false0000720500AMTECH SYSTEMS INC00007205002023-12-132023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 13, 2023 |

Amtech Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Arizona |

000-11412 |

86-0411215 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 S. Clark Drive |

|

Tempe, Arizona |

|

85288 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (480) 967-5146 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

ASYS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 13, 2023, Amtech Systems, Inc. (the “Registrant” or the “Company”) announced by press release a summary of its revenue and business status as of September 30, 2023. A copy of the press release is included as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

The information contained in this Current Report, including the accompanying Exhibit 99.1, is furnished pursuant to Item 2.02 of Form 8-K and shall not be incorporated by reference into any filing of the Registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information in this Current Report, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

AMTECH SYSTEMS, INC. |

|

|

|

|

Date: |

December 13, 2023 |

By: |

/s/ Lisa D. Gibbs |

|

|

|

Name: Lisa D. Gibbs

Title: Vice President and Chief Financial Officer |

EXHIBIT 99.1

Amtech Fourth Quarter Fiscal 2023 Business Update

TEMPE, Ariz., December 13, 2023 -- Amtech Systems, Inc. ("Amtech") (NASDAQ: ASYS), a manufacturer of thermal processing, wafer cleaning and chemical mechanical polishing (CMP) capital equipment and related consumables used in semiconductor, advanced mobility and renewable energy manufacturing applications, today announced a summary of its revenue and business status as of September 30, 2023.

Fourth Quarter Fiscal 2023 Business Update

•Net revenue of $27.7 million

•Customer orders of $18.2 million

•Book to bill ratio of 0.7:1

Fiscal 2023 Business Update

•Net revenue of $113.3 million

•Customer orders of $103.9 million

•Book to bill ratio of 0.9:1

•Backlog of $51.8 million

Due to the prolonged downturn and general economic conditions in the semiconductor industry and delays in the adoption of next-gen polishing tools, the Company anticipates an impairment charge in our Material and Substrate segment as of September 30, 2023. Due to the complexity and judgement involved in the valuation and impairment analyses, we are working with our external auditors to finalize the audit procedures. When complete, the Company will issue a press release with its fourth quarter and full year fiscal 2023 financial results as well as file its Annual Report on Form 10-K.

“We experienced continued softness in demand across several of our end markets during the fourth quarter and have taken actions to reduce fixed costs and expenses. These actions include a reduction in force at each of our businesses, as well as a decision to exit the legacy PR Hoffman equipment business. The long-term opportunities for Amtech’s products remain strong, and the actions we are taking will allow us to significantly improve profitability as demand recovers,” commented Mr. Bob Daigle, Chief Executive Officer of Amtech.

Net revenues decreased 10% sequentially and 14% from the fourth quarter of fiscal 2022. The decrease from prior year is primarily attributable to lower shipments from our Shanghai manufacturing facility partially offset by an increase in shipments of our high temperature belt furnaces and the addition of Entrepix in fiscal 2023. The sequential decrease is primarily due to a decrease in equipment shipments across our business segments. We are experiencing lower bookings in multiple areas of our business due to the softness in the semiconductor market.

Unrestricted cash and cash equivalents at September 30, 2023, were $13.1 million dollars, compared to $14.3 million dollars at June 30, 2023.

At September 30, 2023, we were not in compliance with the Debt to EBITDA and Fixed Charge Coverage Ratio financial covenants under our Loan Agreement. On December 5, 2023, we entered into a Forbearance & Modification Agreement (the “Forbearance Agreement”) with UMB Bank related to such non-compliance, pursuant to which UMB Bank agreed to forbear from exercising its rights and remedies available to it as a result of such defaults. We will be operating under the terms of this Forbearance Agreement through January 17, 2025 (the “Forbearance Period”).

Outlook

Operating results can be significantly impacted, positively or negatively, by the timing of orders, system shipments, logistical challenges, and the financial results of semiconductor manufacturers. Additionally, the semiconductor equipment industries can be cyclical and inherently impacted by changes in market demand. Actual results may differ materially in the weeks and months ahead.

