher or lower than the price per share paid by investors in this offering.

We have broad discretion in how we use the net proceeds of this offering, and we may not use these proceeds effectively or in ways with which you agree.

We have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Our management will have broad discretion as to the application of the net proceeds of this offering and could use them for purposes other than those contemplated at the time of this offering. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our common shares.

Investors in this offering will experience immediate dilution in the book value per share of the common shares purchased in the offering.

The common shares sold in this offering, if any, will be sold from time to time at various prices. However, the expected offering price of our common shares will be substantially higher than the pro forma net tangible book value per share of our outstanding common shares. After giving effect to the sale of our common shares in the aggregate amount of $75.0 million at an assumed offering price of $4.37 per share, the last reported sale price of our common shares on August 6, 2020 on the Nasdaq Global Select Market, and after deducting estimated commissions and estimated offering expenses, our pro forma as-adjusted net tangible book value as of June 30, 2020, based on 71,256,579 common shares outstanding as of June 30, 2020 plus 9,548,780 common shares issued under the Sale Agreement from June 30, 2020 to July 24, 2020, would have been approximately $174.6 million, or approximately $1..78 per common share. This represents an immediate increase in pro forma net tangible book value of approximately $0.52 per common share to our existing shareholders and an immediate dilution in pro forma as-adjusted net tangible book value of approximately $2.59 per common share to new investors of our common shares in this offering. See “Dilution” on page S-9 of this prospectus supplement.

It is not possible to predict the aggregate proceeds resulting from sales made under the Sale Agreement.

Subject to certain limitations in the Sale Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to Jefferies at any time throughout the term of the Sale Agreement. The number of shares that are sold through Jefferies after delivering a placement notice will fluctuate based on a number of factors, including the market price of our common shares during the sales period, any limits we may set with Jefferies in any applicable placement notice and the demand for our common shares. Because this offering can be terminated at any time and the price per share of each common share sold pursuant to the Sale Agreement will fluctuate over time, it is not currently possible to predict the aggregate proceeds to be raised in connection with sales under the Sale Agreement.

We do not expect to pay dividends in the foreseeable future. As a result, you must rely on stock appreciation for any return on your investment.

We do not anticipate paying cash dividends on our common shares in the foreseeable future. Any payment of cash dividends will also depend on our financial condition, results of operations, capital requirements and other factors and will be at the discretion of our board of directors. Accordingly, you will have to rely on capital appreciation, if any, to earn a return on your investment in our common shares. Furthermore, we may in the future become subject to additional contractual restrictions on, or prohibitions against, the payment of dividends.

USE OF PROCEEDS

We may issue and sell our common shares having aggregate sales proceeds of up to $75.0 million from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that, in the future, we will sell any shares under or fully utilize the Sale Agreement with Jefferies as a source of financing.

We currently intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures, research and development expenditures, preclinical study and clinical trial expenditures, acquisitions of new technologies and investments and business combinations.

The precise amount and timing of the application of these net proceeds will depend upon a number of factors, such as the timing and progress of our research and development efforts and the timing and progress of any partnering efforts. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds from this offering. Depending on the outcome of our efforts and other unforeseen events, our plans and priorities may change and we may apply the net proceeds of this offering in different manners than we currently anticipate. Accordingly, our management will have broad discretion in the timing and application of these net proceeds. Pending application of the net proceeds as described above, we intend to temporarily invest the proceeds in short-term, interest-bearing instruments.

DILUTION

If you invest in our common shares in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share and our pro forma net tangible book value per share after this offering. We calculate net tangible book value per share by dividing our net tangible book value, which is tangible assets less total liabilities, by the number of outstanding common shares.

The net tangible book value of our common shares as of June 30, 2020 was approximately $65.5 million, or approximately $0.92 per common share.

Our pro forma net tangible book value as of June 30, 2020 was $102.0 million, or $1.26 per common share. Pro forma net tangible book value per share represents pro forma net tangible book value divided by the pro forma number of common shares outstanding, after giving effect to our issuance and sale of 9,548,780 common shares pursuant to the Sale Agreement from June 30, 2020 to July 24, 2020.

