0000719135false00007191352023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 9, 2023

Date of Report (date of earliest event reported)

APYX MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-31885 | 11-2644611 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

5115 Ulmerton Road, Clearwater, Florida 33760

(Address of principal executive offices, zip code)

(727) 384-2323

(Issuer's telephone number)

_____________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | APYX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 - Results of Operations and Financial Condition

On November 9, 2023, Apyx Medical Corporation (the "Company") issued a press release reporting on its results of operations for the third quarter ended September 30, 2023. A copy of that press release is attached hereto as Exhibit 99.1 and incorporated by reference herein. Such information, including the Exhibit 99.1 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits

(d)

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: November 9, 2023 | Apyx Medical Corporation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| By: | /s/ Tara Semb | |

| | Tara Semb | |

| | Chief Financial Officer, Secretary and Treasurer | |

Apyx Medical Corporation Reports Third Quarter 2023 Financial Results and Updates Full Year 2023 Financial Outlook

Advanced Energy Sales increased 39% year-over-year in Q3

CLEARWATER, FL — November 9, 2023 - Apyx Medical Corporation (NASDAQ:APYX) (the “Company”), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today reported financial results for its third quarter ended September 30, 2023, and updated its financial expectations for the full year ending December 31, 2023.

Third Quarter 2023 Financial Summary:

•Total revenue of $12.0 million, up 31% year-over-year.

◦Advanced Energy revenue of $9.8 million, up 39% year-over-year.

◦OEM revenue of $2.1 million, up 5% year-over-year.

•Net loss attributable to stockholders of $4.6 million, down $1.1 million, or 20%, year-over-year.

•Adjusted EBITDA loss of $3.1 million, down $0.8 million, or 21%, year-over-year.

Highlights Subsequent to Quarter End

•On November 9, 2023, the Company announced a new, five-year credit agreement with Perceptive Credit Holdings IV, LP (“Perceptive”), an affiliate of Perceptive Advisors. The credit agreement provides for a facility of up to $45.0 million consisting of senior, secured term loans. The Perceptive credit facility matures on November 8, 2028 and includes an initial loan of $37.5 million and a delayed draw loan of $7.5 million. The initial loan of $37.5 million was fully funded on November 8, 2023, with approximately $11.0 million of the proceeds used to satisfy all obligations under the Company’s MidCap credit agreement, as well as approximately $2.5 million of transaction fees and other expenses related to the transactions.

•On November 9, 2023, the Company and Tara Semb, Chief Financial Officer, announced that Ms. Semb would be leaving the Company in order to pursue other opportunities. Ms. Semb’s departure is not due to any disagreement with the Company on any matter, including matters related to the Company’s operations, policies, practices, financial reporting or controls. The Board of Directors initiated a formal search process which has resulted in the Company identifying her successor. Ms. Semb plans to continue in her position as Chief Financial Officer until her successor is formally appointed.

Management Comments:

“We delivered Advanced Energy revenue growth in the third quarter of 39% year-over-year, fueled primarily by global sales of our generators, which increased by more than 65% both in the U.S. and internationally, along with significant contributions from handpiece sales as well.” said Charlie Goodwin, President and Chief Executive Officer. “Our Advanced Energy sales performance benefited from multiple factors, including our recently obtained FDA 510(k) clearances for new clinical indications, the commercialization of our next-generation Apyx One Generator and strong demand from distributors in key geographic regions. We complemented our revenue performance with continued profitability improvements as well, reducing our net loss attributable to stockholders and adjusted EBITDA by 20% and 21% year-over-year, respectively.”

