ALSTOM SA : Option for payment of dividend 2022/23 in shares: Calendar and terms

July 11 2023 - 10:30AM

ALSTOM SA : Option for payment of dividend 2022/23 in shares:

Calendar and terms

Option for payment of

dividend

2022/23

in sharesCalendar and terms

ALSTOMSociété Anonyme with share

capital of €2,672,986,855Headquarters: 48, rue Albert Dhalenne,

93400 Saint-Ouen-sur-Seine 389 058 447 R.C.S. Bobigny

11

July

2023 – The Combined Shareholders’

Meeting, which took place today, approved the dividend related to

the 2022/23 fiscal year for an amount of €0.25 gross per share, and

has decided to offer to each shareholder an option, with respect to

100% of the dividends attached to the shares owned by such

shareholder, for payment of such dividend to be made in cash or in

new shares. The ALSTOM’S shareholders will be able to receive

dividend, depending on their choice, either in cash, or in new

ALSTOM shares.

Calendar for dividend payment:

-

Ex-dividend date: 17 July 2023

- Record

date : 18 July 2023, at the closing of the trading

session

- Opening

date to opt for dividend payment in new shares: 19 July

2023

- Closing date to opt for

dividend payment in new shares: 1st September 2023

(Shareholders not exercising their option at the latest by 1st

September 2023 inclusive, will be paid their dividend fully in

cash).

- Results

of option for dividend payment in new shares: 5 September

2023

- Dividend

payment date in cash, delivery of the new shares: 7

September 2023

Terms of dividend payment:

Shareholders wishing to opt for the payment of

dividends in shares will have to request such payment method from

the financial intermediaries empowered to pay the dividend or from

Uptevia, holding the Company’s direct registered form shares

accounts, for those shareholders holding direct registered form

shares. Any shareholder who has not elected for its dividends to be

paid in shares at the latest by 1st September 2023 inclusive, will

be paid his/her dividend fully in cash.

The issue price of the new shares to be issued

in payment of the dividend has been set at €23.75. This price

corresponds to 90% of the average of the prices quoted at the

beginning of the twenty trading sessions preceding the date of the

General Meeting, less the net amount of this dividend and rounded

up to two decimal places.

If the amount of the net dividend in respect of

which the shareholder exercises its option does not correspond to a

whole number of shares, the shareholder may obtain the immediately

lower whole number of shares plus a cash balancing payment.The

shares issued as payment for the dividend will carry immediate

dividend right and will be fully assimilated to ordinary shares

comprising the share capital of the Company.

New shares will be admitted to trading on

Euronext Paris (Code ISIN: FR0010220475) as of 7 September 2023, on

the same quotation line than the existing shares.

Disclaimer

This release constitutes the information

document required under article 1, paragraphs 4 (h) and 5 (g) of

the chapter I of the Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017. This release does

not constitute an offer to the public nor a solicitation to

purchase or subscribe for securities. This release and any other

document related to the payment of the dividend in the form of new

shares of the Company may not be published outside France, unless

such publication complies with applicable local laws and

regulations. Moreover, such publication may not constitute an offer

to purchase or subscribe for securities, in any country where such

an offer would break applicable local laws and regulations. The

option for payment of the 2022/23 dividend in the form of new

shares of the Company shall not be available to any shareholder

residing in any country where such an option would require a

registration or an authorisation to be granted by local financial

market authorities; Shareholders residing outside France are

expected to inform themselves on the applicable local laws and

regulations applicable to the option. For tax purposes related to

the payment of the dividend in the form of new shares, shareholders

are expected to inform themselves on the applicable taxes with

their tax advisor. When deciding whether or not they will exercise

the option, shareholders are advised to take into account the risks

associated with an investment in shares. For any further

information about the Company, please refer to Chapter "Risk

factors" of the Universal Registration Document 2022/23 of the

Company filed on 6 June 2023 with the AMF under reference

D.23-0459 (available on the Company’s website,

http://www.alstom.com)

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more

information, please visit www.alstom.com |

|

|

|

| |

Contacts |

Press

:Thomas ANTOINE - Tel.: +33 (0)6 11 47 28 60

thomas.antoine@alstomgroup.comSamuel MILLER – Tel.: +33 (0)6 65 47

40

14samuel.miller@alstomgroup.com Investor

Relations : Martin VAUJOUR – Tel.: +33

(0)6 88 40 17 57martin.vaujour@alstomgroup.com Estelle

MATURELL ANDINO – Tel.: +33 (0)6 71 37 47

56estelle.maturell@alstomgroup.com |

|

- 2023.07.11 - Alstom_AGM Dividends_EN COM

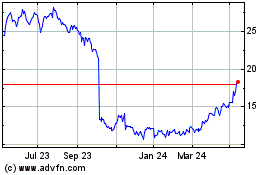

Alstom (EU:ALO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alstom (EU:ALO)

Historical Stock Chart

From Nov 2023 to Nov 2024