After giving effect to the sale of our common shares in the aggregate amount of $75.0 million at an assumed offering price of $4.37 per common share, the last reported sale price of our common shares on August 6, 2020 on the Nasdaq Global Select Market, and after deducting estimated commissions and estimated offering expenses, our pro forma as-adjusted net tangible book value as of June 30, 2020 would have been approximately $174.6 million, or approximately $1.78 per common share. This represents an immediate increase in pro forma net tangible book value of approximately $0.52 per common share to our existing shareholders and an immediate dilution in pro forma as-adjusted net tangible book value of approximately $2.59 per common share to new investors of our common shares in this offering, as illustrated by the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per share

|

|

|

$

|

4.37

|

|

|

Net tangible book value per share as of June 30, 2020

|

$

|

0.92

|

|

|

|

|

Increase in pro forma tangible book value per share attributable to shares sold pursuant to the Sale Agreement from June 30, 2020 to July 24, 2020

|

$

|

0.34

|

|

|

|

|

Pro forma net tangible book value per share as of June 30, 2020

|

$

|

1.26

|

|

|

|

|

Increase in pro forma net tangible book value per share after this offering

|

$

|

0.52

|

|

|

|

|

Pro forma as adjusted net tangible book value per share as of June 30, 2020, after giving effect to this offering

|

|

|

$

|

1.78

|

|

|

Dilution per share to new investors in this offering(1)(2)

|

|

|

$

|

2.59

|

|

(1) Calculated as the difference between the assumed public offering price per common share and the pro forma as-adjusted net tangible book value per share after this offering.

(2) The foregoing is based on 71,256,579 common shares outstanding as of June 30, 2020 plus 9,548,780 common shares issued under the Sale Agreement from June 30, 2020 to July 24, 2020 and excludes as of such date:

•approximately 20 million of our common shares issuable upon the conversion of Preferred Shares outstanding as of June 30, 2020, including accrued dividends thereon as of June 30, 2020;

•11,017,404 of our common shares issuable upon the exercise of stock options outstanding as of June 30, 2020, at a weighted average exercise price of $4.57 per common share, of which stock options to purchase 6,281,447common shares were then exercisable (less 103,900 of our common shares issued upon the exercise of stock options subsequent to June 30, 2020, at a weighted average exercise price of $5.20 per common share);

•2,943,633 of our common shares reserved for future grants of stock options (or other similar equity instruments) under the 2016 Plan as of June 30, 2020 (less 108,200 of our common shares issuable upon the exercise of stock options granted under the 2016 Plan since June 30, 2020, at a weighted average exercise price of $1.87 per common share);

•2,250 of our common shares reserved for future grants of stock options (or other similar equity instruments) under the 2011 Plan as of June 30, 2020; and

•1,500,000 of our common shares reserved for future issuance under the 2020 Employee Stock Purchase Plan as of June 30, 2020.

The table above assumes for illustrative purposes that an aggregate of 17,162,471 of our common shares are sold during the term of the Sale Agreement with Jefferies at a price of $4.37 per share, the last reported sale price of our common shares on the Nasdaq Global Select Market on August 6, 2020, for aggregate net proceeds of approximately $72.6 million, after deducting commissions and estimated aggregate offering expenses payable by us. The pro forma as adjusted information is illustrative only and will adjust based on the actual price to the public, the actual number of shares sold and other terms of the offering determined at the time our common shares are sold pursuant to this prospectus. The shares pursuant to the Sale Agreement with Jefferies are being sold from time to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $4.37 per share shown in the table above, assuming all of our common shares in the aggregate amount of $75.0 million during the term of the Sale Agreement with Jefferies is sold at that price, would increase our pro forma as adjusted net tangible book value per share after the offering to $1.84 per share and would increase the dilution in pro forma net tangible book value per share to new investors in this offering to $3.53 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $4.37 per share shown in the table above, assuming all of our common shares in the aggregate amount of $75.0 million during the term of the Sale Agreement with Jefferies is sold at that price, would result in our pro forma as adjusted net tangible book value per share after the offering remaining at $1.69 per share but would decrease the dilution in pro forma net tangible book value per share to new investors in this offering to $1.68 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

To the extent that any options have been or are exercised, preferred shares are converted, new options are issued under our equity incentive plans or as inducement awards or we otherwise issue additional common shares in the future, there will be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders.

PLAN OF DISTRIBUTION

We previously entered into the Sale Agreement with Jefferies relating to our common shares. In accordance with the terms of the Sale Agreement, we may offer and sell up to $75.0 million of our common shares from time to time through Jefferies, acting as sales agent. Sales of our common shares, if any, under this prospectus supplement and the accompanying prospectus will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act including sales made directly on or through the Nasdaq Global Select Market or any other existing trading market for our common shares provided such sales are conducted on a market or exchange outside of Canada or to persons resident outside of Canada.