Mr. Goodwin continued: “Ultimately, we did not see the level of revenue performance in our Advanced Energy segment that we had anticipated in the third quarter. We believe this was due to a combination of factors, including stronger-than-anticipated seasonality, surgeon reticence to purchase capital equipment given the current financing environment and sales and marketing team execution that did not meet our expectations. Our updated guidance reflects both our third quarter results and our revised expectations for the balance of the year. We are committed to

achieving our stated expectations for 2023 by executing our growth strategy in the fourth quarter, while continuing to leverage our recent progress in securing new 510(k) clearances, introducing new products and raising awareness of the safety and efficacy of our Renuvion technology for cosmetic procedures at both the surgeon and patient level. Subsequent to quarter end, we capitalized on the multiple regulatory, operating and commercial milestones achieved in 2023 to secure a new credit facility with Perceptive Advisors, providing us with additional capital – with more favorable terms overall than our prior agreement – which significantly strengthens our balance sheet and enhances our financial flexibility.”

The following tables present revenue by reportable segment and geography:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Increase/Decrease | | Nine Months Ended

September 30, | | Increase/Decrease |

| (In thousands) | 2023 | | 2022 | | $ Change | | % Change | | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Advanced Energy | $ | 9,836 | | | $ | 7,080 | | | $ | 2,756 | | | 38.9 | % | | $ | 31,248 | | | $ | 26,258 | | | $ | 4,990 | | | 19.0 | % |

| OEM | 2,140 | | | 2,034 | | | 106 | | | 5.2 | % | | 6,439 | | | 5,641 | | | 798 | | | 14.1 | % |

| Total | $ | 11,976 | | | $ | 9,114 | | | $ | 2,862 | | | 31.4 | % | | $ | 37,687 | | | $ | 31,899 | | | $ | 5,788 | | | 18.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Increase/Decrease | | Nine Months Ended

September 30, | | Increase/Decrease |

| (In thousands) | 2023 | | 2022 | | $ Change | | % Change | | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | | | | | | | | | |

| Domestic | $ | 8,652 | | | $ | 6,997 | | | $ | 1,655 | | | 23.7 | % | | $ | 27,660 | | | $ | 22,492 | | | $ | 5,168 | | | 23.0 | % |

| International | 3,324 | | | 2,117 | | | 1,207 | | | 57.0 | % | | 10,027 | | | 9,407 | | | 620 | | | 6.6 | % |

| Total | $ | 11,976 | | | $ | 9,114 | | | $ | 2,862 | | | 31.4 | % | | $ | 37,687 | | | $ | 31,899 | | | $ | 5,788 | | | 18.1 | % |

Third Quarter 2023 Results:

Total revenue for the three months ended September 30, 2023 increased $2.9 million, or 31% year-over-year, to $12.0 million, compared to $9.1 million in the prior year period. Advanced Energy segment sales increased $2.8 million, or 39% year-over-year, to $9.8 million. OEM segment sales increased $0.1 million, or 5% year-over-year to $2.1 million. The increase in Advanced Energy sales was primarily due to growth in domestic sales, which was driven by sales of the Company's recently launched Apyx One Console to both new and existing customers. Advanced Energy sales also benefited from growth in international generator and handpiece sales. The increase in OEM sales was due to increased sales volume to existing customers. For the third quarter of 2023, revenue in the United States increased $1.7 million, or 24% year-over-year, to $8.7 million, and international revenue increased $1.2 million, or 57% year-over-year, to $3.3 million.

Gross profit for the three months ended September 30, 2023, increased $2.2 million, or 39% year-over-year, to $8.0 million, compared to $5.8 million in the prior year period. Gross profit margin for the three months ended September 30, 2023, was 66.6%, compared to 63.2% in the prior year period. The increase in gross profit margins for the three months ended September 30, 2023 from the prior year period is primarily attributable to changes in the sales mix between the Company's two segments, with the Advanced Energy segment comprising a higher percentage of total sales and sales mix within our Advanced Energy segment. These increases were partially offset by geographic mix within the Advanced Energy segment, with international sales comprising a higher percentage of total sales, and by product mix.

Operating expenses for the three months ended September 30, 2023 increased $1.1 million, or 9% year-over-year, to $12.6 million, compared to $11.5 million in the prior year period. The year-over-year change in operating expenses was driven by a $0.8 million increase in salaries and related costs, a $0.2 million increase in selling, general and administrative expenses and a $0.2 million increase in research and development expenses. These increases were partially offset by a $0.1 million decrease in professional services.

