false000177078700017707872024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

10x Genomics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39035 | 45-5614458 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

6230 Stoneridge Mall Road

Pleasanton, California 94588

(925) 401-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A common stock, par value $0.00001 per share | | TXG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 15, 2024, 10x Genomics, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the fourth quarter and full year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished pursuant to Item 2.02 in this Current Report on Form 8-K and the press release attached as Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | | | | |

Exhibit No. | | Description of Exhibits | |

| | | |

| 99.1 | | | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | 10x Genomics, Inc. |

| | | |

| | By: | /s/ Eric S. Whitaker |

| | Name: | Eric S. Whitaker |

| | Title: | Chief Legal Officer |

| | | |

| Date: | February 15, 2024 | | |

Exhibit 99.1

10x Genomics Reports Fourth Quarter and Full Year 2023 Financial Results and Provides Outlook for 2024

Q4 2023 revenue growth of 18% and FY 2023 revenue growth of 20% over the corresponding periods of 2022

PLEASANTON, Calif. February 15, 2024 – 10x Genomics, Inc. (Nasdaq: TXG), a leader in single cell and spatial biology, today reported financial results for the fourth quarter and full year ended December 31, 2023 and provided outlook for 2024.

Recent Highlights

•Revenue was $184.0 million for the fourth quarter and $618.7 million for the full year of 2023, representing 18% and 20% increases over the corresponding periods of 2022.

•Increased cumulative instruments sold to 5,966 as of the end of 2023, comprising 5,180 Chromium instruments, 531 Visium instruments and 255 Xenium instruments.

•Launched preorders for Visium HD Spatial Gene Expression, enabling whole transcriptome spatial discovery at single cell-scale resolution.

•Unveiled and launched preorders for the first two products featuring Chromium GEM-X technology, the next generation of the company's leading single cell technology architecture, enabling higher performance at larger scale and lower cost.

"Our innovation engine has consistently delivered transformational technologies that have enabled our customers to expand the frontiers of science," said Serge Saxonov, Co-founder and CEO of 10x Genomics. "We're building on last year's extraordinary launch of Xenium with new, franchise-defining products in each of our three platforms that will take our portfolio to the next level. Our priority is to ensure our customers' success with these new products as we work together to deliver on the full promise and potential of single cell and spatial biology to advance human health."

Fourth Quarter 2023 Financial Results

Revenue was $184.0 million for the three months ended December 31, 2023, a 18% increase from $156.2 million for the three months ended December 31, 2022. This increase was primarily due to a higher volume of Spatial instruments and consumables sold.

Gross margin was 63% for the fourth quarter of 2023, as compared to 76% for the corresponding prior year period. The decrease in gross margin was primarily due to product mix with a higher mix of Spatial instruments sold.

Operating expenses were $171.0 million for the fourth quarter of 2023, a 20% increase from $142.5 million for the corresponding prior year period. The increase was primarily driven by $19.6 million of in-process research and development expense related to an agreement to acquire certain intangible and other assets earlier this year and impairment charges related to long-lived assets.

Operating loss was $55.2 million for the fourth quarter of 2023, as compared to an operating loss of $23.1 million for the corresponding prior year period. Operating loss also includes $38.9 million of stock-based compensation for the fourth quarter of 2023, as compared to $41.0 million for the fourth quarter of 2022.

Net loss was $49.0 million for the fourth quarter of 2023, as compared to a net loss of $17.2 million for the corresponding prior year period. This includes $19.6 million of in-process research and development expense related to an agreement to acquire certain intangible and other assets earlier this year.

Full Year 2023 Financial Results

Revenue was $618.7 million for the year ended December 31, 2023, a 20% increase from $516.4 million for 2022.

Gross margin was 66% for full year 2023, as compared to 77% for 2022. The decrease in gross margin was primarily due to product mix with a higher mix of Spatial instruments sold.

Operating expenses were $674.6 million for full year 2023, as compared to $564.0 million for 2022, an increase of 20%. The increase was primarily driven by $61.0 million of in-process research and development expense related to an agreement to acquire certain intangible and other assets earlier this year and higher personnel expenses including stock-based compensation expense.

Operating loss was $265.3 million for full year 2023, as compared to an operating loss of $167.9 million for 2022. This includes $167.0 million of stock-based compensation for full year 2023, as compared to $136.8 million for full year 2022.

Net loss was $255.1 million for full year 2023, as compared to a net loss of $166.0 million for 2022. This includes $61.0 million of in-process research and development expense related to an agreement to acquire certain intangible and other assets earlier this year.

Cash and cash equivalents and marketable securities were $388.7 million as of December 31, 2023.

2024 Financial Guidance

10x Genomics expects full year 2024 revenue to be in the range of $670 million to $690 million, representing 8% to 12% growth over full year 2023 revenue.

