America's Car-Mart Reports Diluted Earnings per Share of $1.55 on Revenues of $161 Million

February 19 2019 - 5:04PM

America’s Car-Mart, Inc. (NASDAQ: CRMT) today announced its

operating results for the third quarter of fiscal year 2019.

Highlights of third quarter operating

results:

- Income before taxes of $14.3

million vs. $5.8 million for prior year quarter

- Net earnings of $10.9 million, or

$1.55 per diluted share vs. net earnings of $13.4 million, or $1.82

per diluted share for prior year quarter (diluted earnings per

share for prior year quarter includes $1.32 for the effect of the

enactment of the Tax Cuts and Jobs Act (“Tax Act”) in December 2017

and $(.10) for a one-time retirement bonus paid to retiring

CEO)

- Revenues of $161 million compared

to $147 million for the prior year quarter; current quarter

includes a $2.2 million increase in interest income and same store

revenue increase of 8.5%

- Increased sales volume productivity

with 27.9 retail units sold per store per month, up from 27.2 for

the prior year quarter

- Average retail sales price

increased $484, or 4.5% from the prior year quarter to $11,146

- Gross profit margin percentage

remained consistent at 41.5%

- Collections as a percentage of

average finance receivables increased to 13.2% from 12.5% for the

prior year quarter. The weighted average contract term

decreased to 32.0 months from 32.4 months at the prior year

quarter-end and decreased from 32.1 months at the end of the second

quarter of 2019

- Net Charge-offs as a percent of

average finance receivables decreased to 6.2% from 7.4% for the

prior year quarter

- Accounts over 30 days past due

decreased to 3.2% from 4.1% at January 31, 2018

- Average percentage of finance

receivables current increased to 83.0% from 80.4% at January 31,

2018

- Provision for credit losses of

25.4% of sales vs. 29.5% for prior year quarter

- Selling, general and administrative

expenses at 18.9% of sales vs. 20.2% for prior year quarter (19.4%

excluding the one-time retirement bonus paid to retiring CEO)

- Active accounts base over 75,000,

an increase of almost 4,000 from April 30, 2018

- Debt to equity of 69.5% and debt to

finance receivables of 31.4%

- Strong cash flows supporting the

$7.1 million increase in finance receivables, $1.5 million in net

capital expenditures and $10.2 million in common stock repurchases

(141,500 shares) with a $5.9 million increase in total debt

Highlights of nine-month operating

results:

- Income before taxes of $41.5

million vs $25.2 million for prior year period

- Net income of $33.0 million or

$4.66 per diluted share vs. net income of $26.3 million or $3.48

per diluted share for prior year period (diluted earnings per share

for prior year period includes $1.28 for the effect of the

enactment of the Tax Act in December 2017 and $(.10) for a one-time

retirement bonus paid to retiring CEO)

- Income tax benefit related to

share-based compensation of $1.5 million ($.22 per diluted share)