Income tax (benefit) expense for the three months ended September 30, 2023 and 2022 was $(0.3) million and $0.1 million, respectively.

Net loss attributable to stockholders for the three months ended September 30, 2023 was $4.6 million, or $0.13 per share, compared to $5.8 million, or $0.17 per share, in the prior year period.

Adjusted EBITDA loss for the three months ended September 30, 2023 and 2022 was approximately $3.1 million and $3.9 million, respectively.

First Nine Months of 2023 Results:

Total revenue for the nine months ended September 30, 2023, increased $5.8 million, or 18%, to $37.7 million, compared to $31.9 million in the prior year period. Advanced Energy segment sales increased $5.0 million, or 19% year-over-year, to $31.2 million, compared to $26.3 million in the prior year period. OEM segment sales increased $0.8 million, or 14% year-over-year, to $6.4 million, compared to $5.6 million in the prior year period. For the first nine months of 2023, revenue in the United States increased $5.2 million, or 23% year-over-year, to $27.7 million, and international revenue increased $0.6 million, or 7% year-over-year, to $10.0 million. The increase in Advanced Energy sales was driven by domestic sales of the Company’s recently launched Apyx One Console to both new and existing customers. The increase in OEM sales was due to increased sales volume to existing customers, as well as incremental new sales upon the commencement of the supply arrangement related to the completion of the development portion of some of the Company’s OEM development agreements.

Net loss attributable to stockholders for the nine months ended September 30, 2023 was $9.1 million, or $0.26 per share, compared to $17.1 million, or $0.50 per share, in the prior year period. Included in net loss for the nine months ended September 30, 2023 was a $2.7 million gain on the sale-leaseback of our Clearwater, FL facility.

Full Year 2023 Financial Outlook:

The Company is updating its financial guidance for the year ending December 31, 2023 to:

•Total revenue in the range of $53.0 million to $54.0 million, representing growth of approximately 19% to 21% year-over-year, compared to total revenue of $44.5 million for the year ended December 31, 2022. The Company’s prior guidance range for total revenue was $59.0 million to $62.0 million, representing growth of 33% to 39% year-over-year.

◦Total revenue guidance assumes:

▪Advanced Energy revenue in the range of $44.5 million to $45.5 million, representing growth of approximately 21% to 24% year-over-year, compared to Advanced Energy revenue of $36.8 million for the year ended December 31, 2022. The Company’s prior guidance range for Advanced Energy revenue was $51.0 million to $54.0 million, representing growth of 39% to 47% year-over-year.

▪OEM revenue of approximately $8.5 million, representing growth of approximately 10% year-over-year, compared to $7.7 million for the year ended December 31, 2022. The Company’s prior guidance for OEM revenue was $8.0 million, representing growth of 4% year-over-year.

•Net loss attributable to stockholders of approximately $16 million, compared to $23.2 million for the year ended December 31, 2022. The Company’s prior guidance for net loss attributable to stockholders was approximately $10.5 million.

Conference Call Details:

Management will host a conference call at 8:00 a.m. Eastern Time on November 9, 2023 to discuss the results of the quarter, and to host a question and answer session. To listen to the call by phone, interested parties may dial 877-407-8289 (or 201-689-8341 for international callers) and provide access code 13741467. Participants should ask for the Apyx Medical Corporation Call. A live webcast of the call will be accessible via the Investor Relations section of the Company’s website and at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=wXKixaYt

A telephonic replay will be available approximately three hours after the end of the call through the following two weeks. The replay can be accessed by dialing 877-660-6853 for U.S. callers or 201-612-7415 for international callers and using the replay access code: 13741467. The webcast will be archived on the Investor Relations section of the Company’s website.