Each time we wish to issue and sell common shares under the Sale Agreement, we will notify Jefferies of the number of shares to be issued, the dates on which such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may not be made. Once we have so instructed Jefferies, unless Jefferies declines to accept the terms of such notice, Jefferies has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of Jefferies under the Sale Agreement to sell our common shares are subject to a number of conditions that we must meet.

The settlement of sales of shares between us and Jefferies is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales of our common shares as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Jefferies may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Jefferies a commission equal to 3.0% of the aggregate gross proceeds we receive from each sale of our common shares. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We estimate that the total expenses for the offering, excluding any commissions or expense reimbursement payable to Jefferies under the terms of the Sale Agreement, will be approximately $120,000. The remaining sale proceeds, after deducting any other transaction fees, will equal our net proceeds from the sale of such shares.

Jefferies will provide written confirmation to us before the open on the Nasdaq Global Select Market on the day following each day on which common shares are sold under the Sale Agreement. Each confirmation will include the number of shares sold on that day, the aggregate gross proceeds of such sales and the proceeds to us.

In connection with the sale of the common shares on our behalf, Jefferies will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of Jefferies will be deemed to be underwriting commissions or discounts. We have agreed to indemnify Jefferies against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute to payments Jefferies may be required to make in respect of such liabilities.

The offering of our common shares pursuant to the Sale Agreement will terminate upon the earlier of (i) the sale of all common shares subject to the Sale Agreement and (ii) the termination of the Sale Agreement as permitted therein.

This summary of the material provisions of the Sale Agreement, does not purport to be a complete statement of its terms and conditions. A copy of the Sale Agreement is filed as an exhibit to a current report on Form 8-K filed under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and incorporated by reference in this prospectus supplement.

Jefferies and its affiliates may in the future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates, for which services they may in the future receive customary fees. In the course of its business, Jefferies may actively trade our securities for its own account or for the accounts of customers, and, accordingly, Jefferies may at any time hold long or short positions in such securities.

This prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Jefferies, and Jefferies may distribute this prospectus supplement and the accompanying prospectus electronically.

Notwithstanding the above, the securities: (i) have not been qualified for distribution by prospectus in Canada, and (ii) may not be offered or sold in Canada during the course of their distribution except pursuant to a Canadian prospectus or in reliance on an available prospectus exemption.

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising from and relating to the acquisition, ownership, and disposition of common shares acquired pursuant to this prospectus. This section applies only to a U.S. Holder that holds common shares as capital assets for U.S. federal income tax purposes. In addition, it does not set forth all of the U.S. federal income tax consequences that may be relevant in light of the U.S. Holder’s particular circumstances, including alternative minimum tax consequences, the potential application of the provisions of the Code known as the Medicare contribution tax and tax consequences applicable to U.S. Holders subject to special rules, such as:

•certain financial institutions;

•dealers or traders in securities who use a mark-to-market method of tax accounting;

•U.S. expatriates and certain former citizens or long-term residents of the United States;

•persons holding common shares as part of a hedging transaction, straddle, wash sale, conversion transaction or other integrated transaction or persons entering into a constructive sale with respect to the common shares;

•persons whose functional currency for U.S. federal income tax purposes is not the U.S. dollar;

•entities classified as partnerships for U.S. federal income tax purposes;

•tax-exempt entities, including an “individual retirement account” or “Roth IRA”;

•persons that own or are deemed to own ten percent or more of our shares (by vote or value); or

•persons holding common shares in connection with a trade or business conducted outside of the United States.

If an entity that is classified as a partnership for U.S. federal income tax purposes holds common shares, the U.S. federal income tax treatment of a partner will depend on the status of the partner and the activities of the partnership. Partnerships holding common shares and partners in such partnerships should consult their tax advisers as to the particular U.S. federal income tax consequences of owning and disposing of the common shares.

This section is based on the Code, administrative pronouncements, judicial decisions, final, temporary and proposed Treasury regulations, all as of the date hereof, any of which is subject to change or differing interpretations, possibly with retroactive effect.