compared to $777,000 ($.10 per diluted share) for the prior

year period

- Revenues of $492 million compared

to $443 million for the prior year period; current period includes

a $6.0 million increase in interest income and same store revenue

increase of 10.5%

- Retail unit sales increase of 5.6%

to 37,163 from 35,189 for the prior year period with improved

productivity at 29.3 retail units sold per store per month, up from

27.9 for the prior year period

- Net Charge-offs as a percent of

average finance receivables of 19.2%, down from 21.2% for prior

year period

- Provision for credit losses of

25.9% of sales vs. 28.6% of sales for prior year period

- Strong cash flows supporting the

$41.5 million increase in finance receivables, $5.2 million

increase in inventory, $3.0 million in net capital expenditures and

$24.1 million in common stock repurchases (347,155 shares) with an

$18.4 million increase in total debt

“We had a good quarter as we continue to see

across the board improvements resulting from our focus on the

Company’s Non-Negotiables related to inventory, facilities and

associates, collections practices and expense management. There is

real purpose in our work as we move forward with our efforts to be

a great company in the eyes of our associates, customers and

shareholders while improving lives in communities we serve. We

believe that communities are better when served by America's

Car-Mart. We have an obligation to grow our customer count at a

rate that is in line with our ability to support associates and

customers at the very highest levels. There is tremendous demand

for our service, and we will continue to make significant

investments in our people especially in our General Manager

Recruitment, Training and Advancement Program,” said Jeff Williams,

President and Chief Executive Officer. "Our productivity

improvements have been made possible because of the investments

we’ve made and it’s nice to see us leverage those investments so

quickly. We are very excited about our future, and we will continue

to invest in the key areas of the business. Our most important

Non-Negotiable is related to how our blocking and tackling efforts

are impacting customer relations and customer experience. Improving

the customer experience at various touch points, without

sacrificing basic daily discipline, is emerging as our top

opportunity, and we are in a unique position to really move the

needle in this important area."

“We currently have four new dealership openings

in process. These dealerships will be in Conway, Arkansas, Bryant,

Arkansas, Chattanooga, Tennessee and Tyler, Texas,” said Mr.

Williams. “Three of these dealerships will be managed by

top-performing General Managers as we expand the number of

locations and customers served to leverage their talents. Tyler,

Texas is a re-opening and will be managed individually by an

experienced General Manager. We are optimistic about these

locations and excited to get started in these communities.”

“It is nice to see all of our key financial

metrics continue to improve. Sales volume productivity is up 2.6%

with same store revenues up over 8%, net charge-offs are down 120

basis points, collections are up 70 basis points, and the

quarter-end delinquency percentage is down significantly. The

financial results follow the operational improvements that Jeff

mentioned. The fact that we were able to continue to invest in the

key areas of the business and at the same time see some leveraging

with our expenses is indicative of our commitment to grow in a

healthy manner," said Vickie Judy, Chief Financial Officer. “We are

all working very hard to make this company great and to take

advantage of the opportunities that are in front of us as we help

associates and customers succeed."

“We repurchased 141,500 shares of our common

stock during the quarter at an average price of $72.20 for a total

of $10.2 million. Since February 2010 we have repurchased 6.1

million shares at an average price of approximately $36. We plan to

continue to repurchase shares opportunistically as we move forward.

During the first nine months of the fiscal year, we have added over

$41.5 million in receivables, repurchased $24.1 million of our

common stock, funded $3.0 million in net capital expenditures, and

increased inventory by $5.2 million to support higher sales levels

with only a $18.4 million increase in debt. Our balance sheet is

very strong with a debt to finance receivables ratio of 31.4%,”

added Ms. Judy. “We will continue to focus on strong cash-on-cash

returns while being mindful of the continuing infrastructure

investment needs in the key areas of the business.”

Conference Call

Management will be holding a conference call on

Wednesday, February 20, 2019 at 11:00 a.m. Eastern Time to discuss

third quarter results. A live audio of the conference call

will be accessible to the public by calling (877) 776-4031.

International callers dial (631) 291-4132. Callers should

dial in approximately 10 minutes before the call begins. A

conference call replay will be available two hours following the

call for thirty days and can be accessed by calling (855) 859-2056

(domestic) or (404) 537-3406 (international), conference call ID

#4196898.

About America's Car-Mart

America’s Car-Mart, Inc. (the “Company”)

operates 143 automotive dealerships in eleven states and is one of

the largest publicly held automotive retailers in the United States

focused exclusively on the “Integrated Auto Sales and Finance”

segment of the used car market. The Company emphasizes

superior customer service and the building of strong personal

relationships with its customers. The Company operates its

dealerships primarily in small cities throughout the South-Central

United States selling quality used vehicles and providing financing

for substantially all of its customers. For more information,

including investor presentations, on America’s Car-Mart, please

visit our website at www.car-mart.com.

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements address

the Company’s future objectives, plans and goals, as well as the

Company’s intent, beliefs and current expectations regarding future

operating performance and can generally be identified by words such

as “may,” “will,” “should,” “could, “believe,” “expect,”

“anticipate,” “intend,” “plan,” “foresee,” and other similar words

or phrases. Specific events addressed by these

forward-looking statements include, but are not limited to:

- new dealership openings;

- performance of new dealerships;

- same store revenue growth;

- future overall revenue growth;

- the Company’s collection results, including but not limited to

collections during income tax refund periods;

- repurchases of the Company’s common stock; and

- the Company’s business and growth strategies and plans.