Webcast and Conference Call Information

10x Genomics will host a conference call to discuss the fourth quarter and full year 2023 financial results, business developments and outlook after market close on Thursday, February 15, 2024 at 1:30 PM Pacific Time / 4:30 PM Eastern Time. A webcast of the conference call can be accessed at http://investors.10xgenomics.com. The webcast will be archived and available for replay for at least 45 days after the event.

About 10x Genomics

10x Genomics is a life science technology company building products to accelerate the mastery of biology and advance human health. Our integrated solutions include instruments, consumables and software for single cell and spatial biology, which help academic and translational researchers and biopharmaceutical companies understand biological systems at a resolution and scale that matches the complexity of biology. Our products are behind breakthroughs in oncology, immunology, neuroscience and more, fueling powerful discoveries that are transforming the world’s understanding of health and disease. To learn more, visit 10xgenomics.com or connect with us on LinkedIn or X (Twitter).

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. All statements included in this press release, other than statements of historical facts, may be forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "might," "will," "should," "expect," "plan," "anticipate," "could," "intend," "target," "project," "contemplate," "believe," "see," "estimate," "predict," "potential," "would," "likely," "seek" or "continue" or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include statements regarding 10x Genomics, Inc.'s product momentum, potential, progress and launches, our expected performance advantages and benefits of using our products and services, customer usage and adoption of our products and our financial performance and results of operations, including our expectations regarding revenue and guidance. These statements are based on management's current expectations, forecasts, beliefs, assumptions and information currently available to management. Actual outcomes and results could differ materially from these statements due to a number of factors and such statements should not be relied upon as representing 10x Genomics, Inc.'s views as of any date subsequent to the date of this press release. 10x Genomics, Inc. disclaims any obligation to update any forward-looking statements provided to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law. The material risks and uncertainties that could affect 10x Genomics, Inc.'s financial and operating results and cause actual results to differ materially from those indicated by the forward-looking statements made in this press release include those discussed under the

captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the company's most recently-filed 10-K and elsewhere in the documents 10x Genomics, Inc. files with the Securities and Exchange Commission from time to time.

Disclosure Information

10x Genomics uses filings with the Securities and Exchange Commission, our website (www.10xgenomics.com), press releases, public conference calls, public webcasts and our social media accounts as means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD.

Contacts

Investors: investors@10xgenomics.com

Media: media@10xgenomics.com

10x Genomics, Inc.

Consolidated Statement of Operations

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Revenue (1) | $ | 183,979 | | | $ | 156,232 | | | $ | 618,727 | | | $ | 516,409 | |

Cost of revenue (2) | 68,197 | | | 36,827 | | | 209,414 | | | 120,386 | |

| Gross profit | 115,782 | | | 119,405 | | | 409,313 | | | 396,023 | |

| Operating expenses: | | | | | | | |

Research and development (2) | 65,267 | | | 63,614 | | | 270,332 | | | 265,667 | |

| In-process research and development | 19,578 | | | — | | | 60,980 | | | — | |

Selling, general and administrative (2) | 86,125 | | | 78,887 | | | 343,330 | | | 298,300 | |

| | | | | | | |

| Total operating expenses | 170,970 | | | 142,501 | | | 674,642 | | | 563,967 | |

| Loss from operations | (55,188) | | | (23,096) | | | (265,329) | | | (167,944) | |

| Other income (expense): | | | | | | | |

| Interest income | 4,637 | | | 2,815 | | | 16,906 | | | 6,647 | |

| Interest expense | (8) | | | (125) | | | (33) | | | (476) | |

| Other income (expense), net | 3,961 | | | 3,995 | | | (307) | | | (198) | |

| | | | | | | |

| Total other income | 8,590 | | | 6,685 | | | 16,566 | | | 5,973 | |

| Loss before provision for income taxes | (46,598) | | | (16,411) | | | (248,763) | | | (161,971) | |

| Provision for income taxes | 2,354 | | | 804 | | | 6,336 | | | 4,029 | |

| Net loss | $ | (48,952) | | | $ | (17,215) | | | $ | (255,099) | | | $ | (166,000) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.41) | | | $ | (0.15) | | | $ | (2.18) | | | $ | (1.46) | |

| Weighted-average shares used to compute net loss per share, basic and diluted | 118,565,724 | | | 114,757,572 | | | 117,165,036 | | | 113,858,684 | |

| | | | | | | |

(1)The following table represents revenue by source for the periods indicated (in thousands). Spatial products includes the Company’s Visium and Xenium products:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Instruments | | | | | | | | |

| Chromium | | $ | 11,150 | | | $ | 15,243 | | | $ | 47,866 | | | $ | 58,552 | |

| Spatial | | 27,248 | | | 7,089 | | | 75,605 | | | 13,844 | |

| Total instruments revenue | | 38,398 | | | 22,332 | | | 123,471 | | | 72,396 | |

| Consumables | | | | | | | | |

| Chromium | | 118,144 | | | 120,238 | | | 420,316 | | | 400,433 | |

| Spatial | | 22,170 | | | 11,359 | | | 59,237 | | | 35,155 | |

| Total consumables revenue | | 140,314 | | | 131,597 | | | 479,553 | | | 435,588 | |

| Services | | 5,267 | | | 2,303 | | | 15,703 | | | 8,425 | |

| Total revenue | | $ | 183,979 | | | $ | 156,232 | | | $ | 618,727 | | | $ | 516,409 | |