A “U.S. Holder” is a holder who, for U.S. federal income tax purposes, is a beneficial owner of common shares, and who is:

•a citizen or individual resident of the United States;

•a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state therein or the District of Columbia;

•an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

•a trust if (1) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have authority to control all substantial decisions of the trust or (2) the trust has a valid election to be treated as a U.S. person under applicable U.S. Treasury Regulations.

U.S. Holders should consult their tax advisers concerning the U.S. federal, state, local and non-U.S. tax consequences of owning and disposing of common shares in their particular circumstances.

Passive Foreign Investment Company Rules

Under the Code, we will be a passive foreign investment company, or PFIC, for any taxable year in which, after the application of certain “look-through” rules with respect to subsidiaries, either (i) 75% or more of our gross income consists of “passive income,” or (ii) 50% or more of the average quarterly value of our assets consist of assets that produce, or are held for the production of, “passive income.” For purposes of the above calculations, we will be treated as if we hold our proportionate share of the assets of, and receive directly our proportionate share of the income of, any other corporation in which we directly or indirectly own at least 25%, by value, of the shares of such corporation.

Passive income includes, among other things, interest, dividends, rents, certain non-active royalties and capital gains. Based on the composition of our gross income and assets in 2019, our reasonable estimates of our gross income and assets for 2020, and the nature of our business, we have determined that we were not a PFIC for our 2019 taxable year and we do not expect to be a PFIC for our taxable year ending December 31, 2020. Nevertheless, whether we are a PFIC in 2020 or any future taxable year is uncertain because, among other things, (i) we currently own, and will own after the closing of this offering, a substantial amount of passive assets, including cash, (ii) the valuation of our assets that generate non-passive income for PFIC purposes, including our intangible assets, is uncertain and may vary substantially over time, and (iii) the composition of our income may vary substantially over time. If we are a PFIC for any year during which a U.S. Holder holds common shares, we will continue to be treated as a PFIC with respect to that U.S. Holder for all succeeding years during which the U.S. Holder holds common shares, even if we ceased to meet the threshold requirements for PFIC status, unless the U.S. Holder makes a valid deemed sale or deemed dividend election under the applicable Treasury regulations with respect to its common shares.

If we are a PFIC for any taxable year during which a U.S. Holder holds common shares (assuming such U.S. Holder has not made a timely mark-to-market election, as described below), gain recognized by a U.S. Holder on a sale or other disposition (including certain pledges) of the common shares would be allocated ratably over the U.S. Holder’s holding period for the common shares. The amounts allocated to the taxable year of the sale or other disposition and to any year before we became a PFIC would be taxed as ordinary income. The amount allocated to each other taxable year would be subject to tax at the highest rate in effect for individuals or corporations, as appropriate, for that taxable year, and an interest charge would be imposed on the amount allocated to that taxable year. Further, to the extent that any distribution received by a U.S. Holder on its common shares exceeds 125% of the average of the annual distributions on the common shares received during the preceding three years or the U.S. Holder’s holding period, whichever is shorter, that distribution would be subject to taxation in the same manner as gain, described immediately above.

A U.S. Holder can avoid certain of the adverse rules described above by making a mark-to-market election with respect to its common shares, provided that the common shares are “marketable.” Common shares will be marketable if they are “regularly traded” on a “qualified exchange” or other market within the meaning of applicable Treasury regulations. The common shares will be treated as “regularly traded” in any calendar year in which more than a de minimis quantity of the common shares are traded on a qualified exchange on at least 15 days during each calendar quarter (subject to the rule that trades that have as one of their principal purposes the meeting of the trading requirement as disregarded). The Nasdaq Global Select Market is a qualified exchange for this purpose and, consequently, if the common shares are regularly traded, the mark-to-market election will be available to a U.S. Holder. If a U.S. Holder makes the mark-to-market election, it will recognize as ordinary income any excess of the fair market value of the common shares at the end of each taxable year over their adjusted tax basis, and will recognize an ordinary loss in respect of any excess of the adjusted tax basis of the common shares over their fair market value at the end of the taxable year (but only to the extent of the net amount of income previously included as a result of the mark-to-market election). If a U.S. Holder makes the election, the U.S. Holder’s tax basis in the common shares will be adjusted to reflect the income or loss amounts recognized. Any gain recognized on the sale or other disposition of common shares in a year when we are a PFIC will be treated as ordinary income and any loss will be treated as an ordinary loss (but only to the extent of the net amount of income previously included as a result of the mark-to-market election).