These forward-looking statements are based on

the Company’s current estimates and assumptions and involve various

risks and uncertainties. As a result, you are cautioned that

these forward-looking statements are not guarantees of future

performance, and that actual results could differ materially from

those projected in these forward-looking statements. Factors

that may cause actual results to differ materially from the

Company’s projections include, but are not limited to:

- the availability of credit facilities to support the Company’s

business;

- the Company’s ability to underwrite and collect its accounts

effectively, including but not limited to collections during income

tax refund periods;

- competition;

- dependence on existing management;

- availability of quality vehicles at prices that will be

affordable to customers;

- changes in financing laws or regulations; and

- general economic conditions in the markets in which the Company

operates, including but not limited to fluctuations in gas prices,

grocery prices and employment levels.

Additionally, risks and uncertainties that may

affect future results include those described from time to time in

the Company’s SEC filings. The Company undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. You

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the dates on which they are

made.

____________________________Contacts:

Jeffrey A. Williams, President and CEO (479) 418-8021 or Vickie D.

Judy, CFO (479) 418-8081

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

% Change |

|

As a % of Sales |

| |

|

|

|

|

|

Three Months Ended |

|

2019 |

|

Three Months Ended |

| |

|

|

|

|

|

January 31, |

|

vs. |

|

January 31, |

| |

|

|

|

|

|

2019 |

|

2018 |

|

2018 |

|

2019 |

|

2018 |

| Operating

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Retail

units sold |

|

11,963 |

|

11,420 |

|

4.8 |

% |

|

|

|

|

|

|

| |

Average

number of stores in operation |

|

143 |

|

140 |

|

2.1 |

|

|

|

|

|

|

|

| |

Average

retail units sold per store per month |

|

27.9 |

|

27.2 |

|

2.6 |

|

|

|

|

|

|

|

| |

Average

retail sales price |

|

$ |

11,146 |

|

$ |

10,662 |

|

4.5 |

|

|

|

|

|

|

|

| |

Same store

revenue growth |

|

8.5% |

|

7.1% |

|

|

|

|

|

|

|

|

|

| |

Net

charge-offs as a percent of average finance receivables |

6.2% |

|

7.4% |

|

|

|

|

|

|

|

|

|

| |

Collections

as a percent of average finance receivables |

|

13.2% |

|

12.5% |

|

|

|

|

|

|

|

|

|

| |

Average

percentage of finance receivables-current (excl. 1-2 day) |

83.0% |

|

80.4% |

|

|

|

|

|

|

|

|

|

| |

Average

down-payment percentage |

|

5.5% |

|

5.5% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Period End

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stores

open |

|

143 |

|

140 |

|

2.1 |

% |

|

|

|

|

|

|

| |

Accounts

over 30 days past due |

|

3.2% |

|

4.1% |

|

|

|

|

|

|

|

|

|

| |

Finance

receivables, gross |

|

$ |

542,893 |

|

$ |

497,652 |

|

9.1 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Statement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales |

|

|

$ |

139,803 |

|

$ |

128,166 |

|

9.1 |

% |

|

100.0 |

% |

|

100.0 |

% |

| |

|

Interest

income |

|

21,251 |

|

19,048 |

|

11.6 |

|

|

15.2 |

|

|

14.9 |

|

| |

|

|

|

Total |

|

161,054 |

|

147,214 |

|

9.4 |

|

|

115.2 |

|

|

114.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cost of

sales |

|

81,740 |

|

74,951 |

|

9.1 |

|

|

58.5 |

|

|

58.5 |

|

| |

|

Selling,

general and administrative |

|

26,488 |

|

25,945 |

|

2.1 |

|

|

18.9 |

|

|

20.2 |

|

| |

|

Provision

for credit losses |

|

35,555 |

|

37,872 |

|

(6.1) |

|

|

25.4 |

|

|

29.5 |

|

| |

|

Interest

expense |

|

2,110 |

|

1,482 |

|

42.4 |

|

|

1.5 |

|

|

1.2 |

|

| |

|

Depreciation and amortization |

|

985 |

|

1,057 |

|

(6.8) |

|

|

0.7 |

|

|

0.8 |

|

| |

|

(Gain) loss

on disposal of property and equipment |

|

(100) |

|

84 |

|

(219.0) |

|

|

(0.1) |

|

|

0.1 |

|

| |

|

|

|

Total |

|

146,778 |

|

141,391 |

|

3.8 |

|

|

105.0 |

|

|

110.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Income before

taxes |

|

14,276 |

|

5,823 |

|

|

|

|

10.2 |

|

|

4.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Benefit)