Investor Relations Contact:

ICR Westwicke on behalf of Apyx Medical Corporation

Mike Piccinino, CFA

investor.relations@apyxmedical.com

About Apyx Medical Corporation:

Apyx Medical Corporation is an advanced energy technology company with a passion for elevating people’s lives through innovative products, including its Helium Plasma Technology products marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Renuvion® and J-Plasma® offer surgeons a unique ability to provide controlled heat to tissue to achieve their desired results. The Company also leverages its deep expertise and decades of experience in unique waveforms through OEM agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Apyx Medical Corporation website at www.ApyxMedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to, projections of net revenue, margins, expenses, net earnings, net earnings per share, or other financial items; projections or assumptions concerning the possible receipt by the Company of any regulatory approvals from any government agency or instrumentality including but not limited to the U.S. Food and Drug Administration (the “FDA”), supply chain disruptions, component shortages, manufacturing disruptions or logistics challenges; or macroeconomic or geopolitical matters and the impact of those matters on the Company’s financial performance.

Forward-looking statements and information are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause the Company’s actual results to differ materially and that could impact the Company and the statements contained in this release include but are not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the FDA and other governmental and regulatory bodies, both domestically and internationally; the impact of the March 14, 2022 FDA Safety Communication on our business and operations; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment; liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations; and other risks that are described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| Sales | $ | 11,976 | | | $ | 9,114 | | | $ | 37,687 | | | $ | 31,899 | | | |

| Cost of sales | 3,998 | | | 3,357 | | | 12,857 | | | 11,009 | | | |

| Gross profit | 7,978 | | | 5,757 | | | 24,830 | | | 20,890 | | | |

| Other costs and expenses: | | | | | | | | | |

| Research and development | 1,276 | | | 1,061 | | | 3,596 | | | 3,289 | | | |

| Professional services | 1,831 | | | 1,936 | | | 5,165 | | | 6,611 | | | |

| Salaries and related costs | 4,667 | | | 3,871 | | | 14,770 | | | 13,944 | | | |

| Selling, general and administrative | 4,841 | | | 4,671 | | | 15,474 | | | 14,675 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total other costs and expenses | 12,615 | | | 11,539 | | | 39,005 | | | 38,519 | | | |

| Gain on sale-leaseback | — | | | — | | | 2,692 | | | — | | | |

| Loss from operations | (4,637) | | | (5,782) | | | (11,483) | | | (17,629) | | | |

| Interest income | 248 | | | 73 | | | 478 | | | 93 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense | (585) | | | (1) | | | (1,362) | | | (12) | | | |

| Other (expense) income, net | (19) | | | (35) | | | 622 | | | 551 | | | |

| Total other (expense) income, net | (356) | | | 37 | | | (262) | | | 632 | | | |

| Loss before income taxes | (4,993) | | | (5,745) | | | (11,745) | | | (16,997) | | | |

| Income tax (benefit) expense | (318) | | | 50 | | | (2,519) | | | 216 | | | |

| Net loss | (4,675) | | | (5,795) | | | (9,226) | | | (17,213) | | | |

Net loss attributable to non-controlling interest | (46) | | | (31) | | | (120) | | | (78) | | | |

| Net loss attributable to stockholders | $ | (4,629) | | | $ | (5,764) | | | $ | (9,106) | | | $ | (17,135) | | | |

| | | | | | | | | |

| Loss per share: | | | | | | | | | |

| Basic and Diluted | $ | (0.13) | | | $ | (0.17) | | | $ | (0.26) | | | $ | (0.50) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Weighted average number of shares outstanding - basic and diluted | 34,642 | | 34,569 | | 34,614 | | 34,488 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

|

| | | | | | | | | | | |

| September 30, 2023

(Unaudited) | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 22,134 | | | $ | 10,192 | |

| | | |

| | | |

| Trade accounts receivable, net of allowance of $652 and $668 | 12,648 | | | 10,602 | |

| Income tax receivables | — | | | 7,545 | |

| Other receivables | 596 | | | 99 | |

| Inventories, net of provision for obsolescence of $611 and $457 | 11,285 | | | 11,797 | |