However, a mark-to-market election generally cannot be made for equity interests in any lower-tier PFICs that we own, unless shares of such lower-tier PFIC are themselves “marketable.” As a result, even if a U.S. Holder validly

makes a mark-to-market election with respect to our common shares, the U.S. Holder may continue to be subject to the PFIC rules (described above) with respect to its indirect interest in any of our investments that are treated as an equity interest in a PFIC for U.S. federal income tax purposes. U.S. Holders should consult their tax advisors as to the availability and desirability of a mark-to-market election, as well as the impact of such election on interests in any lower-tier PFICs.

Alternatively, a U.S. Holder can make an election, if we provide the necessary information, to treat us and each lower-tier PFIC as a qualified electing fund, or a QEF Election, in the first taxable year we (and our relevant subsidiaries) are treated as a PFIC with respect to the U.S. Holder. If a U.S. Holder makes a QEF Election with respect to a PFIC, the U.S. Holder will be currently taxable on its pro rata share of the PFIC’s ordinary earnings and net capital gain (at ordinary income and capital gain rates, respectively) for each taxable year that the entity is classified as a PFIC and will not be required to include such amounts in income when actually distributed by the PFIC. We intend to provide the information necessary for a U.S. Holder to make a QEF Election with respect to us and to cause each lower-tier PFIC which we control to provide such information with respect to such lower-tier PFIC. If such election remains in place while we and any lower-tier PFIC subsidiaries are PFICs, we and our subsidiaries will not be treated as PFICs with respect to such U.S. Holder. A U.S. Holder must make the QEF Election for us and for each of our subsidiaries that is a PFIC by attaching a separate properly completed IRS Form 8621 for each such PFIC to the U.S. Holder’s timely filed U.S. federal income tax return.

In addition, if we are a PFIC or, with respect to a particular U.S. Holder, are treated as a PFIC for the taxable year in which we paid a dividend or for the prior taxable year, the preferential dividend rates discussed above with respect to dividends paid to certain non-corporate U.S. Holders would not apply.

If a U.S. Holder owns common shares during any year in which we are a PFIC, the U.S. Holder must file annual reports, containing such information as the U.S. Treasury may require on IRS Form 8621 (or any successor form) with respect to us, with the U.S. Holder’s federal income tax return for that year, unless otherwise specified in the instructions with respect to such form.

U.S. Holders should consult their tax advisers concerning our PFIC status and the application of the PFIC rules.

General Rules Applicable to the Ownership and Disposition of Common Shares

The following discussion describes the general rules applicable to the ownership and disposition of the common shares but is subject in its entirety to the special rules described above under the heading “Passive Foreign Investment Company Rules.”

Distributions on Common Shares

A U.S. Holder that receives a distribution with respect to a common share will be required to include the amount of such distribution in gross income as a dividend (without reduction for any Canadian income tax withheld from such distribution) to the extent of our current and accumulated “earnings and profits,” as computed for U.S. federal income tax purposes. Subject to the passive foreign investment company rules described above, a distribution generally will be treated as a dividend to the extent paid out of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles). To the extent that a distribution exceeds our current and accumulated “earnings and profits,” such distribution will be treated first as a tax-free return of capital to the extent of a U.S. Holder's tax basis in the common shares and thereafter as gain from the sale or exchange of such common shares. (See “Sale or Other Taxable Disposition of Common Shares” below). However, we may not maintain the calculations of our earnings and profits in accordance with U.S. federal income tax principles, and each U.S. Holder may have to assume that any distribution by us with respect to the common shares will constitute ordinary dividend income. Dividends paid by a “qualified foreign corporation” to certain non-corporate U.S. Holders may be eligible for taxation at a reduced capital gains rate rather than the marginal tax rates generally applicable to ordinary income provided that a holding period requirement (more than 60 days of ownership, without protection from the risk of loss, during the 121-day period beginning 60 days before the ex-dividend date) and certain other requirements are met. Each U.S. Holder is advised to consult its tax advisors regarding the availability of the reduced tax rate on dividends to its particular circumstances. However, if we are a PFIC for the taxable year in which the dividend is paid or the preceding taxable year, we will not be treated as a qualified foreign corporation, and therefore the

reduced capital gains tax rate described above will not apply. Dividends received on common shares by corporate U.S. Holders generally will not be eligible for the “dividends received deduction.” The dividend rules are complex, and each U.S. Holder should consult its own tax advisors regarding the application of such rules.