provision for income taxes |

|

3,381 |

|

(7,556) |

|

|

|

|

2.4 |

|

|

(5.9) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net income |

|

$ |

10,895 |

|

$ |

13,379 |

|

|

|

|

7.8 |

|

|

10.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dividends

on subsidiary preferred stock |

|

$ |

(10) |

|

$ |

(10) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net income attributable

to common shareholders |

|

$ |

10,885 |

|

$ |

13,369 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

$ |

1.61 |

|

$ |

1.88 |

|

|

|

|

|

|

|

|

|

| |

Diluted |

|

|

$ |

1.55 |

|

$ |

1.82 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

6,751,026 |

|

7,106,715 |

|

|

|

|

|

|

|

|

|

| |

Diluted |

|

|

7,003,389 |

|

7,345,428 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

% Change |

|

As a % of Sales |

| |

|

|

|

|

|

Nine Months Ended |

|

2019 |

|

Nine Months Ended |

| |

|

|

|

|

|

January 31, |

|

vs. |

|

January 31, |

| |

|

|

|

|

|

2019 |

|

2018 |

|

2018 |

|

2019 |

|

2018 |

| Operating

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Retail

units sold |

|

37,163 |

|

35,189 |

|

5.6 |

% |

|

|

|

|

|

|

| |

Average

number of stores in operation |

|

141 |

|

140 |

|

0.7 |

|

|

|

|

|

|

|

| |

Average

retail units sold per store per month |

|

29.3 |

|

27.9 |

|

5.0 |

|

|

|

|

|

|

|

| |

Average

retail sales price |

|

$ |

11,062 |

|

$ |

10,487 |

|

5.5 |

|

|

|

|

|

|

|

| |

Same store

revenue growth |

|

10.5% |

|

3.3% |

|

|

|

|

|

|

|

|

|

| |

Net

charge-offs as a percent of average finance receivables |

19.2% |

|

21.2% |

|

|

|

|

|

|

|

|

|

| |

Collections

as a percent of average finance receivables |

|

39.2% |

|

37.2% |

|

|

|

|

|

|

|

|

|

| |

Average

percentage of finance receivables-current (excl. 1-2 day) |

82.0% |

|

80.5% |

|

|

|

|

|

|

|

|

|

| |

Average

down-payment percentage |

|

5.8% |

|

5.8% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Period End

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stores

open |

|

143 |

|

140 |

|

2.1 |

% |

|

|

|

|

|

|

| |

Accounts

over 30 days past due |

|

3.2% |

|

4.1% |

|

|

|

|

|

|

|

|

|

| |

Finance

receivables, gross |

|

$ |

542,893 |

|

$ |

497,652 |

|

9.1 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Statement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales |

|

|

$ |

430,315 |

|

$ |

386,867 |

|

11.2 |

% |

|

100.0 |

% |

|

100.0 |

% |

| |

|

Interest

income |

|

61,925 |

|

55,883 |

|

10.8 |

|

|

14.4 |

|

|

14.4 |

|

| |

|

|

|

Total |

|

492,240 |

|

442,750 |

|

11.2 |

|

|

114.4 |

|

|

114.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cost of

sales |

|

251,274 |

|

225,780 |

|

11.3 |

|

|

58.4 |

|

|

58.4 |

|

| |

|

Selling,

general and administrative |

|

79,068 |

|

73,537 |

|

7.5 |

|

|

18.4 |

|

|

19.0 |

|

| |

|

Provision

for credit losses |

|

111,619 |

|

110,778 |

|

0.8 |

|

|

25.9 |

|

|

28.6 |

|

| |

|

Interest

expense |

|

5,895 |

|

3,978 |

|

48.2 |

|

|

1.4 |

|

|

1.0 |

|

| |

|

Depreciation and amortization |

|

2,949 |

|

3,244 |

|

(9.1) |

|

|

0.7 |

|

|

0.8 |

|

| |

|

(Gain) loss

on disposal of property and equipment |

|

(88) |

|

188 |

|

(146.8) |

|

|

- |

|

|

- |

|

| |

|

|

|

Total |

|

450,717 |

|

417,505 |

|

8.0 |

|

|

104.7 |

|

|

107.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Income before

taxes |

|

41,523 |

|

25,245 |

|

|

|

|

9.6 |

|

|

6.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Benefit)