For the first fiscal quarter ending December 31, 2023, we expect revenues in the range of $21 - $24 million with EBITDA nominally negative. Although the near-term outlook for revenue and earnings is challenging, we remain confident that the long-term outlook is strong for both our consumables and equipment serving advanced mobility and advanced packaging applications. We took actions during the first quarter of fiscal 2024, which will reduce Amtech's structural costs by approximately $4 million annually and better align product pricing with value. These steps will significantly improve results and enhance profitability through market cycles.

A portion of Amtech's results is denominated in Renminbis, a Chinese currency. The outlook provided in this press release is based on an assumed exchange rate between the United States Dollar and the Renminbi. Changes in the value of the Renminbi in relation to the United States Dollar could cause actual results to differ from expectations.

Conference Call

Amtech Systems will host a conference call today at 5:00 p.m. ET to provide a business update. The call will be available to interested parties by dialing 1-877-407-0784. For international callers, please dial +1-201-689-8560. A live webcast of the conference call will be available in the Investor Relations section of Amtech’s website at: https://www.amtechsystems.com/investors/events.

A replay of the webcast will be available in the Investor Relations section of the company’s website at http://www.amtechsystems.com/conference.htm shortly after the conclusion of the call and will remain available for approximately 30 calendar days.

About Amtech Systems, Inc.

Amtech Systems, Inc. is a leading, global manufacturer of thermal processing, wafer cleaning and chemical mechanical polishing (CMP) capital equipment and related consumables used in semiconductor, advanced mobility and renewable energy manufacturing applications. We sell process equipment and services used in the fabrication of semiconductor devices, such as silicon carbide (SiC), silicon power, electronic assemblies and

modules to semiconductor device and module manufacturers worldwide, particularly in Asia, North America and Europe. Our strategic focus is on growth opportunities which leverage our strengths in thermal and substrate processing. Amtech's products are recognized under the leading brand names BTU International, Entrepix, Inc., PR Hoffman™ and Intersurface Dynamics, Inc.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this press release is forward-looking in nature. All statements in this press release, or made by management of Amtech Systems, Inc. and its subsidiaries ("Amtech"), other than statements of historical fact, are hereby identified as "forward-looking statements" (as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995). The forward-looking statements in this press release relate only to events or information as of the date on which the statements are made in this press release. Examples of forward-looking statements include statements regarding Amtech's future financial results, operating results, business strategies, projected costs, products under development, competitive positions, plans and objectives of Amtech and its management for future operations, efforts to improve operational efficiencies and effectiveness and profitably grow our revenue, and enhancements to our technologies and expansion of our product portfolio. In some cases, forward-looking statements can be identified by terminology such as "may," "plan," "anticipate," "seek," "will," "expect," "intend," "estimate," "believe," "continue," "predict," "potential," "project," "should," "would," "could", "likely," "future," "target," "forecast," "goal," "observe," and "strategy" or the negative of these terms or other comparable terminology used in this press release or by our management, which are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. The Form 10-K that Amtech filed with the Securities and Exchange Commission (the "SEC") for the year-ended September 30, 2022, listed various important factors that could affect the Company's future operating results and financial condition and could cause actual results to differ materially from historical results and expectations based on forward-looking statements made in this document or elsewhere by Amtech or on its behalf. These factors can be found under the heading "Risk Factors" in the Form 10-K and in our subsequently filed Quarterly Reports on Form 10-Qs, and investors should refer to them. Because it is not possible to predict or identify all such factors, any such list cannot be considered a complete set of all potential risks or uncertainties. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

|

Contacts: |

Amtech Systems, Inc. |

Lisa D. Gibbs |

Chief Financial Officer |

(480) 360-3756 |

irelations@amtechsystems.com |

Sapphire Investor Relations, LLC

Erica Mannion and Mike Funari

(617) 542-6180

irelations@amtechsystems.com |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

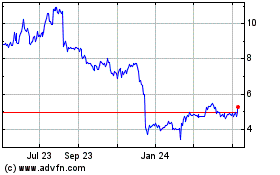

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Apr 2024 to May 2024

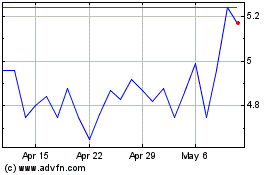

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From May 2023 to May 2024