Sale or Other Taxable Disposition of Common Shares

Upon the sale or other taxable disposition of common shares, a U.S. Holder generally will recognize capital gain or loss in an amount equal to the difference between the U.S. dollar value of cash received plus the fair market value of any property received and such U.S. Holder's tax basis in such common shares sold or otherwise disposed of. A U.S. Holder’s tax basis in common shares generally will be such holder’s U.S. dollar cost for such common shares. Gain or loss recognized on such sale or other disposition generally will be long-term capital gain or loss if, at the time of the sale or other disposition, the common shares have been held for more than one year.

Subject to the PFIC rules discussed above, preferential tax rates currently apply to long-term capital gain of a U.S. Holder that is an individual, estate, or trust. There are currently no preferential tax rates for long-term capital gain of a U.S. Holder that is a corporation. Deductions for capital losses are subject to significant limitations under the Code.

Receipt of Foreign Currency

The amount of any distribution paid to a U.S. Holder in foreign currency, or on the sale, exchange or other taxable disposition of common shares, generally will be equal to the U.S. dollar value of such foreign currency based on the exchange rate applicable on the date of receipt (regardless of whether such foreign currency is converted into U.S. dollars at that time). A U.S. Holder will have a basis in the foreign currency equal to its U.S. dollar value on the date of receipt. Any U.S. Holder who converts or otherwise disposes of the foreign currency after the date of receipt may have a foreign currency exchange gain or loss that would be treated as ordinary income or loss, and generally will be U.S. source income or loss for foreign tax credit purposes. Different rules apply to U.S. Holders who use the accrual method. Each U.S. Holder should consult its own U.S. tax advisors regarding the U.S. federal income tax consequences of receiving, owning, and disposing of foreign currency.

Foreign Tax Credit

Subject to the PFIC rules discussed above, a U.S. Holder that pays (whether directly or through withholding) Canadian income tax with respect to dividends paid on the common shares generally will be entitled, at the election of such U.S. Holder, to receive either a deduction or a credit for such Canadian income tax. Generally, a credit will reduce a U.S. Holder’s U.S. federal income tax liability on a dollar-for-dollar basis, whereas a deduction will reduce a U.S. Holder’s income that is subject to U.S. federal income tax. This election is made on a year-by-year basis and applies to all foreign taxes paid (whether directly or through withholding) by a U.S. Holder during a year.

Complex limitations apply to the foreign tax credit, including the general limitation that the credit cannot exceed the proportionate share of a U.S. Holder’s U.S. federal income tax liability that such U.S. Holder’s “foreign source” taxable income bears to such U.S. Holder’s worldwide taxable income. In applying this limitation, a U.S. Holder’s various items of income and deduction must be classified, under complex rules, as either “foreign source” or “U.S. source.” Generally, dividends paid by a foreign corporation should be treated as foreign source for this purpose, and gains recognized on the sale of stock of a foreign corporation by a U.S. Holder should be treated as U.S. source for this purpose. However, the amount of a distribution with respect to the common shares that is treated as a “dividend” may be lower for U.S. federal income tax purposes than it is for Canadian federal income tax purposes, resulting in a reduced foreign tax credit allowance to a U.S. Holder. In addition, this limitation is calculated separately with respect to specific categories of income. The foreign tax credit rules are complex, and each U.S. Holder should consult its own U.S. tax advisors regarding the foreign tax credit rules.

Backup Withholding and Information Reporting

Payments made within the U.S., or by a U.S. payor or U.S. middleman, of dividends on, and proceeds arising from the sale or other taxable disposition of, common shares will generally be subject to information reporting and backup withholding if a U.S. Holder (a) fails to furnish such U.S. Holder’s correct U.S. taxpayer identification number (generally on Form W-9), (b) furnishes an incorrect U.S. taxpayer identification number, (c) is notified by the IRS that such U.S. Holder has previously failed to properly report items subject to backup withholding tax, or (d) fails to certify, under penalty of perjury, that such U.S. Holder has furnished its correct U.S. taxpayer identification number and that the IRS has not notified such U.S. Holder that it is subject to backup withholding tax. However, certain exempt persons generally are excluded from these information reporting and backup withholding rules. Backup withholding is not an additional tax. Any amounts withheld under the U.S. backup withholding tax rules will be allowed as a credit against a U.S. Holder’s U.S. federal income tax liability, if any, or will be refunded, if such U.S. Holder furnishes required information to the IRS in a timely manner.