provision for income taxes |

|

8,464 |

|

(1,095) |

|

|

|

|

2.0 |

|

|

(0.3) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net income |

|

$ |

33,059 |

|

$ |

26,340 |

|

|

|

|

7.7 |

|

|

6.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dividends

on subsidiary preferred stock |

|

$ |

(30) |

|

$ |

(30) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net income attributable

to common shareholders |

|

$ |

33,029 |

|

$ |

26,310 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

$ |

4.82 |

|

$ |

3.59 |

|

|

|

|

|

|

|

|

|

| |

Diluted |

|

|

$ |

4.66 |

|

$ |

3.48 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

6,846,707 |

|

7,336,687 |

|

|

|

|

|

|

|

|

|

| |

Diluted |

|

|

7,087,430 |

|

7,556,255 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

January 31, |

|

April 30, |

|

January 31, |

| |

|

|

2019 |

|

2018 |

|

2018 |

| |

|

|

|

|

|

|

|

| Cash and

cash equivalents |

$ |

1,624 |

|

$ |

1,022 |

|

$ |

534 |

| Finance

receivables, net |

$ |

414,913 |

|

$ |

383,617 |

|

$ |

380,384 |

| Inventory |

|

$ |

38,822 |

|

$ |

33,610 |

|

$ |

38,094 |

| Total

assets |

$ |

493,555 |

|

$ |

455,584 |

|

$ |

455,848 |

| Total

debt |

$ |

170,737 |

|

$ |

152,367 |

|

$ |

148,172 |

| Treasury

stock |

$ |

228,412 |

|

$ |

204,325 |

|

$ |

188,319 |

| Total

equity |

$ |

245,677 |

|

$ |

230,535 |

|

$ |

234,856 |

| Shares

outstanding |

6,685,013 |

|

6,849,161 |

|

7,056,179 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Finance

receivables: |

|

|

|

|

|

| |

Principal

balance |

$ |

542,893 |

|

$ |

501,438 |

|

$ |

497,652 |

| |

Deferred

revenue - payment protection plan |

(20,748) |

|

(19,823) |

|

(18,908) |

| |

Deferred

revenue - service contract |

(10,224) |

|

(10,332) |

|

(9,672) |

| |

Allowance

for credit losses |

(127,980) |

|

(117,821) |

|

(117,268) |

| |

|

|

|

|

|

|

|

| |

Finance

receivables, net of allowance and deferred revenue |

$ |

383,941 |

|

$ |

353,462 |

|

$ |

351,804 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Allowance

as % of principal balance net of deferred revenue |

25.0% |

|

25.0% |

|

25.0% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Changes in

allowance for credit losses: |

|

|

|

|

|

| |

|

|

Nine Months Ended |

|

|

| |

|

|

January 31, |

|

|

| |

|

|

2019 |

|

2018 |

|

|

| |

Balance at

beginning of period |

$ |

117,821 |

|

$ |

109,693 |

|

|

| |

Provision

for credit losses |

111,619 |

|

110,778 |

|

|

| |

Charge-offs, net of collateral recovered |

(101,460) |

|

(103,203) |

|

|

| |

|

Balance at end of

period |

$ |

127,980 |

|

$ |

117,268 |

|

|

| |

|

|

|

|

|

|

|

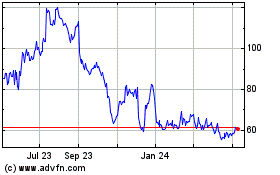

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

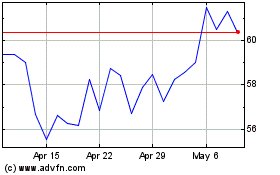

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Apr 2023 to Apr 2024