The following table presents revenue by geography based on the location of the customer for the periods indicated (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Americas | | | | | | | | |

| United States | | $ | 99,322 | | | $ | 82,828 | | | $ | 360,091 | | | $ | 284,987 | |

| Americas (excluding United States) | | 4,520 | | | 2,794 | | | 13,101 | | | 8,791 | |

| Total Americas | | 103,842 | | | 85,622 | | | 373,192 | | | 293,778 | |

| Europe, Middle East and Africa | | 50,589 | | | 43,001 | | | 142,276 | | | 117,068 | |

| Asia-Pacific | | | | | | | | |

| China¹ | | 11,748 | | | 16,277 | | | 50,965 | | | 64,356 | |

| Asia-Pacific (excluding China) | | 17,800 | | | 11,332 | | | 52,294 | | | 41,207 | |

| Total Asia-Pacific | | 29,548 | | | 27,609 | | | 103,259 | | | 105,563 | |

| Total Revenue | | $ | 183,979 | | | $ | 156,232 | | | $ | 618,727 | | | $ | 516,409 | |

1 Includes Hong Kong effective from the first quarter of 2023. Comparative periods have been adjusted for this inclusion.

(2)Includes stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | $ | 1,928 | | | $ | 1,511 | | | $ | 7,068 | | | $ | 5,259 | |

| Research and development | 17,608 | | | 17,865 | | | 72,804 | | | 59,211 | |

| Selling, general and administrative | 19,382 | | | 21,598 | | | 87,078 | | | 72,378 | |

| Total stock-based compensation expense | $ | 38,918 | | | $ | 40,974 | | | $ | 166,950 | | | $ | 136,848 | |

10x Genomics, Inc.

Consolidated Balance Sheets

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 359,284 | | | $ | 219,746 | |

| Marketable securities | 29,411 | | | 210,238 | |

| Restricted cash | — | | | 2,633 | |

| Accounts receivable, net | 114,832 | | | 104,211 | |

| Inventory | 73,706 | | | 81,629 | |

| Prepaid expenses and other current assets | 18,789 | | | 16,578 | |

| Total current assets | 596,022 | | | 635,035 | |

| Property and equipment, net | 279,571 | | | 289,328 | |

| Restricted cash | — | | | 4,974 | |

| Operating lease right-of-use assets | 65,361 | | | 69,882 | |

| Goodwill | 4,511 | | | 4,511 | |

| Intangible assets, net | 16,616 | | | 22,858 | |

| Other noncurrent assets | 3,062 | | | 2,392 | |

| Total assets | $ | 965,143 | | | $ | 1,028,980 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 15,738 | | | $ | 21,599 | |

| Accrued compensation and related benefits | 30,105 | | | 32,675 | |

| Accrued expenses and other current liabilities | 56,648 | | | 59,779 | |

| | | |

| Deferred revenue | 13,150 | | | 7,867 | |

| Operating lease liabilities | 11,521 | | | 9,037 | |

| | | |

| Total current liabilities | 127,162 | | | 130,957 | |

| | | |

| | | |

| | | |

| | | |

| Operating lease liabilities, noncurrent | 83,849 | | | 86,139 | |

| Deferred revenue, noncurrent | 8,814 | | | 3,165 | |

| Other noncurrent liabilities | 4,275 | | | 2,976 | |

| Total liabilities | 224,100 | | | 223,237 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Preferred stock, $0.00001 par value; 100,000,000 shares authorized, no shares issued or outstanding as of December 31, 2023 and December 31, 2022 | — | | | — | |

Common stock, $0.00001 par value; 1,100,000,000 shares authorized and 119,095,362 and 115,195,009 shares issued and outstanding as of December 31, 2023 and 2022 | 2 | | | 2 | |

| Additional paid-in capital | 2,025,890 | | | 1,839,397 | |

| Accumulated deficit | (1,284,420) | | | (1,029,321) | |

| Accumulated other comprehensive loss | (429) | | | (4,335) | |

| Total stockholders’ equity | 741,043 | | | 805,743 | |

| Total liabilities and stockholders’ equity | $ | 965,143 | | | $ | 1,028,980 | |

| | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

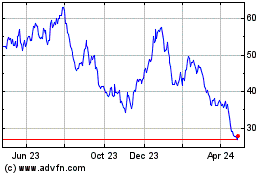

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Apr 2024 to May 2024

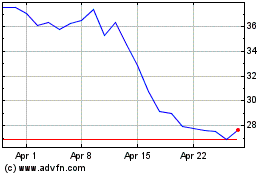

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From May 2023 to May 2024