THE ABOVE SUMMARY IS NOT INTENDED TO CONSTITUTE A COMPLETE ANALYSIS OF ALL TAX CONSIDERATIONS APPLICABLE TO U.S. HOLDERS WITH RESPECT TO THE ACQUISITION, OWNERSHIP, AND DISPOSITION OF COMMON SHARES. U.S. HOLDERS SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO THE TAX CONSIDERATIONS APPLICABLE TO THEM IN THEIR OWN PARTICULAR CIRCUMSTANCES.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of the principal Canadian federal income tax considerations under the Income Tax Act (Canada) and the regulations thereunder (collectively, the “Tax Act”) generally applicable to a Non-Canadian Holder (as defined below) arising from and relating to the acquisition, ownership, and disposition of common shares acquired pursuant to this prospectus.

This summary is applicable to a purchaser who acquires common shares pursuant to this offering and who, for the purposes of the Tax Act and any applicable tax treaty at all relevant times: (i) is not (and is not deemed to be) a resident in Canada, (ii) holds such common shares as capital property, (iii) deals at arm’s length and is not affiliated with the Company or the underwriter, (iv) does not use or hold (and will not use or hold) and is not deemed to use or hold the common shares in, or in the course of, carrying on a business in Canada, (v) does not carry on an insurance business in Canada and elsewhere, and (vi) is not an “authorized foreign bank” as defined in the Tax Act (each, a “Non-Canadian Holder”).

This summary does not apply to a Non-Canadian Holder (i) that is a “financial institution”, as defined in the Tax Act for purposes of the “mark-to-market property” rules; (ii) an interest in which is or would constitute a “tax shelter investment” as defined in the Tax Act; (iii) that is a “specified financial institution” as defined in the Tax Act; or (iv) that has or will enter into a “synthetic disposition arrangement” or a “derivative forward agreement”, as those terms are defined in the Tax Act, in respect of common shares pursuant to this offering. All such Non-Canadian Holders should consult their own tax advisors with respect to an investment in common shares.

This summary is based on the current provisions of the Tax Act, our understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency (the “CRA”), all specific proposals to amend the Tax Act announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Tax Proposals”), and the current provisions of the Canada-US Tax Convention (1980) (the “Canada-US Tax Treaty”). This summary assumes that the Tax Proposals will be enacted in the current form proposed and does not otherwise take into account or anticipate any changes in the law or in the administrative policies and assessing practices of the CRA, whether by judicial, administrative, or legislative decisions or action, and whether prospective or retroactive in effect, nor does it take into account tax legislation or considerations of any province or territory of Canada or any jurisdiction other than Canada.

The summary is of a general nature only, is not exhaustive of all Canadian federal income tax considerations, and is not intended to be, and should not be construed to be, legal or tax advice to any particular Non-Canadian Holder of the common shares and no representation with respect to the Canadian tax consequences to any particular Non-Canadian Holder is made. The relevant tax considerations applicable to the acquiring, holding and disposing of common shares pursuant to this offering may vary according to the status of the holder, the jurisdiction in which the holder resides or carries on business and the holder’s own particular circumstances. Accordingly, each Non-Canadian Holder should consult with their own tax advisors with respect to the Canadian federal income tax consequences to them of acquiring, holding or disposing of the common shares.

Dividends

Dividends paid or credited (or deemed to be paid or credited, including on a repurchase or redemption of the common shares by the Company) on the common shares to a Non-Canadian Holder will generally be subject to withholding tax under the Tax Act at a rate of 25%, subject to reduction under the provisions of any applicable tax treaty that the Non-Canadian Holder is entitled to the benefits of, which withholding tax will be withheld and remitted by the Company for the account of the Non-Canadian Holder as required by law. For Non-Canadian Holders who are resident in the U.S. for purposes of, and are entitled to the benefits of, the Canada-U.S. Tax Treaty (a “U.S. Holder”), and are the beneficial owner of such dividends paid on the common shares, the Canadian withholding tax may generally be reduced to the rate of 15%, or if such Non-Canadian Holder owns at least 10% of our voting shares, to the rate of 5%. Not all persons who are resident of the U.S. for purposes of the Canada-US Tax Treaty will be qualified for the benefits of the Canada-US Tax Treaty. Non-Canadian Holders who may be eligible for a reduced rate of withholding tax on dividends (if any) pursuant to any applicable tax treaty should consult with their own tax advisors with respect to taking all appropriate steps to obtain the benefit of a reduced withholding rate, including the execution and delivery to us of CRA Form NR301, NR302, or NR303.