| | | |

| | | |

| Prepaid expenses and other current assets | 3,487 | | | 2,737 | |

| | | |

| Total current assets | 50,150 | | | 42,972 | |

| Property and equipment, net | 2,093 | | | 6,761 | |

| Operating lease right-of-use assets | 5,274 | | | 710 | |

| Finance lease right-of-use assets | 74 | | | 115 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other assets | 1,855 | | | 1,217 | |

| | | |

| Total assets | $ | 59,446 | | | $ | 51,775 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,050 | | | $ | 2,669 | |

| | | |

| Accrued expenses and other liabilities | 7,914 | | | 8,928 | |

| Current portion of operating lease liabilities | 310 | | | 216 | |

| Current portion of finance lease liabilities | 20 | | | 37 | |

| Total current liabilities | 10,294 | | | 11,850 | |

| Term loan, net | 9,009 | | | — | |

| Long-term operating lease liabilities | 4,992 | | | 470 | |

| Long-term finance lease liabilities | 58 | | | 73 | |

| Long-term contract liabilities | 1,326 | | | 1,408 | |

| Other liabilities | 181 | | | 181 | |

| Total liabilities | 25,860 | | | 13,982 | |

| EQUITY | | | |

| | | |

| | | |

| | | |

| Preferred Stock, $0.001 par value; 10,000,000 shares authorized; 0 issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Common stock, $0.001 par value; 75,000,000 shares authorized; 34,643,855 issued and outstanding as of September 30, 2023 and 34,597,822 issued and outstanding as of December 31, 2022 | 35 | | | 35 | |

| Additional paid-in capital | 78,154 | | | 73,282 | |

| Accumulated deficit | (44,841) | | | (35,735) | |

| Total stockholders' equity | 33,348 | | | 37,582 | |

| Non-controlling interest | 238 | | | 211 | |

| Total equity | 33,586 | | | 37,793 | |

| Total liabilities and equity | $ | 59,446 | | | $ | 51,775 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION

RECONCILIATION OF GAAP NET LOSS RESULTS TO NON-GAAP ADJUSTED EBITDA

(Unaudited)

|

Use of Non-GAAP Financial Measure

We present the following non-GAAP measure because we believe such measure is a useful indicator of our operating performance. Our management uses this non-GAAP measure principally as a measure of our operating performance and believes that this measure is useful to investors because it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that this measure is useful to our management and investors as a measure of comparative operating performance from period to period. The non-GAAP financial measure presented in this release should not be considered as a substitute for, or preferable to, the measures of financial performance prepared in accordance with GAAP.

The Company has presented the following non-GAAP financial measure in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net income (loss) attributable to stockholders (GAAP) plus income tax expense (benefit), interest, depreciation and amortization, stock-based compensation expense and other significant non-recurring items.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss attributable to stockholders | $ | (4,629) | | | $ | (5,764) | | | $ | (9,106) | | | $ | (17,135) | |

| Interest income | (248) | | | (73) | | | (478) | | | (93) | |

| Interest expense | 585 | | | 1 | | | 1,362 | | | 12 | |

| Income tax (benefit) expense | (318) | | | 50 | | | (2,519) | | | 216 | |

| Depreciation and amortization | 186 | | | 216 | | | 540 | | | 688 | |

| Stock based compensation | 1,351 | | | 1,692 | | | 4,200 | | | 5,056 | |

| Gain on sale-leaseback | — | | | — | | | (2,692) | | | — | |

| Adjusted EBITDA | $ | (3,073) | | | $ | (3,878) | | | $ | (8,693) | | | $ | (11,256) | |

| | | | | | | |

| | | | | | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

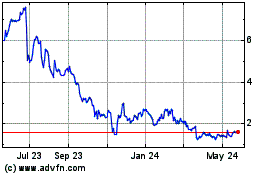

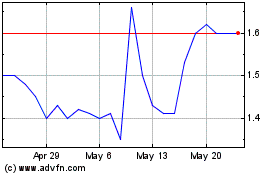

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2024 to May 2024

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From May 2023 to May 2024