Disposition of common shares

A Non-Canadian Holder will not be subject to tax under the Tax Act in respect of any capital gain realized upon the disposition or deemed disposition of common shares (other than on a repurchase or redemption of the common shares by the Company) unless the common shares are “taxable Canadian property” (as defined in the Tax Act) of the Non-Canadian Holder, and the gain is not otherwise exempt from tax in Canada pursuant to the terms of an applicable tax treaty that the Non-Canadian Holder is entitled to the benefits of.

Provided the common shares are listed on a “designated stock exchange” within the meaning of the Tax Act (which currently includes Nasdaq) at the time of disposition, the common shares generally will not constitute “taxable Canadian property” of a Non-Canadian Holder, unless at any time during the 60-months immediately preceding the disposition, (i) one or any combination of (a) the Non-Canadian Holder, (b) persons with whom the Non-Canadian Holder does not deal at arm’s length for purposes of the Tax Act, or (c) partnerships in which the Non-Canadian Holder or persons referred to in (b) hold a membership interest directly or indirectly through one or more partnerships, owned at least 25% of the issued shares of any class or series of the Company’s capital stock, and (ii) more than 50% of the fair market value of the common shares was derived directly or indirectly from one or any combination of (a) real or immoveable property situated in Canada, (b) “Canadian resource properties” (as defined in the Tax Act), (c) “timber resource properties” (as defined in the Tax Act), or (d) an option, interest or right in any such property described in (a) to (c), whether or not such property exists. For a U.S. Holder, even if the common shares are taxable Canadian property to such holder at the time of disposition, the Canada-US Tax Treaty will generally exempt a disposition of common shares from Canadian federal income taxes unless the value of the common shares at that time is derived principally from real property situated in Canada. Common shares may also be deemed to be "taxable Canadian property" in certain other circumstances as set out in the Tax Act.

In the event the common shares are (or are deemed to be) taxable Canadian property to a Non-Canadian Holder at the time of disposition and the gain, if any, realized on the disposition of such common shares is not exempt from tax under the Tax Act by virtue of the terms of an applicable tax treaty, such Non-Canadian Holder will realize a capital gain (or capital loss) equal to the amount by which such Non-Canadian Holder’s proceeds of disposition in respect of the common share exceeds (or is exceeded by) the aggregate of the adjusted cost base of such common share to the Non-Canadian Holder and any reasonable expenses associated with the disposition. The cost to such Non-Canadian Holder of a common share acquired pursuant to this offering generally will be averaged with the adjusted cost base of any other common shares owned by the Non-Canadian Holder as capital property for the purposes of determining the adjusted cost base of each such common share to that Non-Canadian Holder.

Such Non-Canadian Holder whose common shares are taxable Canadian property at the time of disposition is generally required to comply with certain reporting and notification obligations under the Tax Act in respect of the disposition of such common shares including the requirement to file a Canadian income tax return reporting the disposition of such common shares. Non-Canadian Holders whose common shares are taxable Canadian property should consult their own tax advisors for advice having regard to their particular circumstances.

LEGAL MATTERS

Certain United States legal matters in connection with this offering will be passed upon on our behalf by Hogan Lovells US LLP. Certain Canadian legal matters in connection with this offering will be passed upon on our behalf by Farris LLP, Vancouver, British Columbia. Jefferies LLC is being represented in connection with this offering by Cooley LLP, New York, New York, for certain United States legal matters and Bennett Jones LLP, Vancouver, British Columbia, for certain Canadian legal matters.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019 and the effectiveness of our internal control over financial reporting as of December 31, 2019, as set forth in their reports, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s reports, given on their authority as experts in accounting and auditing.

The consolidated financial statements of Arbutus Biopharma Corporation as of December 31, 2018 appearing in Arbutus Biopharma Corporation’s Annual Report on Form 10-K, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, also incorporated by reference herein, and upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge, as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC, at our website at www.arbutusbio.com. Information contained on or accessible through our website is not a part of this prospectus supplement, and the inclusion of our website address in this prospectus supplement is an inactive textual reference only.